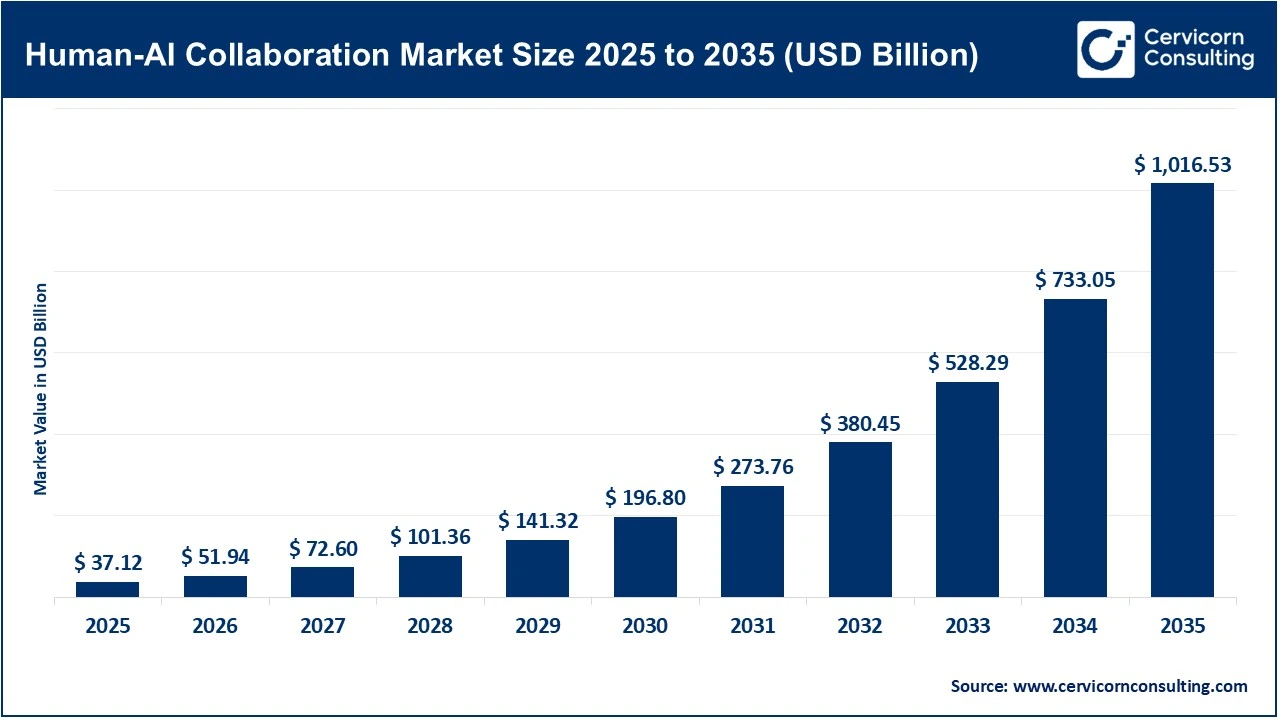

The global human-AI collaboration market size was valued at USD 37.12 billion in 2025 and is projected to be worth around USD 1,016.53 billion by 2035 with a CAGR of 39.2% over the forecast period from 2026 to 2035. The human-AI collaboration market is expected to amplify with the rising requirement of merging human judgements with AI databases for accurate outcomes in major industries such as BFSI and healthcare.

Human-AI collaboration offers a partnership while combining AI’s speed and data processing with human creativity, judgement to achieve better outcomes and decision making by balancing innovation across various fields.

The overall practices of collaboration between humans and AI represent one of the most promising developments in technological evolution. Industries such as healthcare, financial sector as well as creative industries generate potential for the human-AI collaboration market in the upcoming years. Looking at the future, from email clients to project software, AI assistants are observed to suggest responses, summarize data, and identify risks.

The rise of human-AI collaboration will also redefine workforce skills and job roles. Demand will grow for professionals who can effectively interpret AI insights, guide AI systems, and translate outputs into strategic actions. Roles such as AI strategists, human-AI interaction designers, and ethics specialists will become increasingly important. At the same time, AI literacy will become a core competency across industries, ensuring employees can collaborate confidently and responsibly with intelligent systems.

| Startup | Focus offering | Major Investors |

| Humans& | Human-centric AI collaboration tools | SV Angel and Nvidia |

| LangChain Inc | AI agent development platform that enables collaborative applications | Institutional Venture Partners |

| BaseTen Labs Inc | Platform simplifying enterprise AI apps & collaboration | - |

| Toloka | Data solutions for AI model training | Bezos Expeditions |

| Neurofin | GenAI-powered fintech infrastructure | Unleash Capital |

Rising Emphasis Over Workflow Intelligence

Long-term value creation in the human–AI collaboration market is increasingly shifting away from standalone AI model performance toward workflow intelligence and human–AI synergy. As foundational AI models become more accessible and standardized, differentiation now depends on how effectively AI is embedded into end-to-end business workflows and how well it collaborates with human expertise. Organizations that align AI systems with real operational processes, decision checkpoints, and human feedback loops are achieving more sustainable productivity gains and higher return on AI investments.

“According to our analysis, more than 70% of enterprise AI budgets are now allocated to integration, orchestration, and workflow redesign rather than core model training. Enterprises deploying AI within structured workflows report 20–35% productivity improvement compared to pilots focused only on standalone AI tools.”

How Do Date Privacy Challenges Act as Restraint for Human-AI Collaboration Market?

One of the primary challenges stems from data exposure risks in shared collaboration environments. Human–AI collaboration platforms frequently integrate with enterprise productivity tools, messaging platforms, CRM systems, and knowledge repositories. This interconnectedness increases the attack surface for data leaks and unauthorized access. Enterprises remain cautious about allowing AI systems to analyze unstructured and confidential data such as legal documents, medical records, financial transactions, and internal strategy discussions. As a result, organizations delay adoption, limit deployment scope, or restrict AI functionality, slowing overall market growth.

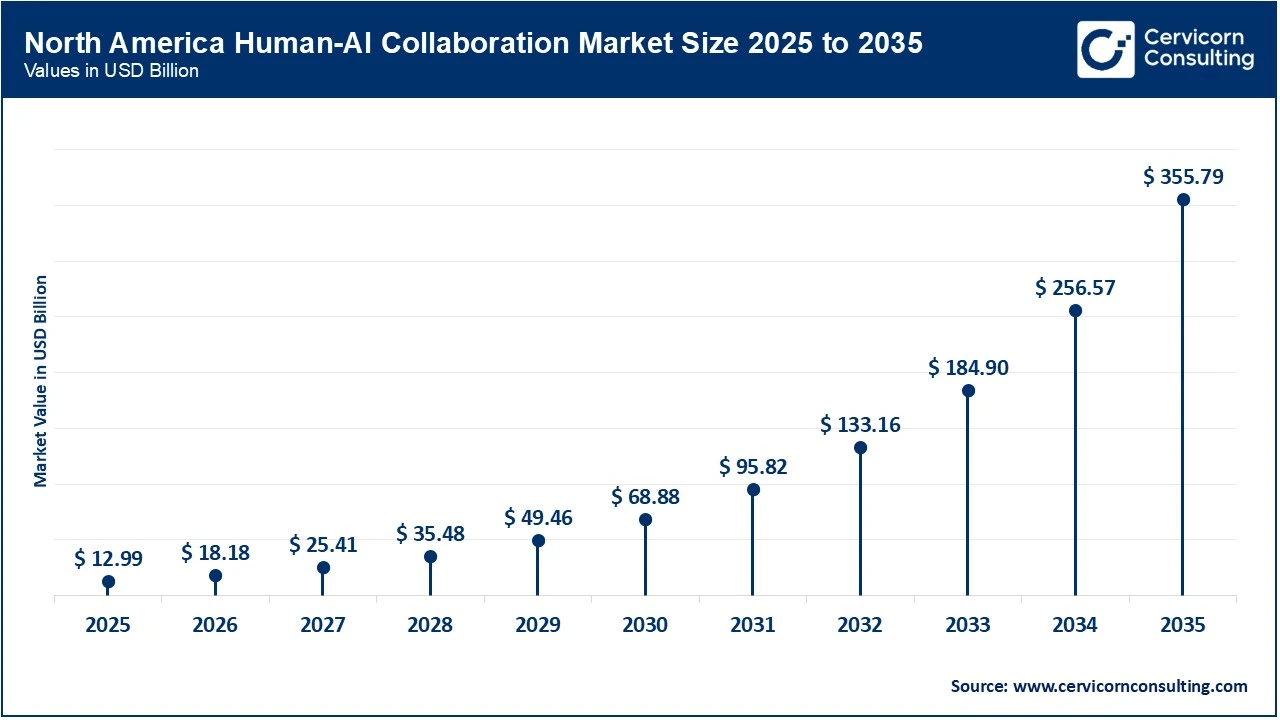

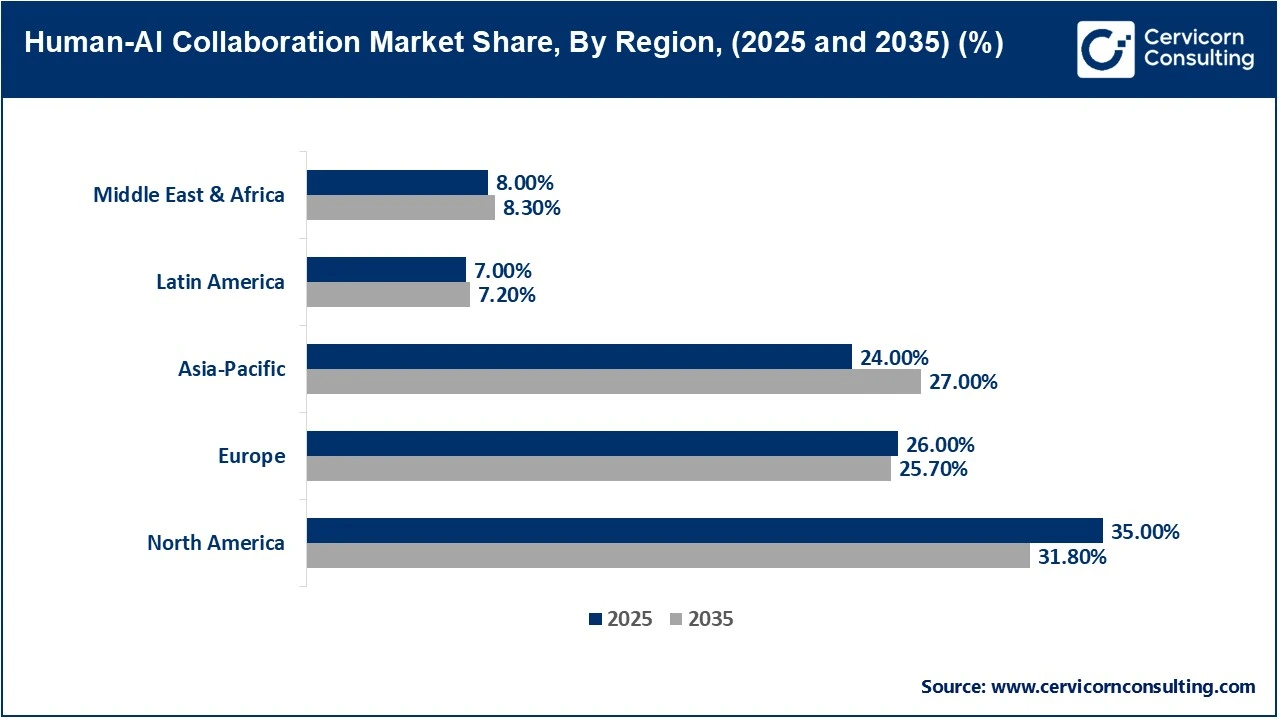

The North America human-AI collaboration market size was valued at USD 12.99 billion in 2025 and is forecasted to hit around USD 323.26 billion by 2035 with a CAGR of 37.7% over the forecast period from 2026 to 2035. North America held the largest share in the global market, with the United States standing out as the dominant hub for innovation, investment, and commercialization. The region’s leadership is backed by massive private sector investment, with major U.S. tech companies such as Microsoft planning to spend up to $80 billion on AI-enabled data centers in 2025, fueling the infrastructure necessary for scalable systems. Large AI startups and platforms are attracting record funding, including a $480 million seed round raised by Humans& at a $4.48 billion valuation, reflecting investor confidence in tools designed to enhance human communication and collaboration.

United States to Hold Vast Potential for Human-AI Collaboration:

The expansion of human-AI collaboration in the U.S. is supported by significant government involvement and public funding for foundational AI research and development. The U.S. National Science Foundation invests over $700 million annually in artificial intelligence research, supporting breakthroughs that feed into collaborative AI ecosystems.

Federal initiatives and partnerships are accelerating adoption in both civilian and defense sectors, including multi-million-dollar contracts such as a $200 million U.S. Department of Defense agreement with OpenAI to develop AI solutions for national security and public service delivery.

Additionally, U.S.-based AI ventures like Sesame secured $250 million for conversational AI smart glasses, while a wave of AI startups in 2025 raised hundreds of millions collectively, including infrastructure and agent technology companies securing rounds of $100 million or more.

The Asia-Pacific human-AI collaboration market size was estimated at USD 8.91 billion in 2025 and is expected to surpass around USD 274.46 billion by 2035 with a CAGR of 41% from 2026 to 2035. Asia Pacific is expected to grow at the fastest rate in human-AI collaboration market, whereas China and Japan are seen to take-over the global industry in the upcoming years with massive investments in AI research and development. Technology leaders such as Microsoft are investing heavily in Asian markets, including a $17.5 billion commitment in India for AI and cloud infrastructure, expanding data centers and supporting local ecosystems that will underpin future collaborative human-AI workflows.

Major global AI firms like OpenAI and Anthropic are establishing regional offices in cities such as Seoul, Tokyo, and Singapore to support rising demand and localize innovation, signaling confidence in Asia as a critical market for collaborative AI solutions. China, India and Japan continue to scale infrastructure and AI deployment at national levels, promoting mass adoption in enterprises and public services, while also expanding standards for algorithmic governance.

The Europe human-AI collaboration market size was reached at USD 9.65 billion in 2025 and is anticipated to grow around USD 261.65 billion by 2035 expanding at a CAGR of 39% from 2026 to 2035. Europe is another significantly growing area for the market. Europe’s strong focus on governance-heavy human–AI collaboration is rooted in its regulatory philosophy, socio-economic priorities, and industrial structure. Unlike regions that prioritize rapid commercialization or large-scale automation, Europe emphasizes responsible AI deployment, where collaboration between humans and AI systems is designed to preserve accountability, transparency, and human oversight.

A key driver behind this approach is Europe’s regulatory architecture, particularly the EU AI Act, GDPR, and updated machinery and product liability regulations. These frameworks explicitly require human oversight in high-risk AI applications, including healthcare, finance, public services, hiring, and law enforcement.

“The AI assistants segment led the human-AI collaboration market in 2025.”

Organizations across industries rapidly adopted AI copilots to augment human decision-making, automate routine tasks, and improve workforce efficiency without replacing human oversight. The proliferation of generative AI models, advancements in natural language processing, and seamless integration with enterprise platforms such as CRM, ERP, and collaboration tools significantly accelerated adoption. Enterprises increasingly view AI assistants as core digital coworkers, supporting knowledge workers in real time while improving speed, accuracy, and scalability across business operations.

Augmented intelligence platforms represent the fastest-growing segment, as enterprises shift from automation-centric models toward collaborative intelligence systems. These platforms emphasize human-in-the-loop frameworks, enabling humans and AI to jointly solve complex problems in areas such as healthcare diagnostics, financial risk analysis, engineering design, and strategic planning. Growth is fueled by regulatory requirements, enterprise trust concerns, and the need for explainable, transparent AI outcomes.

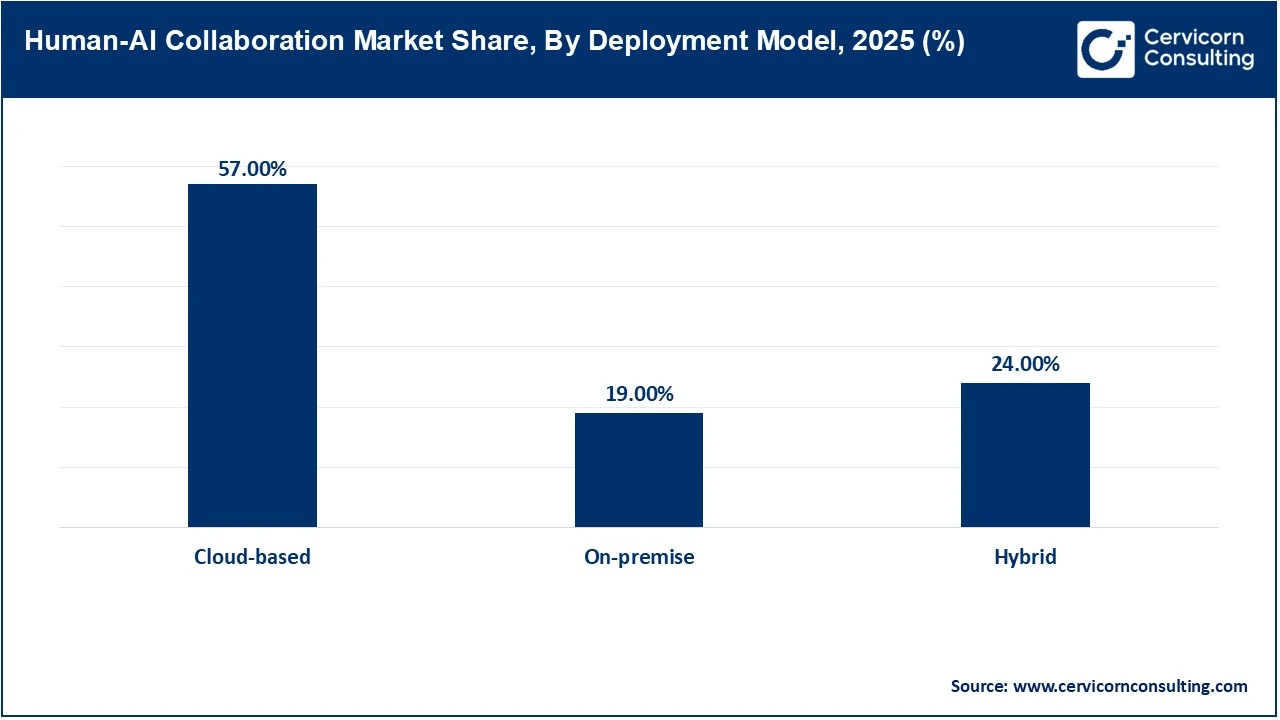

“The cloud-based platforms segment led the human-AI collaboration market by deployment mode.”

Cloud infrastructure enables organizations to continuously update AI models, process large datasets, and integrate collaboration tools across distributed workforces. Enterprises benefit from reduced capital expenditure, faster innovation cycles, and access to advanced AI services without maintaining complex on-premise infrastructure. The dominance of cloud-based deployment is further reinforced by the widespread adoption of SaaS ecosystems, remote work trends, and the growing demand for real-time, AI-assisted collaboration across global teams.

Hybrid deployment models is expected to be the stably-growing deployment segment, as organizations seek to balance cloud agility with data security and regulatory compliance. Industries such as healthcare, BFSI, and government increasingly adopt hybrid architectures to retain sensitive data on-premise while leveraging cloud-based AI capabilities for collaboration and analytics. This approach allows enterprises to maintain control over critical data, ensure low-latency processing, and meet jurisdiction-specific compliance requirements.

“Sales and marketing held the dominating share of the market in 2025.”

AI-powered collaboration tools assist marketing teams in content creation, campaign optimization, customer segmentation, and demand forecasting, while sales teams leverage AI for lead scoring, pipeline management, and conversational intelligence. The direct impact of AI-assisted collaboration on revenue generation and customer experience has made sales and marketing the earliest and most aggressive adopters of human-AI systems.

Product design is significantly growing as a functional segment within the market, supported by advancements in generative design, simulation, and rapid prototyping. Human designers increasingly collaborate with AI systems to explore multiple design iterations, optimize materials, and reduce development cycles. This trend is particularly strong in manufacturing, automotive, consumer electronics, and industrial design, where AI-assisted collaboration enhances creativity while improving cost efficiency and time-to-market.

“The IT and software services industry dominated the market in 2025, this will sustain the position.”

Software teams use AI copilots for code generation, debugging, testing, and system optimization, significantly improving developer productivity and reducing time-to-deployment. The sector’s strong digital maturity, availability of skilled talent, and continuous innovation cycles have positioned IT and software services as the leading adopters and primary revenue contributors in the market.

Human-AI Collaboration Market Revenue Share, By End-User Industry, 2025 (%)

| End-User Industry | Revenue Share, 2025 (%) |

| Healthcare & Life Sciences | 19% |

| Banking, Financial Services & Insurance (BFSI) | 22% |

| Manufacturing & Industrial | 18% |

| Retail & E-commerce | 13% |

| Legal & Compliance | 8% |

| Media, Marketing & Creative | 9.60% |

| Transportation & Logistics | 9.90% |

Retail and e-commerce represent the fastest-growing end-use industry for human–AI collaboration, driven by the need for personalized shopping experiences, demand forecasting, and omnichannel customer engagement. AI-assisted collaboration enables merchandising teams, marketers, and supply chain planners to work alongside AI systems in optimizing inventory, pricing strategies, and customer interactions.

According to the expert panel at Cervicorn Consulting, the most successful organizations have stopped treating AI as a software rollout and started treating it as a workforce transformation. While early adoption focused on surface-level productivity, achieving up to 27% growth in AI-exposed sectorsthe current frontier is Agentic Workflows.

These autonomous agents are no longer just answering queries; they are absorbing complex, multi-step R&D processes, such as shrinking battery cell development cycles from years to weeks. However, a significant "preparedness gap" remains, while 42% of enterprises feel strategically ready, fewer than 20% have mature governance for autonomous agents.

| Company | Primary offering |

| Microsoft | Integrates AI agents into productivity (Office, Teams) and developer tools (GitHub Copilot), enabling human–AI workflow co-creation and automation |

| Provides generative AI support across search, workspace applications, and developer APIs to assist humans in content generation, decision support, and automation. | |

| IBM | Enterprise AI platforms enabling human–AI teaming for analytics, compliance, workflow automation, and domain-specific collaboration. |

| Amazon Web Services | Offers AI building blocks and agent services that support human workflows, code assistance, and cross-platform automation. |

| Salesforce | AI-embedded CRM and service automation tools that combine human expertise with AI-driven insights and assistance. |

| Adobe | Incorporates AI into creative suites to assist content creators and teams in ideation, editing, and collaborative workflows. |

| SAP | AI features integrated into business processes (ERP, HR, supply chain) to augment human decision-making. |

By Type

By Collaboration Model

By Offering

By Deployment Mode

By Organization Size

By End-use Industry

By Region