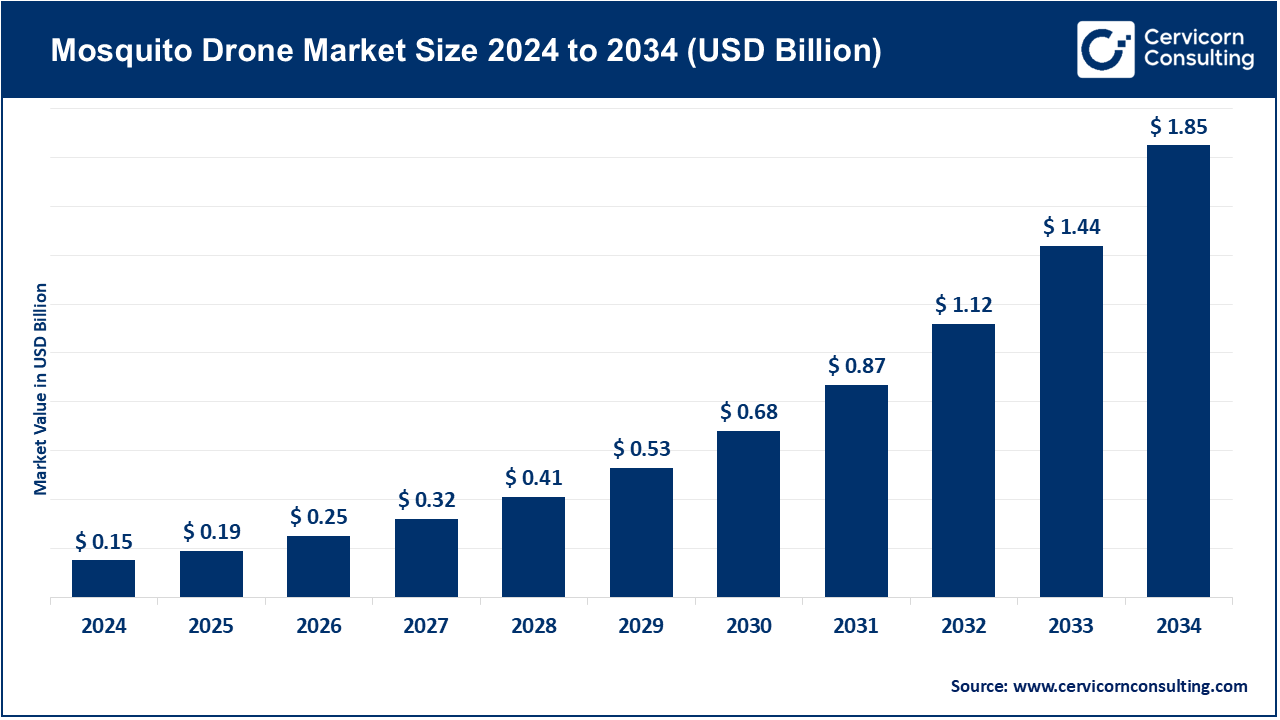

The global mosquito drone market size is anticipated to reach around USD 1.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 28.5% over the forecast period from 2025 to 2034. The mosquito drone market is expected to grow significantly owing to rising global concerns over vector-borne diseases, increased funding for public health surveillance, and the growing adoption of AI-powered drones for targeted mosquito control. Additionally, demand for non-chemical, environmentally sustainable pest control solutions is fuelling adoption across municipal and agricultural sectors. There is an emerging need for innovative mosquito control technologies due to the global escalation of malaria, dengue, Zika, and West Nile diseases. Often, mitigation techniques are traditional, reactive, and resource-heavy. However, surveillance and treatment with drones fitted with thermal imaging or AI mapping allow targeted and precise intervention. These systems facilitate proactive monitoring and intervention of hot zones for breeding as well as intervention.

What is mosquito drone?

A mosquito drone, also known as a micro drone, is a type of unmanned aerial vehicle (UAV) that is extremely small, often resembling the size and flight characteristics of an insect like a mosquito. These drones are designed for covert surveillance, reconnaissance, and data collection in a highly discreet manner. Due to their miniature size, they can access tight spaces, operate in swarms, and remain virtually undetected in many environments. The technology is primarily developed for military and intelligence applications, where their small footprint and agile flight patterns offer a significant advantage for stealth missions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 0.19 Billion |

| Estimated Market Size in 2034 | USD 1.85 Billion |

| Projected CAGR 2025 to 2034 | 28.50% |

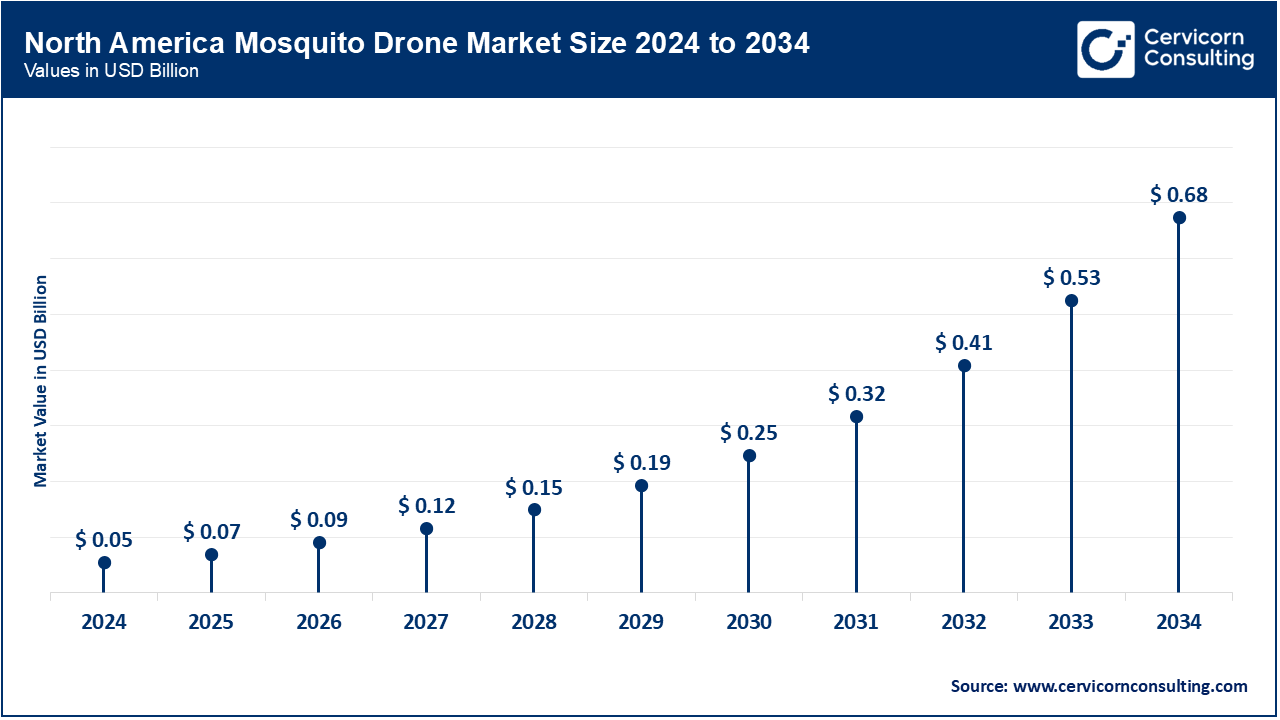

| Leading Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Drone Type, Payload Capacity, Technology, Application, Region |

| Key Companies | DJI Technology Co., Ltd., XAG Co., Ltd., PrecisionVision, VectorDrone, Aerial Response Solutions, Biogents AG, Terra Drone Corporation, Sunbirds SAS, DroneSeed, Bayer AG. |

The mosquito drone market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America: The mosquito drone market is still spearheaded by North America owing to its infrastructure of public drones, funding, and the need for integrated mosquito monitoring systems. The CDC has been sponsoring projects that employ drones for vector control., especially in Florida, Texas, and California. The usage of AI and GIS enables drone technology alongside the worry of the West Nile virus, as well as climate-related expansions of mosquitos, is driving more usage at both state and federal health agencies.

Europe: The need to manage vector-borne diseases and the general surveillance of the environment have propelled public sector undertakings which fuel Europe’s market. Spain, Italy, and Greece are confronting the twin challenges of dengue and chikungunya, hence are using drones for larvicide spraying and breeding site searches. ECDC advocates for innovative technologic approaches in the vector surveillance industry, and with the EU stringent environmental policies, there is increased demand for drones that are environmentally friendly and allow for precise operations. Collaborations between public health institutions and drone manufacturers for research and development are increasing as well.

Asia-Pacific: In the Asia-Pacific region, there is a noticeable expansion of SIT (Sterile Insect Technique) drones in areas with endemic malaria, as their use is increasingly being adopted for rural surveillance and SIT deployment. Programs fostering smart cities are already stimulating the use of drones, alongside government-sponsored digital health programs. Technological innovation in China and Japan is also aiding drone manufacturing by providing inexpensive, high-quality, easily deployable drones at scale. Furthermore, the region benefits from a combination of growing public health issues and a developing drone manufacturing ecosystem.

LAMEA: The rest of the world is considerably lagging behind in terms of SIT drone usage. However, reoccurring outbreaks of Zika, dengue, and chikungunya places LAMEA as a potential region for mosquito drones. Brazil and Columbia have already started testing SIT drone applications. In Africa, NGO-driven deployments are on the rise in malaria-endemic regions, and there is notably a lack of healthcare systems in remote locations which makes drones ideal for mosquito containment. Although restrictive funding and regulatory frameworks exist, international aid and global health partnerships are rapidly advancing change in crucial areas of LAMEA.

Mosquito Surveillance: The mosquito surveillance segment is the dominant force in the market. The use of drones for mosquito surveillance allows for both urban and rural breeding hotspots to be monitored in real-time and in high resolution. Using HD cameras and other sensors, drones are able to spot stagnant water bodies as well as thick vegetation where mosquitoes breed. Several health agencies utilize sophisticated imaging techniques alongside real-time data analysis to track and predict future infestations, monitor areas at high risk for dengue, malaria, and Zika, as well as assess the efficiency of previously implemented operations in those regions. This technique is gaining acceptance internationally, especially due to dwindling resources available for conducting manual inspections in light of the posed risk of insect-borne diseases.

Larvicide/Pesticide Spraying: This section focuses on drones that are designated to spray pesticide and larvicide over infested areas. These drones are equipped with GPS for route optimization. These drones achieve complete coverage of infested sites and eliminate human exposure to chemicals. The ability of these drones to reach difficult and dangerous areas such as wetlands, canals, or garbage places make them indispensable to municipal vector control programs. The emergence of new mosquito-borne diseases has highlighted the need for effective, sustainable spraying options especially in Africa and the Asia-Pacific region.

Sterile Insect Technique (SIT) Deployment: SIT residents disperse sterilized male mosquitoes, which are supervision to reproduce controlling use of population suppression techniques, thus SIT (Sterile Insect Technique Sales) Deployment is a form of SIT. Non-chemical biological approaches have been successful with the Aedes aegypti mosquito. Drones provide automation and scale for these releases, expanding coverage while decreasing costs relative to manual deployment. There is a noted shift towards pilot programs in Latin America, India, and Sub-Saharan Africa as public-private partnerships seek meaningful and sustainable solutions for mosquito control.

Aerial mapping and breeding site detection: Equipped with multi-spectral sensors, AI cameras, and drones, watercourses and vegetation likely to yield mosquito larvae are detected automatically. In addition, they capture thermal images and 3D topographic maps which can be used for targeted precision intervention strategies. This segment forms the foundation of efficient surveillance systems for vast or remote regions. The use of GIS technology together with digital models of the mosquito populations augment the surveillance systems and enhance the predictive and decision-making capabilities in relation to vector control strategies.These are actively used by environmental health agencies and research institutions.

Public Health & Disease Control: Integrated surveillance, spraying, and data analytics into a unified system that proactively addresses disease control issues. These drones are employed by public health departments for timely intervention, outbreak response planning, and reduction of manual work. This segment is now receiving significant government funding due to increased need for pandemic readiness and advanced healthcare systems. Countries fighting chronic malaria, chikungunya, or dengue recurrent outbreaks are heavily investing in drone-enabled disease control solutions.

Fixed-Wing Drones: Fixed-wing drones excel at swiftly covering vast terrains. They are ideal for mapping and surveillance of expansive areas such as forests, wetlands, or floodplains. Moreover, fixed-wing drones are more effective than multi-rotor drones in detecting mosquito habitats and SIT operations performed in broader regions since these drones have longer flight times and ranges. Nevertheless, their effectiveness decreases in dense or urban settings. Such regions are witnessing accelerated adoption in Southeastern Asia and Africa owing to comprehensive national campaigns for vector control.

Multi-Rotor Drones: The multi-rotor drones segment has captured highest revenue share. Due to their ability to hover, take off, and land vertically, multi-rotor drones dominate the mosquito control competition in urban and semi-urban areas. These drones are most suitable for larvicide/pesticide spraying and SIT mosquito releases in densely populated residential and commercial regions. Multi-rotor drones are also easy to operate and their compact design is favorable to municipal health departments and non-governmental organizations. Improvements in battery technology are gradually increasing flight duration, which will expand operational capability in diverse environments.

Hybrid Drones: The longitudinal reach of fixed-wing models hybrid drones along with the hovering and vertical lift abilities of multi-rotors makes them versatile. They are now preferred for enduring complex missions such as maneuvering large rural surveys or conducting targeted spraying. Although more expensive and complicated, these dual purpose drones are ideal for integrated mosquito control operations in regions with varied topography. Such accelerative innovations are expected to shift focus toward strategi multi-functional versaility further advancing this segment.

<5 Kg Payload: Drones in this category are short-range devices designed for surveillance and small area spraying. Drones in this category are lightweight in 117 a compact form used for short range interventions. Local governments, NGO’s and charitable organizations. Their low capacity means they can only perform basic camera functions and low volumetric spraying. However, these drones save time and training. This group is a definition of low cost and ease of implementation in early stage adoption regions.

5–20 Kg Payload: Used by regional health authorities and pest control commercial companies drives this mid-range segment. This range is suitable for moderate to high volume spraying and sensor payloads. These drones are multifunctional. They can easilly work in urban and semi rural environments. There is an increasing sustainable demand for modular and scalable mosquito control branching out from Asia, Latin America and Europe. Countries suffering from seasonal and widespread vector-borne diseases are driving the strong adoption for these products.”

>20 Kg Payload: The drones in this category are capable of large area spraying or transporting a high volume of sterile mosquitoes. Designed for intensive operations over wide geographic areas, these drones are equipped with large capacity tanks, dual batteries, and automated release mechanisms. North America and China, due to their sophisticated infrastructure and government-sponsored vector control programs, are the primary markets along with China. These drones are expensive but offset the costs through reduced operational time and labor leading to a high ROI for governments and enterprises.

GPS and GNSS Integration: The role of GPS in equipping drones is indispensable for mission control, virtual fencing, and maintaining fixed flight routes. Mapping of the breeding sites and pesticide application is done with geo-referenced accuracy through GNSS (Global Navigation Satellite System) integration. This technologies allow drones to achieve and maintain multiple flight position consistency through successive flights which improves intervention consistency. This area supports all types of mosquito drones and is advancing with RTK (Real-Time Kinematics) which achieves centimeter precision.

Thermal and Multispectral Imaging: With the aid of thermal and multispectral sensors, water bodies, vegetation, and other mosquito habitats can be detected and captured beyond the range of human vision. These sensors are especially useful for the aerial mapping of breeding sites during periods of low light or high humidity. They enable timely targeted action to be undertaken proactively before disease outbreaks. This technology is increasingly being used by government and research institutions for evidence-based public health planning, especially in climate-sensitive countries.

Data Analytics & AI: There are multiple applications of Artificial Intelligence in healthcare. For example, AI technologies are used to process all the volumes of data collected from drones in order to identify possible areas of mosquito-breeding; identify the possibility of future outbreaks developing; and ultimately, create the most effective spray routes. Moreover, machine learning models can support predictive analytics by working in tandem with public health databases for planning purposes. The smart mosquito control platforms are emerging around the world, and this segment is expected to grow rapidly. With this development, the use of AI, along with drones IoT, is revolutionizing vector control operations by accelerating intervention speed, improving precision, and reducing costs.

Market Segmentation

By Drone Type

By Payload Capacity

By Technology

By Application

By Region