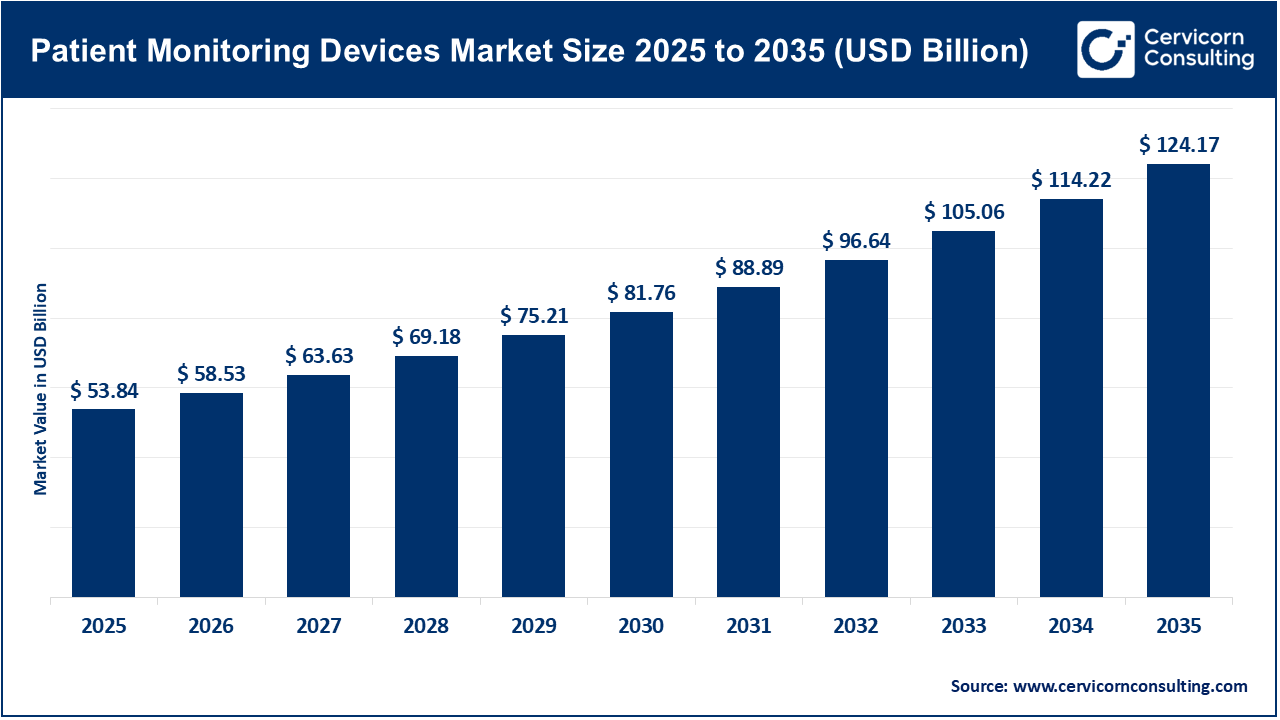

The global patient monitoring devices market size was estimated at USD 53.84 billion in 2025 and is expected to be worth around USD 124.17 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.72% over the forecast period 2026 to 2035. The global patient monitoring devices market is driven by the increasing burden of chronic disease (such as cardiovascular disease, diabetes, and respiratory conditions) coupled with the world's aging population, which is driving demand for continuous multi-parameter monitoring. Technological developments have also contributed as well; the advent of wireless connectivity, wearables, cloud features, and remote monitoring facilitate increasingly flexible care and pro-active patient management in a home/community environment.

In addition to clinical demand and technology evolution, there are structural forces in the market associated with the shift from episodic care to value based care, and the proliferation of outpatient and home care. The focus on cost containment, reduction of hospital length of stay (LOS), and improved outcomes help reinforce a case for monitoring devices that allow for early detection and intervention. Adoption is also being supported by the evolving reimbursement environment in many regions, as well as telehealth models that expand the use of monitoring devices from hospitals to ambulatory and home-based settings.

What are patient monitoring devices?

Patient monitoring devices are medical devices that monitor, record, and display vital physiological data about patients on a continuous or intermittent basis to evaluate their health status and detect any abnormalities. They allow health care professionals to monitor such critical signs as heart rate, blood pressure, oxygen saturation, temperature, and respiratory rate. The use of patient monitoring devices can facilitate timely diagnosis and intervention, which can save the patient’s life. These devices are in use in hospitals and clinics, and increasingly in home-care, because they support real-time monitoring of patients and the remote management of patients.

Types of patient monitoring devices:

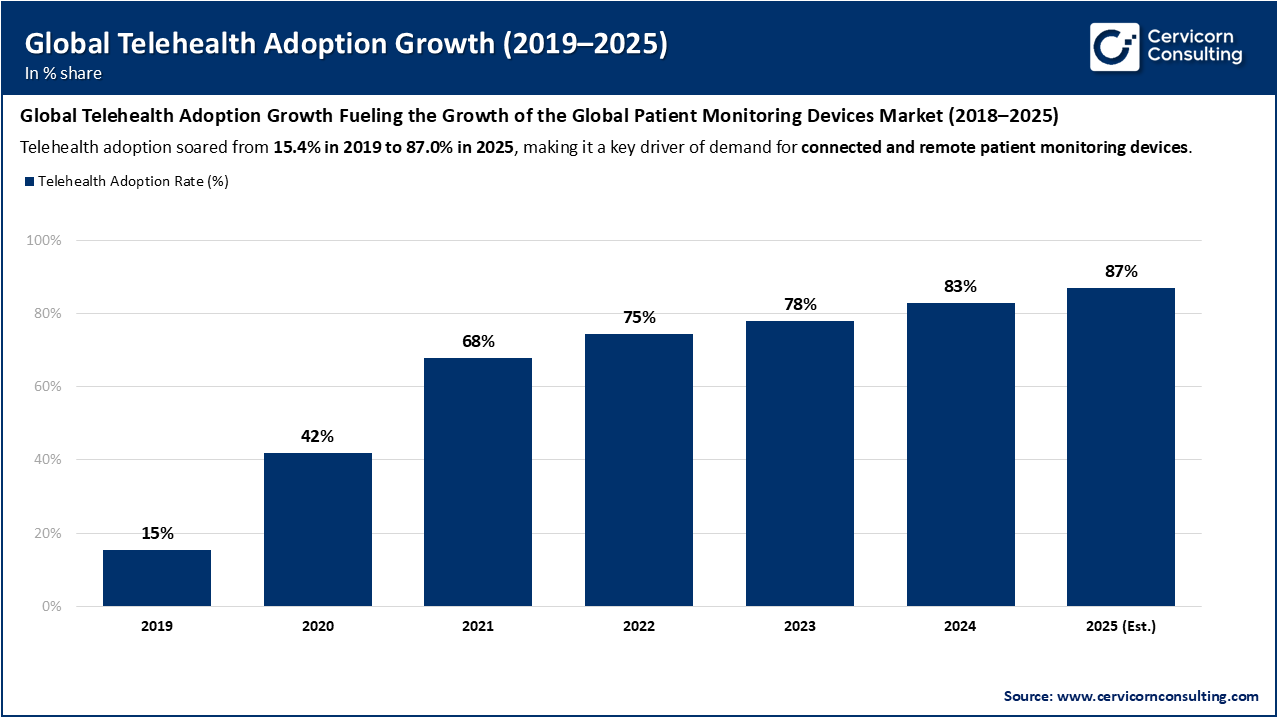

Rising Telehealth Adoption Accelerating Patient Monitoring Devices Market Growth

The rapidly increasing adoption of telehealth and telemedicine services is a critical factor driving the patient monitoring devices market as healthcare systems move toward remote and digital care delivery. By integrating connected monitoring technologies, clinicians can monitor patients’ underlying health metrics continuously and in real time, irrespective of the patient’s location. In this manner, access to care and continuity of health management are improved for patients dealing with chronic diseases, after acute care, and their overall life management. Wearable sensors, mobile health applications, and remote diagnostic tools connected to cloud processing all allow for data transmission straight to the healthcare provider, enabling timely intervention, reduced hospital readmissions, and improved efficiency. The growing use of telehealth systems improves patient outcomes and convenience. Telehealth systems also help enable cost-effective, value-based care, further improving global acceptance of patient monitoring technology utilization.

The rapid transformation of telehealth usage, jumping from 2019 levels to the predicted usage in 2025, is clearly a driver for the patient monitoring devices industry. The widespread acceptance of virtual consultations and telehealth has made the connected, real-time, wearable monitoring solution increasingly compelling. The continuous visibility of patients’ vital signs outside of the hospital offers improved outcomes while reducing the healthcare cost burden. Thus, it is evident that the increased adoption of telehealth platforms and their various features have evolved patient monitoring from hospital to a central pillar of a digital and home care ecosystem.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 58.53 Billion |

| Estimated Market Size in 2034 | USD 124.17 Billion |

| Projected CAGR 2026 to 2035 | 8.72% |

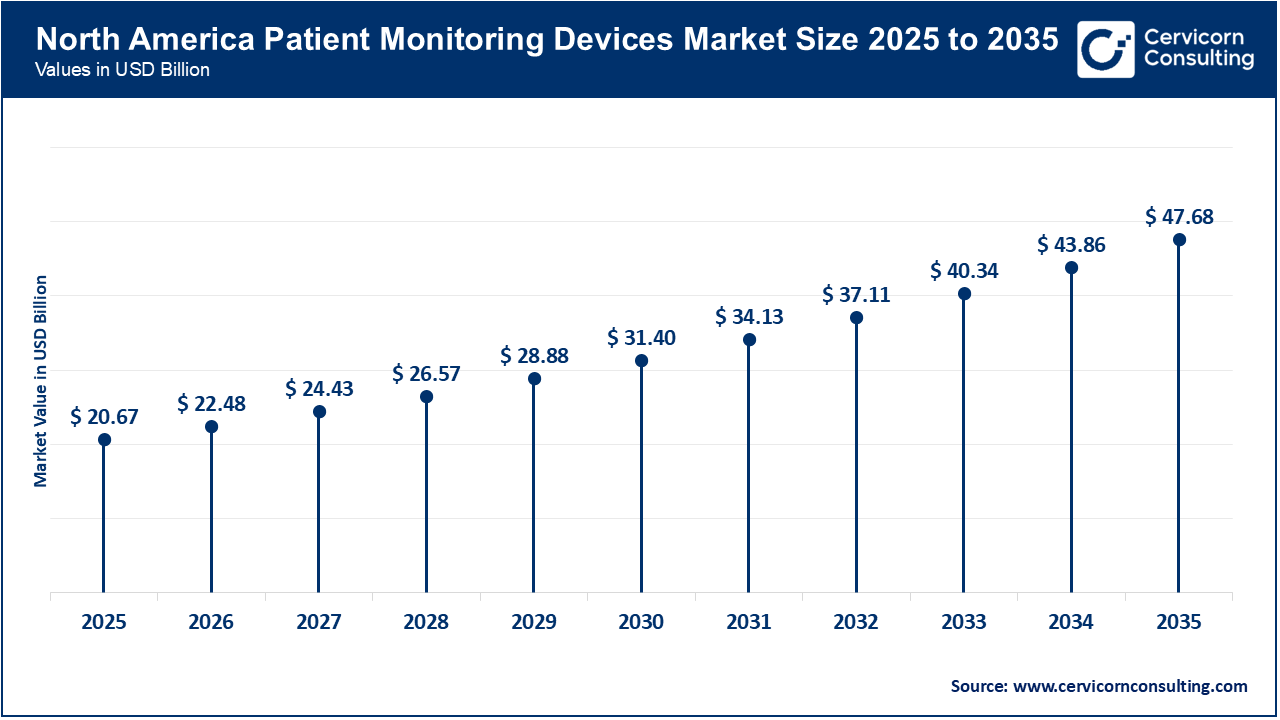

| Top-performing Region | North America |

| Fastest Expanding Area | Asia-Pacific |

| Key Segments | Product, End-use, Region |

| Key Companies | Boston Scientific Corporation, Hill-Rom Holdings, Inc., Natus Medical, Abbott Laboratories, Edwards Lifesciences Corporation, Koninklijke Philips N.V., OMRON Corporation, Compumedics Limited, Masimo Corporation, Medtronic plc, Nihon Kohden Corporation, GE Healthcare, Drägerwerk AG & Co. KGaA, Getinge AB |

Rising Prevalence of Chronic Illness: The increasing prevalence of chronic illness, such as cardiovascular, diabetes, hypertension, respiratory, are significant drivers of patient monitoring devices market. In order to control symptoms and avoid complications, patients with chronic illnesses may need to have their health evaluated accurately and continuously. As health systems are advocating for earlier diagnosis and non-treatment of illnesses and conditions, there has been an accelerating increase in the use of monitoring devices to help monitor human dynamics, there are diagnostics system dedicated specifically to some conditions such as ECG monitors, glucose meters, pulse oximeters. Additionally, the increase in older adults within developed and developing countries also put a demand for such devices because older patients generally require greater and longer-term management for comorbidities.

Increased Use of Telehealth and Remote Monitoring Practices: The digital transformation of healthcare due to COVID-19, telehealth and remote monitoring became an accepted practice for both patients and providers overall. Health care users and providers rely more and more on connected remote monitoring systems as a take on virtual practice, but also for ongoing monitoring system of patient health data, and sharing health data. Providers have shifted practice toward remote monitoring to better respond effectively to health information greatly reducing the need to go to urgent care, emergency, or other facilities. Overall, remote monitoring systems increase patient's comfort for receiving ongoing monitoring in their familiar environment. The connection between AI, IOT, and cloud analytics is also improving the accuracy of diagnostic care as health care providers use remote patient monitoring in diagnostic care.

High Cost of Advanced Monitoring Devices: One of the major barriers hindering the patient monitoring devices market is the high cost associated with purchasing, installing, and maintaining advanced systems. Invested in and powered by AI, multi-parameter monitoring devices and connected wearables tend to have large upfront cost barriers to entry and may limit accessibility for low-income areas and small health care facilities. Additionally, there are recurring expenses for staff training, connectivity infrastructure, and software upgrades, all of which can put a strain on hospital budgets, particularly in health systems with limited resources.

Data Security and Privacy Concerns: As monitoring devices utilize more digital connectivity and cloud-based data transfer, data privacy, and associated security issues are becoming more evident. Data breaches, hacking, and misuse of private patient health record data are some of the major barriers to market growth. Compliance with stringent regulations, such as HIPAA (in the U.S.) and GDPR (in Europe), adds to the burden, because secure data and infrastructure must be supplied, which is neither simple nor cheap. For these and other reasons, data security and privacy will be a factor in curbing the adoption/usage rate of monitoring devices and will inhibit hospitals from fully utilizing these devices.

Expansion of Home Healthcare and Wearable Technology: A global trend toward home healthcare and personalized medicine is presenting new growth opportunities for the patient monitoring devices market. Wearable devices (smart watches, biosensors, or fitness trackers) have multiple advanced features that will now continuously monitor heart rate, oxygen saturation, sleep, etc. Not only are these devices allowing the patient to play a more active role in their health by promoting less visits to hospital and provider settings, but they also allow a more objective flow of data to the hcp, which supports preventive care and early diagnosis, and ultimately better outcomes for the patient and system.

Growth Potential in Emerging Markets: The developing world, particularly in Asia-Pacific, Latin America, and portions of the Middle East, are being rapidly upgraded regarding healthcare infrastructure and warmly supported by locally and internationally supported digital health initiatives. Due to rising costs of healthcare and greater awareness of chronic disease management on behalf of patients, and young and developing telecommunication networks, many developing areas are ideal candidates for market expansion. Also, manufacturers are increasingly turning to developing nations to market cost-effective, inserted, and non-intrusive monitoring solutions as potential growth opportunities.

Interoperability Issues Among Devices: Interoperability continues to be a significant issue for the patient monitoring devices market. Devices from manufacturers still have non-standardized data forms, software systems, and communication protocols and cannot integrate smoothly into hospital information systems and EHRs. Lack of small scale interoperability limits applications and analysis of data across devices, and burdens clinical workflows increasing overall inefficiencies with patient care. Efforts to establish global interoperability standards are currently being pursued, but many of the advances remain fragmented at this time, prohibiting full realized value of connected healthcare ecosystems.

Shortage of Skilled Professionals: Advanced technology with monitoring systems requires qualified and experienced people in order for them to be operated and meaningfully used. However, many clinics and healthcare institutions particularly in developing countries do not have trained clinicians, technicians, or IT professionals to leverage complex monitoring data into meaningful information. This shortage of trained personnel will result in a full underutilization of available technologies and the monitoring of patients. Similarly, until it can be recognized and addressed, the full capabilities of smart monitoring devices cannot be achieved, resulting in a critical problem for long-term industry growth.

The patient monitoring devices market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America patient monitoring devices market size reached at USD 20.67 billion in 2025 and is expected to be worth around USD 47.68 billion by 2035. North America dominates the market, propelled by advanced health systems, widespread adoption of digital health technologies, and increases in chronic diseases, such as diabetes, cardiovascular disease and obesity. The U.S. is particularly predominant in North America, driven significantly by large investments in telehealth and AI-enabled monitoring systems in a fully reimbursed remote patient monitoring environment. Trends for growth are also supported in North America because of the prominent players in the industry including Medtronic, GE HealthCare and Philips Healthcare, who are at the forefront of technology development and increasing market share. The expansion of home health care, and systems that include IoMT (Internet of Medical Things) systems will also continue to drive advancements in the market

Recent Developments:

The Asia-Pacific patient monitoring devices market size reached at USD 12.76 billion in 2025 and is expected to be worth around USD 29.43 billion by 2035. The Asia-Pacific region is the fastest growing region when it comes to new developments in patient monitoring devices, and marks a growing area of development in the future of care delivery. Countries such as China, India, Japan and South Korea are witnessing the digital evolution of healthcare as a result of government-led initiatives to provide smart hospitals and remote monitoring systems. Increasing attention on healthcare, affordability of wearable devices and smartphone penetration are driving the growth of adoption and utilization of wearable and monitor technology by healthcare and consumers. Local manufacturing and partnerships with global medtech companies are an additional consideration for adoption to reduce costs and increase access in urban and rural areas.

Recent Developments:

The Europe patient monitoring devices market size reached at USD 15.78 billion in 2025 and is expected to be worth around USD 36.38 billion by 2035. Europe holds a major share of the patient monitoring device market, due to significant government initiatives pushing the digital health agenda, an increasingly aging population, and increases in value-based care. Countries like Germany, the U.K., and France are leading among public and private health systems using remote patient monitoring (RPM). Due to the European Union's strong emphasis on data security and interoperability standards and high levels of acceptance of wearable technology, a connected and patient-centered healthcare ecosystem is being fostered. In addition, advances in telemedicine and chronic disease management initiatives are enabling growth across the region.

Recent Developments:

Patient Monitoring Devices Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.4% |

| Asia-Pacific (APAC) | 23.7% |

| Europe | 29.3% |

| LAMEA | 8.6% |

The LAMEA patient monitoring devices market size reached at USD 4.63 billion in 2025 and is expected to be worth around USD 10.68 billion by 2035. The LAMEA region has emerging opportunities in the market driven by advances in health related infrastructure, prevalence of noncommunicable diseases, and government initiatives to improve access to timely and quality care. Although budget constraints and unequal access to implementation remain issues, partnerships between global medical device companies and healthcare teams will drive development in the region.

Recent Developments:

The patient monitoring devices market is segmented into product, end-use, and region.

The cardiac monitoring devices segment dominates the market due to increased cardiovascular disease rates and the need for real-time cardiac data. The leading cause of death worldwide is heart illness, which is encouraging health providers to employ ECG equipment, implantable loop recorders, and mobile cardiac telemetry. For patients, wireless and AI technology in smart ECG devices and wearable ECG monitors have improved efficiency, convenience, and reflectivity. Innovations like cloud ECG analytics and smart phone patches have increased diagnostic accuracy and encouraged proactive therapy. This segment of patient monitoring devices dominates the market due to clinical demand to meet patient population growth, technical advancement, and integration with remote monitoring systems.

Blood glucose monitoring devices are expected to be the fastest-growing segment due to rising diabetes diagnoses worldwide. Continuous glucose monitoring (CGM) systems and other wear monitoring sensing devices provides patients and carers real-time glucose level monitoring and reducing the need for finger stick blood sugar testing. Digitized connectivity also allows clinicians to document highlighted glucose data from CGM devices via an app or similar device/laptop computer incorporation into telehealth services, improving glucose adjustments and individual treatment. Awareness of diabetes control and preference for minimally invasive technologies have increased. All of these factors are driving home care and outpatient blood glucose monitoring device segment growth.

Patient Monitoring Devices Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Cardiac Monitoring Devices | 15.6% |

| Blood Glucose Monitoring Systems | 14.8% |

| Multi-parameter Monitoring Devices | 13.4% |

| Respiratory Monitoring Devices | 11.2% |

| Temperature Monitoring Devices | 9.7% |

| Hemodynamic/Pressure Monitoring Devices | 8.9% |

| Fetal & Neonatal Monitoring Devices | 7.6% |

| Neuromonitoring Devices | 6.3% |

| Weight Monitoring Devices | 6.0% |

| Other Devices | 6.5% |

Hospitals will continue to rule the patient monitoring device market. This is due to actual patient influx, real-time patient monitoring, type and availability of advanced technology, continuous patient monitoring needs in critical care, and health providers using the full range of patient monitoring devices in the ICU, emergency department, and post-operative care. Hospitals using integrated patient monitoring services share patient data across departments, which health professionals say improves decisions and efficiency. Due to the large reimbursement options for patient monitoring, high-acuity monitoring and artificial-intelligence products will be adopted in hospitals, and health system functioning will always be compared to patient monitoring and other safety standards.

Home care settings will be the fastest growing end-use segment as a result of a global shift towards patient-centered care and remote monitoring care solutions. Home patient monitoring devices, especially wearable sensing monitors, wireless connectivity, and telemedicine services, have improved significantly. Recent research shows that patients can monitor vital signs at home and anticipate outcomes as well as hospital patients. With a growing number of chronic disease patients and an ageing population, patients and health providers want cheaper, non-invasive care and fewer patient visits. Remote patient monitoring minimizes readmissions and improves access in remote locations, so health systems can accommodate rising populations. Patient monitoring gadgets will become more popular in the home as health systems move towards decentralized solutions.

Industry Leaders’ Perspectives: Voices Shaping the Future of Patient Monitoring Devices (2025):

Geoff Martha – Chairman & CEO, Medtronic plc

“Connected care is not just about devices any longer; it’s about creating an intelligent ecosystem that anticipates the needs of the patient before the clinician intervenes.”

Martha expects the patient monitoring devices market to move towards predictive, continuous, and personalized care driven by AI and data analytics. Under his stewardship, Medtronic has been focused on enhancing remote monitoring, while also embedding smart sensors into the normal delivery of care thus linking the COVID hospital and home, which is very much in keeping with this new notion of connected care. His perspective indicates a shift away from traditional, reactive monitoring to proactive management of health; in other words, technology putting actionable information into the hands of clinicians reducing their workloads while improving patient engagement through real-time, cloud-connected systems.

Peter Arduini – President & CEO, GE HealthCare

“We’re going from monitoring to meaningful insights - where data becomes actionable implementations that save lives.”

Arduini believes the market for patient monitoring devices is entering a phase during which innovations such as artificial intelligence and edge computing will completely remake the delivery of care for patients. GE HealthCare is focused on research to develop monitors that are wearable and wireless, that leverage AI to provide real-time analytics, and decrease response times in emergencies. His perspective reflects a collective gaze in the industry towards intelligent automation, reliability in the diagnostic process, and clinician-facing products that are capable of converting large streams of patient data into clinical action that improve patient outcomes and operational efficiencies.

Market Segmentation

By Product

By End-use

By Region