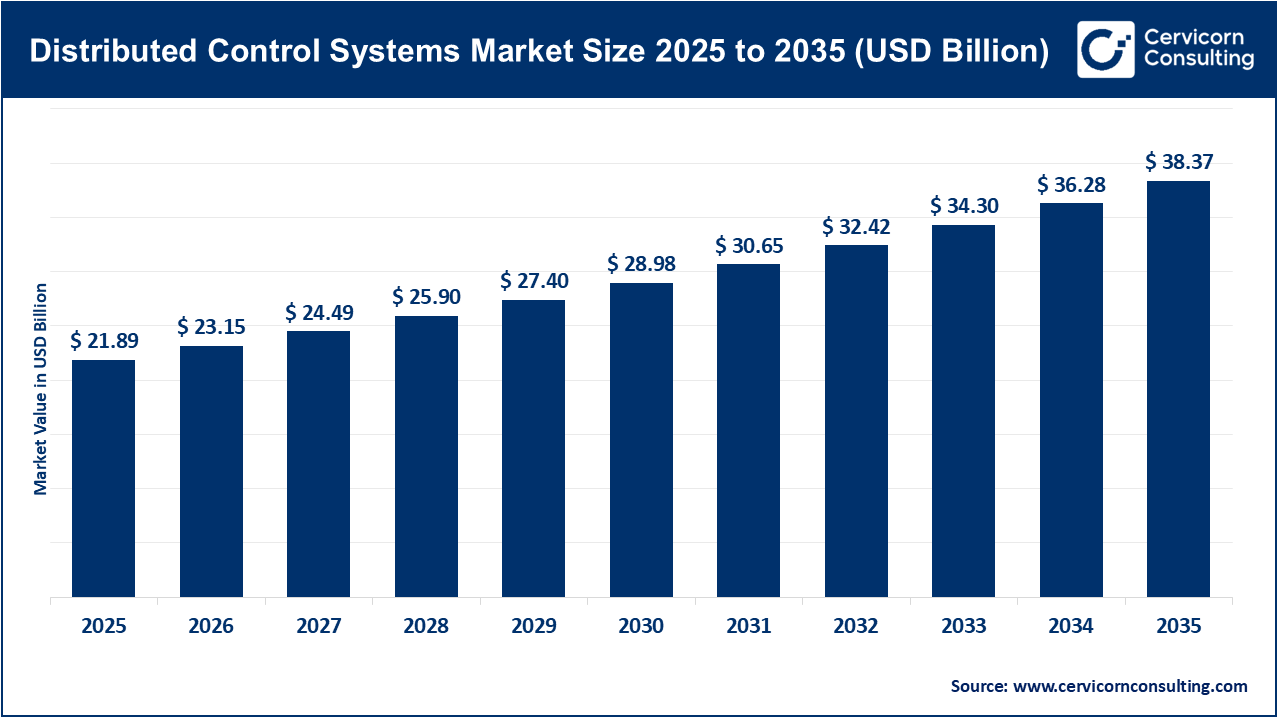

The global distributed control systems market size was estimated at USD 21.89 billion in 2025 and is expected to be worth around USD 38.37 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.8% over the forecast period from 2026 to 2035. The distributed control systems (DCS) market growth is driven by twin forces of industrialization in emerging economies and digitalization of existing facilities in developed economies. Current studies show that the DCS market is experiencing a general weighting of value shifting from proprietary hardware, to software-defined architectures and lifecycle services.

The DCS market represents the backbone of modern industry, as the first intelligence layer for high-availability process industries. A DCS is simply defined as a computerized control system used for a process or plant, in which the controlled elements are distributed across the system, rather than centralized at a single point. DCS solutions improve reliability and allow for the management of ongoing process loops that are common in oil and gas, power generation, chemical processing, etc. As industrial operations begin to transition to autonomous, data-driven business models, the DCS has shifted from a basic regulatory controlling entity to an intelligent platform for enterprise-wide optimization.

IIoT and O-PAS Driving the DCS Market Transformation

The addition of IIOT to the DCS architecture reveals a new trend of transition from a traditional "air-gapped" security model to a connected, rich, data environment. Research finds that IIOT-enabled DCS services are able to transmit data seamlessly from field sensors to cloud-based analytics engines in an environment that breaks the "silo" of information that has constrained industrial solutions for decades. IIOT enabled predictive maintenance, where machine learning utilizes vibration, temperature, and pressure data to predict failures in machinery prior to happening, reducing unplanned outages in many industries.

In conjunction with IIOT, is the growing influence of the open process automation (O-PAS). The DCS market has traditionally been characterized by proprietary "walled gardens" of hardware and software from different vendors. This vendor lock-in resulted in very high TCO or total cost of ownership, as the ability to integrate best-in-class, third-party technologies was limited. The O-PAS initiative is a government and multi-vendor supported effort to create vendor neutral architecture, which will allow for interoperability and plug and play ecosystem of controllers, I/O modules and software applications from different manufactures - where all devices can work together. Open standards are expected to lower barriers for innovation, and allow for modular upgrades of control systems on a much more frequent basis.

Industry Statistics in the DCS Market

| Category | Statistic | Details |

| Brownfield Modernization | Share of DCS projects in developed markets | 65–70% of new DCS contracts in North America and Europe are linked to brownfield upgrades rather than new plants |

| Open Automation | OPA / O-PAS pilot adoption | 20+ large end users globally are actively piloting or evaluating Open Process Automation–based DCS architectures |

| Cybersecurity | Plants upgrading control system security | Over 60% of industrial operators list cybersecurity compliance as a primary trigger for DCS replacement |

| IIoT Integration | DCS projects with cloud/edge analytics | 55% of new DCS installations now include IIoT connectivity or advanced analytics layers |

| Predictive Maintenance | Reduction in unplanned downtime | DCS-enabled predictive maintenance delivers 15–30% reduction in unplanned outages in process industries |

| Energy Efficiency | Energy savings via advanced control | Advanced process control (APC) on DCS platforms delivers 5–10% energy savings in continuous processes |

| Digital Twin Adoption | Large capital projects using digital twins | 35% of large petrochemical and power projects integrate digital twins with DCS during design and operations |

| Sustainability | Emissions monitoring deployments | 45% of European DCS investments include emissions measurement and reporting functions |

1. Government Digitalization Initiatives and National Infrastructure Upgrades

Government policies and national modernization programs are perhaps the most effective catalysts for DCS adoption. In several developing countries, particularly in the Asia-Pacific region, state-backed initiatives to improve domestic manufacturing capacity are fueling the construction of new "greenfield" projects which leverage the latest DCS technologies to remain globally competitive with high efficiency and low emissions. National infrastructure plans that have focused on smart grid development and upgrades of water treatment facilities required advanced distributed control to manage the complex and geographically dispersed infrastructure assets.

In developing economies, the government focus has shifted toward the digitalization of critical infrastructure to advance national resilience. Modernization grants and tax incentives are increasingly offered to a range of industry operators who implement energy-efficient control systems and resilient cybersecurity. Regulatory obligations placed on industrial operators such as carbon emissions balance reporting has improved the DCS from an operational tool to a critical requirement for corporate ESG Environmental, Social and Governance (or sustainability reporting) compliance.

2. Corporate Strategic Alliances and Recent Technological Advances

The DCS market is currently experiencing a period of market strategic realignment that is characterized by partnerships between traditional industrial technology companies and technology focused software companies which are bridging the gap and convergence between "Operational Technology" (OT) and "Information Technology" (IT) domains. For example, recent breakthroughs in edge computing have enabled DCS vendors to process data closer to the source eliminating latency and bandwidth constraints to the cloud. Edge processing is especially important for high safety critical applications that require feedback response times at the millisecond level.

Technological advances are being made with "autonomous" control systems. Autonomous DCS platforms do not rely on pre-programmed logic (like a conventional control system) but rather utilize reinforcement learning capabilities to autonomously balance changing process conditions in real time. This means optimizing complex chemical reactions or power grid loads without constant human decision-making. The rise of 5G connectivity in industrial plants has vastly allowed to easily make wireless sensors and mobile HMI (Human-Machine Interface) solutions possible, providing operators flexibility with their placement to ultimately improve situational awareness on the plant floor.

3. Transition Toward Software-Defined and Cloud-Based Control Architectures

Perhaps the most significant strategic milestone for the DCS market was a concerted effort to transition toward software-defined control. The development of software-defined control architecture allows fully mature control logic to decouple from the physical hardware and run on standardized high-performance servers or in virtual environments. This evolutionary step is similar to that of the enterprise IT market when mainframes transformed into cloud-native architectures. Software-defined DCS offers previously unrealized scalability by allowing operators to add or modify control loops through software updates rather than performing physical rewiring.

Additionally, cloud-based control architectures are quickly becoming popular, particularly amongst multi-site fleet management applications. Like software-defined DCS, the core real-time control is run onsite for safety and reliability advancements, but the higher-level optimization and historical data analyses is being performed in the cloud. The hybrid cloud/software-defined occurred in the enterprise IT space is beginning to happen in the DCS space. Global organizations can thus compare their facilities in real time and optimize fleet control strategies that apply for the entire enterprise. More that emergent is the on-demand App Store model for industrial applications, where third-party developers will design optimization "apps" that run on the DCS platform that extend its functionality and life cycle value.

Increasing Demand for Automation in Energy and Power Generation

The demand for consistent and efficient energy is arguably the principal driver of the DCS market. As the world moves to a more sophisticated energy mix comprised of traditional fossil fuels, nuclear energy, and large-scale renewables, the call for sophisticated control systems to maintain grid stability and plant efficiency also increases. In the power generation segment, DCS platforms synchronize turbines, control boiler pressures, control the combustion of fuel, etc. Even if a modern DCS provides a 1% improvement in efficiency, the potential for millions of dollars in fuel savings is realized. The reduction of CO2 emissions for a large-scale power plant would be significant as well.

At the same time, the emergence of decentralized energy resources (DERs) and microgrids requires the type of distributed intelligence that only a DCS can provide, and is necessary to meet global climate action goals. Unlike centralized grids, modern energy networks balance variable input from solar and wind systems, while simultaneously providing consistent baseload power. DCS technology is being modified to provide the high-speed communication and complex logic necessary for the speed and complexity of modern systems. DCS technology is perfectly suited to provide reliable technologies to facilitate the generation of electricity to meet the demand while minimizing waste across the grid.

Modernization of Aging Industrial Infrastructure in Developed Economies

Roughly 80% of the industrial infrastructure in North America and Europe was installed 20-30 years ago, nearing functional obsolescence. Many of the poorly connected legacy systems will require replacement at a minimum cost with modern DCS systems that are cyber secure, internet enabled and IIoT ready. The shift towards modern DCS systems encompasses an entire ecosystem that includes modernization at brownfield sites, all while providing systems with flexible payment and investment models based on historic CAPEX benefits of aged infrastructure.

Modernization is more than replacing aging parts but rather, upgrading aging infrastructure in a strategic way that also imbues operational resiliency with new software that provides higher degree functions providing better diagnostic capabilities and alarm management. Advanced software provides seamless user experience with enhanced functionality that reduces human error, a leading cause of accidents in industrial work environments. While providing DCS modernization with aged infrastructure extends capital asset life, companies materially increase safety and significantly mitigate environmental impacts.

High Initial Capital Expenditure and Maintenance Costs

The most significant restraint in the DCS market is the initial capital expenditure (CAPEX) required to procure and install the systems. A large industrial facility adopting a comprehensive DCS can incur tens of millions of dollars of capex. These costs include hardware and vendors offered software licenses and includes the extensive engineering services needed to design, configure, and commission the system. Many manufacturers across the globe are navigating a volatile economy and do not have sufficient incentive or confidence to adopt new DCS investments and potentially, sustain aging parts for a few more years.

In addition to the initial costs, the long-term maintenance and lifecycle OPEX will compound over time. Although DCS capabilities are flexible, it does require regular software updates, cybersecurity patches and hardware replacements to remain fully functional as well as secure and the specialized nature of a DCS often leaves operators needing to depend on the original equipment manufacturer (OEM) and pay very high service fees. SMEs struggle to balance costs and operational continuity compared to larger multinationals, which often have larger pools of capital to buffer initial and follow-on costs.

Complexity in System Integration and Interoperability with Legacy Assets

More than anything, however, companies are still grappling with the difficulty of deploying a new DCS alongside legacy assets and third-party systems. Most industrial plants are heterogeneous in their mix of equipment from different eras and manufacturers. It will be a massive engineering feat to ensure that a new DCS can communicate with legacy Programmable Logic Controllers (PLCs) and a wide range of sensors and enterprise resource planning (ERP) software. Research shows that integration hurdles are one of the top reasons projects are delayed and cost more than planned in DCS migrations.

Additionally, there is no standardized communication protocol with legacy equipment, which creates data silos, or data in a specific machine, or data trapped in a subsystem. Modern standards like OPC UA and MQTT are on the horizon, but what is often truer to many plant floors is a variety of proprietary protocols. The lack of interoperability limits the potential for plant-wide optimizations, and also increases the risk of operations being disrupted during a DCS-replacement transition.

Expansion of Smart Manufacturing and Industry 4.0 Frameworks

The push for Industry 4.0 and smart manufacturing presents a massive opportunity in the DCS market. Industry 4.0 relies on cyber-physical systems, real-time data, and decentralized decision-making to create a highly flexible and efficient production environment. The DCS is the brain of the industrial plant, making it the logical platform for hosting enhanced capabilities. The growth of smart manufacturing efforts is creating demand for a DCS solution that can integrate with AI, AR for maintenance, and advanced robotics.

The nature of the DCS is changing from a system that maintains a set point, to a system that can optimize production in relation to market demands, raw material quality, and energy prices. The question of market-responsive manufacturing necessitates a level of integration between both the shop floor and top floor that had been impossible until now. DCS vendors that can provide the integration and advanced tools for optimization, will be well-positioned to take advantage of this growing market opportunity.

Growth in Renewable Energy and Green Hydrogen Portfolio

The global energy transition will provide new application perspectives for DCS solutions, particularly in renewable energy and green hydrogen production. While solar and wind farm facilities have historically used simple control and automation mechanisms, the size and complexity of these projects drove the need for distributed control. The larger offshore wind farms will require robust cost-effective systems for power conversion, structural health monitoring, and coordination of interactions with an onshore grid.

Green hydrogen is encouraging because it involves the electrolysis of water as the renewable electricity demand increases. The electrolysis process is delicate and requires precise temperature, pressure, and electrical input control to maximize production efficiency and maintain process safety. As the green hydrogen economy develops, and the demand for hydrogen production continues to grow, the urgency for DCS solutions specifically developed for green hydrogen production will develop. This is a blue ocean opportunity for vendors who can develop specialized logic for the process and meet the needed safety protocols for the hydrogen industry.

Vulnerability to Sophisticated Cyber Threats in Interconnected Systems

DCS platforms are becoming more interconnected and integrated with an IT network (i.e. at plant or enterprise level) architecture thus are a more attractive target for sophisticated cyber threats. On an IT network, the attack surface has expanded, whereas historically industrial systems were protected by isolation. Cyberattacks on critical infrastructure (i.e. power plants or water treatment), can have significant impacts on society and result in environmental issues or fatalities.

The conundrum is that many of the components of DCS were developed with longevity and reliability in mind and less focus on security. Retrofitting security onto these platforms is challenging, as industrial processes are "always-on" and vendors must to secure the platform without interrupting operations. Vendors are being forced into a "security-by-design" mindset, with integrated hardware-root-of-trust, encryptions communications, and implementing multi-factor authentication into their architectures. While those concepts and technologies are evolving rapidly, security will always be an issue for the industry.

Shortage of Skilled Workforce to Operate and Maintain Advanced DCS

There is a dire shortage of skilled workers in the industrial sector that can operate and maintain advanced DCS systems. This talent shortage is often referred to as a shortage of "Purple People", qualified individuals that have the right blend of Operational Technology (OT) and Information Technology (IT). The DCS design moving from hardware-centric to software-centric to data-centric architecture drives the required skill set alignment away from traditional mechanical or electrical engineering and further towards software development, data analytics, and cybersecurity.

The challenge of workforce is compounded by the "Silver Tsunami," which is the wealth of plant operating talent nearing retirement. This generation of plant operators carries decades of tribal knowledge of specific processes to capture and transfer to the new era of digitally native workforce. With the limited number of personnel with advanced DCS kits, the manufacturing and oil and gas firms will not be able to achieve maximum benefits from their investment in DCS. As a result, the returns for adavanced features would slow down and the firms would operationalize consultants at more expense.

The distributed control systems market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America distributed control systems market size was valued at USD 6.83 billion in 2025 and is forecasted to reach around USD 11.97 billion by 2035. The North American DCS market is mature and focused on modernizing aging industrial assets. Many refineries and power plants in the region were built decades ago and require replacement of control systems that vendors no longer support and cannot meet cybersecurity standards.

Analysts indicate that brownfield modernization is the major factor supporting growth in North America. Most DCS upgrades will not only improve reliability, but allow companies to benefit from the Industrial Internet of Things (IIoT). The trend of advanced analytics and remote monitoring is a focused interest of industrial operators who want to optimize asset performance, by reducing operational costs, and increasing reliability. Moreover, North America is leading the Open Process Automation (OPA) movement, with significant end users like ExxonMobil pushing for vendor neutral architectures and designs to improve and lessen long term total cost of ownership.

Recent Developments:

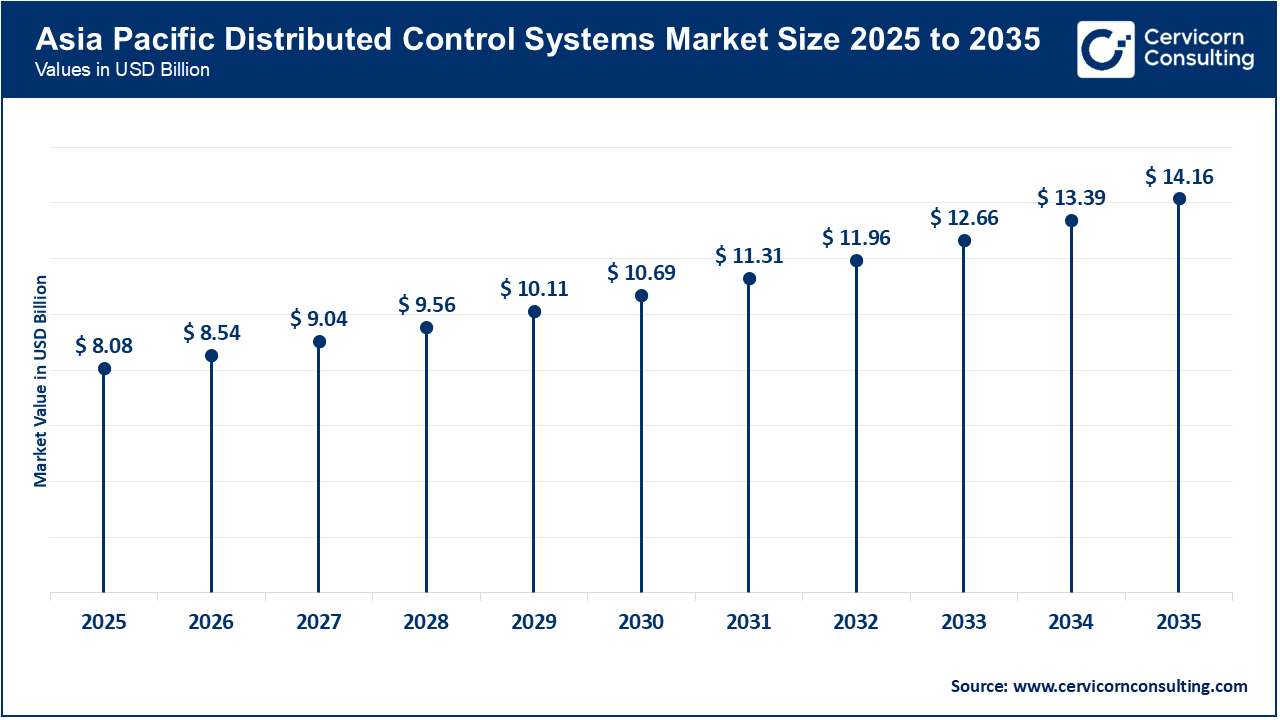

The Asia-Pacific distributed control systems market size was estimated at USD 8.08 billion in 2025 and is forecasted to hit around USD 14.16 billion by 2035. The Asia Pacific region is currently the largest and fastest growing DCS market, with rapid industrialization and infrastructure development, in addition to supportive government policies in China, India and Vietnam. Expansion of the DCS market in APAC is not driven by upgrades to existing industrial infrastructure, unlike North America, expanded DCS market in APAC is driven by greenfield projects, new industrial infrastructure.

Data shows that China is the leading DCS market player in the APAC market by a large margin, supported by heavy investments in chemical and petrochemical and power sectors. The Chinese government’s Made in China 2025 initiative has helped accelerate the adoption of advanced automation and smart manufacturing technologies. The demand for DCS is also on the rise in India because of expansion plans to increase refining capacity, improving power distribution network to support a growing population and economy.

Recent Developments:

The Europe distributed control systems market size was reached at USD 4.68 billion in 2025 and is projected to surpass around USD 8.21 billion by 2035. The European DCS market is influence by the regions environmental regulations and plans toward the Green Deal and carbon neutrality. Energy efficiency, emissions measurement and integration of renewable resources are primary factors influencing DCS investment in the European region.

Research suggests that European Industrial Operators are increasingly using DCS as a tool to manage sustainability. The ability to optimize process parameters allows companies to reduce energy consumption and waste from raw materials. Europe is also at the forefront of Industry 4.0 frameworks that include a focus on the digitalization of the manufacturing value chain. Germany is a hotbed for automation-related innovation, including a focus on high-end software and cybersecurity.

Recent Developments:

DCS Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific (APAC) | 36.9% |

| North America | 31.2% |

| Europe | 21.4% |

| LAMEA | 10.5% |

The LAMEA distributed control systems market was valued at USD 2.30 billion in 2025 and is anticipated to reach around USD 4.03 billion by 2035. The LAMEA (Latin America, Middle East, and Africa) market presents a diverse market landscape for DCS that largely is tied to the oil and gas sector in the Middle East and mining use in various locations across Africa and South America.

In the Middle East, the DCS market is driven by the massive petrochemical complexes located in Saudi Arabia, UAE, and Qatar. These countries have made significant investments in downstream diversification from crude oil exports to high-value chemical production, resulting in a requisite number of sophisticated DCS installation. Research has shown that the Middle Eastern market is also at the front end of adopting digital twin processes for lifecycle management of capital projects of this size. Latin America and Africa are actively growing due to the modernization of mining operations and in the water and wastewater treatment sectors.

Recent Developments:

The distributed control systems market is segmented into component, application, end use, and region.

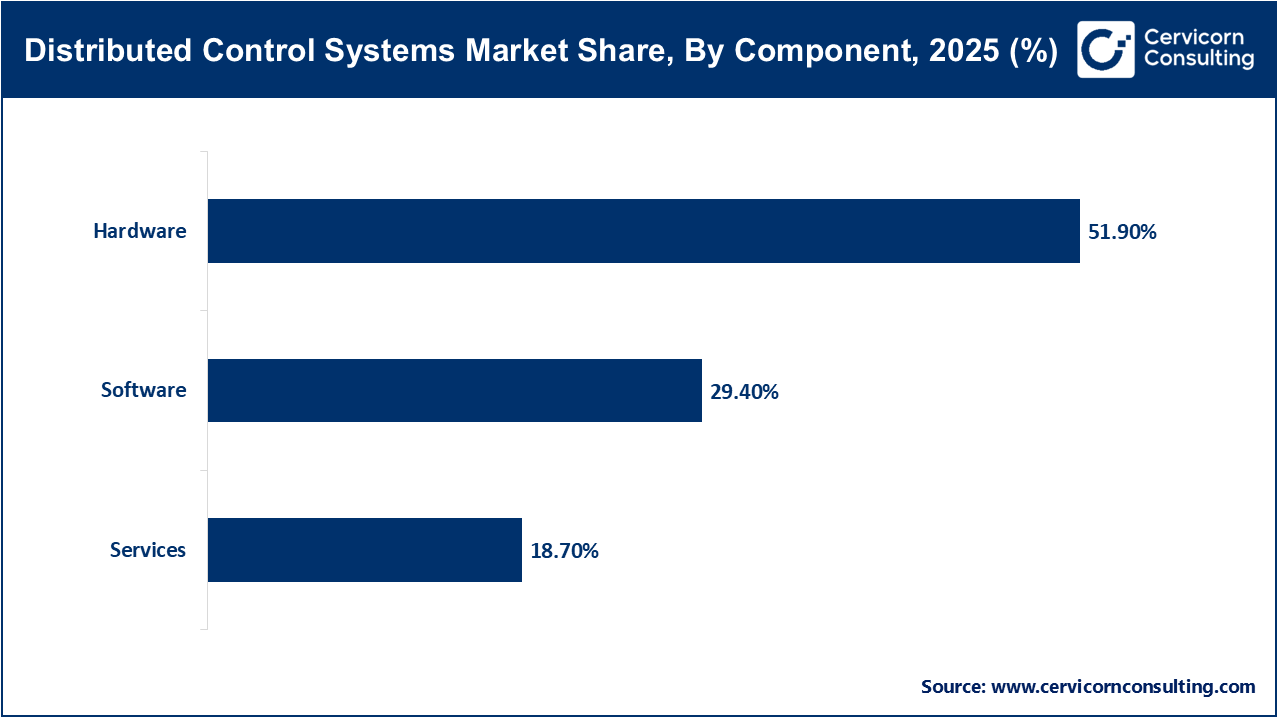

Hardware is considered the physical framework of the DCS. Hardware includes controllers, I/O modules, operator stations, and networks. Historically, the segment represents the largest portion of the market revenue for the DCS product family based on the physical amount of equipment needed to automate large industrial plants. Market research suggests the demand for high-availability controllers remains steady as all industrial facilities require dependable equipment in harsh environments. The hardware segment is currently transitioning from proprietary "black box" hardware to off-the-shelf platforms, based on the need to reduce capital costs when procuring, and to enable customers to replace legacy hardware when it reaches the end of its lifecycle.

Software is considered the intelligence layer of the DCS system. Software includes the tools that enable process visualization, engineering, and data management. This includes Human-Machine Interfaces (HMI), historian databases, and Advanced Process Control (APC) algorithms. Market data demonstrates the software segment is experiencing growth as the industry adopts AI and machine learning for predictive maintenance and real-time optimization. People are living in a world now that has programmable software, software is increasingly "software-defined" services that provide providers with an opportunity for flexibility and scope.

Services represent the fastest growing segment in the DCS market, illustrating the strategic shift from awarding services under a product-centric approach, to an outcome-based approach. This segment includes everything from project engineering, installation, maintenance, cybersecurity services, etc. Services are being rewarded from market demand for system specialization as a result of the interconnectedness of industrial systems. Additionally, the labor market in developed economies is creating a "skills gap" that have prompted many industrial operators to pay and outsource the maintenance and optimization of their DCS systems to either the original equipment manufacturers (OEMs) or specialty operations/field service companies.

Continuous processes involve the unbroken flow of material through various stages of the production process that typically occur in industries such as oil and gas, power generation, and water treatment. In such environments, the DCS must achieve 99.999% uptime, as even a momentary lapse can result in significant losses or hazards. Studies suggest that continuous processes remain the largest application area for DCS since the scale of global energy and utility infrastructure is massive. The focus in this segment centers on stability, safety-instrumented systems (SIS), and reliability over a long-term period.

DCS Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Continuous Process | 76.8% |

| Batch Process | 23.2% |

Batch processes, on the other hand, work with discrete quantities of material or "batches" that require changing recipes and configurations from time to time. Batch processes are commonly used in industries such as pharmaceuticals, food and beverage, and specialty chemicals. The DCS used in batch processes must be able to handle complex sequences and transitions and adaptable. Research suggests that the batch process category continues to take share due to increased demand for personalized medicines and high-variety, low-volume manufacturing. The ISA-88 standard for batch control was key to enabling interoperability and modularity in this area.

The chemicals industry is still one of the more significant end-users of DCS. Chemical manufacturing involves highly volatile processes that require precision control of temperature, pressure, and flow rate for product quality and safety. Market trending shows that much of DCS procurement is driven by the rapid expansion of chemical production capacity in emerging markets. Furthermore, the chemicals vertical is beginning to adopt practices such as digital twins and more advanced analytical information to be more resource efficient and reduce carbon footprints while integrating DCS at the enterprise level.

Pharmaceuticals has become another high-growth vertical for DCS as a result of recent global pandemic crises that required rapid production vaccine development and manufacturing. The governed by relatively strict regulatory standards such as the FDA’s 21 CFR Part 11 that require strong data integrity and audit trails; therefore, DCS solutions for the pharmaceuticals should emphasize electronic record-keeping and the recipe management along with validated software environments. Studies indicate that the transition to "Pharma 4.0" models are driving requests for DCS solutions with modular architectures that enable a shorter duration of facility reconfigurations.

DCS Market Share, By End Use, 2025 (%)

| End Use | Revenue Share, 2025 (%) |

| Oil & Gas | 26.3% |

| Chemicals | 24.7% |

| Power Generation | 15.1% |

| Metals & Mining | 10.4% |

| Food & Beverages | 8.6% |

| Pharmaceuticals | 6.3% |

| Pulp & Paper | 4.8% |

| Others | 3.8% |

The energy and power generation vertical (in traditional fossil fuels or renewable energy sources) is another foundational market for DCS. In traditional power plants, DCS controls boiler and turbine control. In oil and gas, the DCS controls upstream (production), midstream (transport), and downstream (refining) operations. The transition to renewable energy also creates new DCS opportunities for the coordination and management of smart grids and green hydrogen production facilities. Reports show that the need for modernized aging power grids in North America and Europe are motivating DCS upgrades that enable better management of the ongoing intermittently of renewable energy sources power generation.

The global distributed control systems market is at a critical inflection point. This transition period has overlapped the legacy period which characterized proprietary, hardware-centric architectures, to a future period that embraces software-driven agility, open standards, and digital integration. The segments of the market and regional dynamics continue to support a resilient and rapidly evolving environment.

By Component

By Application

By End Use

By Region