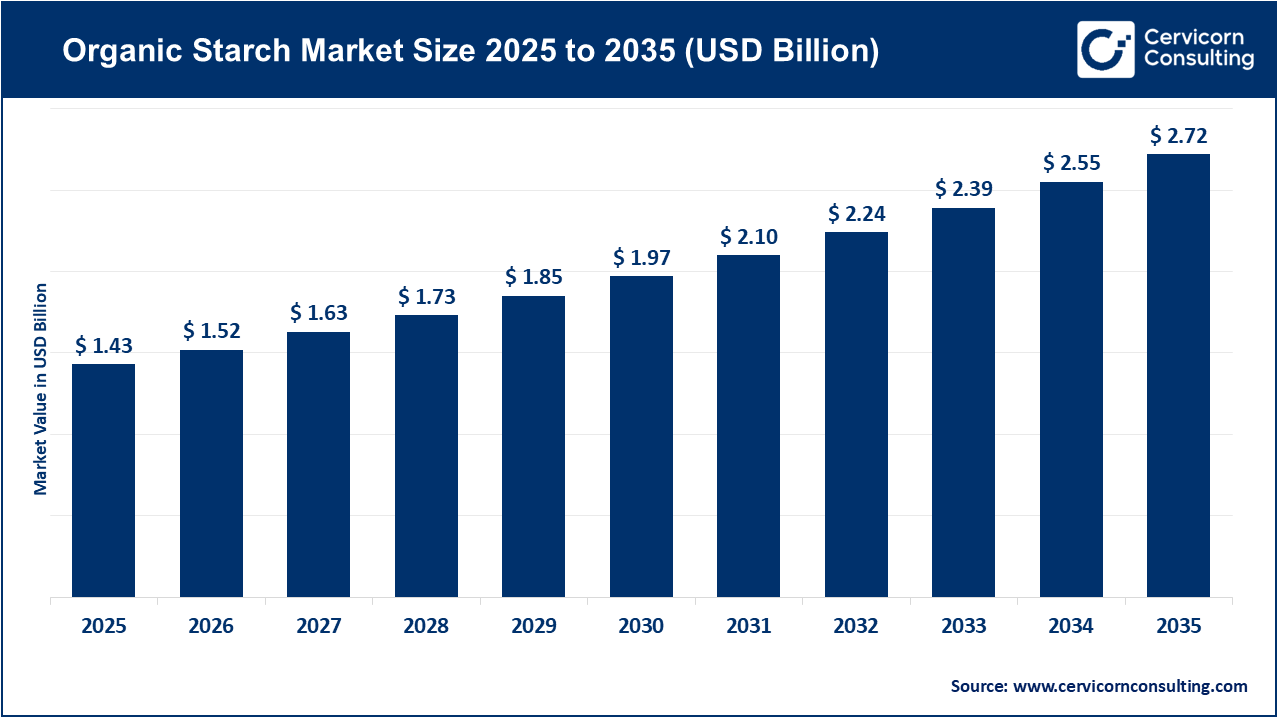

The global organic starch market size valued at USD 1.43 billion in 2025 and is expected to be worth around USD 2.72 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.6% over the forecast period 2026 to 2035. The organic starch market is experiencing rapid growth as more consumers are seeking clean-label and naturally occurring ingredients. As the preference for food without synthetic additives continues to rise, companies are increasingly using organic starch to provide a natural thickening and stabilizing agent as part of their formulations. Food manufacturers also find it advantageous to use organic starch, because it allows for greater health-related claims and it provides a competitive edge in the increasingly competitive organic snack market, organic bakery market and organic baby food products. Increased regulatory scrutiny of chemical additives in foods has also caused companies to look to organic alternatives for their formulation.

With the increasing availability of organic starches has come a parallel growth in organic farming and improved supply chain systems. Additionally, brands emphasising sustainability are well-positioned by the increasing demand for organic products that are derived from environmentally friendly farming practices. The continued growth of disposable incomes in emerging markets has also resulted in greater demand for premium organic products. Further, growth in industries such as pharmaceuticals, cosmetics and biodegradable packaging will continue to increase the overall usage of organic starch and drive overall expansion opportunities in the organic starch market.

Growing Consumer Awareness of Organic and Natural Ingredients

The increase in consumer awareness of organic and natural ingredients is a key factor driving the organic starch market. More consumers are aware of the advantages of clean-label products and prefer to purchase food products that do not contain chemicals, pesticides, and artificial additives. This change in attitude toward cleaning label products is one of the most significant factors driving the growth of the organic starch market. Consumers associate organic ingredients with improved health, transparency, and sustainability, and therefore, the market has seen an increase in the number of companies reformulating their products to use organic starches to align with consumer expectations. The growing public awareness continues to augment the growth of the organic starch market and further motivate manufacturers to create new organic product lines.

1. Clean-label regulation pushing shift toward organic starch

The clean labels regulation, effective 1 January 2024, will be implemented to push food manufacturers to reduce their use of non-organic agricultural ingredients which means that the majority of producers will have to reformulate their recipes by replacing conventional starches with certified organic starches. This forced transition by many manufacturers has created a significant increase in the demand for organic starch, and in turn accelerated the growth of the organic starch market.

2. Rising adoption by food & beverage developers for additive-free formulations

A recent report shows that 33% of food and beverage developers have adopted organic starch as their preferred ingredient because of its purity and functional versatility. The growing trend towards additive-free clean label foods has increased the use of organic starch in sauces, baked goods, ready-to-eat meals, and dairy products. The result of the increased adoption by the food and beverage development industry has correspondingly increased the growth of the organic starch market.

3. Expansion of starch sources beyond corn - rise of specialty starches from peas, cassava, potato, bean

The organic starch market has expanded well beyond the traditional corn starch product. Producers are now using alternative sources of starch. These alternative sources include such items as peas, cassava, potatoes, and beans. This has created a wide variety of functional starch properties that meet specific dietary needs (e.g., gluten-free, allergen-free), and as a result, the number of applications for organic starch has dramatically increased. Increasing the number of applications for organic starch has made organic starch much more appealing as a product and is driving organic starch’s growth as a market.

4. Innovation in processing and product offerings by major food-ingredient companies

Leading food ingredient suppliers have introduced new clean-label organic starch products and starch-based solutions. The new clean-label organic starch products and starch-based solutions allow food processors to eliminate synthetic additives from their products, as they provide an opportunity for food producers to respond to changing consumer preferences. As a consequence, there will be an increase in the availability of organic starch products and a greater functionality of organic starch in the marketplace, which will ultimately increase the overall market for organic starches.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 1.52 Billion |

| Estimated Market Size in 2035 | USD 2.72 Billion |

| Projected CAGR 2026 to 2035 | 6.60% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Source, Product Type, End Use, Region |

| Key Companies | Cargill Incorporated, Beneo GmbH, Ingredion Incorporated, AGRANA Beteiligungs-AG, ORGANICWAY Food Ingredients Inc., NutriPea, SACCHETTO S.p.A., Herba Ingredients BV, American Key Food Products, Gujarat Ambuja Exports Limited (GAEL), A&B Ingredients, Ettlinger Corporation, Roquette Frères, Medikonda Nutrients, PURIS, Archer Daniels Midland Company |

The organic starch market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

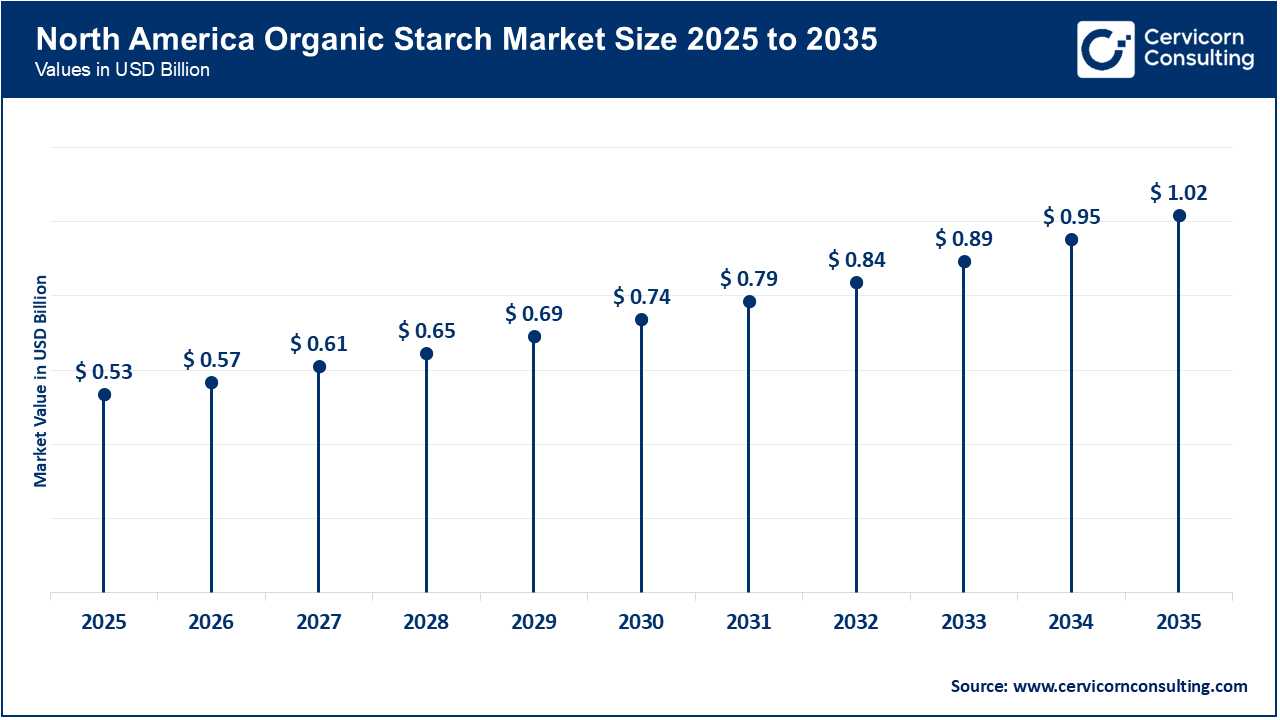

The North America organic starch market size valued at USD 0.53 billion in 2025 and is predicted to reach around USD 1.02 billion by 2035. The North America has been fueled by the increased consumer demand for clean label, organic, and non-GMO food products. Consumers are becoming increasingly aware of health and nutrition as well as avoiding synthetics, so there is a high demand for natural thickeners and stabilizers. In light of consumer preferences, and to meet the requirements of various regulations, food manufacturers in the USA and Canada continue to use more organic starch in lieu of conventional starch.

Recent Developments:

The Asia-Pacific organic starch market size estimated at USD 0.47 billion in 2025 and is forecasted to surpass around USD 0.89 billion by 2035. The Asia Pacific region is experiencing growth as a result of fast-paced urbanisation, rapidly rising disposable income, and a greater desire for healthy/natural & clean label food products among consumers. Additionally, manufacturers are providing organic starches for clean label, plant-based, and gluten-free formulations due to the increase of food service establishments serving convenience foods and modern diets, which is leading to an all-time demand for organic starches in the Asia Pacific region.

Recent Developments:

The Europe organic starch market size reached at USD 0.33 billion in 2025 and is projected to hit around USD 0.62 billion by 2035. Growing consumer awareness regarding health, natural ingredients, and clean label foods is a major driving force in developing the European organic starch market. For many European consumers, plant-based, additive-free, and organic-certified products are the preferred choice in the bakery, sauces, dairy, and meat-alternative segments. This growing awareness among European consumers is thus creating demand for organic starch as a natural ingredient.

Recent Developments:

Organic Starch Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 37.40% |

| Europe | 22.80% |

| Asia-Pacific | 32.60% |

| LAMEA | 7.20% |

The LAMEA organic starch market size valued at USD 0.10 billion in 2025 and is anticipated to reach around USD 0.20 billion by 2035. The LAMEA region is experiencing growth due to increasing consumer awareness of organic and natural products and the potential for growth in agriculture and export markets. As more producers enter into the organic supply chain due to the expansion of organic farming, the demand for organic starch will also increase. This is especially true for export markets and regional food industries that seek out clean-label and sustainable ingredients.

Recent Developments:

The organic starch market is segmented into source, product type, end use, and region.

Corn is the dominating segment of the organic starch market because it can be easily obtained, processed and is cost-effective. Organic corn production is well established in many parts of the world, providing manufacturers with a reliable supply chain. Corn starch is heavily used in a variety of products including bakery goods, snacks, sauces, and confectionery. Consequently, there is a high demand for corn starch throughout the food industry, due to its functionality and positive global production rates.

Organic Starch Market Share, By Source, 2025 (%)

| Source | Revenue Share, 2025 (%) |

| Corn | 35% |

| Rice | 10% |

| Potato | 12% |

| Cassava | 20% |

| Tapioca | 5% |

| Pea | 8% |

| Wheat | 6% |

| Others | 4% |

Cassava is the fastest-growing segment of the market, which has gained momentum because it contains gluten-free, clean label and hypoallergenic qualities. Cassava is heavily sought after in a number of applications, including bakery products, dairy substitutes and gluten-free products where manufacturers value both a neutral flavor as well as a smooth texture in cassava starch. Furthermore, organic cassava production is increasing in Asia, Africa, and South America, resulting in a larger supply available for manufacturers. This will make cassava starch one of the fastest-growing choices in the organic starch market.

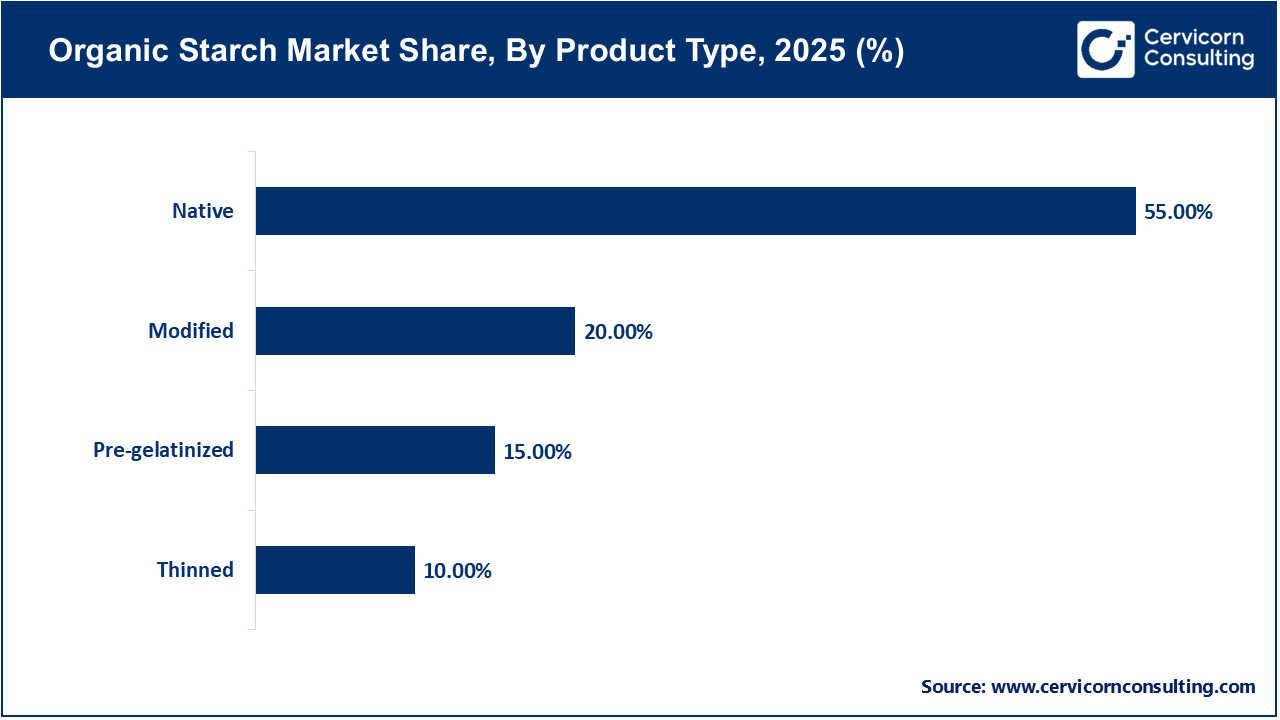

Native starch is the leading product in the market as it is the most natural and least processed product. As a result, food manufacturers utilize native starch as a thickening agent, stabilizing agent, and moisture-binding agent in many foods, including sauces, soups, baked goods, and ready-made meals. This product's clean label quality aligns with consumer preferences for simple, familiar ingredients, contributing to a wider range of uses and, thus, enabling native starch to remain the dominant product type in this market.

Pre-gelatinized starch is the fastest-growing segment, due to the fact that it offers instant dissolvability and easy processing capabilities. Pre-gelatinized starches are suitable for injected food products, instant dry mixes and cakes, as well as for medicinal purposes. The increasing consumer demand for convenience food products is creating a strong preference among manufacturers for starches that increase texture with short cooking times. The flexibility to use pre-gelatinised starches will continue to contribute to rapid growth within the organic starch market.

The food industry is a dominant segment of the market as it utilizes more organic starch than any other segment for purposes such as being a natural thickening agent, binder, or stabilizer. Organic starches are a vital ingredient within the bakery, snack, baby food, sauce, and beverage industries. Currently, the growing demand from consumers for organic products and the presence of clean-label ingredients supports this segment of organic starches, making the food industry the leading consumer of organic starches.

Organic Starch Market Share, By End Use, 2025 (%)

| End Use | Revenue Share, 2025 (%) |

| Food Industry | 70% |

| Paper Industry | 8% |

| Chemical Industry | 7% |

| Textile Industry | 5% |

| Pharmaceutical Industry | 10% |

The pharmaceutical industry is the fastest growing segment, due to the ever-increasing use of organic starches for tablet, capsule, and coating applications. Organic starches are used as a natural binder and disintegrant in pharmaceutical formulations; therefore, they are well-suited for clean-label pharmaceutical formulations. As a result of the trend towards natural and safe excipients within the healthcare sector, there is an increasing demand for organic starches, making them the fastest growing end-use segment of the overall organic starch market.

By Source

By Product Type

By End Use

By Region