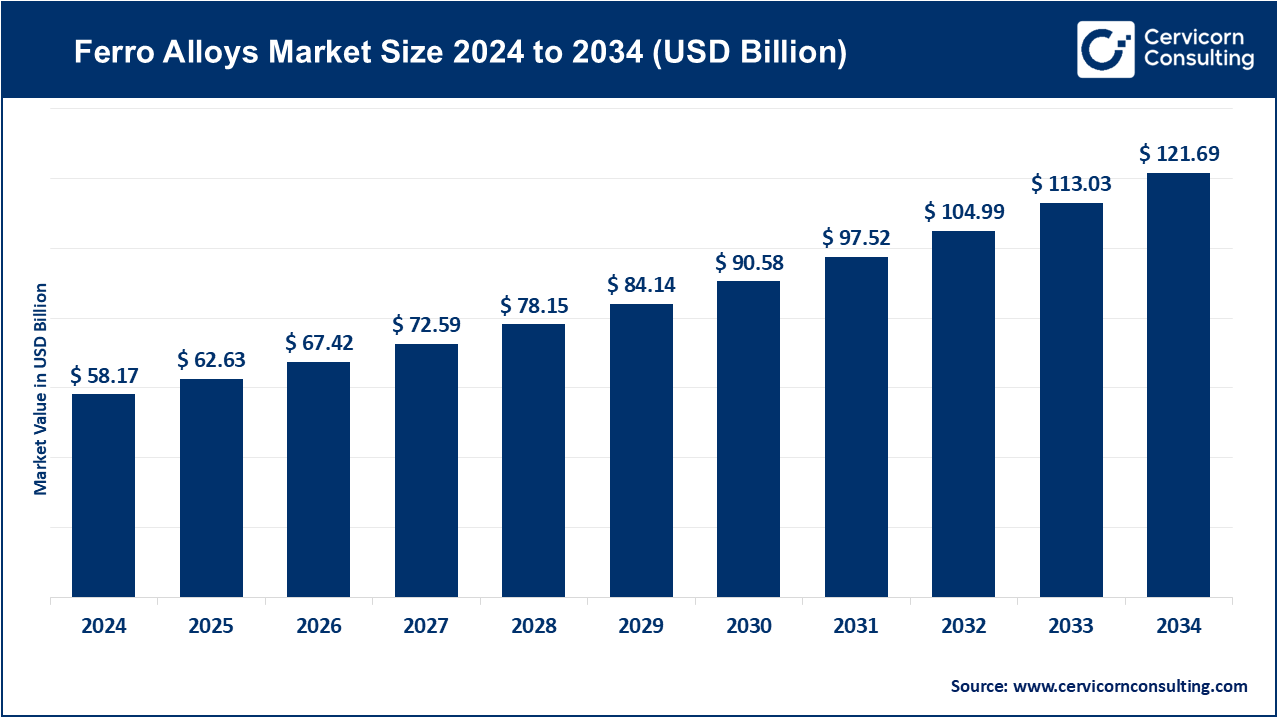

The global ferro alloys market size was valued at USD 58.17 billion in 2024 and is expected to be worth around USD 121.69 billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.66% over the forecast period from 2025 to 2034. Due to their growing use as alloying additives in several industries ferro alloys are witnessing remarkable development. This is being fuelled by the need for high-strength steel and by increasing infrastructural development. Demand for products made from steel and alloyed steels as well as construction steels for the automotive projects are also driving this need. The focus on the increased market growth for stoveware on steel manufacturing includes the cost-efficiency and the operational effectiveness. Steel manufacturing advanced engineering including electric arc and environmental adaptation of the smelting is increasing. Sophisticated manufacturing engineering and centres specially designed for advanced steel manufacturing are popular in the steel manufacturing and ferro alloys industry.

Long-term strategic growth includes industry partnership, innovative development in alloy formulation and shifts towards steel and ferro alloys which carry positive environmental and health footprints. Future of the ferro alloys industry is heavily influenced by the industrial, infrastructural and trade policies of the government designed to promote growth.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 62.63 Billion |

| Estimated Market Size in 2034 | USD 121.69 Billion |

| Projected CAGR 2025 to 2034 | 7.66% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Raw Material, Application, End-User, Region |

| Key Companies | Indian Metals & Ferro Alloys Ltd. (IMFA), Maithan Alloys Ltd., Sarojini Ferro Alloys, Balasore Alloys, Tata Steel Ferro Alloys & Minerals Division (FAMD), Simran Industries, Mortex Group, Jaydeep Steelwork India Pvt. Ltd., SRG Group, Owais Metal & Mineral Processing Ltd. |

The ferro alloys market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The biggest growth is happening in the Asia-Pacific region which is made up of China, India, Japan, and South Korea. China is still the largest consumer and producer of ferro alloys as the production of steel and development of autos and infrastructure is still booming. With India’s increasing urbanization and industrialization, the demand for construction-grade steel and specialty alloys is further increasing. Japan and South Korea’s high-purity ferro alloys come from their high-tech industries as they manufacture autos and machinery. Countries in Southeast Asia like Thailand, Indonesia, and Vietnam are also building up their steel production and making bigger partnerships with ferro alloy producers which will help with growth for the Southeast Asia Region and the whole Asia-Pacific Region.

In North America, ferro alloys demand comes from the construction, automotive, and machinery industries, resulting in the region performing better than the rest of the world. The U.S. and Canada have the region's consumption market dominance due to the highly developed steel manufacturing, energy-efficient smelting, and ferro alloys quality-control infrastructures. Investments in urban development projects and industrialization and infrastructure development actively fuel demand. The demand from the aerospace and defense industries cannot be overlooked, as they require the high-strength, heat-resistant steels alloys such as ferro nickel and ferro titanium. The latest technologies, such as climate-compliant production and AI-driven optimization of manufacturing processes provide even more proof of the expertise within the North America ferro alloys market.

In Europe, the demand for high-performing steels and highly developed environmental protection legislation makes Europe the world’s second largest market. Germany, France, and Italy are the largest consumers in the market, for stainless steel, automotive, and infrastructure purposes. The production of sustainable steel and low-carbon high-purity ferro alloys is the region's main focus. The aerospace, defense, and energy industries use the special alloys more and more, as more investments are made in automation and digital monitoring systems, which provide the energy-efficient furnaces. These systems enable manufacturers to reduce costs while compliant to the EU norms on emissions, which provides steady growth for the market.

Ferro Alloys Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 14.40% |

| Europe | 18.50% |

| Asia-Pacific | 61.30% |

| LAMEA | 5.80% |

The LAMEA region offers great growth potential for ferro alloys, primarily supported by urbanization trends, industrial growth, and mining activities. Within LAMEA, Brazil, South Africa, and the UAE are key players, given the availability of ferrous alloy raw materials like manganese, chromite, and nickel ores. Construction and industrialization fueled by government investments enhances demand for ferro alloys. Local partnerships with global steel and alloy producers have improved access to advanced ferro alloys. Construction of modern smelting facilities will allow the region to meet regulatory demands and drive adoption of ferro alloys, establishing LAMEA as a region of significant growth potential after 2025.

Ferro Manganese: Ferro manganese is vital in producing high-grade steel to improve hardness, strength, and toughness. It is particularly necessary in manufacturing structural steel, automotive components, and heavy machinery. Ready availability and high demand for manufactured steel in the construction and automotive industries in the Asia-Pacific and European regions strongly drives the demand for ferro manganese. Leading companies like Eramet and South32 target the production of high-quality ferro manganese with optimal carbon levels to satisfy the varying industrial needs and standards of ferro manganese. Steel manufacturers tend to prefer low-carbon and medium-carbon ferro manganese for the enhancement of specialized steel's mechanical attributes.

Ferro Silicon: Ferro silicon is vital to enhance the elasticity, corrosion resistance, and hardness of steel. It is extensively used in the production of electrical steels, automotive components, stainless steel, and various other auto parts. In the automotive and electrical equipment industries, especially in Europe, North America, and China, demand for ferro silicon is increasing due to the use of advanced smelting and purification techniques to provide consistent alloy quality. It is also gaining prominence in foundries for casting, due to its deoxidizing attributes and ability to improve the flow, durability of steel, and overall ferro silicon content.

Ferro Chrome: Ferro chrome is a key ingredient in making stainless steel. It gives stainless steel its hardness, heat resistance and helps with corrosion. The largest consumers are the countries with the biggest stainless steel industries such as China, India and South Africa. As the stainless steel industry uses chrome more and more, the chrome producers such as Glencore and Tata Steel focus on making ferro chrome of greater purity to meet the international standards. The need for more stainless steel is seen in construction, automobiles and in various consumer goods such as appliances where the aesthetics of the item is as important as its durability.

Ferro Nickel: Ferro nickel is also necessary for stainless steel because it helps provide the toughness, heat resistance and corrosion protective layers. The demand for ferro nickel is also high in specialty steels for the aerospace, defensive and automotive industries. In order to meet the rising demand, ferro alloy producers are optimizing their alloys and adopting more energy efficient and cost-effective smelting methods to address the environmental impacts. The leading producers of ferro nickel such as Vale and Sumitomo are investing in nickel-rich ferro alloys to satisfy the rising demand in high-grade stainless steel and various industrial equipment.

Silico Manganese: Silico manganese is used to steel metallurgy to deoxidize steel, as well as other mechanical qualities such as hardness and tensile strength. Silico manganese is used in the construction, machinery and automotive industries, especially in emerging markets such as India, Brazil, and Southeast Asia. Cost effective alloys enhanced performance such that the applicatons cascaded to mass market steel alloys. This has streamline the steel market to manganese.

Others: Specialty alloys such as ferro vanadium, ferro molybdenum, and ferro titanium used in high performance steel, for the aerospace, power generation, and defense sectors. This is due to the extreme strength, heat resistance, and wear that is provided by these alloys. While the demand for these alloys is niche, there is an increase in the intended sectors due to modern technology, stricter industry standards, and more uses in precision engineering.

Manganese Ore: Manganese ore is the first raw material in the production of ferro manganese and silico manganese, both of which are essential in enhancing the strength, hardness, and wear resistance of steel. Leading producers of manganese ore are South Africa, Australia, and Gabon, which sell high quality ore to steelmakers in the Asia-Pacific, Europe, and North America. The manganese content and quality of the ore are significant as they determine the performance of the alloy and the overall quality of the steel. Continuous demand for manganese-based ferro alloys is driven by the increase in construction, automotive, and machinery manufacturing. To meet the demand high quality standards, manufacturers are now concentrating on cost-efficient camouflaged technologies for smelting manganese ore.

Chromite Ore: Production of ferro chrome, the primary input for the production of stainless steel and high grade steels, uses Chromite ore. The leading suppliers are South Africa, India, and Kazakhstan. The availability, quality, and price of Chromite are the key determinants of production cost of stainless steel. The stainless steel industry, particularly in Europe and China, is the primary end user of high grade ferro chrome for construction, automotive, and household appliances. Manufacturers are now concentrating on advanced techniques for refining and smelting to produce low-carbon ferro chrome high in quality which meets the global standards. The demand for ferro chrome in the stainless steel industry is growing significantly, particularly in Europe and China.

Ferro Alloys Market Share, By Raw Material, 2024 (%)

| Raw Material | Revenue Share, 2024 (%) |

| Manganese Ore | 38.90% |

| Chromite Ore | 24.50% |

| Nickel Ore | 15.60% |

| Silicon | 18.90% |

| Others | 2.10% |

Nickel Ore: Nickel Ore is used in the production of ferro nickel, which is used in the production of tougher, heat resistant and corrosion resistant steel. The main producers of nickel ore are Indonesia, the Philippines, and Russia. Ferro nickel is essential in the production of high-performance stainless steel and other specialty steels used in the automotive, aerospace, and energy industries. High demand for quality ferro nickel is driven by the increasing production of electric vehicles and the expanding renewable energy infrastructure. To meet advanced steel application requirements, manufacturers are concentrating on producing low-carbon, high-purity ferro nickel to high environmental standards.

Silicon: Silicon is the primary constituent in the production of ferro Silicon which is used to improve the strength, elasticity and corrosion resistance of steel. The key suppliers are China and Brazil. The production of stainless steel, electrical steel and foundry applications ferro silicon is used widely. High-purity ferro silicon, which is used in the production of electric motors, transformers and automotive parts is crucial in the electrical and automotive industries. To produce quality alloys, efficient production and the ability to maintain consistent silicon content are essential.

Other Raw Materials: Vanadium, molybdenum, and titanium ores are included in the specialty ferro alloys category. Ferro alloys are used in the aerospace, defense, and energy sectors for high strength, corrosion resistance, and thermal stability. The need for high-performance steel for the infrastructure, industrial machinery, and power generation industries is driving the investments in and refining technologies and alliances with suppliers of raw materials.

Steel Production: For ferro alloys, steel production is still the largest application segment. The construction, automotive, and machinery industries, especially in the fast-growing Asia-Pacific region, are the main drivers of demand. Weakness, hardness, ductility, and rust resistance of steel can all benefitted from the addition of ferro alloys. To comply with global standards and sustainablity practices, steel makers are shifting to low carbon, high purity alloys. Major steel manufacturers are improving the efficiency of their operations with automated systems that integrate alloys and energy-efficient furnaces.

Foundries & Castings: Alloyed castings with enhanced mechanical properties, superior flow, and diminished contraction during solidification are produced in foundries with the assistance of ferro alloys. Heavy equipment castings, parts of industrial machinery, and automobile parts are made from alloyed castings. The production of castings that are augmented with ferro alloys has been driven by growth in the automotive industry as well as the production of industrial machinery. To achieve consistent quality and meet performance requirements, industry-specific standards, companies are focusing on precise alloying on advanced casting systems.

Ferro Alloys Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Steel Manufacturing | 45.10% |

| Foundries & Castings | 18.20% |

| Automotive & Machinery | 14.80% |

| Aerospace & Defense | 9.60% |

| Power & Energy | 7.20% |

| Others | 5.10% |

Automotive & Machineries: The steel needed for vehicle and chassis engines and for industrial machinery has the greatest dependence on ferro alloys. For Developing Countries like India, China, and Brazil, during the rising vehicle production and industrialization, the demand for automotive alloy maker's ferromanganese and ferrochrome alloys increased. Weight and vehicle durability are important for corrosion resistant vehicles. Alloyed and strengthened steel are used for better wiel wear, long service, improved performance and wiel wear for industrial machinery and equipment.

Aerospace & Defense: Specialty alloys are for aircraft, defense vehicles and military equipment. For the aircraft, defense modernization programs, private aircraft production and the expanding commercial aviation in the US, Europe, and Asia Pacific, are all the reasons for the rising demand in aerospace sector. Extreme conditions of temperature, stress and corrosion in the environment are all the conditions alloyed with ferro nickel and ferro titanium in the aerospace and defense alloys.

Power & Energy: Ferro alloys are crucial in pipelines, turbines, and other energy infrastructure where the alloys must withstand high temperatures, high pressures, and extreme corrosion. The segment benefits from increased investments in thermal, renewable (solar and wind), and nuclear energy. Power plants' increasing energy and cost efficiency demands high-performance alloys that require less maintenance across the plant's lifecycle.

Other Industrial Applications: Ferro alloys find use in the electronics, chemical processing, and specialized construction materials industries. They enhance the mechanical and corrosion resistance of industrial machinery, tools, and equipment. As industries emphasize durability and high-grade steel in specialized applications, the demand for these alloys increases.

Construction & Infrastructure: Ferro alloys form the backbone of the production of high-strength, corrosion-resistant steel used in the construction of bridges, buildings, railways, and urban developments. The demand for such alloys increases due to urbanization and large-scale government-funded infrastructure projects in emerging economies. Specialized alloys are critical in ensuring the structural safety, durability, and longevity of these urban infrastructure projects.

Automotive & Transportation: Ferro alloys are essential in the production of automotive steel used in body panels, chassis, engines, and exhaust systems. The growing demand for electric vehicles and hybrid vehicles, as well as commercial fleets, fuels further growth. Manufacturers rely on ferro alloys to reduce weight and improve corrosion resistance as well as structural performance for safety and fuel efficiency of the vehicles.

Ferro Alloys Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2024 (%) |

| Construction & Infrastructure | 38.70% |

| Automotive & Transportation | 24.80% |

| Machinery & Equipment Manufacturing | 16.40% |

| Aerospace & Defense | 11.20% |

| Energy & Power Generation | 8.90% |

Machinery & Equipment Manufacturing: Manufacturing of industrial machinery, construction tools, and agricultural equipment relies on ferro alloy-strengthened steel for durability, wear resistance, and operational efficiency. Due to the expanding industrial and manufacturing activities, the global demand for high-performance steel and the ferro alloys that accompany it increase.

Aerospace & Defense: Aircraft, defense vehicles, and military equipment need specialty ferro alloys due to the unique strength, heat resistance, and lightweight properties these alloys offer. This segment is fueled by military modernization and spending, as well as private aerospace projects. For aerospace applications, ferro nickel, ferro titanium, and ferro molybdenum are most critical.

Energy and Power Generation Sector: Ferro alloys and steels are important for the construction of power generation plants, pipelines, and wind and other renewable energy infrastructures, as well as for turbines. The steels in these constructions are exposed to extreme environments such as high temperatures, high pressures, and corrosive conditions. The renewable energy drives, construction of nuclear plants, and investments in fossil fuel infrastructures trigger the growth of ferro alloys needed for such power generation facilities. The ferro alloys needed for these applications tend to have higher mechanical and thermal performance.

Market Segmentation

By Type

By Raw Material

By Application

By End-User Industry

By Region