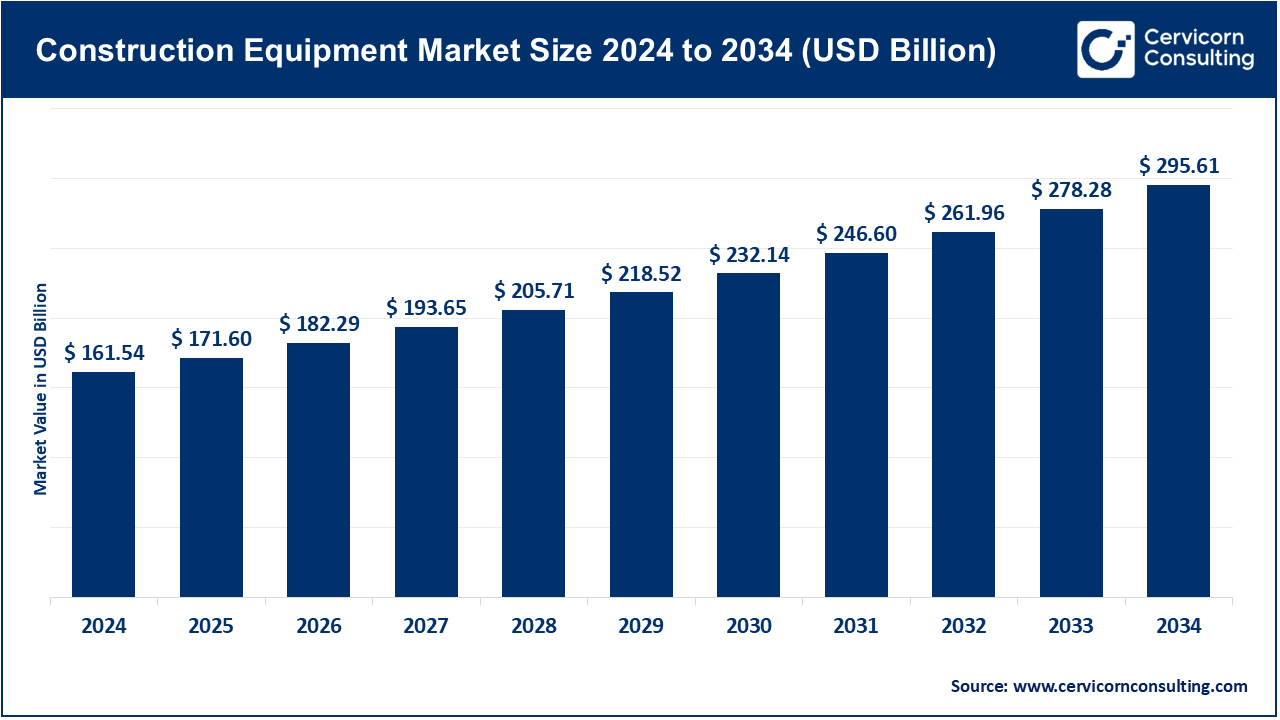

The global construction equipment market size was estimated at USD 161.54 billion in 2024 and is expected to be worth around USD 295.61 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.23% over the forecast period from 2025 to 2034. The construction equipment market is recording a bullish trend owing to the fast urbanization, investment in infrastructure, and upgrading of technologies. The rise in the demand of smart cities, green construction and an efficiency-based solution is also adding to the pace of the market. The combination of automation, IoT, telematics, and the use of AI-driven technologies are improving productivity, safety, and cost efficiency in projects.

What is the construction equipment?

The construction equipment market can be defined as the industry that produces and consumes the construction equipment including excavators, loaders, cranes, bulldozers, graders, and concrete equipment utilized in building, mining and infrastructure schemes. More equipment is being outfitted with GPS guidance and electrification, telematics, and predictive maintenance, which allow quicker project delivery, a lower environmental impact, and easier fleet management. The market is one of the most promising spheres that will surely bring changes to the way constructions are performed across the globe, with the focus on sustainability and innovation.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 171.60 Billion |

| Estimated Market Size in 2034 | USD 295.61 Billion |

| Projected CAGR 2025 to 2034 | 6.23% |

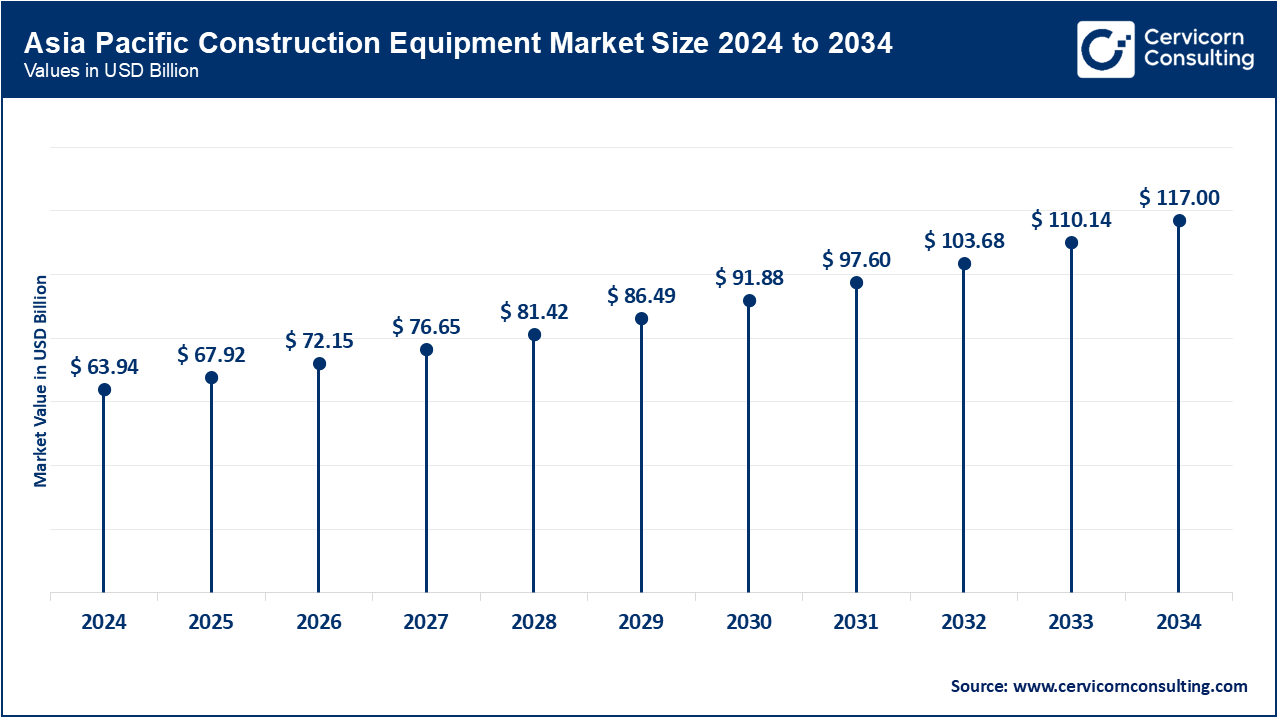

| Leading Region | Asia-Pacific |

| Key Segments | Equipment Type, Power Source, Engine Capacity, Power Output, Application, End User, Region |

| Key Companies | Caterpillar, Inc, CNH Industrial America LLC., Deere & Company, Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation, LIEBHERR, MANITOU Group, SANY Group, Terex Corporation, AB Volvo |

The construction equipment market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Asia-Pacific is the fastest developing region from urbanization and infrastructure scaling to rapid adoption of technologies. In June 2025 Volvo CE announced plans to expand crawler excavator production in South Korea, Sweden, and North America which underscores the Asia Pacific region’s emergence in technology-enabled localized manufacturing and solidifies the region’s importance in global equipment supply chains.

North America is leading in the market due to the strong infrastructure spending, emerging digital technologies, and resilient supply chains. In June 2025, Volvo Construction Equipment announced a $260 million investment to add a crawler excavator assembly line in the U.S. which aimed to reduce exports and boost local manufacturing. This underscores North America’s agility in production and flexibility in digital supply strategy as well as maintaining regulatory compliance.

Europe is pursuing the “green and digital first” growth of construction equipment catalyzed by stringent regulatory frameworks and entrepreneurial innovation ecosystems. In April 2025, Hitachi Construction Machinery showcased Europe’s leadership in emission-free heavy equipment by launching the hydrogen model of the zero-emission excavator along with integrated digital services, highlighting the construction innovation ecosystem’s capability to streamline construction processes.

Construction Equipment Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 27.40% |

| Europe | 21.60% |

| Asia-Pacific | 39.58% |

| LAMEA | 11.42% |

The opportunities offered by the LAMEA region are underpinned by urbanization, the development of renewable infrastructure, and rugged region adaptable equipment. While there may not be recent developments related to construction equipment in the news, the region's infrastructure investment and need for robust equipment certainly highlight the growing opportunities in LAMEA. Reliability and flexibility in construction equipment continues to be in demand for the government-sponsored projects and urban development in Latin America, Middle Eastern mega projects, and African infrastructure undertakings.

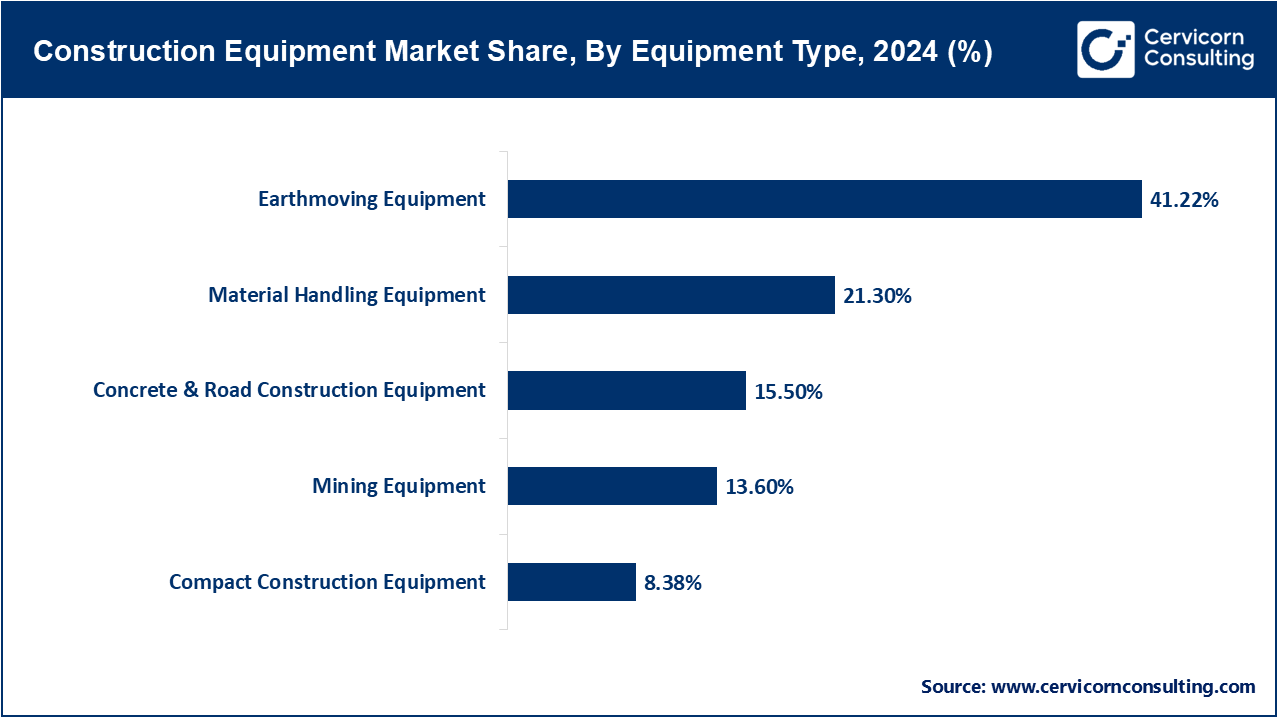

Earthmoving Equipment: Excavators, bulldozers, and graders are some of the services used for digging and moving soil for infrastructural projects. They continue to hold the largest share of the equipment market owing to the relentless demand for infrastructure, roads, and housing developments. CASE Construction Equipment showcased new MIDI excavators and backhoe loaders with productivity-enhancing features, along with electric models, at the international expo in June 2025. This further highlighted the increasing need for versatile earthmoving equipment across urban and rural projects.

Material Handling Equipment: This subsegment covers cranes, forklifts, and telehandlers used for lifting and moving the heavy loads in construction and logistics. Their position in ports and warehouses, and in large and complex infrastructure projects is critical. Manitowoc launching its latest Grove rough-terrain crane in North America designed for heavy lifting in space constrained sites in April 2025 illustrates the growth of material handling equipment. Such material handling equipment continues to advance with improved safety and higher load efficiency.

Concrete and Road Construction Equipment: These include concrete mixers, asphalt pavers, and pumps, as well as compactors, which are important for the construction of highways, bridges, and other commercial facilities. This equipment is are being utilized more and more as the government spends more on infrastructure. In Europe, the Wirtgen group in May 2025 introduced an advanced compact cold milling machine designed for sustainable road construction. The industry is updating concrete and road equipment to improve their emissions efficiency and environmental impacts.

Mining Equipment: Essential for mineral, coal, and metal extraction are hydraulic shovels, large excavators, dump trucks, and drilling rigs, which are heavy construction machines. These form the backbone of heavy industries and are largely used by industries that require raw materials. In Australia, Komatsu in March 2025 launched their next-generation autonomous open pit haul trucks designed to enhance safety and productivity in open pit mines. This is one instance of the reliance of the mining industry on sophisticated, high-capacity equipment.

Compact Construction Equipment: These includes mini excavators, compact skid-steer loaders, and compact wheel loaders. These are designated for smaller and urban projects. These equipment are popular for their fuel efficiency and maneuverability in tight spaces. Recently in Europe, Bobcat launched its new electric track loader which has zero emission which is suitable for urban construction. This is an example of the need for compact equipment in construction in sustainable projects in urban cities.

Diesel-powered Equipment: Diesel engines dominate the construction equipment market because of their reliability and high torque output, especially for heavy-duty machinery like excavators and bulldozers. They are widely used in large infrastructure and mining projects due to their fuel efficiency and established refueling infrastructure. In March 2025, Caterpillar announced enhancements to its Stage V-compliant diesel engines to reduce particulate matter emissions while maintaining power. This reflects how traditional diesel power is adapting to stricter emission standards globally while remaining the backbone of the industry.

Electric Equipment: Electric-powered construction equipment is gaining traction due to zero emissions, reduced noise, and lower operational costs. Compact machines such as mini excavators, loaders, and forklifts are the most common electrified models used in urban construction sites. Volvo CE launched its EC500 Electric Excavator in February 2025, targeting heavy-duty construction projects with battery capacity suited for full-shift operation. This shows how electric solutions are scaling up beyond compact equipment to tackle larger applications.

Construction Equipment Market Share, By Power Source, 2024 (%)

| Power Source | Revenue Share, 2024 (%) |

| Diesel-powered Equipment | 52.36% |

| Electric Equipment | 21.39% |

| Hybrid Equipment | 10.50% |

| CNG/LNG-powered Equipment | 8.90% |

| Hydrogen-powered Equipment | 6.85% |

Hybrid Equipment: Hybrid construction machines combine diesel engines with electric drives or hydraulic accumulators to improve fuel efficiency and cut emissions. They are particularly useful in markets transitioning from diesel to full electric where cost and infrastructure are still challenges. In January 2025, Komatsu introduced its HB365LC-4 hybrid excavator in Europe, claiming up to 20% better fuel efficiency than conventional models. This demonstrates hybrids’ role as a bridge technology for sustainable construction.

CNG/LNG-powered Equipment: Natural gas-powered construction equipment is still niche but expanding in regions with strong natural gas infrastructure. They provide lower greenhouse gas emissions and operating costs compared to diesel. In December 2024, JCB showcased its 3CX backhoe loader powered by CNG in India, highlighting local demand for cleaner alternatives in urban construction. Such equipment is increasingly promoted in regions struggling with air quality issues.

Hydrogen-powered Equipment: Hydrogen-powered machines are at the cutting edge of sustainable construction technology, offering high energy density and fast refueling compared to batteries. They are being tested in heavy-duty and long-duration applications where electrification remains difficult. In February 2025, Hyundai Construction Equipment announced successful field trials of its 14-ton hydrogen excavator in South Korea. This points to hydrogen’s potential for future adoption in large-scale construction projects.

Residential Construction: Residential projects require precision work and compact equipment such as mini-excavators and skid-steer loaders, which can manoeuvre into tight spaces. Bobcat’s new electric compact track loader, which offers zero-emission performance and manoeuvrability, is ideal for urban housing developments and was unveiled in Europe in February 2025.

Commercial Construction: The construction of office buildings, retail centers and complexes requires. Commercial developments make use of mid sized to heavy equipment. There is also a growing focus on these sectors’ sustainability. Volvo CE showcased the ECR25 Electric excavator and L120 Electric loader at BuildTech Asia in March 2025, illustrating how commercial construction in Asia is adopting electric equipment.

Industrial Construction: Industrial construction such as factories and warehouses need heavy, rugged equipment specially designed for use in production areas such as factories or in close proximity to them. Caterpillar’s upgraded diesel excavators, with enhanced emissions control released in July 2024, continue to deliver high productivity, which makes them compatible with large scale industrial environments.

Infrastructure (Roads, Bridges, Airports): Infrastructure projects often work with large excavators, pavers, and rollers. These projects are usually under tight deadlines and are demanding high performance. Volvo CE released the ECR230 Electric mid-size excavator in May 2025, aimed at heavy-duty infrastructure work while also offering reduced emissions, ideal for the expansion of infrastructure projects on a global scale.

Mining & Quarrying: Mining and quarrying utilize specialized autonomous and teleoperated equipment to optimize their operations in demanding and harsh conditions. Komatsu’s most recent autonomous haul trucks, which are targeted for use in open pit mining, were unveiled in Australia in March 2025. These trucks are purposefully built to improve safety and operational efficiency in environments where human interaction is difficult and perilous.

Construction Companies: The construction companies segment has generated highest revenue share in the market. These firms create demand for different types of machines which vary in size from compact to heavy-earthmoving equipment based on the nature of the project. As an example, in July 2025, Caterpillar announced the deployment of autonomous haul trucks tailored for infrastructure developers, demonstrating how OEMs serve end-users with project-specific solutions.

Mining Companies: The mining sector requires uniquely specialized, large capacity machines which are capable of operating for extended periods in rough terrain. In March 2025, Komatsu released autonomous haul trucks in Australia which exemplifies the continued thrust towards automation for safety and productivity in mining.

Infrastructure Developers: The public or private infrastructure developers are the ones who usually lead the equipment demand as they are the ones implementing mega projects like highways or airports and bridges. In May 2025, Volvo CE launched its EC230 Electric excavator aimed at infrastructure applications bringing powertrain modernization in alignment with the ever-growing need for sustainable large-scale projects.

Government & Municipal Bodies: In public works, parks, and other public services, municipalities tend to prefer equipment with low emission and noise for urban operations. Such was the case in January 2025 when Oslo announced that 98% of their municipal construction fleet was operating fossil-fuel free in 2023, executing the majority of city projects with electric machines.

Rental Service Providers: Utilizing machinery on rent offer equipment rental companies an innovative approach for adopting versatile or green technologies demanded by their customers. At BuildTech Asia in March 2025, Volvo CE showcased electric models in their product lines including the L120 Electric loader, proving how rental fleets can help their clients wanting eco-friendly equipment—even on a short-term lease.

Market Segmentation

By Equipment Type

By Power Source

By Engine Capacity

By Power Output

By Application

By End User

By Region