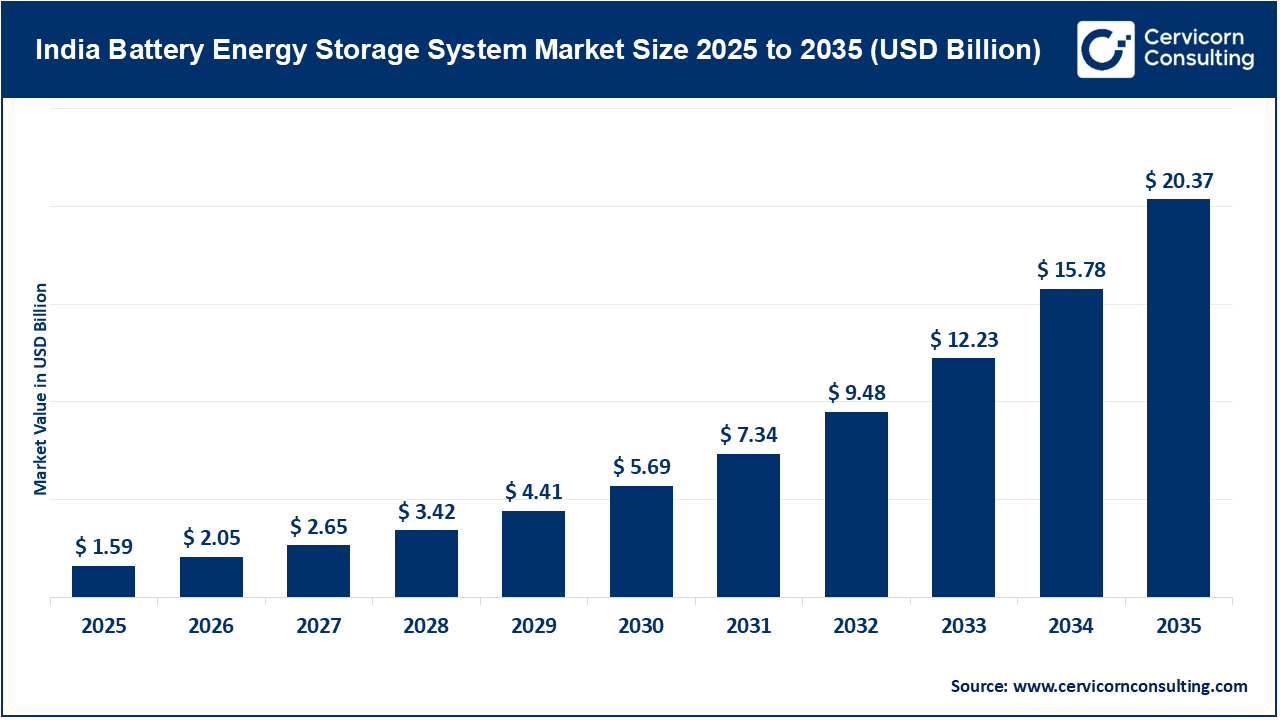

The India battery energy storage system (BESS) market size was valued at USD 1.59 billion in 2025 and is expected to be worth around USD 20.37 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 29.1% over the forecast period from 2026 to 2035. The India BESS market is in a high-growth phase, transitioning from small-scale lead-acid applications to sophisticated large-scale lithium-ion applications. Historically, the BESS market was primarily made up of residential and small-commercial interests using traditional lead-acid batteries for Uninterruptible Power Supply (UPS) systems. Increasingly, modern BESS attention will be paid to grid-scale installations and industrial applications specifically intended to provide energy efficiency and reliability. The total market value for energy storage in India will be worth between USD 120 billion and USD 130 billion by 2030, illustrating the magnitude of investment needed for grid modernization.

The Indian energy landscape is going through a transition driven by ambitious decarbonization targets and rapid growth in intermittent renewable energy sources. This report presents a strategic analysis of the India Battery Energy Storage System (BESS) market, highlighting BESS's role in the national target of 500 GW of non-fossil fuel capacity by 2030.

The Role of Energy Storage in India’s Path to 500 GW of Renewables

India's transition to become part of the global energy transition is one of the fastest growing renewable energy programs in the world. As India's economy rapidly increases, the balance between growing the economy while being environmentally sustainable continues to be difficult. The primary technical issues facing the continued growth of solar and wind generation is the intermittency of these renewable energy sources. Deliberate policy decisions must be made to continue to have reliable electric service to the public. Battery Energy Storage Systems (BESS) has gone from a localized pilot interest to a national strategic priority. The power sector is now seeing BESS as an important part of the grid, in addition to providing backup power, and ancillary services, such as peaking and time-shifting of energy.

The BESS market's importance stems from the Government of India target of achieving 500 GW of installed renewable energy by 2030. In order to achieve this target, storage will need to undergo massive growth in capacity given the "duck curve" reality of high solar generation during the day to the drastic need for ramp-up capacity as the sun sets and demand increases. Overall, the BESS market is predicted to grow substantially, with annual battery demand projected to grow from only 3 GWh in 2020 to more than 260 GWh in 2030. This report will describe the journey facing the BESS market, while evaluating other technological, economic, and regulatory factors that may affect the future of energy storage in India.

Recent Investments Activity in the India Battery Energy Storage System Market

| Investor | Investment Project | Value and Capacity Details |

| Avaada Group | Renewable energy + BESS projects in Gujarat | INR 36,000 crore (USD 4.3 Bn) for 5 GW solar + 1 GW wind + 5 GWh BESS projects |

| Power Grid Corporation of India | Awarded 2,000 MWh BESS grid project | Strategic utility-scale storage capacity (capacity awarded to Powergrid) |

| ValueQuest Tristar Fund | Funding in Waaree Energy Storage Solutions | INR 125 crore for growth of Waaree BESS unit |

| Prostarm Info Systems | BESS manufacturing plant in Haryana | INR 25 crore investment for 1.2 GWh facility |

| Honda Motor (via stake in OMC Power) | Stake investment in distributed battery systems | To support scalable clean energy/EV battery repurposing |

| ENGIE | First major BESS project in India | 280 MW / 560 MWh awarded under GUVNL tender |

| Adani Group | Strategic entry into BESS | 1,126 MW / 3,530 MWh project underway 15 GWh additional capacity planned by 2027 |

1. Launch of Production Linked Incentive Scheme for Advanced Chemistry Cell

One of the most pivotal milestones for the Indian BESS market is the unveiling of the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) manufacturing. With a financial outlay of around INR 18,100 crore, the scheme is intended to create domestic manufacturing capacities of 50 GWh. This policy aims to promote the production of high-performance, advanced technology cells made in India, which will lower the "geopolitical vulnerability" of foreign-produced cells, specifically from China. The PLI scheme links incentives with value addition and scale, which fosters additional manufacturing research and development and local supply chain development.

2. Growth of Round-the-Clock Renewable Energy Hybrid Projects

According to the research study, there has been a significant shift in the market for Round-the-Clock (RTC) renewable energy projects that use solar, wind, and storage. Unlike a traditional plain vanilla solar or wind tender, RTC tenders require how the developer will provide confirmed and consistent power that mimics a thermal power plant's supply. This movement will hybridize renewable assets and where BESS is required to bridge the gaps when solar or wind is unavailable. Cost will continue to decline and the demand for industrial consumers to have "firm" green power from distribution companies (DISCOMs) will increase. Therefore, RTC projects will become more competitive.

3. Use of BESS on National Grid for Ancillary Services

The use of BESS on the national grid for ancillary services represents a strategic trend to enable an improved grid stability. As renewable capacity continues to be integrated into the grid, the grid system experiences increasing volatility on the frequency and voltage parameters. Research shows that BESS can respond to frequency excursions in milliseconds, whereas traditional thermal plants take longer. More recently, pilot initiatives by the Solar Energy Corporation of India (SECI) and NTPC have proven the effectiveness of employing BESS for primary and secondary frequency control, leading to a larger focus on grid health.

4. Shift Towards Lithium Iron Phosphate for Higher Thermal Stability

Technologically, the Indian market is experiencing a distinct transition toward Lithium Iron Phosphate (LFP) chemistry from Nickel Manganese Cobalt (NMC) variants. The reason for this shift is the thermal stability of LFP batteries which is more compatible with the high ambient temperatures. LFP batteries can withstand high thermal runaway and therefore have a much lower probability of fire in stationary storage applications. LFP batteries also have a charge/recharge cycle life and cost per cycle which are much better suited for long-term utility-scale projects.

Rapid Growth of Renewable Energy Capacity and Grid Infrastructure Modernization Needs

High Upfront Capital Investment and Global Supply Chain Volatility

Growth of EV Infrastructure and Solar-Plus-Storage for C&I

Regulatory Framework Gaps and Limited Domestic Raw Material Availability

The Indian battery energy storage system market is segmented into technology, storage system, connection type, ownership, energy capacity, application, and region.

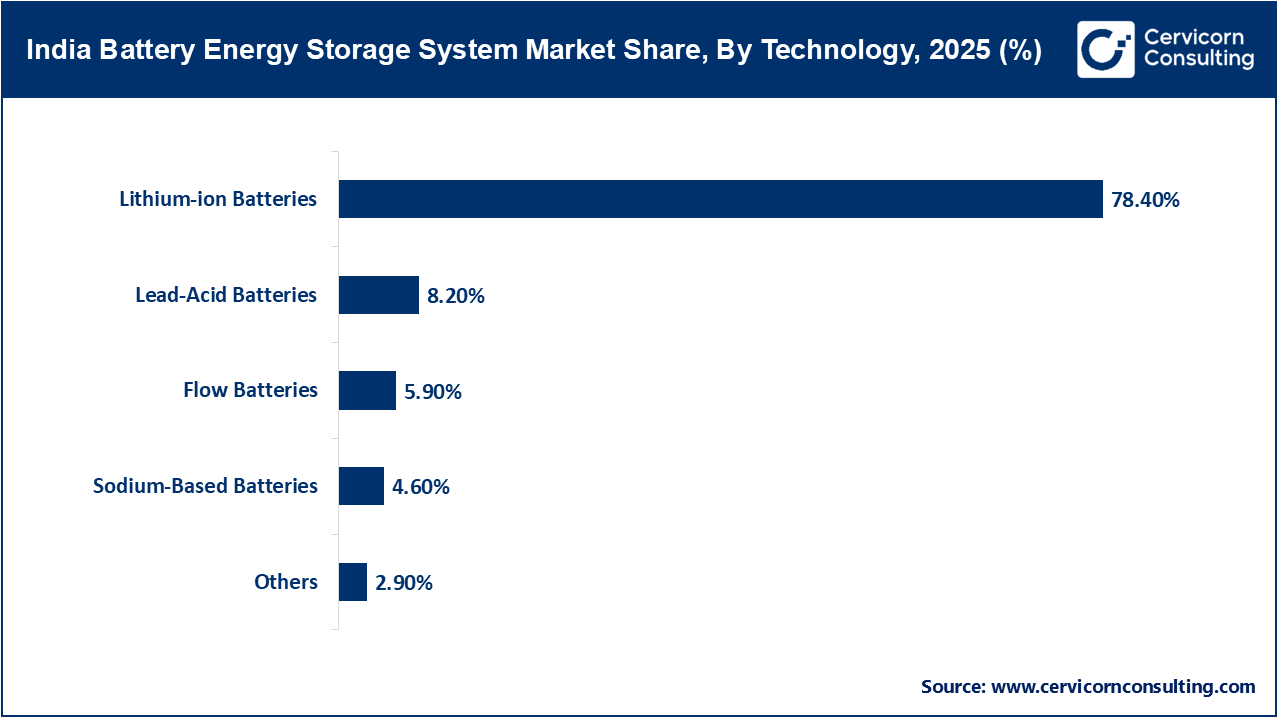

Lithium-ion Types: LiFePO4, NMC, NCA

Lithium-ion technology is the most reputable, and therefore the most widely adopted, energy storage battery on the market due to its high energy density, high cycle efficiencies, and decreasing costs. Lithium Iron Phosphate (LiFePO4 or LFP) is the most suitable chemistry for stationary storage BESS in India. The chemistry of LFP provides higher safety margins for deterioration (notably fire and explosions) and is not as prone to thermal runaway in comparison to Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminium (NCA) types.

Furthermore, LFP has a long cycle life, and utilities will retain units in service for at least an estimated 10-15 years. In comparison, while NMC and NCA provide higher energy density, they are sold with higher prices due to the reliance on cobalt, and are more susceptible to price interruptions due to potential supply chain issues and risks. NMC is popular in the portable electronics and high-performance EV segments of the BESS market; however, in the stationary energy storage market in India, NMC emergence has begun to be minimally challenged by LiFePO4 unit pricing and 'more higher safety margins’.

Existing Lead-acid Technologies: Flooded and Sealed Lead-acid

Lead-acid remains a relevant but declining segment of the Indian battery energy storage market. While most emerging technologies have better cycle lifetimes and overall performance, lead-acid advantages include low upfront cost and a well-established recycling ecosystem in India. Flooded lead-acid batteries corner the market as the basic battery backup generator at homes in rural areas; sealed Lead-Acid (VRLA) lead acid batteries are used for telecommunications and small scale UPS systems. However, due to lead-acids adoption of the limited depth of discharge (DoD), short cycle life, and high maintenance requirements, lead-acid technologies are not sufficient for high cycling demand, and therefore unsuitable to meet intermittent renewable energy generation and storage.

Application of Emerging Technologies: Flow Batteries and Sodium-based Batteries

With the need for long-duration energy storage (LDES) improving, some emerging technologies have focused on Vanadium Redox Flow Batteries (VRFB). Unlike lithium-ion batteries, flow batteries can decouple power and energy and storage of 8 to 12 hours (for example, increasing the electrolyte tanks' volume). This makes flow batteries ideal for multi-day storage. Moreover, sodium-ion may be a possible consideration as a "value alternative" to lithium. India's abundant sodium mineral deposits and the use of aluminum (instead of copper) for current collectors make Sodium-ion battery technology potentially process-related and economically substantial for stationary applications within the next several years.

The BESS market is segmented on future and existing configurations using Front-of-the-meter (FTM) and Behind-the-meter (BTM) definitions. FTM configurations typically represent utility-scale battery installations connected directly to the transmission or distribution grid. These are primarily used by the operator for bulk energy shifting and ancillary services. BTM configurations, in relation directly to customer use, is the distribution and installation of BESS on the customer-side of the utility meter. BTM systems are primarily installed primarily for residential, commercial, and industrial, and electricity uses as "peak shaving" (reducing electricity consumption and costly kWh purchase charges during peak tariffs) and to manage and mitigate power quality and/or fluctuations on the grid.

India BESS Market Share, By Storage System, 2025 (%)

| Storage System | Revenue Share, 2025 (%) |

| Front-of-the-meter | 71.6% |

| Behind-the-meter | 28.4% |

On-grid BESS systems are most common in India, designed to provide voltage stability, support and operate around the central grid to provide ancillary services, while also providing to participate in energy export (energy price arbitrage). Off-grid connection architectures are particularly important for India's remote and hilly geography, which are economic to extend the central grid. Here, BESS acts as the battery energy management system, providing a solution to balance local renewable energy generation systems with local electricity demand, with the goal of supplying 24/7 electricity to isolated, off-grid communities.

India BESS Market Share, By Connection Type, 2025 (%)

| Connection Type | Revenue Share, 2025 (%) |

| On-grid | 84.7% |

| Off-grid | 15.3% |

The ownership models of energy storage systems (ESS) in India are changing. Most early pilot projects have utility-owned models. However, now the "Third-party" or "Battery-as-a-Service" (BaaS) model is gaining traction. In this model, a specialized storage developer builds and operates the Battery Energy Storage System (BESS) and either utility or consumer pays a monthly fee for the BESS service. This model minimizes the technical and financial risk to the end-user. Customer-owned models remain strong in the commercial and industrial (C&I) space where businesses prefer to have ownership of their energy assets to maximize return on investment (ROI).

India BESS Market Share, By Ownership, 2025 (%)

| Ownership | Revenue Share, 2025 (%) |

| Utility-owned | 59.8% |

| Third-party Owned | 25.4% |

| Customer-owned | 14.8% |

The scale of the BESS projects in India is quickly expanding. Small-scale projects (below 100 MWh) are typically for localized distribution support or for industrial backup. Medium-scale projects (100 - 500 MWh) are quickly becoming the mainstream standard for Round the Clock (RTC) renewable hybrid tenders. Large scale projects (above 500 MWh) are being developed as "standalone" storage assets, at the national transmission level, to deliver significant, bulk, energy shifting, and grid wide frequency regulation.

India BESS Market Share, By Energy Capacity, 2025 (%)

| Energy Capacity | Revenue Share, 2025 (%) |

| Below 100 MWh | 29.7% |

| Between 100–500 MWh | 45.1% |

| Above 500 MWh | 25.2% |

Utilities are the largest application vertical because state led procurement and grid-scale requirements. Commercial and industrial (C&I) in the private investment space is the largest application vertical because C&I companies are striving to satisfy their "green energy" mandates and reduce operational cost. The residential space, which typically has simpler inverters, is starting to introduce integrated solar + storage systems, although the average Indian household continues to struggle with cost.

India BESS Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Utility | 69.6% |

| Commercial | 20.3% |

| Residential | 10.1% |

The strategic assessment of the BESS market in India shows a market that is at a pivotal point in development. With the dual motivations of integrating renewable energy and modernizing the grid, the market is moving from niche applications into the core of the national energy strategy. The launch of the ACC PLI scheme, as well as the allocation of Viability Gap Funding (VGF) for 4000 MWh of storage is very positive milestone toward national resource sovereignty and economic viability.

However, there are several challenges ahead to be met in order to see sustained growth. Creating innovation to tackle the high CAPEX, bridging regulatory gaps with time-of-use tariffs, and growing a domestic supply of critical minerals are all important to sustained growth. As the technologies migrate toward LFP, one can see a practical response to the climate/economic conditions in India; additionally, Sodium-ion and Flow batteries will have their role in the longer-term roadmap. Ultimately, the development of the BESS market will be the "glue" that will allow India to achieve its 500 GW renewable dream and to be a leading market in achieving a clean energy transition.

By Technology

By Storage System

By Connection Type

By Ownership

By Energy Capacity

By Application