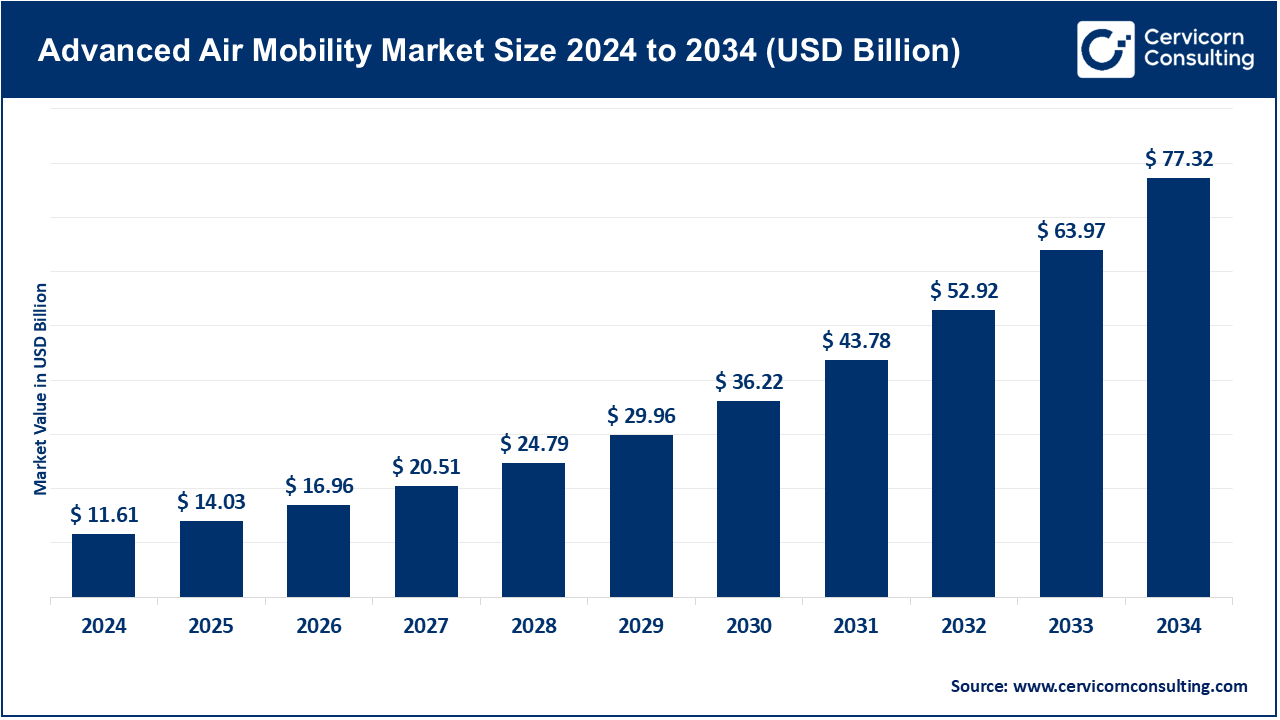

The global advanced air mobility market size was reached at USD 11.61 billion in 2024 and is expected to be worth around USD 77.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.30% over the forecast period from 2025 to 2034. The advanced air mobility market is expected to grow at a significant rate owing to rising urban congestion, advancements in electric propulsion technologies, and increasing investments in sustainable air transport. Supportive government regulations and growing demand for faster, on-demand intra- and inter-city transportation are further propelling market expansion globally.

The advanced air mobility (AAM) sector focuses on building and weaving together new flying services such as electric vertical-takeoff-and-landing (eVTOL) vehicles, self-flying drones, and city air taxis that carry both people and packages. Driving this effort are cities clogged with traffic, a rising demand for cleaner transport, and steady leaps in battery power, lighter materials, and onboard automation. Money is pouring in from aerospace majors, hungry startups, and government funds eager to speed AAM beyond the prototype stage, while regulators draft rules for safe airspace, certification, and public trust. Partnerships among airframers, ride-hailing firms, and utility builders are already laying down the first pieces of a network that can grow nationwide. With urban areas swelling and smart-city plans gaining ground, the AAM ecosystem stands ready to reshape short hops, crisis rescues, and last-mile delivery by offering quicker, greener, and far more flexible choices than cars or trucks.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 14.03 Billion |

| Expected Market Size in 2034 | USD 77.32 Billion |

| Projected CAGR 2025 to 2034 | 21.30% |

| Dominant Area | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Mode of Operation, Vehicle Type, Propulsion Type, Range, Maximum Take-off Weight, Application, End User, Region |

| Key Companies | Urban Aeronautics, Volocopter, The Boeing Company, Archer Aviation, Joby Aviation, EHang Holdings Limited, Wisk Aero, Airbus SE, Lilium GmbH, Vertical Aerospace, Embraer SA, Kitty Hawk, Bell Textron Inc. |

Pilot Operated: In October 2024 the FAA issued a Special Federal Aviation Regulation (SFAR) that spells out pilot credentials and operating rules for powered-lift machines, including eVTOLs flying air-taxi routes. The rule eases Part 135 certification for pilot-flown AAM services. In mid-2024 Archers Midnight eVTOL gained a commercial operating nod under this framework. Joby Aviation, meanwhile, carried out its first urban test flight with a human crew in November 2023. Taken together, these moves supply a firm legal baseline for crewed advanced air mobility. Clearly defined training tracks and certification paths support safety and skill in the cockpit. As a result, eVTOL travel has moved from prototype test beds to an overseen public service.

Advanced Air Mobility Market Revenue Share, By Mode of Operation, 2024 (%)

| Mode of Operation | Revenue Share, 2024 (%) |

| Pilot operated | 76.50% |

| Autonomous/remotely operated | 23.50% |

Autonomous/Remotely Operated: By March 2024 the full Remote ID rules will take effect, mandating that every drone broadcasts its ID and real-time location so regulators can safely monitor flights operated at a distance. NASA and the FAA have already cleared their shared UAS Traffic Management system for beyond-visual-line-of-sight missions below 400 feet, opening the door to large-scale remote service. Later that year Joby Aviations purchase of the autonomy pioneer Xwing brought cutting-edge software and hardware under existing FAA certifications. At the same time, the agency specified the responsibilities of local governments in protecting privacy and overseeing unmanned aircraft. Together, these regulations set clear rules, a chain of accountability, and uniform safety benchmarks for autonomous advanced air mobility operations. Built-in oversight tools allow authorities to track risks even when a human pilot is not onboard. Taken as a whole, this legal framework makes remote flying safer for the public and easier for industry to adopt.

eVTOL Aircraft: The FAA in 2023 advanced eVTOL regulation with its Urban Air Mobility Concept of Operations v2.0 and a powered-lift SFAR, officially acknowledging the new tech. In November Joby flew a city demo over Manhattan, and in midsummer 2024 the company logged a 523-mile test with a hydrogen-electric prototype. Archer Aviation also won Part 135 approval to run its Midnight air taxi. Meanwhile, Draft Advisory Circular AC 21.17-4 is framing type certification for winged powered-lift designs. Together, these moves give a legal and operational bedrock for rolling out commercial eVTOL service. Ongoing guidance covers safety, noise limits, and pilot rules.

Advanced Air Mobility Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| EVTOL Aircraft | 79.10% |

| STOL Aircraft | 13.40% |

| Conventional fixed-wing aircraft | 7.50% |

STOL Aircraft: Short takeoff-and-landing planes still fall under Part 23, yet the ConOps v2.0 places them in its tiered urban air corridors. Although large-scale STOL operations have yet to launch, normal certification channels keep regulatory work moving. Drafts of future SFARs are expected to extend powered-lift provisions to STOL airplanes that reach defined performance benchmarks. This wording suggests planned integration, yet remains subject to findings from operational service. Meanwhile, current rules still encompass STOL models, leaving them legally in the clear as authorities gather real-world proof.

Conventional Fixed-Wing Aircraft: Conventional fixed-wing aircraft still operate under long-standing Part 23 and Part 25 airworthiness rules, as well as ordinary air-traffic-control requirements. On that foundation, the FAA and EASA started aligning guidance in June 2024 to help these planes work alongside new AAM services. Although no separate regulations have emerged, the effort signals a growing legal framework that aims to weave legacy aircraft into urban air routes. Such moves are intended to let older models share city skies peacefully with the next generation of on-demand air mobility.

Electric Propulsion: The Electric segment has dominated the market in 2024. Electric propulsion occupies a central role in urban air mobility because FAA regulations-specified in the agency's SFAR and in 2023's second Urban Air Mobility Concept of Operations-plainly call for it. Joint FAA and EASA guidance released in June 2024 fleshes out the type-certification benchmarks intended for these all electric vehicles. On the ground, FAA-endorsed test flights conducted by leading advanced-air-mobility operators already show that electric craft can soar safely within the existing rulebook. The regulators license framework for e-VTOLs now factors in verified pilot curricula, quiet-operation protocols, and broad environmental compliance. Also, ElevateOS signed off on Joby in mid-2024, cementing electric power as an everyday operational mainstay. Simply put, planners who sit down to draft vertiport permits must take electric propulsion as their first legal duty. All these official signs put electric AAM on track to become the cornerstone for tomorrows city-to-city air service.

Gasoline-Powered Flight: Conventional piston aircraft still meet FAA Part 23 and Part 25 standards, yet city-level environmental rules are tightening and limiting their movement in crowded neighborhoods because of exhaust and noise. The FAA Urban Air Mobility Concept of Operations pushes for electric flying at low altitudes and quietly sidelines gas machines along primary urban routes. New regulations expressly demand clean power before any craft can be linked to vertiport networks. Zoning boards and environmental reviewers routinely write gasoline engines out of approval plans for emerging air-mobility terminals. Certified day-to-day operation is becoming rare as regulators and city administrations pull back on allowing them in urban airspace. In response, manufacturers are channelling resources into all-electric or hybrid-driveline projects. Collectively, these moves signal a clear and ongoing shift in the legal landscape guiding sustainable city air travel.

Turbine (Turbo): Aircraft powered by traditional gas turbines still gain certification through familiar FAA pathways, yet flying them above crowded neighborhoods invites tight new noise and emissions rules. Under existing powered-lift codes and low-altitude corridor plans, turbine trips are practically barred unless engines are retrofitted with heavy hush kits. Concept-of-operations papers for urban air mobility openly favor zero- or low-emission power systems wherever they touch city air. Even where the regulation book still allows turbine flights, local noise ordinances frequently bench those missions. City-approved vertiports routinely add further bans on turbine hardware. In short, the legal landscape now cheers for quieter, cleaner tech in order to meet AAM goals. Industry therefore realigns, sending turbine airframes toward long-haul regional runs or quiet freight routes that avoid metropolitan airspace.

Reciprocating (Piston): Light piston planes still fall under familiar FAA Part 23 rules, yet new urban air-mobility visions rank them low because of tough environmental targets. Developers eye verti-port licenses and find approval tied to engines that burn little fuel and make even less noise. Noise and emission thresholds baked into federal regs and local zoning now all but box out fixed-piston powerplants from dense precincts. Although technically permitted, piston flights in AAM settings struggle to win site clearances or grant money. As a result, public agencies and investors gravitate toward all-electric or hybrid prototypes that fit prized clean-air mandates. The policy pendulum thus redirects capital away from classic reciprocating power, sidelining it in the fast-evolving network of aerial mobility hubs.

Hybrid Propulsion: The hybrid segment is expected to witness the highest CAGR over he forecast period. Under current powered-lift rules, the FAA welcomes hybrids such as Jobys hydrogen-electric proof-of-concept, which logged a remarkable 523-mile leg in mid-2024. The statutory frame leans on performance-based criteria, letting blended systems clear safety and noise limits along the same certification highway as full-electric models. By permitting pilots to mix battery power with small quantities of fuel at low altitude, the agency opens corridors where range anxiety vanishes. This policy meshes with broader green goals because the bulk of flight still runs on clean kilowatts. Approvals for region-spanning hybrid routes echo the regulators comfort with transitional technologies. Such vehicles follow the same training regimens and sound caps that apply to their all-electric peers, provoking no extra burden for crews or operators. Above all, the legal nod to hybrids reinforces their value as a hedge for diverse fleets, offering planners and passengers additional options when demand spikes or infrastructure falls short.

Below 100-km Range: The Below 100-km Range segment has held leading position. The FAA Urban Air Mobility Concept of Operations opens routes shorter than 100 km as first urban air taxi corridors. These flights will be staffed by pilots qualified under the 2024 powered-lift SFAR. Domestic operator Archer already launched test runs in the zone, drawing on the new training rules and existing vertiport procedures. Required minimums cover visibility, noise emissions, and real-time battery checks. The short leg missions also profit from lighter Part 135 frameworks and fast-track city sound permits. Altogether, these legal tools sketch the working service area for early eVTOL rides. Limiting distances lets regulators contain risk while gradually spreading supporting infrastructure. As a result, initial fare-based flights link tightly packed metropolitan pairs.

100-250-km Range: Flights spanning 100 to 250 km gain formal approval via powered-lift and Part 135 clearances, a path already exercised in Jobys 2024 523-mile hydrogen-electric trial. FAA advice matches the longer range promise with robust safety checks for endurance missions. Common standards govern forward visibility, noise levels, and energy reserve at landing. Carriers must also prove hybrid systems and complete standard environmental reviews. Planning vertiports for these corridors usually requires notice and cooperation across city or even state lines. The resulting regulations anchor business cases for fare-paying regional shuttles. In essence, the framework allows service to grow step by step from crowded city blocks to wider interurban networks.

250-500 km Range: Flights falling within the 250 to 500-kilometer band now hitch onto fresh FAA Advisory Circulars that sketch airworthiness rules and day-to-day operating expectations. Although no scheduled service exists yet, early test hops bag BVLOS exemptions and clear technical proof of concept. Current regulations pertain mainly to trial runs and not formal timetables, and reviewers fixate on kinetic risk and energy reserves. Each operator still needs route-specific Part 135 sign-off or a formal waiver before turning wheels. Fueling networks and vertiport spacing are also weighed legally during standard environmental reviews. Presently rare, these flights lay down the regulatory paving stones for mid-range AAM once ground systems mature.

More than 500 km Range: Remarkable outings-such as Jobys 840-kilometer hydrogen-electric hop scheduled for mid-2024-show the FAAs readiness to stretch powered-lift limits through special one-off letters. Nevertheless, everyday commercial flights beyond the 500-kilometer threshold fall outside present plans for urban corridors. Legal scrutiny now zeros in on reserve energy, safety specs, and ground infrastructure that often lie far past normal vertiport grids. Carriers therefore must file tailored Part 135 applications that disclose extended-range capabilities and supporting systems. Policy backing is still in its infancy, waiting on type-certification scale-up and coordination across state lines. These standout missions create valuable legal templates for tomorrow's routes, yet widespread service hinges on harmonizing laws, fuel availability, and ramp infrastructure.

Cargo Transport: The cargo transport segment has dominated the market in 2024. Companies like Zipline within Part 135 now fly cargo BVLOS under short-term waivers granted for 2023-2025, paving the way for drone delivery under the law. Every mission still follows noise limits, defined routes, and environmental checks spelled out in the FAA's UAM Concept of Operations. Legal rules also bind drones to the same remote ID and crew training that govern manned aircraft. Regulators demand on-site observers and designated safety buffers for each flight. Approval of vertiports or smaller hubs carries cargo-specific conditions that must be met before ground facilities begin operations. This growing body of law sets the stage for large, compliant drone delivery networks.

Passenger Transport: The passenger transport expected to witness the highest CAGR throughtout forecast period. Mid-2024 saw the first Part 135 certificate issued, allowing Archer's Midnight to enter service while in June the FAA approved Jobys ElevateOS, creating a formal ground for paying air taxis. Updated rules now spell out the licenses pilots must hold, visibility and altitude floors, public-safety checks, and tight noise limits. Every new vertiport or passenger route still faces community meetings and full environmental studies, just as with highways or runways. Operators must also comply with Special Federal Aviation Regulation guidelines on sightlines, backup gear, and other measures for passenger safety. Each approval marks the shift from test flights to paying passengers. Taken together, these pathways mark the start of a new era in city travel.

Mapping and Surveying: More than 5,200 firms still lean on FAA Part 107 rules and Section 333 exemptions for overhead surveys. Starting March 2024, Remote ID will let regulators see who flies what, boosting trust in drone maps. LAANC grants almost instant permission for jobs below 400 feet. FAA privacy FAQs remind pilots that local laws may still ban flights over backyards in real time. Operators must log every flight, complete training, and keep remote ID on. Together, these rules help drones mix safely with city traffic while delivering precise topographic data.

Special Mission: Since 2023, Beyond Visual Line of Sight waivers and UTM services have powered green monitoring and disaster missions. The FAA now fast-tracks clearances for time-critical sorties so help can arrive minutes after an event. Crews still observe weight limits and fly only along routes set in advance. UTM platforms allow fire authorities and search teams to share airspace without conflicting paths. Jurisdictional laws also outline liability, privacy, and public-safety duties during high-pressure operations. Many operations still require Part 135 certificates or mission-specific exemptions. This solid legal framework turns unmanned aircraft into immediate, on-scene assets for wildfires, missing-person rescues, and live environmental monitoring.

Surveillance and Monitoring: Beginning in March 2024, Remote ID mandates that every flying drone continuously transmits its ID and location, making oversight clear and holding operators accountable. The Low Altitude Authorization and Notification Capability (LAANC) streamlines instant approval for monitoring flights below 400 feet in airspace surrounding busy airports. The FAA also reminds local governments that their privacy and trespass laws must shape drone use while still meeting public safety needs. Pilots therefore must keep sensors within prescribed limits and work strictly inside designated altitudes and flight paths. Any surveillance project needs a written plan proving it will not interfere with air traffic or exceed acceptable noise levels. Federal and state rules then guide how long video and other data can be stored, who may access it, and what reports the public should see. Collectively, these safeguards allow trustworthy monitoring to occur as part of broader advanced air mobility initiatives.

Commercial End Use: The FAAs 2023 Drone Act, a soon-to-launch powered-lift SFAR set for October 2024, and the revised UAM ConOps v2.0 now rest beneath one joint rulebook for commercial AAM activity. By early summer 2024, six firms-Archer, Joby, and others-had secured Part 135 certificates giving them official permission to carry fare-paying passengers. New permitting protocols spell out noise limits, green checks, and clear pilot-training benchmarks. Software platforms such as ElevateOS now hold official nods to run those flight decks. Vertiport licenses must fit local zoning, keeping city planners in the loop. Taken together, these rules lay a strong, united groundwork for AAM services to sprout in americas big towns.

Advanced Air Mobility Market Revenue Share, By End Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Commercial | 70.10% |

| Government & Military | 29.90% |

Government & Military End Use: In 2024 Joby clinched a $131 million deal with the U.S. Air Force for early-model eVTOLs, the first major federal order in the sector. The latas Agility Prime effort, paired with AFWERX, points to legal cover and dollars for defense projects. Bases run by the military enjoy lighter environmental reviews because federal permits supersede local rules. Agility Prime also welcomes hybrid test beds, letting innovators push the envelope before full certification. Key defense specs for propulsion and airworthiness are now being woven into the FAA's Powered-Lift guidance. Altogether, these partnerships set clear legal trails and tech corridors that connect military missions with everyday civilian AAM operations.

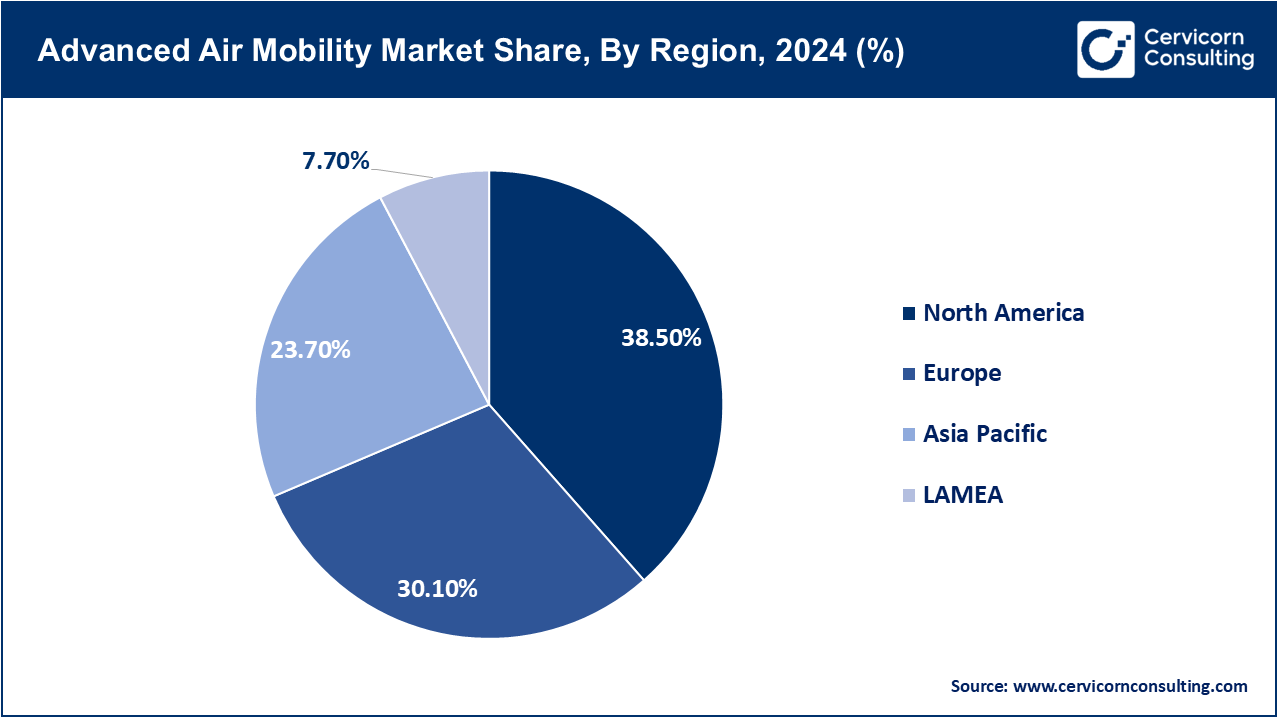

The advanced air mobility market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

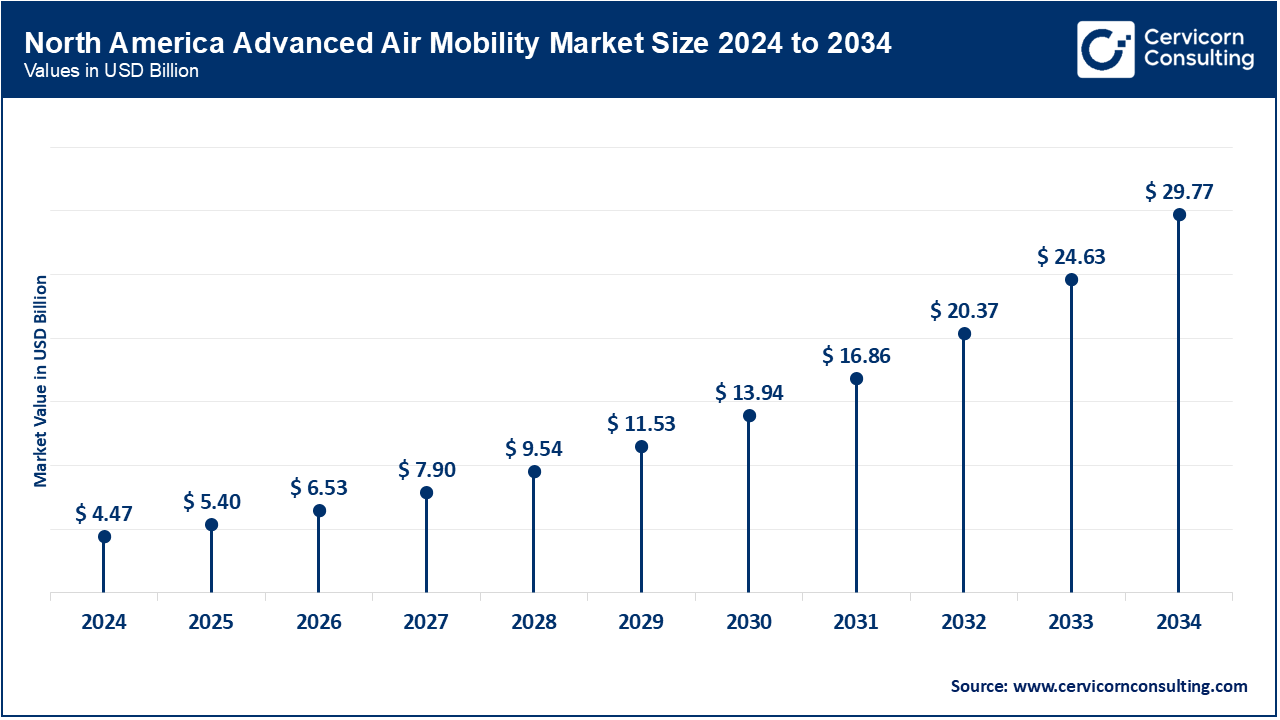

North America currently sits at the forefront, led by the United States, where early regulatory steps were taken through the FAA's UAM ConOps and SFAR rules introduced between 2023 and 2025. In 2024 Joby Aviation received a Special Airworthiness Certificate for its eVTOL prototype, while Archer Aviation secured Part 135 approval, clearing the path for initial air-taxi trials. Canada, meanwhile, advances the agenda through NAV CANADA, which is building a drone-traffic-management network that will slot AAM operations into controlled airspace. In Mexico, local authorities are testing using aerial vehicles to move freight to remote rural towns, an effort likely to gain momentum from U.S.-Mexico aerospace innovation pacts. Together, the region's seasoned aviation framework, robust R&D assets and cohesive public-private partnerships keep North America in the lead.

Europe is positioning itself as an early regulatory leader. In 2023 the European Union Aviation Safety Agency released an Innovative Air Mobility framework that aligns many rules with those of the FAA. The United Kingdom has backed air-taxi trials by Skyports and Vertical Aerospace through sandbox approvals from the Civil Aviation Authority. In Germany, Volocopters VoloCity eVTOL completed public demonstration flights in early 2024. France plans AAM services for the 2024 Paris Olympics, with test corridors unveiled by Groupe ADP and Airbus. Combined pan-European funding, innovation programs, and coherent rules across borders make the region an attractive early market.

Asia-Pacific is emerging as the worlds quickest adopter of advanced air mobility, largely because China is pouring money into eVTOL research. In early 2023 EHang secured the first-ever type certificate for a passenger-carrying autonomous eVTOL, a milestone awarded by Chinas Civil Aviation Administration. Meanwhile, India is promoting AAM through new DGCA pilot-training rules and green-corridor trials in Bangalore and other cities. Japan witnessed a successful test flight of SkyDrivers SD-05 and aims nationwide service by 2025 under the Ministry of Land, Infrastructure and Transport. Australia is working with Eve Air Mobility on urban trials, and South Koreas K-UAM Grand Challenge also targets a 2025 rollout. Government backing combined with a maturing tech ecosystem is pushing the region forward.

Latin America and the Middle East and Africa (MEA) are gradually carving out space in AAM, with Brazil at the forefront, Eve Air Mobility and ANAC aim to roll out certified eVTOL services by 2026. State-sponsored initiatives, such as the Santos Dumont innovation lab, back urban air mobility experiments while other Brazilian and regional governments eye AAM for remote freight. Even with gaps in rules and ground infrastructure, international alliances and small test flights are speeding up local readiness. In MEA the UAE and Saudi Arabia lead, as Joby and Skyports launch air taxis in Dubai and NEOM weaves autonomous flight into its Vision 2030 plan. Meanwhile, in Sub-Saharan Africa, South Africas SANSA oversees drone trials delivering medicine and blood. Although rules are still evolving, large investments and smart-city schemes point to solid future demand for AAM in both regions.

Leading companies in the AAM market—such as Urban Aeronautics, Volocopter, Boeing, Archer Aviation, and Joby Aviation—are spearheading developments in eVTOL technology, autonomy, and urban integration. Joby secured a $0.131 billion U.S. Air Force contract under Agility Prime, while Archer collaborates with United Airlines for commercial air taxi rollouts. Boeing’s Wisk Aero is co-developing autonomy standards with NASA, and Volocopter prepares for a major debut at the 2024 Paris Olympics. Urban Aeronautics is testing CityHawk for emergency services in Israel. Together, these players are shaping regulatory, safety, and infrastructure frameworks essential for global AAM deployment.

Market Segmentation

By Component

By Mode of Operation

By Vehicle Type

By Propulsion Type

By Range

By Maximum Take-off Weight

By Application

By End Use

By Region