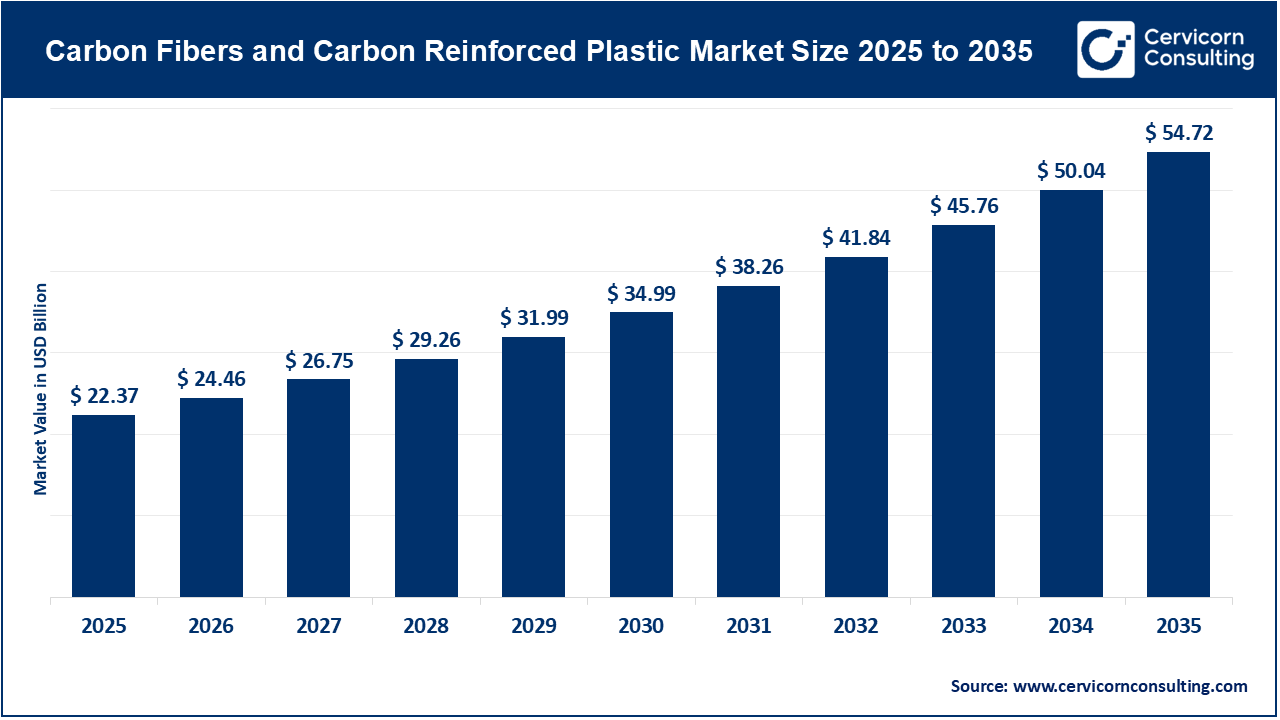

The global carbon fibers and carbon reinforced plastic market size was reached at USD 22.37 billion in 2025 and is expected to be worth around USD 54.72 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.4% over the forecast period 2026 to 2035. The global carbon fiber (CF) and carbon fiber reinforced plastics (CFRP) market is driven by the dual pressures of industrial decarbonization and maximizing extreme materials performance.

The carbon fiber and carbon fiber-reinforced plastic (CFRP) market is one of the technically advanced segments within the global materials marketplace. With extraordinary strength-to-weight ratios, stiffness, and chemical resistance, these materials have transitioned from a niche and specialized military, and aerospace applications to more commercialized industrial usage. This demand growth is underpinned by the global transition towards a low-carbon economy where weight reductions improve energy efficiencies and decrease greenhouse gas emissions.

The principal growth drivers across the CF and CFRP market are complex with various regulatory forces and commercial applications. In the aerospace marketplace, the recovery of commercial aviation, and next-generation narrow-body aircraft development is creating sustained demand for lightweight structural components. The wind energy sector has been discovered to be a major consumer, as the increasing length of turbine blades often greater than 100 meters have primarily utilized carbon fiber spar caps to increase structural integrity while limiting overall mass. Furthermore, the automotive sector, progressing towards electric vehicles (EV), will have a pronounced impact within the CFRP sector, as the development of battery enclosures for EV, offer superior electromagnetic shielding, low weight, and fire-resistance compared to metals.

The Rise of Carbon Fiber Recycling within Circular Economy Models

The shift to a circular economy is one of the most defining trends in the carbon fiber industry due to the high environmental and economic costs of the production of virgin fiber. Energy demands for the production of virgin carbon fiber is one of the most energy intensive industries, with energy demand often greater than 200 MJ/kg, translating into significant carbon footprints associated with these materials. Therefore, recovering carbon fibers that have reached their end-of-life (EoL) from large composite parts and manufacturing scrap has become more important. Recent studies have shown that advanced recycling methods, specifically pyrolysis and solvolysis, can now recover fibers which retain upwards of 90% of their mechanical properties. This recovered carbon fiber typically finds applications in the automotive, electronics, and sporting goods industries as a recyclable source of non-structural, and semi-structural applications that support sustainability objectives and reduces landfill.

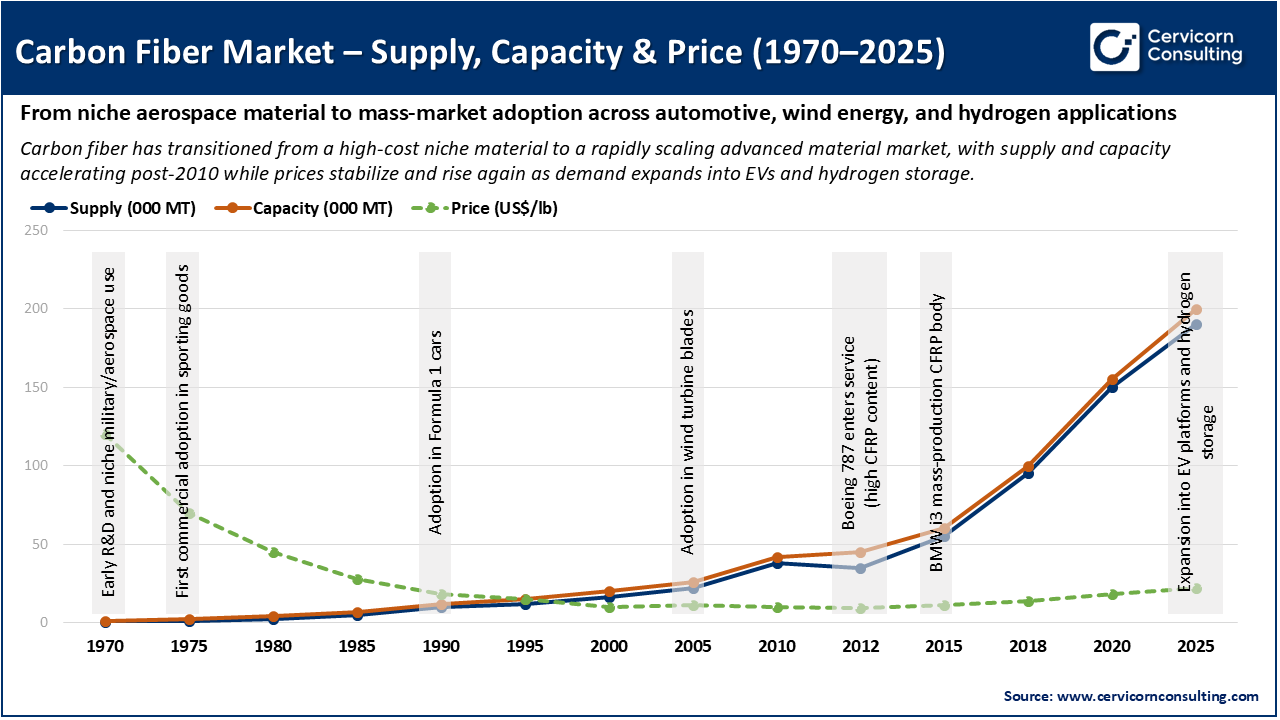

Carbon fiber has evolved from a high-cost niche material to a mainstream advanced material, and this transition is strongly driving market growth. Early price reductions enabled adoption beyond aerospace into sports, automotive racing, and wind energy, while major milestones such as the Boeing 787 and BMW’s mass-production CFRP vehicles triggered large-scale capacity expansion. Today, rapid growth in EVs, renewable energy, and hydrogen storage is pushing both supply and capacity sharply upward, tightening the supply–demand balance and supporting higher prices. This combination of expanding applications, scale-driven production growth, and strategic importance in decarbonization is accelerating the overall carbon fiber market.

1. Major Government Sustainability Initiatives and Subsidies

Government policies have and will continue to support, the adaptation of CF and CFRP materials. The European Union has introduced the Green Deal and vehicle CO2 emission targets under penalty charges, which has incentivized manufacturers to develop lightweight materials for use in vehicles. The federal funding over the years for nanotechnology and advanced materials has exceeded USD 30 billion, which states have used to develop funding for more efficient production of carbon fiber and recycling. China's "Made in China 2025" has acted as a government funded milestone and created unprecedented state support for the domestic carbon fiber supply chain and has decreased dependence on foreign imports of carbon fiber. China has positioned themselves to dominate the renewables (wind) and Electric Vehicle (EV) market.

2. Increased Scale of Contracts for Automotive Production

A major milestone in the commercialization of CFRP has occurred in recent years by securing multi-year contracts for high-volume vehicle platforms. In years prior, carbon fiber would only be found in supercars, but now major OEM's are strategically integrating CFRP into mass-produced electric vehicles in the carbon fiber battery enclosures in battery enclosures, structural pillars, and others. The automotive industry expects its composite market to be USD 28 billion by 2025 in part due to large scale agreements. This growth and shift from a "prototype" to a "series production" presents challenges that require a more sustainable supply chain for carbon fiber materials.

3. Increased Production Capacity from Leading Global Manufacturers

To stave off a potential supply crunch from the aerospace recovery and the burgeoning wind energy boom, leading manufacturers have announced capacity expansions. Toray Industries, Hexcel, and Solvay all expanded precursor and carbonization lines in North America and Asia. The expansion focused not only on adding volume, but also on diversifying the product space by producing "large-tow" fibers that are more economical for industrial applications like wind turbine blades and hydrogen storage). The carbon fiber global supply is being ramped up to ensure fiber supply does not become a bottleneck for the emerging green energy section.

4. More Strategic Use of Thermoplastic Composites in Next Generation Aerospace

The aerospace industry has reached a milestone for use of thermoplastic CFRP which have major advantages in terms of weldability, impact resistance, and recyclability compared to thermosets. Major aerospace programs are increasingly specifying thermoplastic composites for secondary structures and interior components, mostly supported by developments in rapid-cure systems and automated processing capabilities that are better aligned with the production rates of new narrow-body aircraft. Thermoplastic resins can also be "re-melted" and re-formed in the future, which is a potential pathway to recycling aircraft structures and place the aerospace sector in line with global circular economy targets.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 24.46 Billion |

| Market Size in 2035 | USD 54.72 Billion |

| CAGR from 2026 to 2035 | 9.40% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Precursor Type, Source, Resin Type, Manufacturing Process, End-Use Industry, Region |

| Key Companies | Toray Industries, Inc., Hexcel Corporation, Mitsubishi Chemical Corporation, Teijin Limited, SGL Carbon, Solvay S.A., Zoltek Companies, Inc., DowAksa Advanced Composites, Formosa Plastics Corporation, Gurit Services AG, TPI Composites, Hyosung Advanced Materials, Nippon Graphite Fiber Co., Ltd., Röchling, Carbon Composites, Inc. |

The carbon fibers and carbon reinforced plastic market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

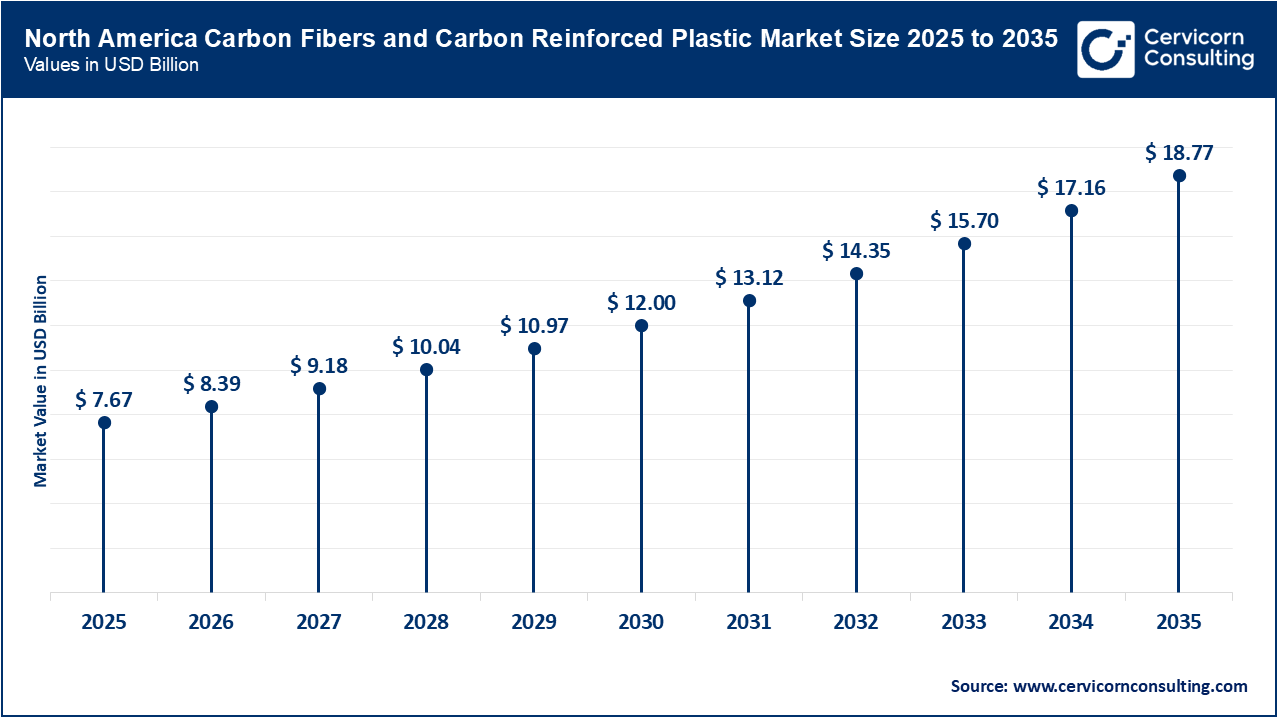

The North America carbon fibers and carbon reinforced plastic market size was valued at USD 7.67 billion in 2025 and is estimated to surpass around USD 18.77 billion by 2035. North America will continue to be the foundation of the market, with growth driven by enormous aerospace and defense resources. North America is home to some of the largest aircraft OEMs and a myriad of researchers and composite manufacturers. We are currently seeing a massive investment towards defense modernization, with new carbon fiber applications critical in stealth aircraft, missiles and next generation UAVs. The U.S. government’s focus on domestic manufacturing and the Inflation Reduction Act have paved new avenues for deploying clean energy technologies, as offered insulation incentives to developing carbon fiber storage for hydrogen, and components for electric vehicles.

Recent Developments:

The Asia-Pacific carbon fibers and carbon reinforced plastic market size was accounted for USD 7.27 billion in 2025 and is forecasted to grow around USD 17.78 billion by 2035. The Asia-Pacific (APAC) region is the fastest growing region, which is lead by China, Japan, and South Korea. This growth is driven by the sheer size of the region's dominance in global manufacturing, especially in automotive and electronics. China's focus on self-sufficiency in carbon fiber, combined with large investments into wind energy, has put China in a global lead for industrial grade fiber consumption. Japan, the last leader in precursor and high-modulus carbon fibers, is still the technological lead, while South Korea is a budding customer to the hydrogen economy with CFRP high-pressure storage tanks.

Recent Developments:

The Europe carbon fibers and carbon reinforced plastic market size was estimated at USD 5.84 billion in 2025 and is predicted to hit around USD 14.28 billion by 2035. Europe is the most advanced region in terms of uptake of sustainability standards and carbon fiber and the circular economy, with its region experiencing growth, particularly due to the European Green Deal, and strict regulations around vehicle emissions and waste regulations. The region has the most developed offshore wind market, which has created a steady demand and commitment to high-performance carbon fiber. Additionally, the region is developing the recycled carbon fiber supply chain and bio-based resin system to be at the forefront of innovation for 'green' composites.

Recent Developments:

Carbon Fibers and Carbon Reinforced Plastic Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 34.3% |

| Asia-Pacific | 32.5% |

| Europe | 26.1% |

| LAMEA | 7.1% |

The LAMEA carbon fibers and carbon reinforced plastic market was valued at USD 1.59 billion in 2025 and is anticipated to reach around USD 3.89 billion by 2035. The LAMEA region is emerging as a market for CF and CFRP, with future demand tied to industrialisation and resource demand. The Middle East is increasingly focused on diversifying away from oil, which is leading to investment into advanced manufacturing and aerospace hubs. Latin America is also experiencing growth in aerospace supply and renewable energy, particularly in Brazil and Mexico. Currently LAMEA is a very small share of the global market, but offers long-term opportunity as infrastructure projects and industrial capabilities grow.

Recent Developments:

The carbon fibers and carbon reinforced plastic market is segmented into precursor type, source, resin type, manufacturing process, end-use industry, and region.

Polyacrylonitrile (PAN)-based carbon fiber is expected to continue being the dominating market segment since it accounts for over 90% of total global production from its balanced combination of tensile strength, tensile modulus, and cost. While other precursors such as pitch exist (pitch is expected to account for the fastest growth segment; see below), industrial and aerospace high-performance applications prefer PAN because of the high carbon content and mechanical properties of fibers that yield the highest strength after carbonization. Established infrastructure for manufacturing, and the maturity of the technology, will likely keep PAN, the industry standard for structural reinforcements.

Carbon Fibers and Carbon Reinforced Plastic Market Share, By Precursor Type, 2025 (%)

| Precursor Type | Revenue Share, 2025 (%) |

| Polyacrylonitrile (PAN)-based Carbon Fiber | 89.8% |

| Pitch-based Carbon Fiber | 10.2% |

While currently a niche, the pitch-based carbon fiber sector is growing quickly in specialized applications where high thermal conductivity and stiffness is paramount. Pitch-based carbon fibers, made from petroleum or coal tar pitch, are critical for high-end satellite components, heat sinks in electronics, and specialized industrial machinery where thermal management is as critical as inherent structural integrity. This growth in pitch-based carbon fiber is being driven by the space economy and increasing power density of modern electronic systems requiring advanced heat dissipation materials.

The virgin carbon fiber segment continues to dominate, particularly in safety-critical systems such as aerospace and defense industries where traceability of materials and consistent mechanical performance or reliability is a must have. Even with high energy intensity and cost, virgin fiber offers continuous high strength filaments to meet the demands of primary structural components. The long term dominance of virgin fiber is also bolstered by long term agreements between first tier fiber producers and OEM aerospace companies guaranteeing continuity of a high specification material for next generation aircraft programs.

Carbon Fibers and Carbon Reinforced Plastic Market Share, By Source, 2025 (%)

| Source | Revenue Share, 2025 (%) |

| Virgin Carbon Fiber | 87.6% |

| Recycled Carbon Fiber | 12.4% |

The recycled carbon fiber (rCF) segment is the fastest growing source type driven by the need for sustainable materials solutions and the growing volumes of composite waste. Recycling technologies have been maturing and as the cost of recovered fiber becomes less than virgin fiber, industries such as automotive, consumer electronics, and sporting goods quickly adopt rCF in non-structural applications. The move towards rCF is also accelerated by government mandates for all "end-of-life" vehicles to be recycled and new supply chains that transform process and manufacturing scrap and waste into value as a commodity.

Thermosets resins, particularly epoxies, continue to dominate as the matrix material in the advanced CFRP world due to their outstanding adhesion to carbon fibers, high thermal stability, and proven track record in aerospace applications. Thermoset composites are the gold standard for high-stress environments requiring dimensional stability and resistance to creep. However, the long cure times associated with thermosets and lack of recyclability are forcing the industry to consider quicker curing alternatives or even bio-based options to enhance their environmental profile.

Carbon Fibers and Carbon Reinforced Plastic Market Share, By Resin, 2025 (%)

| Resin | Revenue Share, 2025 (%) |

| Thermoset Resins | 71.5% |

| Thermoplastic Resins | 28.5% |

Thermoplastic resin is the fastest growing resin type based on suitability for high volume automated production. Unlike thermosets, thermoplastics can be melted and reshaped which lends well for quickly moving through automated production processes. As a result, thermoplastics are very attractive in the automotive and consumer electronics type composites. Furthermore, the base recyclability of thermoplastic CFRPs fits nicely into sustainability agendas worldwide making thermoplastics the top matrix choice for the new generations of environmental composites.

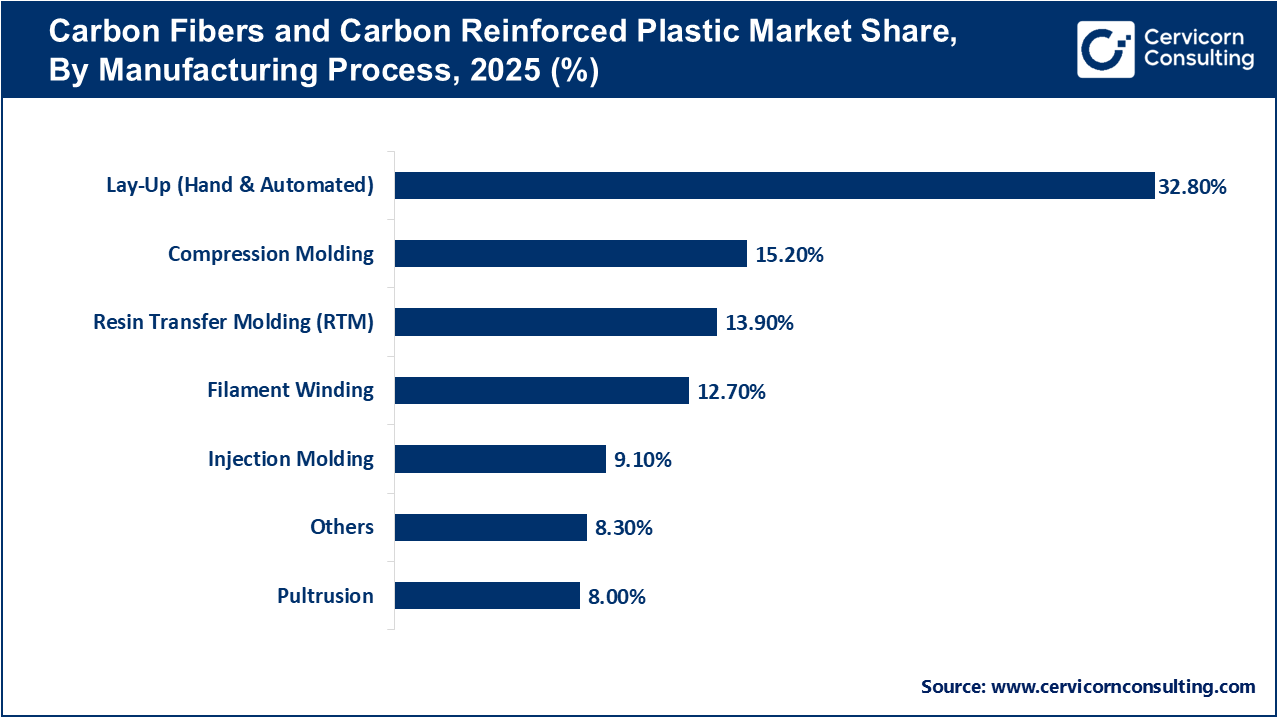

Manual lay-up and automated lay-up followed by compression mold or autoclave cure remains the dominant process, particularly for complex aerospace and high-end automotive parts. This method provides complete control of fiber orientation, and is critical to optimizing the strength of composite characteristics for the final component. Although labor-intensive, the advances in automated fiber placement (AFP) are sustaining the dominance of this process with increasing throughput and minimizing human error in the high-specification chain.

Resin Transfer Molding (RTM) and injection molding are the fastest growth manufacturing processes due to a rising demand for high-volume production in automotive and industrial applications. These closed-mold, or "one-shot" processes provide an excellent surface finish and great dimensional tolerance, allowing for complex parts to be produced with integrated features in one step. New developments of high-pressure RTM (HP-RTM) have reduced the cycle times and made this a competitive technology for mass-market vehicle components as well as industrial applications, where cost-per-part is the main consideration.

Aerospace & defense continues to be the largest end-use segment and largest consumer of carbon fiber by value. The value proposition of carbon fiber's high strength-to-weight ratio is crucial to the next generation of commercial aircraft like the Boeing 787 and Airbus A350, as well as for military jets and satellite structures. This is the most tested industry for weight reduction and certification standards justify large investments for weight reduction, keeping this industry primary in demand for high-performance carbon fiber.

Carbon Fibers and Carbon Reinforced Plastic Market Share, By End-Use Industry, 2025 (%)

| End-Use Industry | Revenue Share, 2025 (%) |

| Aerospace & Defense | 33.7% |

| Automotive | 21.4% |

| Wind Energy | 11.8% |

| Sporting Goods | 9.2% |

| Marine | 5.9% |

| Civil Engineering | 5.1% |

| Pipe & Tank | 4.3% |

| Medical | 3.9% |

| Electrical & Electronics | 3.1% |

| Others | 1.6% |

While aerospace and defense continue to dominate, the fastest growing end-use industries for CF and CFRP are in automotive and wind energy. In the automotive space, the market is driven by the desires for lightweight EV components to maximize battery range, while in wind energy the growth is predominantly driven by the need for "greener" and larger offshore turbines which require carbon fiber for lightweight structural reinforcement of wind turbine blades. Both industries are pledged to large-scale industrialization of carbon fiber, which is expected to dramatically increase the overall volume of carbon fiber consumed globally in the coming years.

By Precursor Type

By Source

By Resin Type

By Manufacturing Process

By End-Use Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Carbon Fibers and Carbon Reinforced Plastic

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Precursor Type Overview

2.2.2 By Source Overview

2.2.3 By Manufacturing Process Overview

2.2.4 By Resin Type Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Demand for Lightweight Materials in the Aerospace and Defense Market

4.1.1.2 Rapid Growth of Wind Energy Sector and Increasing Turbine Blade Lengths

4.1.2 Market Restraints

4.1.2.1 Costly Production and Complexity of CFRP

4.1.2.2 Difficulty with Repairability and Recycling Infrastructure

4.1.3 Market Challenges

4.1.3.1 Volatile Raw Material Prices and Supply Chain Disruption

4.1.3.2 Environmental Regulation for the use of Chemicals in Resins

4.1.4 Market Opportunities

4.1.4.1 Electric Vehicle (EV) Market Growth and Battery Enclosures

4.1.4.2 New Opportunities in Medical Prosthetics and High-End Electronics

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Carbon Fibers and Carbon Reinforced Plastic Market, By Precursor Type

6.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Snapshot, By Precursor Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Polyacrylonitrile (PAN)-based Carbon Fiber

6.1.1.2 Pitch-based Carbon Fiber

Chapter 7. Carbon Fibers and Carbon Reinforced Plastic Market, By Source

7.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Snapshot, By Source

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Virgin Carbon Fiber

7.1.1.2 Recycled Carbon Fiber

Chapter 8. Carbon Fibers and Carbon Reinforced Plastic Market, By Resin Type

8.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Snapshot, By Resin Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Thermoset Resins

8.1.1.2 Thermoplastic Resins

Chapter 9. Carbon Fibers and Carbon Reinforced Plastic Market, By Manufacturing Process

9.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Snapshot, By Manufacturing Process

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Lay-Up (Hand & Automated)

9.1.1.2 Compression Molding

9.1.1.3 Resin Transfer Molding (RTM)

9.1.1.4 Filament Winding

9.1.1.5 Injection Molding

9.1.1.6 Pultrusion

9.1.1.7 Others

Chapter 10. Carbon Fibers and Carbon Reinforced Plastic Market, By End-User

10.1 Global Carbon Fibers and Carbon Reinforced Plastic Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Aerospace & Defense

10.1.1.2 Automotive

10.1.1.3 Wind Energy

10.1.1.4 Sporting Goods

10.1.1.5 Marine

10.1.1.6 Civil Engineering

10.1.1.7 Pipe & Tank

10.1.1.8 Medical

10.1.1.9 Electrical & Electronics

10.1.1.10 Others

Chapter 11. Carbon Fibers and Carbon Reinforced Plastic Market, By Region

11.1 Overview

11.2 Carbon Fibers and Carbon Reinforced Plastic Market Revenue Share, By Region 2024 (%)

11.3 Global Carbon Fibers and Carbon Reinforced Plastic Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Carbon Fibers and Carbon Reinforced Plastic Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Carbon Fibers and Carbon Reinforced Plastic Market, By Country

11.5.4 UK

11.5.4.1 UK Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Carbon Fibers and Carbon Reinforced Plastic Market, By Country

11.6.4 China

11.6.4.1 China Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Carbon Fibers and Carbon Reinforced Plastic Market, By Country

11.7.4 GCC

11.7.4.1 GCC Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Carbon Fibers and Carbon Reinforced Plastic Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Toray Industries, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Hexcel Corporation

13.3 Mitsubishi Chemical Corporation

13.4 Teijin Limited

13.5 SGL Carbon

13.6 Solvay S.A.

13.7 Zoltek Companies, Inc.

13.8 DowAksa Advanced Composites

13.9 Formosa Plastics Corporation

13.10 Gurit Services AG

13.11 TPI Composites

13.12 Hyosung Advanced Materials

13.13 Nippon Graphite Fiber Co., Ltd.

13.14 Röchling

13.15 Carbon Composites, Inc.