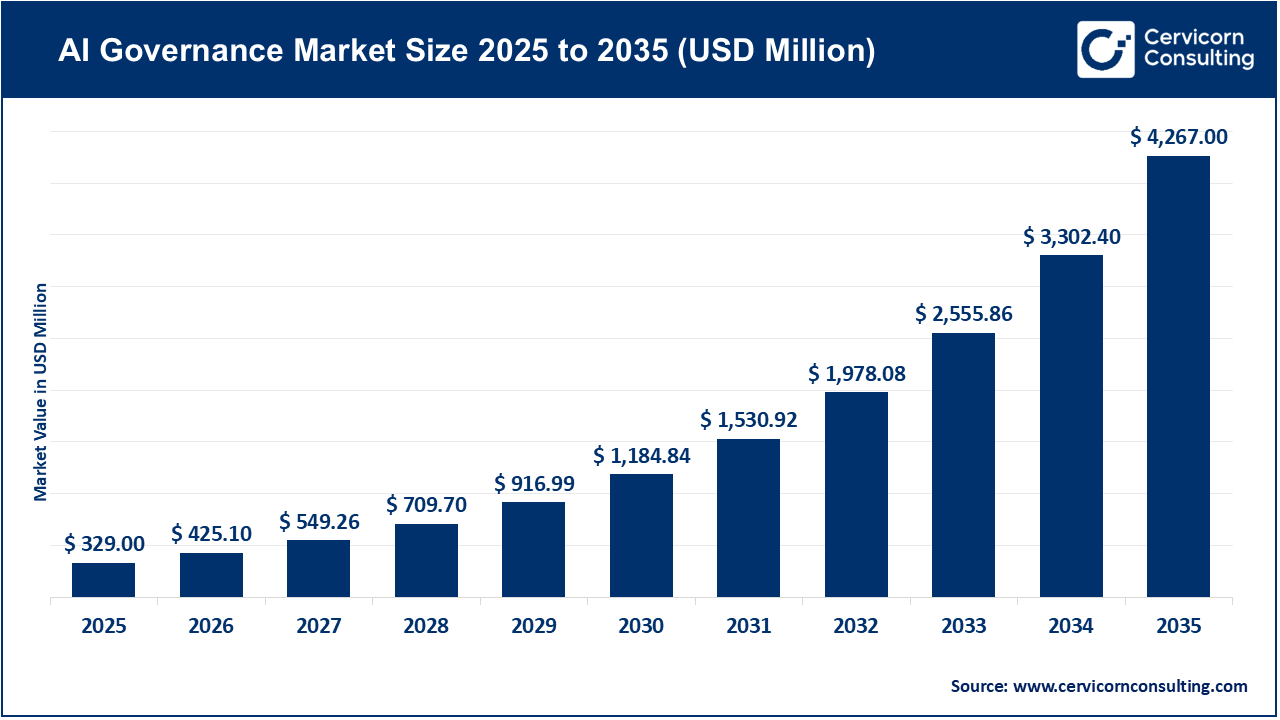

The global AI governance market size was valued at USD 329 million in 2025 and is expected to surpass around USD 4,267 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 29.2% over the forecast period from 2026 to 2035. The global artificial intelligence governance market is experiencing a paradigm shift from a world of voluntary ethical codes to a world of enforced regulatory compliance. With the emerging use of AI to power critical infrastructure, regulatory frameworks are front and center for all corporate and national priorities.

The growth trajectory is primarily due to the development of AI in high-stakes sectors such as finance and healthcare. In finance, AI is being positioned as a strategic tool to increase market liquidity and help implement risk management strategies, which presents a need to ensure there is sufficient oversight to avoid systemic failures. In healthcare, the use of AI, specifically in clinical evaluation and diagnostics, is creating demand for similar governance frameworks to be created to support high standards of patient safety and data privacy regulations. Additionally, the considerable GDP growth potential from AI (potentially up to 26% growth by 2030 in some regions) provides a strong incentive for governments to invest in stable governance environments for attracting AI-related investment from private enterprises.

Definition and scope of AI Governance

AI governance is the governance framework of rules, practices and technological systems designed to assure that AI systems are conceived, designed, developed, deployed, and monitored in an AI and legally compliant manner, as well as pursuant to ethical standards and organizational values. AI governance is broad in scope, considering data lineage, model explainability and verifiability, bias review and detection processes, and ongoing validity and performance monitoring. Unlike traditional IT governance of development and monitoring protocols, AI governance must consider both the probabilistic and the evolving nature of machine learning models, often evolving with time and deriving different or unexpected outputs.

The market is transitioning from merely a risk mitigation focus, to a performance optimization focus, to a strategic de-risking focus. Governance platforms are now acting as a centralized Control Plane for AI, enabling an organization to oversee the entire lifecycle of AI (from ingestion and training, to deployment and decommissioning) which includes managing Shadow AI deployment where employees are using unsanctioned AI tools (risking proprietary data and security in the process). By establishing visibility for the enterprise on these AI systems organizations will transition from a reactive model to a proactive stance (compliance-by-design).

Rising Need for Explainable AI Is Accelerating AI Governance Adoption

The AI governance market is expected to see growth due to the increased demand for model transparency and explainability. This is to satisfy regulator, consumer, and internal stakeholder pressure to understand how an organization's AI components make decisions. In the high-impact use cases of credit score, insurance underwriting, healthcare diagnostics, and hiring, it poses a high level of risk (legal, ethical, and reputational) for organizations due to the use of non-transparent black box models. Regulations and new guidelines require organizations to move towards a model governance platform that offers explainable outcomes, audit trails, and human oversight. This is so that businesses can show that they are tracing decisions back to a rationale and providing members with a model-based understanding of how their AI systems function. Explainable AI will build trust and help organizations resolve issues in a timely manner while allowing for the responsible growth of AI systems. It will position transparency as a strategic necessity and not just a technical preference.

AI Governance Market – Investment & Development Insights

| Indicator | Insight |

| Venture capital investment in AI governance & responsible AI startups (2024–2025) | Over USD 3.5–4.0 billion globally, driven by regulatory readiness and enterprise demand |

| Average annual enterprise spend on AI governance platforms | USD 0.5–2.5 million per large enterprise, depending on scale and regulatory exposure |

| Growth in Responsible AI and governance-related R&D budgets | 25–35% YoY increase among large enterprises adopting generative AI |

| Share of AI projects requiring formal governance review | 60%+ of enterprise AI initiatives in regulated industries |

| Increase in demand for AI governance consulting services | 30%+ YoY growth, especially in BFSI, healthcare, and government sectors |

| Cloud-based AI governance platform investment share | 55% of total platform investments, reflecting preference for scalable deployments |

| Share of AI governance solutions integrated into DevOps / MLOps pipelines | 48%, indicating shift toward operationalized governance |

1. Global Regulatory Milestones and Policy Frameworks

The most significant recent trend within the AI Governance market is the formalization of the EU AI Act in August 2024. The EU AI Act represents the first horizontal regulation on artificial intelligence in the world, which delineates AI systems by risk levels and has stringent requirements for "high risk" applications. The Act has already begun to set standards for companies around the world that begin prepping their operations for the Act's rules and regulations to avoid exorbitant fines.

The rest of the world is also reaching regulatory milestones. Italy recently released its "Strategy Italy 2025" plan that lays out a clear horizon on inclusive and sustainable national AI development, and lays out its views on how governance should be accomplished to achieve the country's economic aspirations. Although the United States has not made progress on federal legislation to regulate AI as quickly, many states have begun drafting their own AI-related bills, and the 2023 Executive Order on Safe, Secure, and Trustworthy AI at the federal level was a first for governance. While the path is not complete, the world's leaders are moving onto a spectrum of "hard" regulation away from the "soft" ethical guidelines that marked the last 10 years.

2. Strategic Mergers, Acquisitions, and Partnership Deals

The AI governance market is experiencing consolidation, whereby major technology providers are integrating governance into their software platforms. Microsoft, AWS, Google, and others are acquiring or forming partnerships with AI safety and compliance applications or startups to bolster its "Trust, Risk, and Security Management" (AI TRiSM) portfolio. AI Governance is now recognized as a critical part of an organization's AI infrastructure and no longer as a value-add or optional product.

The technology firms and traditional consulting and auditing firms are forming many partnership and merger types as well. Some application software firms are partnering with the "Big Four" accounting firms to deliver the complete and full solution that organizations are looking for to combine technical monitoring with legal, regulatory and compliance expertise. The evolving complexities of "algorithmic audits," as defined by emerging regulations, are colliding the need for organizations to have a baseline technical knowledge combined with an understanding of the legal requirements they need to comply with in the marketplace.

3. New Technology and Product Innovation

The AI governance landscape is rapidly innovating towards real-time monitoring and automated compliance. New product launches and features are more frequently delivering "AI black box recorders" that will track every decision an AI makes and record an audit log for regulators and upper management to pull as needed. The nascent call for synthetic data generation tools is also growing. This is where organizations and businesses utilize some artificial intelligence tools to train and test their data models without using their real member's data and privacy.

Finally, "Privacy-Preserving Machine Learning" (PPML) is beginning to wrestle for dominance in the governance landscape with new techniques such as federated learning and differential privacy that are beginning to be included as features of governance platforms for organizations to examine data, within strict data protection laws. All of these technological advances are rapidly moving toward a future of autonomous governance, whereby compliance will be built into the AI ecosystem.

The AI governance market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

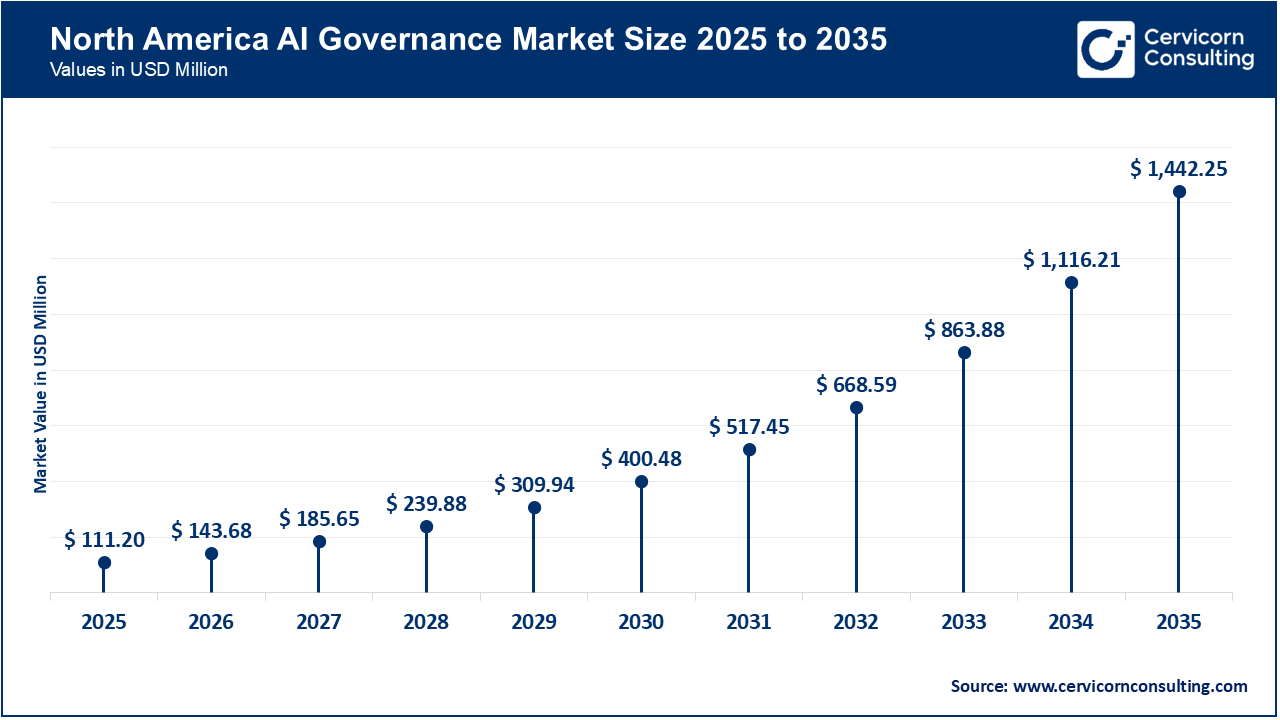

The North America AI governance market size was estimated at USD 111.20 million in 2025 and is projected to reach around USD 1,442.25 million by 2035. North America represents a mature and commercially advanced AI governance market, driven by widespread enterprise AI adoption and increasing regulatory coordination across federal and state levels. While the U.S. does not yet have a single comprehensive AI law, guidance from federal agencies, executive actions, and sector-specific rules are pushing organizations to formalize governance structures. Enterprises are proactively investing in governance platforms to manage legal exposure, reputational risk, and internal AI sprawl. Strong demand is also supported by the region’s high concentration of AI developers, cloud providers, and regulated industries.

Recent Developments:

The Asia-Pacific AI governance market size was accounted for USD 88.50 million in 2025 and is forecasted to grow around USD 1,147.82 million by 2035. The Asia-Pacific region is characterized by diverse regulatory maturity levels and policy approaches, creating a strong need for flexible and localized AI governance solutions. Countries such as China emphasize strict state-led controls, while others like Japan, South Korea, and Australia pursue risk-based and innovation-friendly frameworks. Rapid AI adoption across manufacturing, fintech, and smart infrastructure further increases governance complexity. As organizations operate across multiple APAC jurisdictions, demand is rising for governance platforms that support regional compliance customization, data sovereignty, and scalable deployment models.

Recent Developments:

The Europe AI governance market size was reached at USD 80.93 million in 2025 and is expected to hit around USD 1,049.68 million by 2035. Europe is the most regulation-driven market globally, anchored by the implementation of the EU AI Act and complementary digital regulations. The region’s approach mandates risk classification, documentation, transparency, and post-deployment monitoring, making governance tools essential rather than optional. Both European and non-European enterprises operating in the EU are aligning their global AI practices with EU standards to avoid fragmentation. This “compliance-first” environment has accelerated adoption of governance solutions focused on risk management, auditability, and lifecycle oversight.

Recent Developments

AI Governance Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 33.8% |

| Europe | 24.6% |

| Asia-Pacific | 26.9% |

| LAMEA | 14.7% |

The LAMEA AI governance market was valued at USD 48.36 million in 2025 and is anticipated to reach around USD 627.25 million by 2035. The LAMEA region is emerging as a high-potential market, driven by a mix of regulatory development and sovereign AI investment. Latin American and African countries are increasingly drafting AI strategies focused on ethics, inclusion, and data protection to attract investment and manage societal risk. Meanwhile, Middle Eastern nations are investing heavily in sovereign AI infrastructure, national models, and localized governance frameworks. These dynamics favor cloud-based governance platforms, advisory services, and scalable solutions tailored to evolving regulatory environments.

Recent Developments:

The AI governance market is segmented into component, functionality, deployment mode, organization size, Industry vertical, and region.

Solutions segment dominates the AI governance market due to their central role in enabling policy enforcement, risk assessment, auditing, and lifecycle management of AI systems. Enterprises prioritize integrated governance platforms that provide dashboards, automated controls, reporting, and compliance management across multiple AI use cases. As regulatory scrutiny increases, organizations prefer scalable, end-to-end software solutions that can be embedded directly into AI development and deployment workflows, making solutions the primary revenue contributor in this segment.

AI Governance Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Solutions | 64.2% |

| Services | 35.8% |

Services segment is the fastest-growing component as organizations increasingly require external expertise to design, implement, and operationalize AI governance frameworks. Consulting, implementation, audit, and managed services are in high demand, particularly among enterprises navigating complex regulatory environments or lacking in-house expertise. As governance moves beyond tooling into organizational transformation, demand for advisory and ongoing compliance services is expected to accelerate rapidly.

Risk and compliance functionality segment currently dominates the market, driven by regulatory mandates and enterprise risk mitigation needs. Organizations prioritize capabilities that help identify regulatory exposure, automate compliance reporting, and ensure alignment with evolving AI laws. This functionality is critical for enterprises operating across multiple jurisdictions, making it the most widely adopted and commercially mature segment.

AI Governance Market Share, By Functionality, 2025 (%)

| Functionality | Revenue Share, 2025 (%) |

| Risk & compliance | 26.8% |

| Data governance for AI | 19.4% |

| Transparency & explainability | 16.1% |

| Monitoring & operations | 14.7% |

| Ethics & Responsible AI | 12.3% |

| Model governance | 10.7% |

Transparency and explainability is the fastest-growing functionality segment as trust becomes a core requirement for AI adoption. Enterprises are increasingly required to explain AI decisions to regulators, customers, and internal stakeholders, especially in high-impact use cases. Advances in explainable AI techniques and growing demand for human-readable model insights are driving rapid adoption of this functionality across industries.

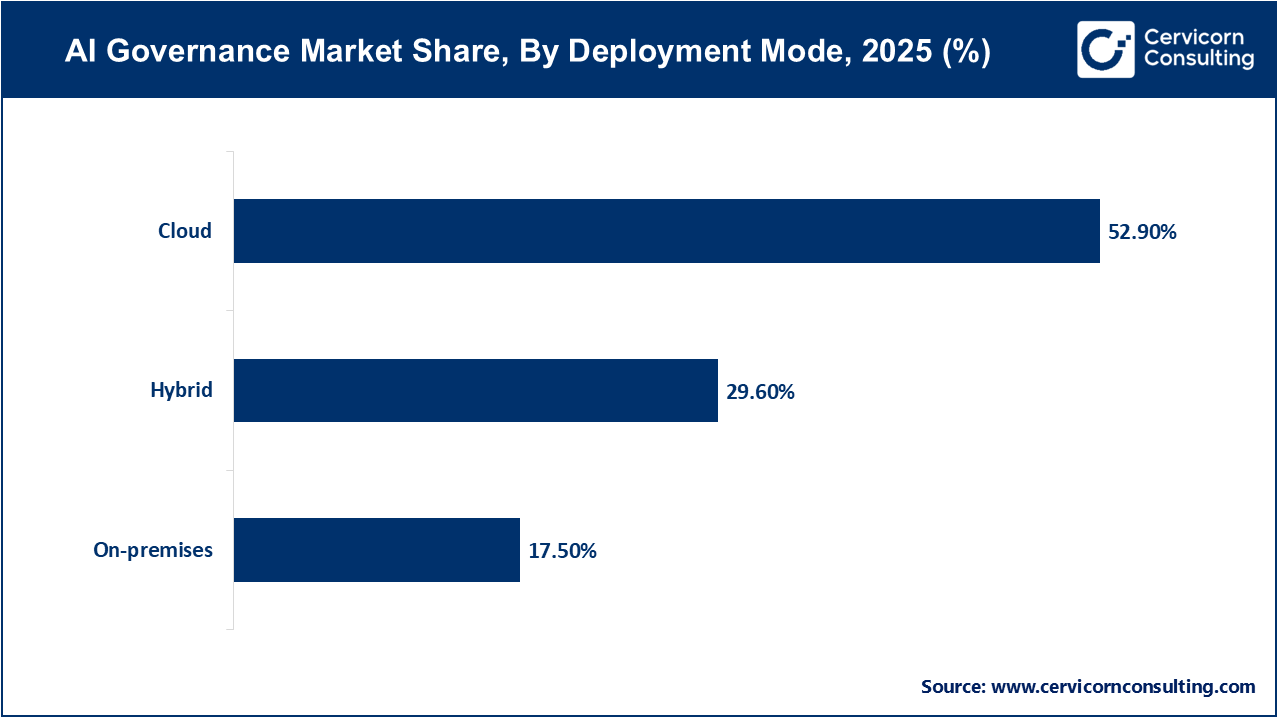

Cloud deployment dominates the AI governance market due to its scalability, flexibility, and lower upfront costs. Cloud-based platforms enable centralized governance across distributed AI environments, making them ideal for enterprises with geographically dispersed teams. The ability to update compliance rules and monitoring mechanisms in real time further strengthens cloud adoption, particularly among large organizations and digital-first enterprises.

Hybrid deployment is the fastest-growing segment as organizations seek to balance flexibility with data sovereignty and security requirements. Regulated industries increasingly prefer hybrid models that allow sensitive data or critical AI workloads to remain on-premises while leveraging cloud capabilities for analytics and reporting. This deployment mode is gaining traction as enterprises adopt more complex, multi-environment AI architectures.

Large enterprises dominate the AI governance market due to their early adoption of AI technologies, higher regulatory exposure, and greater financial capacity. These organizations often operate across multiple regions and industries, requiring sophisticated governance frameworks to manage risk, compliance, and ethical considerations. Their scale and complexity make governance platforms a necessity rather than an option.

AI Governance Market Share, By Organization Size, 2025 (%)

| Organization Size | Revenue Share, 2025 (%) |

| Large enterprises | 71.4% |

| SMEs | 28.6% |

Small and medium-sized enterprises represent the fastest-growing segment as AI adoption expands beyond large corporations. Cloud-based and modular governance solutions are lowering entry barriers, enabling SMEs to implement governance without heavy infrastructure investment. As regulations increasingly apply regardless of company size, SMEs are rapidly adopting lightweight governance tools to remain compliant and competitive.

The BFSI sector dominates the AI governance market due to its heavy reliance on AI for credit scoring, fraud detection, risk modeling, and customer analytics. Strict regulatory oversight and the high consequences of AI errors make governance essential in this sector. Financial institutions are early adopters of governance platforms to ensure transparency, fairness, and regulatory compliance.

AI Governance Market Share, By Industry Vertical, 2025 (%)

| Industry Vertical | Revenue Share, 2025 (%) |

| BFSI | 26.5% |

| Government & defense | 18.2% |

| Healthcare & life sciences | 16.9% |

| Manufacturing | 14.1% |

| Retail & consumer goods | 11.6% |

| Telecommunications | 7.4% |

| Others | 5.3% |

Healthcare and life sciences is the fastest-growing industry vertical, driven by the rapid adoption of AI in diagnostics, drug discovery, and clinical decision support. The high stakes associated with patient safety and regulatory approval are accelerating demand for governance frameworks that validate model accuracy, bias, and reliability. As clinical AI applications expand, governance adoption in this sector is expected to grow at a strong pace.

The global AI governance market has moved from being a peripheral consideration, to a keystone of the modern digital economy. The market is projected to be worth USD 4,267 million by 2035 - indicative of the premium value trust and safety presents in a world increasingly influenced by AI. The movement from voluntary ethics to mandatory regulation, as seen with the EU AI Act, provides the necessary regulatory framework for enterprises to transparently scale their AI deployments whilst maintaining compliance. While the cost of compliance and technical complexity presents challenges, governance automations and "governance-by-design" will define the moving forward.

Ultimately, the AI governance market of the future will be defined by its value bridging innovation and regulation. Sovereign AI and generative AI are transforming the services influenced by AI, the organizations that succeed will not see governance as a cost, but a strategic asset. By embedding structures of transparency, fairness, and accountability in their AI, enterprises can create the long-term trust needed to maximize the potential of artificial intelligence. The evolution of AI governance, will undoubtedly be one of the remaining tech developments to shape the decade.

By Component

By Functionality

By Deployment Mode

By Organization Size

By Industry Vertical

By Region