Water Treatment Chemicals Market Size and Growth 2025 to 2034

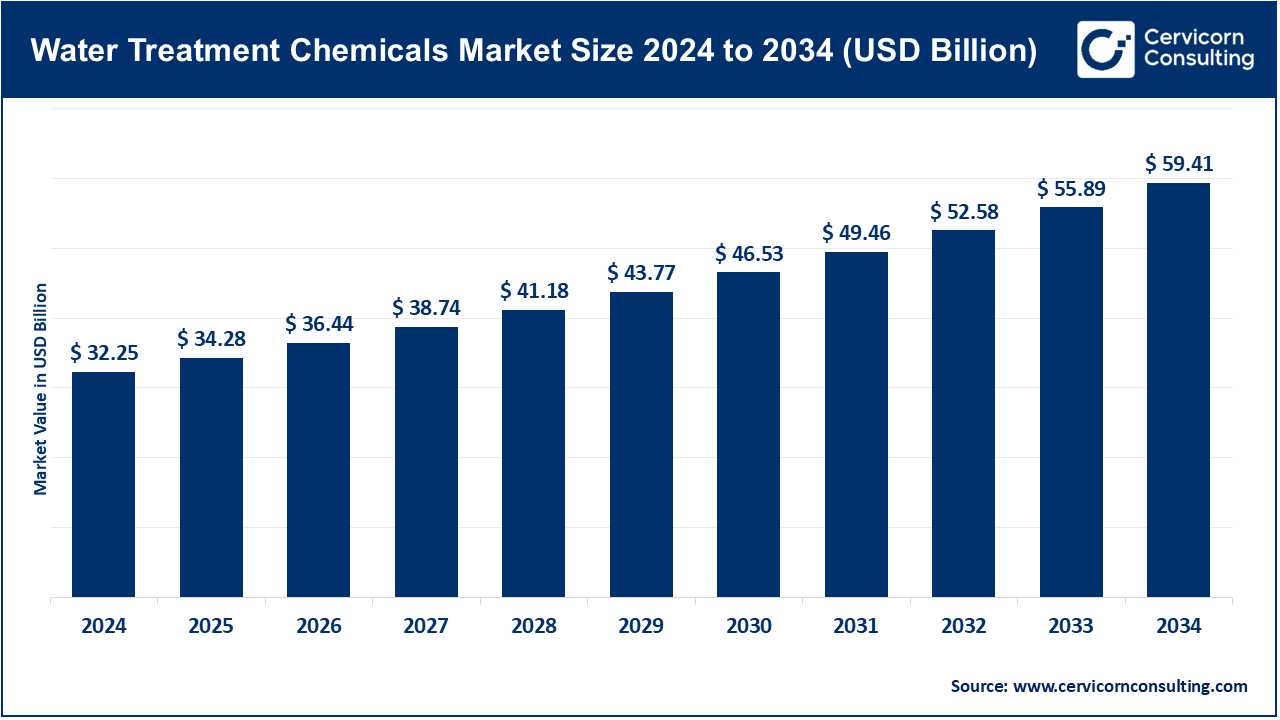

The global water treatment chemicals market size was estimated at USD 32.25 billion in 2024 and is expected to be worth around USD 59.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.3% over the forecast period from 2025 to 2034.

The global water treatment chemicals market is essential in providing clean and safe water for end-use markets such as municipal, industrial, commercial, and residential sectors. Water treatment chemicals are employed to remove unwanted contaminants and make water safe, useful, or reusable for human consumption. Water treatment chemicals are coagulants, flocculants, disinfectants, corrosion inhibitors, scale inhibitors, biocides, and others. The global water treatment chemicals market has bloomed due to quick industrialization and urbanization and increasing concern over water scarcity and environmental regulations. Further, increasing awareness of waterborne diseases and clean drinking water has provided the market an additional boost to its growth.

The main growth factors for this market are strict government regulations regarding wastewater discharge and pollution control, which require industries to treat wastewater before discharging it. In addition to this regulation, increasing global population numbers (especially in urban areas) has increased demands for potable water and wastewater management, leading to chemical demand for treatment. Moreover, high-quality water will remain a necessity for processing and production in industries such as power generation, oil & gas, food & beverage, and pharmaceuticals, as their activities will continue to grow, therefore increasing chemical usage. Technological developments of water treatment formulations, and novel, consumer- and eco-friendly and efficient chemicals are also factors into the growth of the market by achieving performance and sustainability goals.

Even with growth potential, the water treatment chemicals market has faced several challenges. One challenge is how the volatility of raw materials affects the manufacturers' cost structure and opportunities for profitability. Other challenges are that many chemical agents are being scrutinized for toxicity, biodegradability, or environmental effects as regulatory agencies focus on the chemical composition used, and likewise for newer water treatment technology adoption including membrane filtration, ultraviolet purification, and reverse osmosis. An association with chemical-based treatment will limit acceptance and adoption leading the water treatment chemicals market to stagnate or be limited in growth. Additionally, smaller businesses struggle to justify the total cost of ownership for chemical treatment systems as the operating and maintenance costs can be restrictive. The only way forward for many industry participants will be through innovation, cost-reduction, and staying environments standards and regulations.

Report Highlights

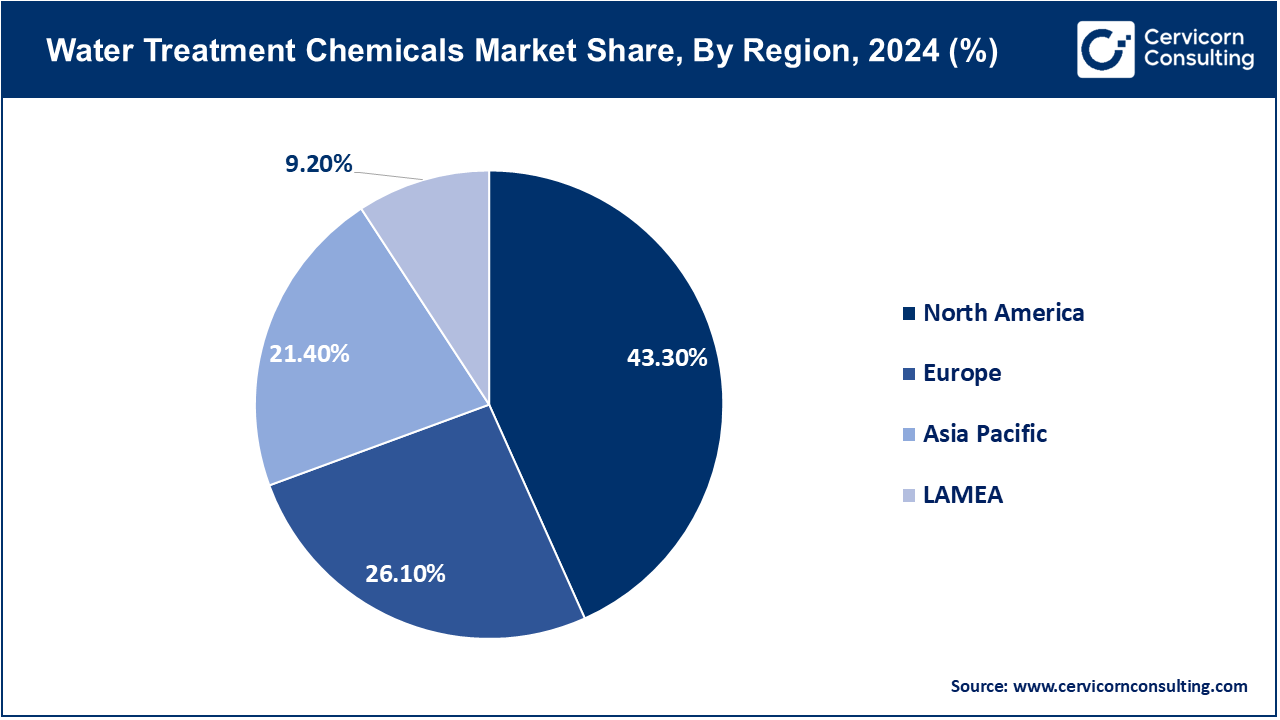

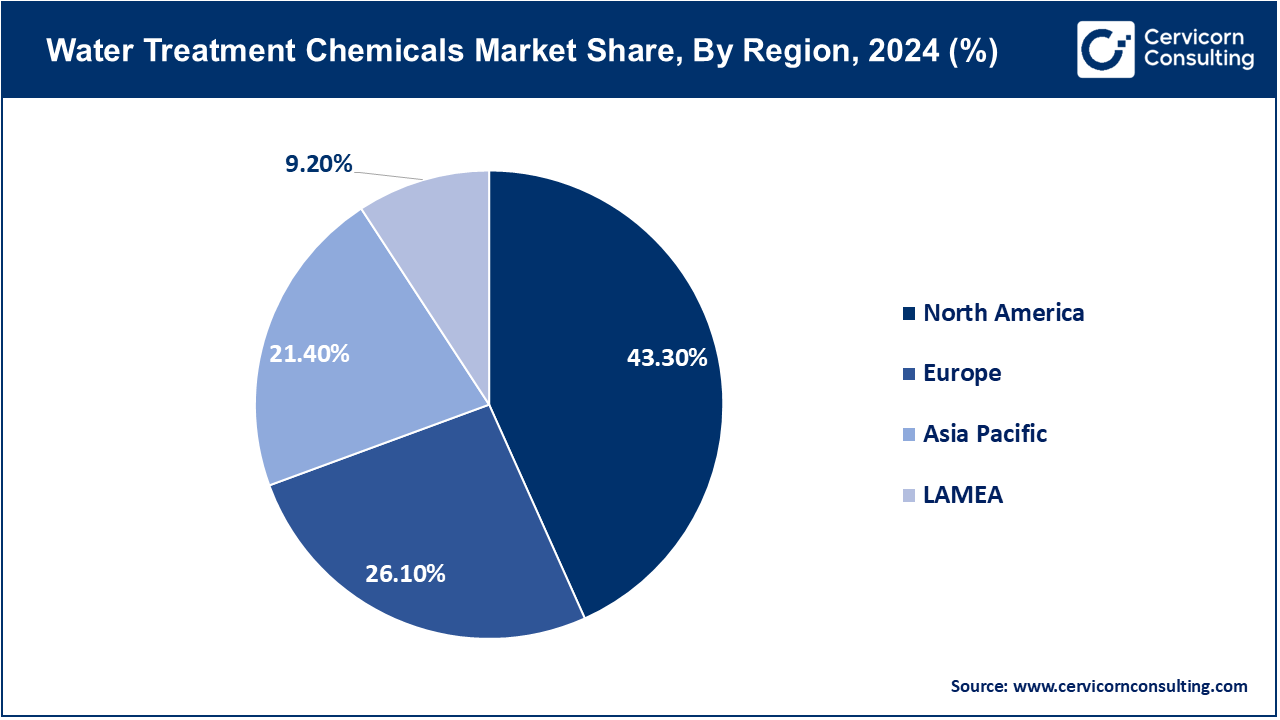

- By Region, North America has accounted highest revenue share of around 43.3% in 2024.

- By Sales Channel, the distributors segment captured the largest revenue share of 45% in 2024.

- By Source, the synthetic segment contributed to a significant 83% revenue share in 2024.

- By Type, about 30.8% revenue share was recorded by coagulants & flocculants in 2024. The coagulants and flocculants segment thus holds the first position by market share in the global water treatment chemicals market. These are purpose chemicals involved in municipal or industrial water-treatment processes, predominantly in solid-liquid separation. They suspend fine particles that settle due to the aggregation facilitated by these chemicals: suspended particles, organic matter, and any other form of impurities that make water clearer and safe for use or discharge. Their demand remains continuously high due to their widespread use in wastewater treatment plants, systems for drinking water treatment, and industrial sectors such as power generation, mining, and food and beverage. The rapid urbanization and growing attention of the global community towards sustainable water management, coupled with stringent regulatory frameworks enacted on effluent discharge, act as major factors fuelling the demand for coagulants and flocculants. They further lead to the dominance of these chemicals in the market due to their unsuccessful compatibility over different water chemistries and in combination with other treatment chemicals. Emerging economies in the Asia-Pacific are the major growth contributors due to their growing infrastructure and industrial activities.

- By Application, in 2024, the wastewater treatment segment controlled a revenue share of close to 32.30%. This market growth occurs due to the global shifting focus toward environmental sustainability, stringency in regulations on wastewater discharge, and growing volumes of municipal and industrial wastewater. With the craze of cities growing bigger with industrialization, a generation of wastewater has increased, especially in emerging economies, for which the treatment must be given priority. Wastewater treatment chemicals are those that include coagulants, flocculants, disinfectants, and pH adjusters to ensure that these chemicals treat wastewater contaminants and make certain the water is clean enough for discharge or reuse. Also, an increasing awareness regarding water reuse and circular water systems is increasing the demand for chemical treatment within this segment. However, governments and environmental bodies on a global scale are ensuring wastewater treatment compliance with quality standards, providing further market growth impetus. All in all, wastewater treatment is the most prominent application segment because it plays the most prominent role in pollution control and conservation of water resources.

- By End-Use Industry, the municipal water treatment projected to dominate with a 33.4% revenue market share in 2024. The demand for treatment chemicals for municipal wastewater is fuelled by the demand for clean and safe drinking water and strict government wastewater treatment and environmental protection regulations. Municipal water treatment plants generally use large volumes of chemicals during various stages, including disinfection, coagulation, flocculation, and pH adjustment, to achieve compliance with water quality standards. Urbanization, population growth, and aging infrastructure in several countries force local governments to rethink upgrading and expansion of their municipal water treatment systems. Also, various mechanisms to raise public awareness about the dangers of contaminated water translate into investment in municipal water treatment. Many developing nations have access to treated water, often from donor and government programs, which further increases demand for treatment chemicals. Given the size of municipal applications, coupled with legislative backing and vital imports, this segment catapults into being the leading end-use industry in water treatment chemicals.

Market Growth Factors

- Rising Demand for Clean Water in Industrial and Municipal Sectors: There is a growing demand for clean water globally in both the industrial and municipal sectors because of increasing population pressures and industrialization. Major industries such as energy (power generation), oil & gas, food & beverage and pharmaceuticals require large quantities of processed water during their operations. In fact, none of these water resources can be withdrawn or discharged without treatment beforehand. For this reason, more and more water treatment chemicals including coagulants, flocculants, corrosion inhibitors, and biocides are being consumed. Municipalities (particularly in developing regions) are also investing significantly in infrastructure for water treatment to provide safe drinking water and proper sanitation. In addition to safe drinking water, municipalities are also increasingly adopting water reuse and recycling. As the volumes and sources of treated wastewater continue to increase, so does the demand for adequate chemical treatment to meet water quality guidelines. The need for chemical treatment will sustain growth in the market, especially in drought-stricken and water-stressed areas, where there is an immediate need for water purification, making it a significant contributor to global market growth.

- Stringent Environmental Regulations on Wastewater Disposal: Ecological protective agencies around the world have enacted tough regulations to control pollution from wastewater discharges by industries and municipalities. Regulatory agencies such as the U.S. Environmental Protection Agency (EPA), the European Environment Agency (EEA) and other national regulatory bodies impose strict limits on effluent, which motivates organizations to seek viable wastewater treatment systems. To meet these standards, industries are utilizing water treatment chemicals that can neutralize contaminants and lessen the application of materials that threaten the environment. The penalties for exceeding standards can be considerable and may include remediation costs and legal fees, driving companies toward more costly but effective chemical treatment options. Industries under acute regulatory pressure to clean effluent are situated predominantly in industries such as textiles, mining, pulp & paper and petrochemicals, as these sectors produce high volumes of hazardous discharge. Thus, the marketplace for specialist treatment chemicals, particularly pH adjusters, anticalins and defoamers, is increasing rapidly to meet compliance demands. Compliance requirements are one of the driving forces of this market growth around the world.

- Rapid Urbanization and Infrastructure Development: Urban population growth places significant strain on existing water supply and sanitation systems, especially in developing countries. As cities grow and new urban sites are established, the pressure to provide adequate first-stage water treatment infrastructure grows as well. Governments and private developers are using funds to establish and enhance water and wastewater treatment plants owned by municipalities, which in-turn increases the demand for water treatment chemicals. In urban infrastructure projects, city planners understand that a stable water quality is critical for residential, commercial, and industrial uses, so chemical treatment is a vital part of the plan. Plus, as urban areas endorse sustainability and smart cities, water recycling or zero-liquid discharge systems are becoming more common practice, which are dependent on sophisticated treatment chemicals to meet the required benchmarks. Thus, new construction and urban sprawl that include water treatment solutions is an essential component of growth in this market, a factor which is especially notable in China, India, Brazil, and Indonesia.

- Growing Awareness of Waterborne Diseases and Hygiene: More awareness about water borne diseases such as cholera, typhoid and dysentery has changed perception and policy relating to access to clean water. To recover from health concerns over access to clean water, especially realizing the recent events of the COVID-19 pandemic that seemed to happen all at once; everyone's views of sanitation and hygiene greatly impacted water safety, including ultimately to prioritize the multiplicity of health concerns about water access have increased expenditure into various forms of water treatment at the household and subsequently at municipal levels. Access to treated chemicals for disinfecting water; biocidal treatments; and chlorinated treatments are important for pathogen removal and achieving a safe and sanitary water supply. Non-governmental organizations, along with WHO and UNICEF, are increasing the importance and focus on access to clean water in underserved areas, which is driving further adoption of chemical treatments used to make water supply safe. An additional positive factor that supports the steady demand for water treatment chemicals is the growing adoption of point-of-use water treatment systems in rural and semi-urban households. All together, these events support a demand profile that demonstrates steady demand for water treatment chemicals, with public health awareness being a strong pillar supporting growth for the market moving forward.

Market Trends

- Growing Adoption of Zero Liquid Discharge (ZLD) Systems: Zero Liquid Discharge (ZLD) systems are becoming more commonplace in many water-intensive industries such as power generation, textiles, oil & gas, and pharmaceuticals. ZLD is a treatment process that provides assurance that no industrial wastewater is discharged to the environment. ZLD provides a means to recycle and recover almost all wastewater as clean water, and the remaining waste is converted to solids. As a system, ZLD requires significant quantities of water treatment chemicals to address the risks of fouling, scaling, and corrosion, specifically anticalins, coagulants, flocculants, and pH adjusters, for these water treatment processes to operate efficiently. Increasingly stricter environmental regulations (primarily overseas) are starting to take hold globally, and ZLD systems are being adopted more frequently, especially in developing nations like India and China. This added adoption will translate to more chemicals being used, especially unique chemical formulation customized for each ZLD operation. Additionally, not only does the trend of ZLD use increase the global amount of chemicals consumed, it also drives the innovation for formulations that are multi-functional and more environmentally friendly for their application.

- Digitalization and Smart Water Management: Digital transformation is changing how we monitor and apply water treatment chemicals as we shift from a water treatment industry reliant on arrangements, documentation and operator observations to an industry that can take advantage of sensors, algorithms, and real-time analytics. These new sensors and systems provide more accuracy in dosing and optimization. They are considerably more efficient in terms of accurately dosing water treatment chemicals while eliminating human error, while also lowering not only the wastes associated with chemical application, but also the operational costs associated with treating the water. Chemical programs save resources because they can also recognize early indications of contamination and adjust treatment protocols on their own, making chemicals more efficient. This type of process with intelligent systems is being embraced more and more by municipalities and the industrial sector because they support reduction in maintenance, energy use and risk of regulatory non-compliance. The growth of "smart water grids" and IoT-enabled dosing systems is most prevalent in North America and Europe, and the demand for treatment chemicals compatible with automated systems is rising. With smart water management becoming more common, chemical manufacturers are putting money into data-driven solutions with fit-for-use chemical blends suited to digital systems.

- Increased Focus on Decentralized Water Treatment: Decentralized water treatment systems are trending, particularly in remote, rural, disaster-prone, and developing regions lacking centralized infrastructure. These systems can often be modular, quick to deploy, and the means by which communities quickly access clean water. The chemicals used must be easy to use, efficient at low application volumes, and are best if they continuously perform its function under the worst possible conditions. As a result, there is increased demand for ready to use highly concentrated multi-purpose water treatment chemicals such as disinfectants/coagulants, anti-corrosives, aquatics, etc. Moreover, many decentralized systems using solar or low energy means to treat water. This is evident in Sub-Saharan Africa, Southeast Asia, and parts of Latin America. Governments, NGOs and private companies promoting water accessibility will continue to drive the adoption of decentralized systems, creating opportunities for chemical companies targeting mobile and scalable water treatment options.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 34.28 Billion |

| Expected Market Size in 2025 |

USD 59.41 Billion |

| Projected CAGR 2025 to 2034 |

6.30% |

| Superior Region |

North America |

| Booming Region |

Asia-Pacific |

| Key Segments |

Type, Source, Sales Channel, Application, End-Use, Region |

| Key Companies |

SUEZ, BASF SE, Baker Hughes Company, Dow, Ecolab, Solenis, Kemira, Nouryon, SNF, Cortec Corporation |

Market Dynamics

Market Drivers

- Expansion of Desalination Projects: The increased number of desalination projects globally is in part resulting from the limited supply of freshwater, especially in arid and semi-arid environments. Desalination plants are a sea water-based process and therefore rely on a large volume of water treatment chemicals to perform desalination and reduce scaling, fouling, and biological growth in desalination systems. The chemicals, including anticalins, biocides, and coagulants, are necessary to ensure these systems function efficiently for optimal corrosion protection of valuable desalination infrastructure. Countries in the Middle East, Africa, and parts of Asia-Pacific are heavily investing in desalination technology in response to domestic and national water security efforts; this expansion in desalination will directly influence the marketplace for specialized treatment chemicals that are better suited to last in harsh seawater and high-pressure environments. Furthermore, since newer methods for desalination are predominantly membrane-based, we expect a corresponding increase in demand for high-quality chemical formulations that are designed for compatibility with these newer membranes, creating opportunities for water treatment chemical suppliers & manufacturers.

- Increased Adoption of Water Recycling and Reuse Technologies: As international consciousness grows surrounding water conservation and sustainability, many municipalities and industries are now transitioning to water recycling and reuse systems. These systems reduce the overall consumption of fresh water through the treatment of wastewater to a level that will allow it to be reused as non-potable or even potable applications. Water recycling entails a great deal of chemically based treatments, including flocculation, pH adjustment, chemical disinfection and removal of organic and inorganic constituents. Transitioning to water reuse requires advanced chemical formulations to achieve the desired water quality for a specific treatment goal. Industrial sectors such as textiles, pulp and paper, mining, and manufacturing electronics, have been embracing water reuse solutions to comply with regulations and sustainability goals. Even at the urban level, treated greywater is usually recycled or reused in irrigation or toilets, and industrial processes. As more organizations implement water reuse and recycling systems to lower their environmental footprint and operating costs, the demand for effective and improved efficiency in water treatment chemicals will grow as these new systems are implemented.

- Growth of the Food & Beverage and Pharmaceutical Industries: The water treatment chemicals market will be buoyed by the fast-growing food & beverage, and pharmaceutical industries. The food & beverage, and pharmaceuticals industries require large amounts of high-purity water to produce, clean, and maintain product quality. Effective water treatment methods, substances, and, for specialty pharmaceuticals, drug substances being generally directed towards higher-quality levels by meeting strict quality requirements (i.e., USP or EU Pharmacopeia) are key components of water purification. Similarly, the food & beverage industry can only benefit from treated water to ensure sanitation in processing, packaging, and cleaning to protect food quality and extend shelf life. The need for water treatment chemicals is mutually reinforced by public policy regarding requirements for health and safety standards, requiring the two industries to rely on disinfectants, anti-foaming agents, corrosion inhibitors, etc. As these industries grow, particularly in developing regions, the consumption of water treatment chemicals will continue to grow to meet operational needs, quality control, and policy compliance. Water treatment chemicals will therefore remain valuable enablers of consumer/product safety and an efficient production stream.

Market Restraints

- Environmental and Health Concerns Related to Chemical Usage: One of the main limitations of the water treatment chemicals market is the growing concern over their potential environmental and health effects. Water treatment chemicals, like chlorine, coagulants, and biocides, can create harmful byproducts and potentially lead to challenges in toxicity if not fully controlled. Regulatory agencies around the world have reacted by placing stricter controls on levels that are permissible leading diving companies to make more use of suitable alternatives or to improve their monitoring processes through technology. Additionally, with increased environmental group activity and public awareness campaigns, there is growing pressure for industries and municipalities to reduce potential reliance on hazardous materials. These increased pressures can bring limits on traditional chemicals and potentially slow market development. These concerns can have an impact not only on the safety of workers but also on the potential effects (in the long term) of discharging into the environment. The concepts of reducing impacts on the environment thus remains a challenge for the market. Still, it may also lead to innovative water treatment practices.

- Availability of Alternative Treatment Technologies: The emergence and rapid expansion of alternative water treatment technologies represents a significant threat to the traditional water treatment chemicals marketplace. Techniques involving ultraviolet (UV) disinfection, reverse osmosis (RO), nanofiltration, and electrochemical treatment are gaining traction due to them being not only effective but also using fewer chemicals. The likelihood of lower OPEX costs downstream, reduced environmental footprint, and superior performance removing specific contaminants makes them appealing to facilities and municipalities. As an example, UV is an efficient way to gain microbial control without having to use chemicals which can lead to disinfection byproducts. As industries and municipalities search for cost-effective solutions that meet their sustainable practices and agenda, the shift toward non-chemical (or low chemical) processes is clearly becoming more pronounced. In some developed countries, stringent environmental regulations have created a conducive environment for these technologies. As indicated above, the continued movement toward such non-chemistry water treatment options will also reduce demand for traditional chemical-based treatment methods, especially in high-income and urbanized areas, inhibiting overall growth.

- Fluctuations in Raw Material Prices: Volatility in raw materials required for manufacturing water treatment chemicals is another significant band aid for the market. Key inputs like chlorine, sulphur, and caustic soda experience global supply-demand imbalance and are influenced by factors like geopolitical issues, trade bans, offsets due to energy prices, transportation shortages, or domestic environmental regulations restricting feedstock distribution. This will always put terrible pressure on the end user as manufacturers will never be able to maintain a stable price. Especially in price-sensitive markets, consumer consumption may decrease, or consumers may switch to alternative options when raw material prices increase. As a side note, constraints on supply chains about delivery of products or shortages of feedstock due to domestic environmental laws all compound and exacerbate manufacturers' difficulties in meeting demand in a consistent, cost-effective manner. These economic uncertainties lead to a lack of profitability and translate into hesitance to invest into further capacity in the water treatment chemical sector. In this regard, positive and negative input costs will always continue to benefit or harm manufacturers and end users in the water treatment chemical market Globally.

Market Opportunities

- Green and Bio-Based Water Treatment Chemicals: Sustainability is a global phenomenon which is influencing a demand for ecological water treatment chemicals, which presents a tremendous opportunity in market growth. Traditional chemicals such as chlorine, phosphates and synthetic polymers are facing regulatory limitations due to environmental issues. There is more growth opportunity in developing bio-based water treatment chemicals, which includes plant-based biocides, biodegradable corrosion inhibitors, and natural coagulants and flocculants. The places in odours and food & beverage processing, pharmaceuticals and municipal water treatment to mention a few areas are considering these alternatives for ESG (Environmental, Social, and Governance) initiatives and not attracting regulatory fines. Businesses adopting green chemistry innovations have a tremendous opportunity to capitalize on market share by marketing non-toxic, biodegradable and renewable provide providers. Collaborating with bioscience businesses and government legislation for sustainable water treatment will support this market segment. With increasing consumer and corporate awareness around ecological and environmentally preferable practices in water treatment, the market for bio-based water treatment chemicals should blossoming over the next decade.

- Expansion in Emerging Markets: Rapid industrialization and urbanization, coupled with water scarcity, are eliciting booming demand for water treatment chemicals in emerging economies. The countries in question, from China-India-Mexico-Brazil-South Africa, are raising water quality standards, primarily affecting power generation, textiles, and food processing sectors. Aging infrastructure and additional requirements for municipal wastewater treatment further create lucrative opportunities. Governments in these regions are investing in water infrastructure projects and offering incentives for private-sector participation. For instance, India's Jal Jeevan Mission and China's sponge city initiatives spur the requirement for corrosion inhibitors, coagulants, and disinfectants. Companies with localized production and cost-optimized solutions that also work with regional players can derive significant advantage in these fast-growing markets.

- Smart Water Treatment & IoT-Enabled Chemical Dosing Systems: The very foundation of transformation with the advent of AI, IoT, and automation, is chemical dosing efficiency. Using smart sensors and predictive analytics, water quality is monitored in real time to use chemicals in the most optimal manner and reduce wastage. Anywhere where automated dosing systems are being used - oil & gas, power generation, municipal water treatment - the common aim has always been to reduce costs while maximizing compliance. An IoT chemical management platform provider can really set itself apart by introducing remote monitoring, predictive maintenance, and insight-driven data analysis amongst other features. For instance, AI-based systems could be able to inform about scaling or corrosion trends; hence, chemical dosing could be adjusted ahead of time. As smart-city projects boom and Industry 4.0 is embraced by the industrial world, a great demand will come for innovative water-treatment solutions, hence creating a lucrative niche for chemical suppliers embracing technology.

Market Challenges

- Biofilm Resistance to Biocides: Biofilms, slimy layers made up of bacteria, fungi, and algae, develop in pipelines, cooling towers, and membranes, and are increasingly developing resistance to traditional biocides such as chlorine, bromine, and quaternary ammonium compounds. This resistance forces water treatment companies to go after much stronger, more specialized antimicrobial agents, for instance, enzyme-based treatments or nanoparticle biocides, which are very costly and require special regulatory approval. On the other hand, constant and excessive applications of biocides produce DBPs that may be harmful, thus leading to even more rigorous environmental regulations. Industries such as power plants, oil & gas, and food processing have been witnessing inexplicable biofilm resistances that result in clogged filters or escalated energy consumption. To counter this situation, researchers have taken up experiments on quorum quenching (bacterial communication disruption) or phage therapy (viruses to target bacteria). However, these are still fledgling developments, thereby leaving industries to deal with persistent microbial contamination and skyrocketing operational expenses.

- Compatibility Issues with Aging Infrastructure: Many water treatment systems operate with decades-worth of outdated infrastructure not tailored to the more modern chemical formulations. To cite an example, these legacy steel pipes could corrode upon being treated with the new phosphate-based corrosion inhibitors, whereas concrete reservoirs might be subjected to wear and tear from high-level doses of anti-scaling acids. Repairing the old systems, retrofitting them, or their full replacement generally entails huge financial implications, and so industrial operators often settle for stop-gap measures that mitigate treatment effectiveness. Municipalities are more time and budget constrained. They thus end up using diluted chemicals or outdated treatment methods, which are eventually more costly to maintain. And then some of the advanced chemicals-polyphosphates or organic polymers, to name a few-interact with old piping materials in ways not predicted by the industry and cause even more leaks or contamination. So, a company must weigh chemical effectiveness against material compatibility, with customization often the only option available to them, which increases costs.

- Trade Secret & Formulation Protection: Water treatment chemicals are generally proprietary blends whose exact compositions are kept secret from patenting to prevent disclosure thereof. However, competitors may investigate formulations through chemical means, producing a once lost market share. Some territories (China, for example, and India) count weaker IP protections under which local manufacturers produce cheap versions of a branded chemical. Massive investments go toward obscure additive mixtures and cleverly encrypted supply chains to keep the formula secret, but the litigation route is costly and usually never regains lost profits. Other than these, sustainability pressures demand companies to disclose the chemicals' environmental impact and even expose their formulations. This very challenge necessitates firms to pace constant innovation with the protection of their intellectual property-the ultimate high stakes tunnel in an already competitive market.

Regional Analysis

The water treatment chemicals market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Why does the North America region dominate the water treatment chemicals market?

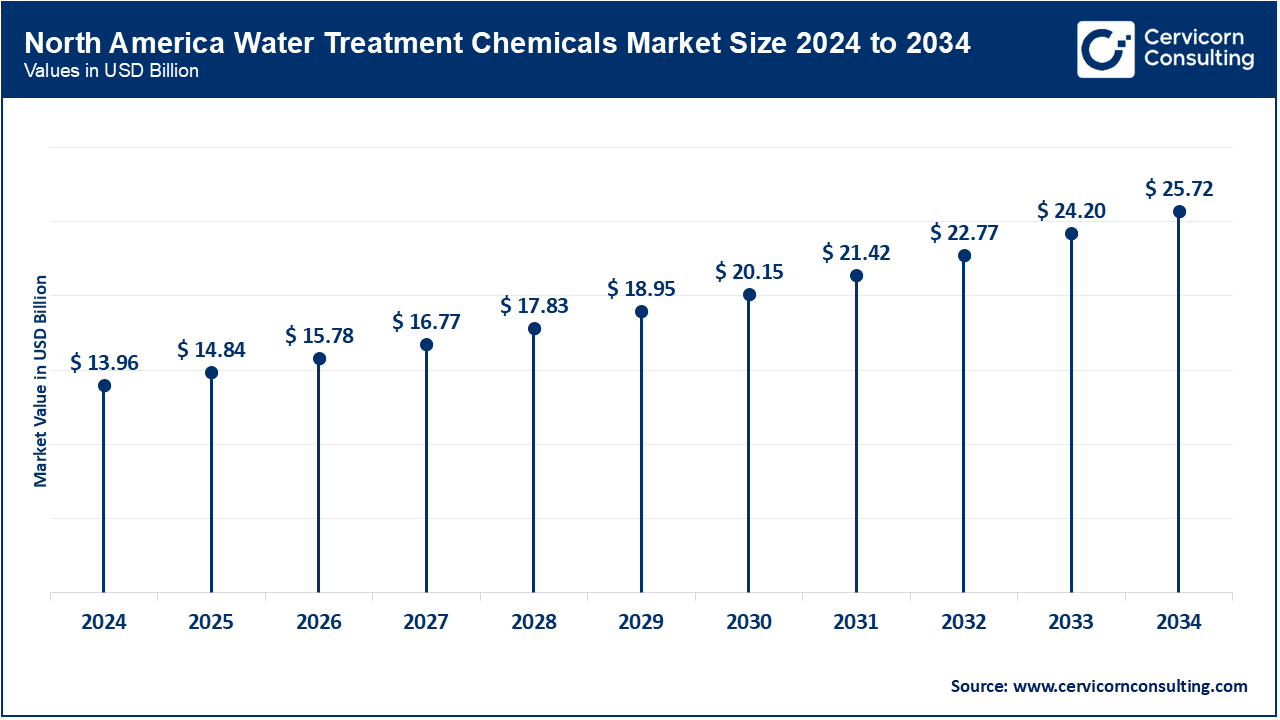

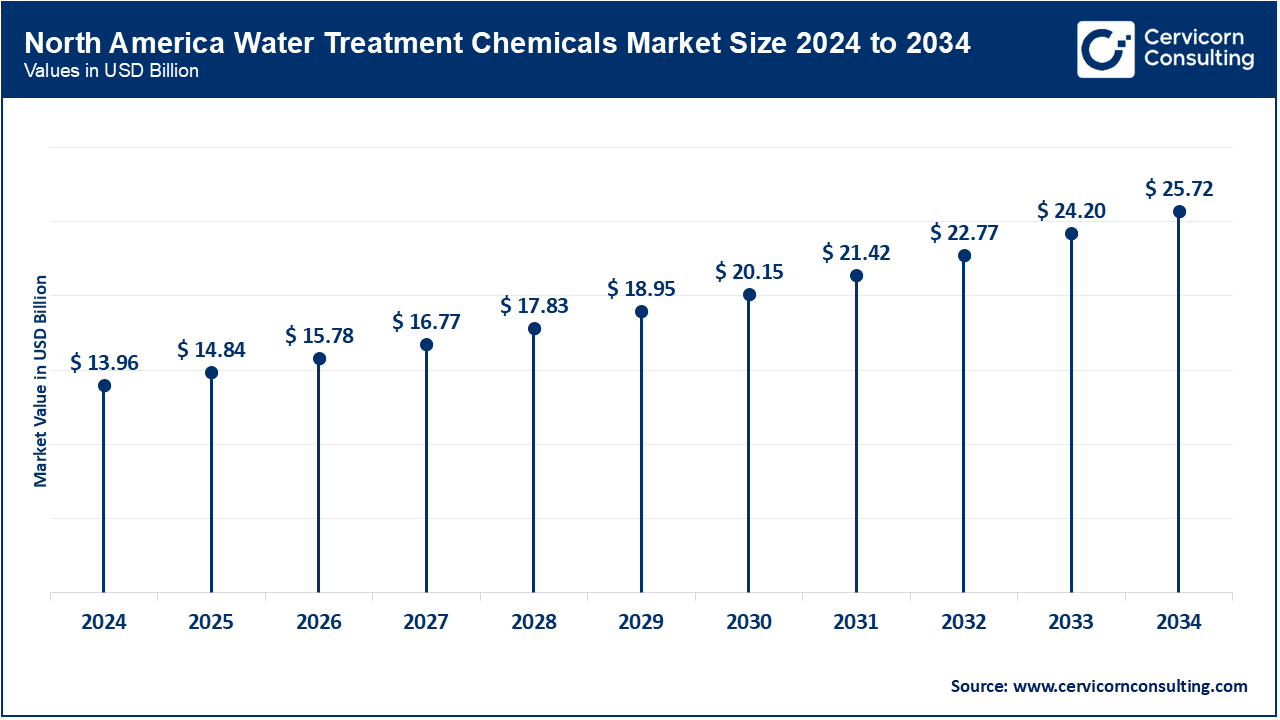

- The North America water treatment chemicals market size was valued at USD 13.96 billion in 2024 and is expected to reach around USD 25.72 billion by 2034.

The North America dominated the market by environmental regulatory stringency, old water infrastructure, and growing industrialization. The U.S. and Canada stand top in installing advanced water treatment applications, wherein governmental policies such as the Clean Water Act and Safe Drinking Water Act back this initiative. From increased demand for safe drinking water in municipal, oil & gas, power generation, and food & beverage sectors, the consumption of chemicals such as coagulants, corrosion, and biocides is further increased or created. The presence of major players in the industry and investment into R&D and infrastructure upliftment’s also reinforce the market. Further, water stress due to climate change and the need for recycling wastewater increase the demand for chemicals, especially in drought-hit zones. With the smart water treatment technologies coming into play and on-going infrastructure modernization, North America is anticipated to maintain its top-line in the coming years.

Why does Europe represent a considerable share of the water treatment chemicals market?

- The Europe water treatment chemicals market size was reached at USD 8.42 billion in 2024 and is projected to hit around USD 15.51 billion by 2034.

Europe represents a considerable share of the market owing to stringent environmental laws and a very high level of awareness on water conservation. With countries such as Germany, France, and Great Britain leading in the reuse of wastewater and zero-liquid discharge applications, this market for treatment chemicals has been built. The EU Water Framework Directive has stringent requirements laid down for wastewater treatment, especially industrial and municipal wastewater treatment. Mostly apart from that, these chemicals are required by the food & beverage, chemical, and pharmaceutical industries. The regional development environment, focusing on circular economy principles and sustainability, is catalysing innovation in bio-based and eco-friendly water treatment solutions. Increasing private-sector interest in and public-sector provision of desalination and water reuse projects along Southern Europe will continue to support demand. The ageing infrastructure and operational cost hikes aside, Europe, with its stringent regulatory backing and sustainability agenda, is a strong force in the global water treatment chemicals market.

What makes Asia-Pacific the fastest-growing region in the water treatment chemicals market?

- The Asia-Pacific water treatment chemicals market size was accounted for USD 6.90 billion in 2024 and is expected to surpass around USD 12.71 billion by 2034.

Asia-Pacific remains the fastest-growing region, with its growth being pursued by rapid industrialization, urbanization, and population increase. Countries like China, India, and Japan witness high demands for clean water from industries as well as in municipalities. Market growth is, however, propelled by various government initiatives such as the Clean Ganga Mission of India and strict pollution control laws in China. Efficient water treatment in the region is needed to ensure compliance with various standards in power generation, mining, and textiles industries. Increasing concern over water scarcity and pollution is encouraging the government and private sectors to invest in water reuse and desalination projects. Emerging economies carry the demand of chemicals in the wake of technological developments, expanding industrial base, and growing infrastructure. The region is still trying to overcome issues such as uneven enforcement and access, especially in rural areas. However, in the long term, the increasing awareness level and infrastructure development in Asia-Pacific are expected to aid the market substantially.

What factors contribute to the LAMEA region showing moderate growth in the water treatment chemicals market?

- The LAMEA water treatment chemicals market size was valued at USD 2.97 billion in 2024 and is anticipated to reach around USD 5.47 billion by 2034.

The LAMEA region exhibits a moderate level of market growth but, nevertheless, unfolds very significant growth potential in the coming period. Latin America, mainly Brazil and Mexico, is engrossed in the establishment and improvement of municipal water and sanitation infrastructure systems. Issues concerning water scarcity in the Middle East, especially in countries like Saudi Arabia and the UAE, are fostering desalination and wastewater recycling to flourish in demand for anti-sealants, biocides, and coagulants. African countries are relatively behind in water treatment infrastructure, but proceed to see positive changes, facilitated by international aid, government programs, and private investments. Produced water treatment is a major contributor to water treatment chemicals in the oil & gas sector of the Middle East. But in some LAMEA countries, economic instability clubbed with poor enforcement of water quality regulations acts as restraints. Rising urbanization and industrialization are expected to pave the way for making this region an important market during the forecast period.

Segmental Analysis

Type Analysis

Coagulants & Flocculants: The coagulants & flocculants segment has captured highest revenue share in the market. The function of a coagulant and a flocculant is the removal of suspended solids, colloids, and other particles through agglomeration into larger clumps that may be readily removed. A coagulant destabilizes the particles through a chemical reaction, whereas a flocculant promotes the further growth of flocs into sizes acceptable for sedimentation or filtration. Such chemicals are required in municipal water treatment, industrial wastewater, and sludge dewatering processes. Aluminium sulphate, polyalanine chloride, or iron salts are used as coagulating agents, while polyacrylamides are flocculants. Growing demand for clean water and stringent environmental regulations have thrust these chemicals into adoption, especially in developing areas where infrastructure is being built. Moreover, food & beverage, mining, oil & gas, and pulp & paper industries depend on these agents in achieving discharge regulations and water reuse goals. As water is becoming a scarce commodity, this segment would thus grow steadily.

Corrosion Inhibitors: Corrosion inhibitors are chemicals added to water systems, preventing corrosion and the degradation of metal surfaces. These inhibitors essentially work by sitting on the metal surface, hence limiting the direct exposure of metal to oxygen and moisture. Large-scale applications are seen in cooling towers, boilers, and various water systems, mostly in power plants, refineries, and chemical manufacturing industries. Some of the common corrosion inhibitors are phosphate-based, molybdate-based, and zinc-based chemical compounds. This segment is experiencing growth due to the rising demand to enhance the life of expensive tooling and pipeline infrastructure, cut down costs of maintenance, and enable operational efficiency. Being adopted as a corrosion inhibitor increasingly under the global thrust to green construction and minimizing unplanned downtime in industrial operations. Furthermore, the research on environmentally safe, non-toxic formulations opens growth possibilities amid strict environmental regulations.

Biocides & Disinfectants: It is in this sector that the required sanitization of different water systems is carried out by killing microbes, pathogenic bacteria, algae, fungi, etc. The chemicals act as important barriers to provide microbiological safety to the drinking water and safeguard industrial processes like cooling towers and reverse osmosis units. Commonly used disinfectants include chlorine, bromine, hydrogen peroxide, isothiazolinones, etc. These disinfectants are mainly used in pharmaceutical, food processing, pulp & paper, and municipal sectors. In the post-COVID era, the demand for biocides has risen immensely because sanitation and public health have become areas of great concern. Sampling microbial control with as little environmental impact as possible remains the challenge. Stringent norms concerning chemical discharge and an increasing number of biofilm challenges tend to create an atmosphere of innovation in this segment. A shift is taking place in the disinfectant segment toward innocuous, biodegradable, and non-residual disinfectants, with greater growth thus being expected in regions undergoing rapid urbanization and industrialization.

Scale Inhibitors: Scale inhibitors avert the formation of scale deposits like calcium carbonate and calcium sulphate in water systems. The scaling, in turn, drastically lowers heat exchanger efficiency, pipeline efficiency, and boiler efficiency. These inhibitors act against crystal growth and deposition mechanisms. Scale inhibitors have their utility in industrial scales-prone water systems-their demand is considerably elevated in oil & gas, power generation, and desalination industries. Phosphonates and polycarboxylates are the most commonly scale inhibitors. Global water stress coupled with increasing usage of recycled water forms the backdrop of demand for effective scale control solutions. Furthermore, membrane-based filtration systems that have come of age bulk on strong prefiltration with scale inhibitors. Thus, non-phosphorus and greener alternatives are picking pace to meet the environmental regulations. As water systems grow complex and scaling risks become thornier, the advanced scale inhibitors market will witness growth opportunities.

Chelating Agents: Water-treatment chelating agents bind with metal ions responsible for scaling, fouling, and discoloration of all sorts. Chelating agents in solutions keep metals away from precipitation, therefore keeping water and treatment procedures well enhanced. Some common chelating agents include EDTA, NTA, and citric acid. They find applications in industrial cleaning, boiler water treatment, and in municipal water systems. According to regulatory requirements and sustainability, the demand for biodegradable and eco-friendly chelating agents is on the rise. These agents win crucial applications in industrial use wherever metal ions affect product quality or process efficiency. Nowadays, in view of growing complexity of water sources and higher performance demands set by manufacturing industries, the chelating agent’s market is observed moving towards high-efficiency and environment-friendly formulations. Being the backbone in sustaining the system for longevity in terms of performance make chelating agents a must for modern water treatment systems.

Anti-foaming Agents: Anti-foaming agents, also called defoamers, are used to counteract or inhibit foam formation in water treatment systems. Foam can cause disruptions in process efficiency, overflowing of systems, and interference in chemical treatment applications. The agents finish off by destabilizing the foam bubbles that eventually collapse. From their name, we get some type examples, for instance, silicone, oil, and water defoamers. Such anti-foaming solutions find application in industries such as wastewater treatment plants, chemical manufacturing, and food processing. Growth in industrial activity and related operational efficiency fuel their demand. Regulatory bodies impose constraints on effluent quality, thereby requiring efficient foam control measures. At the forefront are technological advances that have furthered low-residue and biodegradable anti-foaming agents, especially where stringent environmental and product purity concerns are laying their demands. Owing to the proliferation of biological treatment processes (e.g., activated sludge), it is expected that the demand for efficient anti-foaming solutions will grow steadily in innumerable industries.

pH Adjusters & Stabilizers: Acids, bases, types of pH adjustment chemicals are crucial in water treatment to regulate and maintain the pH balance in the water. A correct pH would guarantee maximum performance for other water treatment chemicals and would protect the equipment as well from corrosion or scaling. Some of the most common acids and bases available are sulfuric acid, hydrochloric acid, sodium hydroxide, and lime. The chemicals are employed in water treatment at the municipal level, in power plants, in industries, and food processing units. They chiefly act in conditioning water chemistry for biological treatment, chemical reactions, and downstream equipment. Rising awareness on water quality and process efficiency has increased the demand for precise pH control. This segment has picked up with the advent of real-time pH monitoring and automated pH dosing technology. Moreover, industries have shifted on to safer and efficient pH regulators with stringent environmental and occupational safety standards, further supporting the segment's growth.

Others: The Others category in the market consists of various specialized chemicals, including oxidants, coagulant aids, filter aids, agents for fluoridation, and nutrient supplements for biological treatment. These chemicals perform very specialized niche applications about specific water quality challenges and treatment processes. For instance, these filter aids are considered to enhance the efficiency of filtration systems, while nutrient supplements are required for the sustenance of microbial activity in biological reactors. With the rising complexity of industrial effluents and increasing use of advanced treatment technologies like membrane filtration, MBR, and zero liquid discharge, this sector is gaining stature. Customization and application-specific performance stand as important trends in this category. Due to stringent and customized water treatment processes, demand for such correlating chemicals to be used in water treatment processes is on the increase. Through continuous innovation and custom formulations, demand may additionally go up in the high-tech industry and water-quality-challenged area.

Application Analysis

Wastewater Treatment: The wastewater treatment segment has registered highest revenue share in the market. Water treatment mainly aims at removing contaminants from domestic, municipal, and industrial effluents. For the treatment, there are several chemicals; coagulants, flocculants, neutralizers, and disinfectants, which help break down pollutants and/or remove solids and generally neutralize unfriendly compounds. Environmental regulations, reuse of treated water, and conformity by industries have been the driving factors for this segment. Industries such as textile, food & beverage, pharma, and chemicals rely heavily on wastewater treatment. Being an emerging area, it is experiencing significant growth due to the advent of urban population and greater awareness towards conserving water. Hence, ZLD and biological treatment-based technologies uplift the consumption of chemicals in the domain.

Boiler Water Treatment: Due to the water which is used in the boiler, which causes the deposition of scale and corrosion, and foaming of the solution in the boiler, hence chemicals are used in boiler treatment. These problems cause efficiency losses, downtime costs, and damages to the equipment due to works. Treatment chemicals comprise of oxygen scavengers, anticalins, and pH adjusters that work to ensure proper working and longevity of the boiler in the treatment process. This application finds major application in power, manufacturing, oil & gas, and food processing industries wherein steam is a crucial utility. The growth of a boiler water treatment market is much supported by the increasing focus on energy efficiency and preventive maintenance. With the rapid globalization of various industries along with stringent environmental compliance, the specialized demand for boiler water chemicals is continuously climbing towards market expansion.

Cooling Water Treatment: To avert the formation of microbes, corrosion, and scale, cooling water systems in different industrial facilities are usually treated with chemicals. Often, such systems are working in open-loop configuration and are thus susceptible to bio-fouling and environmental contaminants. Cooling towers and heat exchangers utilize biocides, dispersants, and corrosion inhibitors to maintain efficient heat transfer and operational issues. As industries promote reduction of water consumption through recirculation techniques, the need for more-evolved cooling water treatment solutions rises. Strong demands from sectors like HVAC, petrochemical, and chemical manufacturing have been helping maintain this segment as a crucial application area for the market at large.

Raw Water Treatment: Raw water treatment deals with treating surface or groundwater for industrial, municipal, or potable use, by removing suspended solids, organics, and microbes. The chemicals generally used are coagulants, flocculants, disinfectants, and pH stabilizers. This treatment application is necessary to ensure that water conforms to certain quality standards and is suitable for use in downstream processes or for human consumption. The growing water scarcity and awareness about waterborne contamination diseases have put forward the demand for efficient raw water treatment technologies. Further, the segment is growing on account of urbanization and the demand for clean water from developing countries that lead to investments in large water purification infrastructure.

Water Desalination: Water desalination treatment is the process of treating seawater or brackish water to obtain fresh potable water. Anticalins, biocides, coagulants, and membrane cleaning chemicals are used in the process to keep the RO systems safe and to enhance their efficiencies. Desalination becomes vital in places where there is dearth of fresh water, such as Middle East, North African countries, parts of Asia-Pacific, etc. With growing awareness on climate change and water scarcity, sustenance of drinking water by desalination will see a rise in demand for chemicals. Various governments and private parties are investing in desalination, which makes for a very high-growth segment in the market.

Sales Channel Analysis

Based on sales channel, the global market is segmented into direct sale, distributors and online marketplace. The distributors segment has dominated the market.

Water Treatment Chemicals Market Revenue Share, By Sales Channel, 2024 (%)

| Sales Channel |

Revenue Share, 2024 (%) |

| Direct Sale |

35% |

| Distributors |

45% |

| Online Marketplace |

20% |

End-Use Industry Analysis

Municipal: The municipal segment has accounted for a highest revenue share. Water treatment chemicals find an application in the municipal sector, especially in all levels of municipal administration. Municipalities are given the responsibility of preparing potable water and treating wastewater for discharge. Naturally, such chemicals will be used as coagulants, flocculants, disinfectants, or pH adjusters to remove suspended solids, pathogens, and contaminants from the raw water. Increasing trends in urbanization, population growth, and stringent water safety legislations are posing growth potential to this segment. Also, government investments in water infrastructure and recycling are encouraging municipalities to implement chemical treatment at advanced levels. The growth in this segment will remain steady as it is primarily concerned with public health and environmental safety.

Power Generation: Large amounts of water are typical of power plants, particularly thermal and nuclear types. They use this water for cooling, steam generation, and other boiler operations. The treatment chemicals include corrosion inhibitors, anti-scaling agents, and biocides thus preventing corrosion, scaling, and microbial growths. This sector's growth is directly linked to the worldwide demand for electricity, especially in developing countries. Clean water means good efficiency and long life for equipment, which means that chemical treatment of water is a must. With the power sector targeting high efficiency and low emissions, the demand for more advanced treatment chemicals is also growing.

Water Treatment Chemicals Market Revenue Share, By End-Use, 2024 (%)

| End-Use |

Revenue Share, 2024 (%) |

| Municipal |

33.40% |

| Power Generation |

17.80% |

| Oil & Gas |

13.70% |

| Mining & Mineral Processing |

6.20% |

| Chemical Manufacturing |

10.90% |

| Food & Beverage |

5.10% |

| Others |

12.90% |

Oil & Gas: Water treatment processes in this industry vary depending majorly on the upstream, midstream, and downstream segments. Water is supplied to many oil and gas operations such as drilling, Hydraulic Fracturing, or refining. Chemicals put into treatment prevent scaling, corrosion, and microbial contamination inside pipelines and reservoirs. Wastewater treatment is an equally important factor for the industry to meet the norms of environmental discharge. Due to the complex nature of the fluids handled and the typical operational adversity, the industry demands specialised formulations. The growth of the market in this segment comes alongside increasing oil exploration and refining activities, particularly in North America, the Middle East, and the Asia-Pacific Regions.

Mining & Mineral Processing: Water is used for mineral extraction, ore processing, and tailings management. Chemicals would be flocculants and depressants that aid mineral recovery and water recycling. Treatment facilities reduce the environmental impacts of discharges and ensure compliance with regulations. Water management is becoming a main concern for mining operations as demand for minerals grows-especially for batteries and technology. Water reuse performance and increasingly stringent environmental regulations are encouraging upgrading treatment chemicals in this sector and making it a steady growth industry.

Chemical Manufacturing: In chemical industries water is used as the universal solvent, coolant, and process medium. The impurities present in the water can degrade the finished product in both quality and yield, so the treatment must be very accurate. Treatment chemicals are used and supplied for boiler feedwater, cooling water, and wastewater treatment. Saving corrosion and scaling is necessary to save expensive reactors and pipelines. Various chemical processes require specialized treatment methods. This segment depends on industrial output, with regions having high industrial activities like China, Germany, and the U.S. being major consumers of water treatment chemicals.

Others: A wide variety of industries fall within this category, including food & beverage, textiles, pulp & paper, pharma, and semiconductors. These industries use water for processing, cleaning, or cooling and are increasingly adopting water treatment chemicals to meet the ever-stringent regulatory requirements and to inscribe sustainability in their practices. For example, in pharmaceuticals and electronics manufacturing, obtaining ultrapure water is a must. Even small industrial units have now begun to adapt viable treatment solutions because of growing water scarcity and environmental conservation concerns, thereby assisting in the market's growth for such a diverse end-user segment.

Source Analysis

Based on source, the global market is segmented into bio-based and synthetic. The synthetic segment has dominated the market.

Water Treatment Chemicals Market Revenue Share, By Source, 2024 (%)

| Source |

Revenue Share, 2024 (%) |

| Bio-based |

17% |

| Synthetic |

83% |

Water Treatment Chemicals Market Top Companies

Recent Developments

- In October 2023, Solenis, a global specialty chemicals provider for water-intensive industries, completed the acquisition of CedarChem on October 2, 2023. As part of the acquisition, Solenis will acquire all CedarChem operating assets. The acquisition fits Solenis direct go-to-market strategy for providing chemical and wastewater treatment products and services directly to customers.

- In Jan 2022, in connection with making the wastewater treatment plant at Tokoroa fit for the current generation, in South Waikato, Veolia Water Technologies has designed and supplied an upgrade AnoxKaldnes MBBR solution that is small and sustainable. The MBBR solution is a biological process developed by AnoxKaldnes, a Veolia subsidiary, whereby the old sand filters of Tokoroa are converted into a post-denitrification MBBR plant. AnoxKaldnes MBBR is a solution to remove BOD, ammonia, and nitrogen. K5 media is used to give a large, protected surface area and the best environment for biofilm growth so that the plant enjoys high treatment capacity with a low footprint.

- In Jan 2022, The SUEZ Water Technologies & Solutions has won a contract to engineer and construct systems for water treatment, wastewater recycling, and waste recovery for Viny Thai Public Company Limited, a premier market leader in manufacturing plastic and chemical products in Thailand. These technologies and services provide Viny Thai with a compact solution for its resource recovery operations, allowing it, on a consistent basis, to meet discharge limits and keep its water footprint low, alongside reducing operational costs and risks.

- In November 2023, to keep up with the increasing demand for coagulants because of various regulations, Kemira, a global leader in sustainable chemical solutions for water-intensive industries, has announced a substantial expansion of ferric sulphate water treatment chemicals plant capacity at Goole, UK. The new capacity of 70,000 tons will combat the increase in demand brought about by the stricter Asset Management Plan 7 and 8 regulations on phosphorus and other nutrient discharge from wastewater treatment laid down in the Water Industry National Environment Programme in the UK. This new capacity is slated to be operational by Q3 2025.

Market Segmentation

By Type

- Coagulants & Flocculants

- Corrosion Inhibitors

- Biocides & Disinfectants

- Scale Inhibitors

- Chelating Agents

- Anti-foaming Agents

- pH Adjusters & Stabilizers

- Others

By Source

By Sales Channel

- Direct Sale

- Distributors

- Online Marketplace

By Application

- Boiler

- Cooling

- Raw Water Treatment

- Water Desalination

- Wastewater Treatment

- Others

By End-Use Industry

- Municipal

- Power Generation

- Oil & Gas

- Mining & Mineral Processing

- Chemical Manufacturing

- Food & Beverage

- Others

By Region

- North America

- APAC

- Europe

- LAMEA