Cosmetic Dentistry Market Size and Growth 2025 To 2034

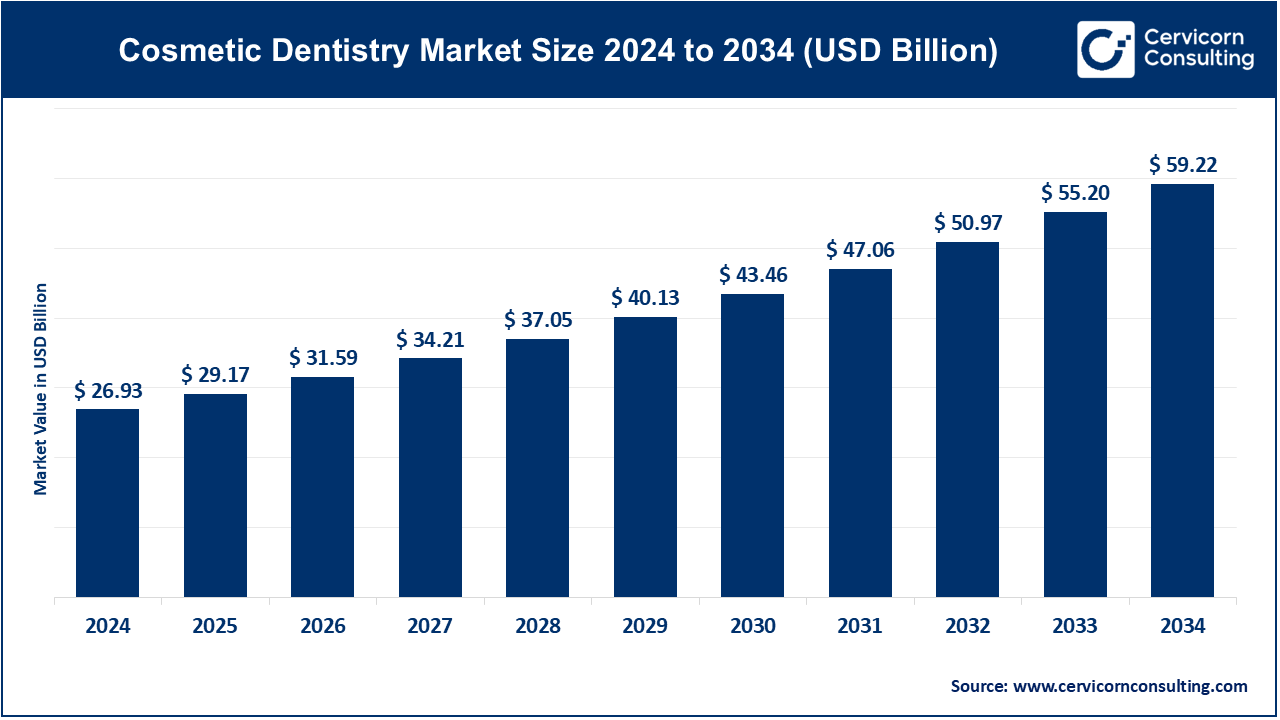

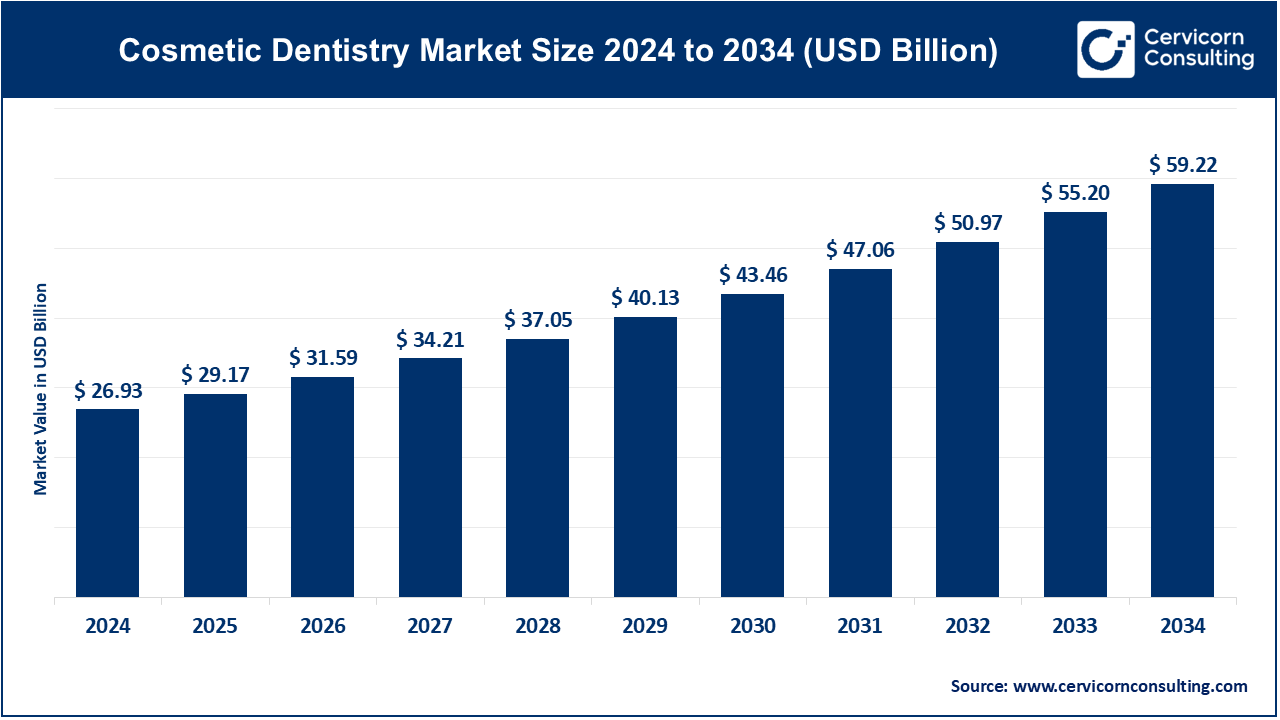

The global cosmetic dentistry market size was reached at USD 26.93 billion in 2024 and is expected to be worth around USD 59.22 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.19% over the forecast period 2025 to 2034. The U.S cosmetic dentistry market size is expected to reach around USD 17.28 billion by 2034 with a CAGR of 8.05%.

The cosmetic dentistry market has experienced significant growth in recent years, driven by increased awareness of aesthetic appearance and the desire for a better smile. As cosmetic dentistry procedures become more affordable and accessible, the market has expanded globally. Factors such as rising disposable incomes, advancements in dental technology, and a growing emphasis on personal appearance have contributed to this growth. Moreover, social media platforms have popularized the concept of an ideal smile, increasing demand for cosmetic dental services. The market is expected to continue growing at a rapid pace, fueled by innovations in minimally invasive treatments and an aging population that seeks to maintain youthful appearances. In 2022, China was the largest importer of beauty products, including those related to cosmetic dentistry, with imports valued at USD 11.1 billion. The United States and Germany also ranked among the top importers. Additionally, the rise of dental tourism, where patients travel abroad for affordable cosmetic treatments, has further accelerated market expansion.

Cosmetic dentistry focuses on improving the appearance of a person's teeth, gums, and smile. It involves various procedures that address dental issues like stained, chipped, or misaligned teeth. Common treatments include teeth whitening, dental veneers, crowns, bridges, and orthodontics. These procedures aim not only to enhance the aesthetic appeal but also to boost confidence and improve oral health. Cosmetic dentists work closely with patients to design personalized treatment plans that meet both functional and cosmetic needs. Advances in technology have made these treatments more accessible, affordable, and comfortable for a wider range of patients.

- According to the World Health Organization's Global Oral Health Status Report (2022), approximately 3.5 billion individuals worldwide are affected by oral diseases, with three-quarters of these cases occurring in middle-income countries. Globally, around 2 billion people suffer from tooth decay in their permanent teeth, while 514 million children experience tooth decay in their primary teeth.

- A news report published by the American Dental Association (ADA) in August 2022 highlights the ADA's release of a revised infection control guide, emphasizing the importance of comprehensive infection prevention and control practices in dental offices and other treatment settings.

The American Academy of Cosmetic Dentistry (AACD) estimated in 2020 that 96% of cosmetic dentistry patients are female, with over 70% of these female patients aged between 31 and 50 years.

Cosmetic Dentistry Market Report Highlights

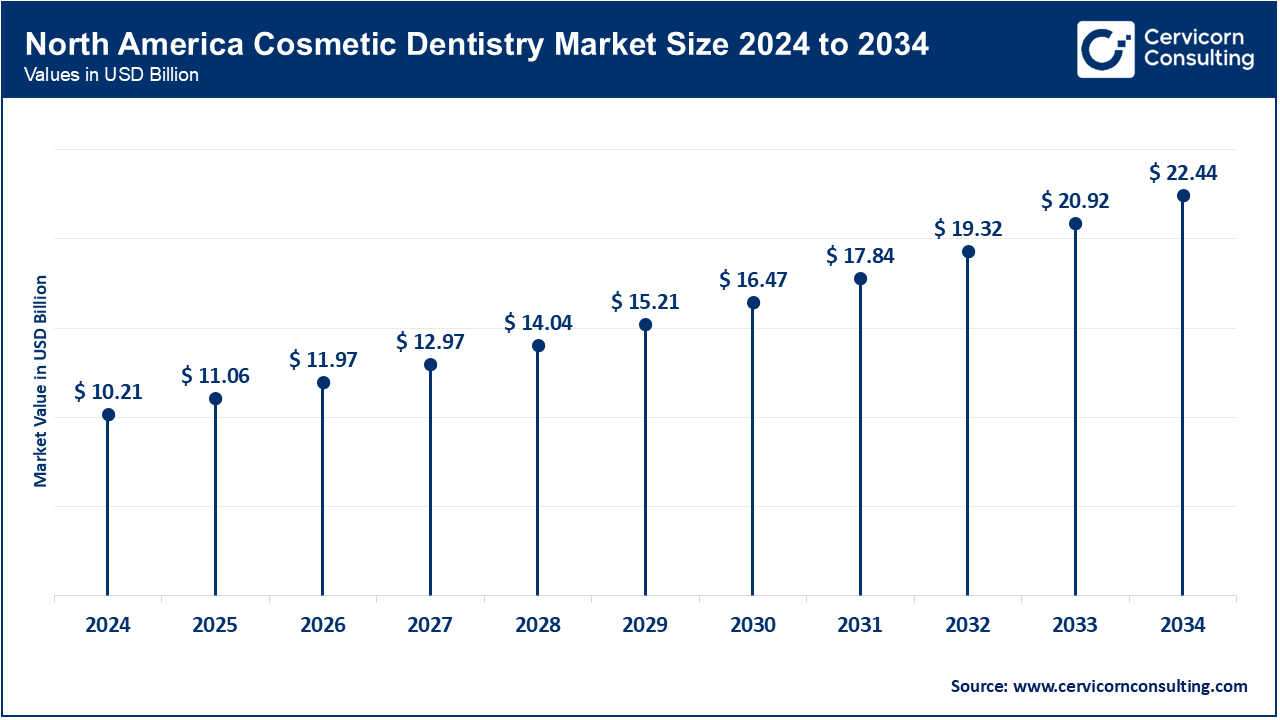

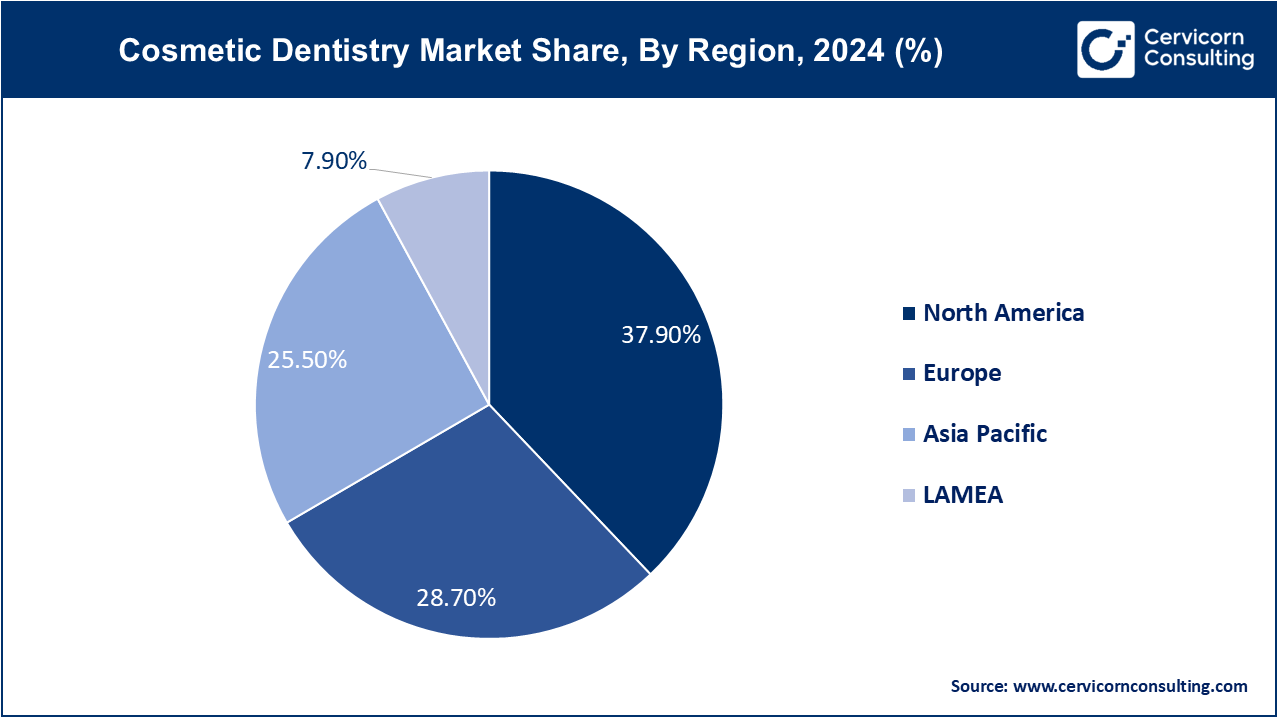

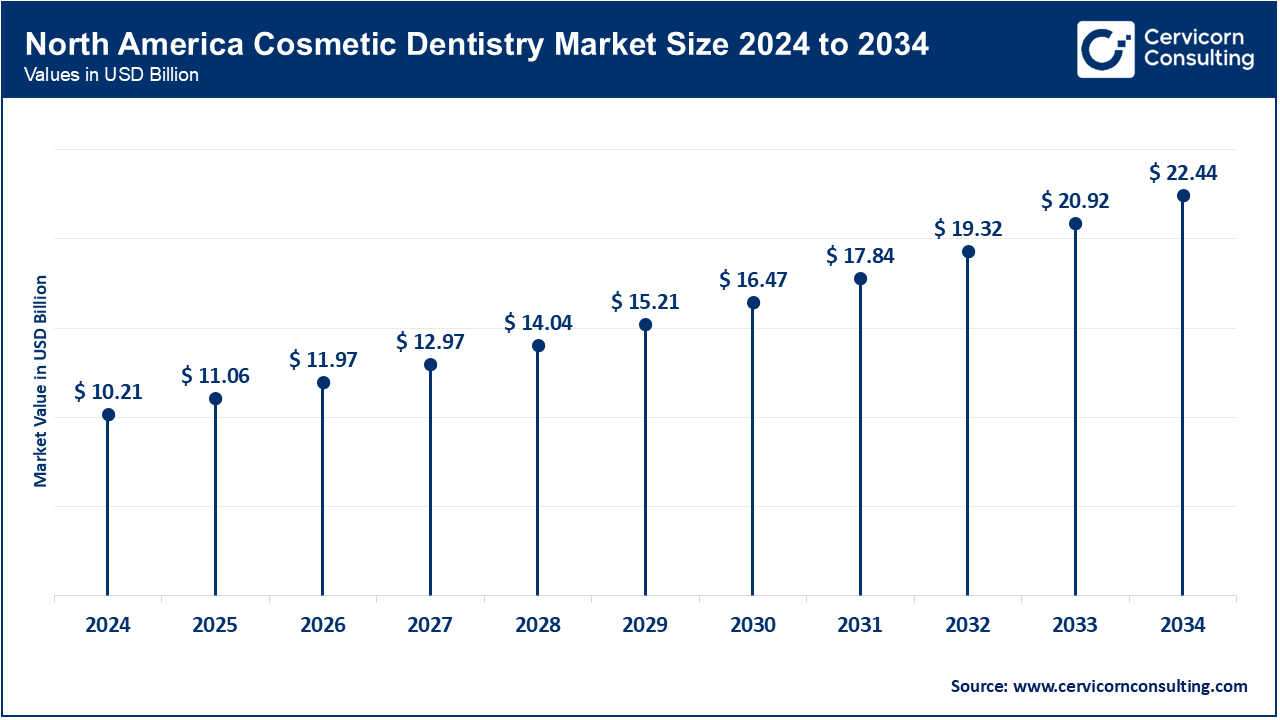

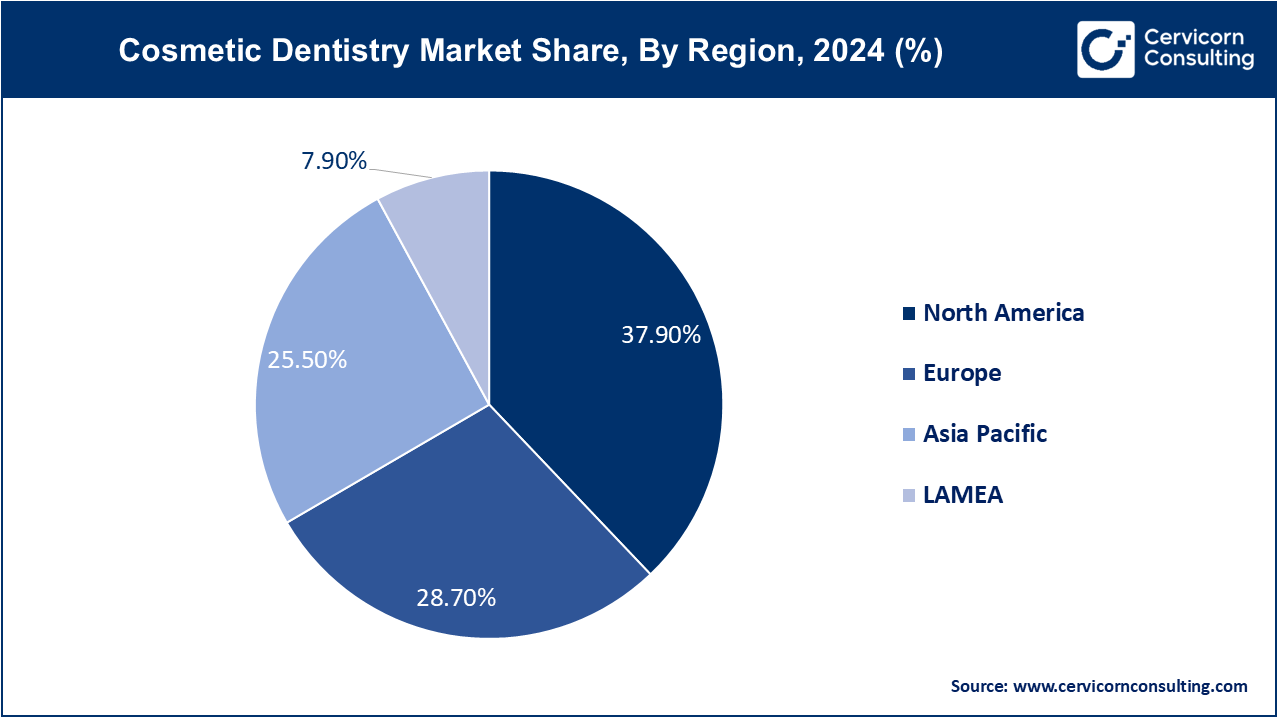

- By region, North America region has dominated the market by holding the highest revenue share of 37.9% in 2024.

- By region, Asia Pacific is experiencing significant growth by generating revenue share of 25.5% in 2024.

- By end user, dental hospitals & clinics segment has recorded highest revenue share of 62.1% in 2024.

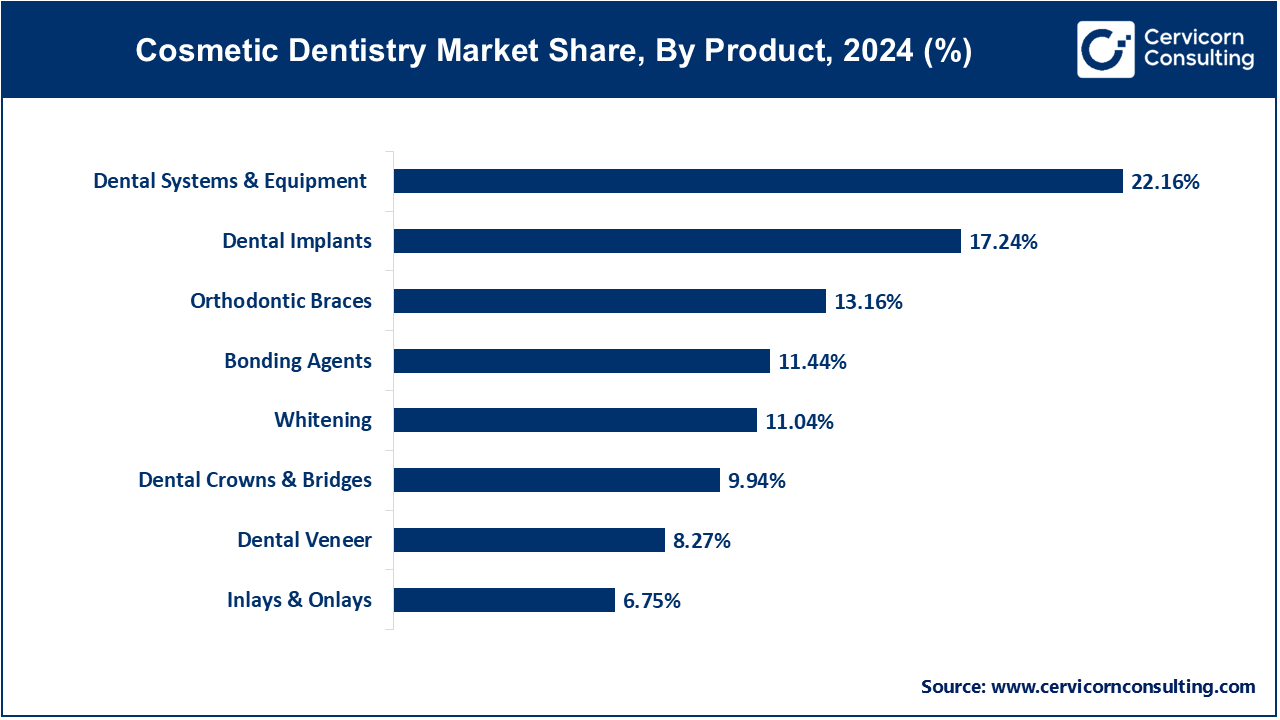

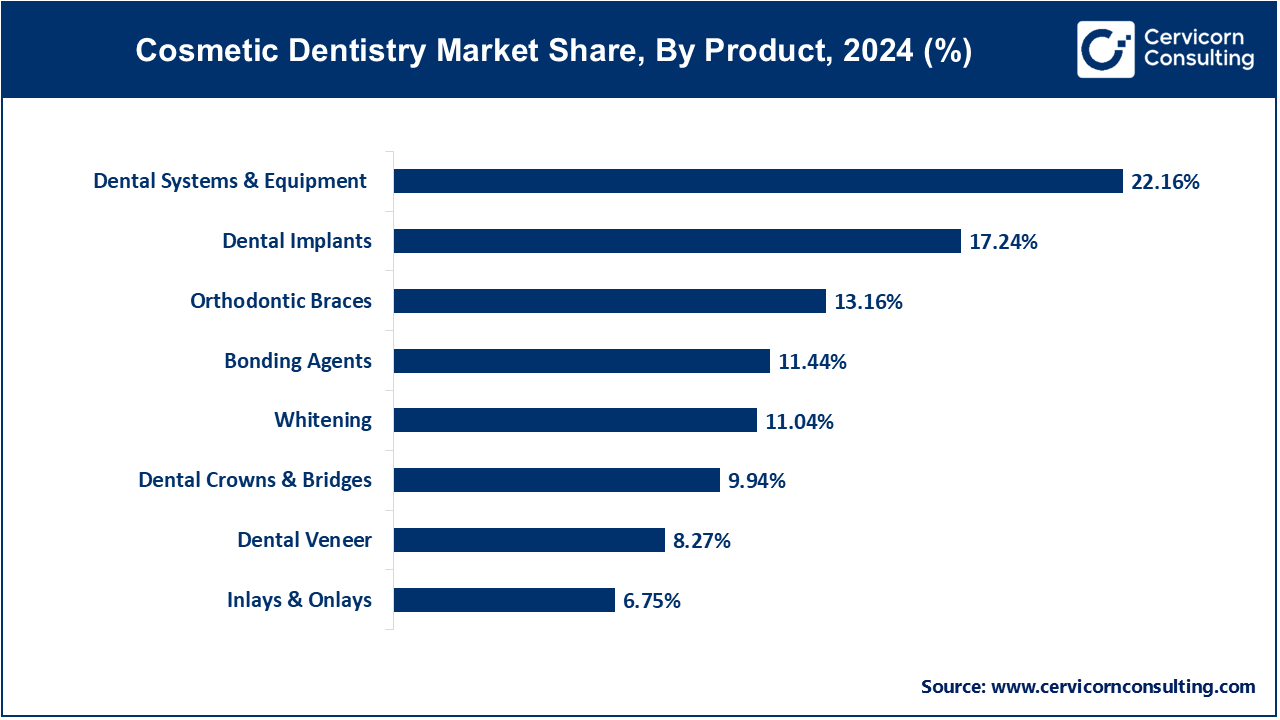

- By product, dental systems & equipment segment has recorded revenue share of 22.16% in 2024.

- By product, dental implants segment has recorded revenue share of 17.24% in 2024.

Cosmetic Dentistry Market Growth Factors

- Rising Aesthetic Awareness: There is an increasing emphasis on aesthetics and personal appearance globally, fueled by social media and celebrity influence. This has led to a growing demand for cosmetic dental procedures to achieve a perfect smile.

- Technological Advancements: Innovations in dental technology, such as 3D printing, digital smile design, and CAD/CAM systems, have revolutionized cosmetic dentistry. These advancements allow for more precise, efficient, and customized treatments, improving patient outcomes and satisfaction.

- Increasing Disposable Income: As disposable incomes rise, especially in emerging economies, more individuals can afford elective cosmetic dental procedures. This financial capability enables a larger demographic to seek enhancements in their dental aesthetics.

- Minimally Invasive Procedures: The trend towards minimally invasive cosmetic procedures is gaining momentum. Techniques such as teeth whitening, bonding, and the use of clear aligners (like Invisalign) offer significant aesthetic improvements with minimal discomfort and downtime, appealing to a broader patient base.

- Aging Population: The global aging population is contributing to the market growth. Older adults are increasingly seeking cosmetic dental solutions to maintain a youthful appearance, driving demand for procedures like veneers, crowns, and dental implants.

- Increased Awareness and Education: Greater awareness of dental health and the availability of cosmetic dentistry options are influencing market growth. Educational campaigns by dental associations and increased access to information online empower consumers to make informed decisions about their dental care.

Cosmetic Dentistry Market Trends

- Digital Dentistry: The integration of digital technologies, such as CAD/CAM (computer-aided design and computer-aided manufacturing), 3D printing, and digital imaging, is revolutionizing cosmetic dentistry. These technologies enhance precision, reduce treatment times, and enable customized solutions tailored to individual patient needs.

- Minimally Invasive Techniques: There is a growing preference for minimally invasive cosmetic procedures. Treatments like teeth whitening, bonding, and the use of clear aligners are gaining popularity due to their effectiveness, minimal discomfort, and shorter recovery periods compared to traditional methods.

- Rise in Veneer Demand: Porcelain and composite veneers are becoming increasingly popular for achieving aesthetically pleasing smiles. Advances in veneer technology have improved their natural appearance, durability, and ease of application, making them a sought-after option for smile makeovers.

- Teeth Whitening Boom: The demand for teeth whitening procedures continues to rise, driven by consumer desire for bright, white smiles. Both in-office and at-home whitening products are seeing significant growth, supported by advancements that offer quicker and longer-lasting results.

- Clear Aligners Popularity: Clear aligners, such as Invisalign, are gaining traction as an alternative to traditional braces. Their discreet appearance and convenience appeal to both adults and teenagers seeking orthodontic correction without the aesthetic drawbacks of metal braces.

- Cosmetic Dentistry in Men: While traditionally more women sought cosmetic dental procedures, there is a noticeable increase in male patients. Men are becoming more conscious of their appearance and are seeking treatments like teeth whitening, bonding, and veneers.

- Holistic and Biocompatible Approaches: There is a growing trend towards holistic dentistry, focusing on the use of biocompatible materials and procedures that promote overall health and well-being. Patients are increasingly concerned about the safety and long-term effects of dental materials, leading to a demand for more natural and health-conscious cosmetic options.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 29.17 Billion |

| Market Size by 2034 |

USD 59.22 Billion |

| Market Growth Rate |

CAGR of 8.19% from 2025 to 2034 |

| Largest Market |

North America |

| Fastest Growing Market |

Asia Pacific |

| Segment Coverage |

By Product, End User and Regions |

Cosmetic Dentistry Market Dynamics

Drivers

Dental Tourism

- The rise in dental tourism is significantly impacting the cosmetic dentistry market. Patients from countries with high dental care costs are increasingly traveling to destinations where they can receive high-quality cosmetic dental treatments at lower prices. This trend is facilitated by the global connectivity and availability of information, enabling patients to explore and choose cost-effective options abroad.

Increased Insurance Coverage

- Improved insurance policies covering certain cosmetic dental procedures are driving market growth. As insurance companies recognize the health benefits of certain cosmetic treatments, more procedures are being included in dental plans, making them more affordable and accessible to a wider population.

Restraints

High Costs

- The high cost of cosmetic dental procedures remains a significant barrier for many potential patients. Treatments like veneers, dental implants, and advanced orthodontics can be prohibitively expensive, limiting access to those with higher disposable incomes and excluding a large portion of the population who cannot afford these services.

Lack of Awareness and Accessibility

- In many regions, particularly in low-income and rural areas, there is a lack of awareness about the benefits and availability of cosmetic dentistry. Additionally, limited access to specialized dental care facilities and professionals hinders market growth, as potential patients may not have the necessary information or resources to seek cosmetic dental treatments.

Opportunities

Technological Integration

- Advancements in technology, such as artificial intelligence, augmented reality, and teledentistry, offer immense growth potential. These innovations can enhance diagnostic accuracy, treatment planning, and patient engagement. For example, AI-powered tools can predict treatment outcomes, while augmented reality can simulate post-treatment appearances, thereby improving patient satisfaction and expanding market reach.

Emerging Markets

- Expanding into emerging markets presents a substantial opportunity. As disposable incomes rise and awareness of cosmetic dentistry increases in developing regions, there is a growing demand for aesthetic dental treatments. Companies that invest in these markets through localized marketing strategies, affordable pricing models, and partnerships with local dental practices can capture a significant share of this untapped potential.

Challenges

Regulatory Hurdles

- Navigating varying regulatory standards across different countries can be challenging for cosmetic dentistry providers. Differences in dental practice regulations, approval processes for new technologies, and certification requirements can create barriers to market entry and expansion. Compliance with these diverse regulations requires significant time, resources, and expertise.

Professional Training and Expertise

- The demand for highly skilled cosmetic dentists poses a challenge, as advanced procedures require specialized training and experience. Ensuring that dental professionals are adequately trained to use new technologies and techniques is critical. The need for continuous education and skill development can strain resources and limit the availability of qualified practitioners, impacting the quality and consistency of cosmetic dental services.

Cosmetic Dentistry Market Segmental Analysis

The cosmetic dentistry market is segmented into product, end user, and region. Based on product, the market is classified into dental systems & equipment, dental implants, dental prosthetics, and others. Based on end user, the market is classified into dental hospitals & clinics, dental laboratories, and others.

Product Analysis

Dental Systems & Equipment: The dental systems and equipment segment has registered highest market share of 22.16% in 2024. This segment is witnessing rapid advancements due to the integration of digital technologies, such as 3D imaging and CAD/CAM systems. These innovations enhance precision and efficiency in cosmetic procedures, driving market growth. Additionally, the demand for high-quality, reliable equipment supports this segment's expansion, with technological advancements continually improving patient outcomes.

Dental Implants: The dental implants segment has covered market share of 17.24% in 2024. The segment is driven by increasing awareness of long-term dental solutions and advancements in implant technology. Implants offer a durable and natural-looking alternative for missing teeth, appealing to patients seeking permanent solutions. Innovations in materials and techniques, such as improved biocompatibility and minimal-invasive methods, contribute to the segment's robust growth and patient satisfaction.

Dental Prosthetics: The dental prosthetics segment is expanding due to advancements in materials and customization technologies. Innovations like digital impressions and 3D printing are enhancing the precision and aesthetic appeal of prosthetics, such as crowns and bridges. As patients seek better-fitting, more natural-looking replacements for missing teeth, the demand for high-quality dental prosthetics continues to rise.

Orthodontics: In 2024, the orthodontics segment has recorded 13.16% of market share. The orthodontics segment is experiencing growth due to the rising popularity of clear aligners and other less visible corrective options. Advances in orthodontic technology, including digital treatment planning and personalized appliances, contribute to the segment's expansion. The increased focus on aesthetic outcomes and patient comfort drives demand for innovative orthodontic solutions, appealing to both adults and adolescents.

Teeth Whitening: The teeth whitening segment has calculated market share of 11.04% in 2024. This segment is flourishing, driven by the high consumer desire for a brighter, more attractive smile. Advances in whitening technology and the availability of both in-office and at-home products contribute to the segment's growth. As more people become conscious of their dental aesthetics, the demand for effective, safe, and convenient whitening solutions continues to increase.

Others: The others segment has measured share of 36.40% in 2024. The others segment encompasses various cosmetic dental procedures and products, including bonding, veneers, and gum reshaping. This segment benefits from the growing interest in comprehensive smile makeovers and the increasing availability of specialized treatments. Innovations and personalized options in this diverse category cater to specific patient needs, contributing to its steady growth and market presence.

End User Analysis

Dental Hospitals & Clinics: The dental hospitals and clinics segment has captured highest market share of 62.1% in the year of 2024. Dental hospitals and clinics are experiencing growth due to rising patient demand for cosmetic procedures and the increasing availability of advanced technologies. The trend towards integrating state-of-the-art equipment and offering a range of cosmetic treatments, from teeth whitening to implants, drives their expansion. Additionally, these institutions are investing in patient-centered care and personalized treatment plans to enhance outcomes.

Dental Laboratories: Dental laboratories segment has generated 27.34% of market share in 2024. Dental laboratories are seeing increased demand driven by advancements in dental technology and materials. The trend towards digital workflows, such as 3D printing and CAD/CAM, enhances the precision and efficiency of prosthetics and restorations. Laboratories are also expanding their services to include customized solutions, supporting the growing need for high-quality, personalized cosmetic dental products.

Others: The others segment has garnered 10.56% of market share in the year of 2024. The others segment includes various end users such as dental supply companies and educational institutions. This segment benefits from the expanding market for cosmetic dentistry, driven by increasing consumer awareness and technological advancements. Educational institutions are investing in training programs, while supply companies are developing and distributing innovative products to support the growing demand for cosmetic dental treatments.

Cosmetic Dentistry Market Regional Analysis

Why North America is leading in the cosmetic dentistry market?

The North America market size is expected to reach around USD 22.44 billion by 2034 increasing from USD 10.21 billion in 2024 with a CAGR of 7.90%. North America dominates the cosmetic dentistry market due to high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on aesthetic appearance. The presence of leading market players and widespread adoption of advanced dental technologies drive growth. Additionally, increasing awareness about dental aesthetics and a high prevalence of dental issues contribute to the robust demand for cosmetic dental procedures in this region.

Why Asia Pacific is experiencing significant growth in the cosmetic dentistry market?

The Asia Pacific market size is calculated at USD 6.87 billion in 2024 and is projected to grow around USD 15.10 billion by 2034 with a CAGR of 10.27%. Asia-Pacific is witnessing rapid growth in the cosmetic dentistry market, fueled by increasing disposable incomes, improving healthcare infrastructure, and rising awareness about dental aesthetics. Countries like China, India, and Japan are key contributors, with a growing middle class seeking aesthetic enhancements. The expanding dental tourism industry, particularly in countries offering cost-effective treatments, also drives market expansion in this region.

Europe Cosmetic Dentistry Market Trends

The Europe market size is measured at USD 7.73 billion in 2024 and is expected to grow around USD 17 billion by 2034 with a CAGR of 8.52%. Europe represents a significant share of the cosmetic dentistry market, driven by rising aesthetic consciousness and a growing aging population seeking dental restorations. Countries like Germany, the UK, and France lead in technological advancements and adoption. Public and private dental insurance schemes supporting cosmetic procedures, along with a well-established dental care system, further bolster market growth in this region.

LAMEA Cosmetic Dentistry Market Trends

The LAMEA market size is forecasted to reach around USD 4.68 billion by 2034 from USD 2.13 billion in 2024 with a CAGR of 6.90%. LAMEA shows promising growth potential in the cosmetic dentistry market, driven by increasing urbanization and rising aesthetic awareness. Countries like Brazil and UAE are notable for their advanced dental care facilities and growing medical tourism sector. However, market growth is tempered by economic disparities and varying levels of access to advanced dental care across the region. Efforts to improve dental health infrastructure and affordability are key to future growth.

Cosmetic Dentistry Market Top Companies

New players like Keystone Dental, Inc. and Biolase, Inc. are leveraging cutting-edge technologies and niche market focuses to gain traction in the cosmetic dentistry market. Keystone Dental specializes in advanced implant systems, while Biolase pioneers in laser dentistry for minimally invasive procedures. Dominating players like Align Technology, Inc., and Dentsply Sirona Inc. drive market growth through continuous innovation and strategic collaborations. Align Technology's Invisalign system revolutionized orthodontics, while Dentsply Sirona's integration of digital solutions enhances treatment efficiency. Collaborations, such as Align's partnerships with dental professionals and Dentsply Sirona's alliances with tech firms, further their market dominance through comprehensive and advanced dental care solutions.

CEO Statements

- Joe Hogan, CEO of Align Technology, Inc.: "Our commitment to innovation and transforming smiles through our Invisalign system continues to drive growth and redefine the orthodontic industry."

- Donald M. Casey Jr., CEO of Dentsply Sirona Inc.: "We are dedicated to advancing dental care through our integrated solutions and digital technologies, empowering dental professionals worldwide to deliver superior patient outcomes."

- Amir Aghdaei, CEO of Envista Holdings Corporation (Danaher Corporation's dental segment): "By focusing on innovation and customer-centric solutions, we aim to lead the transformation of dental care and enhance the quality of life for patients globally."

- Marco Gadola, former CEO of Institut Straumann AG: "Our vision is to be the most customer-focused and innovative oral care company, providing exceptional solutions that address the diverse needs of dental professionals and patients."

- Juan-José Gonzalez, CEO of Ambu A/S (parent company of Nobel Biocare): "We strive to deliver cutting-edge implantology and digital dentistry solutions, driving progress in dental care and improving patient experiences through our commitment to excellence."

- Stanley M. Bergman, CEO of Henry Schein, Inc.: "Our focus on providing comprehensive solutions, coupled with our deep partnerships within the dental community, allows us to support the evolving needs of dental practices and enhance patient care."

Recent Developments

- In June 2023, Aseptico, a dental equipment manufacturer, introduced the AEU-1070 Implant Motor. This compact device features a multifunction foot control and an intuitive interface, streamlining dental implant procedures.

- In May 2023, Henry Schein Inc., a healthcare product and service provider, announced a definitive agreement to acquire S.I.N. Implant System. This acquisition is expected to enable Henry Schein to meet the growing demand for bone regeneration products and implants in both emerging and developed nations.

- In December 2022, ProSmile launched SmartArches Dental Implants, specializing in affordable and reliable dental implant services. Initially serving patients in New Jersey and Pennsylvania, SmartArches plans to expand to eight additional states in 2023.

- In June 2022, ZimVie Inc. launched the FDA-cleared T3 PRO Tapered Implant and Encode Emergence Healing Abutment in the United States. The T3 PRO, an addition to ZimVie's family of dental implants, builds on the proven solutions of the T3 Tapered Implant.

- In March 2021, Crest introduced Crest Whitening Emulsions, a new teeth whitening treatment. This product uses active hydrogen peroxide droplets to effectively remove stains and enhance teeth whitening.

- In January 2021, Nobel Biocare launched Xeal and TiUltra implant and abutment surfaces in the United States. These surface treatments are designed to promote tissue integration at every level of the implant.

Market Segmentation

By Product

- Dental Systems & Equipment

- Dental Implants

- Dental Prosthetics

- Orthodontics

- Teeth Whitening

- Others

By End User

- Dental Hospitals & Clinics

- Dental Laboratories

- Others

By Region

- North America

- APAC

- Europe

- LAMEA