Obesity Clinical Trials Market Size and Growth 2025 to 2034

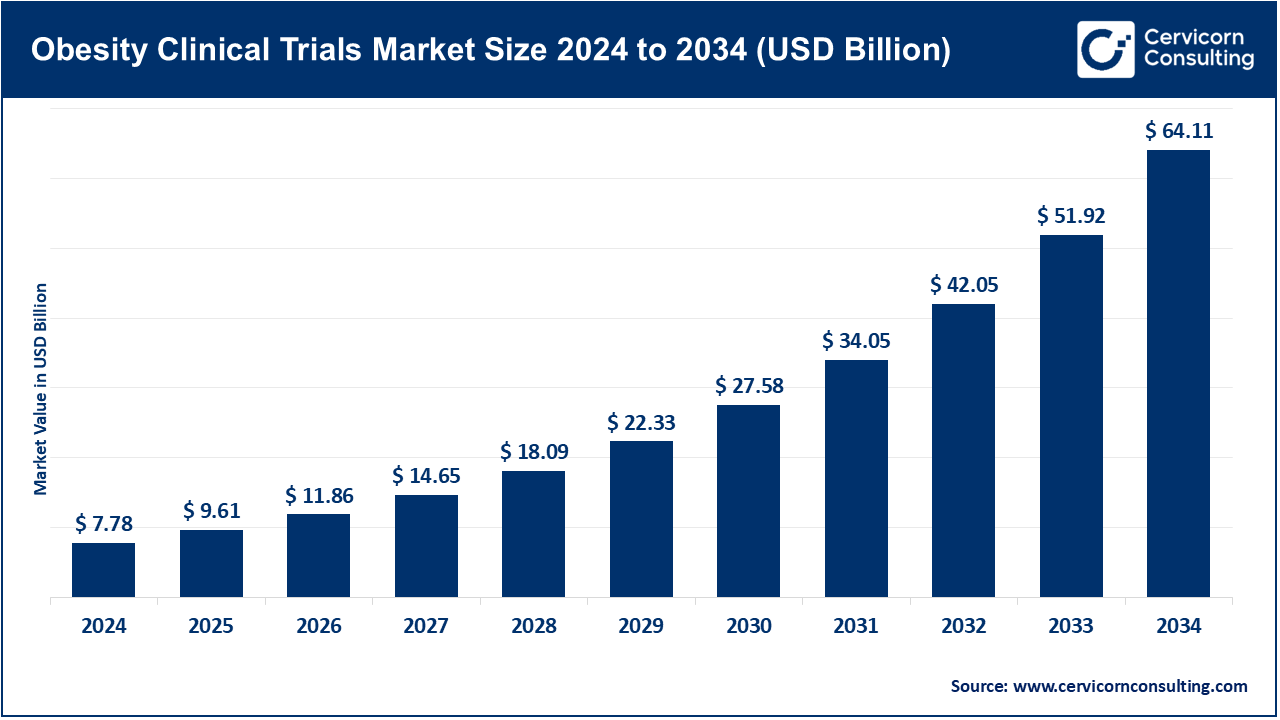

The global obesity clinical trials market size was valued at USD 7.78 billion in 2024 and is anticipated to reach around USD 64.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 23.48% over the forecast period from 2025 to 2034.

The rise in obesity around the world has led to a major public health crisis. Sedentary lifestyles, ultra-processed diets, and more people living in cities are largely to blame. This growing problem is a key driver of activity in clinical trials. The World Health Organization reported that in 2022, around 2.5 billion adults were marked as overweight, and nearly 890 million of those reached the level of obesity. If trends continue, this figure could soar to 4 billion by 2035. Obesity frequently coexists with serious health conditions such as type 2 diabetes, cardiovascular disease, and various mental health disorders. In response, pharmaceutical developers are increasingly focusing on multi-indication trials that assess new therapies not only for weight loss but also for managing these comorbidities. An ICON survey showed more than 64% of participants think mixing treatment methods will shape future obesity care. When asked what the main focus should be, 55% chose diabetes, 48% highlighted metabolic disorders, and 38% pointed to heart and blood vessel conditions. These interconnected health needs enhance the opportunity for clinical trials and expedite the development of new treatments.

What is Obesity Clinical Trials?

Obesity affects approximately 1 billion people and is a priority in clinical research. This problem is closely associated with health problems such as type 2 additional metabolism problem fatty liver disease and heart disease. Recent progress in medicines, such as GLP-1 receptor agonists semaglutide (Wegovy) and tirzepatide (Zepbound), have transformed the way of treating obesity. Not only have these new therapies improved the outlook for patients, but they have also given rise to a surge in the number of clinical trials. Both large pharmaceutical companies and biotech startups are entering the field. They are driving the development of next-generation therapies. This includes dual and triple agonists, oral formulations, and combination treatments. All these aims to offer better solutions for those dealing with obesity.

Obesity Clinical Trials Market Report Highlights

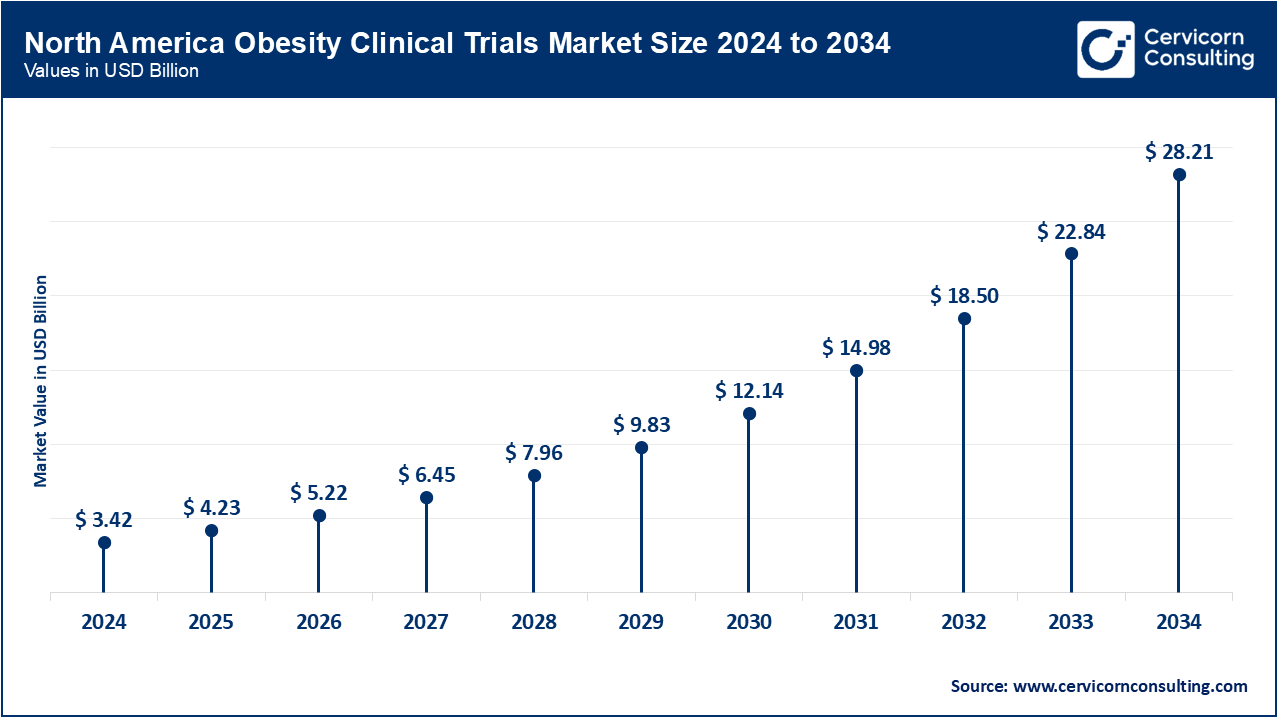

- By Region, North America held revenue share of 44% in 2024. This expansion is fueled by increasing rates of obesity and continued advances in medications.

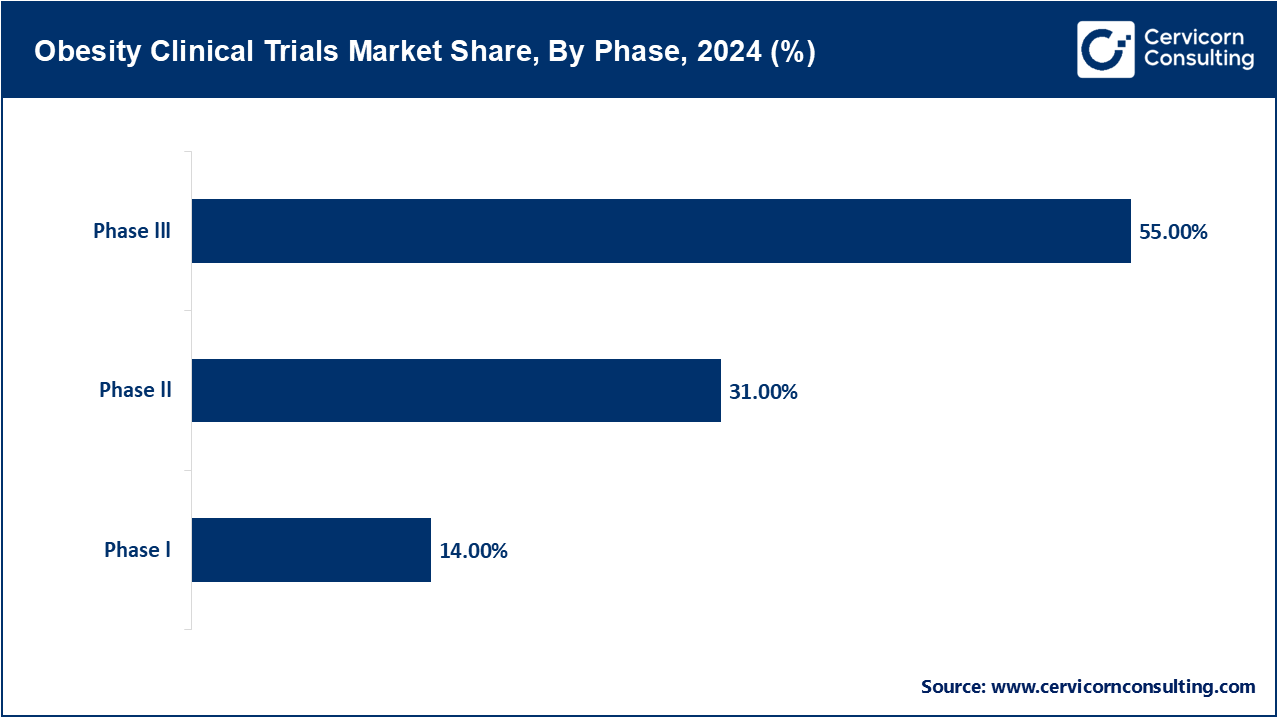

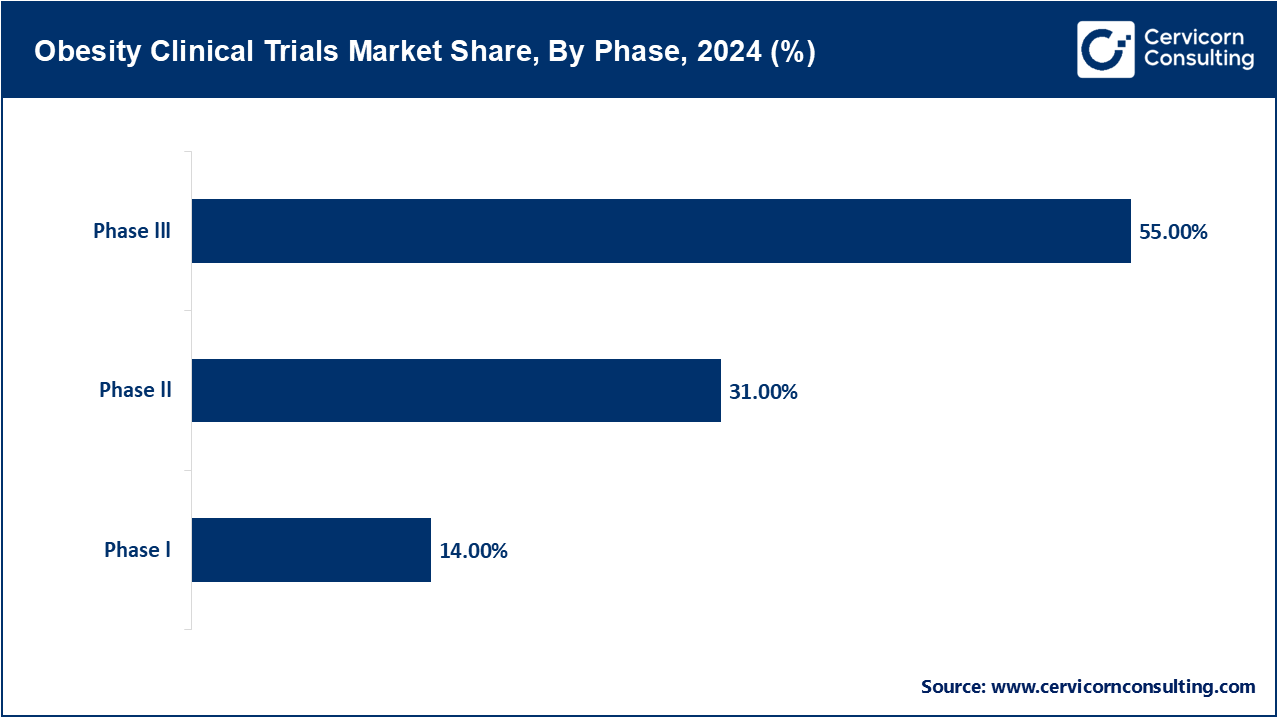

- By Phase, the phase III trials are the largest segments of the market with revenue share of 55%. This is primarily due to a large number of mid- to late-stage trials with GLP-1 drugs and combination drugs.

- Phase I trials likewise continue to grow, with more biotech companies conducting them, and more first-in-human trials proceeding forward.

- By Indication, the obesity with comorbid conditions segment has generated revenue share of 60% in 2024.

- By Study Design, the interventional studies segment accounted for a revenue share of 70% in 2024.

- Observational studies are increasing, in particular, in studies of lifestyle and behaviour interventions.

- Obesity studies with co-morbidities such as type 2 diabetes, cardiovascular disease, NAFLD and PCOS are now common in trials.

- A noteworthy trend is the shift to a multi-endpoint design, that enables a broader therapeutic scope within single studies.

Obesity Clinical Trials

| Year |

New Obesity Trials Registered |

Estimated Total Active Trials |

| 2020 |

180 |

600 |

| 2021 |

210 |

700 |

| 2022 |

250 |

850 |

| 2023 |

300 |

1000 |

| 2024 |

320 |

1100 |

Obesity Clinical Trials Market Trends

- Personalized and Precision-Based Approaches: Recent advancements in genomics, metabolic profiling, and biomarker identification are changing how we treat obesity. Researchers are focusing more on specific patient groups by looking at genetic predispositions, hormonal responses, and lifestyle factors. This tailored approach not only improves drug effectiveness but also helps reduce side effects by matching treatments more closely to individual patient profiles. Given the complex nature of obesity and its many contributing factors, this targeted method allows for more precise therapies and better patient results. This growing interest has caught the attention of pharmaceutical companies and regulatory agencies. Big strides in precision obesity treatments are showing clear results. Clinical trials are confirming that combining therapies, using targeted approaches, and sticking to oral medications are all working. In the REDEFINE 1 trial, Novo Nordisk’s CagriSema (semaglutide plus cagrilintide) led to a 20.4% average drop in weight over 68 weeks, versus only 3.0% in the placebo group. Non-diabetic participants lost up to 23%. In REDEFINE 2, the diabetic group lost 13.7% compared to 3.1% with placebo, proving the treatment’s strength across different patient types.

- Rise of Decentralized Clinical Trials (DCTs) and Hybrid Models: The emergence of decentralized clinical trials (DCTs) and hybrid models is revolutionizing the way obesity research is conducted. These innovative approaches utilize remote monitoring technologies, telemedicine consultations, wearable devices, and digital health platforms to minimize the necessity for in-person visits. This flexibility is particularly critical in obesity studies that often require long-term follow-ups and a diverse patient population. Decentralized trials enhance patient recruitment and retention by offering greater convenience and reducing geographic barriers, all while facilitating the continuous collection of real-world data. Recent data show that digital clinical trial approaches have jumped over 40% in metabolic disease programs from 2020 to 2024, and participants are sticking with the protocol 15 to 20% longer than in standard brick-and-mortar models. Collectively, these trends signify a shift towards more inclusive, efficient, and scientifically advanced frameworks for clinical research, positioning the obesity trials market for ongoing growth and innovation in the coming years.

Obesity Clinical Trials Market Dynamics

Market Drivers

- Increased funding and strategic collaboration: Greater investment and better coordination are important new developments in the war against our overweight epidemic. Governments in the developed world — including the U.S., Europe and some of the Asia-Pacific region — are Drangers out national strategies and issuing research grants to address this rising threat. Meanwhile, big pharmaceutical companies like Novo Nordisk and Eli Lilly are investing billions in developing new obesity drugs, especially GLP-1 receptor agonists. This investment is fueling a boom in clinical trials at all phases. Partnerships with academia, CROs and digital health companies are also key. They assist to streamline trial logistics, access additional patients and refine data. Together, this supportive network is breaking down walls to clinical entry, promoting innovation and moving the clock along rather rapidly for obesity drugs. This growth is turbocharging the global pipeline for obesity studies. New glucagon-like peptide-1 (GLP-1) receptor drugs are now pushing body weights down by 10% to 20%—numbers that are almost on par with the effects of surgical options. These medications have quickly become key players in obesity trials, sparking what can be termed a clinical gold rush, with over 80 new treatments currently being tested.

- Growing demand for non-invasive therapeutic alternatives: At the same time, there is a noticeable shift in demand for non-invasive treatment options. While bariatric surgery is effective, it has risks, high costs, and long recovery times. Because of this, more people are looking for safer and easier drug options for obesity. This change is driving clinical research into new drug formulations that aim to provide the metabolic benefits of surgery without invasive procedures. Patients, healthcare providers, and healthcare systems are increasingly choosing drug-based methods that are simpler to use, scalable, and can provide long-term health benefits with few side effects. This trend is pushing pharmaceutical companies to expand their research on obesity and speed up trials for promising new medications. Forecasts now say worldwide sales of these agents could top $150 billion by 2035. And the story is only getting richer: therapies that layer GLP-1s with amylin, like Novo Nordisk’s CagriSema, are showing weight losses over 20% in early trials and seem to have gentler side-effect profiles.

Market Restraints

- High cost and complexity of clinical trials: Investing in clinical trials for obesity, in particular, new pharmacological treatments, is expensive. This is predominantly because obesity is a chronic condition and large, long-term studies are needed. Such trials are typically conducted over the course of several years, include thousands of patients and require careful monitoring to assess not only weight loss but also long-term safety in a wide array of patients. In addition, the inclusion of biomarkers, digital health devices and comorbidity tracking increase the cost and operational burden of such studies. Meanwhile, the average Phase III trial cost in any disease group runs about $255 million, with complicated designs pushing that to $345 million or more.

- Patient recruitment and retention: Making matters worse, it’s hard to recruit, differences in culture and a lack of health literacy and access to trial sites (particularly in rural areas and in underserved communities) are also barriers to recruitment. Decentralized and hybrid trial models are attempting to increase access, but are still not widely used. The challenges underline the pressing necessity for improved trial design and patient involvement approaches. Surveys reveal that 80% of studies still miss enrollment deadlines, and hurdles in recruiting patients account for nearly a third of all timeline slips.

Market Opportunities

- Growing Focus on Preventive Healthcare: As healthcare systems worldwide focus more on prevention rather than treatment, obesity has become a major issue in public health policy and drug research. It is a leading risk factor for many chronic diseases. Governments and private healthcare groups are putting more resources into early intervention efforts. This shift has led to an increased demand for clinical trials. These trials focus not only on weight-loss drugs but also on therapies aimed at preventing obesity-related diseases like diabetes, heart disease, and non-alcoholic fatty liver disease (NAFLD). This shift toward prevention broadens the scope of clinical research and creates opportunities for new drug combinations, lifestyle intervention studies, and the use of digital health tools to track and maintain positive health outcomes. Governments and private health networks are now pouring more money into early intervention programs. Some national health plans have even raised the cash for prevention programs by as much as 20% in the last five years.

- Expanding Clinical Research into Emerging Markets: Another important opportunity is expanding clinical research into emerging markets, especially in areas like Asia-Pacific, Latin America, and the Middle East. Cities grow fast, food choices change, and people move less, sending obesity numbers higher—for instance, Mexico, Saudi Arabia, and Malaysia each see more than 30% of adults classified as obese, and some Pacific Islands report numbers above 50%. These regions are experiencing quick urban growth and changes in eating habits, which are causing obesity rates to rise. However, the infrastructure for clinical trials in many of these countries is still not fully used. As awareness increases and healthcare systems improve, these regions present a large, untapped group of patients for obesity trials. Conducting research in these locations not only speeds up participant recruitment but also improves the diversity of clinical data, which regulators and payers are increasingly valuing. Moreover, the lower operational costs in these regions make it more affordable to conduct trials, particularly for early-stage companies.

Market Challenges

- Biological Complexity of Obesity as a Disease: Obesity is a complicated condition that results from a mix of different factors, including genetics, hormones, environmental influences, lifestyle choices, and psychological aspects. This complexity makes it hard to create standard treatments or protocols for clinical trials. People who struggle with obesity often face various health issues, such as type 2 diabetes, hypertension, and depression. People who are overweight often suffer from health-related problems like type 2 diabetes, high blood pressure or depression. People living with obesity often have more than one related health problem: up to 44% also have type 2 diabetes, around 60% have high blood pressure, and 20 to 25% struggle with depression, making it tricky to judge how well a new drug is working and to tease out the specific effects of one treatment alone. As a result, trials are more costly and time consuming, with the negative possibility that the treatment appears to help, albeit in certain subgroups.

- Regulatory Ambiguity and Shifting Approval Standards: In the past, regulatory bodies like the FDA and EMA have closely examined anti-obesity medications. They focused on concerns about long-term safety, cardiovascular risks, and the possibility of misuse. The FDA says that to win get a new obesity drug must show that, compared to a dummy pill, it causes an average body weight drop of at least 5% after one year and must also prove that it does not raise heart risks, a goal that demands long and costly studies that can push the final budget up by 20 to 30%. Over the years, several weight-loss drugs have been removed from the market, leading to a cautious regulatory environment. Obtaining the approval of new treatments requires costly and lengthy clinical data programs demonstrating not only efficacy and safety, but also sustainable weight loss.

Obesity Clinical Trials Market Segmental Analysis

Phase Analysis

Phase I: The major objective of Phase I studies is to assess safety, tolerability, and pharmacokinetics of new anti-obesity agents. Studies in small healthy volunteer populations or obese volunteer populations make an integral part of early validation but constitute a relatively smaller portion of the market because there are very few such studies and they run for a shorter duration compared to later phase studies.

Phase II: Presently, there has been a great uptick of phase II trials since in this phase, the efficacy of the drug is being assessed together with dosage optimization on a larger group of the population with obesity. In turn, this helps determine which dosages of the investigational drugs may be most effective and safe. Currently, there is great development regarding GLP-1 as well as GIP agonists besides new oral formulations and combination therapies. The successful medications semaglutide and tirzepatide have thus opened up an avenue/pipeline/floodgate for increased amounts of phase II studies to test next generation dual and triple agonists promised to bring efficacy with lesser side effects.

Phase III: In Phase III clinical trials, new therapies for obesity are tested for safety and effectiveness in large, multicultural populations, with 3000 to 5000 participants for the 12–18-month study period. These trials are essential to validating the effectiveness of new therapies, to tracking unwanted side effects, and to comparing new treatments with the current standard of care. Leading pharmaceutical companies, including Novo Nordisk, Eli Lilly, and Amgen, are currently engaged in multiple ongoing Phase III studies globally to support submissions to regulatory authorities and pursue market access.

Indication Analysis

Monotherapy for Obesity: Monotherapy for obesity is the use of one pharmaceutical agent in assisting patients diagnosed with obesity to reduce and maintain weight loss. This has traditionally been a less active area of clinical investigations until recently over the past decade primarily due to newer agents such as GLP-1 receptor agonists. These medications, semaglutide (Wegovy) and liraglutide (Saxenda) have indicated effectiveness as monotherapies resulting in average weight reduction of about 10-15% in clinical studies which shifted the perception that obesity treatment should only involve pharmacologic management after not achieving adequate results from lifestyle interventions. The positive outcome of these medications catalyzed further research into akin and next-gen therapies including tirzepatide (Zepbound) as well as trial drugs like AMG 133, pemvidutide, and CT-388.

Obesity Clinical Trials Market Share, By Indication, 2024 (%)

| Indication |

Revenue Share, 2024 (%) |

| Monotherapy for obesity |

40% |

| Obesity with comorbid conditions |

60% |

Obesity with Comorbid Conditions: Many clinical trials today focus on obesity and type 2 diabetes. These conditions often occur together and share metabolic pathways. Researchers are studying medications like tirzepatide and semaglutide for their potential to help with weight loss and improve blood sugar control. This has attracted significant interest from pharmaceutical companies and regulatory agencies. Semaglutide (Wegovy/ Ozempic) and tirzepatide (Mounjaro) are leading the GLP-1 receptor agonists thus capturing 60 to 70 percent of the market share in obesity pharmacotherapy because of their efficacy in weight management and glycemic control. Semaglutide was the largest selling obesity drug in 2024, capturing nearly 40% of sales and was quickly adopted in the US and Europe.

Study Design Analysis

Interventional Studies: Interventional studies are the studies that actually test new anti-obesity therapies by actively assigning interventions to participants. Most of the clinical trials for obesity management are centered on new and innovative pharmacotherapy, like GLP-1 receptor agonist (semaglutide) and dual agonist (tirzepatide) as well as the new combination therapies, and are randomized, double-blind, placebo-controlled trials (RCTs). These trials are designed to assess weight maintenance (often >15% body weight reduction), metabolic changes (HbA1c, lipid profiles), and long-term cardiovascular risks. Important examples are the SURMOUNT and STEP trial programs, landmark RCTs with proven significant benefits that have provided a strong evidence base for regulatory and clinical adoption.

Obesity Clinical Trials Market Share, By Study Design, 2024 (%)

| Study Design |

Revenue Share, 2024 (%) |

| Interventional studies |

70% |

| Observational studies |

22% |

| Expanded access studies |

8% |

Observational studies: In such studies, participants are observed in their natural settings and does not involve any active intervention. Such studies have gained immense importance since the burning of understanding the natural course of obesity, patient behavior and adherence patterns, and long-term effects of lifestyle changes or approved therapies.

Expanded Access Studies: One smaller part of the whole are expanded access studies, which allow patients with severe or stubborn obesity to try out new treatments that are not part of formal clinical trials. This is particularly true when there’s no good choice. These trials offer a way for people to access the drug in a compassionate-use setting and provide valuable safety information before it gains full regulatory approval.

Obesity Clinical Trials Market Regional Analysis

Why is Asia-Pacific fastest-growing place in the obesity clinical trials market?

- The Asia-Pacific obesity clinical trials market size was valued at USD 1.56 billion in 2024 and is expected to reach round USD 12.82 billion by 2034.

The Asia-Pacific region is becoming the fastest-growing place. Obesity rates have gone up a lot, especially in countries like China, India, Japan, and South Korea. China now has more than 180 million adults with obesity, India more than 135 million, and both Japan and South Korea have recorded at least a 30% rise in obesity over the past 20 years. This is because cities are growing quickly, diets are changing, and people are becoming more sedentary. These countries have a lot of patients who aren't being used to their full potential, which makes them appealing to global sponsors who want to add more trial sites. The area also has low-cost operational environments and is seeing improvements in clinical infrastructure. These countries' governments are starting to put more money into research on obesity and public health programs, which will help the economy grow even more.

Why is the North America region dominating the obesity clinical trials market?

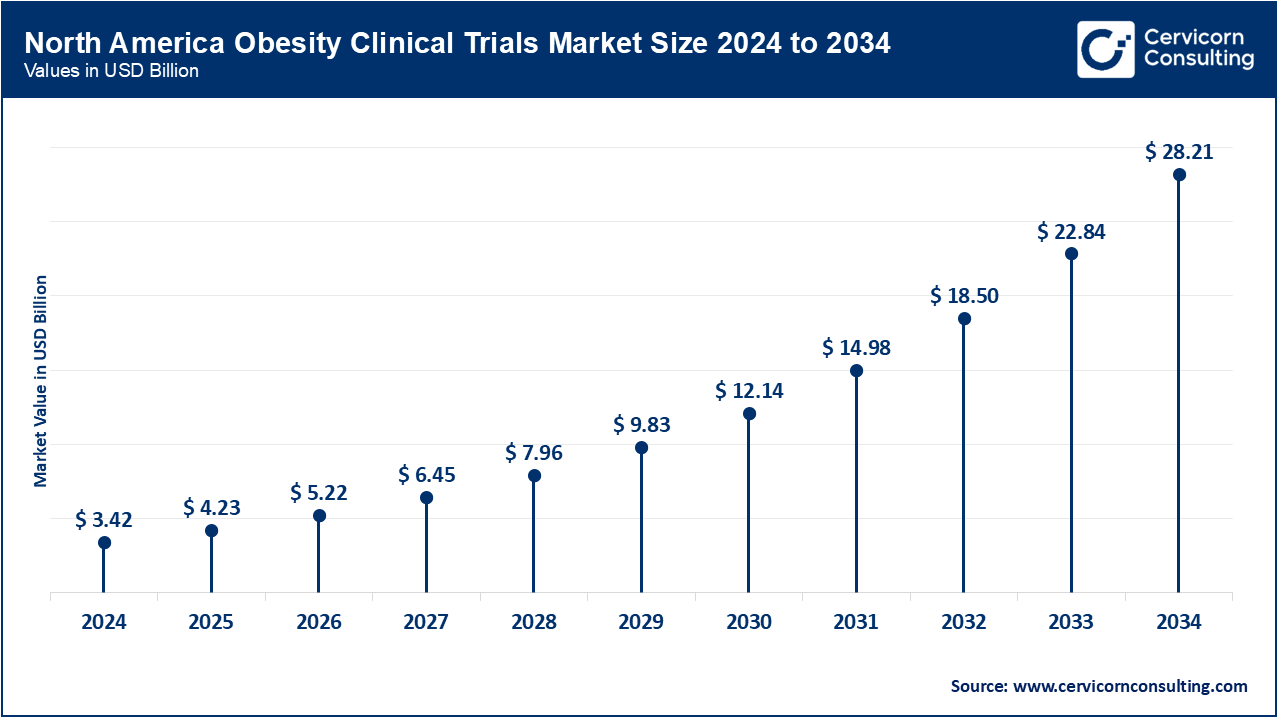

- The North America obesity clinical trials market size was estimated at USD 3.42 billion in 2024 and is projected to surpass around USD 28.21 billion by 2034.

The United States remains the main hub for clinical trials in obesity medication in North America. The strength of our status rests heavily on two strong factors: more than 42 of every 100 adults in the country are now considered obese, and we have an experienced clinical research system already in place. America has state-of-the-art medical facilities, well known CRO’s and a good regulatory environment from the FDA. There is also substantial investment in R&D, for example, Eli Lilly, Pfizer, Novo Nordisk pumping billions into research creates a strong pipeline of trials and planned trials. These drugs have set new benchmarks in obesity treatment, achieving notable weight loss while ensuring solid safety profiles. Meanwhile, key players like Pfizer, AstraZeneca, and Amgen are actively developing their own obesity treatment pipelines. Many of these companies are exploring new oral formulations and are interested in creating dual or triple-action medications. For example, Pfizer is investigating next-generation oral GLP-1 candidates, while Amgen is making progress with a new GLP-1/GIP receptor agonist that has shown encouraging results in early trials. Furthermore, a wave of biotech startups, such as Verve Therapeutics, Metsera, and Structure Therapeutics, is entering the market. These companies are gaining significant venture capital investment and are focusing on innovative methods that target genetic pathways and metabolic signaling to address obesity more effectively.

Obesity Clinical Trials Market Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

44% |

| Europe |

26% |

| Asia-Pacific |

20% |

| LAMEA |

10% |

What are the driving factors of Europe obesity clinical trials market?

- The Europe obesity clinical trials market size was accounted for USD 2.02 billion in 2024 and is predicted to hit around USD 16.67 billion by 2034.

Europe ranks second in the world for obesity clinical research, making up about 25 to 28% of all trials happening worldwide. This creates a supportive environment for obesity research. The region focuses on preventive healthcare and lifestyle intervention studies, which matches the goals of obesity trials. Additionally, EU-funded projects and public-private partnerships are improving clinical capabilities across the continent. The field of obesity clinical trials is changing quickly. This shift is mainly due to more research and development, new treatments, and strong competition between large pharmaceutical companies and agile biotech startups. Currently, Novo Nordisk and Eli Lilly are at the forefront with their GLP-1 receptor agonists: semaglutide, known as Wegovy, and tirzepatide, marketed as Mounjaro/Zepbound.

LAMEA Obesity Clinical Trials Market Trends

- The LAMEA obesity clinical trials market was valued at USD 0.78 billion in 2024 and is anticipated to reach around USD 6.41 billion by 2034.

Latin America is now increasingly being considered as a possible market for trials focusing on obesity, particularly in Brazil and Mexico. The increasing level of obesity in such countries is forcing governmental regulations and increasing the demand for therapies that work. Clinical trial expenditure in Latin America is also lower and patient recruitment generally more rapid because there is a high need for treatments and limited access to advanced therapies. Middle East and Africa are the regions, where countries such as, Saudi Arabia, UAE and South Africa obesity figures are on the rise, due to lifestyle changes and economic growth. In the Middle East and Africa, places such as Saudi Arabia, the UAE, and South Africa are watching obesity numbers rise. In Saudi Arabia, one in three adults is now classified as obese, and in the UAE the rate has passed 27%.

Obesity Clinical Trials Market Top Companies

Recent Developments

- August 2024: Eli Lilly announced that tirzepatide met both primary goals in the Phase III SUMMIT trial. The trial showed an average weight loss of about 15.7% over 52 weeks, which was much higher than the 2.2% seen with the placebo. It also indicated a significant improvement in exercise capacity and a decrease in inflammation. This strengthens the case for tirzepatide as a potential effective treatment for obesity.

- June 2024: Altimmune announced that it successfully completed an End-of-Phase II meeting with the FDA for its investigational obesity therapy pemvidutide, which is a non-GLP-1 candidate. This marks the start of a four-arm Phase III program with about 5,000 participants. It clearly shows the potential of this treatment as an alternative for patients who cannot tolerate GLP-1 treatments.

- May 2024: Results for Roche’s Dual GLP‑1 and GIP agonist CT‑388 were very significant in a Phase 1b trial. Subjects lost about 18.8% of their weight on average over 24 weeks. These initial results suggest that CT‑388, the next-generation anti-obesity agent, has a strong chance of success.

Market Segmentation

By Phase

- Phase I

- Phase II

- Phase III

By Indication

- Monotherapy for obesity

- Obesity with comorbid conditions

By Study Design

- Interventional studies

- Observational studies

- Expanded access studies

By Region

- North America

- APAC

- Europe

- LAMEA