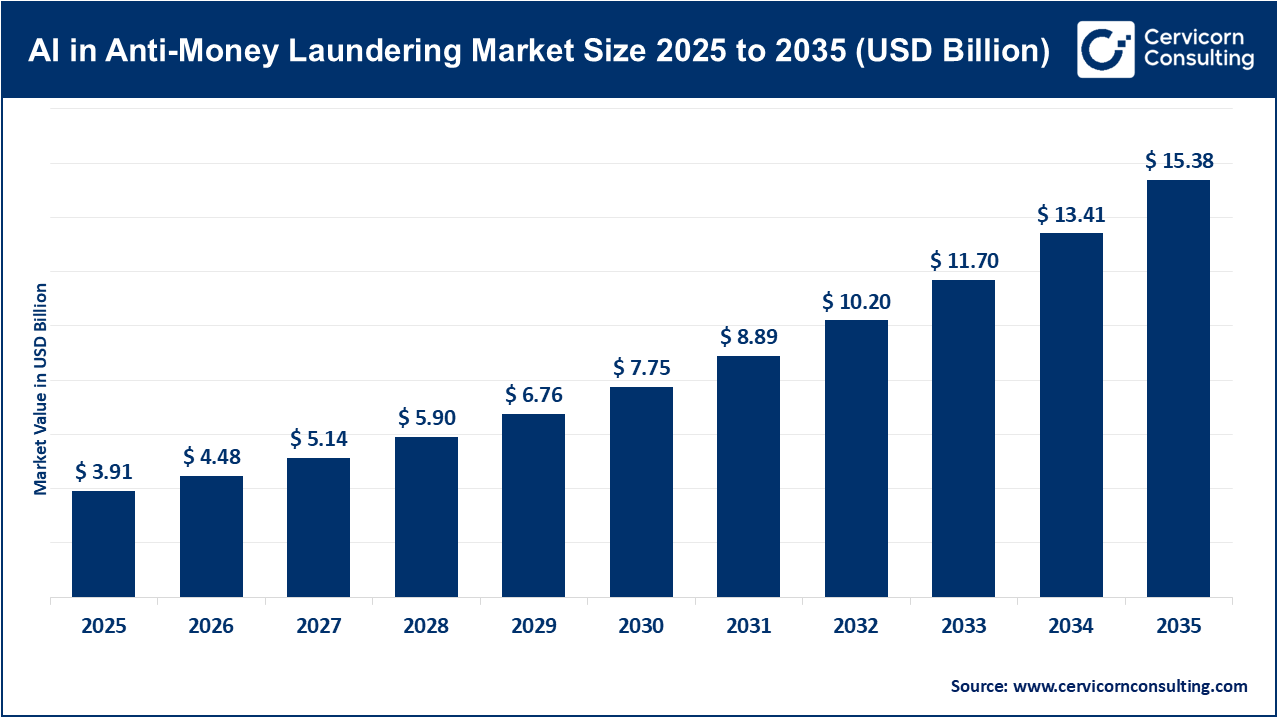

The global AI in anti-money laundering market size was valued at USD 3.91 billion in 2025 and is expected to be worth around USD 15.38 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 14.7% over the forecast period 2026 to 2035.

The AI in anti-money laundering (AML) market is driven by rising global financial crime, complex transaction behavior, and stricter regulatory compliance requirements. Financial institutions adopt AI to improve detection accuracy, reduce false positives, and manage growing transaction volumes efficiently. Recent developments include the use of machine learning for real-time monitoring and advanced analytics for better risk scoring.

Market growth is further supported by digital banking expansion, increased online payments, and adoption of cloud-based AML platforms. Regulators are encouraging explainable AI models, leading vendors to improve transparency and auditability in their systems. Integration of AML and fraud detection, along with monitoring of cryptocurrency transactions, is also accelerating AI adoption across the market.

Increased Regulatory Compliance Driving the AI in Anti-Money Laundering Market

Rising regulatory pressure is a major driver for adopting AI in anti-money laundering systems. Regulators worldwide require financial institutions to monitor transactions more closely, identify suspicious behavior quickly, and report activities accurately. Traditional rule-based AML systems struggle to meet these expectations due to high false positives and slow investigations. AI helps institutions comply by improving detection accuracy, enabling real-time monitoring, and automating large volumes of compliance tasks efficiently.

In recent years, regulators have also increased penalties for non-compliance, pushing organizations to modernize their AML frameworks. AI supports explainability, audit trails, and consistent reporting, which are critical during regulatory examinations. As regulations expand to cover digital payments, fintech platforms, and cryptocurrencies, AI-based AML solutions are becoming essential tools to maintain compliance while controlling operational costs.

Key Regulatory Compliances Driving AI Adoption in AML

| Compliance and Regulation | Region | How It Drives AI Adoption |

| Anti-Money Laundering Act (AMLA) | United States | Requires advanced transaction monitoring and timely suspicious activity reporting |

| Bank Secrecy Act (BSA) | United States | Mandates continuous monitoring and record-keeping, increasing reliance on automation |

| Financial Action Task Force (FATF) Guidelines | Global | Encourages risk-based AML approaches supported by AI analytics |

| 6th Anti-Money Laundering Directive (6AMLD) | European Union | Expands criminal liability, pushing firms toward stronger AI-driven detection systems |

| Markets in Crypto-Assets Regulation (MiCA) | European Union | Enforces AML controls for crypto activities using advanced analytics |

| Know Your Customer (KYC) Regulations | Global | Drives AI use for identity verification and ongoing customer risk assessment |

1. HSBC adopting generative AI for AML operations (2025)

In 2025, HSBC expanded its use of generative AI and advanced analytics to support anti-money laundering investigations and transaction monitoring. This initiative focuses on improving alert investigation speed, summarizing complex cases, and supporting compliance teams with data-driven insights. The move reflects growing confidence among large global banks in using AI for mission-critical compliance activities. It drives the market by setting a strong precedent for enterprise-scale AI adoption, encouraging peer banks to modernize legacy AML systems and invest in advanced AI platforms.

2. SymphonyAI recognized as a leader in AI-driven AML platforms (2025)

In 2025, SymphonyAI gained major industry recognition for its AI-powered AML and financial crime solutions. This milestone highlights the market’s shift toward intelligent transaction monitoring, behavioral analytics, and automated case management. Recognition from industry analysts increases trust among financial institutions evaluating AI vendors. It drives market growth by accelerating vendor adoption cycles, boosting investment in AI innovation, and reinforcing the shift away from rule-based AML systems.

3. Government push for explainable AI in AML compliance (2024–2025)

Between 2024 and 2025, regulators in North America and Europe increased focus on explainable and transparent AI models used in AML compliance. Financial institutions are now expected to clearly explain how AI systems identify suspicious activity and support regulatory audits. This initiative reduces regulatory uncertainty around AI usage while raising compliance standards. It drives the market by pushing vendors to develop explainable AI features, strengthening trust in AI-based AML tools, and expanding adoption among highly regulated banks and financial institutions.

4. Expansion of AI-based crypto transaction monitoring solutions (2024–2025)

During 2024 and 2025, AML technology providers significantly expanded AI-driven blockchain and cryptocurrency monitoring capabilities. These solutions analyze transaction flows, wallet behavior, and cross-chain activity to detect laundering schemes involving digital assets. This development responds to increasing regulatory scrutiny of crypto markets and growing financial crime risks. It drives the AI in AML market by creating new demand from crypto exchanges, fintech firms, and traditional banks entering digital asset services.

Rising financial crime and transaction complexity

The AI in anti-money laundering market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

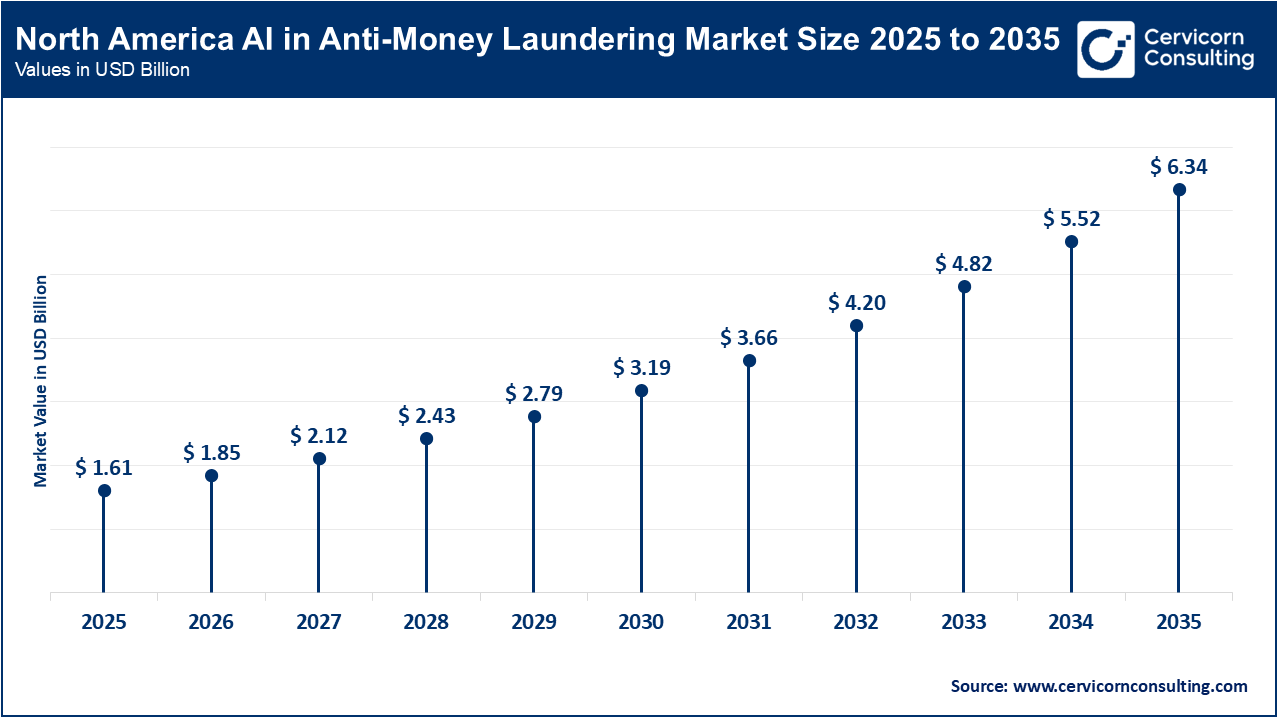

The North America AI in anti-money laundering market size was valued at USD 1.61 billion in 2025 and is expected to hit around USD 6.34 billion by 2035. North America’s AI in AML market growth is driven by intense regulatory enforcement and compliance priorities, as financial institutions seek to avoid costly penalties and strengthen controls. Following significant enforcement actions, such as the appointment of a compliance monitor at TD Bank after major AML failures institutions are investing more in AI-enabled systems to improve transaction monitoring, risk assessment, and suspicious activity reporting. This focus on AI for compliance and risk reduction is expanding adoption across both traditional banks and fintech segments, making North America a key region for advanced AML technology deployment.

Recent Developments:

The Asia-Pacific AI in anti-money laundering market size was estimated at USD 0.88 billion in 2025 and is projected to grow around USD 3.45 billion by 2035. The Asia-Pacific region is a major growth engine for the AI in AML market due to booming fintech markets, government digital finance initiatives, and strong demand for advanced analytics tools. Countries like China, India, Japan, and South Korea are integrating AI into AML compliance to support expanding digital financial ecosystems and regulatory frameworks. The region’s rapid adoption of digital payments and financial inclusion strategies increases demand for scalable AI solutions that can detect complex money-laundering patterns across diverse and high-volume data environments.

Recent Developments:

The Europe AI in anti-money laundering market size was reached at USD 1.08 billion in 2025 and is forecasted to surpass around USD 4.23 billion by 2035. Europe’s AI in AML market is propelled by strong regulatory pressure and innovation in compliance technologies. The European AML ecosystem is evolving as regulators and industry groups emphasize the need for advanced analytics and AI to manage complex financial crime risks, with studies warning that current AML systems may be near breaking point without AI enhancements. This encourages banks and fintechs to adopt AI-powered screening and monitoring to meet stringent standards and avoid penalties. Additionally, collaborative regulatory strategies such as the UK Financial Conduct Authority’s supportive AI oversight initiatives help balance innovation with risk management.

Recent Developments:

AI in Anti-Money Laundering Market Share, By Region, 2025 (%)

| Region | Market Share, 2025 (%) |

| North America | 41.20% |

| Europe | 27.50% |

| Asia-Pacific | 22.40% |

| LAMEA | 8.90% |

The LAMEA AI in anti-money laundering market was valued at USD 0.35 billion in 2025 and is anticipated to reach around USD 1.37 billion by 2035. In LAMEA, the AI in AML market is driven by rising digital finance adoption and supportive government initiatives to modernize financial crime compliance. Urban fintech growth and regtech collaborations are increasing demand for AI solutions, particularly in major markets like Brazil and South Africa, where regulators and financial institutions are investing in screening and detection technologies. While some countries face infrastructure and cost challenges, overall, digital transformations and financial sector modernization stimulate market development.

Recent Developments:

The AI in anti-money laundering market is segmented into component, technology, deployment mode, application, end user, and region.

Software solutions dominate the market as they form the core of AI-based AML operations, including transaction monitoring, risk scoring, sanctions screening, and case management. Financial institutions rely on software platforms to process massive transaction volumes in real time and adapt to evolving financial crime patterns. Continuous upgrades, model retraining, and integration with core banking systems further strengthen the dominance of software offerings.

AI in Anti-Money Laundering Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Software | 68.7% |

| Services | 31.3% |

Services are growing rapidly as organizations seek expert support for AI model deployment, regulatory alignment, and system optimization. Many financial institutions lack in-house expertise to manage complex AI systems and rely on vendors for implementation and managed services. Frequent regulatory updates and the need for ongoing model validation continue to fuel strong growth in this segment.

Machine learning dominates the technology segment due to its proven effectiveness in identifying suspicious patterns across large transaction datasets. ML models improve detection accuracy by learning from historical cases and adapting to new threats. Regulators are more familiar with ML compared to newer AI techniques, supporting wider acceptance and deployment across financial institutions.

AI in Anti-Money Laundering Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Machine Learning (ML) | 42.8% |

| Deep Learning | 18.6% |

| Natural Language Processing (NLP) | 15.4% |

| Robotic Process Automation (RPA) | 13.1% |

| Explainable AI (XAI) | 10.1% |

Explainable AI is expanding quickly as regulators demand transparency in automated AML decision-making. Financial institutions must justify why transactions or customers are flagged as suspicious. XAI tools provide clear model insights and audit trails, making AI decisions defensible during regulatory examinations and accelerating adoption in highly regulated environments.

On-premises deployment remains dominant, especially among large banks, due to strict data security and regulatory compliance requirements. Institutions prefer maintaining full control over sensitive customer and transaction data. Compatibility with legacy systems and internal governance policies further support continued use of on-premises AML solutions.

AI in Anti-Money Laundering Market Share, By Deployment Mode, 2025 (%)

| Deployment Mode | Revenue Share, 2025 (%) |

| On-Premises | 56.9% |

| Cloud-Based | 43.1% |

Cloud-based deployment is the fastest-growing segment due to its scalability, flexibility, and cost efficiency. Cloud platforms allow faster deployment of AI models and easy handling of growing transaction volumes. Fintechs, digital banks, and mid-sized institutions increasingly adopt cloud-based AML solutions to support rapid business expansion.

Transaction monitoring dominates the application segment because it is a mandatory AML function across all regulated financial institutions. AI enhances monitoring by detecting complex patterns such as layering, structuring, and cross-border laundering. The continuous increase in transaction volumes further strengthens the demand for AI-driven monitoring systems.

AI in Anti-Money Laundering Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Transaction Monitoring | 32.4% |

| Customer Due Diligence (CDD) | 14.6% |

| Enhanced Due Diligence (EDD) | 9.8% |

| Know Your Customer (KYC) | 12.7% |

| Sanctions & PEP Screening | 11.3% |

| Fraud Detection & Prevention | 13.9% |

| Regulatory Reporting & Compliance Automation | 5.3% |

Fraud detection and prevention is growing rapidly as financial institutions integrate AML and fraud analytics into unified platforms. AI enables real-time detection of fraud-related money laundering activities, particularly in digital payments. The rise of instant payments and online fraud is accelerating growth in this application area.

Banks and financial institutions dominate the market due to their high exposure to regulatory risk and financial crime. They process large transaction volumes and face strict reporting obligations. Significant compliance budgets and continuous system upgrades support their strong adoption of AI-based AML solutions.

AI in Anti-Money Laundering Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Banks & Financial Institutions | 52.6% |

| Insurance Companies | 9.7% |

| Capital Markets & Investment Firms | 8.4% |

| FinTech Companies | 11.8% |

| Payment Service Providers | 7.1% |

| Cryptocurrency Exchanges & VASPs | 6.2% |

| Government & Regulatory Bodies | 4.2% |

FinTech firms and cryptocurrency exchanges are the fastest-growing end users due to rapid user growth and increasing regulatory oversight. These digital-first organizations require scalable, real-time AML solutions. Growing enforcement actions and compliance expectations are driving strong adoption of AI-powered AML platforms in this segment.

By Component

By Technology

By Deployment Mode

By Application

By End User

By Region