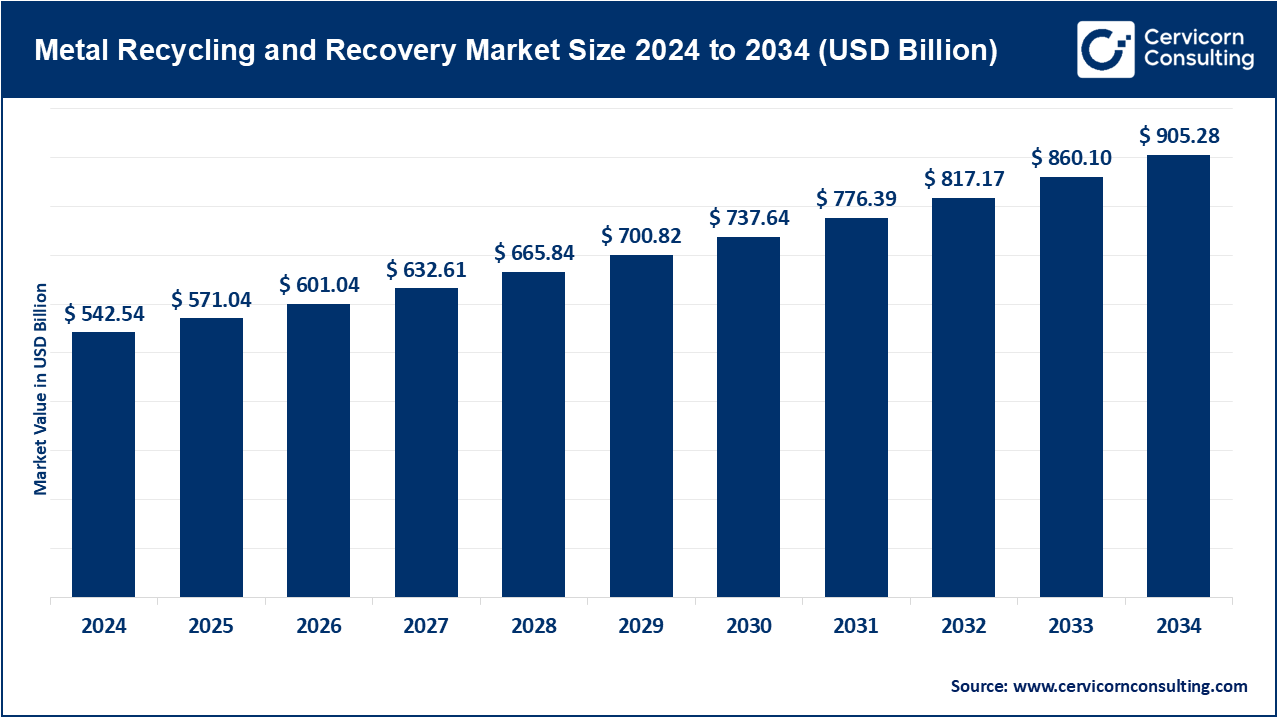

The global metal recycling and recovery market size was valued at USD 542.54 billion in 2024 and is expected to be worth around USD 905.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.25% over the forecast period from 2025 to 2034. The metal recycling and recovery market is likely to grow significantly owing to rising demand for sustainable raw material sourcing, stringent environmental regulations, and increased focus on circular economy practices across various industries. The transition towards low-carbon manufacturing in sectors such as automotive, construction, and electronics is pushing industries to adopt secondary metal sources to reduce energy use and carbon emissions. Moreover, global urbanization and infrastructure renewal projects are generating high volumes of scrap metal, boosting recovery efforts and promoting closed-loop recycling systems to meet material efficiency goals.

The process of gathering, processing, and reusing scrap metal to create new metal products is known as metal recycling and recovery. The gathering of scrap from diverse sources, such as consumer goods, end-of-life products, and industrial waste, is one of the steps in this process. After being gathered, the metal is cleaned, shredded, and sorted in order to get it ready for melting. Before being cast into new shapes like billets, ingots, or sheets, the prepared scrap is first melted down in furnaces and then refined to eliminate impurities. Because it drastically cuts down on the need for energy-intensive primary metal production from raw ore, this process is very advantageous from an economic and environmental standpoint. Additionally, it reduces greenhouse gas emissions from mining and smelting, landfill waste, and natural resource depletion.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 571.04 Billion |

| Expected Market Size in 2034 | USD 905.28 Billion |

| Projected CAGR 2025 to 2034 | 5.25% |

| Leading Region | Asia-Pacific |

| Key Segments | Metal Type, Source, Recycling Method, End-Use Industry, Region |

| Key Companies | Amcor plc, Sealed Air, Tetra Pak, Huhtamaki Oyj, Mondi, DS Smith, Atlantic Packaging, ProAmpac, Constantia Flexibles, Genpak, Crown Holdings, Inc., Gerresheimer AG, Stora Enso, WestRock Company, NEFAB GROUP, Scholle IPN, Greiner Packaging, Ball Corporation, Oji Holdings Corporation, Ardagh Group S.A., RAFESA, Trivium Packaging, Envases Group. |

The metal recycling and recovery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

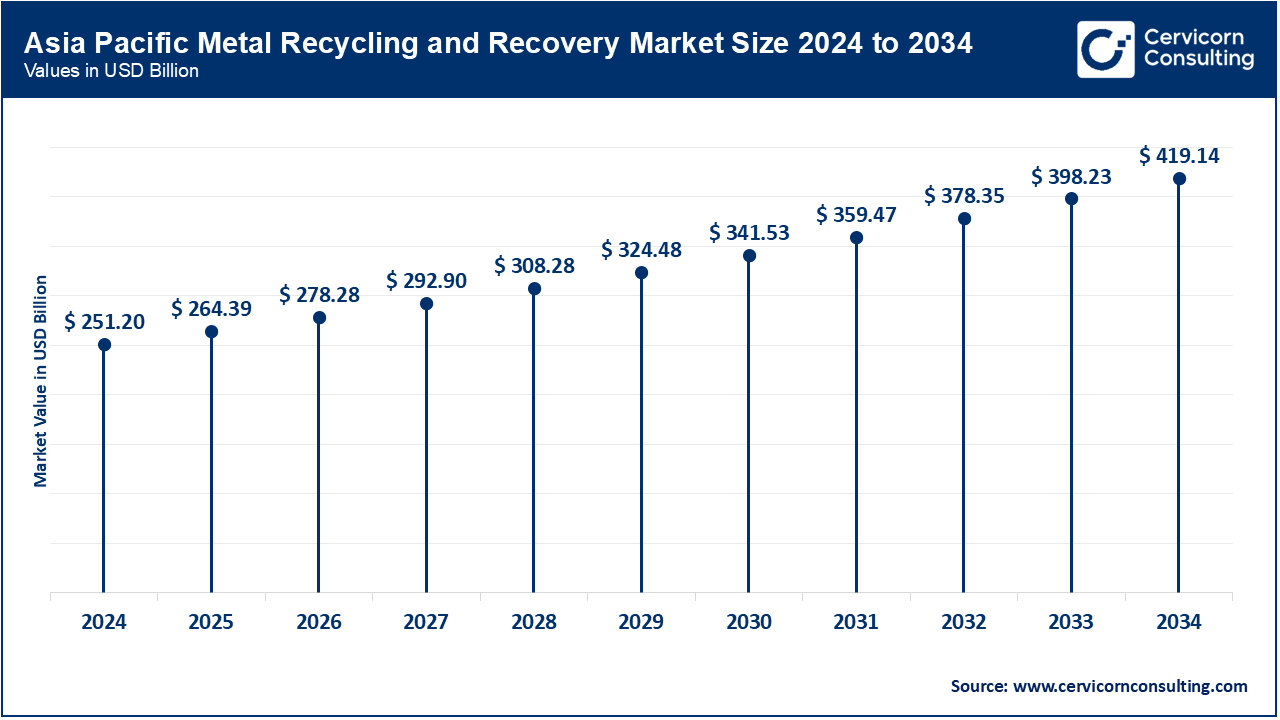

Asia-Pacific remains the global leader in metal recycling, underpinned by accelerated urbanisation, deepening production ecosystems, and a strengthening preference for recycled inputs among manufacturers. The principal nation-states—China, India, Japan, and South Korea—exhibit contrasting dynamics: China excels in steel scrap processing, while India systematically strengthens its non-ferrous recovery framework. Although the informal sector retains a substantial operational presence, formalized processing capacity, urban-mining initiatives, and dedicated e-waste facilities are gaining ground. Policy-driven incentives, coupled with ascending commodity prices, are collectively propelling a comprehensive upward shift in the entire recycling value chain.

North America benefits from an established metal recovery ecosystem distinguished by a dense network of processing facilities, a capable industrial base, and a rigorous regulatory framework. The United States and Canada lead in sourcing scrap supply, incorporating state-of-the-art separation technologies, and satisfying robust demand from automotive, building, and packaging sectors. Heightened regulatory requirements and corporate commitments to sustainable material stewardship are directing fresh investment toward circular-economy programmes. The regional transition to electric vehicles, together with a rising focus on recovering electronic waste, is driving faster reclaiming of both non-ferrous and precious metal fractions.

Europe, in contrast, occupies a global leadership position, energised by the European Union’s Green Deal, circular-economy policies, and coherent extended-producer-responsibility frameworks. Germany, the United Kingdom, France, and Italy account for most regional recycling volumes, supported by high collection efficiencies and the pervasive adoption of advanced processing techniques. A robust framework of landfill diversion policies, combined with escalating public and corporate awareness of resource circularity, is reinforcing the metal-recycling landscape. Advances in e-waste processing, hydrometallurgical metal extraction, and open-loop alloy recovery are collectively enlarging treatment capacity and markedly enhancing recovery rates for both non-ferrous and precious metals.

Metal Recycling and Recovery Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 18.40% |

| Europe | 27.80% |

| Asia-Pacific | 46.30% |

| LAMEA | 7.50% |

The LAMEA region is progressively asserting itself in the global metal-recycling value chain, underscored by a growing dedication to sustainable waste governance. Brazil and South Africa lead in the export of ferrous and non-ferrous scrap, while several Gulf states are allocating investment to advanced shredding and pyrometallurgical facilities as a strategy to broaden non-hydrocarbon fiscal bases. Shortfalls in logistics and the continued presence of unregistered operators remain obstacles, nevertheless, ongoing construction momentum, increasing mineral recovery, and targeted international partnerships are driving progress. Government-backed recycling initiatives and recently adopted circular-economy regulations are reshaping the competitive landscape for the formal processing sector.

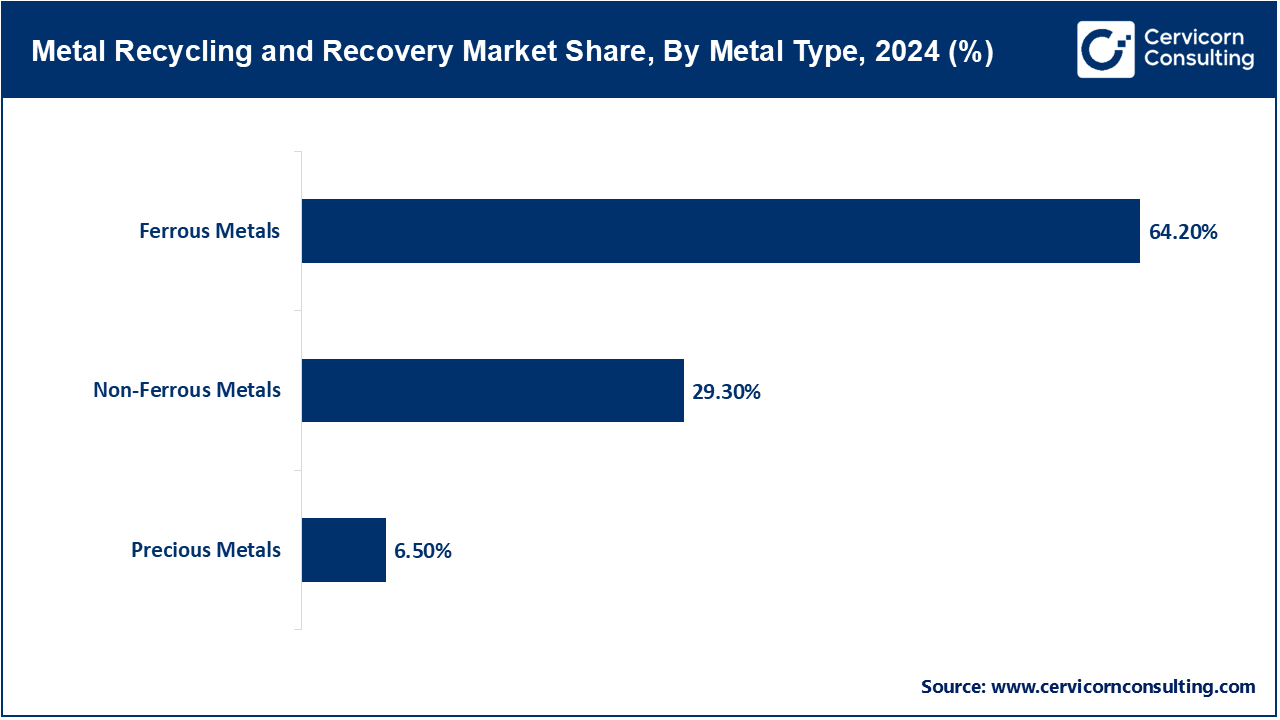

Ferrous Metals: Ferrous metals—primarily iron and its numerous alloys—dominate international metal recycling, owing to their vital roles in structural beams, automotive frames, and high-volume manufacturing sectors. Current automated magnetic separation systems proficiently segregate ferrous scrap from non-ferrous fractions, enhancing both logistical throughput and yield recovery. Repeated cycles of melting and solidification in ferrous alloys yield resistance to loss of tensile strength and ductility, thus limiting the deterioration of mechanical properties and enabling consistent reprocessing. This built-in durability, combined with compliance to rigorous engineering and safety standards, establishes the economic viability and environmental integrity of circular supply chains. The presence of a well-established processing infrastructure, alongside a rising international appetite for low-carbon steel, further reinforces the market for ferrous scrap. The recovery of ferrous metals significantly curtails energy consumption and greenhouse gas emissions when contrasted with primary iron production, thereby affirming their critical contribution to the advancement of sustainable manufacturing.

Non-Ferrous Metals: Non-ferrous metals—aluminium, copper, zinc, and lead—demonstrate outstanding recyclability, preserving material performance through multiple reuse iterations and thus maintaining high market value over extended life cycles. This resilience supports sustained consumption in critical sectors including electronics, aerospace, energy, and infrastructure. Aluminium and copper, in particular, are vital to efforts to decarbonise energy systems, both are integral to battery and motor designs in electric vehicles and to the lightweight, high-conductivity components of smart grid systems. Limited terrestrial reserves and rising global commodity prices are rendering the extraction and refining of non-ferrous scrap increasingly cost-effective, thus catalysing the expansion of international recycling and recovery networks.

Precious Metals: Precious metals—principally gold, silver, platinum, and palladium—are chiefly recovered from obsolete electronic assemblies, decommissioned catalytic converters, and selective metallurgical by-products. Escalating commodity prices combined with the deteriorating grades of newly extracted ores compel the adoption of more sophisticated metallurgical processes. Currently, hydrometallurgical methods—especially precisely controlled leaching coupled with targeted solvent extraction—continue to be the preferred strategy, achieving elevated recovery rates and reduced ecological footprint. At the same time, the worldwide surge in consumer electronics and next-generation energy-transmission networks is enlarging the demand reservoir for these indispensable metals. Recovery of such materials through closed-loop processing offers a reliable and cost-competitive alternative to virgin mining, thereby moderating the rising net environmental impact. In parallel, a growing corpus of regulatory frameworks is designating these metals as critical and strategic resources, obliging all supply-chain participants to integrate circular-economy principles at the design, procurement, and end-of-life stages.

Industrial Scrap: Within manufacturing and fabrication, industrial scrap arises at numerous points: defective components, die-cut off-cuts, edge trims, and machining swarf. Such a stream exhibits low contamination, consistent metallurgical composition, and a high capacity for mechanical separation. These attributes render it an excellent intermediary for both smelting operations and alloy formulation. Foundries, stamping shops, and machining centers are the principal generators of this category of scrap. Growing implementation of closed-loop manufacturing systems and circular economy frameworks is strengthening the economic rationale for recycling, as it lowers both the costs of virgin feedstock and the volumes directed to landfills, while simultaneously reducing overall energy demand, especially in well-established industrial corridors.

Consumer Scrap: Consumer scrap arises from the decommissioning of durable goods such as automobiles, household appliances, and electronic devices. Recovery of this stream necessitates labor-intensive disassembly, multi-material sorting, and complex transportation logistics. Initiatives such as extended producer responsibility for vehicles and formal appliance take-back programs have raised metal recovery rates. The segment is experiencing expansion in ferrous and non-ferrous yields, propelled by growing consumption, urban density, and heightened recycling literacy. In emerging economies, the informal sector continues to provide a critical interface for collection and processing, despite challenges in environmental and worker safety standards.

Metal Recycling and Recovery Market Share, By Source, 2024 (%)

| Source | Revenue Share, 2024 (%) |

| Industrial Scrap | 47.60% |

| Consumer Scrap | 16.30% |

| Construction & Demolition Waste | 29.10% |

| E-Waste | 7% |

Construction and Demolition Waste: Construction and deconstruction processes generate significant metal scrap, mainly consisting of steel reinforcement, insulated copper cable, aluminium sections, and various ferrous parts. Collecting these fractions in a methodical manner during the deconstruction stage enables their consolidated retrieval and typically yields sizeable, uniform commodity batches with high market appeal. As design practice evolves toward sustainability-oriented principles and urban infill, the reprocessing of site-generated metal fractions has become a cornerstone of contemporary green-infrastructure imperatives. Reclamation of this material flow mitigates landfill pressure and bolsters the circular use of resources across large-scale civil-engineering programmes.

E-Waste: The volume of electronic waste continues to rise, driven by rapid product turnover, shrinking product lifecycles, and the adoption of densely integrated designs. This waste stream has become a notable reservoir of metals, including copper, aluminium, silver, and rare-earth elements, whose economic and strategic value is amplified as devices become smaller and more complex. Though these factors complic dismantling, they simultaneously create market and technological incentives. State-of-the-art recycling facilities employ combined hydrometallurgical and mechanical interventions to isolate valuable fractions from printed circuit boards, lithium batteries, and consumer devices. National and supranational regulatory instruments, notably the European Union Directive on Waste Electrical and Electronic Equipment, are fostering formal processing, particularly in affluent jurisdictions with established collection-and-take-back infrastructure.

Shredding and Separation: The shredding and separation segment has dominated the market in 2024. In the shredding phase, large metallic feed streams—comprising end-of-life vehicles, discarded white goods, and similar substrates—are mechanically fractured into smaller fragments. The resulting heterogeneous particle cloud is subsequently directed through a sequence of magnetic separation and eddy-current sorting. These techniques reliably divide ferrous from non-ferrous fractions and have been standardised as the core sequence in bulk metallic recycling. The circuit achieves high recovery efficiencies, reduces dependence on labour-intensive manual sorting, and optimises overall throughput. Recent developments—incorporating adaptive control algorithms and sensor-rich sorting arrays—are further refining separation accuracy, particularly for metallurgical feeds exhibiting compositional heterogeneity or specialised surface coatings. These enhancements translate into improved recovery yields and stronger economic justification for the process.

Pyrometallurgical Processing: Pyrometallurgical methods leverage high-temperature smelting to recover metals from intricate feed matrices, including waste electrical and electronic equipment, spent catalysts, and metallic slags. This approach excels in extracting refractory metals—particularly copper and platinum—from complex substrates. Although the process demands considerable thermal energy, it achieves high metallurgical purity and rapid processing times. Recent developments in furnace design, alongside improved off-gas treatment and emissions-capture systems, are progressively minimising the environmental impacts associated with smelting operations.The technique is seamlessly embedded in extensive refining and smelting operations, where it underpins the extraction of both strategic and precious metallic fractions.

Hydrometallurgical Recovery: Hydrometallurgical recovery methods engage aqueous pathways—leaching, precipitation, and solvent extraction—to preferentially segregate valuable metals from electronic scrap and battery feedstocks. These methods excel in recovering high-value and strategic elements, notably gold, cobalt, and lithium. Although the processes demand stringent management of reagents and of aqueous effluents, they achieve elevated recovery rates with reduced energy demand in comparison to conventional pyrometallurgy. The growing heterogeneity and compositional intricacy of incoming waste feeds, alongside tightening regulatory frameworks and rising market demands for sustainability, are prompting operators to designate hydrometallurgy as the leading environmentally benign alternative for the recovery of critical raw materials.

Electrochemical Processes: Electrochemical methods—specifically electrowinning and electro-refining—constitute both effective and highly selective approaches for recovering and purifying metals—copper, zinc, and silver, for example—derived from industrial residues and the low-grade streams remaining after leaching. Both techniques demonstrate remarkable selectivity and yield metal deposits whose purities meet or exceed the stringent specifications imposed by the metallurgy sector. Although the kinetics are slower than mechanical approaches, the technology is indispensable for segments demanding ultra-pure metallic inputs. Its relevance is especially pronounced in battery recycling and in the recovery of by-products from hydrometallurgical circuits, thus reinforcing the emergence of a circular and environmentally benign materials economy.

Automotive: The automotive sector has emerged as a primary driver of worldwide metal recycling through the organized recovery of end-of-life vehicles (ELVs). Substantial quantities of steel, aluminium, and copper are extracted from the vehicle structure, the wiring harness, the entire powertrain, and a range of ancillary components. The growing penetration of electric vehicles is now extending this recovery loop to lithium-ion batteries and permanent magnets that contain rare-earth elements. National and regional legislation mandating responsible ELV treatment, accompanied by extended producer-responsibility frameworks, is directing financial investment toward state-of-the-art dismantling facilities and continent-wide, integrated shredding networks.

Construction: The construction sector routinely substitutes primary load-bearing steel, façade aluminium, piping, and electrical conductors with recycled metal. Material salvaged from demolished buildings and civil-engineering and infrastructure initiatives is reintegrated into fresh ventures, thereby advancing both low-carbon and circular-economy targets. By reducing the appetite for primary alloys and lowering the greenhouse gases emitted by metallurgical kilns, metal recycling also enhances sustainability certification frameworks such as LEED. Given the accelerating global wave of urban expansion and revitalisation projects, the volume of metals retrieved from construction waste is expected to continue growing steadily over the coming decade.

Metal Recycling and Recovery Market Share, By End-Use Industry, 2024 (%)

| End-Use Industry | Revenue Share, 2024 (%) |

| Automotive | 38.40% |

| Construction | 28.20% |

| Electronics | 15.60% |

| Packaging | 12.10% |

| Aerospace & Defense | 5.70% |

Electronics: The growing electronics sector remains the principal engine for metal recovery worldwide, owing to the concentrated, yet varied, metal-bearing matrices present in printed circuit boards, semiconductor dice and interposer layers. Recyclers now recover noble metals—predominantly gold and palladium—together with copper and tin from both advanced integrated circuit (IC) carriers and consumer portable devices. Accelerating global e-waste generation, combined with improvements in automated sorting, depopulation techniques, and increasingly stringent regulatory frameworks, is accelerating the establishment of purpose-built recycling plants. Substantial investment is now directed toward such facilities across North America, continental Europe and Japan, enhancing not only treatment capacity but also increasingly stringent environmental performance standards.

Packaging: Metal packaging, and particularly aluminum beverage cans and steel drums, ranks among the most extensively recycled product categories worldwide, due to the metal’s inherent recyclability and mature reverse logistics networks. The beverage and food industries provide the bulk of supply. Aluminum cans can be remelted in indefinite cycles without loss of material integrity, yielding up to 95% energy savings relative to primary metal production. Corporate sustainability pledges, together with rising consumer demand for environmentally friendly packaging, are accelerating the deployment of closed-loop recovery systems throughout these supply chains.

Aerospace and defense: Aerospace and defense industries are intensifying efforts to reprocess high-value strategic alloys central to airframes and defense platforms—namely titanium, aluminum-lithium, and nickel-based superalloys. Exacting performance specifications dictate processing pathways designed to maintain microstructural fidelity and critical mechanical characteristics. Such material loops reduce dependence on imported strategic minerals while meeting their prime contractors’ sustainability mandates. Though absolute recovery volumes are still slight relative to automobiles and non-defense commercial markets, the premium value per kilogram of these reclaimed aerospace alloys exerts a skewed, yet critical, effect on the entire metals value chain.

By Metal Type

By Source

By Recycling Method

By End-Use Industry

By Region