The global next-generation sequencing in precision medicine market size was valued at USD 6.21 billion in 2024 and is expected to hit around USD 32.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.82% over the forecast period from 2025 to 2034. The next-generation sequencing in precision medicine market is poised for considerable expansion because of its transformative impacts enabling personalized, precise diagnostics and therapeutics. There is an increasing incidence of genetic disorders as well as cancer and rare diseases which are driving a need for genomic-based tailoring of therapies to individual’s genetic make-up. The increase in adoption of next-generation sequencing in oncology, pharmacogenomics, and rare disease detection paired with advanced bioinformatics, declining sequencing costs, and favorable government policies are accelerating market growth. Strategic partnerships between research institutions and biotech companies, along with FDA endorsement of NGS-guided companion diagnostics propel advancement within this paradigm-shifting precision healthcare landscape.

The NGS in precision medicine market is growing rapidly due to an increase in tailored medical care, especially in cancer treatment, diagnostics for rare diseases, and hereditary conditions. NGS is aiding precision medicine as health systems move to more data based and genome-informational models of treatment because it allows clinicians to customize therapies at the genomic level. Both public and private sectors are investing into genomic infrastructure, national biobank initiatives accelerating clinical adoption, which further facilitates clinical uptake. The cloud-based bioinformatics interfaces with AI, which improves interpretation accuracy as well as shortening turnaround times enhancing efficiency available technologies. Pharmaceutical marketers engage NGS for targeted drugs creation and biomarkers discovery, while regulatory support for companion diagnostics further stimulates the expansion of this market.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 7.32 Billion |

| Expected Market Size in 2034 | USD 32.01 Billion |

| Projected CAGR 2025 to 2034 | 17.82% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Application, Product & Service, End Use, Region |

| Key Companies | Illumina, Thermo Fisher Scientific, Roche, Danaher, QIAGEN, Agilent Technologies, Eurofins Scientific, Pacific Biosciences (PacBio), Oxford Nanopore Technologies, Takara Bio, BGI Group (MGI Tech), Merck KGaA, BD (Becton, Dickinson and Company), 10x Genomics, New England Biolabs, Promega Corporation, Revvity (formerly PerkinElmer), Zymo Research, Novogene, LGC Limited |

Whole Genome Sequencing (WGS): WGS deconstructs an individual’s complete DNA encapsulating coding and nonâ€coding as well as regulatory regions. This methodology allows for the detection of single-nucleotide variants, insertions, deletions, copy number variations and even structural variants. Its application is particularly useful in rare disease diagnosis when exome or panel tests fail to provide clear answers, as well as in cancer research where non-coding drivers are essential. The increasing cost of obtaining genomic data coupled with its complexity, has served as a roadblock even though WGS has clinical utility. Ongoing drops in the price of sequencing, coupled with cloud-based bioinformatics, is increasing clinical usefulness. WGS provides personalized therapy bases which are critical for future interventions like gene editing or gene therapy. With expanding population databases, the utility of WGS will increase, further enhancing patient-specific strategies tailored to precise medicine with rich genomic context.

Whole Exome Sequencing (WES): WES concentrates on approximately 1-2% of the genome, focusing on protein-coding areas which are known to contain most mutations that lead to diseases. This approach is less expensive and has lower data volume than WGS, but retains its clinical value. WES is commonly used for diagnosing inherited disorders such as genetic epilepsy, certain types of cardiomyopathy, and developmental delays. In oncology studies, tumor-normal comparisons for the identification of somatic driver mutations are supported by WES. Still, regulatory or structural variants occurring outside exons may be missed. Nevertheless, its standardized approaches in clinical workflows and the balance between coverage and insight make it a mainstay in clinical genetics. Increasing lab accreditation sustenance alongside payer reimbursement supports the continued use of WES in routine diagnostics and translational research.

Targeted Sequencing: In targeted sequencing, gene panels are curated to concentrate on specific loci linked with a particular disease, usually between 50 and 500 genes for oncology panels or pharmacogenomic assays. This approach enables ultra-deep coverage, high sensitivity for low-frequency mutations, and swift turnaround times (often less than 7 days). Furthermore, the panels are cost-effective, easily validated, and clinically reimbursed which secures endorsement from clinical guidelines. Some common uses include the detection of EGFR/ALK mutations in lung cancer, inherited cancer gene panels, prenatal aneuploidy screens, and drug metabolism tests. The limited output data stream makes analysis straightforward which adds to why this method is preferred at hospital laboratories and diagnostic centers. With greater customization options for panels like liquid biopsy for ctDNA, targeted sequencing continues to support precision diagnostics on which daily workflows rely.

RNA Sequencing (RNA-seq): As with other DNA sequencing methods, RNA-seq provides a window into the transcriptional activity of genes and their associated splicing activities. Also, in the context of cancer, RNA-seq is capable of identifying fusion transcripts like BCR-ABL, expression signatures associated with immune evasion or activation, and neoantigens aimed at by the immune system. It helps in therapy selection by prognosis parsing tumors likely to respond to some immunotherapies—classifying tumor subtypes by transcriptomic clustering. For infectious diseases, RNA-seq facilitates pathogen detection through transcriptomic evidence. The handling of biological samples for processing requires more care because their RNA content is delicate. Data interpretation comes with its own set challenges as specialized pipelines are necessary. Despite these technical hurdles, there is an increasing body of evidence supporting the clinical utility of RNA sequencing which is broadening its adoption and pushing it towards diagnostic labs. As methodologies become more defined and settled, RNA-seq will deepen precision profiling along with genomic analyses becoming seamlessly integrated.

Oncology (Cancer Genomics): NGS technology has transformed oncology through tumor profiling, actionable mutation identification, minimal residual disease (MRD) detection, and ongoing resistance assessment. Key oncogenes are monitored such as EGFR and BRCA for gene amplification while BRAF and ALK are assessed through whole exome or genome sequencing alongside RNA-seq. Immunotherapy is guided by TMB and MSI which are measured by NGS. Liquid biopsies permit non-invasive monitoring utilizing ctDNA. Diagnostics from NGS support tailored therapy (e.g., PARP inhibitors, checkpoint inhibitors) and therapeutics development workflows. Oncology pathways in hospitals, academic centers, and CROs are incorporating NGS to enhance patient care. The convergence of testing standards alongside reimbursement models solidifies the role of genomics in modern cancer care.

Infectious Disease: Metagenomic sequencing enables detect pathogens directly from clinical samples which is critical in diagnosing sepsis or rare infectious diseases as well as during outbreaks. It also predicts bacterial, viral, and fungus cultures along with antimicrobial resistance genes enabling fast diagnoses without culture prerequisites. NGS tracked COVID-19 variants throughout the world which informed public health responses regionally. Surveillance is conducted using real-time sequencing at regional labs as well as national agencies. Clinical sequencing assists in the diagnostic odyssey for unknown pathogens enabling more precise antifungal and antibacterial therapies targeted toward individual patients’ needs thereby reducing prolonged hospital stays due to infections post-surgery or chronic infection-related complications following complex surgeries. As pathogenic sequence databases expand with bioinformatics pipelines becoming increasingly streamlined, advanced diagnostics in infectious diseases utilizing NGS are providing cutting-edge monitoring systems responsive to dynamic changes globally.

Rare & Inherited Disorders: Next-generation sequencing (NGS) is especially useful in inherited disorders where clinical phenotypes are vague and non-specific. Exome or whole genome sequencing can uncover the causative variants for various types of epilepsy, immunodeficiencies, neurodevelopmental disorders, and muscular dystrophies. Identifying genetic factors earlier facilitates appropriate intervention and optimized management strategies throughout the course of the disease. Trio-family-based sequencing clarifies the complexities of inheritance and penetrance. There is a growing trend among clinicians and geneticists to consider NGS as first-line tests for conditions without diagnosis due to the reduced time and costs involved, which is further supported by hospital-funded WES/WGS programs along with reimbursement policies. The overarching outcome from this approach is enhanced diagnostic yield with expedited treatment decisions—a necessity for pediatric clinics and epilepsy centers around the world.

Prenatal & Reproductive Health: Through the use of cell-free fetal DNA, non-invasive prenatal testing (NIPT) scans for trisomy 21, 18, 13 alongside sex chromosome aneuploidies. Panels have been broadened to include microdeletions as well as carrier status detection. In IVF, pre-implantation genetic testing (PGT) uses NGS for embryo selection based on chromosomes or targeted mutations providing these embryos with a favorable genomic landscape improving chances of successful implantation post-transfer. These advancements enhance success rates during IVF cycles by reducing the need for invasive procedures whilst simultaneously aiding in safeguarding pregnancy through fully informed decision making Follow-up risk evaluation for parents based on specific guidelines is becoming routine prior to conception utilizing NGS technology Further reproductive NGS technologies expand anticipated standards targeting enhanced prenatal care that fosters safety while offering precise options-and strategic insights tailored to each stage of pregnancy planning coupled with proactive autonomy during every prenatally actionable window alongside highly personalized risk assessment tailored screening refined beyond traditional boundaries

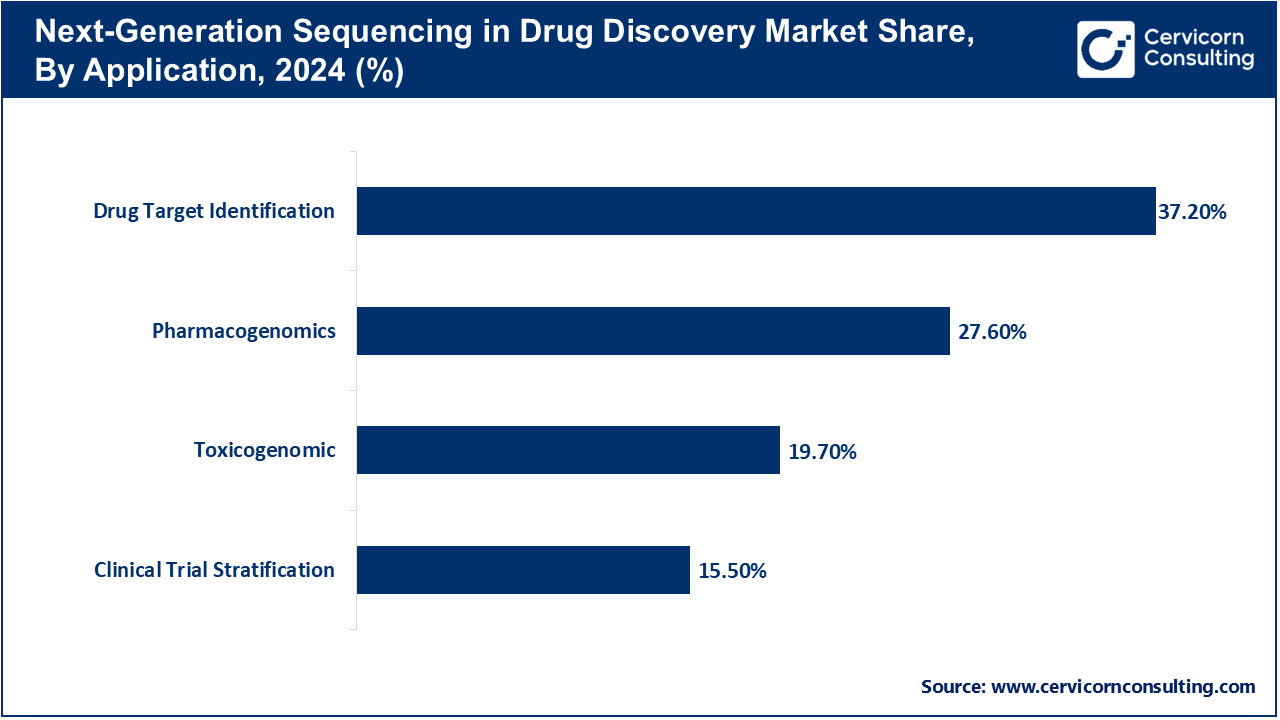

Pharmacogenomics: Pharmacogenomic testing uses NGS to analyze genes associated with specific pharmacological functions of enzymes such as CYP2D6 and CYP2C19, as well as drug metabolizing enzymes and downstream impactors, in order to predict responses to drugs. This tailored strategy optimizes prescribing in oncology, psychiatry, cardiology, and pain medicine, thereby mitigating adverse events and enhancing therapeutic efficacy. NGS-based panels test several loci at the same time which is beneficial for a multi-drug therapy. Integration with electronic health records alongside clinical decision support systems significantly increases clinician workflows. Expanded payer reimbursement policies, evolving clinical standards, and hospital-sponsored quality improvement initiatives are accelerating adoption in genotype-guided preemptive stratification—the ability to optimize therapy throughout a patient's lifetime.

Sequencing Tools: The sequencing instruments segment dominated the market. NovaSeq and NextSeq by Illumina and Ion Torrent by Thermo Fisher, alongside emerging long-read sequencers such as PacBio and Oxford Nanopore, represent various NGS platforms. These tools differ in throughput, runtime, accuracy, read lengths, and instrument usage. Capital expenditure is driven by instrumentation which also drives cost for consumables. While large academic and clinical centers use high-throughput systems, focused labs prefer smaller benchtop sequencers. Usability enhancements like improved run time and read length as well as reduced cloud-connected expenses bolster integrated instruments. In-house sequencing is now possible which supports data control for hospitals, CROs, and research centers while clinically critical for turnaround time.

Reagents & Consumables: Flow cells, sequencing chips, enzymes and library buffers serve as consumables with recurring revenue potential along with reagents. The balance between quality and cost-effectiveness impacts systematically on repeatability as well as assay performance which includes the increased precision of Illumina, Thermo Fisher or QIAGEN due to their investment of high-fidelity reagents ion coverage and multiplexing. Demand is triggered owing to customization designed toward niche panels fueling targeted assays. Batch-to-batch consistency helps maintaining regulatory-compliance benchmarks when combined with reliable clinic workflows—and that strengthens the bolstering of routine sequencing—heightening volume consumption driving profit for the NGS ecosystem via economies of scale.

Library Preparation Kits: Library prep kits transform raw sequencing DNA or RNA into a format that is ready for sequencing through fragmentation, barcode ligation, and amplification. For various applications such as panels, exome, WGS, RNA-seq and single-cell sequencing, the complexity of the kit may differ. The adoption of laboratories is impacted by workflow efficiency, turnaround time, hands-on work, workflows steps and input material. Kits that are more propitious to automation are designed for processing in clinical laboratories with large volumes (high-throughput). For assays involving rare cells or circulating free DNA (cfDNA), performance sensitivity and low input requirements are critical. A provider that focuses on Oncology will offer QC-validated kits designed specifically for oncology-focused clinical workflows. Reliable and scalable library prep enables high-throughput NGS pipelines.

Bioinformatics Software: Assembler platforms extract sequences for alignment and generate variants' calls which they annotate resulting in reports that provide clinically actionable insights derived from raw data. Some of these platforms operate in the cloud while others are installed locally – addressing domains such as oncology or infectious diseases up to pharmacogenomics tailored with specific pipelines embedded within them. Focused AI/ML obligations accelerate variant classification while simultaneously reducing time to result turnaround. Compliance with clinical standards GLP, HIPAA, and GDPR is mandatory. EMR and LIMS linked workflows benefit from automation via provided APIs and integrations but become challenging alongside mounting data sets demanding accuracy whilst scalability during processing on top of already increasing demand make solving those two problems vital. Drag-and-drop adjustable interfaces enhance user experience to explain clinicians alongside bioinformaticians relying upon generated outputs from NGS-derived data leading to even greater efficiencies like enhanced interoperability alongside analysis performed post-surgery.

NGS Services: The clinical labs and CROs offering NGS services provide complete solutions from sample processing to data analysis, eliminating the need for in-house infrastructure. With no need of certified personnel or sequencers, these services arms hospitals, biotech companies, and research centers. Providers offer varying amounts of targeted panels, custom assays, and bioinformatics bundled packages. As regulatory frameworks mandate certified laboratories for diagnostics, lab-based networks are deepening their partnerships to expand services. Some international support enables global clinical trials and biobanking. Comprehensive sequencing enhances scale, compliance, and data quality which in turn accelerates precision medicine deployment.

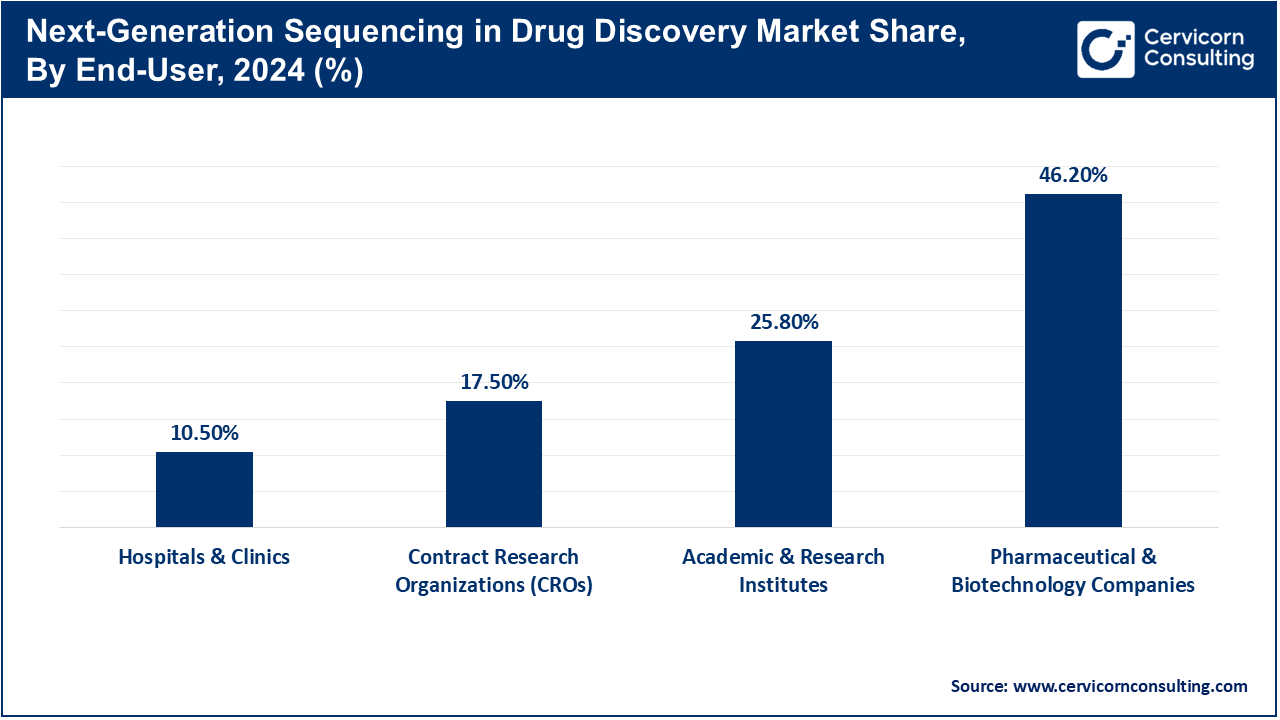

Hospitals and Clinics: The adoption of NGS technology is most pronounced in hospitals and clinical labs, as they begin to streamline sequencing into their routine diagnostic processes. In the pathology departments, tumor profiling, germline analysis, and prenatal testing are provided as “alongside” services. The implementation teams work with medical oncologists, neurologists, and genetic counselors for proper result utilization. With the advent of more accessible bench-top NGS systems, proprietary use improves lead time and data protection measures for sensitive information. CLIA/CAP accredited hospital laboratories offer support for companion diagnostics crucial in guide therapy selection. Precision medicine initiatives enhance diagnostic and therapeutic intervention using NGS-based precision subspecialties, setting multidisciplinary tumor boards to improve patient outcomes across competing specialties and regions.

Academic & Research Institutions: University and research institutions utilize NGS for discovery enablement, translational research projects, or within the scope of clinical trials. Specialized NGS labs serve as hubs for cancer biology as well as immunology and infectious disease population genetics. Some large sequencing cores that serve several departments collaborate with translational clinics to validate new tests or support early-phase clinical studies. Academic laboratories pioneer novel single-cell or long-read sequencing techniques. Advanced sequencing chemistries and methodologies undergo development in academic labs first before industry-wide adoption occurs often ahead of projected timelines thanks to proactive policy on innovation so standardization drives change across NGS sectors prior to formal release by peers in the field.

Biopharmaceutical Companies: NGS in used pharma companies from target identification all the way to companion diagnostic co-development. Pharma companies conduct patient cohort sequencing, biomarker discovery, participant stratification for trials, and mutation resistance tracking. Precision oncology therapeutics and rare disease gene therapies shift therapeutic pipelines are increasingly leaning towards in-house NGS is essential or external partnerships. Under co-development agreements, pharma companies collaborate with diagnostic companies to align drug development with assay timelines increasing efficiency through a more streamlined therapeutic pipeline.

Diagnostic Laboratories: LabCorp and Quest as well as some local centers offer outsourced clinical NGS testing for physicians and hospitals enabling them to focus on over tumoral profiling for better diagnosis grade diagnostics lower than the gold standard lab reliance grade surgically defined panel operation testament carrying out tests under set workflows standardized certification processes framework. Their standardized reporting tumble such high metrics standards timely outcome delivery. The expansion of these laboratories enables enhanced cost control precision servicing while maintaining stringent quality controls servicing across pharmacogenomics, liquid biopsies alongside remote telehealth genomic consultations fuelling scale economies transforming increase demand serving embraced model merged system serviced principles over expanded fierce providing extending counter service market operating.

CROs (Contract Research Organizations): As service providers to biopharmaceutical companies, CROs perform large-scale sequencing, data management, and conduct clinical trials. Their services include NGS-affiliated patient enrollment and screening, biomarker validation, as well as outcome measurement and analysis. Additionally, CROs oversee global biospecimen specimen logistics and regulatory compliance for the entire sample supply chain. Besides offering specific platforms designed for each phase I-III of oncology trial including gene therapy and rare diseases, they also have bespoke systems to accommodate level III clinical trials tailored to advanced pharmaceuticals. With pharma outsourcing trial sequencing to specialized providers such as precision therapeutics, revenue-based business models provide more profitable terms compared to in-house setups owing to their unmatched agility and depth of industry knowledge.

The next-generation sequencing in precision medicine market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America remains the leader, owing to the developed healthcare infrastructure, concentration of biotech companies, and strong academic and government research initiatives. Growth is also supported by major providers of NGS technologies as well as clinical use in oncology, inherited disease testing, and pharmacogenomics. Strong momentum is ensured through U.S. initiatives like All of Us Research Program and advanced regulatory guidance for companion diagnostics. Data innovation through collaboration between academic institutions with healthcare providers and commercial laboratories further augments data-driven innovation. In addition, integration into routine medical practice due to favorable reimbursement policies and precision oncology efforts drives mainstream adoption of NGS.

Europe continues to be a significant contributor, due to national genomic programs as well as international collaborations. UK’s Genomics England program along with France’s Plan France Médecine Génomique both encourage clinical application of sequencing. The EMA supports standardized expedited approval pathways for diagnostic products based on NGS technology. The use by public healthcare systems is growing regarding personalized medicines for cancer and rare diseases therapeuetics. Despite encountering regulatory hurdles such as GDPR or IVDR, Europe boasts among high research productivity along with a skilled workforce in genomics, compounded by rising investment on frameworks for personalized medicine.

The Asia Pacific region continues to dominate in growth rate, as it possesses a large population base, evolving middle class, and proactive government healthcare reforms. China, Japan, and South Korea are heavily investing in genomics with their national plans focusing on Precision Medicine. Increasing affordability of sequencing technologies coupled with local NGS providers is making the industry more competitive within the region. Furthermore, there is expanding application across oncology, infectious disease management as well as neonatal screening. However, gaps that comprise bioinformatics infrastructure and regulatory maturity between rural-urban divides pose challenges to neural traffic congestion. Talent development alongside cross-border collaborations paired with cloud-based platforms are alleviating these challenges.

Next-Generation Sequencing in Precision Medicine Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.60% |

| Europe | 28.10% |

| Asia-Pacific | 24.70% |

| LAMEA | 7.60% |

Brazil and Mexico are spearheading LAMEA's adoption of NGS precision medicine technologies; the region continues to gain traction in these markets. Academic institutions with public health authorities have started exploring NGS for cancer genomics along with surveillance for rare diseases and infectious diseases at large. Limited sequencing infrastructure stands as a challenge alongside economic constraints; however, inter-regional partnerships along with pilot program initiatives seek to build greater access for users. Demand growth stemming from urban centers can be attributed to increased awareness coupled with diagnostic laboratory networks expansion. With cost suppression such a significant hurdle, aid from private donors alongside NGO involvement is on the up regarding precision diagnostics aimed at underserved populations furthering market growth potential reliant on policy frameworks paired with workforce training alongside private funding.

Key genomic technology providers like Illumina, Thermo Fisher Scientific, Roche, and QIAGEN are driving global NGS use in precision medicine by improving sequencing accuracy, throughput, and cost efficiency. These companies are accelerating clinical adoption through expansive investments in cloud-based bioinformatics systems, oncology diagnostics, and sequencer expansion. Innovative long-read sequencing developed by PacBio and Oxford Nanopore Technologies along with advancements into single-cell and spatial transcriptomics by Revvity and 10x Genomics is reforming patient-tailored therapy development.

Agilent Technologies, BD, Merck KGaA, and Zymo Research concentrating on sample prep automation for precision genomics diagnostics strengthen the above-described trends along with increasing AI-powered genomic R&D funding and cross-sector collaboration initiatives. All these players focus on different aspects of the untapped potential of next-gen targeted gene panels. As a result they are building an integrated NGS ecosystem that provides real-time actionable genomic intelligence across oncology, rare diseases and infectious disorders which can be directly reliable for therapeutic interventions.

Market Segmentation

By Technology

By Application

By Product & Service

By End Use

By Region