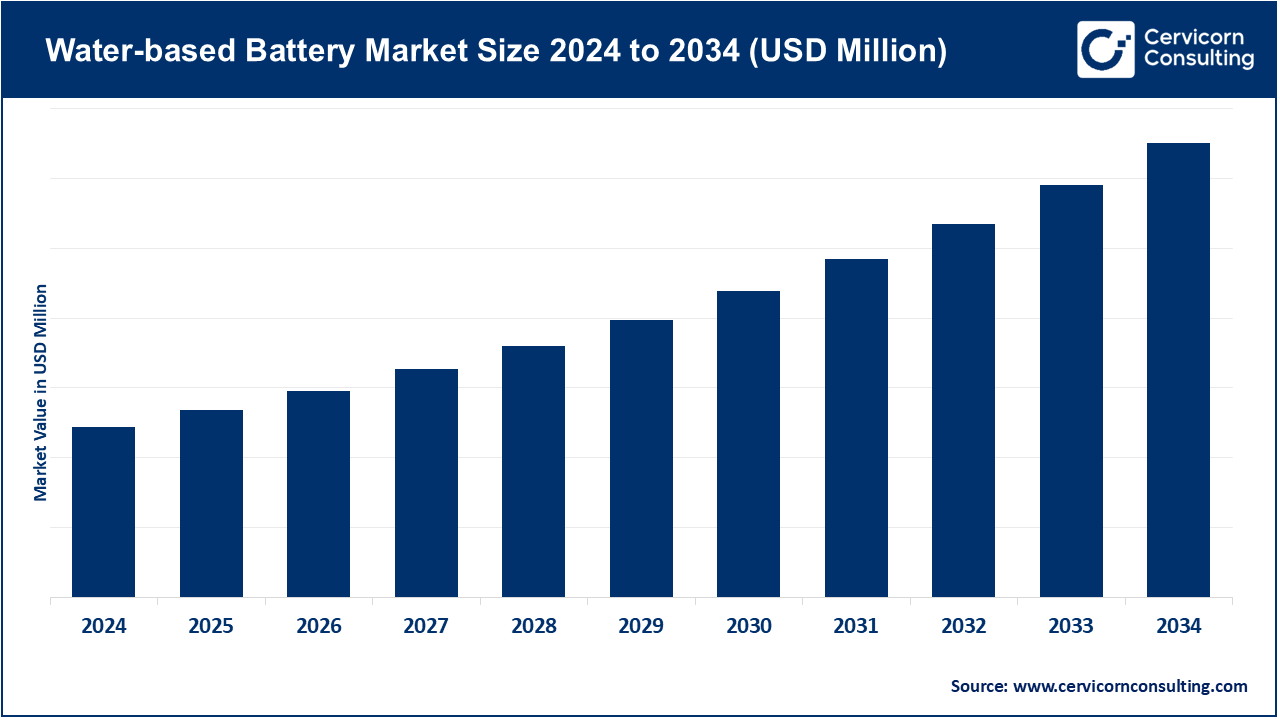

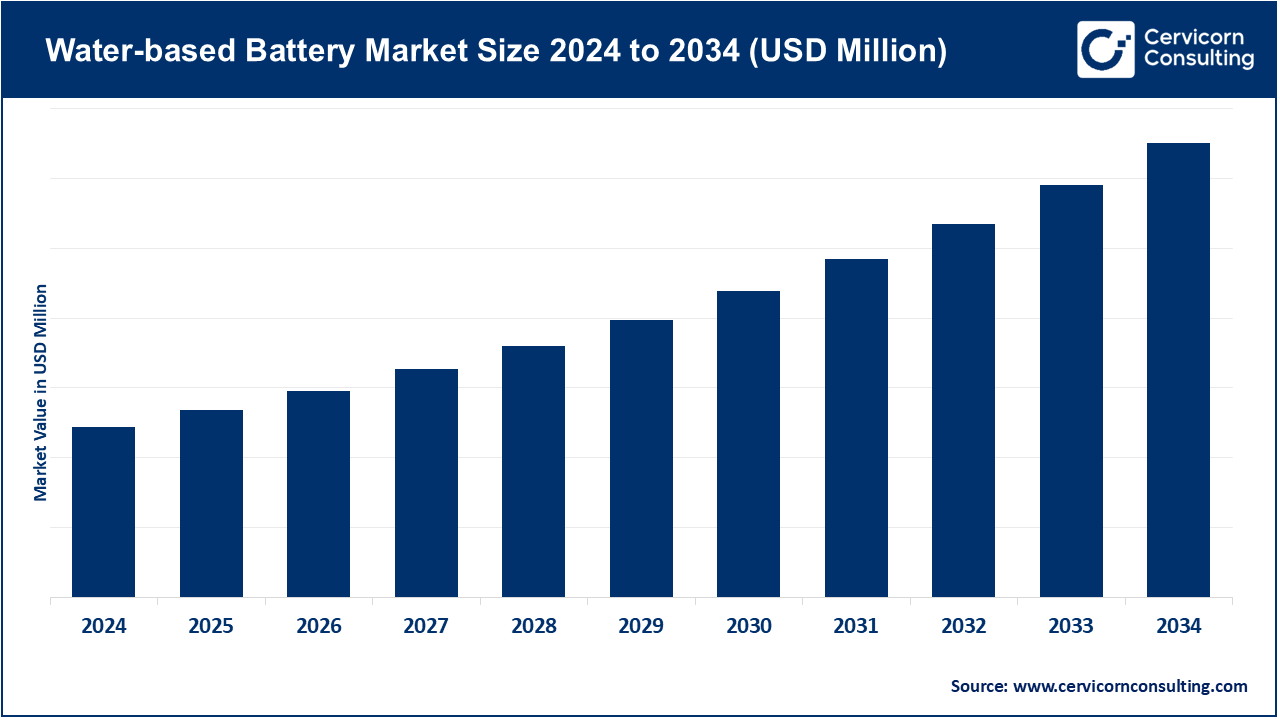

Water-based Battery Market Size and Growth Factors 2025 to 2034

The global water-based battery market is expanding at a CAGR of 25.1% from 2025 to 2034. The market for water-based batteries has shown remarkable growth as industries search for safe and affordable substitutes for the lithium-ion battery. The use of water-based electrolytes lowers battery production cost and minimizes fire risks associated with conventional lithium batteries. The unit also utilizes eco-batteries which allow for easy environmentally-friendly production. Water-based batteries are increasingly used to manage the intermittency of renewable sources such as wind and solar batteries. With the rise in global demand for the incorporation of renewables and stable grid storage, water-based batteries are being researched for use in portable electronics and possibly for electric vehicles.

The momentum stems from the combination of government policies, commercially underpinned sustainability goals, and heavy investment in the zinc-ion, aluminum-ion, and other novel technologies. Water-based batteries bring strategic benefits of operational efficiency, lowering reliance on limited and expensive materials, and aligning with circular economy policies. With the rapid global shift for energy transition, these batteries are transforming from being an alternative option to a widely used mainstream technology; intended to provide the most cost-effective, safe and reliable energy storage systems in the world.

Report Highlights

- By Region, Asia-Pacific leads with 50.8% share due to large-scale investments in renewable energy, rapid urbanization, and government incentives promoting sustainable battery technologies. Countries like China and Japan are driving adoption through industrial and residential energy storage projects, making APAC the largest regional market.

- By Battery Type, Aqueous sodium-ion batteries dominate with 38.6% share owing to their cost-effectiveness, high safety, and eco-friendly profile. Adoption is increasing in grid storage and commercial applications, as technological improvements enhance performance and efficiency.

- By Application, Grid energy storage holds 41.2% share due to the rising integration of renewable energy and the need for stable electricity supply. Utilities and power providers rely on water-based batteries to manage peak loads and support large-scale energy distribution.

- By Deployment Mode, On-grid systems capture 46.3% share as they integrate seamlessly with existing power infrastructure. Their widespread use in industrial and urban regions ensures reliable energy distribution and efficient grid management.

- By End-User, Utilities and power providers hold 44.5% share as the primary adopters, leveraging water-based batteries for energy storage, peak load management, and renewable integration. Regulatory support and long-term cost savings drive adoption in this segment.

Market Trends

- Eco-Safe Storage Solutions: The recent development in the water-based battery market is growing popularity of non-toxic and eco-safe energy storage solutions. Water-based batteries unlike Lithium-ion systems have fire risks and environmental hazards, thus they use harmless electrolytes, thus are very appealing in urban and residential storage. As an example, in early 2025, scientists at Harvard University commercialized an aqueous organic battery that withstood more than 10,000 cycles without a capacity loss. Not only does this innovation alleviate the safety concerns, but also enhances compliance with regulations of sustainable power systems, pushing the industry to $4.5 billion by the year 2027.

- Integration with Renewable Energy: The other important trend is the integration of water-based batteries with renewable energy sources such as solar and wind among others. They are scalable and have a long cycle life, thus suitable to stabilize intermittent sources of power and microgrids. In May 2025, as an example, a 50 MWh water-based battery storage project was commissioned in Germany, the largest in Europe, to meet wind and solar variations. This tendency is associated with the increase in the need in flexible storage technologies capable of speeding up decarbonization. Integration with the renewables is anticipated to be close to 8.2 billion in the market value by 2030.

Report Scope

| Area of Focus |

Details |

| Water-based Battery Market CAGR |

25.10% from 2025 to 2034 |

| Dominant Region |

Asia-Pacific |

| Key Trends |

Eco-Safe Storage Solutions, Integration with Renewable Energy |

| Key Segments |

Battery Type, Application, Deployment Mode, End User, Region |

| Key Companies |

ESS Tech, Inc., Zinc8 Energy Solutions, Redflow Limited, Primus Power, Enerpoly AB, Aquion Energy, Furukawa Electric Co., Ltd., VRB Energy, CellCube Energy Storage Systems, Dalian Rongke Power Co., Ltd., Sonnen GmbH, CATL, HiNa Battery Technology Co., Ltd., Lockheed Martin |

Market Dynamics

Market Drivers

- Safety and Sustainability: The nature of water-based batteries is a highly safe chemistry, which removes the risks of fire or thermal runaway found in lithium-ion batteries. Non-toxic electrolytes have compliance benefits and acceptance by the populace as the governments advocate green energy infrastructure. In 2024, the U.S. Department of Energy guaranteed $0.12 billion of grants to hasten the investigation on aqueous battery systems as utilized in grid scale applications. Such regulatory and financial support makes the water-based batteries a safer, greener and socially acceptable alternative that drives the market trend to a $12-billion market in 2032.

- Low Cost and Readiness of Raw Materials: Water based batteries take advantage of cheap and abundant raw materials; zinc, iron and manganese as compared to lithium and cobalt which experience the fluctuations of prices and geopolitical uncertainties. This low cost strategy can be implemented on a mass basis, particularly in developing countries where renewable grids are being built out. According to a 2025 SkyQuest report, aqueous zinc-ion batteries would cost 35-40 percent less than lithium-ion systems to store data. Consequently, the cost aspect is likely to drive the world water-based battery market to 5.8 billion dollars in 2029 especially in Asia-Pacific where the most rapid growth is taking place on the grid.

Market Restraints

- Reduced Energy Density: Water-based batteries have significant disadvantage in energy density relative to lithium-ion despite the advantages. This renders them inappropriate to small and high performance applications such as electric cars or handheld electronics. The same research papers published by MIT in 2025 reported that aqueous zinc-ion batteries produce only 6080 Wh/kg, much less than the 200250 Wh/kg of lithium-ion. This limitations in their performance makes them only be applicable in immobile storage which could inhibit their application in dynamic segments of energy storage market. This constraint may prevent the market to surpass 15-billion by 2035 unless there are innovations to improve the efficiency of electrolytes.

- Infrastructure and Transition Costs: The change to water-based batteries involves the infrastructure improvement and redesigning of existing storage systems optimized to lithium-ion. The initial integration costs tend to be prohibitive to smaller utilities and even to private operators. As an example, a report in the Global Trade Magazine in 2025 noted that aqueous systems would add 20-30% in the early stages than a lithium-ion retrofit, as the former would need to be integrated into the existing microgrids. This relates to a cost barrier that is disproportionately large to small-scale adopters, preventing further penetration of water-based systems, even though such systems have long-term benefits.

Market Challenges

- Scaling Pilot to Commercialization: The key challenge here is to scale up water-based battery technologies out of lab prototypes to large-scale commercial applications. Although pilot projects have proved to be promising, the problem of consistency, reliability and permanence in diverse environments remains a challenge. The largest aqueous zinc-flow pilot plant in China was delayed in June 2025 because of supply chain delays and the problem of electrolyte stability. Until businesses address such bottlenecks, it will continue to limit commercialization at the gigawatt-hour scale, which will limit global deployment to less than the already estimated projected $10 billion by 2030.

- Rivalry with the Advanced Chemistries: The other threat is that of rivalry with other up and coming battery technology such as the solid-state, sodium-ion and flow batteries. These all have their own benefits, and the fast R&D investment can change the mindset of the investor towards the water-based systems. In a 2025 report by BloombergNEF, sodium-ion batteries were estimated to take a market share of $11.3 billion by 2030, and would directly compete with aqueous batteries in stationary storage. The water based solutions of the market dominance require the race to be ever inventive in a bid to stay relevant in the market as opposed to the competitors.

Market Opportunities

- Expansion of Grid-Scale Energy Storage: A large scale integration of renewable energy presents one of the largest opportunities in which water-based batteries can be used to offer a stable and extended storage capacity. Aqueous systems are the best systems to balance demand and supply when governments aim to achieve 24/7 renewable grids. In the year 2025 the EU declared a fund of $6 billion in the next-generation grid storage where a substantial portion of the money was allocated to water-based technologies. This places the market in the vantage point of enjoying direct gains of policy-based investments that have the potential of opening up new sources of revenue worth 20 billion dollars by 2035.

- Rural Electrification and Emerging Markets: Developing markets are another key growth potential, and in this case, water-based batteries can facilitate inexpensive and non-dangerous energy supply. Their non-toxicity and the fact that they use large quantities of raw materials make them the best in terms of rural electrification projects. As an example, in Africa and Southeast Asia, pilot projects with zinc-water batteries have been able to operate schools and clinics off-grid at only a fraction of the cost of lithium-ion. This segment is one of the most socially influential segments of the industry, as the revenue of this segment hits up to 4.2 billion by 2030, simply because of the scale of electrification.

Regional Analysis

The water-based battery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America hit notable growth

North America has been on the forefront in implementing water-based battery to store grid and residential storage. In June 2025, ESS Inc. increased projects on iron-flow battery projects in California, with emphasis on renewable integration and energy resilience. The zinc-ion and aqueous sodium-ion batteries are being used in the U.S and Canada in utilities to serve peak shaving, microgrids, and commercial storage.

Europe Market Trends

Europe focuses on sustainability and regulatory adherence in battery adoption through water. Germany Sonnen GmbH released zinc-manganese batteries in May 2025 that can be used in the home and businesses. France, the UK, and the Netherlands have been testing aqueous sodium-ions and zinc-air solutions to be used in smart grids and infrastructures.

Asia-Pacific is leading the market

Asia-Pacific is the region that deploys water-based batteries the quickest due to renewable expansion and favorable regulations. In August 2025, CATL in China introduced sodium-ion storage batteries on a commercial and residential basis. Off-grid electrification and industrial microgrids are being done using zinc-ion and zinc-air systems in Japan, South Korea, and India.

LAMEA Market Trends

Water-based batteries are slowly being used in off-grid and rural projects in Latin America, the Middle East, and Africa. In March 2025, South Africa put microgrids based on zinc-manganese into operation, and the UAE and Brazil tested zinc-air and aqueous sodium-ion-based renewable injections and industry.

Segmental Analysis

Battery Type Analysis

Zinc-Ion Batteries: Zinc-ion batteries are rechargeable aqueous systems which use zinc ions as charge carriers, which is safe, cheap and has a long cycle life. In August 2025, Georgia Tech announced zinc-ion batteries work better with fast charging, which enhances durability in grid and industrial tasks. The progress depicts an increased use of zinc-ion batteries in the storage of large scale energy.

Zinc-Manganese Batteries: These are batteries that use manganese dioxide cathodes with Zinc anodes to store low-cost, safe and stable energy. In July 2025, a U.S. startup announced a prototype zinc-manganese battery with more than 2,000 stable cycles as a pilot project in utility-scale. The new product helps in the growing popularity of fixed storage options.

Aqueous Sodium-Ion Batteries: The sodium-ion aqueous batteries employ sodium-ion as their electrolyte, which is aqueous and provides a high level of safety, low price, and sustainable storage. In April 2025, CATL began commercial production with its sodium-ion brand Naxtra with 175 Wh/kg energy density, marking a move toward commercial production. These batteries are coming up as a lithium-free alternative.

Zinc-Air Batteries: Zinc-air batteries utilise oxygen of the air as the cathode reactant, which gives them high energy density in order to store energy over the long term. In May 2025, Indian Oil declared pilot projects to ascertain zinc-air batteries to store renewable energy in rural areas. This demonstrates their possibilities of off-grid and grid-support.

Other Water-based Chemistries: Nickel-zinc, iron flow and hybrid aqueous batteries are also developed to be stored in an eco-friendly and high-cycle. In June 2025, German scientists reported an iron-based aqueous battery with more than 10,000 cycles that can be used commercially, with a focus on sustainability and durability.

Application Analysis

Grid Energy Storage: Batteries Are used to stabilize renewable power outputs and to balance peak loads. In July 2025, State Grid in China commissioned a 50 MWh zinc-ion system to integrate into the solar system. The project also brings out the growing utility-scale use of water-based batteries.

Residential Storage: House batteries serve to provide power during the outage of power, or to store surplus solar energy safely. In June 2025, a Japanese startup announced a zinc-ion home battery that is aimed at minimizing the use of lithium. The batteries are becoming affordable in residential applications.

Commercial and Industrial Storage: The batteries save on electricity and supply industries with constant power. In August of 2025, a Korean company piloted an aqueous sodium-ion system of 20 MWh in an industrial park. This shows the feasibility of water-based solutions in businesses.

Microgrids & Rural Electrification: Off-grid communities and small islands are energized with renewable energy through batteries. An African project has installed batteries of zinc-manganese to provide electricity to isolated villages in May 2025. This demonstrates their contribution towards increasing access to energy in underserved areas.

Military & Defense: Batteries are military and defense-friendly, secure and portable in nature. In April 2025, the U.S. Army experimented with zinc-air batteries to soldier-portable power packs. This is indicative of the need to have high-energy storage that is durable and needed at the most critical applications.

Deployment Mode Analysis

On-Grid: Batteries integrated with utility grids help balance supply and demand and enhance renewable integration. In June 2025, California utilities installed zinc-based systems to stabilize wildfire-prone areas. On-grid solutions are key for grid reliability and energy transition.

Off-Grid: Off-grid deployment powers remote communities, islands, and industrial sites without access to the main grid. In May 2025, Indonesia launched an off-grid program using zinc-ion systems for island electrification. These systems provide sustainable alternatives to diesel generators.

Hybrid Systems: Hybrid systems combine batteries with solar, wind, and other renewables for resilient energy. In August 2025, a Spanish microgrid integrated aqueous sodium-ion batteries with solar and wind farms. Hybrid deployment ensures continuous power and maximizes renewable usage.

End User Analysis

Utilities & Power Providers: Large utilities use batteries to stabilize the grid, manage the peak, and integrate renewable energy. In July 2025, EDF Energy stated that it had a pilot project with zinc-air stabilization of wind energy. This brings out the use of water-based batteries in the utility scale.

Residential Consumers: Batteries are used by homeowners as solar storage and backup power, and energy independence. In June 2025, South Korea made zinc-ion home battery subsidies available. The residential deployment is showing increased market acceptance.

Commercial & Industrial Enterprises: Companies use batteries to reduce the cost of electricity and to ensure business continuity. In August 2025, Siemens Energy experimented with water-based batteries as a reliable backup of the data centers. Industrial adoption is more focused on efficiency and benefits of sustainability.

Government & Public Sector: Batteries are employed in hospitals, schools, and municipal grids by governments to have a resilient energy supply. Germany invested in iron-based aqueous battery projects, to be used in public buildings, in May 2025. Critical infrastructure energy security is enhanced through the deployment of infrastructure publicly.

Defense & Emergency Services: Batteries offer portable power that is long-lasting, military bases, emergency response, and disaster recovery. Aqueous sodium-ion packs of emergency communication systems were tested by NATO in April 2025. These implementations are high-demand, mission-critical applications.

Water-based Battery Market Top Companies

Recent Developments

- In September 2024, Ivanhoe Electric’s VRB Energy subsidiary has secured a 0.05 billion investment through a partnership with China’s Red Sun group, splitting the proceeds to form a 51/49 joint venture in China and to establish a U.S.-based vanadium redox flow battery manufacturing business in Arizona. The joint venture will build new production lines in China for grid-scale battery systems with a market focus in Asia, the Middle East, and Africa, while VRB Energy ramps up domestic U.S. production and maintains access to key intellectual property with Red Sun’s support.

- In July 2024, Enerpoly, a Stockholm-based zinc-ion battery maker, has acquired Nilar’s advanced production line and dry electrode technology after Nilar’s bankruptcy, enabling rapid expansion and cost-effective scaling of zinc-ion battery manufacturing for grid and critical applications, while lowering costs, emissions, and waste. This strategic move, supported by an $0.008 billion Swedish Energy Agency grant, positions Enerpoly as an industry-leading European supplier using locally sourced materials and cutting-edge processes.

Market Segmentation

By Battery Type

- Zinc-Ion Batteries

- Zinc-Manganese Batteries

- Aqueous Sodium-Ion Batteries

- Zinc-Air Batteries

- Other Water-based Chemistries

By Application

- Grid Energy Storage

- Residential Storage

- Commercial & Industrial Storage

- Microgrids & Rural Electrification

- Military & Defense

By Deployment Mode

- On-Grid

- Off-Grid

- Hybrid Systems

By End-User

- Utilities & Power Providers

- Residential Consumers

- Commercial & Industrial Enterprises

- Government & Public Sector

- Defense & Emergency Services

By Region

- North America

- APAC

- Europe

- LAMEA