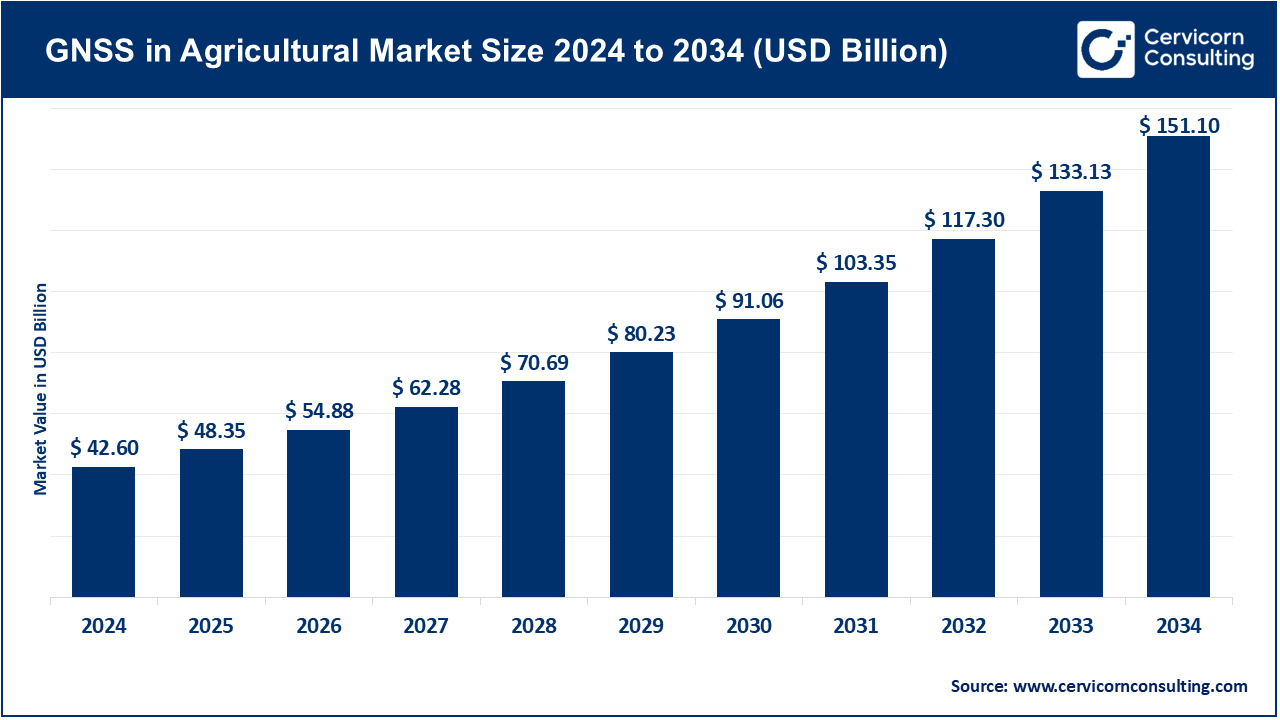

The global GNSS in agricultural market size was valued at USD 42.60 billion in 2024 and is anticipated to reach around USD 151.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.5% from 2025 to 2034. The GNSS (Global Navigation Satellite System) in agriculture market is catching the pace with farmers and agribusiness needing precision, efficiency, and sustainability in their efforts. As the demand to maximize crop production and minimize wastage of resources alongside adapting to a changing climate, GNSS technology is a revolutionizing solution. Precision planting and variable-rate fertilization, automated guidance of tractors and harvesters, etc. all of this allows farmers to make data-driven decisions, enhancing the precision of their operations and the reduction of the environment impact.

Applications in agriculture NSS In agriculture, location, guiding, and timing of farming uses NSS, typically GPS, GLONAS, Galileo and BeiDou, to denote NSS. The establishment of precision and smart farming is one of the key growth factors accompanied by the use of GNSS as a tool to track the field variability, chart the soil properties, and forecast crop performance. Whether it is cereals, horticulture, or specialty crops, GNSS assists farmers to adhere to on-site-specific approaches, run yield-projection models or provide customized interventions to boost productivity. Moreover, a GNSS-based solution can be used with internet of things (IoT), drone and artificial intelligence (AI) driven analytics platforms to improve farm management, sustainability monitoring, and resource efficiency. This means GNSS is no longer a purely navigation solution but a means of innovation, sustainability and market competitiveness of the agricultural market on a global scale.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 48.35 Billion |

| Expected Market Size in 2034 | USD 151.10 Billion |

| Projected CAGR 2025 to 2034 | 13.50% |

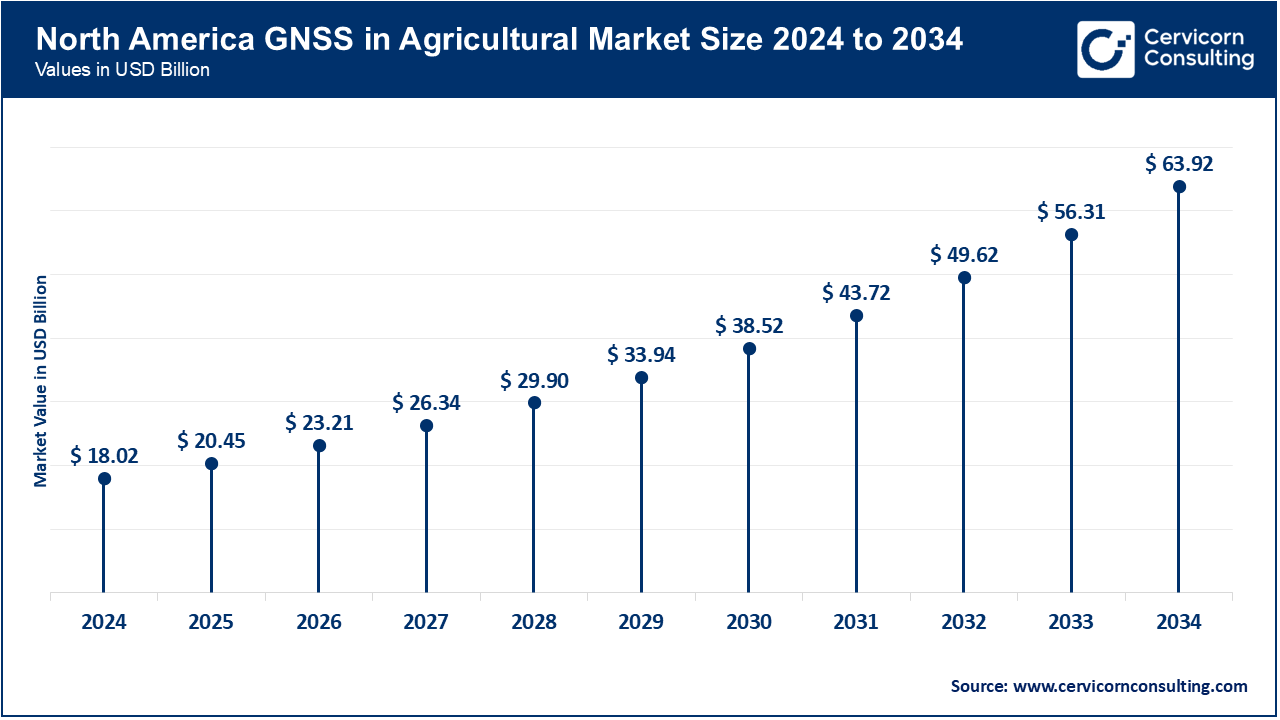

| Dominant Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Precision Agriculture, GNSS Receivers and Components, GNSS-Based Software Solutions, GNSS Integration Services, End-User Region |

| Key Companies | John Deere, Trimble, AG Leader, Topcon Agriculture, Hexagon Agriculture, Raven Industries, CNH Industrial, AgJunction, Leica Geosystems, NovAtel, Hemisphere GNSS, Deere & Company, SatSure, AgEagle Aerial Systems, Topcon Positioning Group |

The GNSS in agricultural market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America continues to lead the market, fuelled by expansive acreage and precision-tech implements. In March 2025, John Deere fielded GNSS-steered cultivators throughout the U.S. Corn Belt, refining seed placement precision and curtailing extraneous inputs. Complementary to this, Midwest producers are deploying GNSS for regulated water delivery, detailed topographic mapping, and programming autonomous field vehicles. The continent further embraces cloud and machine-learning driven management suites to bolster yield projections and resource optimisation. Parallel progress is evident in Canada, where producers are adopting GNSS-enabled collar systems for herd localisation, thereby fine-tuning pasture rotations. Collectively, these activities reaffirm North America’s strategic investment in digitised, resource-efficient agriculture.

Europe’s GNSS uptake in agronomy proceeds in a methodical trajectory, balancing regulatory stewardship and ecological integrity. In May 2025, a Bavarian agricultural cooperative rolled out GNSS-assisted variable-rate fertiliser and seed technologies, consistently minimising nutrient drift in sensitive water catchments. Complementary implementations in France and the United Kingdom focus on GNSS-facilitated field surveys and soil profiling to refining nutrient calibrations. A range of continental enterprises is further piloting autonomous tractors equipped with GNSS-informed planting and in-field logistics. In parallel, Spanish vineyard operators are instituting multi-frequency GNSS receivers to constrain range error margins and elevate canopy management precision. This ensemble of innovation, pursued under the auspices of stringent agri-environmental frameworks, epitomises Europe’s calibrated advancement in precision agronomy.

Across the Asia-Pacific region, the integration of GNSS technologies into agriculture is accelerating in response to the extensive landholdings and increasingly technology-driven farming practices. In August 2025, a Chinese agritech consortium deployed a GNSS-assisted precision irrigation programme in rice paddies, achieving an 18% reduction in total water withdrawals. Concurrently, Indian agronomists are equipping monsoon-peak seed drills with GNSS-enabled auto-steering to compress sowing windows and boost land productivity. Japan is field-testing multi-frequency GNSS receivers that enable autonomous tractors to perform high-accuracy, multi-pass tillage on semi-structured vegetable plots. South Korea is rolling out GNSS-based integrated farm-management software that enhances long-term crop rotation modelling and real-time irrigation modelling. The region’s open agrifood ecosystems and a demographic ethos receptive to digital tools are stimulating the pervasive deployment of GNSS technologies.

GNSS in Agricultural Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 42.30% |

| Europe | 30.20% |

| Asia-Pacific | 19.40% |

| LAMEA | 8.10% |

The LAMEA region is exhibiting a slower horizontal penetration of GNSS in agriculture, yet targeted uptake is evident in well-designed pilot projects. In July 2025, Porto Seguro’s research plots in Brazil applied GNSS-aided variable-rate fertiliser and mapping to rationalise row spacing in dense sugarcane stands. South African farming co-operatives have supplemented centre-pivot control architecture with GNSS receivers to enable closed-loop variable-rate irrigation and yield mapping, commenced in June 2025. The United Arab Emirates is experimenting with low-power GNSS-based sensors to monitor microclimate within hydroponic greenhouses. Pilot livestock farms in the Middle East have equipped grazing sheep with collar-mounted GNSS loggers to analyse paddock efficiency. Collectively, these targeted implementations attest to an emergent, albeit measured, affinity for precision agriculture across the LAMEA agrarian landscape.

Precision Irrigation Systems: The precision irrigation systems segment held leading position in the market. It is a input a critical technological layer into contemporary agronomic practice by employing GNSS informatics, coupled with in situ soil and plant sensors, to manage hydric delivery with extreme accuracy. By modulating application rates in real-time in accordance with soil volumetric moisture and real-time phenological demands, these infrastructures not only minimize hydric waste but also curtail ancillary energy expenditure linked to unwarranted pumping and conveyance. Observations from a commencement deployment in a Central Valley estate in April 2025 confirmed a net irrigation reduction of 20%, uniform phenotypic benchmarks across diverse field blocks, and correlated reductions in operational expenditure alongside Phyto pathologically robust yield affirmed by agronomy records.

Guidance and Steering Systems: Digitally cipher field practice hierarchies through GNSS-mediated automated alignment of tillage, cultivar, and harvesting implements, securing reductions in geometric overlap and enhancing inter-operation accuracy. The resultant operational envelope extends to planting precision, harvest yield management, and precision nocturnal and diurnal Phyto sanitizer application, concomitantly diminishing edaphic compaction and cumulative field attrition from repetitive traffic. A tactical rollout of GNSS-controlled tillage fleets on an Ontario grain estate in July 2025 documented a 15% uplift in planting operational throughput, concomitant reductions in diesel consumption, and a qualitative modulation of operator fatigue, corroborated by telemetry and ergonomic surveys initiated pre, during, and post-deployment.

Variable Rate Technology (VRT): VRT synthesizes GNSS positioning with multiple sensor inputs to regulate seed, fertilizer, and chemical rates across the field. By matching application rates to spatial crop and soil variability, the technology enhances productivity while minimizing redundant inputs, thus curtailing both cost and ecological disturbance. During a trial conducted in June 2025 on a Nebraska farm, GNSS-assisted VRT was employed. Outcome metrics demonstrated a 10% uplift in crop yield, a reduction in input expenditures, and measurable gains in soil biological and chemical conditions. Precision in field-management tactics has, therefore, been elevated to a new benchmark.

Field Mapping and Soil Sampling: Field Mapping and Soil Sampling pair GNSS guidance with systematic soil core analysis to produce high-resolution soil characterizations. Such data underpins nutrient-steering algorithms and precision fertilizer applications, facilitating tactical crop-management strategies. Following the deployment of a GNSS-reference soil-mapping programme on a Texas operation in July 2025, systematic internal validations confirmed the dimensional capture of nutrient-deficient zones. Fertilizer applications were recalibrated accordingly, leading to marked enhancements in crop quality and notable gains in on-farm operational throughput.

Single-Frequency GNSS Receivers: Single-frequency GNSS solutions offer foundational positioning for small farms and general fieldwork. Their affordability and user-friendliness make them appealing. Accurate enough for everyday mapping, monitoring, and implement guidance, they deliver consistent performance. A Spanish farm adopted single-frequency receivers for field mapping in August 2025. Efficiency in field monitoring rose, data reliability strengthened, and resource management became tighter, with results visible across planned operation cycles.

Dual-Frequency GNSS Receivers: By processing two frequency bands, dual-frequency receivers markedly attenuate errors induced by the troposphere and ionosphere. Consequently, they now serve as the standard in precision-agriculture machinery, where enhanced positioning allows for refined planting, fertigation, and harvesting. A French vineyard in September 2025 upgraded its guidance systems with dual-frequency modules. Rows aligned accurately, nutrient delivery met specified band widths, and yield uniformity favorable improved across the trellis.

Multi-Frequency GNSS Receivers: The multi-frequency GNSS receivers segment held leading position in the market. Multi-frequency systems capture a comprehensive suite of GNSS signals, permitting centimeter-level positioning accuracy essential for autonomous platforms and intricate field tasks. They excel in areas with obstructed views, where persistent signal integrity is paramount. By integrating multi-frequency receivers into its autonomous tractor fleet in October 2025, an Australian operation achieved a uniform operational application of seeds. Labor demand contracted, field traversal became consistently even, and machinery productivity advanced, validating the strategic investment.

GNSS Antennas: Field-grade GNSS antennas collect satellite signals to deliver the positioning accuracy essential for precision agriculture. Designed to operate reliably amid adverse weather, dust, and physical obstructions, these units minimize loss and prevent drift when conditions fluctuate. By enhancing the integrity of the positioning data, superior antennas refine machinery guidance and elevate boundary mapping resolution. In November 2025, a consolidated retrofit of GNSS antennas at an expansive Italian farm was completed. Post-installation, signal-to-noise ratio metrics indicated a 30% uplift. The smoothness of machinery guidance trajectories increased, vehicular drift reduced, and crop zone tracking precision advanced. The integrated outcome was a marked rise in operational throughput, with re-recorded agro-manager efficiency indicators reflecting improved yield mapping cycles.

GNSS Chipsets: GNSS baseband chipsets are the heart of the receiver architecture, translating satellite data into actionable positioning and timing outputs. Next-generation units leverage refined algorithms to slash static and dynamic power budgets while elevating data throughput and latency-sensitive tasks. In December 2025, a research-led consortium at a German agri-tech incubator produced a multi-constellation chipset. Initial benchmarks indicated a 25% decrease in receiver power draw without sacrificing re-acquisition latency, translating to longer operational cycles for field-drawn autonomous systems. The chipset’s elevated processing throughput empowered more granular crop tracking, and field-robot guidance became noticeably more coherent across variable terrain. Subsequent field tests confirmed that the aggregated enhancements contributed quantifiably to data-led decision cycles and yield optimization.

Farm Management Software: FMS synthesizes GNSS datasets to orchestrate planning, monitoring, and administration of agricultural enterprises with maximum efficiency. Workflow is standardized and evidence-led choices are facilitated. The platform further archives historical records, enabling reflective analysis that sharpens prospective agricultural strategy. By January 2025, a Netherlandic agribusiness incorporated a state-of-the-art suite. As a result, resource allocation was optimized, cropping schedules shortened, overheads trimmed, output enlarged, and the tempo of executive functioning accelerated.

Geographic Information Systems: GNSS-backed GIS systems capture and interpret spatial datasets, rendering maps that expose crop heterogeneity and field productivity trends. Precision-centric governance is the consequence, with the technique extending to the systematic calibration of nutrients, irrigation, and other inputs. A Brazilian estate employed a platform in February 2025. Fertilization rates and timings were finely adjusted, productivity estimates sharpened, and soil interventions targeted. Total efficiency was amplified, and boundary decisions attained formerly unattainable levels of precision.

GNSS in Agricultural Market Share, By GNSS Integration Services, 2024 (%)

| GNSS-Based Software Solutions | Revenue Share, 2024 (%) |

| Farm Management Software | 36.80% |

| Geographic Information Systems (GIS) | 25.60% |

| Data Analytics Platforms | 19.20% |

| Decision Support Systems | 18.40% |

Data Analytics Platforms: Platforms that synthesize GNSS and in-field senor intelligence deliver targeted directives suited to the imperatives of precision agriculture. Their structures house predictive models and risk-reducing arrangements. Manifest gains include streamlined exercises, curbed spoilage, and enhanced yield integrity. In March 2025, a British enterprise unveiled a service that models pest prophesy through GNSS inputs. Intervention schedules were fitted pre-emptively, crop attrition was mitigated, resource turns were optimized, and motorway precision attained highly elevated levels, signalling a corroborated uptick in agricultural throughput.

Decision Support Systems: Decision Support Systems harness GNSS alongside an array of farm data to prescribe optimal management prescriptions. By distilling multifaceted agricultural choices into an accessible format, they enhance operational efficacy across the production cycle. The incorporation of contemporaneous weather and soil information serves to attenuate agronomic exposure to risk. An illustrative application occurred in April 2025, when a promotional Argentine cooperative deployed a comprehensive decision support platform. The resulting recalibration of planting schedules yielded both agronomic and operational gains: per-hectare crop productivity ascended, operational throughput expanded, resource waste diminished, and the velocity and precision of decision-making were markedly elevated.

System Integration Services: System Integration Services unify GNSS hardware and software, tailoring the resulting systems for specific agricultural workflows. By synchronizing tractors, sensors, and data platforms, the offering guarantees frictionless data exchange, driving automation, mitigating operator error, and lifting functional throughput. In May 2025, a provider in India installed the integrated solution across its tractor fleet. Automation responded in real time, operator cognitive loads lightened, digital field maps acquired near-metre fidelity, agronomic zone boundaries sharpened, and overall productivity registered sustained improvement.

Consulting and Advisory Services: Consulting Services deliver in-depth, data-driven counsel to guide the adoption of GNSS-enhanced precision agricultural frameworks. By quantifying variable-input, time, and asset costs, the team helps farmers elevate financial returns, conserve resources, and sharpen utilisation of every signal. In June 2025, a South African advisory house endorsed a mixed-crop co-op in the deployment of a phased GNSS layer. Efficiency metrics advanced by 15 per cent, input costs consolidated, the gross agronomic response rose, and progressive knowledge gaps regarding sensor methods narrowed.

GNSS in Agricultural Market Share, By GNSS Integration Services, 2024 (%)

| GNSS Integration Services | Revenue Share, 2024 (%) |

| System Integration Services | 37.20% |

| Consulting and Advisory Services | 20.10% |

| Training and Support Services | 15.40% |

| Maintenance and Upgradation Services | 27.30% |

Training and Support Services: Training Services equip agronomists and operators with mastery of GNSS modules and design practices, while Support Services deliver troubleshooting and continuous maintenance. Increased competencies safeguard the return on the technology investment. In July 2025, a regional training centre in Kenya consolidated its curriculum with field case complements. System rollout exceeded expectations, operator errors decreased by a third, the fidelity of monitoring data increased, and crop metrics reflected an upward paradigm.

Maintenance and Upgradation Services: Regularly sustain and refine GNSS infrastructure to guarantee ongoing operational capability while integrating the latest advancements. These initiatives enhance system dependability and precision, thereby minimizing periods of inoperability. Scheduled modernization enables agricultural users to seamlessly incorporate successive innovations without extensive retraining or investment in entirely new hardware. A representative implementation occurred in August 2025, when a Japanese vendor carried out a comprehensive refresh of nationwide agricultural GNSS nodes. Subsequent measurements reported a 20% reduction in total system downtime. Concurrently, operational accuracy across machine guidance parameters exhibited significant gains, resulting in more fluid trajectory execution and decreased overlap in field passes. These improvements translated to finer data capture rates during in-field crop monitoring and a generalized increase in processing throughput across the agricultural value chain.

Livestock Tracking and Management: The livestock tracking and management segment has generated highest revenue share in the market. By employing GNSS technology, ranchers can continuously log livestock movements, physiological state, and grazing behaviour, leading to more informed herd oversight. The capacity to transmit and analyse position and biometric data in real time minimises livestock attrition and accentuates operational yield. An illustrative case featured a New Zealand ranch, in September 2025, which embedded GNSS collars on cattle. Post-implementation, monitoring accuracy reached centimetre-level precision, enabling targeted feeding prescriptions, optimised pasture utilisation, enhanced health surveillance, and an overall lift in operational throughput.

Land and Field Management: GNSS technologies furnish precision guidance for boundary definition and field geometry, thereby elevating agronomic output per unit area. By supplying finely gridded maps, producers can design crop rotations and allocate agronomic inputs with exactitude. An implementation in Chile, documented in October 2025, showcased the utilisation of GNSS for field geometric optimisation. The resulting yield escalation of 12% was accompanied by more judicious input application and the attainment of complete field coverage, facilitating hyper-accurate preparatory modelling for the ensuing season.

Weather and Climate Monitoring: The convergence of GNSS and sensor networks enables the continuous surveillance of meteorological and microclimatic variables, thereby allowing producers to deploy precautionary measures in a timely manner. The amalgamation of positional and meteorological data fine-tunes irrigation scheduling, fertilisation protocols, and crop protection tactics. A Danish case study, executed in November of 2025, employed an integrated GNSS-based meteorological monitoring system to forecast imminent frost events. The intervention calibrated irrigation cycles, safeguarded affected crops, and optimised field operations, culminating in an observable elevation in agronomic productivity.

Supply Chain and Logistics Management: Satellites employing Global Navigation Satellite Systems (GNSS) monitor agricultural commodities, thereby refining logistical pathways and mitigating spoilage. These systems guarantee punctual receipt, bolster supply-chain velocity, and furnish continuous visibility that sharpens stock administration and anticipatory governance. In December 2025, an American logistics provider integrated GNSS-enabled tracking. The enterprise recorded an 18-per-cent contraction in transit duration. Warehouse oversight exhibited refinement, tactical scheduling was enhanced, product integrity remained uncompromised, and the overall productivity of the chain advanced.

Market Segmentation

By Precision Agriculture

By GNSS Receivers and Components

By GNSS-Based Software Solutions

By GNSS Integration Services

By End-User

By Region