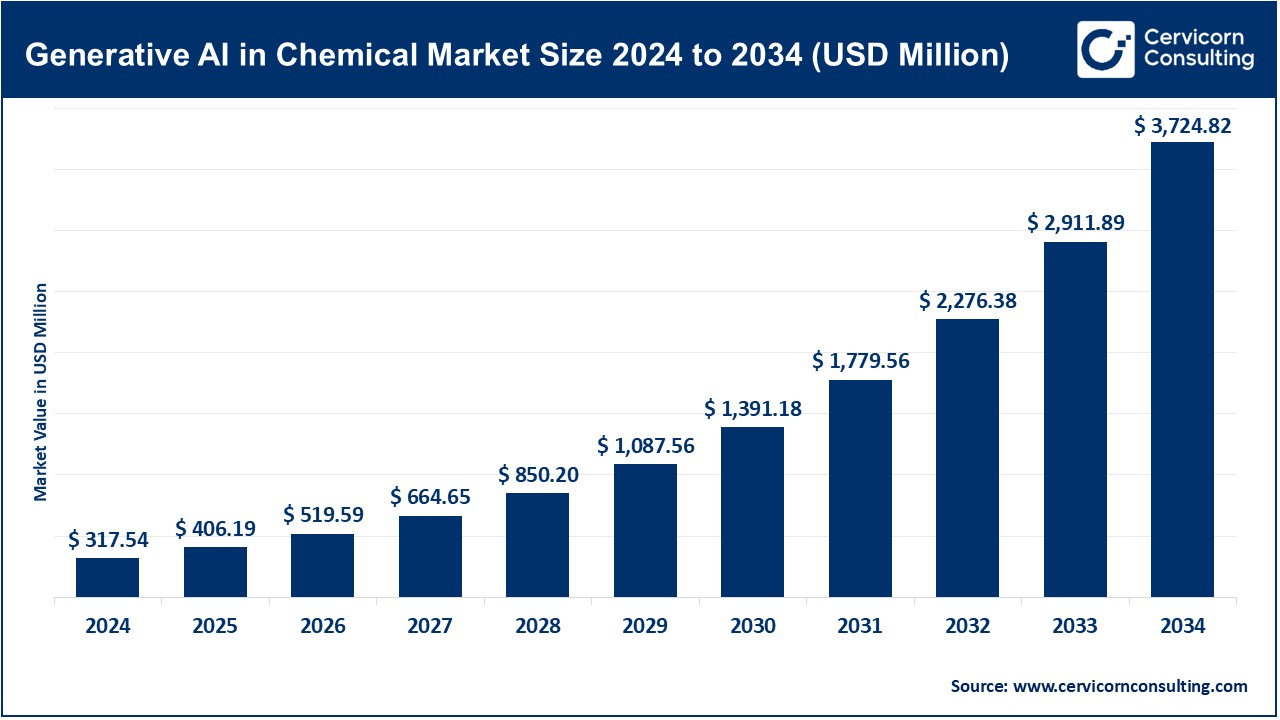

The global generative AI in chemical market size was valued at USD 317.54 million in 2024 and is expected to be worth around USD 3,724.84 million by 2034, exhibiting a compound annual growth rate (CAGR) of 27.91% over the forecast period 2025 to 2034. The generative AI in chemical market is propelled by the rising demand for faster and more cost-effective discovery of new molecules, materials, and formulations. Traditional chemical research and development processes are often slow, require significant resources, and demand considerable capital investment. Generative AI platforms, including deep learning and generative adversarial networks (GANs), facilitate quicker simulation, prediction, and optimization of chemical reactions, molecular structures, and properties, greatly speeding up innovation cycles. As more industries like pharmaceuticals, specialty chemicals, and agrochemicals rely on AI for molecular design and process optimization, incorporating generative AI becomes a strategic necessity.

Another significant driver of growth is the need for green and sustainable solutions. Generative AI is assisting researchers in creating cleaner chemicals and processes by modeling the environmental impact of chemical formulations early in the development phase. Moreover, the growing accessibility of big data, enhancements in computational power, and the broadening of cloud infrastructure are enabling large-scale training and implementation of AI models. Partnerships between the chemical industry and AI startups, coupled with governmental and private sector investments in AI-focused research, are further promoting the use of generative AI technologies in the chemical industry.

What is a Generative AI in Chemical?

The generative AI in the chemical industry refers to the use of advanced machine learning models, such as generative adversarial networks (GANs), variational autoencoders (VAEs), and transformer models, to create, simulate, and optimise novel chemical compounds, materials, and reaction routes. This enables chemists and researchers to automate molecular discovery, predict physical and chemical properties, and design more efficient and durable products. General applications include drug and agrochemical development, catalyst and polymer design, response adaptation, future toxicology, and material innovation for batteries, coatings, and packaging.

Adoption Highlights of Generative AI in Chemical R&D:

| Insight | Details |

| AI Adoption in R&D | Over 50% of chemical companies are integrating AI into R&D pipelines. |

| Time Reduction in Molecule Design | Generative AI reduces molecule design time by up to 70–80%. |

| Key Adoption | Pharmaceuticals and materials science lead in generative AI usage. |

|

Cost Reduction Benefit |

AI-driven chemical modeling can lower R&D costs by 20–40%. |

| Sustainability Focus | Over 30% of AI chemical research now includes sustainability metrics. |

| Patent Growth | AI-generated molecule patents have increased by 5x since 2018. |

| Leading Region | North America leads in AI-chemical collaboration and startup growth. |

Accelerated Molecule and Material Discovery

Generative AI is speeding up the discovery of new molecules and materials. By examining extensive chemical datasets, AI models can forecast molecular properties and propose innovative compounds, thereby lessening the dependence on traditional experimental methods. This technique is particularly noteworthy in pharmaceuticals, where AI assists in creating drug candidates with targeted characteristics, and in materials science, where it supports the production of advanced materials like polymers and catalysts. The collaboration between technology firms and chemical producers, as seen in the partnership of Microsoft and DuPont, exemplifies this trend by utilizing AI to create new chemical products, such as polyurethane.

Integration into Chemical Engineering Education

Educational institutions are rapidly integrating generative AI into chemical engineering courses. By 2024, more than 50% of chemical engineering programs plan to include AI tools for simulation and modeling processes. The purpose of this integration is to equip future chemical engineers with skills in AI-operated design and analysis, preparing them for a workforce where AI is integral to research and development activities.

Enhancement of Sustainability and Green Chemistry

Generative AI is playing a significant role in promoting stability within the chemical industry. AI models assist in designing environmentally friendly compounds and adapting procedures to reduce waste and energy consumption. For example, the AI can predict the environmental impact of chemical processes in the development cycle, enabling the manufacture of greener products. Companies are leveraging AI to achieve sustainability goals by developing chemicals with low toxicity and better biodegradability.

Expansion into Commercial and Sales Operations

In addition to research and development, generative AI is enhancing commercial operations within the chemical industry. Applications of AI encompass customer segmentation, sales forecasting, and targeted marketing strategies. By scrutinizing customer data and market trends, AI assists companies in recognizing new opportunities, refining pricing strategies, and boosting customer engagement, ultimately driving revenue growth.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 406.19 Million |

| Expected Market Size in 2034 | USD 3,724.82 Million |

| Projected CAGR 2025 to 2034 | 27.91% |

| Dominant Area | North America |

| Fastest Growing Area | Asia-Pacific |

| Key Segments | Technology, Deployment Mode, Application, Region |

| Key Companies | Insilico Medicine, BenevolentAI, Exscientia, Cyclica, Atomwise, Recursion Pharmaceuticals, DeepCure, BenchSci, Euretos, Zymergen, Molecular AI, Chemify, Cloud Pharmaceuticals |

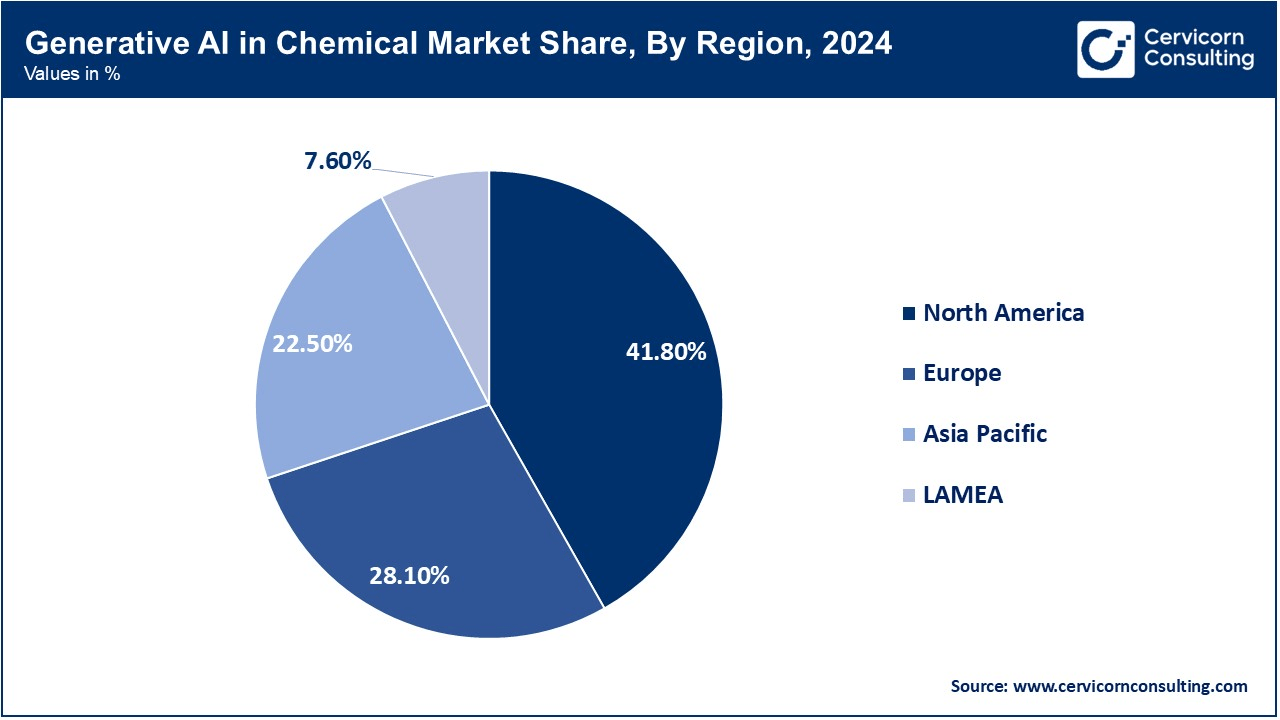

The generative AI in chemical market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

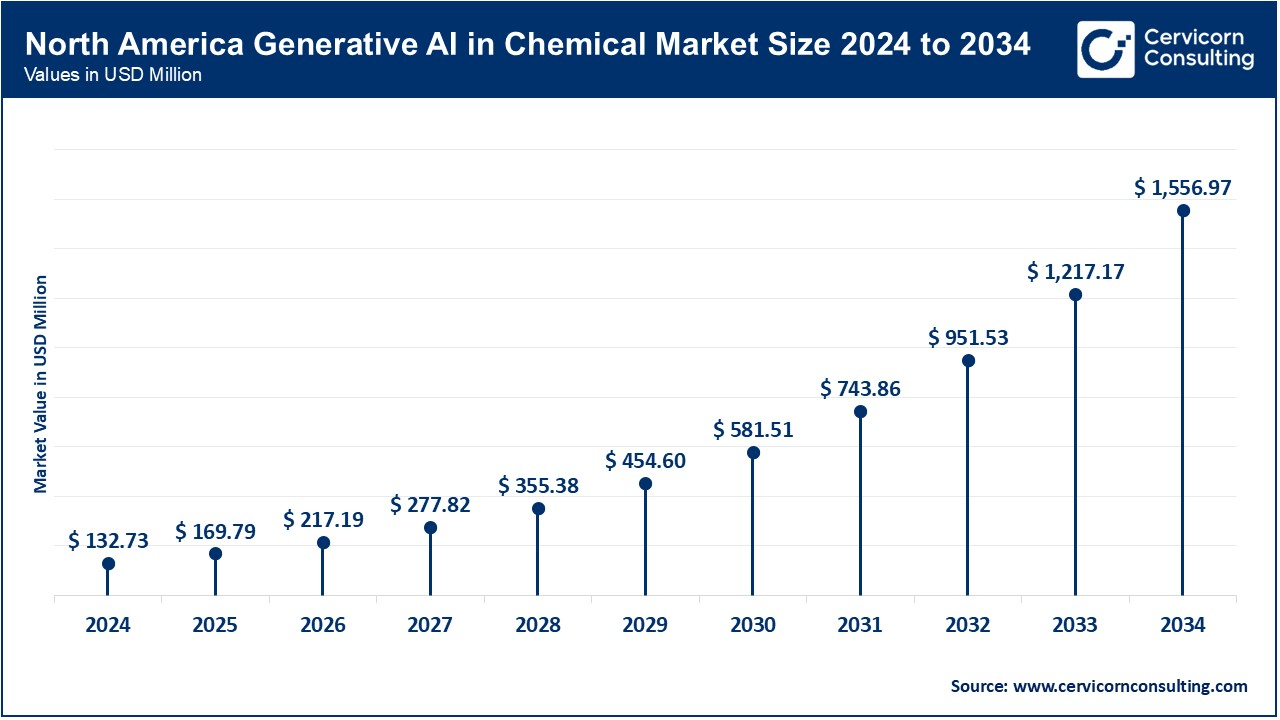

The North America generative AI in chemical market size was valued at USD 132.73 million in 2024 and is expected to hit around USD 1,556.97 million by 2034. North America leads the adoption of generative AI in the chemical sector, driven by a robust innovation ecosystem, significant investment in AI startups, and strong cooperation between technical companies and chemical giants. The United States, in particular, benefits from advanced research institutes, federal funding for AI research, and early adoption by pharmaceutical and specialty chemical companies. Major players such as Dow, DuPont, and 3M have integrated AI into their R&D and production processes to accelerate content innovation and operational efficiency. Additionally, the region promotes the rapid scaling of well-established cloud infrastructure and regulatory clarity for AI-managed chemical solutions.

The Asia-Pacific generative AI in chemical market size was estimated at USD 71.45 million in 2024 and is predicted to record USD 838.08 million by 2034. APAC is the fastest-growing region, fueled by rapid industrialization, large-scale chemical manufacturing, and government support for digital transformation. Countries such as China, Japan, South Korea, and India are making significant investments in AI research and chemical processes. China, in particular, is advancing AI-based chemical modeling and synthesis to bolster its domestic pharmaceutical and materials industries. The increasing demand for advanced materials, fertilizers, and specialty chemicals in the region is driving the use of generative AI for scalable and efficient production.

The Europe generative AI in chemical market size was reached at USD 89.23 million in 2024 and is projected to grow to USD 1,046.67 million by 2034. Europe is a leading region for generative AI in the chemical industry, emphasizing sustainability, green chemistry, and regulatory compliance. Leading chemical companies like BASF, Bayer, and Solvay are utilizing AI to create environmentally friendly materials, reduce energy consumption, and adhere to strict European Union environmental regulations, such as access and green deals. The region also benefits from robust public-private research collaborations and AI initiatives funded by the European Union that promote the ethical and transparent use of AI in industrial applications. Europe's commitment to a circular economy is accelerating the adoption of AI in areas such as waste-to-chemical conversion and life cycle assessment.

The LAMEA generative AI in chemical market size was valued at USD 24.13 million in 2024 and is anticipated to reach around USD 283.09 million by 2034. Latin America, the Middle East, and Africa (LAMEA) represent an emerging opportunity. While AI adoption is still in its early stages, regional governments and multinational firms are starting to adopt AI to improve chemical production efficiency, particularly in petrochemicals and mining-based chemicals. The Middle East, led by countries like Saudi Arabia and the UAE, is making strategic advances toward digital transformations in chemicals as part of their economic diversification plans. In Latin America and Africa, the increasing demand for agricultural chemicals and other essential inputs is encouraging pilot AI projects aimed at enhancing contributions and increasing supply chain efficiency.

The generative AI in chemical market is segmented into technology, deployment mode, application, and regions. Based on technology, the market is classified into machine learning, deep learning, reinforcement learning, quantum computing, and molecular docking. Based on the deployment mode, the market is categorised into cloud-based, on-premises, and hybrid. Based on application, the market is categorised into production optimization, discovery of new materials, pricing optimization, product portfolio optimization, load forecasting of raw materials, process management & control, and feedstock optimization.

Machine Learning (ML) dominates the technology landscape due to its well-developed algorithmic structure and the practical usefulness of this technology throughout the chemical value chain. It is used extensively for predictive analytics, reaction optimization and formulation design. ML assists chemists in analyzing obscures patterns in large experimental datasets, as well as in predicting and discovering complex chemical reactions. Its versatility for all kinds of applications, ranging from input raw material prediction to output product yield optimization, makes it the system of choice for numerous chemical companies.

Quantum Computing is gaining traction rapidly, particularly in simulating quantum level chemical interactions, which classical computers find difficult to model. It is accurate for molecular structure predictions, reaction energy calculations and since can be performed in large scale is also applicable for high-throughput materials discovery. As IBM, Google, and a new crop of quantum startups build more stable and commercially viable systems, chemical companies are investing in pilot projects using quantum algorithms for breakthroughs in catalysis, battery development, and sustainable chemical design.

Cloud-based deployment is leading the market due to its accessibility, real-time data processing, and reduced IT overheads. It enables chemical companies to execute advanced AI workloads without having to purchase local hardware, something that would particularly benefit R&D teams that work around the world. Cloud platforms also embed powerful AI toolkits, facilitate safe storage and scale seamlessly in response to changing operational requirements. Chemical companies, as well as cloud vendors such as AWS, Azure, Google Cloud are forming alliances to deliver AI-as-a-Service offerings.

Hybrid deployment is expanding swiftly, offering flexibility and regulatory compliance. Many chemical manufacturers operate in the highly regulated industry and sensitive data. Hybrid approach allows sensitive data to stay in the lab, but exploit cloud for high-performance computing and AI model training. This implementation raises the bar of liability, complexity and cost on risk and performance with the added pressures of multinational organizations controlling sensitive intellectual and operational property.

Generative AI is revolutionizing material discovery, making this the most dominant application area. AI-powered systems can generate new chemical structures, predict their properties, rank candidates on performance or cost for example, substantially reducing the amount of trial-and-error style experimentation required. AI’s impact is significant in fields such as aerospace, automobiles, electronics, and biomedical engineering, where thinking materials have facilitated the development of lightweight composites, high-strength alloys, and advanced polymers whose properties are fine-tuned for specific applications. Virtual capability to model and validate new materials’ functionality has become a game changer for innovation-led companies.

Generative AI in Chemical Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Discovery of New Materials | 35% |

| Production Optimization | 25% |

| Pricing Optimization | 10% |

| Product Portfolio Optimization | 8% |

| Load Forecasting of Raw Materials | 7% |

| Process Management & Control | 8% |

| Feedstock Optimization | 7% |

Production optimization is emerging as the fastest-growing segment due to increasing need to improve efficiency, reduce emissions and minimize raw material wastage. Generative AI enables the simulation of entire production processes, the determination of the optimal sequence for batches, and real-time prediction of deviations. It offers predictive maintenance, less downtime, and higher throughput based on historical process data. It provides particularly dramatic benefit for continuous process sites, such as petrochemics plants, where small improvements mean big ROI.

The competitive landscape of generative AI in chemical industry is developing rapidly, featuring a mix of established chemical corporations, AI technology providers, and innovative startups. Leading players like BASF, Dow, and DuPont are actively collaborating with technology giants like IBM, Microsoft, and Google to integrate AI capabilities into their research and production pipelines. At the same time, specialized AI firms such as Schrödinger, Kebotix, and Citrine Informatics are gaining traction with advanced platforms focused on molecular generation, material search, and future modeling. Strategic participation, R&D investment, and acquisitions are common as companies aim to gain a technical lead and expedite the introduction of new chemical compounds and materials. The competitive focus is shifting towards sustainable innovation, rapid implementation, and AI-powered product adaptation.

Schrödinger, Inc.

Insilico Medicine

BenevolentAI

Exscientia

Cyclica

Atomwise

Recursion Pharmaceuticals

Market Segmentation

By Technology

By Deployment Mode

By Application

By Region