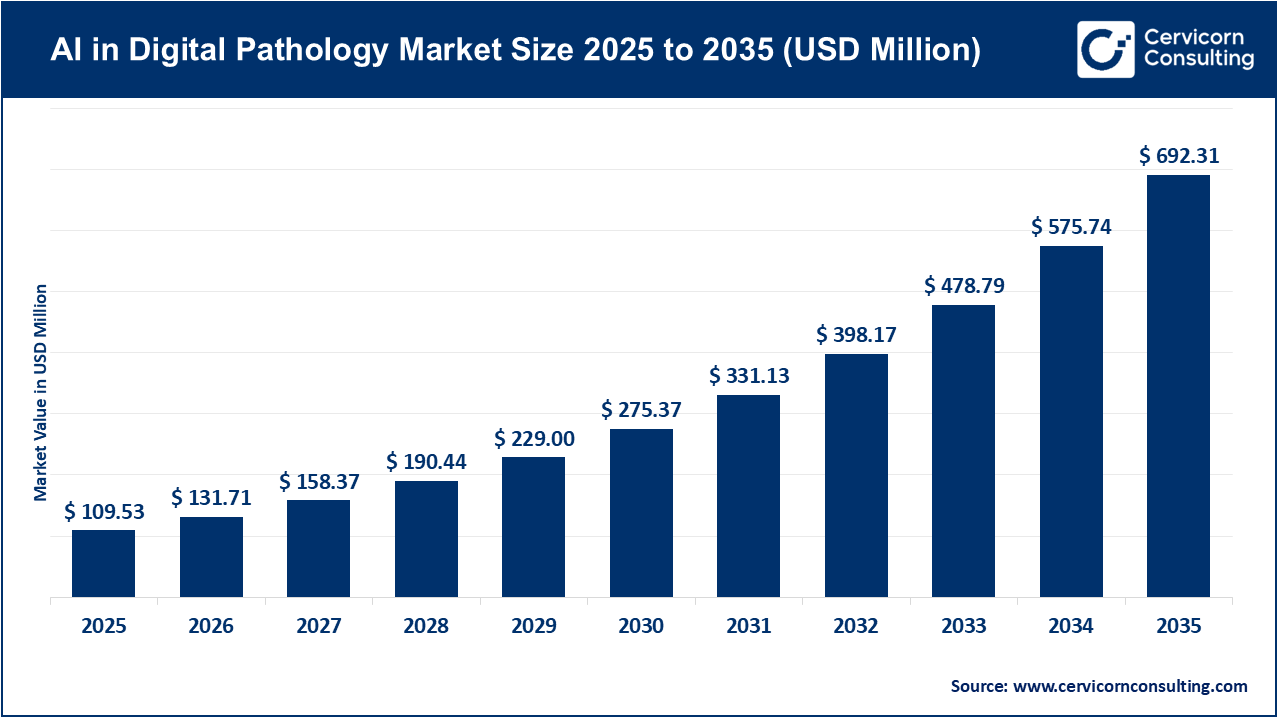

The global AI in digital pathology market size was valued at USD 109.53 million in 2025 and is expected to be worth around USD 692.31 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 20.2% over the forecast period from 2026 to 2035. The growth of the AI in digital pathology market is largely attributed to the increasing need for faster and more accurate diagnostic workflows, as well as the ongoing digitization of pathology laboratories. Traditional glass-slide pathology remains labor-intensive and is often affected by inter-observer variability. Recent studies show that manual review in laboratories can result in 30-40% variability in diagnostic interpretation, especially in oncology cases. The integration of whole-slide imaging (WSI) with AI-based image analysis is helping to reduce subjectivity and improve consistency in slide interpretation. Currently, more than one-third of pathology labs worldwide have adopted digital slides, indicating a significant move toward digital platforms that enable AI-driven analysis, collaboration, and remote consultation.

The shortage of trained pathologists, combined with a rising disease burden such as cancer, is another important factor driving the AI in digital pathology market. In developed healthcare systems, the pathologist workforce is aging, with over 20% expected to retire in the next decade, while the number of cases continues to increase each year. AI-powered digital pathology solutions are being adopted to address this gap by providing automated triage, pre-screening, and quantitative analysis, which allows pathologists to concentrate on more complex cases. The use of AI-driven platforms also supports telepathology and centralized review, making expert diagnostics more accessible in underserved areas. The growing adoption of cloud technology, better integration with laboratory information systems (LIS), and more regulatory approvals for AI-based pathology tools are expected to further support the expansion of these solutions in clinical, pharmaceutical, and research environments.

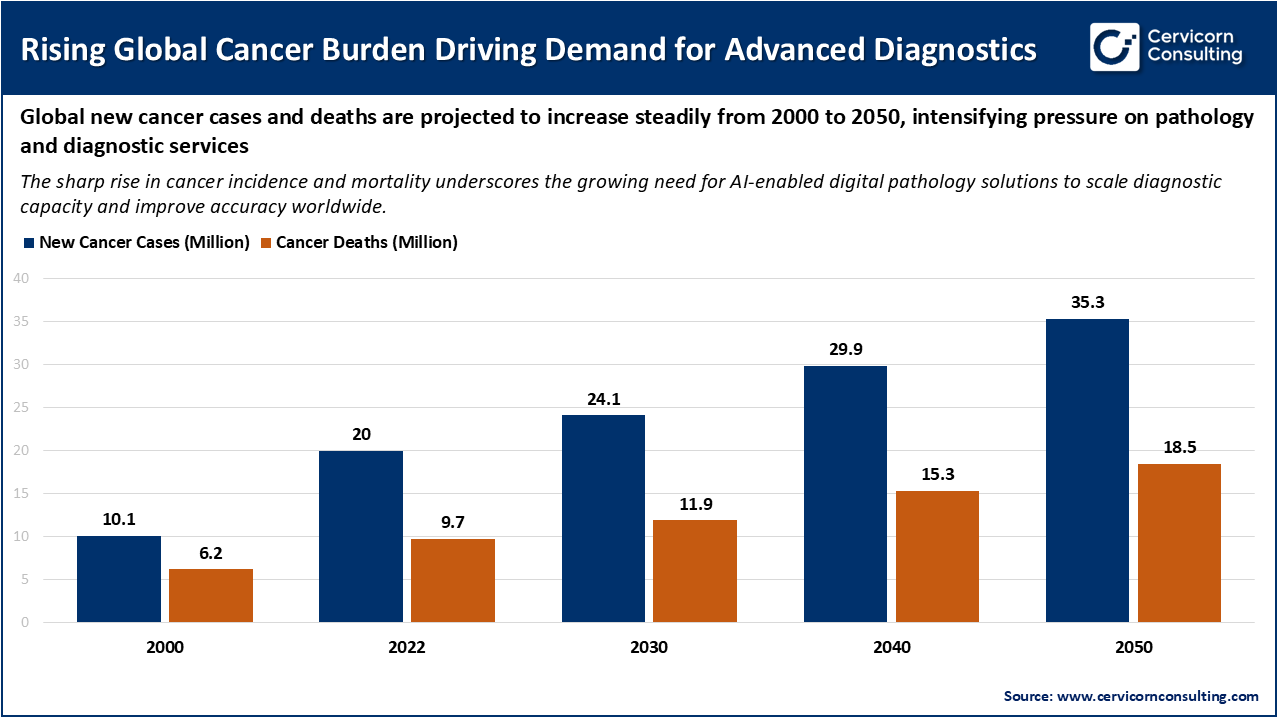

Rising Cancer Burden Amplifies Demand in the AI in Digital Pathology Market

The increasing number of cancer cases is a major factor driving the growth of the AI in digital pathology market. As the global healthcare system faces more pressure to improve diagnostic capacity and accuracy, the need for advanced solutions is rising. Recent data from the World Health Organization shows that new cancer cases are expected to grow from about 20 million in 2022 to over 35 million by 2050, which is an increase of around 77%. This growth is mainly due to an ageing population, population growth, and higher exposure to risk factors like tobacco use and obesity. As cancer cases rise, the number of biopsy samples and slides that need to be analyzed also increases. This puts more strain on pathology resources and creates a strong demand for AI-based digital pathology tools that can process large volumes of samples and help reduce turnaround times.

Certain cancers with high incidence rates add to the growing diagnostic workload and increase demand for digital pathology solutions. For instance, breast cancer had about 2.3 million new cases in 2022, and its incidence is rising by about 3% each year. Lung cancer had around 2.2 million new cases in 2020 and is still the leading cause of cancer death worldwide. Many cancer types require precise and consistent interpretation because of subtle differences in tissue appearance. As a result, AI-powered digital pathology platforms are being used more often to help pathologists by automating detection, measuring biomarkers, and supporting clinical decisions. The combination of rising case numbers and a shortage of trained pathologists in many areas highlights the need for scalable AI solutions. This trend is expected to drive further growth in the market.

Recent Developments in Single-Use Filtration Technologies

1. Ibex Medical Analytics Receives FDA 510(k) Clearance for AI Pathology Tool

In early 2025, Ibex Medical Analytics received FDA 510(k) clearance for its Prostate Detect AI-powered digital pathology solution, which supports pathologists in identifying small and rare prostate cancers in biopsy tissue. This regulatory achievement is significant because only a few AI pathology tools have been authorized for clinical use in the United States. By obtaining this clearance, Ibex addresses a major barrier to adoption, as regulatory approval and clinical trust are essential for integrating AI into healthcare. These clearances confirm the clinical value of AI algorithms, encouraging healthcare providers to adopt AI-enabled workflows and supporting the integration of these technologies into routine diagnostics.

2. Aiforia Obtains IVDR Certification and Launches Multiple CE-IVD AI Models

In February 2025, Aiforia Technologies obtained In Vitro Diagnostic Regulation (IVDR) certification in Europe and launched three new CE-IVD marked AI models for breast and prostate cancer diagnostics. This achievement increases the availability of clinically validated AI models across Europe, where IVDR compliance is required for clinical use. By expanding its portfolio of regulatory-cleared products, Aiforia is reducing barriers for pathology labs and supporting the integration of AI into digital pathology workflows. This is especially important in oncology diagnostics, where there is a strong demand for accurate and automated image analysis.

3. Aiforia Launches Next-Generation AI Technology Platform

In December 2025, Aiforia advanced its technology by launching a next-generation AI platform that uses Vision Transformer architecture and a proprietary Foundation Engine. This new platform increases processing speed and efficiency in training and analyzing whole-slide images. Such technological progress expands the ability of AI tools to manage different tissue types and complex patterns, which improves performance, scalability, and interoperability. These factors are important for encouraging health systems to move from pilot projects to large-scale adoption of AI in digital pathology.

4. Expansion of Roche’s Digital Pathology Open Environment with Multiple AI Algorithms

In late 2024, Roche Diagnostics expanded its Digital Pathology Open Environment by integrating more than 20 advanced AI algorithms from eight collaborators to support cancer research and diagnostics. This development creates an ecosystem where multiple AI tools are available through a single workflow, making it easier for laboratories to integrate these solutions and increasing their clinical value. By offering a suite of validated tools for tasks such as tumor detection and biomarker quantification, this approach supports the broader adoption of AI in digital pathology and strengthens the case for large-scale digitization in the field.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 131.71 Million |

| Market Size in 2035 | USD 692.31 Million |

| CAGR from 2026 to 2035 | 20.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Offering, Neural Network, Function, Use Case, End User |

| Key Companies | Aiforia Technologies, Akoya Biosciences, Ibex Medical Analytics, Paige, PathAI, Proscia, Indica Labs, Roche Diagnostics, Visiopharm, AIRA Matrix, Deep Bio, OptraScan |

The AI in digital pathology market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

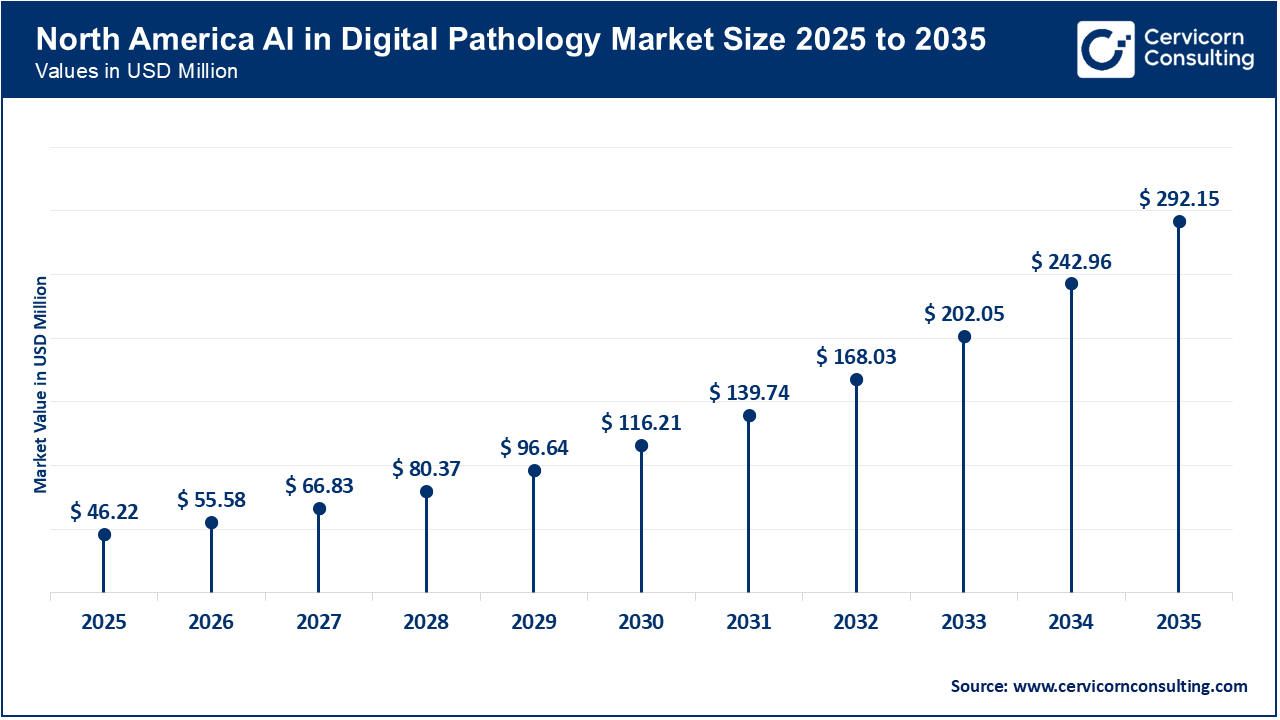

The North America AI in digital pathology market size was valued at USD 46.22 million in 2025 and is expected to be worth around USD 292.15 million by 2035. The North America is experiencing growth due to a dynamic regulatory environment and increasing digitization in large hospitals and reference laboratories. The approval of AI pathology tools by the U.S. FDA, such as Ibex Medical Analytics’ Prostate Detect, is building confidence among buyers by demonstrating clinical utility and safety. As a result, health systems are more willing to invest in scanners, AI platforms, and integration projects, which is accelerating the adoption of these technologies.

Recent Developments:

The Asia-Pacific AI in digital pathology market size was estimated at USD 24.53 million in 2025 and is forecasted to surpass around USD 155.08 million by 2035. In the Asia-Pacific region, the growth of AI in digital pathology is supported by government digital health programs and regulatory pathways that promote local testing and deployment. Rapid modernization of hospitals in China, Japan, and India is also contributing to this trend. National initiatives, such as China’s Healthy China and precision medicine programs, along with Japan’s regulatory sandbox for medical AI, are making it easier for both domestic and global vendors to launch pilot projects and expand commercial deployments and partnerships.

Recent Developments:

The Europe AI in digital pathology market size was reached at USD 30.45 million in 2025 and is projected to hit around USD 192.46 million by 2035. In Europe, the enforcement of IVDR and the increase in CE-IVD-marked digital pathology AI solutions are supporting market growth. When vendors achieve IVDR or CE-IVD status, such as Aiforia’s recent certifications, it reduces uncertainty across different countries. This helps pathology laboratories transition from pilot projects to routine diagnostic use and encourages hospitals and networks to make platform-level purchases.

Recent Developments:

AI in Digital Pathology Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 42.2% |

| Europe | 27.8% |

| Asia-Pacific | 22.4% |

| LAMEA | 7.6% |

The LAMEA AI in digital pathology market was valued at USD 8.32 million in 2025 and is anticipated to reach around USD 52.62 million by 2035. In the LAMEA region, growth is being driven by telepathology projects and commercial partnerships that address shortages of specialists and differences in access to pathology services. Modernization in this region often follows key partnerships and national pilot programs instead of large-scale investments. Collaborations between AI vendors and major private healthcare networks help create reference laboratory use cases, which can then be expanded into multi-site rollouts across the region.

Recent Developments:

The AI in digital pathology market is segmented into offering, neural network, function, use case, end user, and region.

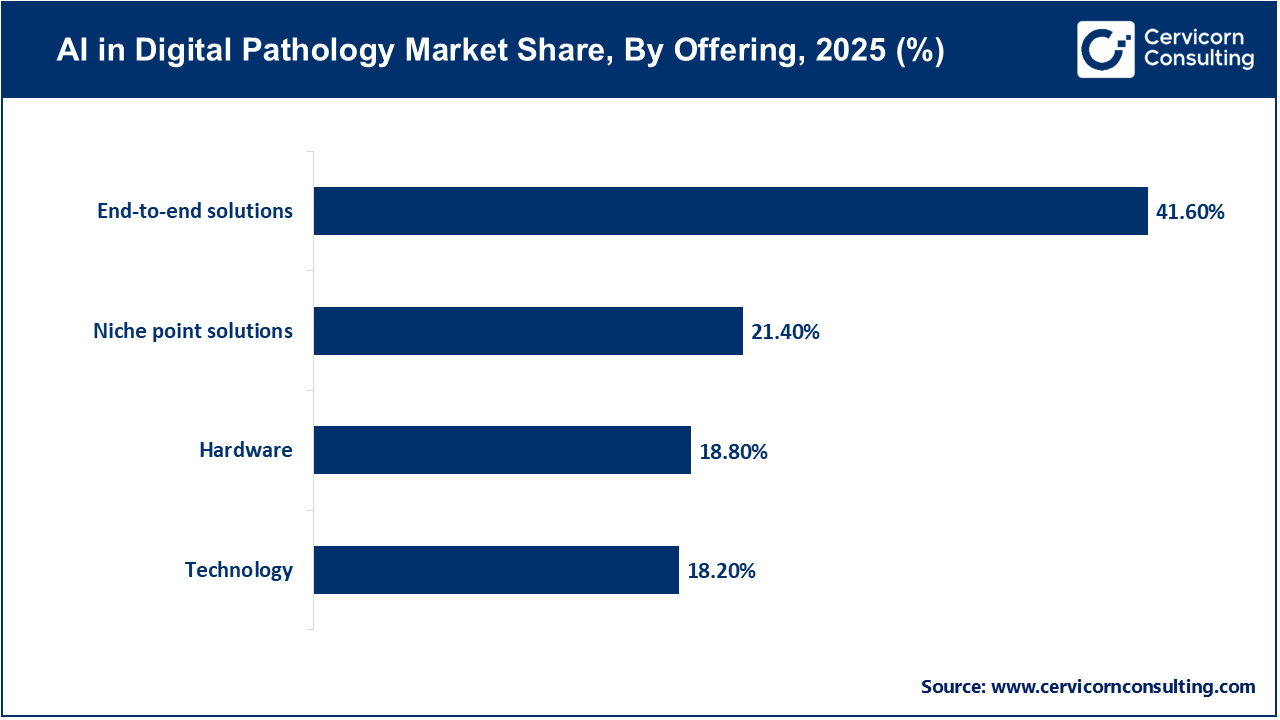

The AI in digital pathology market is currently led by end-to-end solutions. This is largely because healthcare providers are seeking comprehensive platforms that can integrate image acquisition, AI analysis, data management, and workflow orchestration within a single system. By adopting these solutions, hospitals and reference laboratories are able to address interoperability challenges that often arise between scanners, LIS, PACS, and AI algorithms. This is particularly important for larger institutions where seamless integration is essential. Vendors that provide platform-based models are seeing benefits such as recurring subscription revenues, increased customer retention, and the ability to scale across different pathology subspecialties.

AI in Digital Pathology Market Share, By Offering, 2025 (%)

| Offering | Revenue Share, 2025 (%) |

| End-to-end solutions | 41.6% |

| Niche point solutions | 21.4% |

| Technology | 18.2% |

| Hardware | 18.8% |

The hardware is experiencing the fastest growth in the market. This trend is primarily due to the rapid digitization of pathology laboratories around the world. The adoption of whole-slide scanners, high-resolution imaging systems, and high-capacity storage infrastructure has become essential for hospitals and laboratories that are moving away from traditional glass slides. As a result, there has been a significant increase in upfront investments in these technologies. The decreasing costs of scanners, improvements in scan speed, and enhanced image quality are making the transition to digital pathology more feasible, especially for mid-sized and regional laboratories.

CNNs are the leading neural network architecture in the market, mainly because they are highly effective for analyzing high-resolution histopathology images. Their reliability in tasks such as tumor detection, segmentation, grading, and biomarker quantification has been well established. Most AI pathology tools that have received clinical validation and regulatory approval are based on CNNs, which demonstrates their robustness and consistent performance on structured image datasets. The widespread availability of pre-trained CNN models and comprehensive validation studies further supports their adoption, making them easier to implement and optimize for clinical applications. As a result, CNNs continue to be the preferred choice in both diagnostic and research settings.

AI in Digital Pathology Market Share, By Neural Network, 2025 (%)

| Neural Network | Revenue Share, 2025 (%) |

| Convolutional Neural Networks (CNNs) | 56.3% |

| Generative Adversarial Networks (GANs) | 18.7% |

| Recurrent Neural Networks (RNNs) | 9.4% |

| Others | 15.6% |

Generative Adversarial Networks (GANs) and other advanced neural network architectures, such as transformers and foundation models, are currently the fastest-growing segment in the market. This growth is driven by the increasing demand for more advanced AI capabilities in pathology. These models are being adopted for applications like stain normalization, synthetic data generation, virtual staining, and addressing challenges related to data scarcity and variability between laboratories. Their potential to enhance model generalization and reduce the need for manual annotation makes them valuable for expanding AI solutions to new regions. With ongoing improvements in computational power and explainability, the adoption of these advanced architectures is projected to increase further in the coming years.

Image analysis is the leading function in digital pathology because it directly improves diagnostic efficiency and consistency. By automating tasks like cell counting, tumor boundary identification, and biomarker assessment, AI-based image analysis reduces turnaround times and minimizes differences between observers. This is especially important in oncology, where accurate measurement affects treatment choices. Since image analysis provides clear productivity benefits, it remains the main area where AI is first adopted in digital pathology.

AI in Digital Pathology Market Share, By Function, 2025 (%)

| Function | Revenue Share, 2025 (%) |

| Image Analysis | 34.8% |

| Diagnostics | 19.6% |

| Workflow Management | 13.2% |

| Data Management | 9.8% |

| Predictive Analytics | 8.6% |

| Clinical Decision Support Systems (CDSS) | 7.4% |

| Automated Report Generation | 3.5% |

| Quality Assurance Tools | 3.1% |

Predictive analytics and clinical decision support systems are expanding rapidly as AI moves beyond basic analysis to deliver practical clinical insights. These systems use histopathology data along with clinical and molecular information to predict how diseases may progress, the risk of recurrence, and how patients might respond to treatment. The rising need for precision medicine and value-based care is increasing the demand for AI tools that help with prognosis and treatment planning, not just image review. As regulatory bodies become more open to AI-based decision support, this segment is expected to grow even faster.

Disease diagnosis and prognosis represent the largest segment in the use-case analysis, mainly because routine clinical diagnostics make up the majority of pathology workloads. The integration of AI-enabled digital pathology has led to improvements in diagnostic accuracy, standardization, and efficiency, especially in high-burden diseases like cancer. These advancements have made AI tools essential for modern pathology laboratories. Hospitals focus on these applications since they have a direct impact on patient outcomes, operational processes, and adherence to clinical quality standards. Consequently, diagnostic use cases continue to receive the highest levels of investment and deployment in the market.

AI in Digital Pathology Market Share, By Use Case, 2025 (%)

| Use Case | Revenue Share, 2025 (%) |

| Disease Diagnosis & Prognosis | 44.7% |

| Drug Discovery | 28.9% |

| Clinical Workflow | 18.1% |

| Training & Education | 8.3% |

Drug discovery is currently the fastest-growing use case, with pharmaceutical and biopharmaceutical companies adopting AI-driven pathology in their research and development activities. The use of AI allows for high-throughput analysis of tissue samples during preclinical studies and clinical trials, which supports biomarker discovery, patient selection, and assessment of trial endpoints. The increasing focus on personalized therapies and companion diagnostics is also driving the need for advanced pathology analytics in drug development. As a result, partnerships between AI technology providers and pharmaceutical companies are playing a significant role in advancing innovation and increasing adoption in this area.

Hospitals and reference laboratories are the leading end users in the digital pathology market, as they process most diagnostic pathology cases and are under increasing pressure to improve efficiency due to workforce shortages. The adoption of AI-enabled digital pathology allows these institutions to handle higher case volumes, shorten reporting times, and support remote consultations. Large reference laboratories, in particular, are early adopters of advanced AI solutions because automation and scalability are essential for their operations. Their significant purchasing power and operational scale make them the main contributors to market revenue.

AI in Digital Pathology Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Hospitals & Reference Laboratories | 49.5% |

| Pharmaceutical & Biopharmaceutical Companies | 32.1% |

| Academic & Research Institutes | 18.4% |

Pharmaceutical and biopharmaceutical companies are currently the fastest-growing end-user segment. This growth is driven by increased R&D investment and the growing importance of tissue-based biomarkers in drug development. The use of AI in digital pathology enables standardized and reproducible analysis across multiple trial sites, which helps reduce variability and speed up development timelines. As regulatory agencies become more receptive to AI-derived endpoints, pharmaceutical companies are expanding their use of digital pathology from research into later stages of clinical development. This trend is leading to long-term, high-value collaborations between AI solution providers and drug developers.

By Offering

By Neural Network

By Function

By Use Case

By End User

By Region