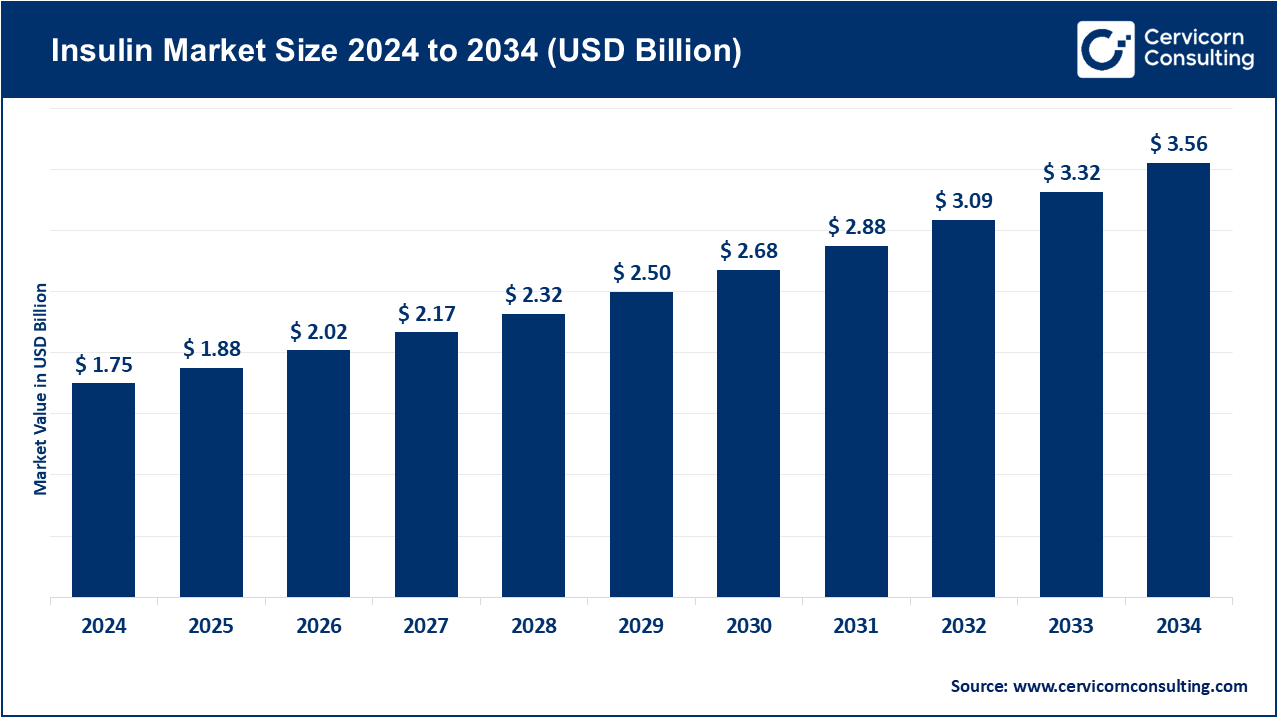

The global insulin market size was valued at USD 1.75 billion in 2024 and is expected to be worth around USD 3.56 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.36% over the forecast period from 2025 to 2034. The increase in consumers’ focus on gut health, immunity, and holistic wellness drives market insulin growth, as consumers increasingly seek natural and functional ingredients. Manufacturers' adoption of innovative extraction and formulation technologies that enhance insulin's purity and functional attributes, as well as its solubility, while lowering production costs makes insulin more marketable. Insulin's prebiotic properties and unique ability to be used as a sugar and fat replacer makes it a favorable ingredient in bakery, dairy, confectionery, and nutraceuticals; allowing the creation of health-promoting, highly after products.

Why insulin?

Insulin can be used in many different product formats, such as powders, syrups, and encapsulated forms. This helps it reach more consumers in the retail and functional food industry. Insulin’s versatility in functional foods and nutraceuticals, advanced processing technologies, and wide-ranging applications help enhance consumer wellness. This versatility also drives growth in the market, improves health outcomes, and opens up new, innovative, and ingredient-driven health innovations.

The insulin market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The North America is expanding because the country has developed food processing industry, is becoming health conscious and is demanding functional ingredients in the dietary supplements. In May 2025, large food and beverage companies in the U.S. added insulin made with chicory to new low-sugar formulations, aiming at the consumer market segment of diabetic and prebiotic consumers. The problem of innovative plant-based nutrition and the very high level of awareness of digestive health also contributes to the leadership of the region. The dominance of the North American market in the world insulin market is consolidated with a strong distribution channel, regulatory clarity by the FDA, and good R&D in prebiotic fibers.

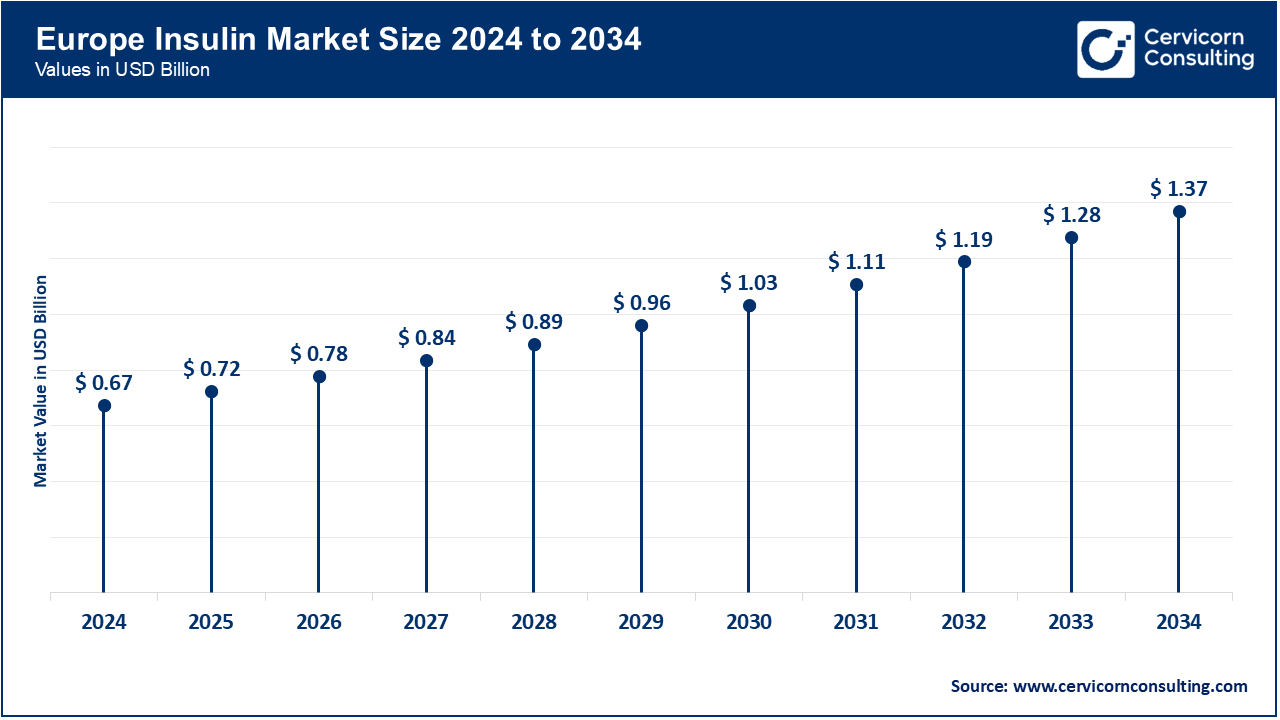

The Europe dominating the market with the increased popularity of clean-label and the long-established chicory root production in countries like Belgium, the Netherlands, and France. The European nutraceutical companies introduced next generation insulin fortified nutritional supplements in April 2025 based on gut microbiome modulation and reduction of sugar in baked goods and in accordance with the safety and nutritional requirements put forward by EFSA. The focus on sustainability, ingredient controls and natural sourcing is making Europe one of the key centers of insulin innovation.

Asia-Pacific is the most rapidly expanding market on insulin as consumers are becoming more conscious of gut health, disposable incomes are rising, and diets are shifting towards functional and low-energy foods. In June 2025 Japanese and Indian nutraceutical giants started to use Jerusalem artichoke-derived insulin in probiotics and synbiotic preparations, strategically changing to microbiome-targeted nutrition. Other nations, such as China, Japan, and South Korea are also increasing their industrial-scale extraction capacities and partnerships with Western ingredient companies, as well as, consolidating their power in the global landscape of insulin.

Insulin Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 20.70% |

| Europe | 38.50% |

| Asia-Pacific | 30.40% |

| LAMEA | 10.40% |

LAMEA serves as an emerging but smaller portion of the market, as a result of growing popularity of fiber-based functional food and dietary supplements. The brands of health foods in Brazil and Mexico started incorporating agave-based insulin in their product lines in the early months of 2025 as a way of promoting natural sweetness and digestive advantages of their products. The UAE and Saudi Arabia in the Middle East are experiencing a growth in health product lines of insulin-enriched beverages and baked products. As the government efforts in nutrition and wellness are encouraged, the region will experience consistent growth opportunities by 2026 and later.

Chicory Root: Chicory root is the most popular commercial insulin source because it has high insulin content, is economical, and is grown in a sustainable way. By March 2025, the European manufacturers increased their chicory processing plants in Belgium and Netherlands to address the increasing demand of prebiotic and clean-label ingredients around the world. The sustained attention to traceability and environmental-friendly extraction processes have positioned chicory-based insulin as the standard in the market.

Agave: Agave based insulin is becoming increasingly popular, especially in North America, due to its mild sweetness and drinkable properties. In April 2025, Mexican manufacturers reported plans with U.S. nutraceutical companies to produce agave-based prebiotic products to be used in diabetic-friendly and low-glycemic foods. Its market growth is further encouraged by its sustainable farming and its high soluble fiber composition.

Insulin Market Share, By Source, 2024 (%)

| Source | Revenue Share, 2024 (%) |

| Chicory Root | 68.20% |

| Agave | 13.50% |

| Jerusalem Artichoke | 10.10% |

| Others | 8.20% |

Jerusalem Artichoke: Jerusalem artichoke is a new and high-quality insulin source that is available in organic and natural product markets as a non-GMO and a high-quality source of insulin. In May 2025, manufacturers of Asian and European food started to implement Jerusalem artichoke-derived insulin in beverages with functional purposes and in infant nutrition products because it will be more effective in prebiotics and have a smaller environmental footprint.

Others: R&D departments of ingredient manufacturers are looking at alternative source materials like dandelion root, banana and burdock root, to diversify sourcing and limit reliance on old crops. By June 2025, small-scale Asian-Pacific startups were testing blended insulin sources to boost bioavailability and stability in dietary supplements.

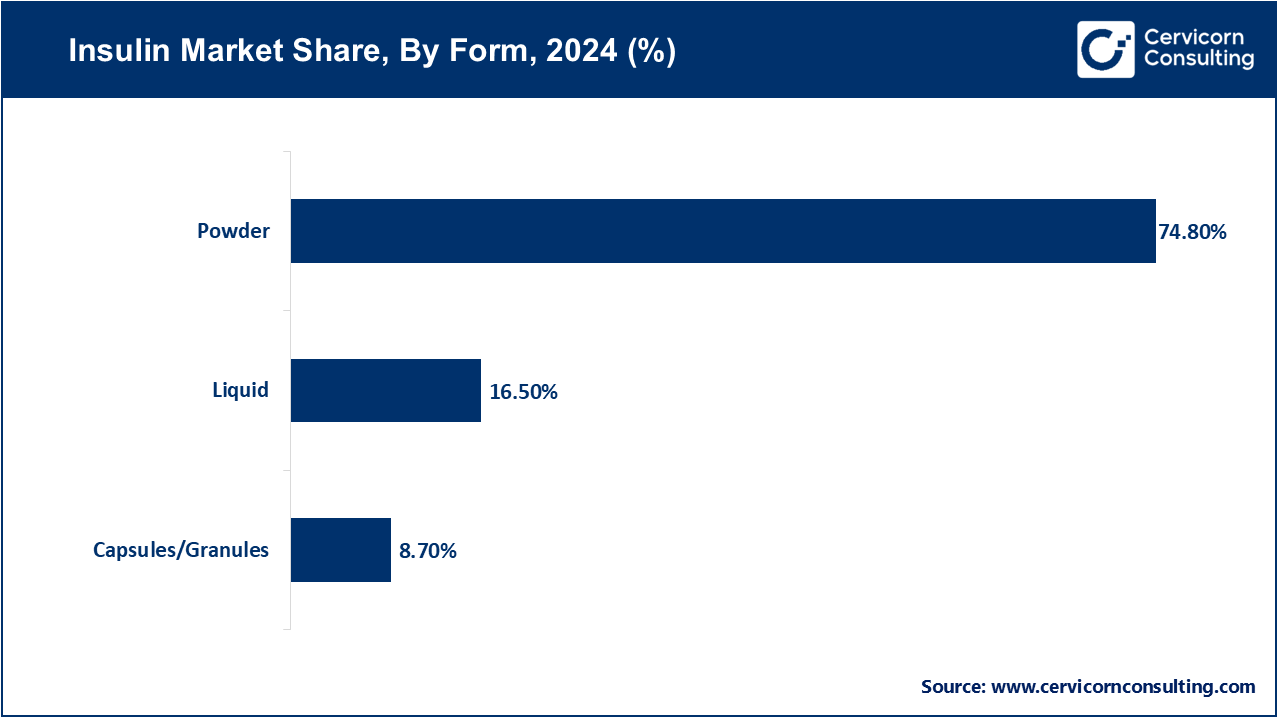

Powder: Powdered insulin still reigns in the market because of its flexibility, stability and its ease of addition in any food formulation. In February 2025, the main European producers of ingredients upgraded their spray-drying and purification systems to manufacture ultra-fine insulin powder with high solubility to be used in ready-to-mix beverages and baked goods.

Liquid/Syrup: Liquid and syrup-based insulin are being employed in dairy products, beverages and nutritional drinks to provide a smoother texture and the homogenous characteristics. When April 2025 comes, it is expected that beverage manufacturers in Asia-Pacific will launch fiber-fortified beverage formulations with insulin syrup as a digestive health agent, aimed at young adults and the elderly.

Capsules/ Granules: This product type serves the nutraceutical and pharmaceutical industries in the first place, specializing in prebiotic dietary supplements and gut health capsules. In May 2025 U.S.-based nutraceutical brands were introduced with insulin granule based formulations mixed in with probiotics that provide synergistic digestive health properties and increased convenience to consumers.

Food & Beverages: Insulin has the greatest usage in the food and beverage segment and is supported by the rising demand of functional and clean-label foods. In March 2025, bakery, dairy and beverage firms in Europe and North America had reformulated a number of low-sugar and high-fiber products with insulin as an ingredient to enhance taste and texture as well as fulfill the health conscious consumer trends.

Dietary Supplements: Prebiotic supplements made of insulin are gaining significant traction, as more and more people learn about the gut microbiota balance. By May 2025, nutraceutical products in Asia-Pacific have launched gummies and tablets fortified with insulin to improve urban consumers with digestive health and immunity support.

Insulin Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Food & Beverages | 36.40% |

| Dietary Supplements | 27.10% |

| Pharmaceuticals | 17.50% |

| Animal Feed | 12.60% |

| Industrial Applications | 6.40% |

Pharmaceuticals: Insulin is used as a drug excipient and stabilizer, along with prebiotic compound in medical nutrition. Pharmaceutical industries in Europe tested insulin in controlled-release drugs formula in June 2025, enhancing the absorption of the ingredient and its gastrointestinal tract.

Animal Feed: There has been a consistent increase in the application of insulin in the feeding of animals especially in enhancing gut health and nutrient absorption in the livestock and pets. Producer responses In Latin America, insulin was included in poultry and swine feed blends, with producers reporting improved feed efficiency and animal growth performance.

Industrial Use: In addition to the food and health sector, insulin is also being used in cosmetics, fermenting media, and biodegradable substances. By July 2025 cosmetic brands in Japan and France had started using insulin as a humectant and skin-conditioning agent in moisturizing formulations as a natural ingredient.

Prebiotic Effect: The most notable functional characteristic of insulin, which aids the proliferation of the healthy gut bacteria, Bifidobacteria and Lactobacillus. Clinical studies in Germany confirmed the effectiveness of insulin-enriched diets in improving gut health and immune response in March 2025, which supports its functional value further.

Fat Replacement: Insulin is a water-binding creamy substance with a creamy texture making it a perfect fat replacement in dairy and bakery items. In April 2025, European dairy companies repackaged low-fat yogurts and spreads using insulin to provide better feel and fewer calories to the mouth.

Insulin Market Share, By Function, 2024 (%)

| Function | Revenue Share, 2024 (%) |

| Prebiotic Function | 36.90% |

| Fat Replacement | 23.20% |

| Sugar Replacement | 12.80% |

| Texturizing Agent | 16.70% |

| Bulking Agent | 10.40% |

Sugar Replacement: As the importance of consumer awareness increases regarding the use of sugar, the low glycemic index and mild sweetness of insulin have predisposed it as a choice of sugar. In May 2025, beverage and confectionery manufacturers in the U.S introduced reduced-sugar product lines which used insulin as a natural sweetener and bulking agent.

Texturizing Agent: Insulin increases viscosity, texture and mouthfeel of low-fat and high-protein foods. Bakery and snack producers began using texturizers based on insulin to preserve the quality of products in gluten-free recipes by June 2025.

Bulking Agent: Insulin is a common ingredient in low-calorie food which gives body and structure without extra calories. By July 2025, some Asian brands of functional snacks included insulin as a bulking fiber to enhance density and satiety as a solution to the increased demand of healthy snacking solutions.

Market Segmentation

By Product

By Source

By Form

By Application

By End User

By Function

By Distribution Channel

By Region