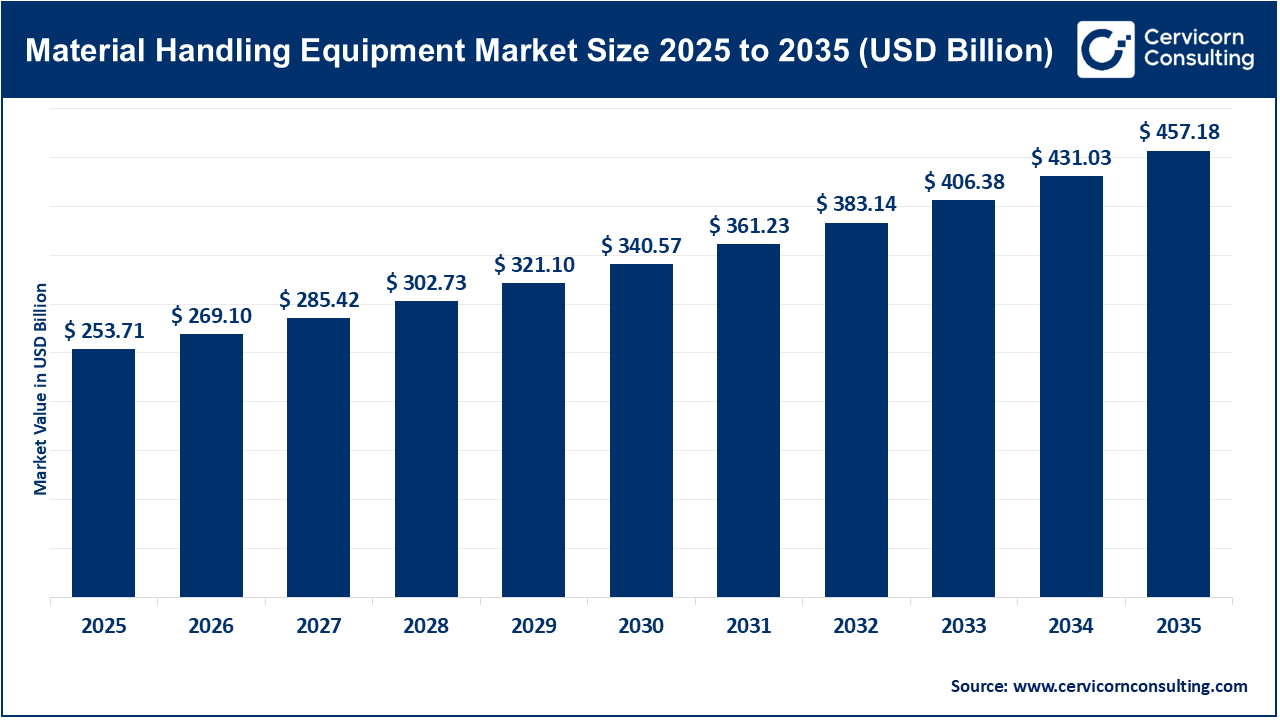

The global material handling equipment market size reached at USD 253.71 billion in 2025 and is expected to be worth around USD 457.18 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.1% over the forecast period 2026 to 2035. The material handling equipment market is expanding as more organizations want to move and store products quickly and easily. Warehouses, factories, and ports are using material handling equipment to eliminate heavy labor and save time. The increase in online shopping has pushed businesses to invest in forklifts, conveyors, cranes, and automated systems in order to process volume of orders. Many companies are also want to improve safety and decrease human labor costs, enhanced efficiency and effectiveness, as such are investing more money in material handling machine systems.

Another significant growth factor for the material handling equipment market is the emergence of automation and smart technology. Organizations are implementing robots, sensors, and software to increase their operations precision and efficiency. The increase in industrial production, particularly in emerging countries, is also contributing to the market growth. Additionally, the emphasis on expedited delivery, increased inventory management, and smart warehousing have led organizations to purchase more advanced material handling equipment.

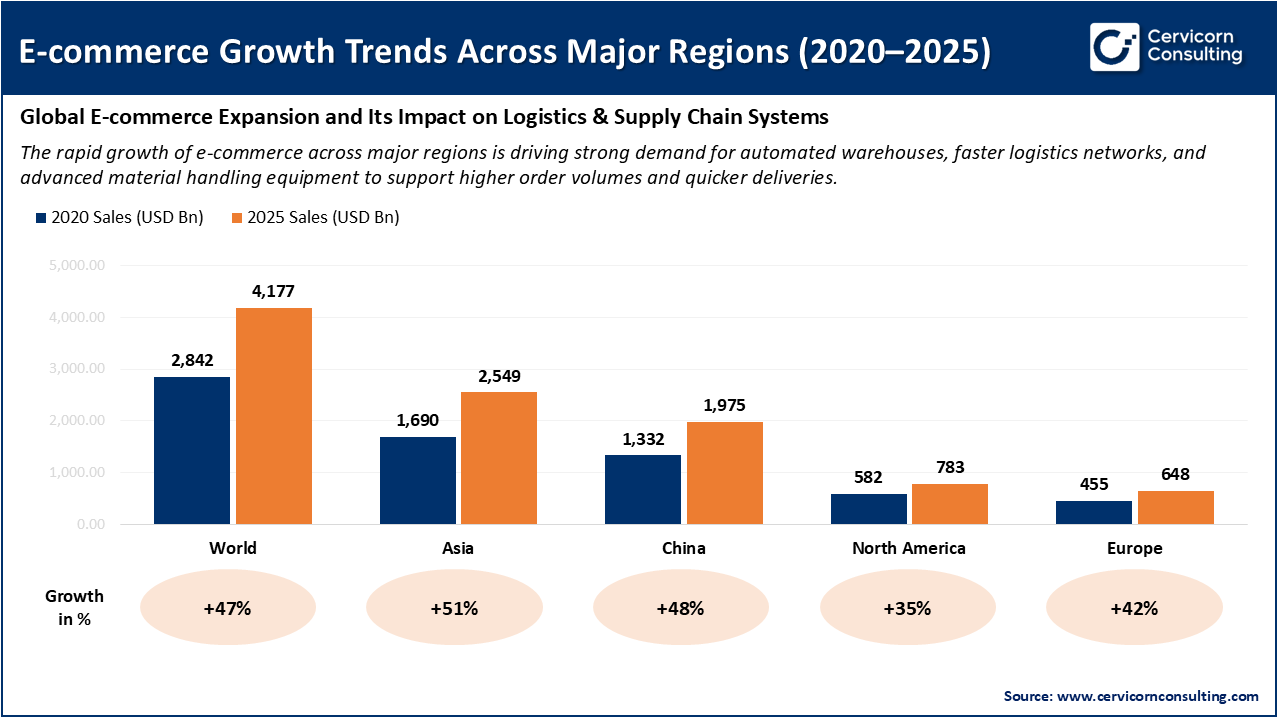

Growth of E-commerce Boosting the Material Handling Equipment Market

The rapid expansion of the e-commerce sector has significantly fueled growth in the material handling equipment market. As online shopping has surged, the number of warehouses and distribution centers has also increased. All of these facilities require fast and efficient methods to move, sort, and store the increasing volume of goods. Consequently, demand for conveyors, forklifts, automated storage systems, and robots is growing. Additionally, logistics companies continue to experience demand from e-commerce customers for quicker order fulfillment and increased volume. As a response to these market pressures, logistics companies are turning to more modern material handling equipment to reduce the amount of manual work, reduce the amount of time it takes to process products, and minimize errors in handling equipment. The advancement of e-commerce is sure to lead to further growth, which in turn will also fuel more demand for advanced material handling systems.

In summary, the significant growth in e-commerce sales in key regions between 2020 and 2025 is directly contributing to the material handling equipment market. As online sales increase, organizations need more sophisticated warehouses, quicker order fulfillment, and more efficient logistics systems. This leads to organizations needing to invest in automation, conveyors, robotics, and storage systems to manage higher throughput with better speed and accuracy. As a result, the expanding demand for e-commerce will increase the adoption of modern material handling solutions throughout global supply chains.

1. “The Raymond Corporation’s iWAREHOUSE® ObjectSense Wins 2025 Innovation Award”

In 2025, SupplyTech Breakthrough selected Raymond Corporation's iWAREHOUSE® ObjectSense system as the "Material Handling Innovation of the Year". The iWAREHOUSE® ObjectSense system promotes operator awareness in warehouse processes by providing dynamic object detection, intelligent alerts, and actionable enhanced situational awareness. It addresses the demand for smarter, more automated solutions by increasing safety, speed and control in intralogistics applications.

2. “Godrej Enterprises Group’s Material-Handling Business Debuts Smart & Sustainable Tech at LogiMAT India 2025”

Godrej Enterprises Group's material handling equipment business unveiled smart and sustainable technology at LogiMAT India 2025. This included eco-friendly materials, digital controls, and modular designs tailored for Indian logistics and manufacturing. Technology demand in emerging regions expands the material handling equipment market and technology is critically localized to be accessible and relevant to the local situation.

3. “Gonvarri Material Handling Sets Strategic Roadmap for 2025-2027, Launches Automation Division”

Gonvarri Material Handling announced its strategic roadmap for the years 2025-2027 that will focus upon digital innovation, worldwide growth and operational excellence, which includes launching a dedicated automation division. Through commitment to automation and heightened global footprint, Gonvarri shows its confidence for increased demand for sophisticated material handling equipment, which, in turn, will create further investment and acceptance within the industry as a whole in the material handling equipment industry.

4. “SILA and Nilkamal Launch Electric-Fleet Rental Solutions for Material Handling Equipment in India”

In July 2025, SILA worked with Nilkamal to introduce a rental-business for electric material handling equipment within India, focusing upon warehouses and the manufacturing sector. This establishes a lower barrier for companies to enter for adoption of modern equipment by offering rental vs purchase. Therefore, demand will likely increase within the material handling equipment industry for electric fleet, especially among smaller companies or companies in developing economies.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 269.10 Billion |

| Expected Market Size in 2035 | USD 457. 18 Billion |

| Projected CAGR 2026 to 2035 | 6.10% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product, End Use, Region |

| Key Companies | Daifuku Co., Ltd., Murata Machinery Ltd., Vanderlande Industries B.V., Honeywell International Inc., Kion Group AG, BEUMER Group, Mecalux, S.A, SSI Schaefer AG, Toyota Material Handling Group, Swisslog Holding AG |

The material handling equipment market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America material handling equipment market size accounted for USD 74.84 billion in 2025 and is forecasted to grow around USD 134.87 billion by 2035. The North American region is considered a mature and technologically sophisticated area of market. The rapid expansion of e-commerce, rising costs associated with labor, and the labor shortage in warehouse fulfillment are motivating firms to make substantial investments in automation and robotic material handling systems. Large distribution centers, smart warehousing, and logistics operations are experiencing growth across the United States and Canada. Additionally, industries such as retail, automotive, and food & beverage utilize sophisticated material handling equipment such as ASRS, mobile robots, and smart conveyor systems. The emphasis on delivery speed, efficient operations, and worker safety is bolstering the ongoing demand in this region.

Recent Developments:

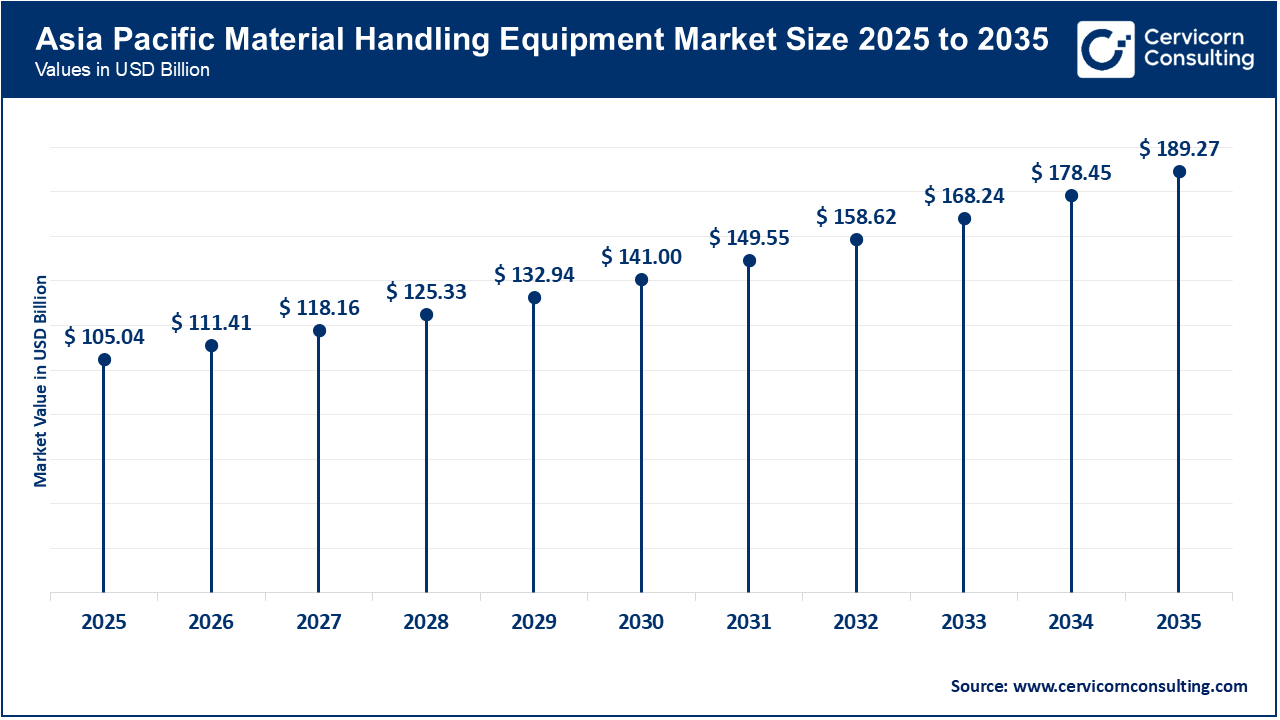

The Asia-Pacific material handling equipment market size estimated at USD 105.04 billion in 2025 and is expected to be worth around USD 189.27 billion by 2035. The Asia-Pacific region is the most rapidly expanding region, due to the rise of industrialization, urbanization, and growth of e-commerce in these markets. Countries such as China, India, Japan, and South Korea are investing heavily in manufacturing facilities, logistics parks, and smart warehouses for the region. The region is benefitting from strong growth in their electronics industry, automotive sector, e-commerce, and heavy industries. Rising foreign investments in various sectors coupled with growth in infrastructure is giving strength to this market expansion. A number of companies are implementing automation in their respective operations, in response to increasing labor costs come competitive pressure.

Recent Developments:

The Europe material handling equipment market size valued at USD 56.07 billion in 2025 and is projected to hit around USD 101.04 billion by 2035. The Europe is propelled by stringent environmental regulations and an emphasis on sustainability. Enterprises in this region are transitioning to energy efficient, low-emission, and electric material handling equipment. Nations, like Germany, France and the UK, are at the forefront of automated Smart Logistics. Furthermore, the evolution of automotive, pharmaceutical and food processing Industry stimulates demand. European companies are proactively developing green warehouses to digital-based supply chain intelligence, operational efficiency and lower carbon footprint, which adds overall strength to the demand for modern material handling systems.

Recent Developments:

Material Handling Equipment Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 29.5% |

| Europe | 22.1% |

| Asia-Pacific | 41.4% |

| LAMEA | 7.0% |

LAMEA (Latin America, Middle East & Africa) Material Handling Equipment Market: Growing Infrastructure and Logistics Development Supporting Adoption of Modern Handling Technologies

The LAMEA material handling equipment market size reached at USD 17.76 billion in 2025 and is anticipated to reach around USD 32 billion by 2035. The LAMEA region is growing steadily with increasing infrastructure investment, financing of ports, and industrialization. Countries in the Middle East are working on logistics hubs and smart ports, while Latin America is developing growth in retail, food processing, and mining industries. In Africa, port modernization and the construction of warehouses are emerging sectors to watch. Although automation is still considered a developing technology, many industries are transitioning toward modern material handling equipment to increase productivity and reduce manual compliance.

Recent Developments:

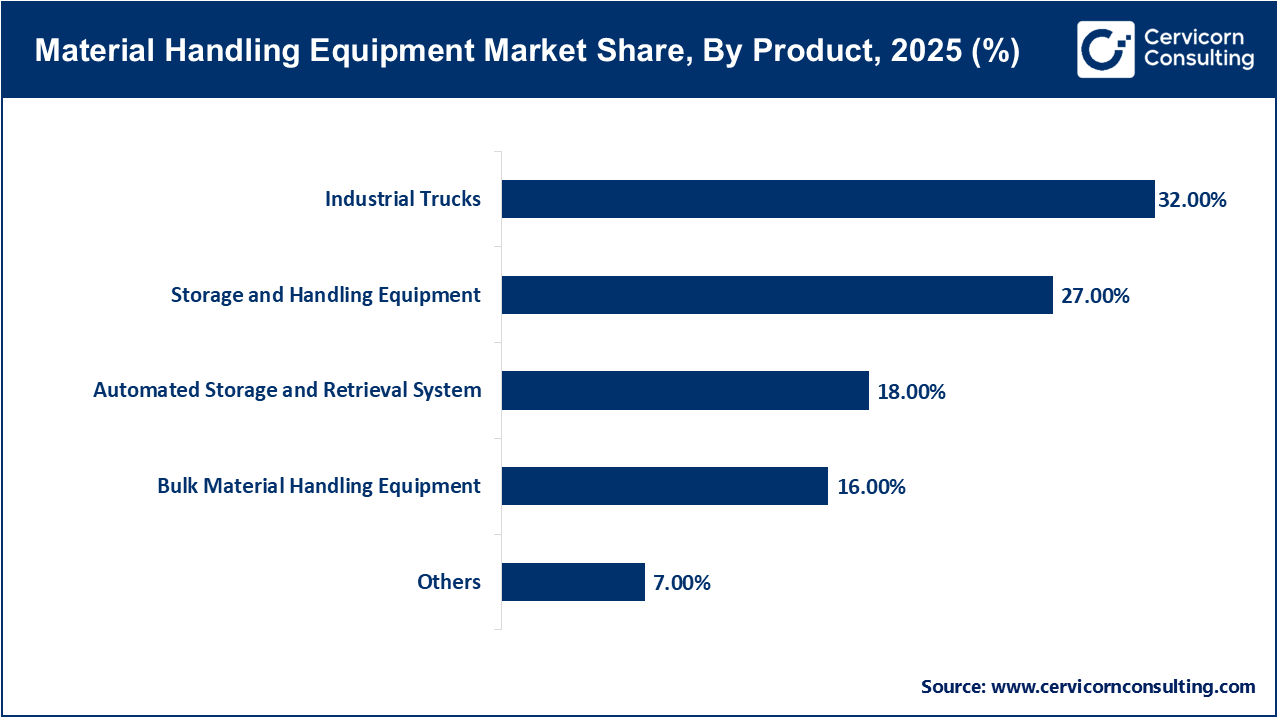

The material handling equipment market is segmented into product, end use, and region.

Industrial trucks, including forklifts, pallet trucks, reach trucks, and stackers, are the leading segment in material handling equipment, as these trucks are widely used throughout almost every industry. Industrial trucks are utilized to lift, move, load, and unload heavy goods in factories, warehouses, construction sites, and ports. Industrial trucks are favored due to their adaptability, minimal operation requirements, and lower cost compared to fully automated systems. Many industrial customers prefer industrial trucks to other forms of material handling due to their ability to be utilized indoors and outdoors, and for the versatility across types of loads and environments. The growth of industrial truck sales is being continuously driven by strong demand from sectors including retail, logistics, manufacturing, and construction.

Automated Storage and Retrieval Systems (ASRS) are the fastest growing segment in the material handling equipment market due to the current trend toward warehouse automation. ASRS incorporates a combination of software, robots, and computer-controlled machines to automatically store and retrieve items from high-density storage aisles. Businesses can use ASRS to reduce human labor, save space, and heighten accuracy with inventory management. As e-commerce increases, with a growing expectation for same-day delivery, with limited space being sold as warehouse space in urban areas, companies have begun heavily investing into ASRS. The focus on smart warehouses, and digital transformation further enables the growth of ASRS systems in the material handling equipment market, along with the rise of Industry 4.0 for the modern supply chain and the increasing importance of Automation.

The e-commerce industry is the primary segment of the material handling equipment market due to its reliance on fast and efficient warehouse operations. Online retailers manage a very high volume of orders on a daily basis, which requires sophisticated handling systems such as conveyors, sorters, robotics, and automated storage. The e-commerce companies also require equipment for packaging, labeling, and order fulfilment. The constant driver of e-commerce companies is the demand for fast delivery, hassle-free returns, and same-day or next-day shipping. With this demand, e-commerce companies are investing more into modernized material handling technologies. The burgeoning growth of fulfillment centers in different regions contribute to the consistency of this segment.

Material Handling Equipment Market Share, By End Use, 2025 (%)

| End Use Segment | Revenue Share, 2025 (%) |

| Automotive | 18% |

| Chemical | 10% |

| Food & Beverages | 14% |

| Pharmaceutical | 9% |

| Semiconductor & Electronics | 11% |

| Aviation | 6% |

| E-commerce | 24% |

| Others | 8% |

The semiconductor and electronics segment is one of the fastest growing end-use industries in the material handling equipment market due to the rising production of electronic devices, electric vehicles, and smart technologies. This industry needs highly precise, clean, and automated handling systems because electronic components are sensitive to dust, vibration, and human error. Automated and robotic handling systems help in protecting these components and improving production efficiency. As global demand for chips, sensors, and electronic components increases, more manufacturing units and cleanrooms are being built. This is creating strong demand for advanced material handling equipment, driving fast growth in this segment.

Recently Introduced Material Handling Equipment:

“Linde Material Handling Launches New Electric Forklift Series and Automation Solutions”

“KION Group AG Integrates ‘Physical AI’ and Launches Battery Recycling Initiative”

By Product

By End Use

By Region