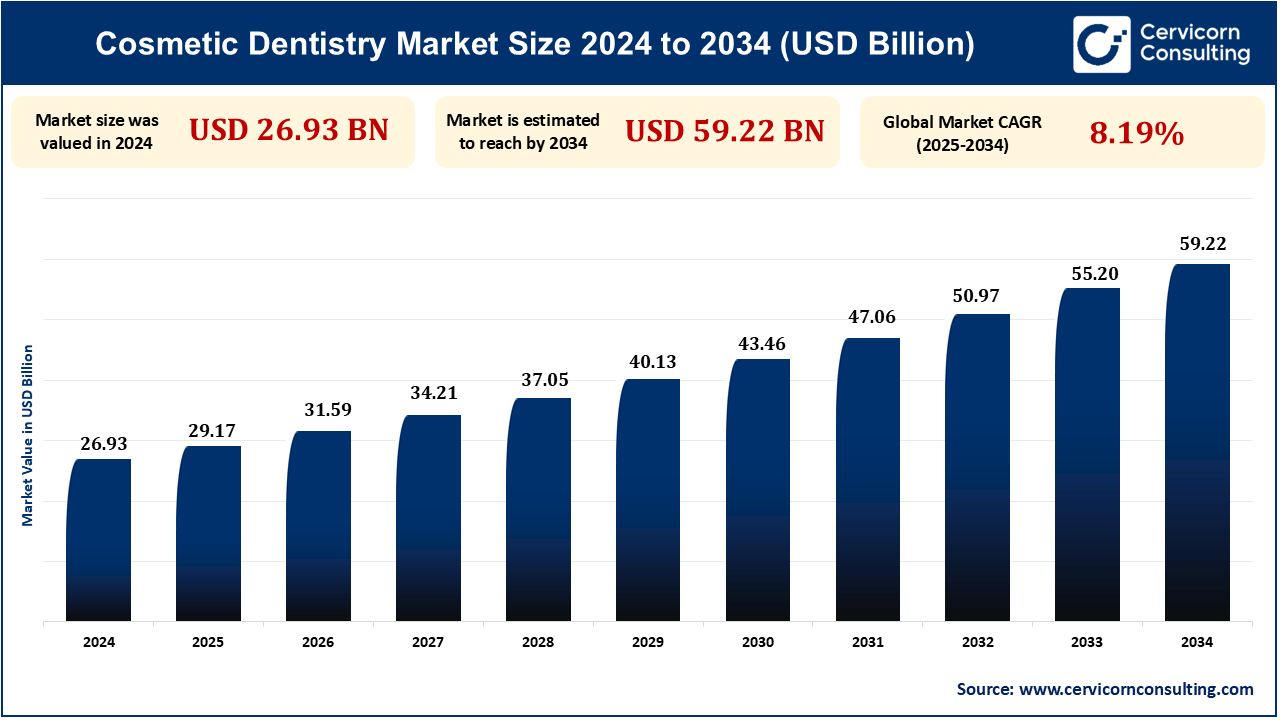

The global cosmetic dentistry market size was measured at USD 26.93 billion in 2024 and is anticipated to reach around USD 59.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.19% from 2025 to 2034. Increased awareness regarding dental aesthetics, technology advancements, and rising disposable incomes. More focus on self-image, especially among millennials, drive demand. Dental tourism and social media also significantly contribute to boosting the market.

The cosmetic dentistry market is all about a set of dental procedures committed to the beautification of teeth, gums, and smiles. These include procedures like teeth whitening, veneers, crowns, bonding, Invisalign, and gum reshaping. With improvements in dental technology, increased oral aesthetic consciousness, and greater disposable income, the market caters to individuals in pursuit of both aesthetics and function in their teeth. With increasing demand from different age groups and social media impact, cosmetic dentistry is on the rise internationally.

One of the major drivers of the cosmetic dentistry market is the rising demand for enhanced dental appearance, fueled by a growing emphasis on self-image and looks. As individuals gain greater awareness of cosmetic dental procedures, treatments such as teeth whitening, veneers, and Invisalign have become more popular, especially among millennials and high-income groups.

Advancements in Dental Technology

With technological improvements in treatments like teeth whitening, 3D imaging, and laser dentistry, cosmetic dentistry has become more efficient, accessible, and effective. These technologies reduce treatment time and improved outcomes, attracting more customers.

In February of 2023, Stratasys introduced the J3 DentaJet 3D printer, an affordable, multi-material printer for compact dental labs. It allows for the simultaneous creation of precise crown, bridge, implantology, and orthodontic models with biocompatible resins. It provides high build tray and High-Speed mode for increased production and reduced post-processing. Glidewell Dental showcases its precision for creating intricate surgical guides.

Influence of social media and Celebrity Culture to Fuel the Market Growth

Social networking websites and endorsement by celebrities have played a major role in influencing public perception towards beauty standards, for instance, the importance of having a beautiful smile. This has partly led to increased demand for cosmetic dental procedures.

In February 2025, A comparative study published by Dove Medical Press Ltd between 150 Arabic Instagram posts regarding aesthetic dentistry, smile modifications, and Hollywood smiles was done. It showed that most of the posts were posted by patients (49.3%) and dentists (32.7%), with a dominant marketing focus (69.3%) and a shocking amount of misinformation (84.0%). Patient-generated posts were most liked but were not professionally accurate, whereas marketing posts were likely to receive likes, followers, and comments.

Regulatory Challenges and Ethical Concerns May Restrain the Market’s Growth

The absence of a special regulatory framework for cosmetic dentistry creates uneven standards and practices, affecting patient safety and quality of treatment. Dental procedures being carried out by unqualified individuals pose serious risks, making it imperative to have strict regulations and monitoring.

For instance, in June 2024, the Dental Council of India (DCI) acted against unqualified practitioners of dentistry and clinics hiring them after increased complaints. State councils are mandated to prosecute offenders of the Dentists' Act of 1948 and 2014 ethics rules, serving cease and desist orders. This is intended to ensure patient safety and maintain professional standards, particularly against unregistered practitioners providing in-home services. Dentists have also embraced the move, convinced that it will protect the profession's reputation.

Rise of Minimally Invasive Procedures to Revolutionize Market Growth

Minimally invasive cosmetic dental procedures such as teeth whitening, clear aligners, and laser procedures are becoming increasingly popular. They provide excellent results with less discomfort and faster recovery than traditional procedures, which is why they are attracting consumers seeking cosmetic improvement with minimal disruption to their lifestyles.

For instance, in April 2025, Align Technology introduced the Invisalign System with mandibular advancement that includes occlusal blocks for Class II skeletal and dental correction of growing patients. The new clear aligner product remedies mandibular retrusion by advancing the mandible and aligning teeth at the same time. The occlusal blocks improve treatment efficiency, comfort, and compliance, particularly among patients between 10-16 years old. This innovation broadens Align's Class II treatment capabilities and reinforces its mission to further clear aligners as the standard of care in digital orthodontics.

| Attributes | Details |

| Cosmetic Dentistry Market Size in 2024 | USD 26.93 Billion |

| Cosmetic Dentistry Market in 2033 | USD 55.20 Billion |

| Cosmetic Dentistry Market CAGR | 8.19% 2025 to 2034 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Players |

|

The Asia Pacific region is expected to grow at the highest rate in the cosmetic dentistry market in the future. The drivers for this growth are the rising population, heightened awareness of dental aesthetics, and an expanding middle class with rising disposable income in countries like China, India, and Japan. Since people are becoming increasingly bothered with the way they appear and their smile, the trend of cosmetic dentistry procedures like whitening, veneers, and orthodontics is bound to increase in this region.

North America's dominance in the cosmetic dentistry market is driven by a large vehicle fleet, aging vehicles, and a mature service sector. High consumer awareness and a growing DIY maintenance trend are expected to sustain its market leadership in the short term.

Dental Systems & Equipment dominated the market share in 2024. They include varied equipment and technologies such as diagnostic imaging systems, dental chairs, sterilizing equipment, and CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems. They are the technologies required to improve the accuracy, efficacy, and outcomes of cosmetic dental procedures. Dental equipment and systems allow dentists to provide more accurate treatments, from basic ones such as whitening teeth to advanced ones such as dental implants and veneers. For example, in March 2025, the Indian dental sector is revolutionizing through digital dentistry, with technology such as intraoral scanners, CBCT imaging, CAD/CAM, and 3D printing improving accuracy, efficiency, and patient experience. By embracing digital workflows, Indian dentists are able to enhance treatment times, enhance case acceptance, and enhance profitability, which makes digital dentistry essential to remain competitive and to ensure long-term success.

The dental hospitals & clinics occupied the leading market share in 2024. They are adequately equipped with the latest technology and have professional dental experts who carry out all kinds of cosmetic treatments such as veneers, implants, whitening, and orthodontics. Dental hospitals and clinics are of key importance in providing direct care and service to patients for cosmetic dental treatment. For instance, in January of 2021, Aspen Dental Management merged ClearChoice Management Services with itself to unite two of the U.S.' largest dental companies and consolidate ownership and operation of over 860 offices spanning over 40 states. This merger improves the market leadership at Aspen Dental, broadens the competitive market positioning, and converts the merged business into the single largest fixed and removable prosthetics provider. Both firms' CEOs indicated that they were optimistic with the partnership, giving the credit to shared intent for providing improved access of patients to good dental care.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2368

Ask here for more details@ sales@cervicornconsulting.com