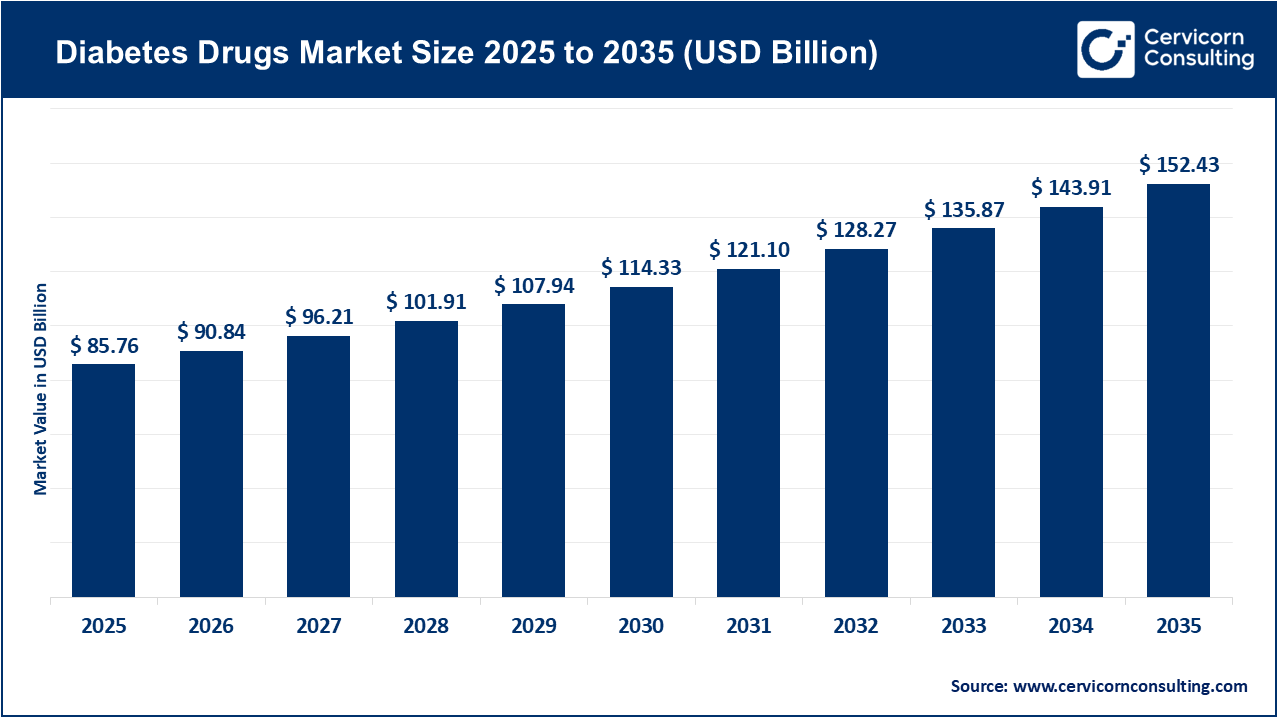

The global diabetes drugs market size reached at USD 85.76 billion in 2025 and is expected to be worth around USD 152.43 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.92% over the forecast period from 2026 to 2035. The diabetes drugs market is driven by a rapid increase in diabetes incidence around the world. For example, the number of adults with diabetes currently exceeds half a billion and is projected to rapidly increase moving forward. This increase has progressed in parallel with rates of obesity, dietary habits, decreased levels of activity, and an aging population with respect to type 2 diabetes. With more patients diagnosed and treated, demand for anti-diabetic medications will emerge that includes new classes of drugs and more forms that are user-friendly to administer.

Simultaneously, the diabetes drugs market is being driven and supported by significant innovation and access to treatment. Advances in drug delivery systems, drug discovery of new therapeutic classes (e.g. GLP-1 receptor agonists, SGLT-2 inhibitors), and availability of generic drug formulations will all further drive this market. Increasing healthcare expenditures, improved awareness of diagnostics for diabetes, and supportive policies from government sources will further increase access to treatment and improved market growth.

Rapidly Rising Patient Numbers and Breakthrough Drug Innovations Fueling the Diabetes Drugs Market

The diabetes drug market is being lifted by a sharp increase in the number of patients with diabetes. The International Diabetes Federation (IDF) stated that nearly 589 million adults (ages 20-79) currently live with diabetes worldwide. The World Health Organization reported the number of the adult population with diabetes rose from 200 million in 1990 to 830 million in 2022. As more patients are diagnosed with type 2 diabetes, especially in low- to middle-income countries, the better the treatments available, which increases the demand for diabetes drug.

At the same time, the diabetes drugs market will also benefit from new therapy development. There are, as reported by an analysis, almost 60 approved drugs that treat diabetes caused by insulin deficiency. A 2025 Subscription Journal report shows new therapeutic processes targeting gut-microbiota modulation, miRNAs, and mitophagy in the treatment of Type 2 diabetes. That allows pharmaceutical companies to create drugs that offer better delivery, less side effects, and better persistence, which creates new patients/providers, the spike in clinical practice is expanding the market further.

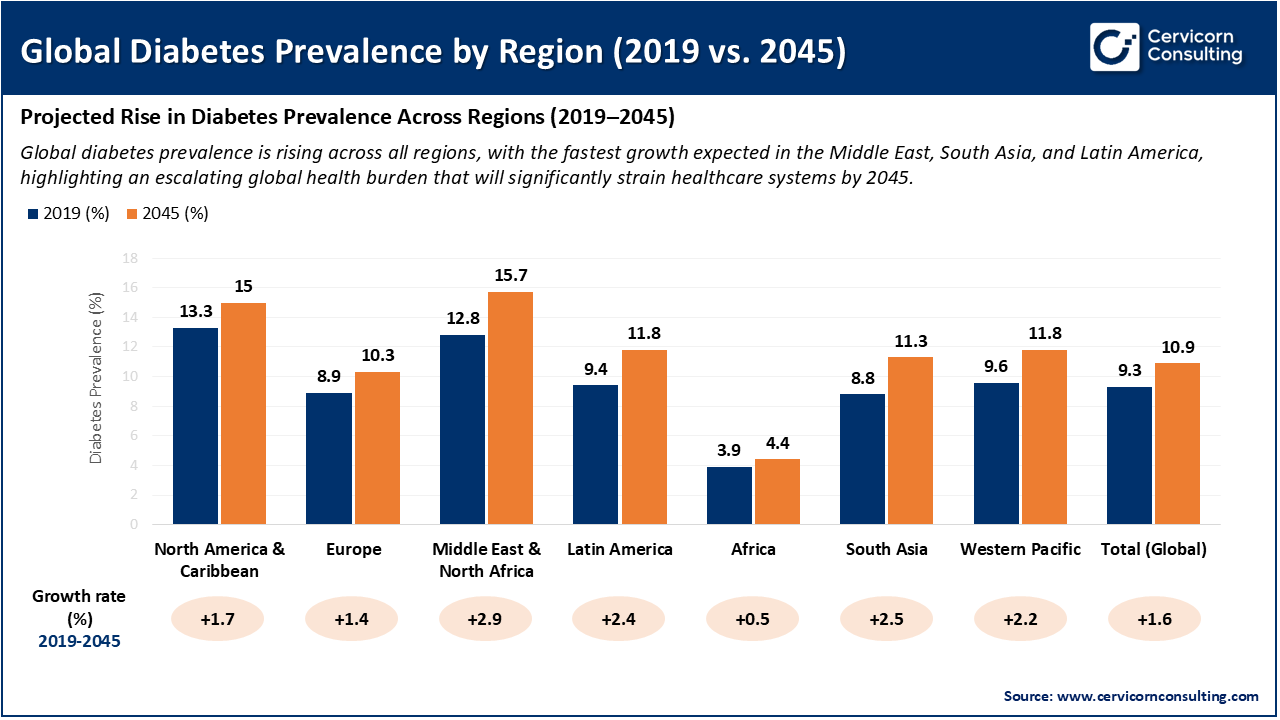

This data shows that rising diabetes prevalence in all regions is creating a growing patient population that is driving higher demand for diabetes drugs market growth. North America is forecasted to increase from 13.3% to 15.0% and the biggest increase is seen in the Middle East & North Africa region with an increase from 12.8% to 15.7%. South Asia and Latin America also see upward momentum with increases of 2.5% and 2.4%, indicating strong future demand for insulin, oral therapies, and modern injectables.

1. FDA approval of Dapagliflozin (Farxiga) for pediatric (10 years & older) type 2 diabetes

In June 2024, the U.S. Food and Drug Administration (FDA) approved dapagliflozin for patients aged 10 and older with type 2 diabetes. This opens up a completely new patient group - children and adolescents - in the diabetes drugs marketplace, broadening both the potential pool of users, as well as creating additional incentive for companies to invest more in pediatric formulations and therapies.

2. Launch of Tirzepatide (Mounjaro) in India for diabetes and weight management

The drug tirzepatide was launched in India in 2025 with respect to type 2 diabetes and weight management (a major comorbidity). This landmark moment is helping propel a growth story for the diabetes drugs marketplace because it is tapping into regions of high prevalence (like India) and capitalizing on the overlapping obesity and diabetes issue that is broadening the scope of market demand in diabetes drugs.

3. Label update for the oral GLP-1 pill Semaglutide (Rybelsus) to include cardiovascular risk reduction

In 2025, a prominent regulatory agency approved the oral semaglutide pill for cardiovascular risk reduction in adults with type 2 diabetes, in addition to glucose control. This advancement can be considered a game-changer to the diabetes drugs market, as it establishes the clinical value of diabetes drugs beyond just sugar lowering and allows for expanded prescribing in those with cardiovascular risk, increasing the potential for uptake and premium pricing.

4. Rapid uptake and dominance of Mounjaro in Indian market value rankings

Following Mounjaro's release, the product had over INR 50 crore in sales in India, within 90 days of launching, with monthly sales increasing almost nine-fold since launch. This is a remarkable demonstration of the speed at which new diabetes drugs can penetrate emerging markets and shows an active market dynamic that validates investment into these regions, and a strong pathway forward for the diabetes drugs market in growth-geographies.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 90.84 Billion |

| Estimated Market Size in 2035 | USD 152.43 Billion |

| Projected CAGR 2026 to 2035 | 5.92% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Drug Type, Route of Administration, Distribution Channel, Region |

| Key Companies | Bayers AG, Johnson & Johnson, Boehringer Ingelheim International GmbH, Novo Nordisk, Dr. Reddy’s Laboratories, AstraZeneca, Eli Lilly and Co., Takeda Pharmaceuticals, Novartis AG, Sanofi, Merck & Co., Sun Pharmaceuticals |

The diabetes drugs market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

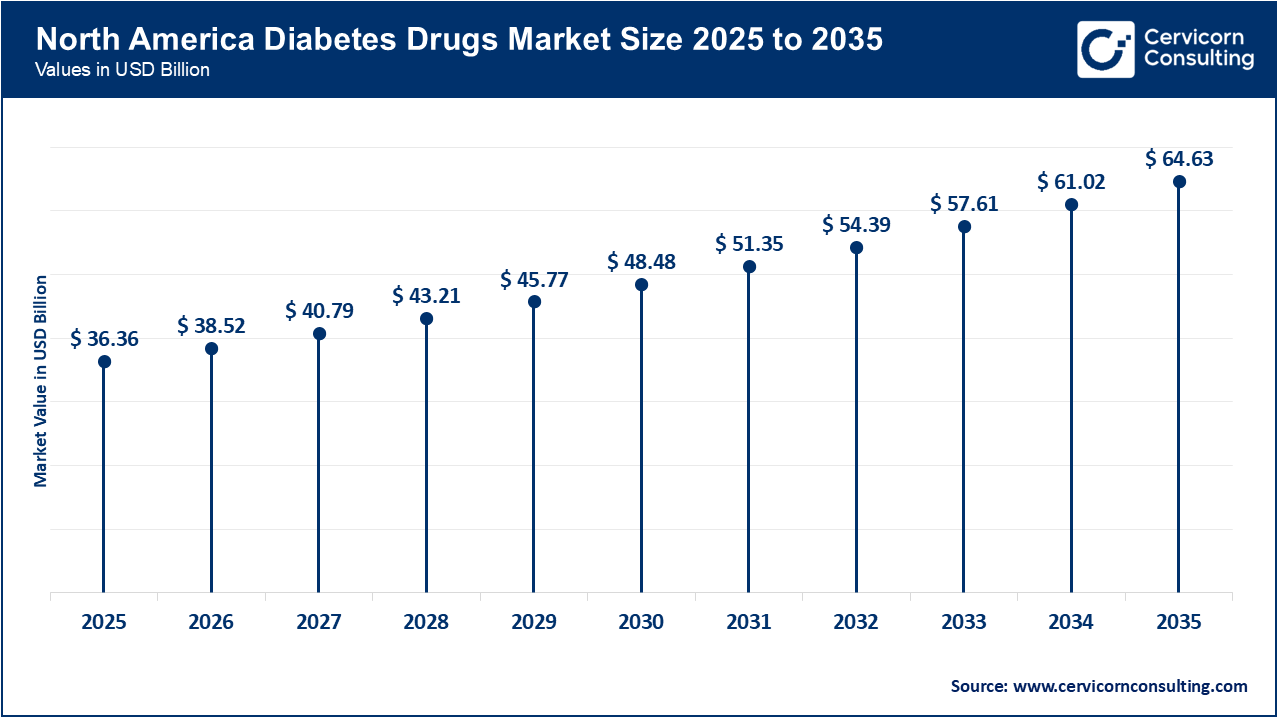

The North America diabetes drugs market size valued at USD 36.36 billion in 2025 and is expected to reach around USD 64.63 billion by 2035. North America has the largest share, due to a higher prevalence of patients, an excellent healthcare system, and a willingness to adopt the next classes of drugs that have demonstrated value, including the GLP-1 receptor agonists and SGLT-2 inhibitors. Additionally, North America has high levels of awareness, insurance coverage, and a speedy regulatory process. Pharmaceutical companies prioritize this region in their budgets due to strong purchasing power and market demand for newer medicines. The increasing rates of obesity and lifestyle-driven risk factors continue to drive the diabetes market and foster the introduction of new products.

Recent Developments:

The Asia-Pacific diabetes drugs market size accounted for USD 17.24 billion in 2025 and is forecasted to hit around USD 30.64 billion by 2035. The Asia-Pacific is the fastest growing regional market, significantly due to increasing diabetes and urbanization, and lifestyle changes that facilitate diabetes risk factors. The rising prevalence of diabetes will closely follow the newly emerging middle class with following desire for modern drugs. In addition, governments are also investing heavily in alternative diabetes screening, awareness and accessibility programs which will further contribute to drug use. Lastly, because of its population size and rapidly increasing acceptance of branded and combination therapies, pharmaceutical companies will continue aggressively entering this region.

Recent Developments:

The Europe diabetes drugs market size estmated at USD 21.70 billion in 2025 and is projected to surpass around USD 38.56 billion by 2035. Europe continues to be a robust market due to encouraging governmental health policies, increasing screening initiatives, and wider reimbursement of advanced treatments for diabetes. There is steady market demand for both oral and injectable anti-diabetic agents spurred by an aging population and the increase of more sedentary lifestyles. Some countries have encouraged early diagnosis of diabetes that stimulates uptake of treatment. The development of new biosimilar insulins is a priority in Europe to control healthcare expenses and subsequently, increase access to treatment.

Recent Developments

Diabetes Drugs Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 42.40% |

| Europe | 25.30% |

| Asia-Pacific | 20.10% |

| LAMEA | 12.20% |

The LAMEA diabetes drugs market size valued at USD 10.46 billion in 2025 and is anticipated to reach around USD 18.60 billion by 2035. The LAMEA region is experiencing increased demand for diabetes drugs due to higher diabetes prevalence, improved health systems and accessibility of medicines, both oral and injectable. Furthermore, economic development and increased health expenditure expands patient access to regular healthcare for diabetes. An increasing number of LAMEA countries are implementing national diabetes care programs that promote the early diagnosis of diabetes and the use of diabetes medications. Major pharmaceutical manufacturers will target LAMEA for growth due to its size and increasing awareness of chronic disease management, particularly type 2 diabetes, which can lead to other chronic diseases.

Recent Developments:

The diabetes drugs market is segmented into drug type, route of administration, distribution channel, and region.

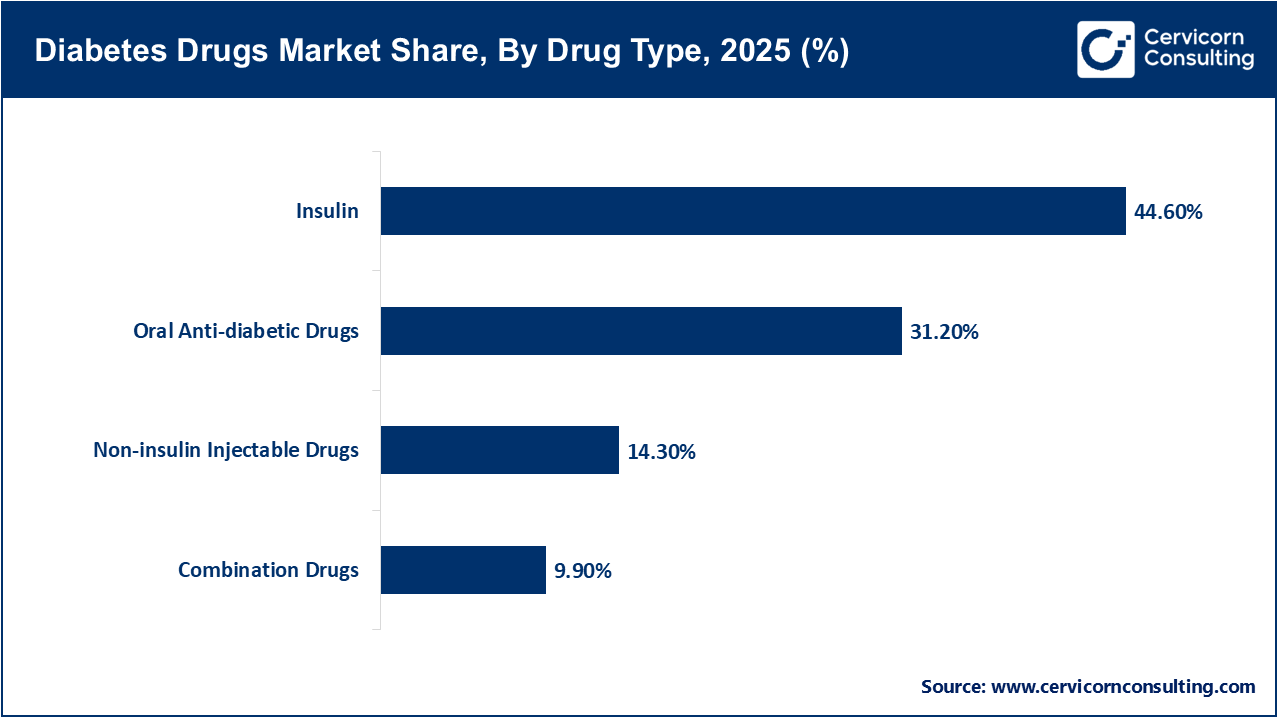

Insulin segment dominates the diabetes drugs market because it is essential for all patients with type 1 diabetes and a significant proportion of people with advanced stage type 2 diabetes. Insulin is a reliable option for blood sugar control, and no other therapeutic option can completely replace its role in many clinical contexts. Insulin is available in many forms (e.g. rapid-acting, long-acting or biosimilar versions) which fosters its availability in hospitals, pharmacies and discharge prescriptions. Thus, it continues to be a first-line treatment as recommended by many national and international guidelines, resulting in ongoing demand. The well-established clinical need for insulin and a clinical history of therapeutic success reinforces that insulin will remain the predominate drug type in the diabetes drugs market.

The non-insulin injectable class is the fastest growing segment because of the increased global demand for GLP-1 receptor agonists, which reduce glucose and assist with significant weight loss. These drugs are both attractive to patients and healthcare providers. The increasing physician confidence based on strong cardiovascular evidence produces a demand for injectable medications for diabetic therapy. The patient acceptability increases with the injections being given weekly and the emergence of new delivery devices to administer these injectables. The increasing use of GLP-1 drugs to treat obesity support this segment as the fastest growing category.

Oral medications lead the market as the preferred dosage form among patients, as they are most frequently concerned with convenience (e.g. easy to store) and ease of administration. Further, oral diabetes medications are available in a variety of formulations. Metformin and oral combination therapies also drive considerable demand for oral agents, making them the primary route in treating diabetes globally. Generic drugs further support affordability and accessibility for oral treatments.

Diabetes Drugs Market Share, By Route of Administration, 2025 (%)

| Route of Administration | Revenue Share, 2025 (%) |

| Oral | 46.20% |

| Subcutaneous | 38.80% |

| Intravenous | 15% |

Subcutaneous is the fastest growing route of administration due to the adoption of injectable therapies like GLP-1 receptor agonists and new insulins globally. These drugs can facilitate improved clinical outcomes and engage in weight reduction, which will further drive demand. New classes of long-acting injectable therapies also contribute to the rapid growth in this market. A number of companies are working on developing easier injection devices, which also supports patient adoption.

Offline pharmacies are the dominant distribution channel, due to the fact that most patients still get their chronic medications from hospital pharmacies and retail pharmacies. Pharmacists play a huge role in guiding patients with dosing and treatment schedules. Additionally, certain regions have limited access to digital healthcare, which continues to bolster offline channels.

Diabetes Drugs Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel Segment | Revenue Share, 2025 (%) |

| Offline (Hospital & Retail Pharmacies) | 82.50% |

| Online Pharmacies | 17.50% |

Online pharmacies are the fastest-growing distribution channel due to growing digital adoption and from the ease of home delivery option. Patients with chronic diseases prefer refills through online pharmacies because it's easier and often times cheaper. Some of these extremely complicated chronic care therapy treatment plans need doc appointments, and telehealth is becoming more popular, as is insurance coverage for digital orders. Some online pharmacies also offer pricing comparable & subscription based refills, and it's becoming a more attractive channel reaching more users each year.

Insulin Icodec – Once-Weekly Basal Insulin by Novo Nordisk (Introduced 2024)

Merilog (Insulin Aspart-szjj) – First Rapid-Acting Biosimilar by Sanofi (Introduced 2025)

Liraglutide 6 mg/ml Injection – New GLP-1 Approval by Biocon (Introduced 2025)

By Drug Type

By Route of Administration

By Distribution Channel

By Region