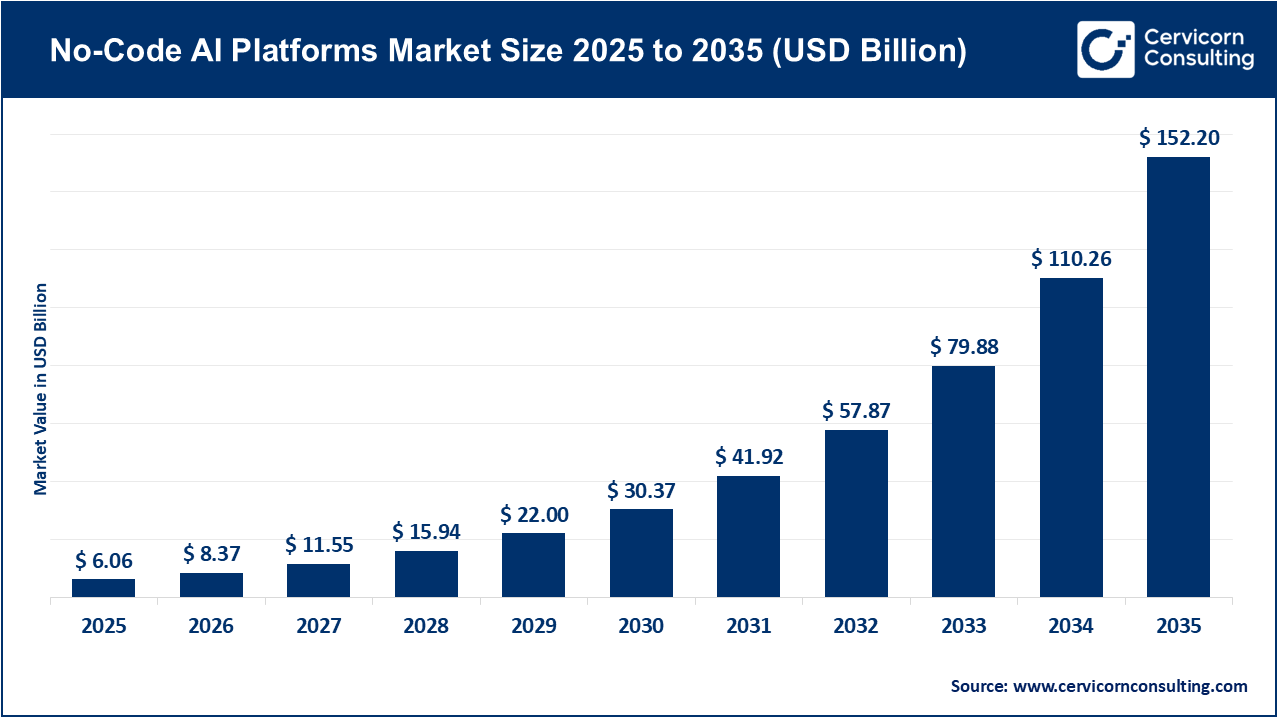

The global no-code AI platforms market size was valued at USD 6.06 billion in 2025 and is expected to be worth around USD 152.20 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 38.05% over the forecast period from 2026 to 2035.

The increasing demand for AI democratization across enterprises is the primary driving force behind the growth of the market for no-code AI platforms. By removing the reliance on data scientists and software developers, many organizations now want their business users, business analysts, and non-technical staff to create their own applications using the no-code approach. The process of reduced development time, reduced cost and accelerated digital transformation has increased as a result of this. The increased use of automation, cloud computing, and data-driven decision-making is evident across multiple industries such as banking, retail, healthcare, and IT services. There is still a huge demand for no-code development platforms which allow organizations to quickly develop chatbots, predictive models, and workflow automation solutions.

Another significant factor driving the growth of the no-code platform market is the difficulty companies face in finding individuals with Artificial Intelligence (AI) and machine learning capabilities, which leads many to seek no-code platforms as alternatives to conventional AI technologies. As companies begin using more natural language processing technologies (NLP), computer vision technologies, and generative AI technologies, the demand for no-code platforms has expanded. These platforms are developing new use cases for conversational interfaces, including customer engagement, process optimization, and content generation. In addition, all of these technologies working together enable SMEs to make larger investments in AI technology and to create cloud-based ecosystems that allow for faster time-to-market and greater efficiency in day-to-day operations.

Rapid Prototyping and Cross-Functional Collaboration Driving No-Code AI Platform Adoption

Rapid prototyping and collaboration provide key growth opportunities for the no-code AI platforms industry, as these tools allow businesses to create, test, and implement AI-based applications within less time than traditional software development processes require. Cross-functional teams comprising business users, data analysts, and specialists can collaborate using visual imaging, drag-and-drop style workflows, and pre-designed AI models, and thus reduce their need for highly skilled developers. These ultimately faster cycles of innovation for organizations create greater opportunities for testing and experimentation, and more responsive organizations to changing market conditions. As organizations place ever-increasing emphasis on agility, cost savings, and reduced time to market, the way in which no-code AI platforms enable faster collaboration and prototyping will greatly increase their appeal to all industries.

1. Microsoft Expands No-Code AI through Power Platform and Government Cloud Initiatives

In 2024-2025, Microsoft are expanding their Power Platform and AI Builder so that businesses and government agencies may build their own Artificial Intelligence products or solutions without expert programming knowledge. This development is aligned with national efforts by governments to digitize their operations within the United States, Europe and Asia, where public officials and departments are moving toward a greater reliance on artificial intelligence in order to enhance citizen service delivery, improve compliance monitoring, and automate workflows. Microsoft is lowering the barriers to AI adoption through the integration of Copilot and Azure AI into low-code platforms, which will enhance business productivity and support the government's objectives related to increasing the efficiency of digital technologies, transparency, and the skill level of employees in the workforce.

2. Google Strengthens No-Code AI Adoption Through Vertex AI and Public Sector AI Programs

Google has enhanced its Vertex AI no-code platform with new features that allow users to use generative AI, predictive analytics, and natural language processing (NLP) to build robust applications without any coding knowledge or experience. This improvement represents a significant milestone toward democratizing access to all types of artificial intelligence (AI) solutions. By making these capabilities available to both the private sector and governmental institutions, Google is further supporting the government's investment in artificial intelligence (AI) innovation within both North America and Europe, as well as providing an avenue for governments and education to create AI capabilities that support the public good. The advantages of making generative AI chatbots, predictive analytics dashboards, automated workflows, and other tools using no-code solutions will keep speeding up the use of no-code AI solutions in public services and many industries with strict rules.

3. IBM Accelerates Enterprise and Government AI Deployment via Watsonx No-Code Expansion

The IBM Watsonx platform has been expanded with the addition of new features that make it easier for enterprises and governments to develop AI models using no-code or low-code tools. In addition to providing new development capabilities to organizations, it will help address regulatory-compliance demands for transparent, safe, and compliant AI solutions. Many government entities and highly regulated industries, such as banking, financial services, and insurance (BFSI), and healthcare, are beginning to use IBM's no-code tools for AI development to deploy predictive analytics, fraud detection, decision-support systems quickly and efficiently while remaining compliant with their respective regulations. This milestone strengthens the market by addressing trust, governance, and scalability, key growth drivers for AI adoption.

4. Salesforce Advances No-Code AI Adoption Through Einstein AI and Public Digital Transformation

Salesforce has expanded no-code functionality to the Einstein AI platform, allowing organizations to create automated tools using AI insights, automation, and customer engagement without the need for any traditional software development. This new incorporation by Salesforce is in direct response to government initiatives that promote the adoption of cloud-first strategies and AI-powered public services throughout North America and Europe. Furthermore, it will enable public agencies and businesses alike to adopt AI in a very rapid and effective manner, thereby accelerating growth within the marketplace while at the same time confirming the important role no-code platforms are playing in large-scale digital transformation initiatives for all leading businesses.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 8.37 Billion |

| Market Size in 2035 | USD 152.20 Billion |

| Market CAGR 2026 to 2035 | 38.05% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Offering, Technology, Data Modality, Application, Vertical, Region |

| Key Companies | IBM, Google, Microsoft, Amazon Web Services (AWS), Salesforce, C3 AI, H2O.ai, Qlik, Clarifai, DataRobot, Dataiku, Levity AI, Akkio, Aito, Obviously AI |

The no-code AI platforms market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

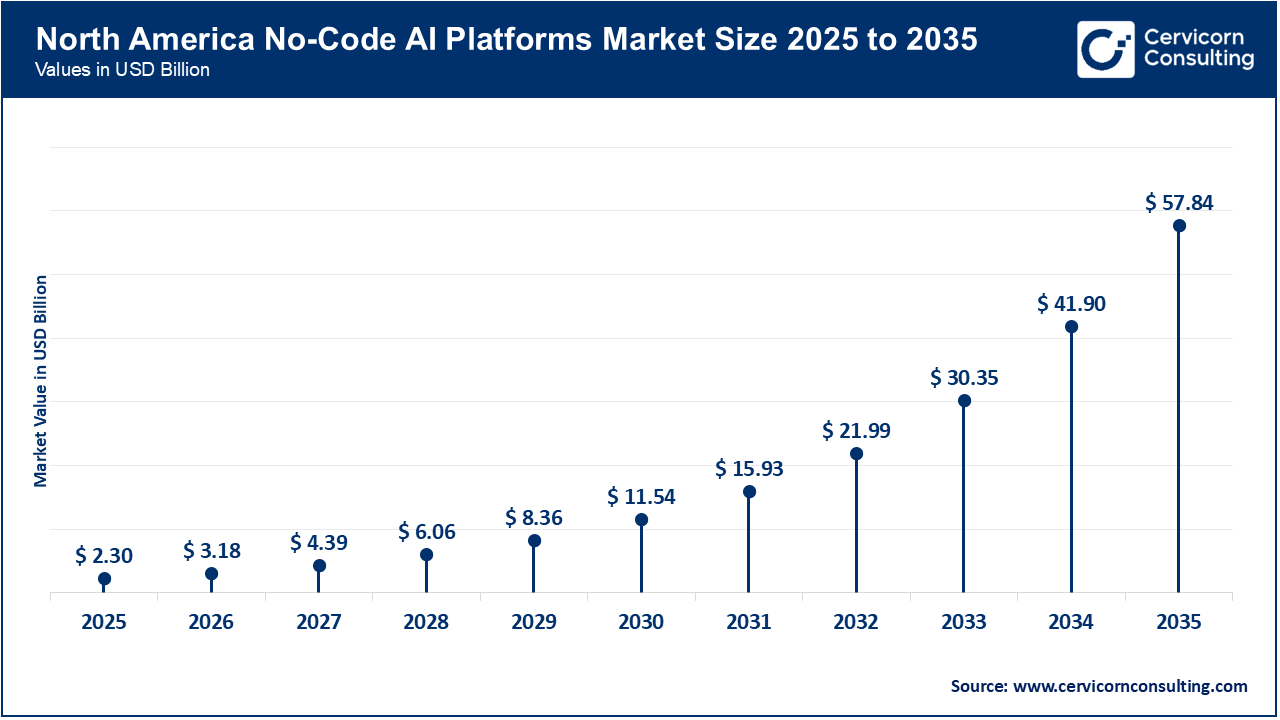

The North America no-code AI platforms market size was valued at USD 2.30 billion in 2025 and is forecasted to grow USD 57.84 billion by 2035. North America dominates the market due to its early adoption of artificial intelligence, strong cloud infrastructure, and high concentration of technology leaders. Many sectors within North America utilize no-code AI platform tools as a means of automating their business processes while also enhancing their customers experiences and interactions through digital transformation activities and automating processes using artificial intelligence tools. The region also has a well-trained workforce skilled in using digital technologies, as well as high levels of investment directed at developing new artificial intelligence solutions through innovation and significant demand for scalable, enterprise-grade AI products. As the presence of large cloud vendors and providers of AI platforms continues to increase, the momentum of the growth and product development of the market will remain strong.

Recent Developments:

The Asia-Pacific no-code AI platforms market size was estimated at USD 1.39 billion in 2025 and is predicted to hit around USD 35.01 billion by 2035. Asia Pacific is the fastest-growing region in the market, because rapid digitalization, increasing usage of cloud services, and increased awareness of AI among small and mid-sized businesses. Countries such as China, India, Japan, and South Korea are making large investments in automation and AI to increase their productivity and competitiveness. The large number of SMBs within this region, along with its rapidly evolving start-up ecosystem and the digital initiatives being supported by governments within the region, are creating robust demand for low-cost, easy-to-use AI platforms. Additionally, no-code tools allow businesses to quickly deploy AI solutions and, therefore, overcome their staffing challenges.

Recent Developments:

The Europe no-code AI platforms market size was reached at USD 1.88 billion in 2025 and is projected to surpas around USD 47.18 billion by 2035. Europe has a significant share of the market due to the strong demand for enterprise automation and increasing interest in responsible and compliant AI. No-code AI platforms are being used by companies in the manufacturing, BFSI, and governmental industries to enhance operational efficiency while remaining compliant with regulations. The significance of data protection, ethical AI, and sustainability in the region has contributed to increasing demand for transparent and explainable AI solutions. Growing investments in digital transformation across Western and Northern Europe are also creating continuous growth within the market.

Recent Developments:

No-code AI platforms market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38% |

| Asia Pacific | 23% |

| Europe | 31% |

| LAMEA | 8% |

The LAMEA no-code AI platforms market was valued at USD 0.48 billion in 2025 and is anticipated to reach around USD 12.18 billion by 2035. Latin America and the MEA Region have the potential to become emerging markets for no-code AI platforms due to recent increases in digital Infrastructure and the demand for affordable, automated solutions. Adopting no-code AI platforms will help businesses in these regions address their limited access to AI-skilled professionals and reduce their technology implementation expenses. The growth of no-code AI platforms is being driven by the continued development of cloud computing services, increased use of mobile devices and the internet, as well as government program initiatives promoting digital inclusion. However, many BFSI, telecommunications, and public sector organizations demonstrate significant long-term growth potential.

Recent Developments:

The no-code AI platforms market is segmented into offering, technology, data modality, application, vertical, and region.

Solutions dominate the no-code AI platforms market due to they are viewed as core platforms utilized by organizations for building, deploying, and managing AI application development. Organizations' primary use of solutions is to automate workflow processes, data analysis, and the realization of AI-driven products without coding. Solutions provide an immediate return on operational value, reduce the amount of time to develop the solution, and enable non-technical individuals to build the AI-driven solution. Organizations' continued role in digital transformation and progression strategies supports the solution's high usage.

No-code AI Platforms Market Share, By Offering, 2025 (%)

| Offering | Revenue Share, 2025 (%) |

| Solutions | 75% |

| Services | 25% |

Services is continue to be the fastest-growing segment in the market because of many businesses looking for to get additional help after they have purchased their initial platform. Businesses are now looking for assistance with platform integrations, customizations, training, and on-going optimizations to maximize their usage of no-code AI tools. With a growing number of businesses adopting no-code AI tools across industries with varying levels of complex data environments, there will continue to be an increasing demand for consulting and managed services. This growing reliance on expert guidance is accelerating the expansion of the services segment.

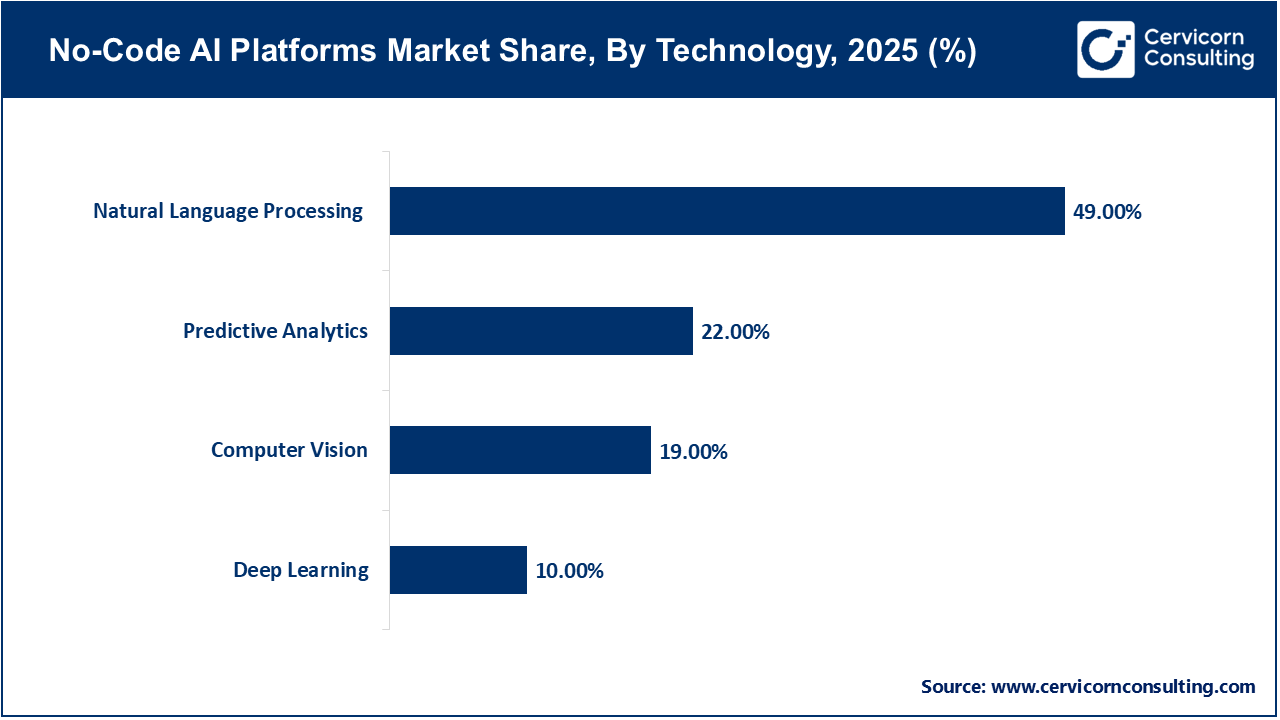

Natural language processing (NLP) dominates the technology segment because it directly supports many of the highest-perceived-value and common use cases in the business world. Organizations of all sectors use some form of language, such as text or speech, to communicate with their customers, employees, and business partners. No-code NLP products make it easier for businesses to develop the types of applications, including chatbots, virtual assistants, automated email responses, and content generation, without technical complexity. Since these applications deliver immediate improvements in customer engagement, improve operational efficiency, and reduce costs, they have become the most widely adopted technology type across many different business sectors. This has made them the largest and most established commercial segment of the no-code AI market.

Predictive analytics is the fastest-growing segments due to organizations are increasingly moving from basic automation to proactive and data-driven decision-making. Companies will seek to be able to predict the future outcomes, such as customer churn, demand patterns, financial risk, operational constraints, and other potential threats, rather than just react to the results of their previous data, as would be done with reports and analysis. Non-technical people can now create, interpret predictive models without any software experience or coding knowledge by using no-code predictive analytics methods. Companies place greater in emphasis on forecasting, risk reduction, and strategic planning. The adoption of predictive analytics technology will continue to increase rapidly, ultimately establishing predictive analytics technology as the fastest-growing segment of the marketplace.

Text segment is primarily dominated by the data modality because most of the enterprise data exists and is generated in a text format. Emails, documents, chat logs, and reports represent textual data, with many organizations storing their enterprise data in PDF and TXT file formats. Text-based solutions are also extensively used in business applications for tasks such as sentiment analysis, classification, summarization, and language generation. As such, they play an important role in daily business operations. Additionally, the ease of working with text data and the maturity of text-based AI tools are both factors contributing to the current level of dominance in the market.

No-code AI Platforms Market Share, By Data Modality, 2025 (%)

| Data Modality | Revenue Share, 2025 (%) |

| Text | 35% |

| Multimodal | 22% |

| Image | 18% |

| Video | 15% |

| Speech & Audio | 10% |

Multimodal data is the fastest-growing segments due to companies are looking for the fastest way to take advantage of AI technology that can analyze and interpret data from multiple sources. The combination of images, sound, and video has many advantages, from improved analytics to enhanced customer interactions. As the number of no-code platforms continues to grow, so will the number of users in various industries have access to that technology.

The workflow automation segment of the market will continue to dominate due to its ability to provide businesses with immediate and measurable improvements in efficiency. Through the use of no-code artificial intelligence (AI) solutions, companies can automate repetitive processes, reduce manual effort, and streamline internal processes without having to write any code. Workflow Automation's direct impact on an organization's productivity, cost savings, and operational speed makes it the most widely utilized application for no-code AI by organizations today.

No-code AI Platforms Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Workflow Automation | 30% |

| Predictive Customer Churn | 20% |

| Chatbots & Virtual Assistants | 16% |

| Text Translation & Generation | 12% |

| Platform Building | 10% |

| Visual Recognition & Object Detection | 7% |

| Others | 5% |

Chatbots and virtual assistants are rapidly becoming one of the fastest-growing segments in the software industry, with an increase in demand for instant and constant engagement with customers. Companies across retail, BFSI, telecoms, and healthcare are all using this technology to answer questions from their customers and help them with their support services and internal assistance. The availability of no-code tools allows companies to deploy chatbots very quickly while providing the ability for ongoing enhancements to the functionality of the chatbots, creating significant growth in this area.

IT & Telecom dominate the segment in the market because these industries were early adopters of digital technologies and AI-driven automation. As a result of this, the need for network optimization, service monitoring, customer analytics, and operational efficiencies has created a large degree of interest in adopting no-code AI solutions. Continued investment into evolving their data infrastructures and bolstered by cultures of continued innovation, the IT & Telecom industries will continue to maintain their dominance in this market.

No-code AI platforms market Share, By Vertical, 2025 (%)

| Vertical | Revenue Share, 2025 (%) |

| IT & Telecom | 28% |

| BFSI | 25% |

| Healthcare | 15% |

| Retail & E-Commerce | 12% |

| Government & Public Sector | 8% |

| Energy & Utilities | 6% |

| Others | 6% |

BFSI is the fastest-growing segment in the market due to banks, financial services, and insurance companies increasing their use of artificial intelligence to support enhanced decision-making and risk management. BFSI is under pressure to identify fraud, anticipate consumer behavior, comply with regulations, and provide a personalized service while maintaining cost-effectiveness. No-code AI platforms allow organizations within the BFSI space to deploy AI models quickly with minimal reliance on specialist development teams. The growing focus on digital transformation and cost efficiency is accelerating adoption across the BFSI sector.

IBM

Microsoft

By Offering

By Technology

By Data Modality

By Application

By Vertical

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of No-code AI Platforms

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Offering Overview

2.2.3 By Data Modality Overview

2.2.4 By Application Overview

2.2.5 By Vertical Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Need to Make AI Accessible to Everyone

4.1.1.2 Increasing Focus on Automation and Faster Business Decisions

4.1.2 Market Restraints

4.1.2.1 Limited Flexibility for Complex and Advanced Use Cases

4.1.2.2 Concerns Around Data Security and Regulatory Compliance

4.1.3 Market Challenges

4.1.3.1 Difficulty in Handling Complex and Advanced AI Requirements

4.1.3.2 Trust, Data Privacy, and Reliability Concerns

4.1.4 Market Opportunities

4.1.4.1 Expanding Adoption Among Small and Medium-Sized Enterprises and Non-Technical Users

4.1.4.2 Integration of Generative AI and Multimodal Capabilities

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global No-code AI Platforms Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. No-code AI Platforms Market, By Technology

6.1 Global No-code AI Platforms Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Predictive Analytics

6.1.1.2 Deep Learning

6.1.1.3 Natural Language Processing

6.1.1.4 Computer Vision

Chapter 7. No-code AI Platforms Market, By Offering

7.1 Global No-code AI Platforms Market Snapshot, By Offering

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Solutions

7.1.1.2 Services

Chapter 8. No-code AI Platforms Market, By Data Modality

8.1 Global No-code AI Platforms Market Snapshot, By Data Modality

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Text

8.1.1.2 Image

8.1.1.3 Video

8.1.1.4 Speech & Audio

8.1.1.5 Multimodal

Chapter 9. No-code AI Platforms Market, By Application

9.1 Global No-code AI Platforms Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Workflow Automation

9.1.1.2 Text Translation & Generation

9.1.1.3 Platform Building

9.1.1.4 Chatbots & Virtual Assistants

9.1.1.5 Predictive Customer Churn

9.1.1.6 Visual Recognition & Object Detection

9.1.1.7 Others

Chapter 10. No-code AI Platforms Market, By Vertical

10.1 Global No-code AI Platforms Market Snapshot, By Vertical

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 BFSI

10.1.1.2 Retail & e-commerce

10.1.1.3 Government & Defense

10.1.1.4 Healthcare & Life Sciences

10.1.1.5 IT & Telecommunications

10.1.1.6 Energy & Utilities

10.1.1.7 Manufacturing

10.1.1.8 Agriculture

10.1.1.9 Media & Entertainment

10.1.1.10 Others

Chapter 11. No-code AI Platforms Market, By Region

11.1 Overview

11.2 No-code AI Platforms Market Revenue Share, By Region 2024 (%)

11.3 Global No-code AI Platforms Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America No-code AI Platforms Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe No-code AI Platforms Market, By Country

11.5.4 UK

11.5.4.1 UK No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific No-code AI Platforms Market, By Country

11.6.4 China

11.6.4.1 China No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA No-code AI Platforms Market, By Country

11.7.4 GCC

11.7.4.1 GCC No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA No-code AI Platforms Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 IBM

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Google

13.3 Microsoft

13.4 Amazon Web Services (AWS)

13.5 Salesforce

13.6 C3 AI

13.7 H2O.ai

13.8 Qlik

13.9 Clarifai

13.10 DataRobot

13.11 Dataiku

13.12 Levity AI

13.13 Akkio

13.14 Aito

13.15 Obviously AI