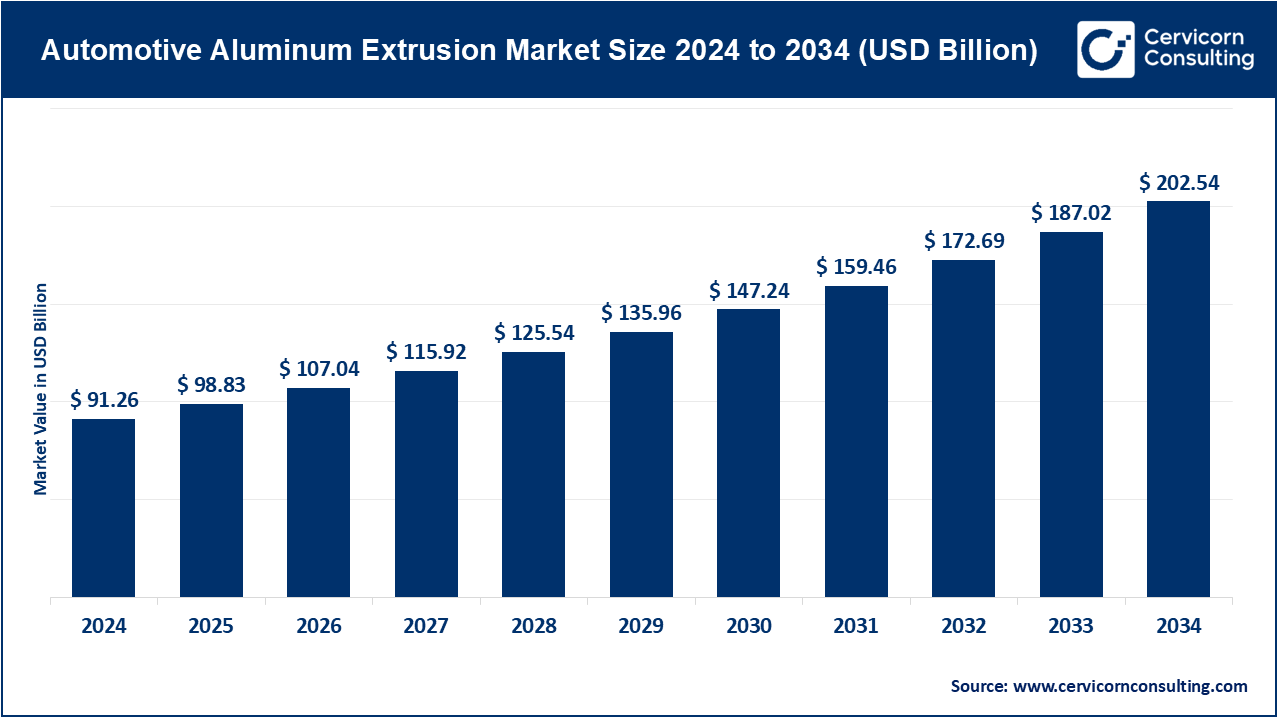

The global automotive aluminum extrusion market size was valued at USD 91.26 billion in 2024 and is expected to hit around USD 202.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.4% over the forecast period from 2025 to 2034. The automotive aluminum extrusion market is currently growing exponentially, with the industries being pressured to strive to meet the net-zero goals, gain green certification, and minimize the impact of those on the environment. The green extrusion solutions move beyond conventional manufacturing approaches by aiming at the reduction of embodied carbon, enhanced energy efficiency, circularity in resources and global climate. Emerging regulatory demands, increased ESG expectations, and a growing concern to reduce climate change are some of the most prominent factors that have led to a rapid adoption rate across industries all over the world. This trend indicates an increased responsibility that potential production must be sustainable to ensure long-run development and competitive benefit.

Improved technology in lightweight alloys, advanced precision of extrusion, and cost-effective production of energy are ensuring that auto aluminum extrusions are becoming scalable and financially viable. The materials are used in automotives, construction, consumer goods, agriculture and manufacturing. Automobile aluminum extrusions help to decarbonize, achieve environmental regulations, and better overall lifecycle measures through the use of lighter weight sustainable materials in place of more traditional materials. By relying on innovations of this kind, business organizations are fast track-switching to a low-carbon and circular economy without compromising profitability, resilience, and the sustainability of operations.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 98.83 Billion |

| Expected Market Size in 2034 | USD 202.54 Billion |

| Projected CAGR 2025 to 2034 | 8.40% |

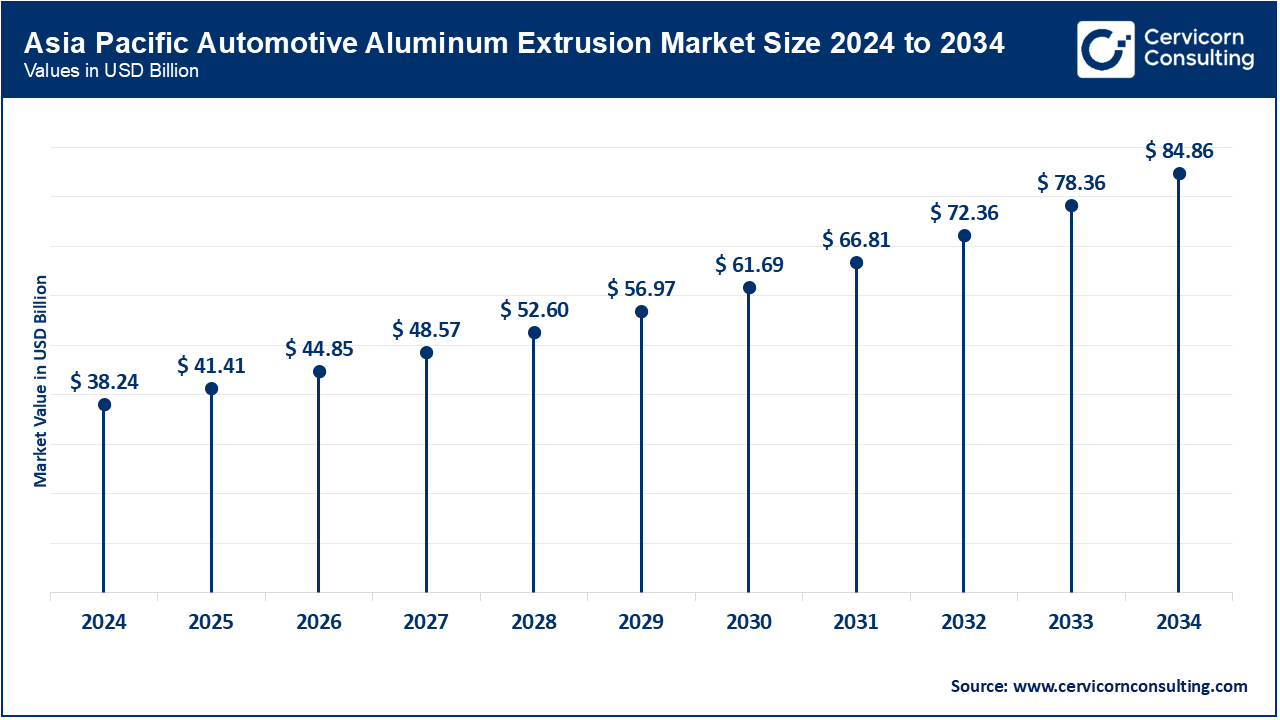

| Dominant Region | Asia-Pacific |

| Key Segments | Vehicle Type, Component Type, Material Type, Process Type, Aluminum Grade, Application, Region |

| Key Companies | Bonnell Aluminum, Constellium, ALCOA Corporation, Press Metal Aluminium Holdings, Hydro Extrusions, Hindalco Industries, Novelis, China Zhongwang Holdings, Sapa Group, Kaiser Aluminum, Gulf Extrusions, Arconic, Norsk Hydro, ETEM Group, UACJ Corporation |

The automotive aluminum extrusion Market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The Asia-Pacific region is now one of the most rapidly growing markets due to new government initiatives, the adoption of aluminum as a renewable material, and the region’s sustainability efforts. In May 2025, the Japanese Ministry of Economy, Trade, and Industry began a scheme to support the use of aluminum extrusions on EVs by subsidizing manufacturers and enhancing EV performance and energy use. China is also pursuing new aluminum extrusion technology to supply the growing need for lightweight metals in the automotive industry. The use of aluminum parts in vehicles is considered one of the most effective ways to improve energy efficiency and reduce emissions. All of these factors are positioning the region as a leader in sustainable automotive manufacturing.

Positive policies and corporate ESG obligations, R&D in low carbon feedstocks, and low carbon aluminum production technologies are contributing factors to growing the market in North America. In response to the growing need for aluminum in the automotive industry, the U.S. Department of Energy announced on July 2025, a USD 0.05 billion grant to be awarded to more industries that would support low carbon feedstock aluminum production technologies that would be aligned with the Inflation Reduction Acts goal and put a sustainment focus on manufacturing. With the strict fuel economy standards and increased performance standards for the automobiles, the manufacturers are rendered to use aluminum extrusions which increases freedom in the fuel economy standards. Lighter automobiles contribute to greater fuel economy and lower greenhouse emissions. Corporate automakers are more inclined to use aluminum now and this is a positive trend against global warming.

In part of the world, the automotive aluminium extrusion business is developing because of the EU policies on climate change, circular economy, and bio-economy policies. Alongside them, The European Commission put into place the Green Deal Industrial Plan, which will support the transition to a net-zero economy, as an example, will also foster the use of low-emission materials such as aluminium, low-emission cars and steel. The automotive industry is trying to comply with the policies set in place, with extrusion aluminium technology invested to meet emission targets. The vehicle emission targets set the research on the creation of a lightweight automobile which is willing to increase fuel efficiency while minimizing the emission of harmful gases. Joint efforts between the business and academia are driving advances in aluminum processing technologies.

Automotive Aluminum Extrusion Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.40% |

| Europe | 25.80% |

| Asia-Pacific | 41.90% |

| LAMEA | 9.90% |

In the LAMEA region, the adoption of renewable energy and bio-based manufacturing processes is stimulating growth in the aluminum extrusion industry for automobiles. In Brazil, the construction of a plant which turns sugarcane bagasse into bio-based polyethylene glycol was brought into operation in April 2025, supplying feedstock for the automobile industry. This initiative is a step towards the adoption of bio-based feedstock in automobile manufacturing. In the Middle East, chemical producers are beginning to utilize solar and biomass energy, which is in agreement with sustainability efforts around the world. This initiative is part of the efforts undertaken to mitigate the aluminum production emission. In Africa, some countries are in the process of developing bio-based materials for the automobile industry from agricultural residues, thus fostering circular economy initiatives.

Passenger Cars: Passenger cars are those cars that are built mainly as transport vehicles, usually carrying a number of 2 to 7 passengers. Aluminum extrusions are commonly employed in making these cars to make them lighter and more economical on fuel. By March, 2025, one of the European vehicle manufacturers launched an aluminum-intensive design of passenger car, which decreased the total weight by 12%, which improved fuel economy and performance. Doors, hoods, and chassis made of lightweight aluminum help to improve handling. This subsegment has been rising in popularity since the consumer base demands cars that are efficient and save on the environment.

Commercial Vehicles: Such commercial vehicles are truck, van and buses, which transport commercial goods or passengers. Such vehicles have aluminum extrusions that save weight and make them able to withstand heavy loads. In July 2025, one significant North American truck manufacturer introduced an aluminum-framed delivery van, which to increase payload capability, reduced curb weight by 15 per cent. Such elements also lead to a reduction in emissions and fuel consumption costs. It is led by the increasing regulation standards in commercial transportation emissions.

Electrical Vehicles (EVs): Electric cars are driven wholly or partly by an electric power source, which means that they utilize lightweight materials to get the maximum possible range of a battery. Due to this reason, aluminum extrusions find their wide application on the chassis and battery enclosures of the EVs. In August of 2025, one of the EV manufacturers underwent a presentation of an all-electric SUV with the aluminum-made structural parts increasing the driving range by 8%. Also, aluminum is useful in controlling battery pack thermal efficiency. In this subsegment, adoption is expanding at a high rate due to the increasing global EV productions.

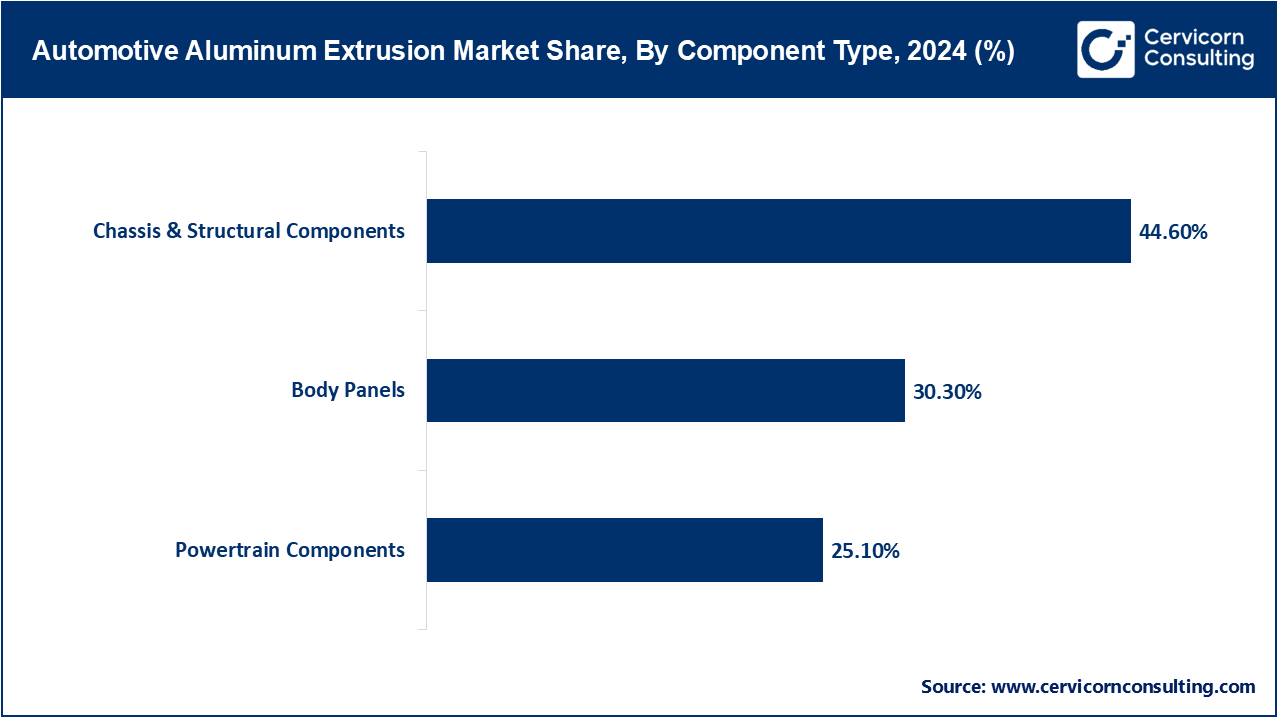

Chassis and Structural Elements: The chassis and structural elements comprise the skeleton of a vehicle which sustains all the mechanical and the body elements. Aluminum extrusions allow the strength with weight reduction, which is vital to the performance and safety. In May 2025, an Asian manufacturer introduced an aluminum-intensive chassis sedan reducing the overall weight of the body by 10%; a consumption-optimized model. They also increase crashworthiness, and durability. The manufacturers are finding that it is increasingly replacing traditional steel with aluminum as a way of achieving light weighting targets.

Body Panels: Doors, hoods, roofs, and the fenders are body panels which make up the exterior shell of any vehicle. Lightweight aluminum extrusions cut weight without sacrificing stiffness, or style. In June 2025, a German automaker launched a passenger car with the aluminum body panels, reducing weight as a whole by 8% with preservation of structural rigidity. This is less harmful to handling, emissions are also minimal. There is a rise in adoption, so it is particularly in the case of high-end and electric cars.

Powertrain Components: Available powertrain components are the engine, the transmission and related systems that create and convey power to the vehicle. These systems are reduced in weight and thermal management is improved by aluminum extrusions. In April 2025, an American car manufacturer introduced an aluminum powertrain housings hybrid vehicle, which is more effective and dissipates heat. The light weight design is also a factor of increased fuel economy and performance. Efficiency and sustainability are transitions that are being turned towards aluminum in this subsegment.

Aluminum Alloys: Aluminum alloys combine aluminum with other additives in order to enhance strength, resistance to corrosion, and durability. They find common application in cars, where they are used to save weight and to increase performance. In January 2025, a Japanese auto manufacturer brought out sedan which had structural components made of aluminum alloy which reduced the weight of the vehicle by 9%. Flexibility of manufacture and better crash performance is also provided by these alloys. They are favored compared to pure aluminum because of good mechanical qualities.

Automotive Aluminum Extrusion Market Share, By Material Type, 2024 (%)

| Material Type | Revenue Share, 2024 (%) |

| Aluminum Alloys | 68% |

| Pure Aluminum | 32% |

Pure Aluminum: Purely aluminum denotes high purity aluminum possessing good corrosion resistance abilities and thermal conductivity. It finds its primary application in situations in which weight savings are very important but where mechanical loads are moderate. In February 2025, a European manufacturer of EVs applied pure aluminum in enclosures of the batteries in effort to enhance thermal management and trim 5% weight of vehicles. Pure aluminium is very light, easily formed and recyclable. It is increasingly getting used in EV-related components where heat dissipation is necessary.

Lightweighting: Lightweighting is the practice of reducing the weight of a vehicle to improve efficiency, handling, and emissions control. Aluminum extrusions are intimately associated with this application because of their high strength-to-weight ratio. In May 2025, one of the Chinese automobile manufacturers launched a lightweight sedan with aluminum structural and body components which reduced the vehicle weight by 12%. Thus, lightweighting improves performance and environmental impact, serving as a key factor in a vehicle’s environmental performance.

Automotive Aluminum Extrusion Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Lightweighting | 48% |

| Safety & Crash Management | 32% |

| Thermal Management | 20% |

Safety & Crash Management: Safety and crash management is the practice of engineering components used in a vehicle to absorb energy and protect occupants during a crash. Aluminum extrusions are incorporated in the side impact beams as well as crumple zones, and roof rails. In June 2025, a North American automobile manufacturer released a vehicle with aluminum crash management structures which improved the safety ratings by 15%. The application of aluminum is ideal because of its strength and energy-absorbing capabilities. Adopting such solutions ensures compliance with regulations as well as the safety of the passengers.

Thermal Management: The control of heat in engines, batteries, and electronics systems to optimize efficiency and safety in the systems requires thermal management. Aluminum extrusions are preferred due to their high thermal conductivity. An European EV maker deployed aluminum battery enclosures and heat sinks in July 2025, augmenting battery cooling and range efficiency in the vehicle. Proper thermal management prolongs the life of vehicle components while also improving the vehicle’s overall performance. For this reason, aluminum is commonly used in EV and hybrid powertrain systems.

Hot Extrusion: Hot extrusion refers to the heating of aluminum materials to a certain temperature and forcing the aluminum through a die in order to obtain the desired shape. This process improves the ductility of the material and enables creation of large parts. In March 2025, a certain U.S. automaker used hot-extruded aluminum frames for the body of new electric SUV which reduced the weight of the SUV by 10% in comparison to conventional parts. This is a common practice in chassis and structural components. Hot extrusion delivers a high level of accuracy, a high degree of improvement in the mechanical properties of the components.

Automotive Aluminum Extrusion Market Share, By Process Type, 2024 (%)

| Process Type | Revenue Share, 2024 (%) |

| Hot Extrusion | 64% |

| Cold Extrusion | 36% |

Cold Extrusion: Cold extrusion, in comparison to hot processes, is carried out at room temperature and thus, results in parts with a better surface finish and improved accuracy of the dimensions. This process is more common for the smaller mechanical and structural parts. In April 2025, a European carmaker used cold-extruded aluminum in suspension brackets with an increase in strength and a reduction in weight by 6%. Compared to hot processes, cold extrusion has a lower electricity consumption. This process is well suited for the manufacture of automotive parts which require high accuracy.

Market Segmentation

By Vehicle Type

By Component Type

By Material Type

By Process Type

By Aluminum Grade

By Application

By Region