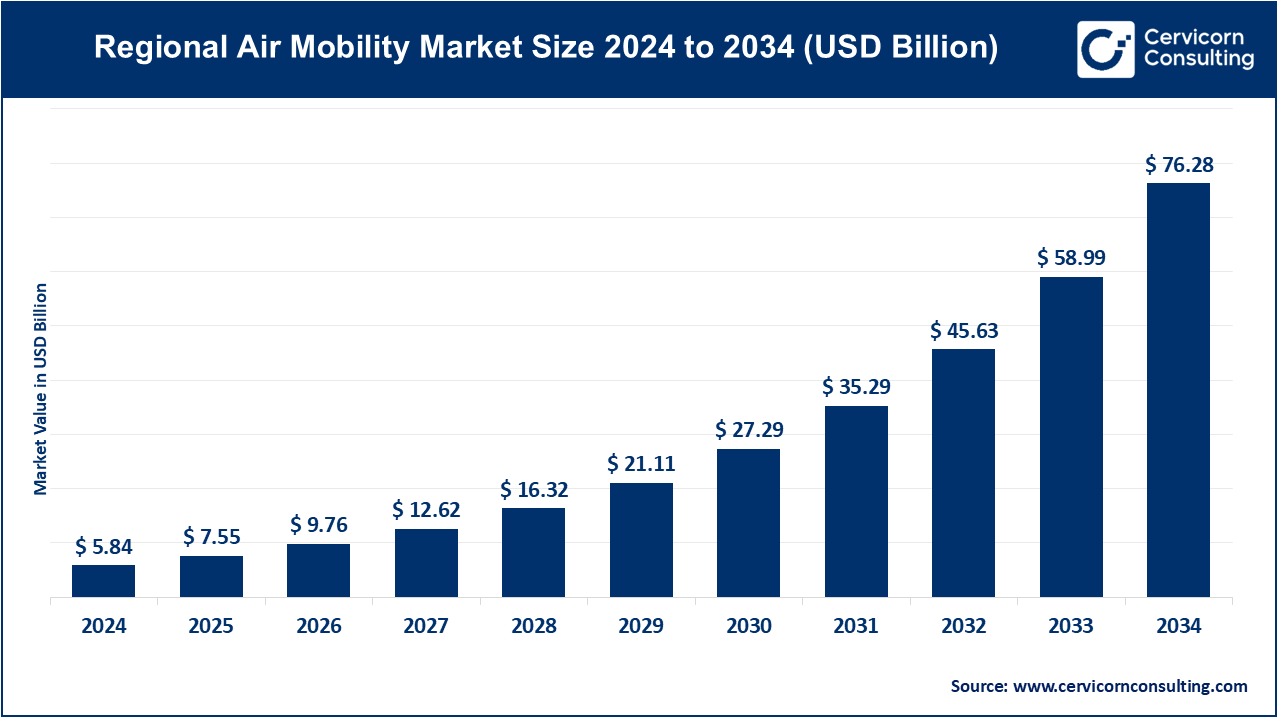

The regional air mobility market size was reached at USD 5.84 billion in 2024 and is expected to be worth around USD 76.28 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 29.30% over the forecast period from 2025 to 2034.

The regional air mobility (RAM) market is witnessing rapid growth due to breakthroughs in electric and hybrid-electric propulsion technology. This technology substantially cuts operating costs and emissions, making smaller short-range aircraft more viable for commercial use, especially for flights between underused regional airports. The market's expansion is clear from the fact that over 4,700 RAM aircraft or powertrains have been ordered or optioned worldwide, indicating strong industry and investor confidence. Moreover, growing environmental regulations and decarbonisation efforts globally are driving a shift from traditional turbine-powered aircraft to cleaner alternatives like electric conventional takeoff and landing (eCTOL) aircraft.

Another key driver of growth is the need to enhance connectivity and accessibility in underserved areas. Currently, more than 5,000 regional airports in North America and Europe alone are underutilised. RAM solutions aim to bridge mobility gaps through point-to-point operations, feeder flights to major hubs, and last-mile air connectivity, particularly in areas where ground mobility is inefficient. Governments and air transport authorities are investing in supporting infrastructure and oversight frameworks. For instance, the European Union Aviation Safety Agency (EASA) has led certification processes for electric aircraft, and NASA's AAM National Campaign is supporting the development of RAM through collaboration with OEMs like Joby, Beta Technologies, and Heart Aerospace. These initiatives reflect increased institutional backing for the commercialisation and deployment of RAM solutions globally.

What is a Regional Air Mobility?

Regional Air Mobility (RAM) involves operating smaller aircraft, typically with 5 to 50 seats, for short to medium-range travel, usually between 50 and 500 kilometres. The aim of RAM is to link regional airfields and remote areas, improving connectivity while supporting long-haul airline routes and road transport. RAM includes aircraft such as electric conventional takeoff and landing (eCTOL), hybrid-electric, hydrogen fuel cell, and small turboprops. Its applications range from passenger shuttles and cargo transport to medical evacuation, business travel, and emergency services. RAM seeks to reduce travel time, lower emissions, and improve access to mobility in areas with inadequate ground infrastructure.

Regional Air Mobility Market: Important Stats and Industry Insights

| Category | Insight/Statistics |

| Energy Efficiency | Electric aircraft consume 60�70% less energy per passenger-kilometer than turboprops. |

| Noise Reduction | RAM aircraft with electric propulsion can reduce noise by up to 90% during takeoff. |

| Flight Time Savings | RAM routes can reduce travel time by up to 60% compared to road or rail alternatives. |

| Fleet Readiness (2025�2030)� �� | Over 100 RAM aircraft models are under development globally. |

| Operator Demand | 70+ regional airlines and charter services have expressed interest or preorders. |

| Infrastructure Cost vs. ROI | Upgrading small regional airports costs 5�10x less than building high-speed rail. |

| Carbon Emission Impact | Widespread RAM adoption could cut 2.2�4.7 million metric tons of CO₂ annually (by 2035). |

| Employment Opportunities | RAM growth could generate over 90,000 jobs globally across design, maintenance, and operations. |

| Passenger Experience | Boarding-to-destination time is cut in half for trips under 500 km. |

| Government Support | The EU, US, and Japan have launched RAM innovation grants and airport adaptation programs. |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 7.55 Billion |

| Expected Market Size in 2034 | USD 76.28 Billion |

| Projected CAGR 2025 to 2034 | 29.30% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Aircraft Type, Range, Propulsion Type, Operation Type, Application |

| Key Companies | Textron Aviation, Pipistrel, Eviation Aircraft, Heart Aerospace, Surf Air Mobility, Ampaire, Bye Aerospace, Daher, De Havilland Canada, Embraer, Tecnam, ATR Aircraft, Universal Hydrogen, ZeroAvia, Joby Aviation |

The regional air mobility market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.�

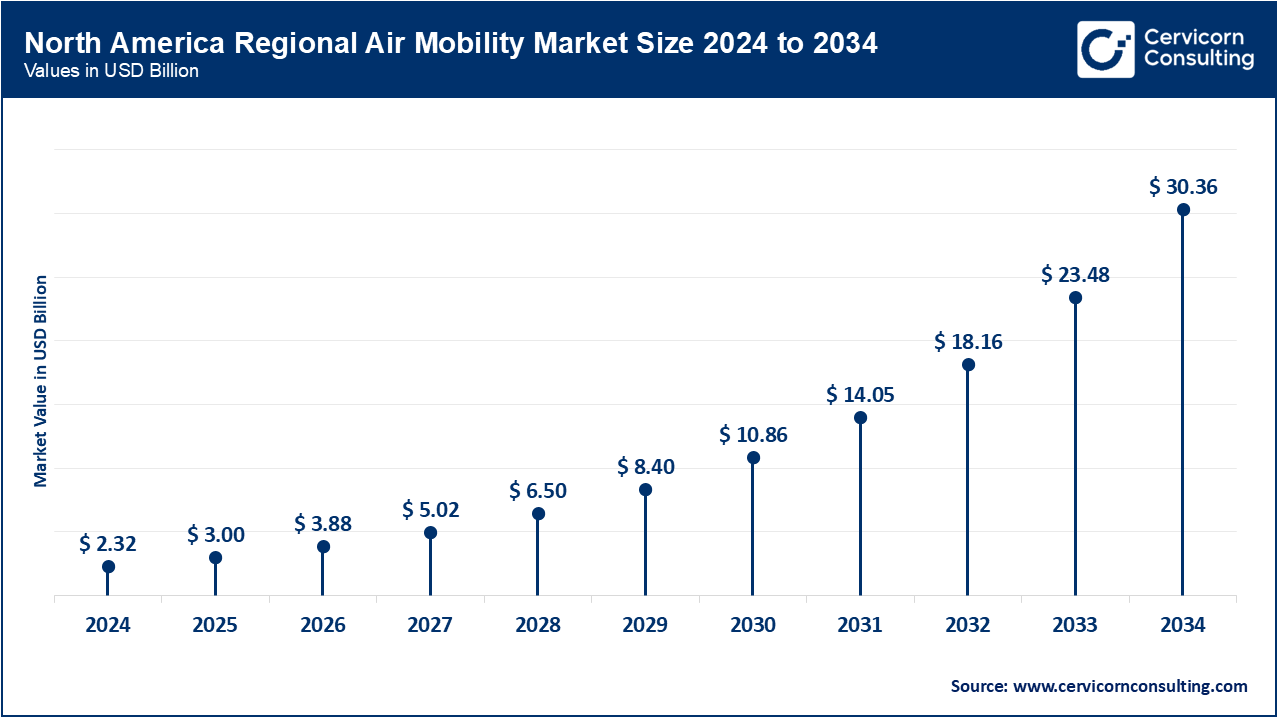

The North America regional air mobility market size was reached at USD 2.32 billion in 2024 and is expected to hit around USD 30.36 billion by 2034. North America is the leading market, due to its established aerospace sector, robust venture capital ecosystem, and open regulatory environment. Both the private sector and the U.S. government are making significant investments in the growth of electric and hybrid aircraft, vertiport infrastructure, and autonomous flight technology. Industry leaders such as Joby Aviation and Archer Aviation have their headquarters located here, establishing the region as the innovation leader in RAM. Furthermore, North America's vast geography and unserved regional airports create a high demand for effective regional air travel solutions.

The Asia-Pacific regional air mobility market size was estimated at USD 1.38 billion in 2024 and is projected to surpass around USD 18 billion by 2034. The Asia-Pacific region is the fastest-growing market for RAM, driven by increasing urbanization, rising disposable incomes, and government efforts to enhance regional connectivity. China, Japan, and Australia are investing heavily in technology and infrastructure to facilitate the use of RAM. High population densities in both urban and rural areas present APAC with immense potential for short- and mid-range regional flights, particularly with electric and hybrid aircraft that offer environmental benefits.

Regional Air Mobility Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.80% |

| Europe | 34.20% |

| Asia-Pacific� | 23.60% |

| LAMEA | 2.40% |

The Europe regional air mobility market size was valued at USD 2 billion in 2024 and is predicted to grow around USD 26.09 billion by 2034. Europe is a key market for RAM, characterized by strict environmental regulations and a strong focus on sustainability. The European Union has launched numerous initiatives, including funding programs like SESAR AAM, to integrate regional air mobility into urban skies using green technology. Regional airports in European countries are being upgraded, and vertiport facilities are being established, providing fertile ground for RAM solutions, especially for short- to medium-haul flights between small towns.

The LAMEA regional air mobility market size was valued at USD 0.34 billion in 2024 and is anticipated to reach around USD 4.42 billion by 2034. LAMEA is an emerging market for RAM with significant potential, owing to vast geographical areas, underdeveloped ground transport infrastructure, and a rising middle class. The lower uptake is primarily attributable to challenges such as a lack of developed airport infrastructure, regulatory complexity, and funding constraints. Governments and private operators are beginning to consider RAM for passenger transport, medical applications, and cargo delivery, particularly in remote or hard-to-reach locations where RAM can offer transformative connectivity.

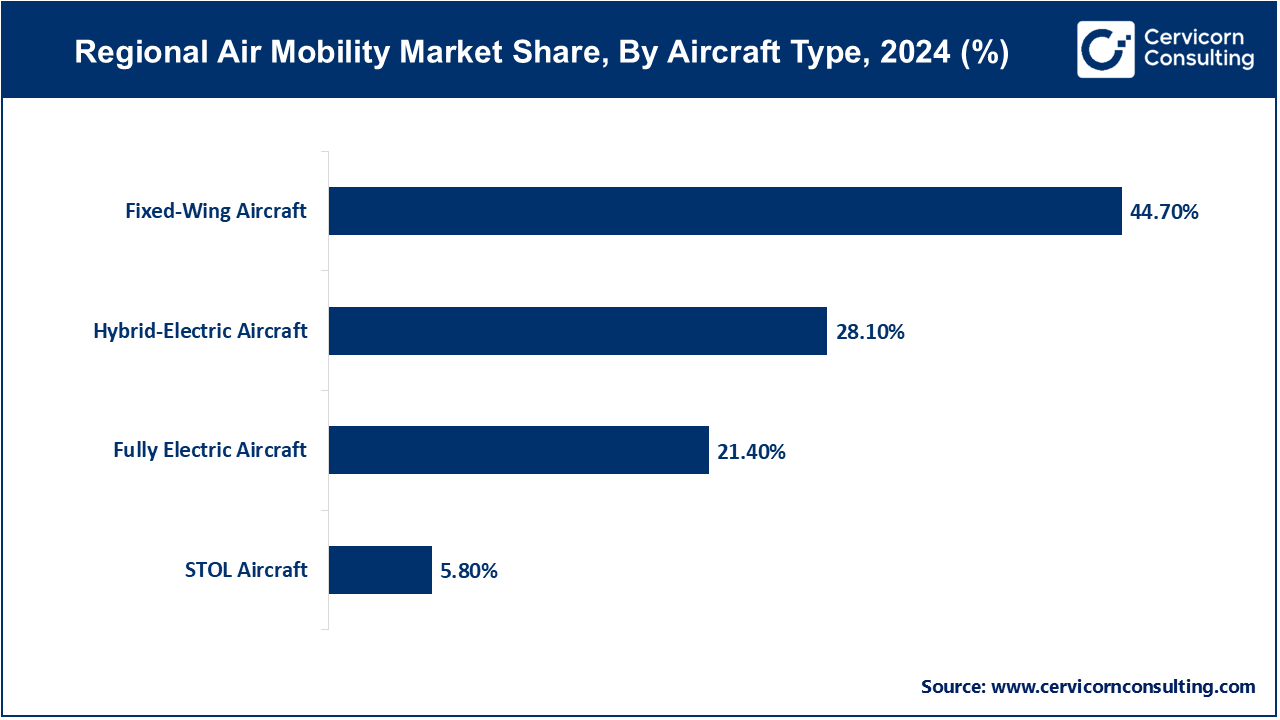

The regional air mobility market is segmented into aircraft type, range, propulsion type, operation type, application, and regions. Based on aircraft type, the market is classified into fixed-wing aircraft, hybrid-electric aircraft, fully electric aircraft, and Short Take-Off and Landing (STOL) aircraft. Based on the range, the market is categorised into short-range (50�150 miles), medium-range (150�300 miles), and long-range (300�500 miles). Based on propulsion type, the market is categorised into conventional fuel-based, hybrid-electric, and fully electric. Based on operation type, the market is classified into scheduled flights, on-demand air taxi services, charter services, and cargo and parcel delivery. Based on application, the market is categorised into passenger transport, cargo & logistics, medical & emergency services, corporate & business aviation, government & military, and others.

Fixed-Wing Aircraft: Fixed-wing aircraft currently dominate the RAM market due to their established technology, longer range, and larger capabilities relative to new designs. They are efficiently operated on most regional routes and are accepted by regulators and operators, serving as the cornerstone of regional air transport today.

Hybrid-Electric Aircraft: Hybrid-electric aircraft are the fastest-growing segment, as they combine the reliability of conventional engines with the environmental benefits of electric power. This segment is quickly gaining investments due to its lower emissions, increased range, enhanced performance, and lower operating costs, making it well-suited for near-term RAM deployment.

Medium-Range (150�300 miles): The medium-range segment dominates because it serves the majority of regional travel demands�between secondary towns and regional centers within an affordable distance. It is also best suited in terms of aircraft size, fuel burn, and travel time, making it the operators' sweet spot.

Short-Range (50�150 miles):�Short-range flights are growing the fastest, fueled by the expansion of city and regional air mobility solutions such as eVTOL aircraft. These short flights alleviate congestion on the roads and provide quick connections, especially in regions with inadequate road infrastructure.

Conventional Fuel-Based:�Conventional fuel-based propulsion currently dominates due to the maturity and infrastructure already available for piston and turbine engines, making it the choice of the majority of regional aircraft today.

Fully Electric: Fully electric propulsion is the fastest-growing segment, thanks to technological advances in batteries and motors. It offers zero-emission flights and significantly quieter engines, delighting regulators and environmentally conscious customers, especially for short-range RAM flights.

Scheduled Flights:�Scheduled flights remain the dominant mode of operation in RAM, supported by traditional airline business models and existing airport infrastructure, serving consistent passenger demand on regional routes.

On-Demand Air Taxi Services: On-demand air taxi services are the fastest-growing segment, driven by the expansion of digital booking platforms, urban air mobility integration, and technological advancements in electric VTOL aircraft. This quick service model is transforming traditional air travel through rapid, personalized regional travel.

Passenger Transport:�Passenger transport is the largest application in RAM, addressing the demand for regional connectivity, reducing travel times, and offering alternatives to congested roads and longer commercial flights.

Medical & Emergency Services:�Medical and emergency services are growing rapidly due to the need for quick, safe air transport in remote or underserved areas. RAM solutions enable quicker patient transport, organ transport, and disaster relief, saving lives and enhancing access to healthcare.

The competitive landscape of the regional air mobility (RAM) market is undergoing rapid transformation, with a diverse mix of established aerospace players, innovative startups, and tech giants focusing on electric and hybrid propulsion. Key industry players like Joby Aviation, Lilium, and Heart Aerospace are investing significantly to develop cutting-edge aircraft and vertiport infrastructure. Meanwhile, major players such as Airbus and Boeing are also expanding their efforts through new ventures and partnerships. The sector is marked by intense research and development, strategic collaborations, and intense competition to secure regulatory approvals and early commercial orders. Companies are also venturing into passenger transport, cargo delivery, and emergency response, creating a dynamic and competitive landscape as they seek to capitalise on new regional connectivity opportunities.

Market Segmentation

By Aircraft Type

By Range

By Propulsion Type

By Operation Type

By Application

By Region