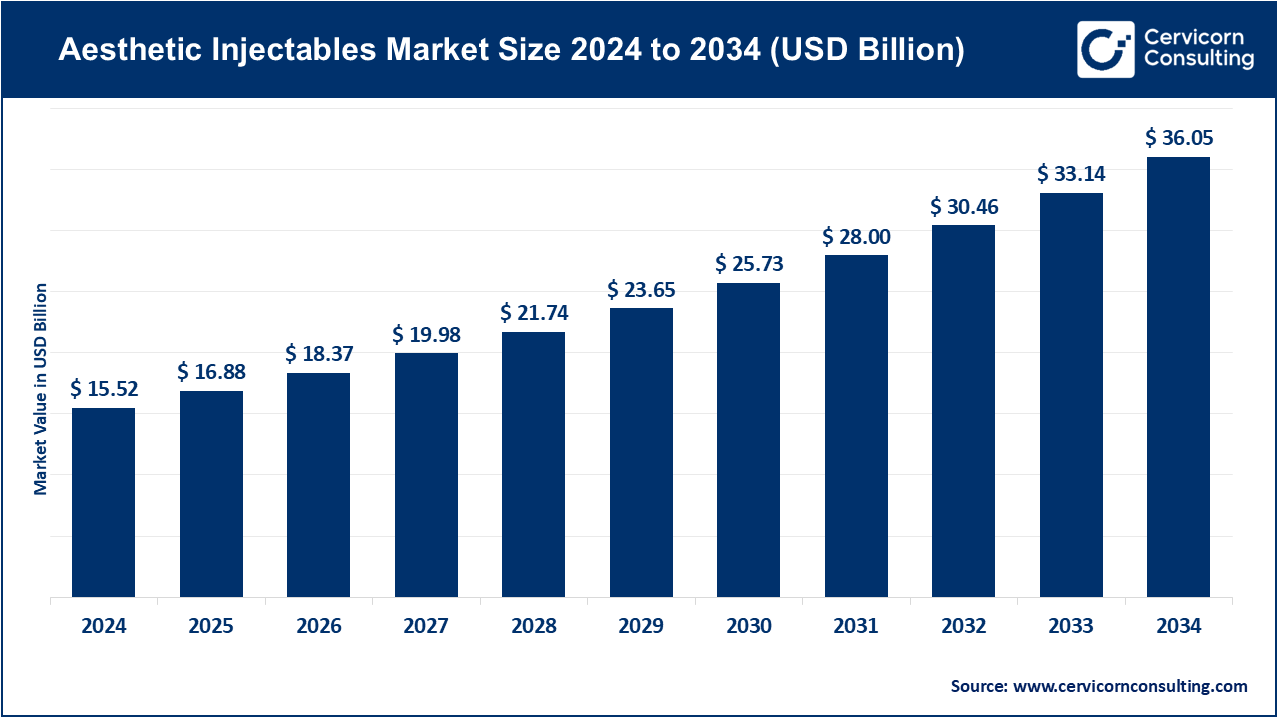

The global aesthetic injectables market size was valued at USD 15.52 billion in 2024 and is expected to be worth around USD 36.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.8% over the forecast period 2025 to 2034. The increasing interest in cosmetic procedures that are less invasive, the enhancement of one's appearance in everyday life, and the popularity of aesthetic injectables are some of the factors that are contributing towards the adoption of the aesthetic injectables technologies. Unlike aesthetic surgery, injectables such as botulinum toxin, hyaluronic acid, and collagen-based fillers have quicker recovery times, less risk, and help achieve immediate results which is a huge benefit and highly attractive for both men and women. The advances in injectables formulation, techniques and safety of injectables offer even more positive outcomes. The impact of social media and the increase in skilled aesthetic practitioners have also heightened consumer demand, especially in emerging cosmetic markets.

With the introduction of personalized and combined aesthetic injectables which incorporate AI facial analysis, 3D imaging, and bio-stimulatory injectables help achieve more natural results, the aesthetic injectables market is rapidly changing in innovative ways. The creation of regenerative and bio-based fillers which incorporate stem cells and collagen stimulators is a huge step towards natural and sustainable aesthetic outcomes. The demand for injectables which offer subtle results and preventive anti-aging are fueling the development of aesthetic injectables for modern cosmetic dermatology. The injectables are a textural improvement in personalized anti-aging, regenerative dermatology and skincare, and contemporary aesthetic medicine. They are expanding the boundaries of what injectables can achieve in modern healthcare and beauty both around the world and specifically in global markets.

Advances in Hybrid & Regenerative Injectables

Technological Integration & Personalized Aesthetics

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 16.88 Billion |

| Expected Market Size in 2034 | USD 36.05 Billion |

| Projected CAGR 2025 to 2034 | 9.80% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Treatment Area, Age Group, Distribution Channel, Region |

| Key Comapnies | AbbVie Inc. (Allergan Aesthetics), Galderma S.A., Merz Pharmaceuticals GmbH & Co. KGaA, Ipsen Pharma, Revance Therapeutics, Inc., Suneva Medical, Inc., Medytox Inc., Sinclair Pharma, Bloomage BioTechnology Corporation Limited, Anika Therapeutics Inc., Prollenium Medical Technologies, Hugel, Inc., Evolus, Inc., Croma Pharma, Bausch Health (Solta Medical) |

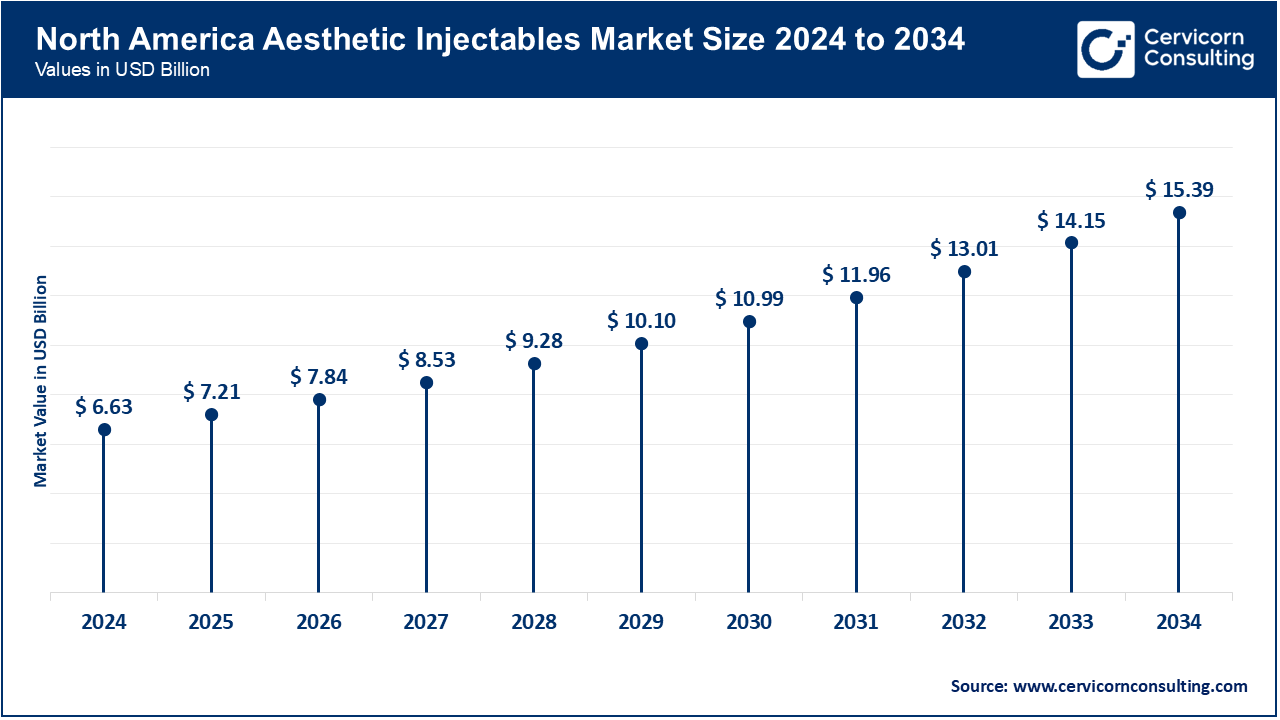

The aesthetic injectables market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is a leader in the market as a result of highly developed healthcare infrastructure as well as high disposable income and early adoption of advanced aesthetic technologies. In June 2025, the pioneer AI-assisted injector system and hybrid filler-toxin products were adopted by dermatology chains in the U.S. This adoption of AI in dermatology demonstrates the region's leader status in quality and precision in aesthetic dermatology. North America is the most profitable market in the world as a result of a strong network of clinics, hospitals, and medical spas, and as a result of technological advancement and consumer demand.

Europe excels in the market due to strong safety and quality regulatory frameworks, established dermatology centers, and focus on safety and quality in the aesthetic dermatology market. In March 2025, several European clinics, in line with highly protective safety standards, released advanced safety-standardized regenerative and bio-stimulating fillers. Europe's strong focus on long-term data, clinical evaluation of processes and use of AI in facial mapping solidifies Europe's status in aseptic injectable dermatology.

The Asia-Pacific region is the fastest growing region, with an increase in demand for aesthetic procedures due to higher disposable incomes, an increase in medical tourism, and an increase in awareness surrounding non-invasive cosmetic procedures. South Korean and Indian clinics performing regenerative polynucleotide fillers and lip augmentation procedures for the first time in May 2025 showcased polynucleotide fillers as a significant advancement in the region. China, Japan, and South Korea are growing their clinical networks and digital consultation networks, confirming the region’s rapid growth in market expansion and digital transformation.

Aesthetic Injectables Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 42.70% |

| Europe | 20.30% |

| Asia-Pacific | 28.20% |

| LAMEA | 8.80% |

Although LAMEA has the smallest market share compared to the world, there has nevertheless been positive growth in the region owing to awareness and the development of clinics in the region. Increased procedures with dermal fillers, botulinum toxin, and lower facial aesthetic surgeries were observed in Brazilian and Mexican metropolitan centers as well as in the middle east, specifically the UAE and Saudi Arabia. Although these are not large-scale, there are country-sponsored initiatives and international relations that will set the region up for growth to come.

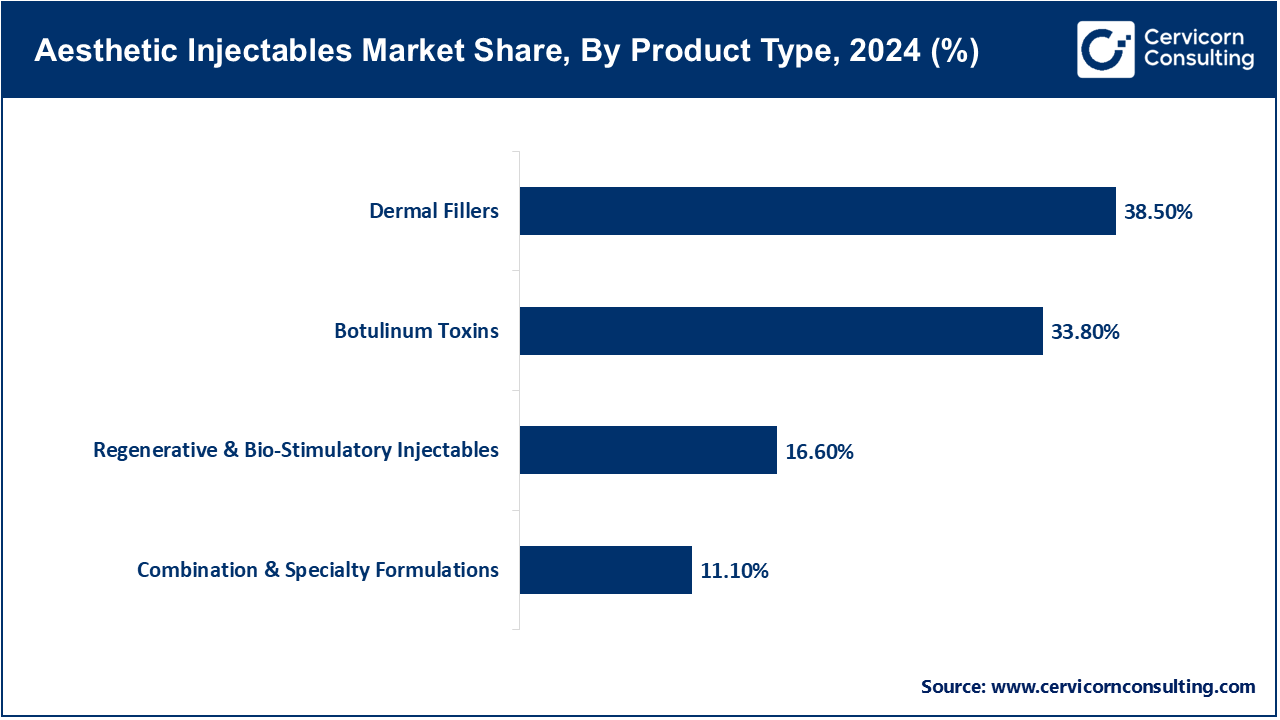

Botulinum Toxins: Self-facing dynamic wrinkles are primarily treated with botulinum toxins due to their muscle-relaxing properties. Allergan commenced its marketing of a next generation formulation to physician clientele in North America in March 2025 as a result of enhanced patient and procedural gratification due to its rapid onset and prolonged duration of effects.

Dermal Fillers: Filling of hollows in the face and wrinkle softening are performed with hyaluronic acid, calcium hydroxylapatite, and collagen-based dermal fillers. Galderma's soft tissue augmentation innovation in Europe was driven by the newly launched advanced hyaluronic acid filler in April 2025, which offered soft tissue augmentation improvement due to tissue integration, as well as filler longevity.

Regenerative & Bio-Stimulatory Injectables: These accomplish prolonged and natural effects by driving the production of collagen and elastin in the body. Adoption of stimulatory injectables received a boost due to the introduction of a polynucleotide-based filler in the Asia pacific region by a South Korean company in May 2025 which enhanced skin elasticity and improved skin texture.

Combination & Specialty Formulations: Fillers and toxins are used in hybrid products to target multiple areas for treatment, for instance wrinkle alleviation and volume restoration. A dual action filler-toxin product launched by a US company in the June of 2025 encapsulates the multitasking tendency in aesthetic solutions.

Facial Wrinkle Reduction: Focusing on the forehead, crow's feet, and frown lines. As of February 2025, the U.S. noted a 12% increase in the carrying out of botulinum toxin procedures. This trend probably reflects a heightened interest in minimally invasive procedures for anti-aging.

Lip and Cheek Augmentation: Adding contour and volumetric distribution to features. As of April 2025, clinics in Europe and especially in the Mediterranean, noted a progressive increase in the use of hyaluronic acid fillers for lip and cheek augmentation, especially within the younger millennial populace desiring refinements.

Aesthetic Injectables Market Share, By Treatment Area, 2024 (%)

| Treatment Area | Revenue Share, 2024 (%) |

| Facial Wrinkle Reduction | 36.80% |

| Lip & Cheek Augmentation | 25.20% |

| Skin Rejuvenation & Anti-Aging | 19.70% |

| Non-Facial Aesthetic Applications | 10.40% |

| Others | 7.90% |

Skin Rejuvenation and Anti-Aging: Fine line treatments, hydration, and texture improvement booster. As of May 2025, the Asia-Pacific clinics embraced rejuvenation with regenerative injectables, amplifying the demand for anti-aging procedures.

Non-Facial Aesthetic: Neck, hands, décolleté, and body contouring. As of June 2025, the Middle East strategic and aesthetic centers noted the use of bio-stimulatory injectables for non-facial areas of the body, signaling the expansion of treatment portfolios.

Clinics & Dermatology Centers: Primary providers of injectables offering specialized treatments. In January 2025, North American AI-derived dermatology chains diversified service portfolios with AI-guided injectables to enhance safety and precision during injectables administration.

Hospitals & Multi-Specialty Centers: These are Hospitals Cosmetic units offering minimally invasive procedures. In March 2025, several European Hospitals aimed at demand integration with aesthetic injectables into dermatology and plastic surgery departments to spear head the growing client demand.

Aesthetic Injectables Market Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Clinics & Dermatology Centers | 57.50% |

| Hospitals & Multi-Specialty Centers | 20.80% |

| Medical Spas & Wellness Centers | 14.90% |

| E-commerce / Direct-to-Consumer Sales | 6.80% |

Medical Spas & Wellness Centers: Non-traditional clinics focusing on beauty and wellness. In April 2025, Asia-Pacific medical spas reported strong uptake of regenerative fillers, driven by growing consumer awareness and preference for holistic aesthetic solutions.

E-Commerce/Direct-to-Consumer Sales: Pre-approved aesthetic products and virtual consultations. In May 2025, U.S. online portals to clinics integrated virtual injectable consultation services, streamlined a clinical procedure and expanded the market reach.

Market Segmentation

By Product Type

By Treatment Area

By Age Group

By Distribution Channel

By Region