AI Agents Market Size and Growth 2025 to 2034

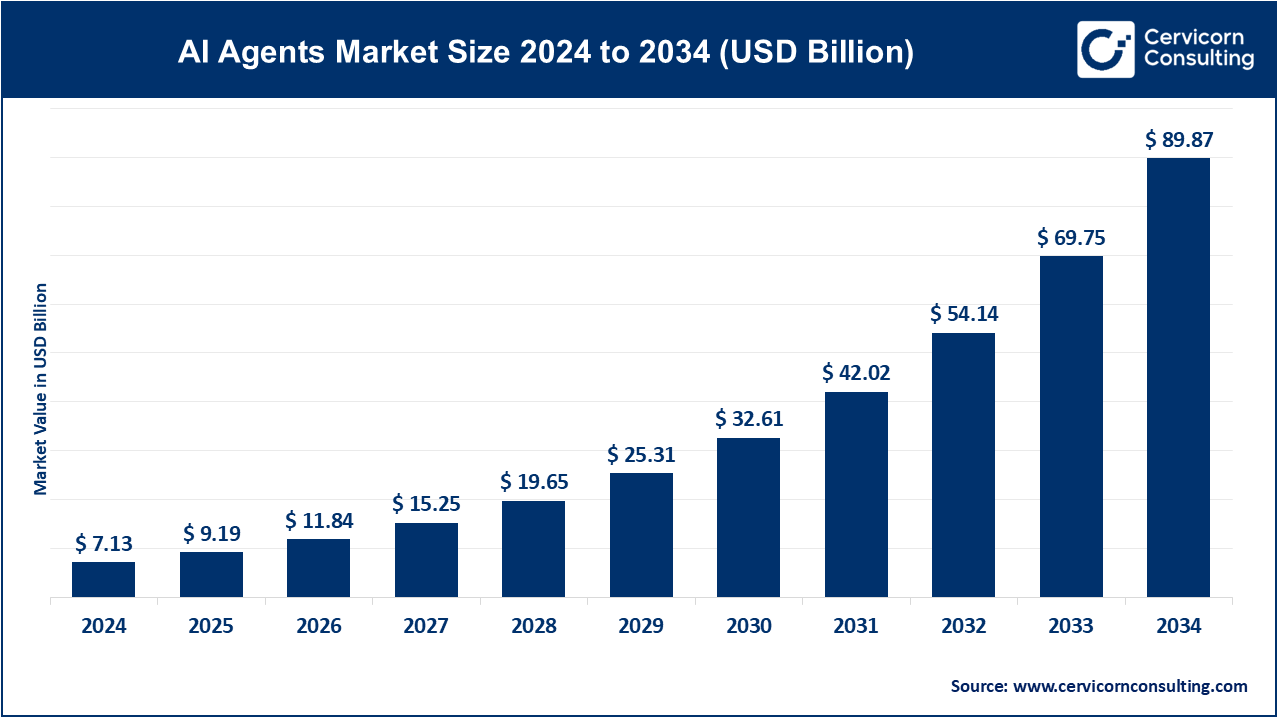

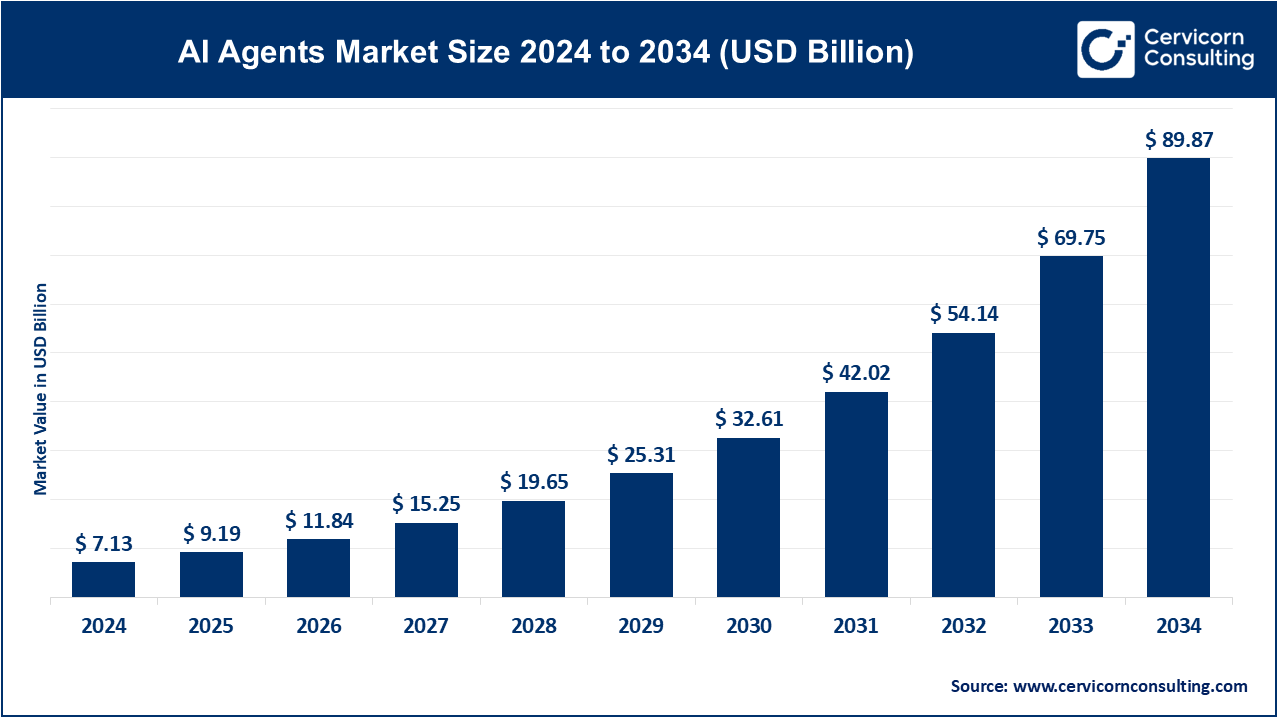

The global AI agents market size was reached at USD 7.13 billion in 2024 and is expected to be worth around USD 89.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 43.98% over the forecast period from 2025 to 2034. The AI agents market is concerned with the design and use of intelligent software systems which are capable of performing tasks, making decisions, and using user or system interfaces for communication, automation, intelligent interaction, and decision making through the means of machine learning, computer vision, and natural language processing. Artificial intelligence agents can enhance efficiency and automation in customer service, healthcare, finance, and industrial operations while also improving personalization and real-time decision making.

The need for digital transformation, enhancement of AI models, especially generative AI and large language models, and increasing enterprise spending on automation are some of the factors fostering growth in the market. The combined efforts of cloud service providers and technology companies are also regulatory interest in ethically framed AI is further advancing this market. With increased sophistication, AI agents will greatly enhance context awareness transforming organizational and individual workflows in an automated environment. From the perspective of an intelligent digital ecosystem, the role of AI is expected to be fundamentally transformative.

Report Highlights

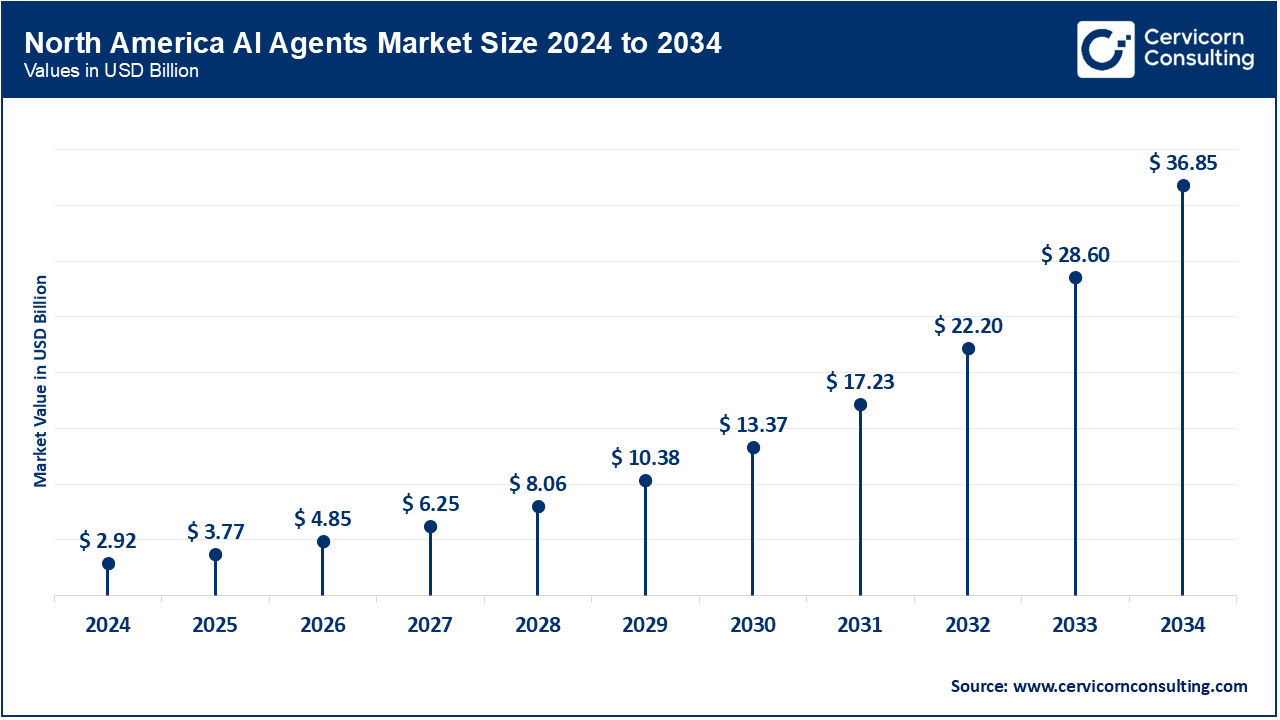

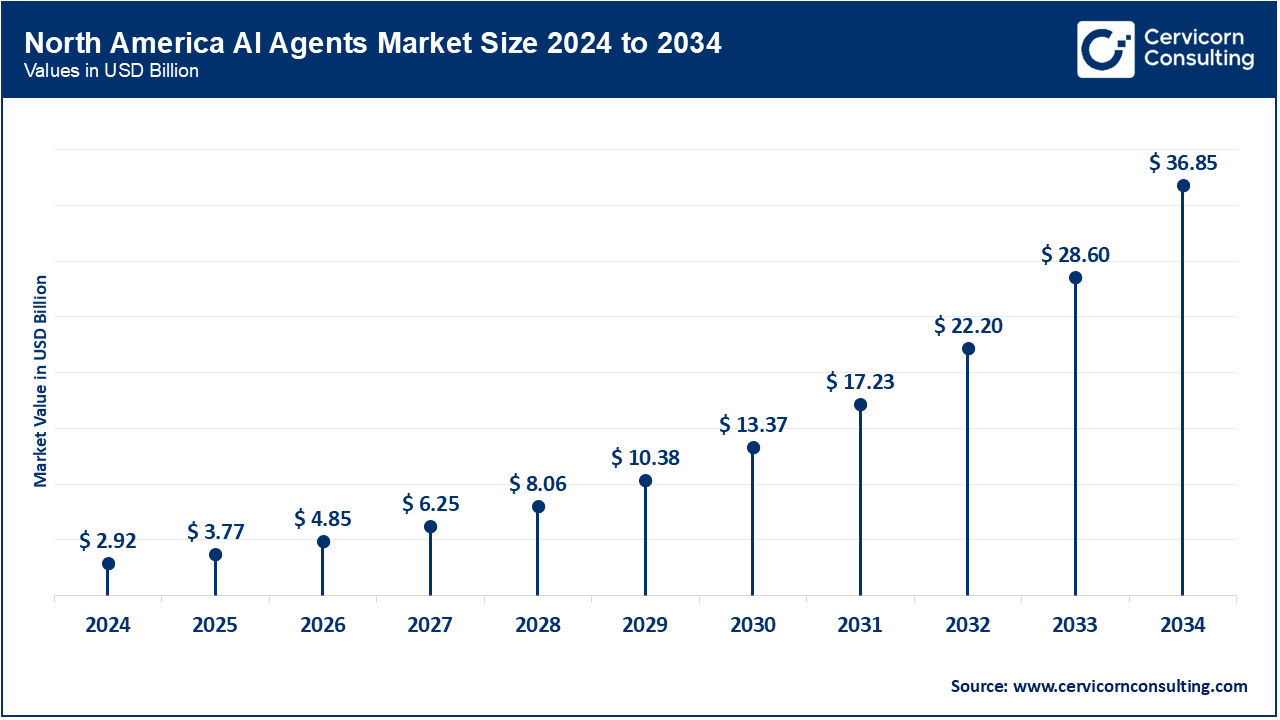

- North America has emerged as the leading region, capturing the highest revenue share of 41% in 2024.

- Asia-Pacific followed with a 34% revenue share, fueled by rapid digital transformation.

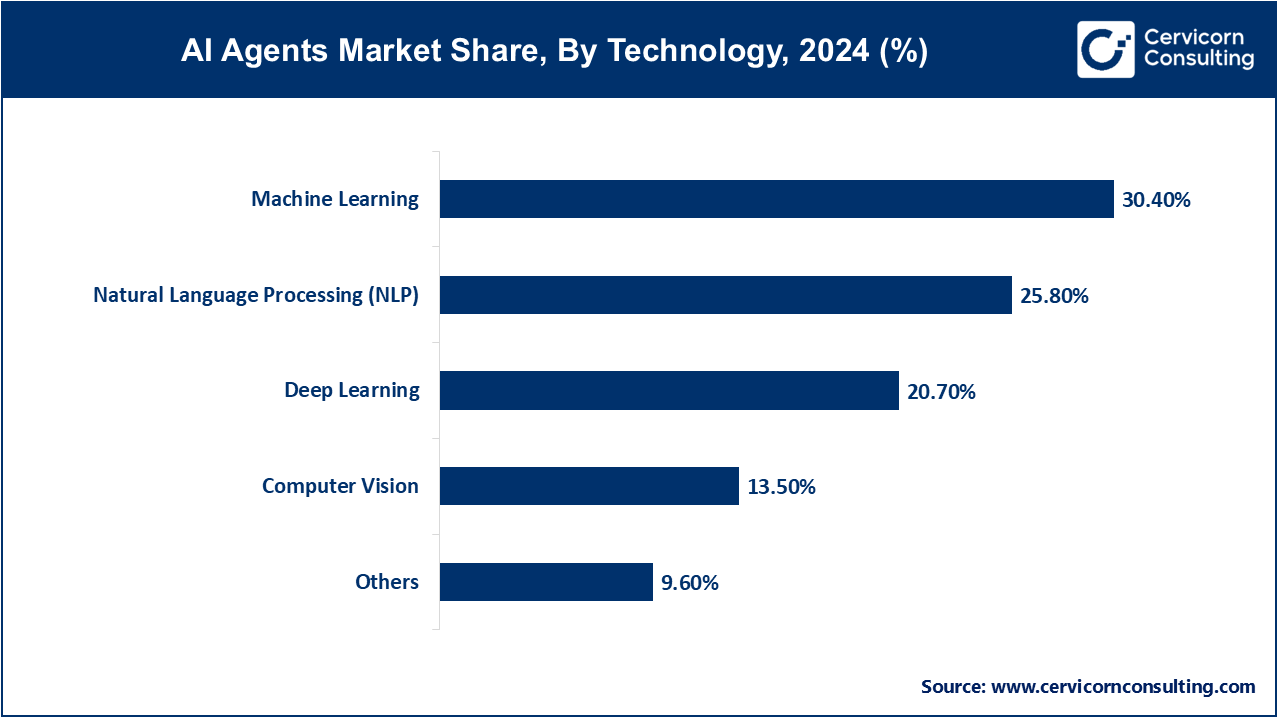

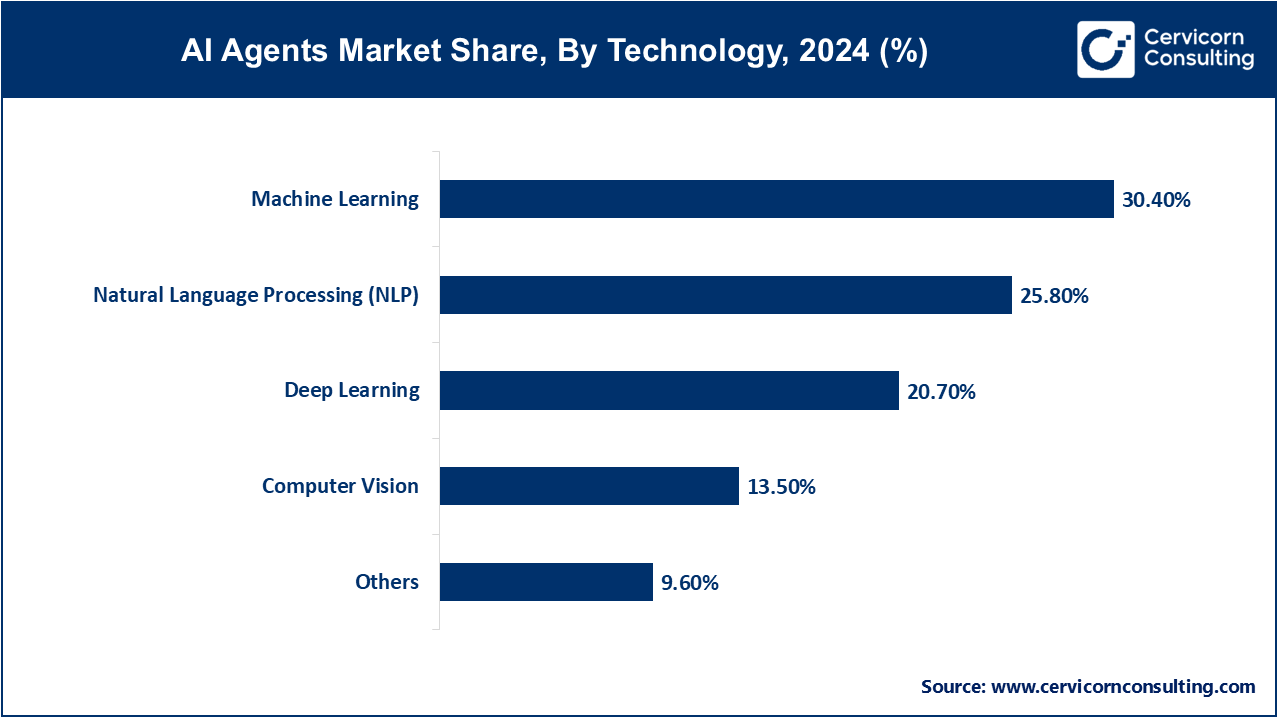

- By technology, the machine learning segment garnered a significant 30.40% revenue share in 2024.

- By agent system, the single agent systems segment held the highest revenue share in 2024.

- By agent type, the ready-to-deploy agents segment were the market leaders in 2024.

- By offering, the horizontal AI agents segment recorded a dominant 57% revenue share in 2024.

- By application, the customer service and virtual assistants segment has captured highest revenue share in 2024.

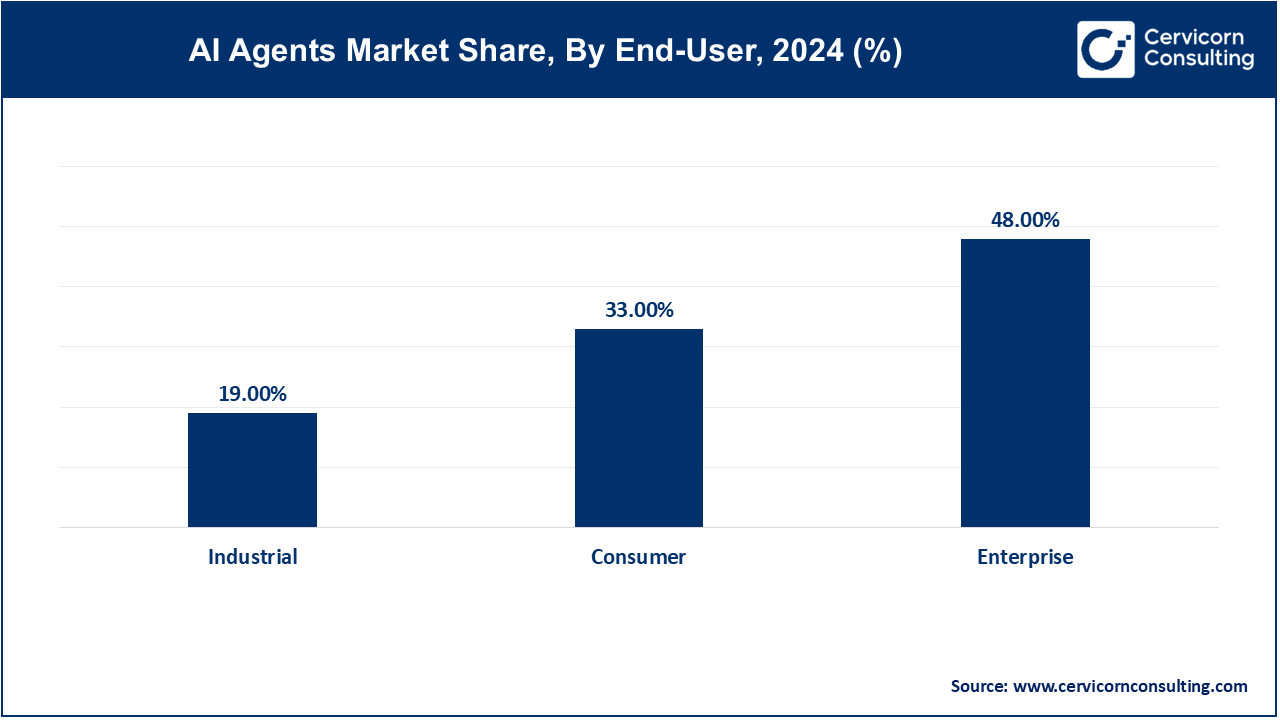

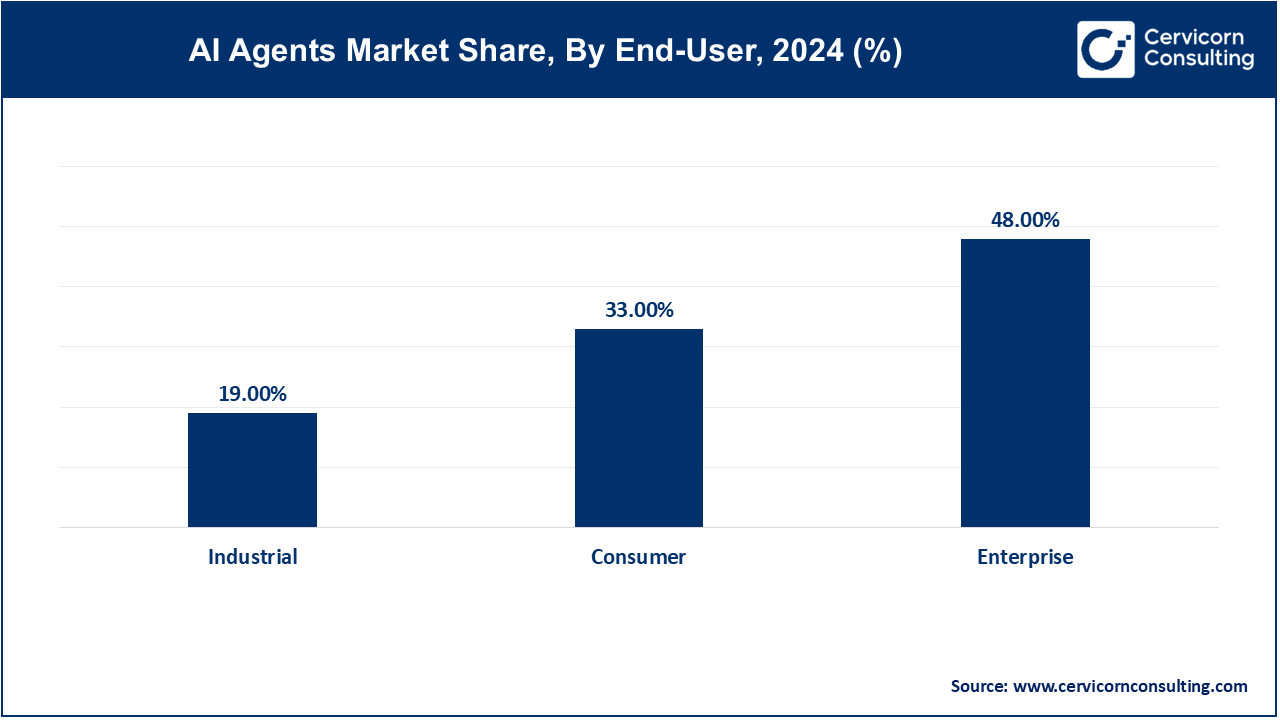

- By end-user, the enterprise segment accounted for a 48% revenue share in 2024.

Market Growth Factors

- Expansion of Smart Devices and IoT Systems: The implementation of AI technologies which concurrently work with smart devices and IoT systems is drastically changing the manner in which businesses operate accepting real-time data and automated control. A good example would be in retail where AI powered agents not only manage stock control but also automate the ordering and restocking of goods thereby reducing operational inefficiencies. In hospitality, AI systems improve customer relations by modifying room temperatures based on historical data on guests’ preferences. There is growth in the global AI in IoT market because of more IoT devices with integrated AI being used in healthcare, agriculture, and even industrial automation. This is central to the fact that more and more sectors depend on AI agents to improve operational efficiency.

- Reduction in Cost of AI Computing Devices: The advancement in the computing infrastructure AI agents deploy has made real-time processing of data a commonplace reality bringing the cost of using AI agents down. New open-source high-performance AI models like DeepSeek-2 make it much easier for businesses to design and customize their own models without spending a fortune. Such movements exemplify the trend of healthy competition and subsequently transparency in the software sector – more options and better products for lower prices serve the market well. This simultaneously means that all types of businesses, including SMEs, are now enabled to use AI agents and improve their operations.

- Artificial Intelligence as a Service Availability via APIs: The integration of AI agents into corporate operations owing to the introduction and rise of APIs and services of AI with cloud technology has become considerably easier. AI features on offer at Google and Microsoft Azure can be adapted to particular business requirements, and then utilized. The flexibility of such AI features has spurred their incorporation across numerous sectors, such as healthcare and finance. Also, in 2024, we saw the launch of AI Gateway for IBM API Connect, enabling a centralized control of AI services access for ease of use and integration. These numerous and diverse innovations indicate just how important cloud-based AI technologies are for modern businesses.

- The Integration of AI Agents in Mobile Apps and Enterprise Systems: Integrating AI agents in mobile apps and enterprise systems changes business operations for the better by enhancing user experience and improving processes. For example, is KPMG’s investment in Google Cloud, where in 2024 they expanded the partnership by $100 million to enable datalytics and cybersecai in advancement of AI for other industries. This program was purposed towards creating advanced AI capabilities in healthcare diagnostics, fraud detection, automation of loan processing, etc. The example we used shows the real change that companies experience in operational productivity and innovativity after embedding AI agents into their systems.

Market Trends

- Shift from Rule-Based Bots to LLM-Powered Conversational Agents: The employment of conversational interfaces powered by LLMs in place of conventional bots signifies a major leap in the AI field’s understanding and capability of response generation. These advanced agents demonstrate the capabilities of understanding context, managing multi-turn dialogues which include more sophisticated conversations and providing precise content. In 2025, OpenAI implemented Model Context Protocol (MCP) on all its products, ChatGPT and Agents SDK included, aimed at unifying cross-ai tool interaction for system-level AI tool interface standardization. This move toward centralization allows ease of cohesive integration and interaction among AI systems marking one of the primary emerging trends of the agents market in AI.

- Adoption of AI Co-Pilots in Productivity and Development Tools: The implementation of automation and real-time assistance has reshaped professional functions through productivity and development tool adoption. AI-based assistants have automated the document drafting, code generation, and data analysis processes, thereby saving considerable time and effort. Companies have integrated AI co-pilots as parts of Microsoft’s Office suite and GitHub has Copilot aiding developers in coding. The trend epitomizes rising dependability on AI to enhance productivity in professional work.

- Rise in Multimodal AI Agents: The processing and interpretation of diverse forms of data, including texts, images, and audios, is being performed by Multimodal AI Agents which are now becoming more popular. These agents enhance user interactions across applications and provide more contextual interactions. For instance, Mercedes-Benz automotive AI agents are integrated into MBUX Virtual Assistant which offers drivers a highly personalized multimodal experience. This marks the movement towards advanced and more flexible AI agents available on the market.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 9.19 Billion |

| Expected Market Size in 2033 |

USD 69.75 Billion |

| Projected Market CAGR 2025 to 2034 |

43.98% |

| Prime Region |

North America |

| Leading Growth Region |

Asia-Pacific |

| Key Segments |

Technology, Agent System, Agent Type, Application, End-User, Region |

| Key Companies |

Google LLC, IBM Corporation, Microsoft Corporation, Salesforce, Inc., SAP SE, UiPath, Amazon Web Services, Inc., Oracle Corporation, Zendesk, Inc., ServiceNow, Inc. |

Market Dynamics

Market Drivers

- Surge in Remote Work and Digital Interactions: The use of working from home increased the necessity for using AI to acquire and use the needed communication, collaboration and productivity tools. AI agents are currently managing emails, helping to schedule meetings, as well as being an assistant during virtual business hours. Their employment is critical at workplaces that operate virtually. There are companies that leverage Zoom and Microsoft Teams and have created specialized AI tools for these platforms to enhance supervisory collaboration. This example further supports the claim that AI agents are necessary to respond to the shifts caused by the new order of businesses.

- Growing Usage of AI Agents for Fraud Detection and Cybersecurity: Advances in technology are contributing to the increasingly developed AI agents in the fraud and cybercrime area by detecting peripheral monitoring and removing threats. The agents analyse enormous data sets for abnormal behaviors that identify patterns that the AI can anticipate timely countermeasure responses. In 2024, KPMG in partnership with Google Cloud created financial security measures for their clients by designing AI systems for fraud prevention. This driver showcases AI agents and their growing responsibility in the protection of digital asset and information.

- Consumer Preference for Voice-Based and Chat-Based Interactions: Consumers are increasingly talking to chatbots or using mobile apps as they provide faster and more efficient ways of interacting with companies. AI agents fulfil these requests by providing instantaneous responses and customized services. To meet this requirement, companies have deployed AI-powered chatbots and voice-responders at their customer service terminals. This motivator factors emphasizes the importance of AI agents in enhancing customer services as well as obtaining proprietary data for the firm.

Market Restraints

- Data Privacy and Regulatory Compliance: Data such as GDPR (EU) and CCPA (California) impose stringent guidelines on AI agents concerning the handling of personal information. AI agents are prone to working with delicate information; thus, these regulations pose challenges towards the efficiency with which these controllers can be deployed. The EU has made suggestions on changes to the AI Act which focuses on enforcement of transparency and responsibility of AI systems, increasing the compliance burden on developers. Corporations deploying AI agents are faced with expensive legal audits and data governance frameworks to avoid heavy fines. Because of these challenges, new companies that do not have legal teams to help them are unable to expand rapidly into new markets.

- High Initial Setup and Integration Costs: With a shift to AI agents, modern-day businesses have to integrate advanced technologies within their operations, however, this comes with a multifaceted cost, which includes, training employees, ongoing maintenance, and infrastructural updates. In 2023, a government report focused on SMEs noted that several businesses pointed out the sophisticated initial expenditures along with intricate system fusion requirements as major bottlenecks for AI agent adoption. This also curtails the adoption of AI in forwarding markets and smaller enterprises.

- Dependence on Quality and Availability of Data: AI agents are highly reliant on data and a lot of underperformances will be due to the validity of the data that is used for decision making, particularly where that data is deemed to be of poor quality due to bias or wrong data. In their report on AI applications, the United States National Institute of Standards and Technology gave particular emphasis to the quality and trustworthiness of data as the primary challenge in AI deployments. This means companies are constrained by the need to gather, cleanse, and curate enormous datasets, which is quite costly.

Market Opportunities

- Expansion in Healthcare Applications: The healthcare industry is experiencing incredible growth due to the introduction of new AI technologies for diagnostics, patient care and even management. With US regulatory bodies, like the FDA, in support of AI diagnostic tools like IDx-DR (to screen for diabetic retinopathy), hospitals will continue to seek AI adoption as an outcome of telehealth services. This encouragement of adoption through regulation helps to create very viable market potential for new innovations.

- Adoption in Government and Public Services: AI tools are also being engaged with broadly across the government sector for functions like citizen engagement use in chatbots, and welfare fraud detection systems. Therefore, AI is enhancing service delivery standards, and facilitating delivery accuracies. For example, in 2023, the UK Government Digital Services engaged with multiple government departments to utilise virtual agents for interactive services powered by AI, promising quicker response times and increases in efficiencies and cost savings. These implementations by public sector institutions greatly diversify market prospects for providers of AI agents.

- Growth in Education and E-Learning Platforms: Increasingly, educational institutions are employing AI agents to facilitate individualized instruction and for administrative tasks. The U.S. Department of Education sponsored some projects cantered around engaging students more effectively through mobile adaptive learning in 2024. It will now be easier for developers of AI agents to address students’ needs in virtual and remote classrooms, which change as education systems evolve.

- Increased Investment in AI Ethics and Transparency: The advancement AI technologies bring more attention to its ethics creating new policies and technologies which aids transparent conduct of AI agents. Partnership on AI published new guidelines on explainable and equitable AI in 2025. Adoption of ethical AI by firms provides them an opportunity to differentiate their offerings deepen trust with users and comply with developing laws and regulations.

Market Challenges

- Ensuring AI Transparency and Explainability: Ensuring sufficient explanation is provided to explain the decision-making processes is one of the main, and most difficult issues with AI agents and is essential for acceptance, trust and compliance to regulation. For 2024 there is already requirements for explanation for decision made by generative AI technologies, with high-risk AI applications, according to the European commission's any day issue, draft AI ACT. Adequate plans, design and validation will need to be established to ensure compliance. If not, then the AI agents will be unusable in regulated sectors like finance and healthcare which is a considerable risk.

- Reducing AI Bias and Fairness Issues: AI agents possess the capacity of introducing, or, at a minimum, perpetuating the bias implicit in data used for training. Consequently, and thus unfair outcomes can result. In 2023 the U.S. Equal Employment Opportunity Commission (EEOC) established guidelines to address bias in AI hiring platforms. Developers are required to have plans for robust bias detection and mitigation, but this is a continual and complex challenge to raise market acceptance of AI, and ensure legal compliance.

Regional Analysis

The AI agents market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

Why is North America leading the AI agents market?

The North America AI agents market size was valued at USD 2.92 billion in 2024 and is expected to reach around USD 36.85 billion by 2034. This region is still embracing AI agents at an unmatched rate as the U.S. significantly increases investment in AI technology in finance, healthcare, and logistics, among other sectors. The recent rebranding AI Safety Institute to Centre for AI Standards and Innovation by the US Department of Commerce captures the intent focus of turning around national security issues related to AI. Canada is also moving forward with the use of AI in public services and other areas. In Mexico, there is growing use of AI in logistics, especially in optimizing freight and supply chain management. This clearly demonstrates the North American efforts aimed at the development of AI in the region.

Why is Europe growing exponentially in AI agents market?

The Europe AI agents market size was estimated at USD 1.43 billion in 2024 and is projected to hit around USD 17.97 billion by 2034. The market is growing exponentially in Europe and France is one of the frontrunners. The EU commissioned InvestAI at the AI Action Summit in 2025 which aims to enhance AI across Europe with an investment of USD 228.2 billion. This includes building AI gigafactories with an investment of €20 billion. France itself has received close to USD 125.5 billion in private investments toward AI. Meanwhile, Germany’s Mistral AI is collaborating with Helsing from the UK to build military AI technologies. The UK is ensuring regulation on artificial intelligence with strong public demand for supervision on ethical use. All these strategies are aimed towards the advancement of AI technologies in the continent and show Europe’s dedication to responsible development of AI.

Why is the Asia-Pacific region driving faster growth in the AI agents market?

The Asia-Pacific AI agents market size was accounted for USD 2.42 billion in 2024 and is predicted to surpass around USD 30.56 billion by 2034. The use of AI agents is particularly acute in the Asia Pacific region with the strong adoption from China, India, and Japan. As per the 2023 Interim Measures for the Management of Generative AI Services, China controls AI technology. India ranks number one in global consumption of ChatGPT at 13.5% of users, and also founded the India AI Safety Institute for responsible AI use. Japan leads the region with AI utilization at 82%. Australia and South Korea are also increasing AI usage across the board in many sectors. These actions signal greater efforts towards strengthening policies and governance frameworks around AI technology in the region.

AI Agents Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

41% |

| Europe |

20% |

| Asia-Pacific |

34% |

| LAMEA |

5% |

Why is LAMEA region emerging in the AI agents market?

The LAMEA AI agents market size was reached at USD 0.36 billion in 2024 and is expected to be worth around USD 4.49 billion by 2034. Brazil is emerging as a key adopter of AI agents in public services, healthcare, and agriculture in the Latin America region driven by national AI programs and international technology partnerships. In the Middle East and Africa, the UAE has set a strategy to become a world leader in artificial intelligence by 2031 and is executing its Strategy for Artificial Intelligence, Abu Dhabi is constructing the world’s largest AI data centre in partnership with Microsoft and G42. Saudi Arabia is intent on AI’s contribution of $135.2 billion to its economy by 2030, with investment focusing on finance, healthcare, and smart cities. Also, South Africa is adopting AI in the provision of public services and infrastructure. These countries are all using AI agents to advance innovation, governance, and sustainable economic growth.

Segmental Analysis

Technology Analysis

Based on technology, the market is classified into machine learning, natural language processing (NLP), deep learning, computer vision and others.

The machine learning segment led the market in 2024, accounting for over 30.5% of the global revenue, reflecting its foundational role in powering intelligent agent behavior, personalization, and predictive capabilities. The deep learning segment is expected to witness highest CAGR over the forecast period.

Agent Type Analysis

Build-Your-Own Agents: The specialized Build-Your-Own Agents solutions allow companies to build AI agents tailored precisely to their requirements. One such agent, Operator, developed by OpenAI, enabled in January 2025 for automated online appointment scheduling and form filling. Such empowerment enables firms to create AI agents that they can seamlessly embed into their processes. The remarkable versatility provided by Build-Your-Own Agents is particular appealing to businesses seeking tailored AI systems.

Ready-to-Deploy Agents: Ready-to-Deploy Agents are complete all-in-one AI systems with every single configuration pre-prepared, which can be directly plugged into the business processes. The agents possess a set of predefined use cases which cuts down the required effort and expenditure of deploying these solutions. An illustration of this is Gupshup's AI Agent Library, launched in 2024, which offers conversational agents trained for different industries to enhance business revenues. Such off-the-shelf solutions are targeted towards businesses that require swift execution without tailor made features. The availability of Ready-to-Deploy Agents enables AI to be incorporated in many industries faster.

Agent System Analysis

Multi-Agent Systems: These systems consist of several AI agents that interact and cooperate to achieve intricate goals. Multi-Agent Systems are excellent for dealing with problems that are either hierarchical or need to be tackled with a Distributed Approach. For example, Siemens AG uses agentic AI to interpret real-time sensor data from industrial machines to enable predictive maintenance, thus averting unplanned downtimes by 25 percent. The collaborative approach of Multi Agent Systems makes them more effective in multi-faceted tasks in different industries.

Single-Agent Systems: Within Single-Agent Systems, an individual AI agent works alone to accomplish certain tasks such as an agent. These systems are appropriate for applications with specific goals that are not very detailed or complicated. Open AI’s Operator, an internet-based task completion agent, is set to launch in 2025 and will exemplify a Single Agent System. Operators do not require much supervision hence single agent systems are appealing to businesses in need of uncomplicated AI support. The operational simplicity of Single-Agent Systems makes them adaptable to various overhead conditions.

Application Analysis

Customer Service and Virtual Assistants: Customer service and virtual assistance AI agents improve the ease of service delivery by responding quickly and accurately. For instance, Walmart employs AI chatbots that automatically manage 80% of customer inquiries, including returns and inventory questions. The incorporation of AI agents into the CRM and other communication systems improves AI personal assistance and automation of systems. They are of great use in marketing and sales automation as productivity is increased tremendously.

Sales and Marketing: AI agents undertake automated precision work in lead allocation, campaign analysis, and meeting scheduling. Customer engagement increased significantly with the deployment of Salesforce's Agentforce in September 2024, with retailers noting chatbot traffic surges of 13-fold during the 2024 holiday season. These agents operate across CRM systems and other communication channels, aiding in efficiency and personalization. In respect of sales and marketing, AI agents optimize workflows further and augment organizational performance.

Human Resources: AI agents in Human Resource Services are streamlining recruitment, onboarding, and employee engagement processes. They streamline document collecting and interview scheduling through candidacy screening, improving HR Processes. AI is evolving HR by driving efficiency and enhancing candidate experiences. In relieving HR professionals of monotonous activities, AI agents allow human resources strategists to devote time to meaningful work. These shifts in practice provide rich examples of how transformatively AI is changing human resource management. Examples like this clearly indicate the adoption of AI applications in human resource management practices.

Sales and Marketing: AI agents also perform more complex roles in sales and marketing by automating several tasks such as lead qualification, meeting scheduling, and campaign analytics. Customer engagement increased significantly with the deployment of Salesforce's Agent force in September 2024, with retailers noting chatbot traffic surges of 13 fold during the 2024 holiday season. These agents operate across CRM systems and other communication channels, aiding in efficiency and personalization. AI agents in sales and marketing perform tasks at organizational operational levels.

Finance Services: AI agents support clients in the financial services industry with customer relations, fraud prevention, and risk assessment. LOXM, an AI at JPMorgan & Chase, executes high-frequency trades and responds to real-time trading stimuli more rapidly than human traders. Armed with these AI agents, decision making and productivity at financial institutions is greatly improved. With real time analysis and automated customer interactions, these examples show the functioning of AI agents in the finance industry.

Other Applications: AI agents are used in many other fields apart from the ones discussed above. In healthcare, for instance, AI agents help with diagnostics and patient care management. These applications illustrate the extensive range of AI agents across sectors. The versatility of AI agents is exemplified in the reduction of unplanned downtime using agentic AI for predictive maintenance performed by Siemens AG. Their further advancement is bound to happen due to enhancing technologies.

End User Analysis

Based on end user, the markey is classified into enterprise, consumer, and industrial. The enterprise segment has dominated the market in 2024, , as companies continue to adopt AI agents for operational efficiency, customer engagement, and digital transformation initiatives. The industrial segment is expected to witness highest CAGR over the forecast period.

AI Agents Market Top Companies

Recent Developments

Recent partnerships in the AI agents market emphasize innovation and cross-industry integration. Microsoft collaborates with OpenAI to enhance AI agent capabilities in productivity and cloud services. Google teams up with Salesforce to embed advanced conversational agents in CRM platforms. IBM partners with SAP to deploy AI agents for enterprise automation and compliance. Salesforce joins forces with AWS to scale AI-driven customer service solutions. These collaborations focus on improving automation, enhancing user experience, and accelerating AI adoption across sectors. Together, they drive the global shift toward intelligent, scalable AI agent technologies.

- In May 2025, At Microsoft Build, Microsoft highlighted the rise of AI agents and its vision for an open agentic web, where AI agents can perform tasks across personal and business contexts. Major announcements included new tools for building and managing AI agents on platforms like Azure AI Foundry, GitHub, and Windows. Microsoft introduced Elli Mobility GmbH, enterprise-grade agent orchestration, and open-sourced GitHub Copilot Chat in VS Code. The company is advancing open standards with Model Context Protocol (MCP) and launched NLWeb for conversational web interfaces. These innovations aim to empower developers and organizations to securely build, deploy, and govern AI agents, accelerating digital transformation.

- In March 2025, Oracle has launched AI Agent Studio for its Fusion Cloud Applications, empowering customers and partners to easily create, extend, deploy, and manage AI agents and agent teams across the enterprise at no extra cost. This platform enables users to customize AI agents for specific business needs, enhancing productivity and automation. AI Agent Studio offers advanced testing, validation, and security tools, and allows seamless integration with Oracle Fusion Applications and third-party agents. The move builds on Oracle’s strategy of embedding AI across its applications, supporting organizations in accelerating digital transformation and maximizing the value of AI investments.

- In May 2025, Google is developing a software AI agent designed to assist software engineers throughout the entire development process, from handling tasks to documenting code, and has been demonstrating this tool to employees and outside developers ahead of its annual developer conference. This agent is part of a broader push to showcase innovative AI products, including voice-enabled Gemini chatbot features, as Google faces increasing investor pressure to deliver results from its AI investments. The company is expected to unveil these advancements at its I/O conference, with the keynote scheduled for May 20 in Mountain View, California

These developments highlight major progress in the AI agents market, with industry leaders like Google, Microsoft, IBM, Salesforce, Amazon, and OpenAI driving innovation in intelligent automation and AI integration. These companies are advancing AI agent capabilities across sectors including customer service, finance, healthcare, and enterprise solutions. Their investments in natural language processing, multi-agent systems, and AI orchestration platforms are accelerating digital transformation worldwide. By focusing on scalable, secure, and explainable AI technologies, they support improved productivity and decision-making. These pioneers align closely with global digitalization trends, enabling businesses to enhance efficiency and customer engagement while shaping the future of work.

Market Segmentation

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Computer Vision

- Others

By Agent System

- Single Agent Systems

- Multi Agent Systems

By Agent Type

- Build-Your-Own Agents

- Ready-to-Deploy Agents

By Application

- Customer Service and Virtual Assistants

- Robotics and Automation

- Financial Services

- Security and Surveillance

- Healthcare

- Marketing and Sales

- Human Resources

- Gaming and Entertainment

- Legal and Compliance

- Others

By End-User

- Enterprise

- Consumer

- Industrial

By Region

- North America

- APAC

- Europe

- LAMEA