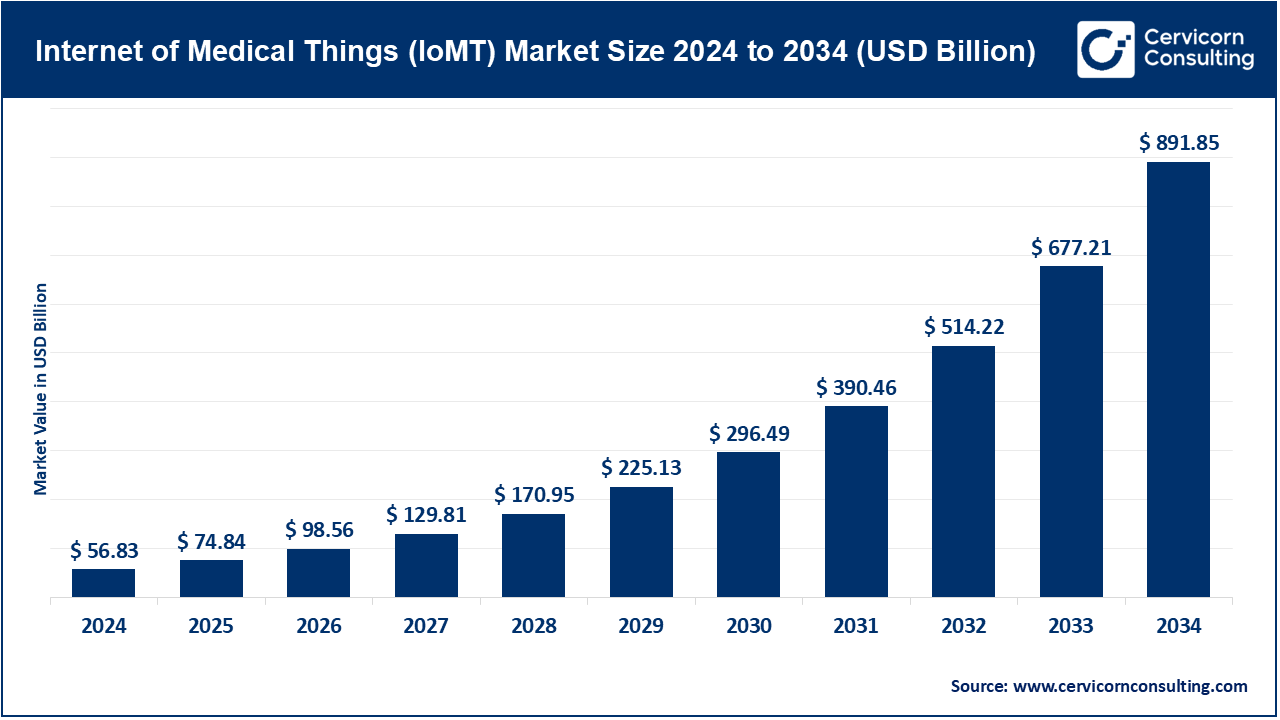

The global internet of medical things (IoMT) market size was valued at USD 56.83 billion in 2024 and is anticipated to reach around USD 891.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 31.70% over the forecast period from 2025 to 2034.

The internet of medical things (IoMT) market growth is driven by an increasing number of chronic diseases, such as diabetes, breathing issues, heart problems, and high blood pressure etc. The World Health Organization (WHO) reports that chronic diseases cause nearly 70% of deaths worldwide. Managing these diseases needs continuous monitoring, quick data sharing, and early treatment. Chronic conditions requiring ongoing management are typical in older adults. As per WHO, chronic diseases are responsible for 74% of global deaths each year, with over 41 million deaths annually. Internet of Medical Things (IoMT) devices, such as ECG monitors, fall detection systems, smart inhalers, and glucose monitoring systems, allow for remote and telehealth care for elderly patients. IoMT has the potential to reduce hospital admissions by up to 45% for patients with chronic illnesses through real-time monitoring and early intervention.

What is internet of medical things (IoMT)?

The internet of medical things (IoMT) refers to a network of medical devices and software that transmit health data over the internet. These systems have transformed the delivery of healthcare services by allowing real-time tracking and monitoring, remote diagnostics, automated caregiving, and data-driven healthcare services. Increased need for remote patient monitoring and effective control of chronic conditions are two main drivers for the growth of this market. In addition, there is a growing use of AI and IoT technologies in healthcare. The adoption of connected health technologies is being driven by the need to shift to value-based care, coupled with a growing need for services.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 74.84 Billion |

| Expected Market Size in 2034 | USD 891.85 Billion |

| Market CAGR 2025 to 2034 | 31.70% |

| Top-performing Region | North America |

| Top Expanding Region | Asia-Pacific |

| Key Segments | Component, Deployment, Application, End-User, Region |

| Key Companies | Medtronic, GE Healthcare, Philips Healthcare, Siemens Healthineers, Abbott Laboratories, Johnson & Johnson, Cisco Systems, IBM Corporation, Boston Scientific, AliveCor |

Growing Demand for Remote Patient Monitoring and Telehealth: The demand for remote patient monitoring (RPM) and telehealth services is rising quickly. A patient's care, chronic illnesses, and the IoMT devices like peripheral monitoring IoMT are evolving to track vital signs, medication adherence, and disease progression. Devices like these are beneficial in the management of chronic illnesses such as diabetes, hypertension and heart diseases. Need for peripheral care became immensely apparent during COVID-19 pandemic owing to the need for hospital decongestion. IoMT technology allows doctors to access real-time data, improves diagnosis accuracy, and reduces emergency room visits, making it key to modern healthcare. Remote patient monitoring through IoMT and AI is projected to reduce hospital readmission rates by 20–30% for chronic disease patients.

Advancements in Technology: Technological upgrades in 5G, Bluetooth, and Wi-Fi, plus new sensors at the medical level help. All these enhancements allow easy data flow from the medical device to the cloud platform to hospitals. The said sensors are energy efficient and small in size with precise real-time data. When combined with secure cloud computing and mobile apps, these technologies create smart, connected IoMT systems. As healthcare providers rely more on data, these technological advancements are essential for improving efficiency, patient outcomes, and personalized care. For instance, Oulu University Hospital in Finland has been a pioneering institution in Europe, being the first hospital to adopt a standalone private 5G hospital network in early 2025. Utilizing the Modular Private Wireless (MPW) 5G system by Boldyn Networks and Nokia, the hospital is now equipped with ultra-reliable, low-latency AI infrastructure. Healthcare cyberattacks targeting IoMT devices increased by 60% between 2022 and 2024, pushing the need for AI-based security monitoring.

Data Security and Privacy Concerns: One major challenge in the IoMT market is the increasing worry about data security and patient privacy. IoMT devices gather patients’ sensitive health information, which is often transmitted and stored in cloud computing systems. Such practices increase cyberattack, data breach, and unauthorized access to sensitive health information. The healthcare sector is a key target for ransomware attacks, which pose significant risks to patients and providers alike. Organizations must also comply with regulations like HIPAA in the U.S. and GDPR in Europe, requiring them to secure data handling, encryption, and access controls. These issues can slow down the adoption of IoMT technology and increase the costs of implementing secure solutions. More than 60% of connected medical devices are running on outdated or unsupported operating systems, increasing vulnerability to attacks.

High Implementation and Integration Costs: Economically, another important barrier is the incorporation of IoMT systems into existing healthcare frameworks. There are high initial costs associated with purchasing networking medical devices, secure networks, training staff, and advanced software ensuring quality control for small clinics and hospitals in the developing world. It might be difficult and take long to connect the IoMT systems to your older systems and EHRs too. Lack of funding as well as lack of digital preparedness make it difficult for a lot of medical professionals to kick start much of these technologies in their wider sense, thus negating the effectiveness of IoMT towards enhancing patient care. According to HIMSS survey, Up to 70% of hospitals globally still rely on legacy IT systems that are incompatible or difficult to integrate with modern IoMT platforms.

Home Healthcare with IoMT Devices: The most significant potential in IoMT lies in home healthcare. There is a global shift towards patient-centered care that is more cost-effective, alongside increasing demand for remote monitoring and treatment services. IoMT devices, like wearable ECG monitors, blood pressure cuffs, glucometers, and smart inhalers, allow real-time tracking of health conditions outside of hospitals. This approach makes things easier for patients, especially the elderly and those with mobility issues, and helps cut down on hospital visits and overall healthcare costs. For example, smart inhalers designed by Propeller Health assist COPD and asthma patients by monitoring inhaler usage alongside environmental triggers. This information is wirelessly transmitted to physicians, allowing for customized treatment plans. Dexcom G7 enables real-time continuous glucose monitoring, improving insulin management. Diabetic patients no longer require frequent hospital visits, facilitating treatment.

Growth in Emerging Markets: Australia, Latin America, and Africa are new emerging economies that can harness IoMT’s capabilities. This is due to increased government investment on digital health, higher smartphone penetration, and the implementation of 5G technology. These areas face a harsh imbalance in the distribution of healthcare professionals and hospitals, which makes IoMT a very attractive answer to these issues. Programs like India’s Ayushman Bharat Digital Mission (ABDM) and China’s digital health pilot zones are already assisting IoMT startups and large companies to provide affordable and scalable services to rural, underserved, and lackily serviced regions. Additional factors indicating the market potential are accessible digital healthcare and an overall rising demand for healthcare services. In Latin America, there are only 2.1 physicians per 1,000 people, compared to 4.5 in developed regions, creating a strong need for remote healthcare solutions like IoMT.

Lack of Standardization and Interoperability: The IoMT market faces a major challenge with a vast diversity of devices, platforms, methods of communication, and a lack of standardization. There is an abundance of IoMT devices ranging from wearables to implantables—but designed by different manufacturers and devoid of collaborative frameworks. This makes interoperability impossible, as information produced by one device is rarely sharable and understandable by other devices. Such a lack of streamlined integration hinders the incorporation of IoMT with electronic health records (EHRs) and other hospital information systems and analytics applications. Consequently, the wide-scale adoption of IoMT solutions within complex healthcare infrastructures tends to be challenging and costly. Without standard protocols and data formats, healthcare providers cannot get a complete view of patient data, which can affect the quality of care and limit AI-driven insights. 60% of hospitals report increased operational costs and delayed IoMT implementation timelines due to integration issues.

Regulatory and Compliance Complexity: Another challenge is the complicated and changing rules around regulations. IoMT devices deal with patient health data and often provide diagnostic or treatment functions, so they must meet strict medical device regulations and data privacy laws. In the United States, these devices need to follow FDA standards. In the European Union, the Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR) apply. Navigating global markets can be quite challenging and time-consuming, particularly with the intricacies of different rules and regulations IoMT devices face in each country. This challenge is multifaceted, for instance, many IoMT devices relying on AI for their functionalities add to the uncertainty as authorities grapple with establishing policies for software as a medical device (SaMD). As of 2024, only 28% of regulatory authorities worldwide have clear policies for Software as a Medical Device (SaMD), leading to uncertainty for AI-enabled IoMT solutions.

Wearable Medical Devices: Wearable medical devices are an important and fast-growing part of the IoMT. Smartwatches, fitness trackers, ECG patches, and blood pressure monitors are examples of wearable and smart clothing devices incorporated with biosensors. They enable users to continuously monitor vital health metrics such as heart rate, blood oxygen levels, body temperature, physical activity, and sleep.

Implantable Medical Devices: Although less prevalent than wearables, implantable medical devices are indispensable for accurate and timely monitoring. Such devices are surgically implanted into the body. They include pacemakers, defibrillators, neurostimulators, and continuous glucose monitoring (CGM) systems, such as those made by Senseonics. Implantable devices can collect long-term health data with little user effort. For example, the Eversense 365-day CGM launched in 2024 marked a significant breakthrough in less invasive glucose monitoring that lasts longer.

Internet of Medical Things (IoMT) Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Hardware | 45% |

| Software | 35% |

| Services | 20% |

Stationary Medical Devices: These allow for people to be monitored from distance, in a clinic, at the hospital and the home. Some of these devices are smart beds, linked-up ventilators, infusion pumps, digital imaging systems and diagnostic monitors. Stationary devices, unlike mobile wearables or implants, are bigger and immobile. They usually integrate directly with hospital information systems. These monitors provide immediate assessment in operating areas, intensive care units (ICUs) and recovery rooms.

Emerging Technologies: Examples of newer devices that fall under the category of emerging technologies include ingestible sensors, portable diagnostic devices, and smart inhalers. Ingestible sensors are miniature devices that patients can swallow, enabling them to monitor their digestion as well as medication adherence. Smart inhalers assist patients suffering from asthma and COPD to monitor both dosage and breathing. Implementing AI with IoMT in hospital operations can improve workflow efficiency by up to 40%, saving both time and cost.

Remote Patient Monitoring (RPM): Remote Patient Monitoring (RPM) is one of the most quickly growing sectors in the healthcare industry. It also relies on connected devices including wearables and home medical equipment to follow patients’ health data outside of the doctor’s office. RPM helps control chronic conditions such as diabetes, heart disease and respiratory problems. It enables the early detection of medical issues and can lead to a decline in hospital visits. Forces behind increased RPM practices are increased longevity of the population, more lifestyle diseases, and more focus on getting bang for the buck in optimised medical care.

Telemedicine: Telemedicine is another significant category that leverages connected health technologies for doctor appointments that are virtual. It gives doctors a way to monitor patients’ health data in real time. With these well-connected instruments, doctors can diagnose from afar with precision.

Clinical Operations and Workflow Optimization: This area of the healthcare sector concentrates on enhancing clinical functions and making workflows more efficient. The IoMT facilitates this by tracking medical devices, overseeing staff movements, and monitoring patients and their conditions within the hospitals. Tools like RFID tags and smart beds help cut waste, improve safety, and ensure resources are used effectively in busy healthcare settings.

In-Hospital Monitoring and Medication Management: In-hospital monitoring uses connected devices in intensive care units (ICUs) and surgical areas to check vital signs in real time. This is crucial for emergencies and acute care. Medication management is another key area. Smart pill dispensers, tracking devices, and reminder systems help make sure patients stick to their treatment plans, especially for the elderly and those with mental health needs.

Hospitals and Clinics: The primary users of IoMT devices are hospitals and clinics. These healthcare centers utilize IoMT technology for real-time patient tracking, more accurate diagnosis, refining workflow processes, and advancing operational efficiency within the facility. A 2023 American Hospital Association (AHA) survey found that over 85% of U.S. hospitals use at least one IoMT-enabled system, such as connected infusion pumps or patient monitoring platforms. The Mayo Clinic uses IoMT-powered remote monitoring for post-surgical patients, which has reduced readmission rates by ~20%. Devices such as smart infusion pumps, connected imaging systems, remote vital sign monitors, and RFID-tagged machines help hospitals deliver quicker and more informed care.

Homecare Settings: Another rapidly growing end-user segment is homecare settings. This growth comes from the rising demand for remote patient monitoring (RPM) and the increasing prevalence of chronic diseases among aging populations. IoMT devices, like wearable ECG monitors, smart glucometers, blood pressure monitors, and fall detection systems, allow patients to get continuous care while staying in their homes.

Long-Term Care Centers and Nursing Homes: Long-term care centers and nursing homes caring for patients suffering chronic conditions with mobility problems also significantly utilize IoMT solutions. These facilities gain from the ability to monitor vital signs, medication compliance, and instant emergency notifications, which automates many of their staff functions while increasing patient safety.

Others: These institutions depend on remote sensors for capturing data in actual environments to evaluate treatment effectiveness, and for more advanced assessments. Equally, pharmaceutical and biotechnology companies utilize IoMT technologies for enabled drug surveillance, patient compliance monitoring, and post-marketing studies.

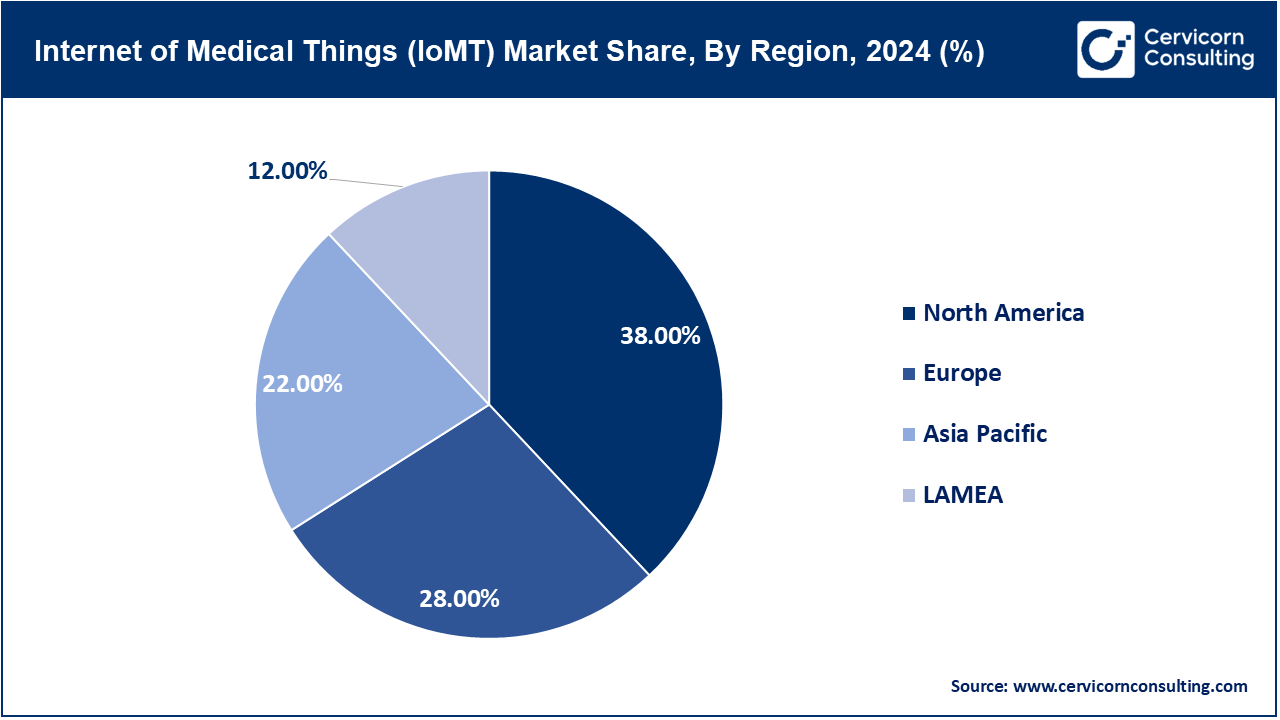

The Asia-Pacific (APAC) region is quickly becoming the fastest-growing market for the IoMT worldwide. It is expected to grow at a rate of over 21% each year for the next five years. For example, India's Ayushman Bharat Digital Mission (ABDM) and China's "Healthy China 2030" strategy promote electronic health records, telemedicine, and mobile health solutions. The rollout of 5G networks in the APAC region helps with faster and more reliable data sharing, which is important for real-time patient monitoring and smart hospital operations. More people in urban areas are also using smartphones and wearables for health tracking. APAC is becoming a center for affordable IoMT innovations. Many startups are creating low-cost solutions for underserved communities. While differences in infrastructure and unclear regulations in some countries can be obstacles, the region's strong growth, government support, and large patient base help it continues to lead in innovation in the IoMT sector.

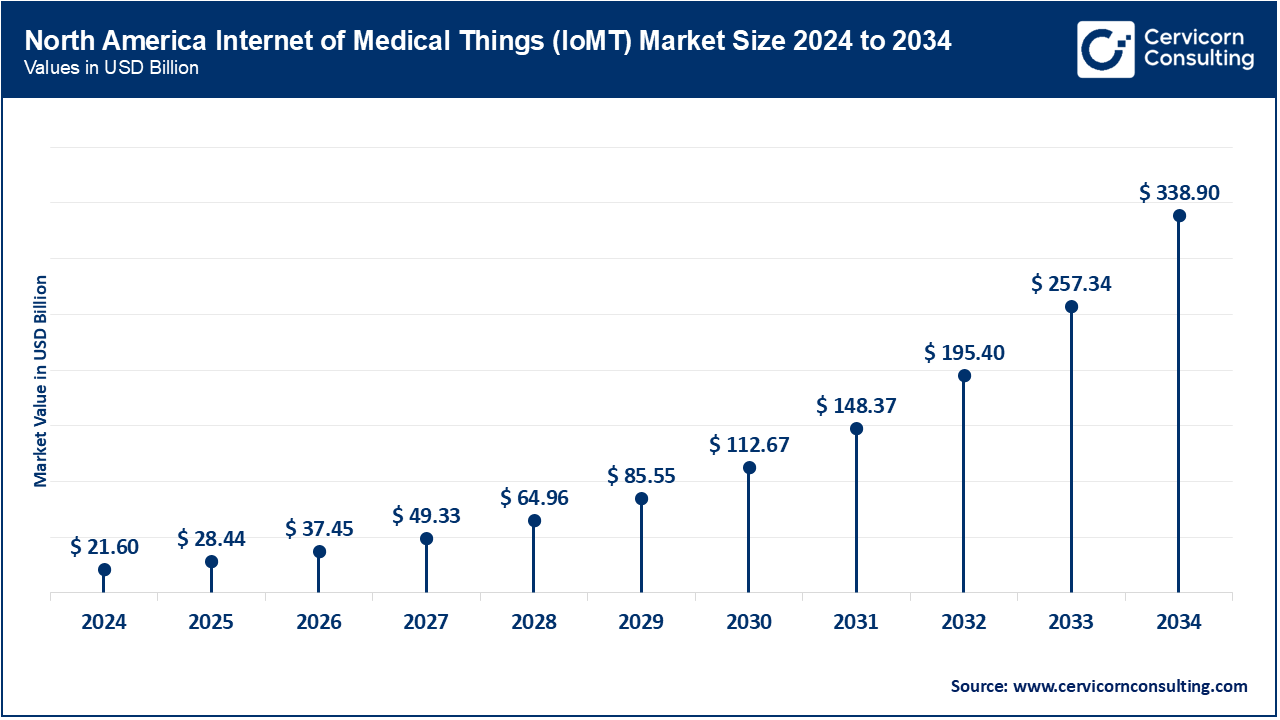

North America, especially the United States and Canada, holds the largest share, accounting for about 38% of total revenue. This leadership comes from a strong healthcare system, early use of connected medical technologies, and solid regulations like HIPAA that ensure data security and interoperability. The region enjoys substantial public and private investments in healthcare digitization. The use of private 5G networks in hospitals and the integration of AI in diagnostic tools are improving the delivery of real-time, data-driven medical solutions. However, challenges like cybersecurity concerns and complicated reimbursement policies remain. The recent launch of private 5G networks—such as the 2025 Nokia MPW installation at Oulu University Hospital—illustrates the impact of exceptionally rapid, low-latency connectivity on the interactive flow of patient data, particularly enhancing outcomes in emergency services and remote surgical interventions.

Europe is the second-largest market. This growth comes from a strong focus on protecting patient data, creating integrated healthcare systems, and promoting collaboration across borders. Key countries like Germany, the United Kingdom, France, and the Netherlands are at the forefront, supported by well-funded public healthcare and forward-thinking digital health plans. While GDPR helps secure patient information, it creates considerable burdens for companies operating in the IoMT industry. Due to divergent healthcare systems among EU member states, integration poses a challenge. Regardless, the European IoMT market is steadily expanding, with an estimated 15 to 16 percent annual growth. For instance, the digital Disease Management Program (dDMP) for managing type 1 and type 2 diabetes was launched by Germany's G-BA in March 2025. The dDMP can only work if the electronic patient record (ePA), continuous glucose monitoring (CGM) systems, and digital health applications (DiGA) all work together perfectly to customize treatments for each patient. A full national launch is planned for 2026.

Latin America is developing a market for the IoMT with potential for moderate growth. This growth comes from urbanization, increased telemedicine, and government efforts to improve healthcare access. In Latin America, countries such as Brazil, Mexico, Argentina, and Chile are at the forefront of adopting digital health technologies, particularly in urban areas. With continued investment and policy changes, Latin America could become an important market for medical IoT solutions in the future. In the regulatory sphere, ANVISA in Brazil updated its technovigilance policies in 2024 to comply with the guidance of the WHO, and in 2025, Latin American countries are moving towards unified frameworks for data protection and telemedicine to enhance trust in IoMT technologies. The use and implementation of IoMT technologies in the Middle East and Africa (MEA) region is in the early adoption stage; however, there are positive indications of growth. This is due to heightened spending in sophisticated health systems and strategic priorities at a national level. The UAE, Saudi Arabia, and South Africa are the primary drivers for this shift. For example, both UAE Vision 2031 and Saudi Arabia Vision 2030 plans seek to improve healthcare through smart hospitals and AI-powered medical services.

Market Segmentation

By Component

By Deployment

By Application

By End-User

By Region