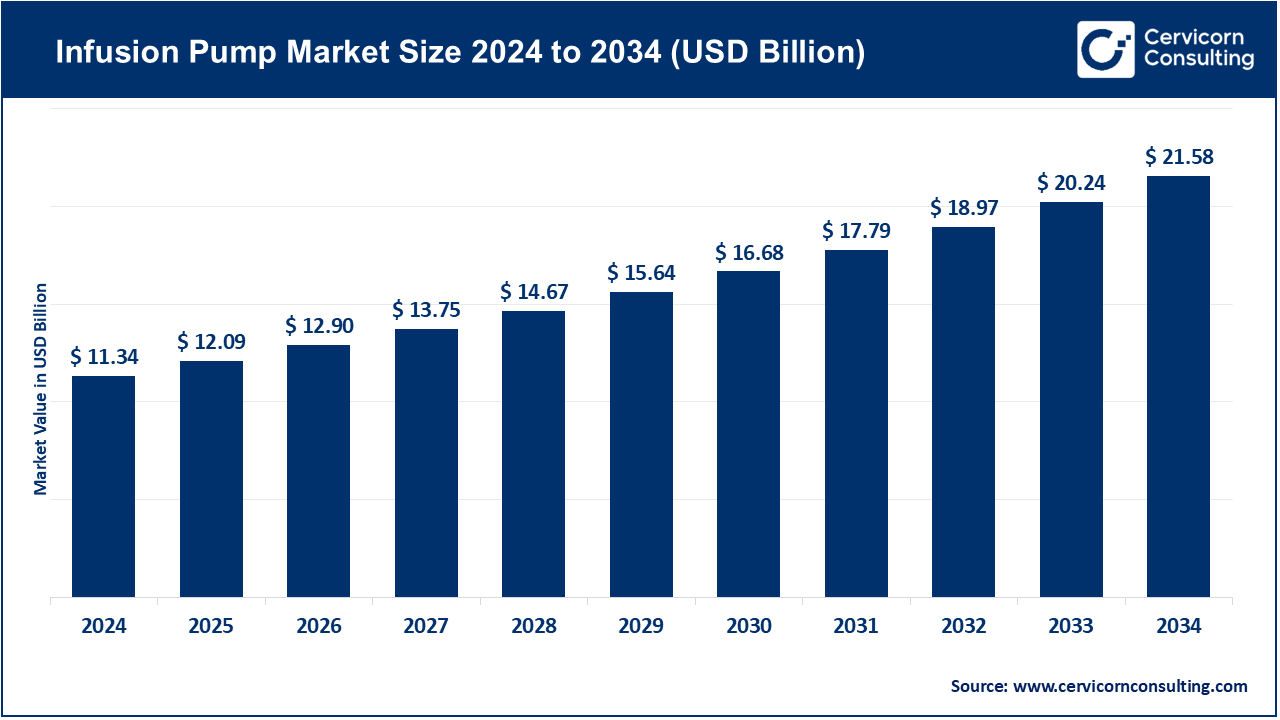

The global infusion pump market size was estimated at USD 11.34 billion in 2024 and is expected to be worth around USD 21.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034. One of the primary drivers of infusion pump market development is the growing number of chronic diseases, the number of their patients in hospitals, and the necessity to provide the accurate and controlled delivery of drugs. They prevent human error and enhance the safety of patients, as these devices are highly accurate when delivering fluids, medications, and nutrients. Smart technologies have also been integrated to make infusion pumps more efficient and reliable (e.g., wireless connectivity, real-time monitoring, automated alerts), which have resulted in larger usage in hospitals, ambulatory care, and home healthcare environments.

Moreover, the market enjoys growth in technologies of portable and wearable infusion systems, which are used in patients who need long-term or outpatient treatment. The growing trend to provide care at home and the rising numbers of geriatric population contributes to the uptake of compact user-friendly pumps. Manufacturers are targeting AI-based and closed loop infusion systems that automatically adjust the dosage to increase accuracy of treatment. These technologies, in combination with increased investments in healthcare and a tendency toward delivering treatment on a personalized level, will most likely drive the infusion pump market over the next several years.

Rewport Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.09 Billion |

| Expected Market Size in 2034 | USD 21.58 Billion |

| Projected CAGR 2025 to 2034 | 6.65% |

| Dominant Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Type, Technology, Mode of Administration, Application, Region |

| Key Companies | Becton, Dickinson and Company (BD), Baxter International Inc., B. Braun Melsungen AG, ICU Medical, Inc., Fresenius Kabi AG, Medtronic plc, Terumo Corporation, Insulet Corporation, Smiths Medical (Smiths Group plc.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

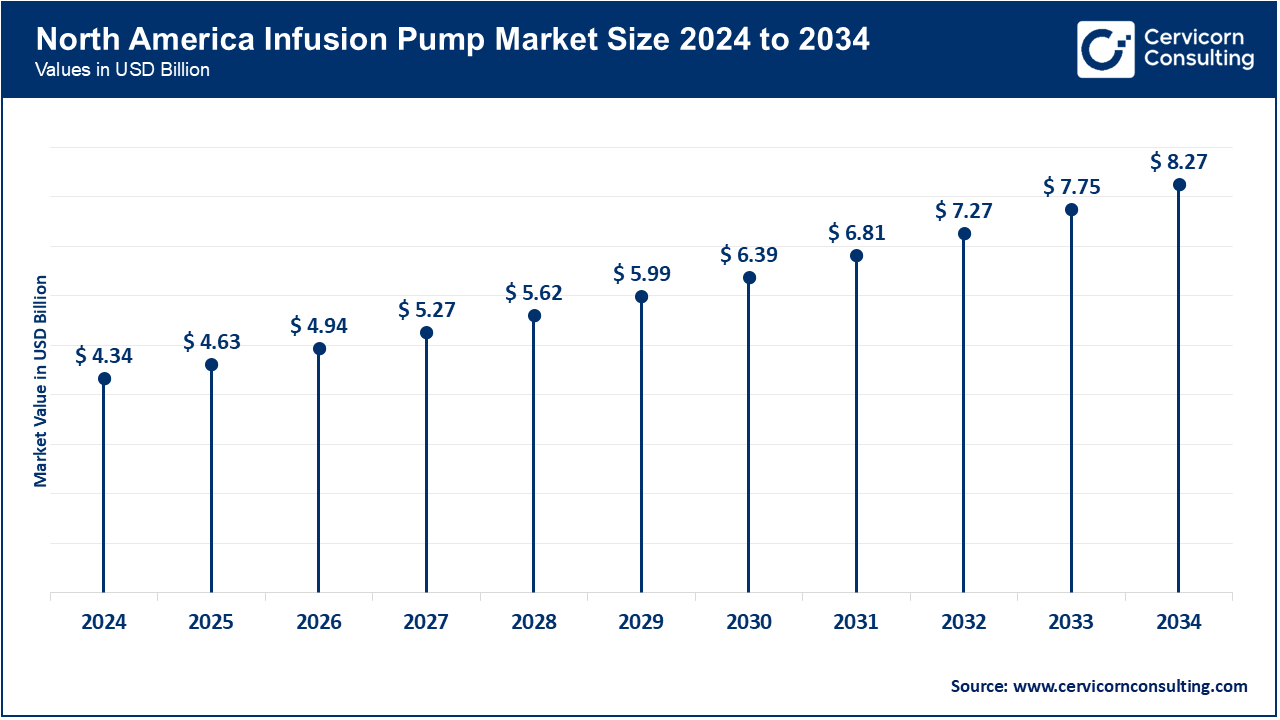

The infusion pump market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The North America is the biggest market in the world due to the well-developed healthcare facilities, high rate of chronic illnesses such as diabetes and cancer, and increased interest in home and personalized treatment. By 2025, the adoption of smart, wearable, and AI-enabled infusion pumps in U.S. hospitals and home healthcare providers would keep rising to boost the accuracy of treatment, patient compliance, and safety. A high regulatory clarity of the FDA, substantial research in smart infusion technologies and distribution channels also solidifies the market in North America.

The second-largest share of the market is attributed to Europe, with the region being backed by high healthcare standards, developed hospitals, and early adoption of smart and AI-enabled devices. In Germany, France, and the UK, European hospitals will have automated and wearable pumps installed in ICUs and oncology centers by April 2025, to deliver drugs precisely and at home. The combination of patient safety concern, regulatory compliance following European Medicines Agency (EMA) and sustainability of medical devices production have also made Europe the innovation centre of infusion pumps technology.

The Asia-Pacific is expanding fastest due to the growing awareness of health care, the rising number of chronic diseases, rising disposable incomes and the expansion of hospital facilities. Japanese, Indian and South Korean home health and hospitals started roll out smart, ambulatory and AI enabled infusion pumps by June 2025 to enhance patient outcomes especially in diabetes, oncology, and pediatrics. Joint ventures with Western technology firms and national research and development are also increasing the use of modern infusion systems in the area.

Infusion Pump Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.30% |

| Europe | 27.10% |

| Asia-Pacific | 24.50% |

| LAMEA | 10.10% |

LAMAE is a new division, with growing investments in healthcare and the growth of the needs of chronic disease management solutions. Portable, wearable, and smart infusion pumps in diabetes, oncology, and pain management therapies began to be adopted by hospitals and home healthcare providers in Brazil, Mexico, UAE, and Saudi Arabia by early 2025. The ongoing expansion of access to healthcare services by the government, as well as increased awareness of advanced infusion technologies, is predicted to lead to a gradual rise in the LAMAE market expansion until 2026 and further.

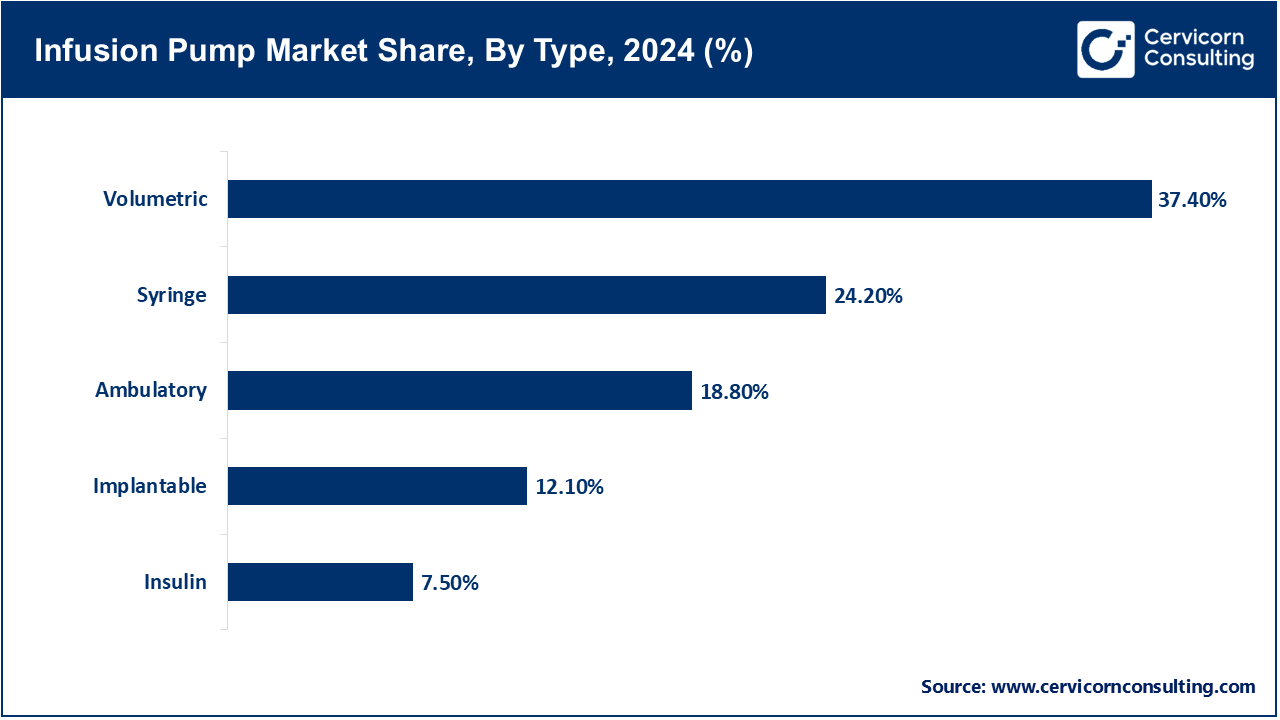

Volumetric: Volumetric types of pumps are commonly deployed in hospital ICUs, operating rooms, and emergency facilities because they have the ability to provide accurate fluid quantities in a given time period. By March 2025, North American and European hospitals had retrofitted their ICUs with high-voltage pumps embedded with wireless connectivity and safety alarms to minimize manual error and improve patient safety. Their ability to transport medications, blood, and nutrients make them a preferred option in long-term and critical care.

Syringe: Syringe pumps are recommended when a small volume of medication is required and precision is necessary, especially in the areas of pediatrics, cancer therapy, and in the neonatal unit. European and Asian hospitals began installing syringe pumps with intelligent monitoring systems to guarantee precise dosing, minimize the chance of over-infusion, and generate data logs to track treatment. Such pumps are especially useful whenever dealing with powerful medications that are highly sensitive.

Ambulatory: Wearable and portable outpatient and home therapy pumps are gaining popularity in the presence of chronic disease and patient preference of home care. In North America, a rise of more than 35 percent in the adoption of ambulatory pumps by May 2025 was reported, with uses in insulin therapy, pain management, and chemotherapy. They are lightweight and battery-operated, giving patients the opportunity to remain mobile as they pursue prescribed treatment.

Implantable: Medications such as opioids or chemotherapy drugs are delivered directly to specific areas over the long-term through surgically implanted pumps. As early as June 2025 European and Japanese hospitals were already installing programmable implantable pumps, decreasing the number of visits to hospitals and increasing the quality of life of chronically ill patients. These pumps are continuous therapy, which is especially helpful with palliative care and severe chronic pain.

Insulin: Insulin pumps are vital to the management of diabetes and they provide sustained glucose levels and better glycemic control. By July 2025, AI-enabled insulin pumps, based on continuous glucose monitoring (CGM) systems, were common in North America and Europe. These devices automatically regulate doses according to real-time glucose levels, improving compliance, and preventing hypoglycemia.

Chemotherapy/Oncology: The use of infusion pumps enables a specific dosage of anticancer drugs to be administered, which reduces toxicity and improves therapeutic response. By March 2025, smart pumps that could be programmed with real-time monitoring and pre-programmed regimens had become common in oncology centers across Europe, lowering nurse workload and improving patient safety.

Pain Management: Implantable pumps and Patient-Controlled Analgesia (PCA) are devices that allow patients to deliver controlled doses of analgesics to chronic or post-operative pain. By April 2025, U.S. hospitals had higher adoption of PCA pumps especially in surgical and palliative care units, thus increasing patient comfort and reducing nurse intervention.

Diabetes Management: Telemonitoring and insulin infusion pumps enhance patient compliance and glycemic control, particularly in patients with insulin and telemonitoring. In May 2025, cloud connected smart pumps in Europe and North America were able to monitor remotely and alter a dose to help avoid any complications, which are reduced to a significant degree.

Gastroenterology / Enteral nutrition: Enteral pumps provide patients who are unable to eat orally, the exact nutrition necessary to aid them in their recovery both in the ICU, long-term care and rehabilitation. Hospitals and nursing homes in Asia-Pacific will increase their usage of enteral pumps by June 2025 to enhance patient outcomes and secure the reliability of delivering nutrients to patients.

Pediatrics and Neonatology: Small-volume infusion is used in NICUs and pediatric care units to deliver medication in a safe and accurate manner. By July 2025, micro-dosing syringe and volumetric pumps should be standard in European and North American neonatal units, making sure that drug delivery is accurate and potential complications are reduced.

Continuous Infusion: Gives a constant supply of fluids or medications during a specific time, which is necessary when using critical care drugs such as vasoactive drugs and chemotherapy. ICUs are filled with continuous infusion pumps that are reliable and provide precise dosing.

Intermittent Infusion: Timetables medicine administration at certain times, most commonly antibiotics, antivirals, and immune modulating agents. Automated intermittent infusion pumps became more common in hospitals in Europe to decrease nursing workload and allow therapeutic consistency.

Infusion Pump Market Share, By Mode of Administration, 2024 (%)

| Mode of Administration | Revenue Share, 2024 (%) |

| Continuous Infusion | 36.80% |

| Intermittent Infusion | 24.10% |

| Bolus Infusion | 19.30% |

| Patient-Controlled Infusion | 14.70% |

| Others | 5.10% |

Bolus Infusion: Enables quick administration of medicine in an emergency. As of May 2025, bolus pumps were more commonly used in U.S. emergency departments to provide rapid analgesia and critical care interventions.

Patient-Controlled Infusion: Allows patients to self- administer medication at predetermined safety thresholds, enhancing satisfaction and adherence. The use of PCA pumps is now becoming more common after surgery, in pain clinics and in chronic care environments both in Europe and the U.S.

Hospitals & Clinics: Hospitals continue to be the most active users of infusion pumps, with ICU, surgical, oncology and chronic care in need. By March 2025, more than half of world consumption was in hospitals in North America and Europe. These facilities have enhanced patient safety, minimized medication errors and eased clinical workflow by adopting advanced smart and volumetric pumps

Home Healthcare Settings: Increased prevalence of chronic conditions, such as diabetes and cancer, and the desire to keep patients at home and receive treatment has increased the use of portable and wearable infusion pumps. Home healthcare providers in the U.S. reported a 40% rise in usage by April 2025 specifically in continuous insulin therapy, outpatient chemotherapy, and pain management, allowing patients access to effective care without the need to visit a hospital regularly.

Infusion Pump Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 38.60% |

| Home Healthcare Settings | 24.70% |

| Ambulatory Surgical Centers (ASCs) | 15.80% |

| Long-Term Care Centers & Nursing Homes | 12.20% |

| Others | 8.70% |

Ambulatory Surgical Centers (ASCs): ASCs are now starting to use infusion pumps in outpatient care, such as chemotherapy, analgesia, and the administration of antibiotics. European ASCs reported extensive use of smart pumps to improve precision of treatment and staff workload and patient safety, especially in short-stay surgical and oncology care by May 2025.

Long-term Care Facilities and Nursing homes: Infusion pumps play an important role in patients who are elderly, chronically ill, and need long-term treatment. The expansion of portable and enteral pumps in Asia-Pacific care facilities by June 2025 will allow providing nutrients, medications, and decrease hospital readmissions, increase patient comfort, and the quality of care.

Infusion Pumps: Traditional / Standalone: This manual programmed basic pumps are still very common in third world countries because of their cheapness, ease of use and reliability. They remained viable and affordable alternatives to small clinics and hospitals with small budgets by March 2025, especially as routine medication and fluid administration solutions.

America-Pacific Smart / Automated Infusion Pumps: Smart pumps, complete with drug libraries, safety alerts, and wireless connectivity, reduce medication errors and are easily incorporated into the electronic health record (EHR) systems. As of April 2025, more hospitals in North America were adopting these systems to enhance workflow efficiency, remote patient monitoring, and effective dosage across several wards.

Wearable Infusion Pumps: Small, portable pumps are well suited to chronic disease management and home care offering patients mobility and convenience. By May 2025, wearable pumps achieved a large following of patients who needed to control diabetes, chronic pain, and outpatient chemotherapy so they could continue therapy throughout their activities in the day.

AI-Enabled Infusion Systems: Predictive dosing, closed-loop control, and internet of things (IoT) connected next-generation pumps provide personalized therapy by adjusting infusion rates according to real-time patient data. Hospitals in Europe and the U.S. tested AI-powered systems by June 2025, which improved patient safety, pharmaceutical delivery, and mitigated the risk of complications by automatically monitoring patients and adjusting medication.

Market Segmentation

By Type

By Application

By Technology

By Mode of Administration

By End User

By Region