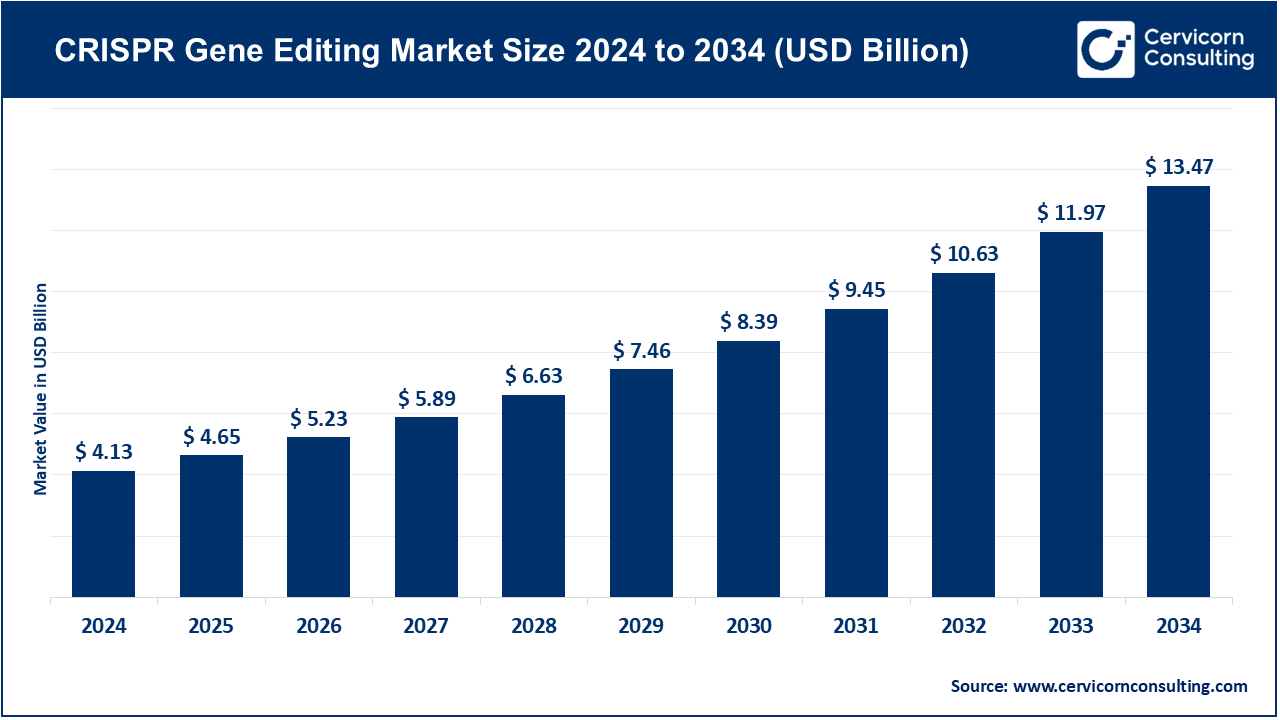

The global CRISPR gene editing market size was valued at USD 4.13 billion in 2024 and is anticipated to reach around USD 13.47 billion by 2034, growing at a CAGR of 12.55% from 2025 to 2034. The increasing incidences of genetic disorders, cancer, and uncommon diseases, coupled with the increased interest in and demand for precision medicine, is rapid acceptance of CRISPR gene editing technologies. Compared to possible alternatives, CRISPR offers accurate and efficient cost modifications to genes, making it possible to enhance treatment outcomes and enable remarkable new studies that drive treatment research. Improved CRISPR delivery mechanisms, including the development of high-fidelity CRISPR systems, viral and non-viral vectors, and Advanced non-viral delivery systems, have all increased safety and system therapeutic scope, and improved market penetration.

In addition, new CRISPR technologies are moving beyond human therapeutics into agriculture, industrial biotechnology, and diagnostic. Pathogen detection technologies, and sustainable biofuel and biofuel crop technologies are advanced to help to revolution agriculture. Dramatic changes to integration of biofuel and biofuel crop technologies enhance biotechnology. Dramatic biotechnology changes are also driven to integration of biofuel and biofuel crop technologies. CRISPR gene editing technology is the basis of the next milestone in healthcare and biotechnology, as it offers revolutionary possibilities in personalized medicine, regenerative medicine, and sustainable bioengineering technologies for biologics.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.65 Billion |

| Estimated Market Size in 2034 | USD 13.47 Billion |

| Projected CAGR 2025 to 2034 | 12.55% |

| Dominant Region | North America |

| Expanding Region | Asia-Pacific |

| Key Segments | Product Type, Service Type, Application, End-User, Region |

| Key Companies | Thermo Fisher Scientific, Merck KGaA, Integrated DNA Technologies (IDT), GenScript Biotech, Takara Bio, Agilent Technologies, New England Biolabs (NEB), Horizon Discovery (PerkinElmer), Charles River Laboratories, Synthego, CRISPR Therapeutics, Editas Medicine, Intellia Therapeutics, Beam Therapeutics, Caribou Biosciences |

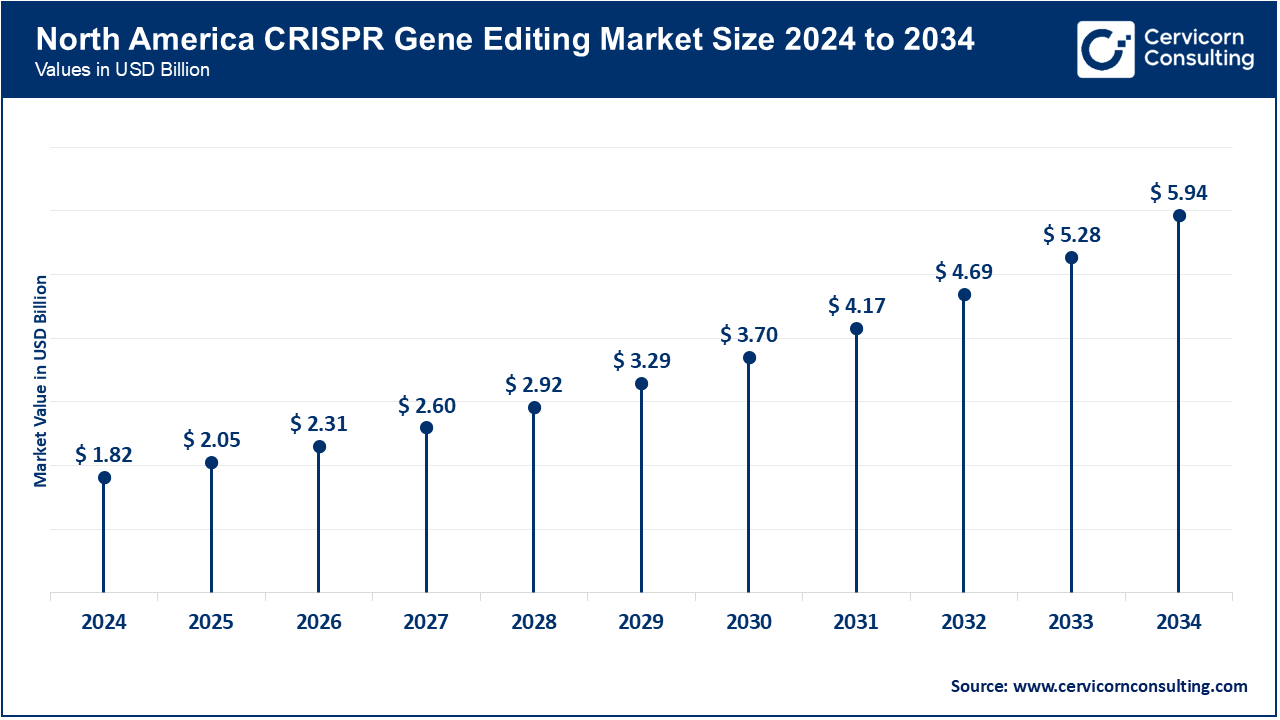

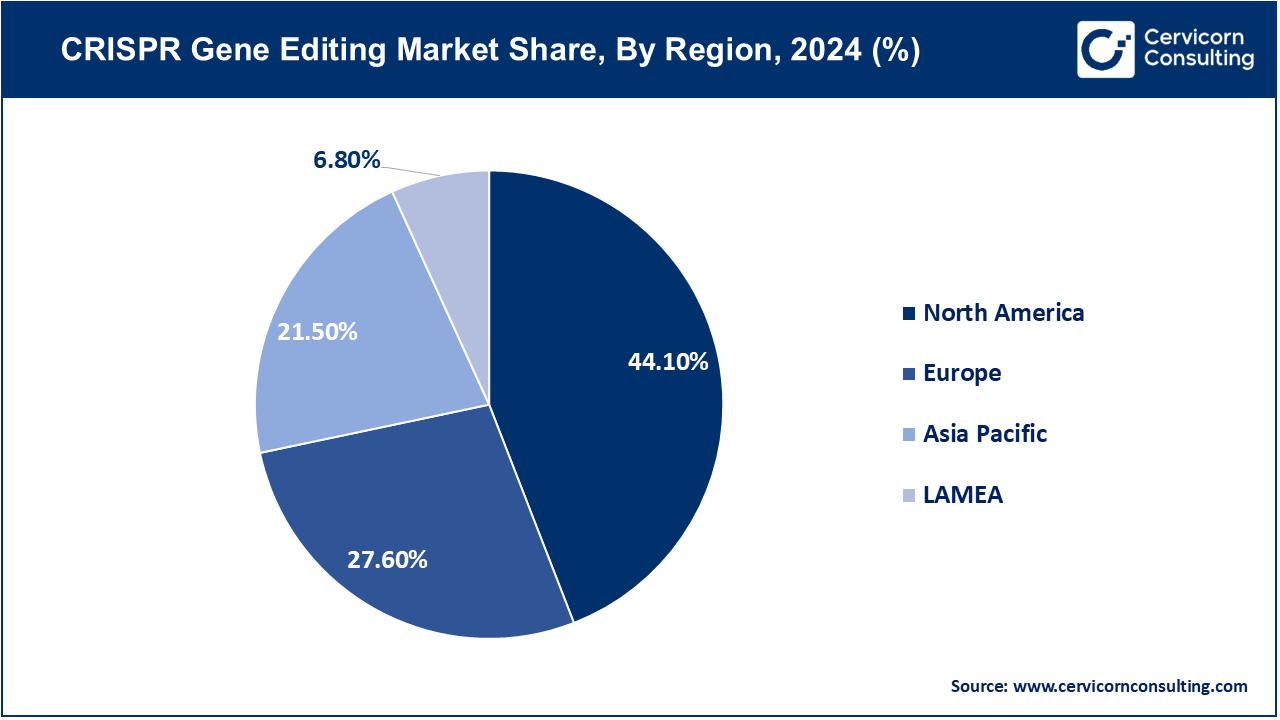

The CRISPR gene editing market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America dominates the market due to its sophisticated biotech ecosystem, robust research infrastructure, and high government and private funding. In June 2025, Vertex CRISPR hematology programs in the U.S. advanced clinical updates, illustrating the region's dominance in therapeutics. With numerous trials moving to advanced phases and innovative non-viral delivery systems like lipid nanoparticles for liver disorders, North America remains the most profitable and innovation-obsessed market.

Europe continues to excel with its distinctive and solid translational research centers and regulatory scrutiny. Integration of CRISPR-based therapies into the region's healthcare systems is ongoing. The UK NHS's approval of limited CRISPR therapies for rare blood disorders in early 2025 illustrates the region's cautious, yet progressive, approach. Europe's concentration on patient safety, long-term data, and compliance, and justified concern in CRISPR for agriculture, is why they will continue to be a strong therapeutic and non-therapeutic hub.

As the fastest growing region, Asia-Pacific has increasing demand in healthcare, agriculture, and biomanufacturing. In May 2025, India approved its first genome-edited rice varieties. This is an important milestone for CRISPR technology, particularly in food security and agriculture. China, Japan, and South Korea are expanding local biotechnological production and CRISPR diagnostics, strengthening the region's rapid growth and transformative potential in therapeutics, agriculture, and industrial biotechnology.

LAMEA has the least CRISPR activity, focusing mainly on academic adoption, research and development, and pilot agricultural and diagnostic projects. In 2025, Brazil launched its first CRISPR crop project, which will contribute to the region's biotechnology potential. Simultaneously, Middle Eastern countries such as Saudi Arabia and the UAE started to construct cutting-edge biotechnological infrastructures. Although the region has limited clinical and commercial activities, growing synergies and country-sponsored programs are positively stimulating international partnerships, which will be beneficial for the region in the future.

CRISPR Kits & Enzymes: Kits As a foundation of gene-editing studies, kits typically include Cas proteins, buffers and other standard reagents. These products facilitate the workflow of exact genome modifications and time required to prepare a procedure hence reducing mistakes and improving research speed. This was significantly improved during April 2025, when Thermo Fisher Scientific introduced a new version of CRISPR enzyme kits in the USA which assured better on-target specificity and reduction of off-target effects, and more stability in performing multi-faceted editing operations.

Guide RNA/gRNA: gRNA enables the finding of an exact gene target by targeting it with CRISPR systems using a specific strand of DNA. Not only does quality gRNA enhance the efficiency of the gRNA system, it also reduces on-target editing successfully. In response to the augmented significance of the same in therapeutic research and functional genomics, on June 2025, Synthego, in Europe, offered a more comprehensive library of synthetic gRNAs that greatly enhanced the precision of genome targeting in human and animal cell lines, accelerating therapeutic research and functional genomics.

CRISPR Libraries: CRISPR Libraries: CRISPR Libraries provide a library of guide RNAs that are useful in genome-wide screens, functional gene studies, and drug target discovery to aid researchers in identifying the role of a particular gene in the genome. The current release of the human CRISPR knockout library by Addgene in the Asia-Pacific region on May 2025, which enables large-scale improvements in functional genomics, simplified the procedure of determining potential therapeutic targets to aid in the fight against many diseases.

Design Tools/Software: AI-based design tools help in the process of guide RNAs selection, off-target prediction, and workflow optimization. This design sub-component assists research as well as therapeutic uses of cutting down the errors and enhancing the likelihood of effective experimental results. In March 2025, Benchling announced a new CRISPR design platform in North America, with AI technology to improve the selection of guides to make edits more efficient, maintaining off-target edits at low levels. This proves the trend of precision editing using software.

Other Products (e.g., plasmids, CRISPR controls): Plasmids and control kits are developed to verify and replicate experimental CRISPR research findings. They are also essential in the QC of high-throughput studies. In January 2025, MilliporeSigma launched better CRISPR control kits in Europe, which are specifically designed to be used in high-throughput screening to help in experimental standardization and reduction of variability.

Services (see separate segment): This encompasses bespoke gene editing and cell line development and validation services as an option to enable CRISPR uptake where the laboratory does not have the capability to do so internally.

gRNA Design & Synthesis: Synthesizing custom gRNA provides accurate, high-fidelity targeting for research, therapeutic, and industrial uses. Synthego offers even more advanced gRNA synthesis services in Asia, including chemically-modified, high-fidelity RNAs for more complex gene-editing and error minimization, starting April 2025.

Cell Line Engineering: CRISPR-based modification of human, animal, or microbial cell lines for therapeutic research, drug screening, and disease modeling was for cell line engineering. As of June 2025, Horizon Discovery provided human iPSC engineering in Europe and partnered with pharmaceutical companies for cell lines used in precision medicine and drug development, which advanced therapeutics.

CRISPR Screening & Validation: Supporting both academic research and commercial drug development, genome-wide screens validate therapeutic targets and identify critical genes. For more efficient target discovery and enhanced pipeline development in biotech companies, Cellecta scaled their CRISPR screening services in the U.S. as of May 2025.

Vector Construction & Delivery Support: This includes designing and constructing viral and non-viral delivery systems for CRISPR components, particularly for in vivo or ex vivo gene editing. As of March 2025, Integrated DNA Technologies unveiled a next generation vector suite for the North American market which provided enhanced transfection with reduced toxicity for safer CRISPR delivery.

Other Services (e.g., epigenome editing, transcriptome editing): These higher-end services offer the capability to finely tune gene expression or RNA transcripts while leaving the foundational genetic sequence unchanged. This further augments CRISPR's versatility for both research and clinical use.

Biomedical and Therapeutic Fields (Gene Therapy, Ex Vivo, In Vivo): In therapeutic development, CRISPR technology is directed toward correcting gene disorders, battling cancers and immune cell manipulation. These applications are gaining attention and driving focused R&D investments. In July 2025, first Phase 2 clinical trial of CRISPR-Cas9 therapy aimed at sickle cell disease was initiated by Vertex Pharmaceuticals, which illustrates adoption of precision genome editing for first rare diseases in U.S.

Agriculture and Crop Improvement: In agriculture, CRISPR technology is aimed at improving crop yields, increasing pest resistance, and minimizing environmental stress. These enhancements contribute to greater food security and sustainability. Supporting climate resilient crop production in Asia, in May 2025, Indian Council of Agricultural Research endorsed CRISPR modified edited wheat variety for field trials.

Industrial Biotechnology and Synethic Biology: CRISPR engineered microbes are utilized in enzyme production, biofuel production, and innovations in synthetic biology. Emphasizing the technology’s impact in industry, in June 2025, a European enzyme manufacturer publicized CRISPR modified microbial strains to increase enzyme production and improve production efficiency.

Diagnostics and Gene Monitoring: In resource poor settings, CRISPR technology is increasingly utilized for diagnostics, particularly in rapid pathogen detection and mutation identification. In May 2025, a CRISPR based point of care TB test was sanctioned in Southeast Asia, enabling rapid and affordable testing in rural clinics which was a significant advancement.

Other Applications (e.g., environmental, biofuel): New applications now include environmental monitoring, microbial bioremediation, bioengineering of sustainable industrial processes, and movement of CRISPR technologies beyond medicine.

Market Segmentation

By Product Type

By Service Type

By Application/Use Case

By End-User/Customer Type

By Region