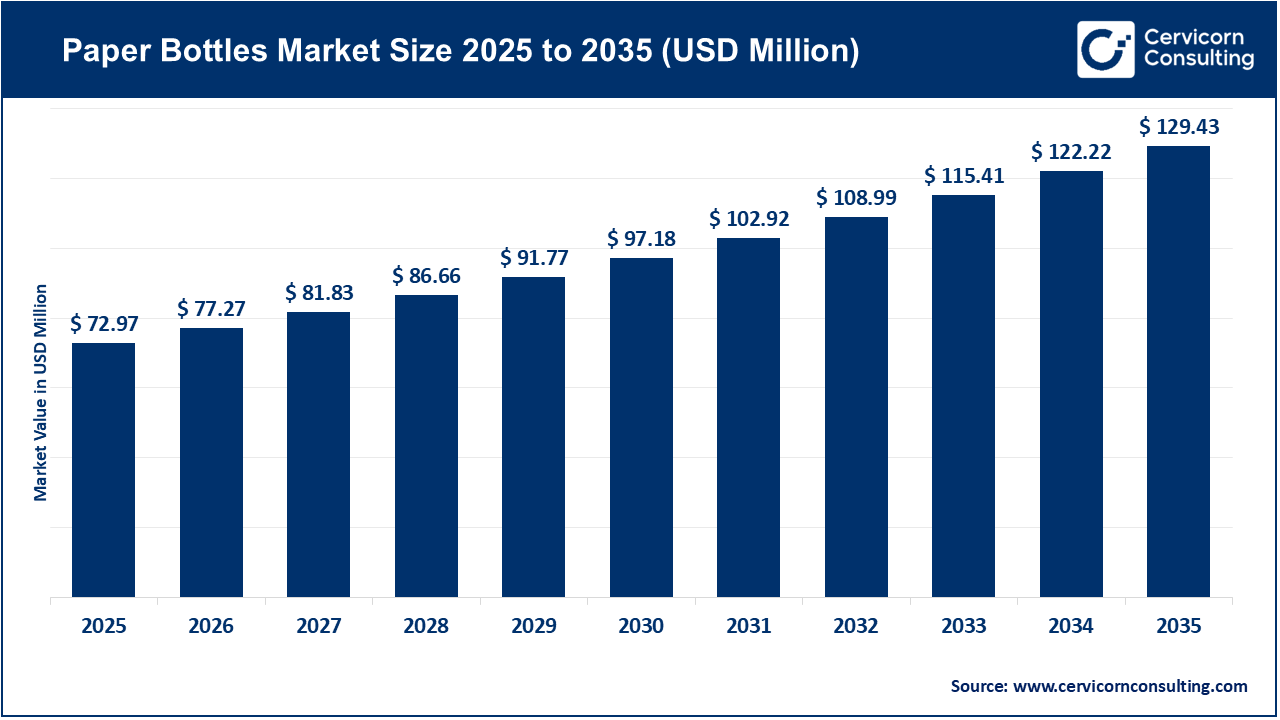

The global paper bottles market size was valued at USD 72.97 million in 2025 and is expected to reach around USD 129.43 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.95% over the forecast period from 2026 to 2035. The rise in environmental awareness and stricter laws regarding the reduction of single-use plastics are two factors contributors to the growth of the paper bottle market. In Europe and parts of North America, numerous government programs, such as bans, taxes, and Extended Producer Responsibility (EPR) programs, have created incentives to develop new products that are recyclable and compostable. Many consumers are demanding sustainable, low-carbon package options, and as a result, beverage, personal care, and household product brands are moving to use paper bottles in place of standard plastic bottles. Strong ESG commitments made by many large global brands and retailers are creating additional incentives for organizations to pursue paper bottle alternatives to traditional plastic bottling.

Technological advancements in paper-based packaging and barrier coatings are also driving substantial growth in the paper bottle market. Many of these new technologies have improved the strength, durability, and liquid-holding capabilities of paper bottles. The adoption of innovative technologies, such as molded fiber technology, water-resistant lining systems, and recyclable bio-barriers, continues to expand the commercial scope of paper bottles while maintaining the integrity of the product in terms of safety and shelf life. In addition, increasing demand for paper-based bottles from North America as a result of growing awareness regarding sustainability and rapid growth in the Asia-Pacific region driven by urbanization, an expanding middle-class consumer base, and government support for green packaging. All of these factors have positioned paper bottles as a viable long-term alternative to plastic packaging.

Government Regulations and Plastic Bans Driving the Shift toward Paper Bottles

The market for paper bottles is being driven in large part by government investments and bans on single-use plastics, as lawmakers around the globe have increased the amount of regulation on reducing plastic waste and carbon emissions. Regulations such as plastic bottle taxes, outright bans on specific types of plastic packaging, mandatory targets for using recycled materials, and EPR (Extended Producer Responsibility) programs are motivating manufacturers to adopt sustainable alternatives. Europe is leading the way with stringent EU Packaging Directives. However, North America & Asia-Pacific are working to develop similar regulatory roadmaps to reduce dependence on plastics. These new policies have increased bot h the cost and compliance burdens associated with using plastic packaging and have provided strong motivation for new product development and commercialization of paper bottles, thus accelerating the acceptance of this type of product in various industries such as beverage, personal care & household.

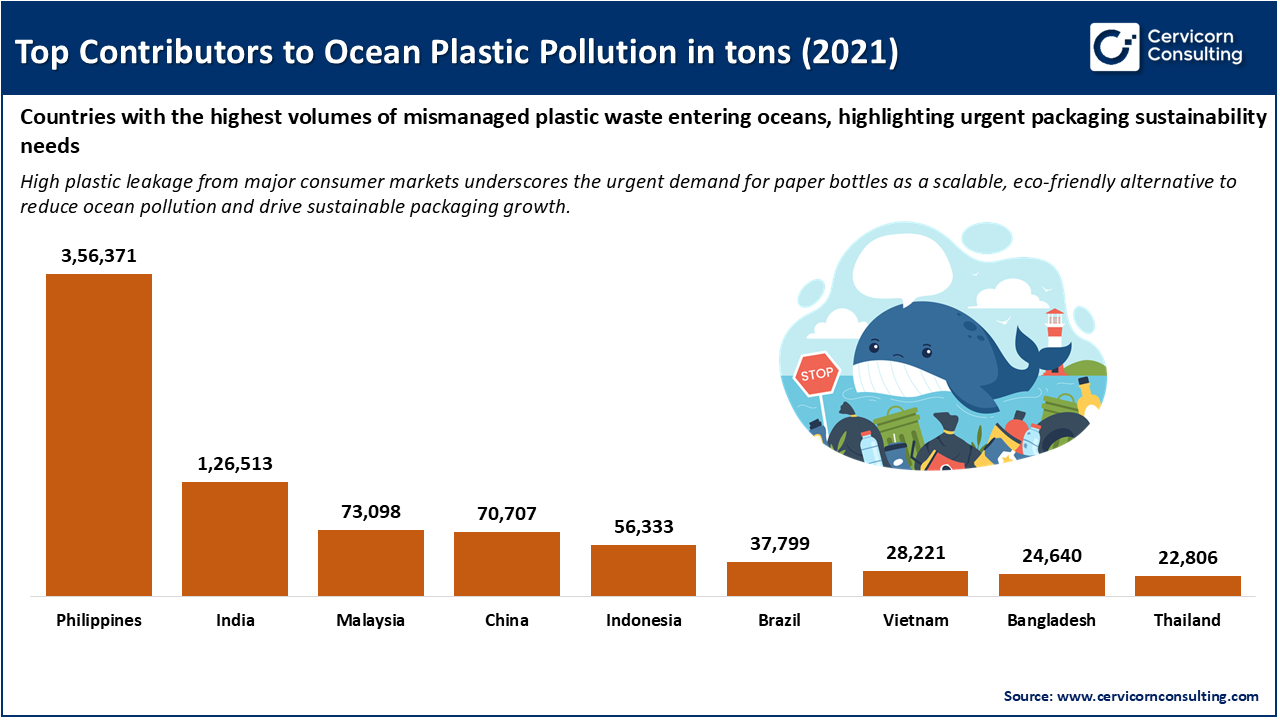

Rising Ocean Plastic Pollution Accelerating the Shift to Paper Bottles

Ocean plastic pollution data highlights the urgent need for sustainable packaging alternatives. In 2021, the Philippines alone released over 356,000 tons of plastic waste into the ocean, while India contributed more than 126,000 tons, with several other Asian countries adding tens of thousands of tons each year. Globally, around 11 million tons of plastic enter the oceans annually, and packaging accounts for over 40% of total plastic use. These figures are driving stricter regulations and corporate commitments to cut plastic consumption, accelerating the adoption of paper bottles as a recyclable, lower-impact alternative and supporting the growth of the paper bottle market.

1: Large-Scale Capital Investment in Advanced Manufacturing Facilities

The paper bottle company (Paboco) was honored by the successful launch of their first commercial-scale production line, moving from experimental pilots to large-volume manufacturing. The launch of a next-generation fiber-forming technology designed to produce millions of paper bottles per year with much lower plastic liner content was the major impetus driving this effort with the global brand. Owners are facing targets for sustainability, coinciding with compliance with the European Union's Packaging and Packaging Waste Regulation (PPWR) initiative requiring all member states to increase overall recyclability. This investment validates market optimism that fiber-based liquid packaging can meet high durability and barrier performance requirements of high market distribution, with a much lower carbon footprint compared to traditional PET or glass containers.

2: National Policy Frameworks Enabling Renewable Packaging Solutions

The European Union implemented the packaging and packaging waste regulation, making a significant government-driven milestone that changed the market's trajectory. Government initiatives are a major driver, mandating recycled content requirements and requiring all packaging sold in the EU to be fully recyclable. For the paper bottle category, this regulation has expedited the transition to mono-material fiber options and moved manufacturers through the early phases of eliminating multi-material laminates that are impossible to recycle. Designing for recycling has now become a legal requirement. This regulatory certainty is allowing investors to finance capital investments in new paper bottle technologies, as sustainability is no longer simply corporate citizenship but a requirement to participate in the market.

3: Collaborative R&D for Bio-based Material Development

In 2025, a large investment was made in Pulpex, a leader in moulded fibre, to establish paper bottle manufacturing regions in both North America and Asia Pacific. This process reflects the global driver of supply chain resilience and producing sustainable packaging closer to consumers to reduce scope. The government also supported favorable policy frameworks such as the Executive Order on Advancing Biotechnology and Biomanufacturing Innovation and provided funding for investment to produce renewable materials. This unprecedented capital access provides for the expansion of R&D centers on advanced bio-based liners and will ensure future products can yield more robust quality paper bottles that can contain, for example, carbonated beverages and beer, which has historically presented major technical challenges for fiber-based structures.

4: Government-Supported Infrastructure for Circular Supply Chain Resilience

In 2025, the Ministry of Industry and Information Technology (MIIT) in China start Initiative such as the National Green Packaging, a comprehensive subsidy program to accelerate bio-based packaging. This initiative has become the strong growth for the paper bottle market in Asia, with a targeted focus on personal care and cosmetics. The Chinese government is supporting companies that use fiber-based bottles for daily use with a subsidy to initiate domestic manufacturing. This type of government action is necessary to address the global plastic waste epidemic in the most populated market and intends to position China as a leader in green chemistry. The initiative will ensure that the proper infrastructure is scaled to produce and recycle bio-based materials and create a robust circular supply chain.

The paper bottles market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Europe paper bottles market size was estimated at USD 21.16 million in 2025 and is projected to surge around USD 37.53 million by 2035. Europe is an advanced and established market for paper bottles largely due to strong regulations that penalize plastic waste and incentivize circular economy structures. Major policies and initiatives such as the Single-Use Plastics Directive and Extended Producer Responsibility (EPR) schemes have created a legal structure whereby manufacturers are incentivized or potentially compelled to seek alternatives that are sustainable packaging solutions. In addition, EU consumers are environmentally aware and, in fact, are willing to pay a premium for sustainable packaging. Additionally, Europe has become a global hub for paper bottles, featuring many of the world's leading and most disruptive packaging startups and global research initiatives.

Recent Developments:

The Asia-Pacific paper bottles market size was reached at USD 17.51 million in 2025 and is forecasted to surpass around USD 31.06 million by 2035. Asia-Pacific region is the fastest-growing market, driven by the rapid growth of urbanization, the emergence of a growing middle class, and the expansion of the largest e-commerce market. The across many cities, such as in China, India, and Southeast Asia, expands the need for packaged consumer goods while overall consumer awareness about plastic pollution is growing. Paper bottles provide an alternative that is still lightweight and durable for e-commerce delivery consumption, which is a major consumer driver in this region. Many Asian governments are developing new waste management policies aimed at preventing ocean plastic pollution, which is beneficial for the growth of the paper packaging industry.

Recent Developments:

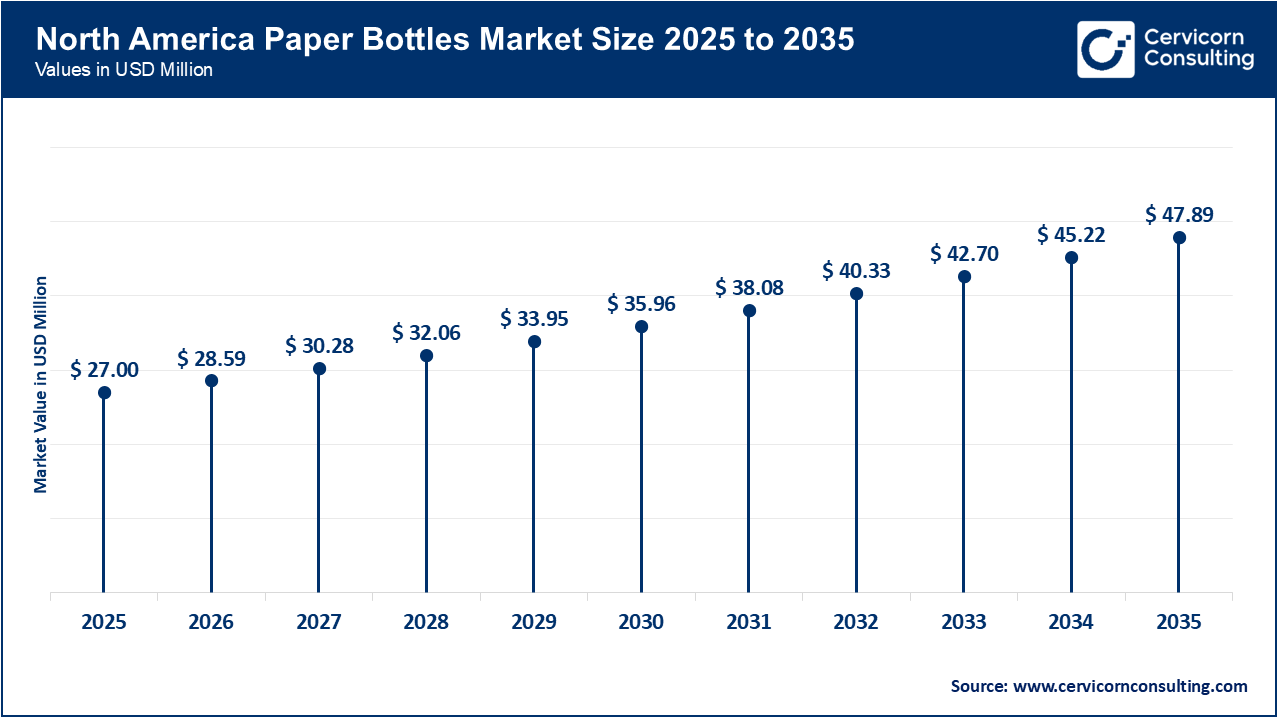

The North America paper bottles market size was estimated at USD 27 million in 2025 and is expected to hit around USD 47.89 million by 2035. The North America region has primarily benefitted from strong consumer preference for sustainable products as well as voluntary sustainability guidelines from retailers. In the U.S., the federal rules are not as stringent as they are in Europe but The Environmental, Social, and Governance (ESG) practices of large retailers like Walmart and Target is likely putting pressure on their suppliers to cut down their plastic footprints. In North America, the lack of plastic has created greater attention related to convenience items that consumers can responsibly purchase for guilt-free consumption, which is driving the need for paper bottles. In addition, North America has significant venture capital and material science expertise to help commercialize new barrier technologies, which, together, will accelerate the chances of broad paper bottle acceptance and limited product launches in paper format.

Recent Developments:

Paper Bottles Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 37% |

| Europe | 29% |

| Asia-Pacific | 24% |

| LAMEA | 10% |

The LAMEA paper bottles market was valued at USD 7.30 million in 2025 and is anticipated to reach around USD 12.94 million by 2035. In Latin America and the Middle East & Africa, the regions are not connected with the underlining societal and economic issues that feed the waste of plastic packaging. Rather, the new opportunities include the sense of environmental awareness and a few ways to improve waste management. In many areas of the region, the recycling infrastructure for plastics is limited, making biodegradable and compostable paper bottles a more attractive option than traditional plastic bottles. The green packaging would align well with the luxury tourism industry, providing effective methods to preserve the pristine images of natural tourist environments. Thus, new and exciting opportunities for expanded green packaging solutions have emerged due to the growing international conditions that require a decrease in plastic waste.

Recent Developments:

The paper bottles market is segmented into capacity, primary usage, end use, and region.

The 101 ml to 500 ml (medium) segment is the dominant segment of the global paper bottling market, as it most closely reflects consumers' existing consumption patterns. This size range matches the existing bottled size of bottled waters, single-serve drinks, and staples in a consumer's day-to-day consumption. From a production perspective, 101 ml to 500 ml bottles offer a solid development in structural integrity and use of materials, as the hydrostatic pressures produced by the liquid are low enough for overall hydrostatic pressure to be managed with existing fiber-based barrier technology. Additionally, humanely, from a standard retail perspective, medium-capacity bottles almost stand alone with existing shelf placements in standard vending machines and shelving spaces for existing PET bottled beverages.

Paper Bottles Market Share, By Capacity, 2025 (%)

| Capacity | Revenue Share, 2025 (%) |

| 101 ml to 500 ml (Medium) | 50% |

| Above 500 ml (Large) | 30% |

| 15 ml to 100 ml (Small) | 20% |

The above 500 ml segment is expected to be the fastest-growing capacity segment due to the need for more sustainable packaging for home-sized products. As consumers become more conscious of the environment and seek alternatives for bulk-sized grocery products such as milk, cleaning products, and family-sized beverages. The advancement in bio-based products and the development of reinforced paper structures has allowed manufacturers to create larger bottles that can hold their shape and stay leakproof longer compared to existing products. Larger formats represent a strategic turn for the market to accelerate the bulk plastic for waste generated by household goods.

The everyday segment dominates the market due to consistent consumption of water, juices, and dairy products. It holds the highest volume of sales from the common need for convenient, portable hydration and nutrition. Large beverage companies are also starting to incorporate paper bottles in their everyday product portfolios to reduce plastic use, as well as appeal to the conscious consumer. The good-looking products in supermarkets and convenience stores are given in paper bottles, therefore maximizing their product visibility and providing a marketing platform for advancing brand sustainability. As paper bottles scale production, the cost per unit will decrease the price for everyday usage

Paper Bottles Market Share, By Primary Usage, 2025 (%)

| Primary Usage | Revenue Share, 2025 (%) |

| Everyday | 55% |

| Sports | 25% |

| Others | 20% |

Sports segment is the fastest growing of the market, at the intersection of health conscious lifestyle and active environmentalists. In particular, athletes and fitness enthusiasts are a prime audience for sustainable packaging, as they typically pay extra for good quality products that align with their personal wellness and environmental values. Manufacturers will create ruggedized paper bottles that are built with ergonomic grips and easy-close lids for use in gyms and outdoor activities. Furthermore, this segment does allow for premium branding and prices, since sports-related products typically at higher price points as high-performing lifestyle accessories. In addition, sporting events are increasing their sponsorships and partnerships by highlighting their commitment to eliminating single-use plastics in their venues.

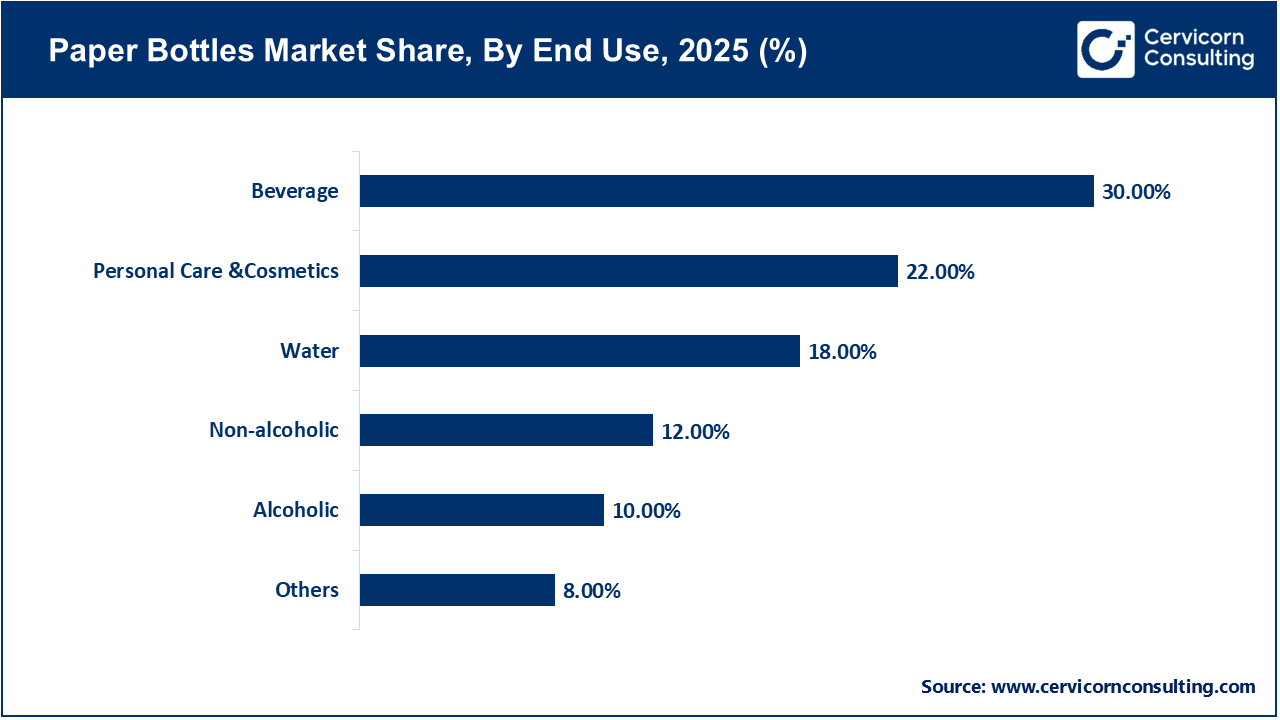

Beverages are the largest segment for the paper bottles market because they contribute to global plastic packaging waste. Research has shown that this segment will consistently have the largest market share as companies come under immense pressure to find alternatives to PET bottles. The beverage industry has the largest market share because it generates the largest amount of plastic waste and therefore has the greatest need to innovate and the research and development spending of global beverage companies continues to support the paper bottle space in everything from mineral water to carbonated soft drinks. Beverage brand transition is also consumer-driven as a proactive strategy to mitigate the risk of plastic taxes and bans.

The personal care and cosmetics segment is growing the fastest because products have the material compatibility with fiber-based packaging. Many cosmetic formulations, such as creams, lotions, and powders, are less chemically aggressive than carbonated beverages. This makes it easier to house them in paper-based composites. The beauty industry also values tactile and aesthetic appeal by nature. The natural and premium feel of a paper bottle fits perfectly into the branding of clean and organic beauty products. The beauty industry can also absorb higher packaging costs by premium pricing, facilitating early adoption of new paper bottle packaging designs.

By Capacity

By Primary Usage

By End Use

By Region