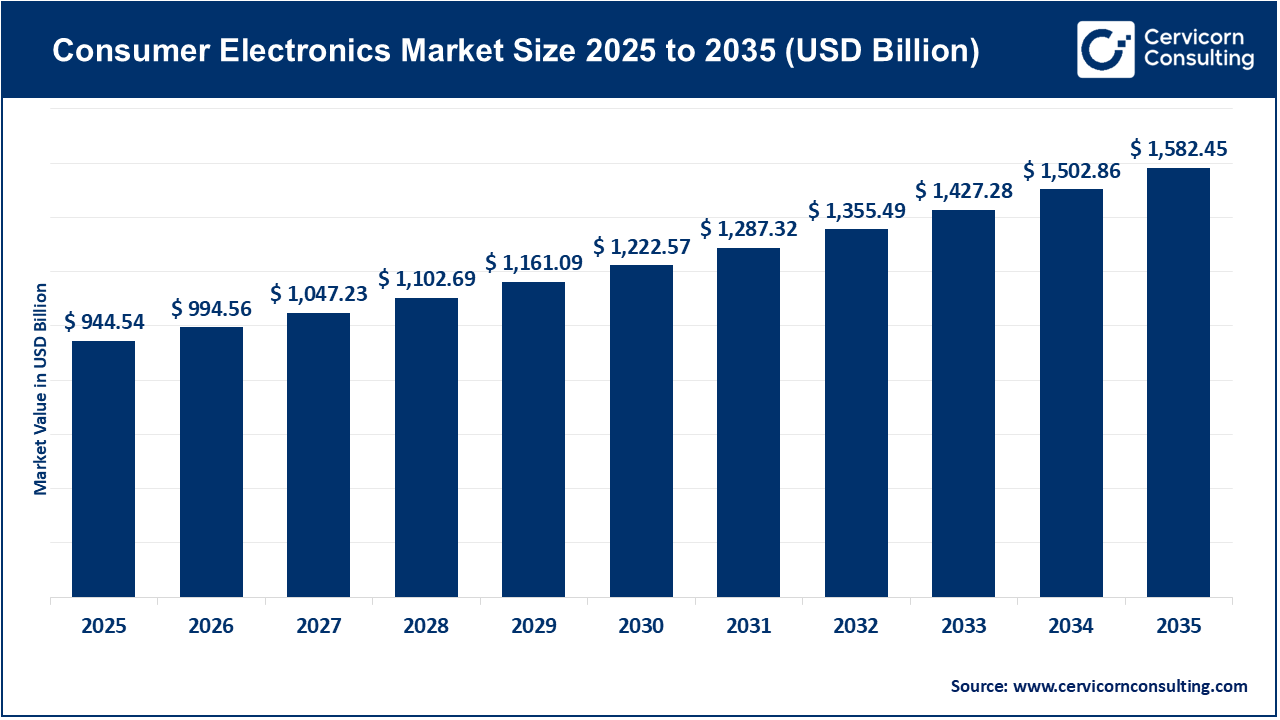

The global consumer electronics market size was estimated at USD 944.54 billion in 2025 and is expected to be worth around USD 1,582.45 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.3% over the forecast period from 2026 to 2035. The consumer electronics market continues to grow because consumers increasingly prefer smart, connected devices that offer convenience and improved performance. Advancements in technologies such as 5G, artificial intelligence (AI), and internet of things (IoT) are making modern electronics faster and more efficient, encouraging more frequent upgrades. Rising incomes, expanding digital infrastructure, and easier online access to products are helping more people purchase smartphones, smart TVs, wearables, and home appliances. As online retail platforms improve delivery speed and product availability, the consumer electronics market experiences steady and widespread global expansion.

Recent developments are also shaping the future direction of the consumer electronics market, especially with strong investments in semiconductor production and AI-enabled devices. Many companies are forming new partnerships and expanding manufacturing capacity to meet the growing demand for advanced electronics. Seasonal spending patterns, rising interest in premium devices, and strong demand from Asia and North America continue to support market momentum. Changes in global supply chains and shifting production hubs also influence pricing, availability, and technology adoption, further impacting the long-term growth of the consumer electronics market.

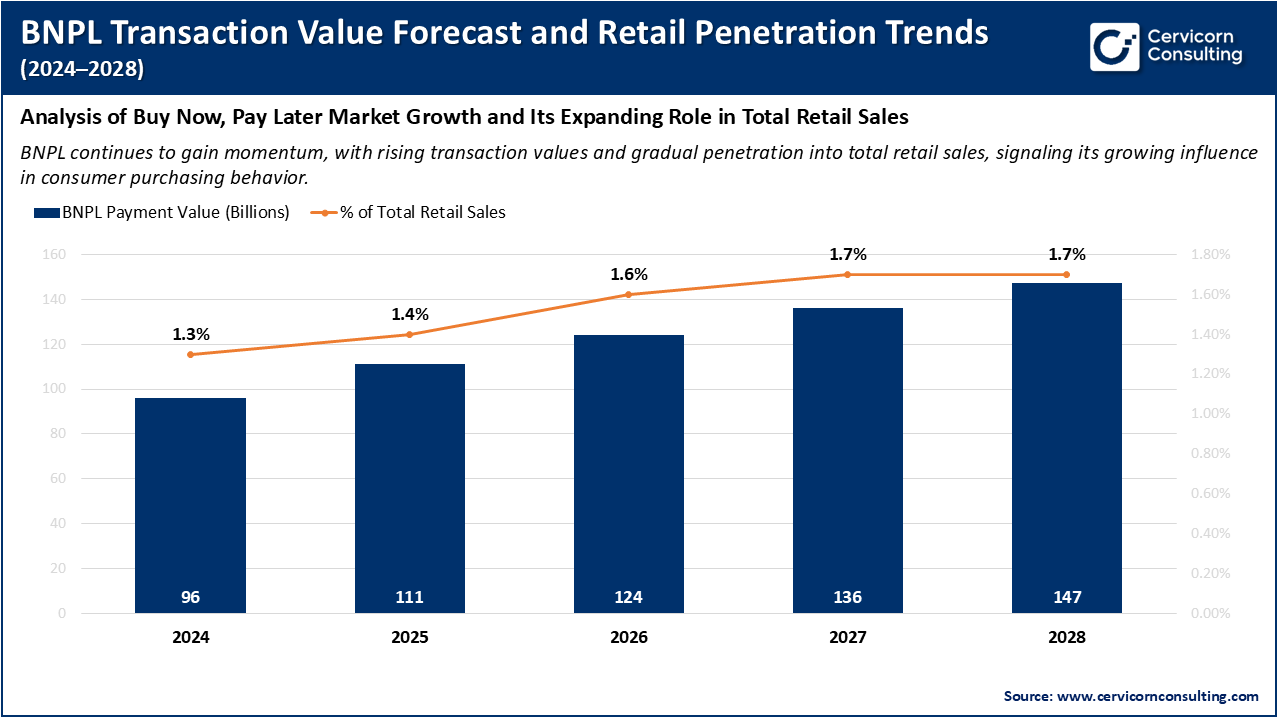

Buy Now Pay Later (BNPL) Services Strengthen Affordability and Drive Electronics Sales

The rise of Buy Now, Pay Later (BNPL) financing is significantly boosting the consumer electronics market by making high-cost devices more affordable for a wider range of customers. BNPL services allow consumers to purchase smartphones, laptops, gaming consoles, and appliances with small scheduled payments, which reduces the immediate financial burden and encourages impulse or early upgrades. This flexible payment structure attracts younger buyers who prefer low-interest or interest-free installment plans over traditional credit cards. As more retailers integrate BNPL options directly into online and in-store checkout systems, consumer confidence and purchasing power continue to rise, leading to increased sales across multiple electronics categories.

In addition, buy now pay later (BNPL) providers are expanding partnerships with electronics brands and e-commerce platforms, creating a smoother purchasing experience that further strengthens market growth. Retailers benefit from higher conversion rates and larger average order values, while consumers gain easier access to premium or emerging technology products. The ongoing digital transformation, combined with rising competition among BNPL providers, is driving lower fees and broader availability of installment plans. As a result, BNPL financing has become an influential growth driver in the consumer electronics market, supporting sustained demand and accelerating adoption of advanced consumer technologies.

1. Apple Announces USD 500 Billion U.S. Investment for Advanced Manufacturing and AI Development

In 2025, Apple Inc. unveiled a massive USD 500 billion investment plan in the United States, including a new manufacturing facility in Houston, expanded R&D centers, and advanced AI and silicon engineering projects. This strategic initiative strengthens the consumer electronics market by boosting output of advanced chips, AI-enabled devices, and cloud infrastructure, while creating thousands of technology jobs and reinforcing supply chain resilience. The investment also fosters innovation in consumer devices such as smartphones, AR/VR products, and smart home applications, enhancing product capabilities and encouraging higher consumer spending globally.

2. Launch of Nintendo Switch 2 and New Global Gaming Console Demand

In 2025, Nintendo released its Nintendo Switch 2, which quickly became one of the fastest-selling gaming consoles worldwide with millions of units sold shortly after launch. This milestone has a strong impact on the consumer electronics market because gaming consoles drive demand for accessories, digital services, and related software ecosystems, increasing overall hardware sales. The success of Switch 2 also signals growing consumer interest in premium entertainment and social-gaming experiences, prompting competitors to innovate and expand offerings, thus expanding the global electronics product cycle.

3. Global Expansion of the Qi2 Wireless Charging Standard (25W)

The Wireless Power Consortium rolled out the upgraded Qi2 25W wireless charging standard in 2025, delivering significantly higher power for faster and more efficient wireless charging across many devices. This development boosts the consumer electronics market by encouraging manufacturers to adopt improved wireless charging in smartphones, wearables, and automotive accessories. Better interoperability and charging performance enhance user convenience, reduce reliance on cables, and support broader adoption of wireless tech products, thus increasing consumer demand and new product launches worldwide.

4. CES 2025 Showcases Breakthrough Consumer Technology Trends Worldwide

CES 2025, the world’s largest annual consumer electronics trade show, highlighted major innovations in AI, smart connectivity, sustainability tech, and healthcare applications. This annual event drives the consumer electronics market by bringing global attention to next-generation products and emerging trends, accelerating technology adoption by businesses and consumers alike. The showcase helps brands launch innovative devices, secure partnerships, and gather international buyer interest, which collectively stimulates product development cycles and boosts global sales across a wide range of consumer electronics categories.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 994.56 Billion |

| Estimated Market Size in 2035 | USD 1,582.45 Billion |

| Projected CAGR 2026 to 2035 | 5.30% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Distribution Channel, End-User, Region |

| Key Companies | Sony Corporation, Samsung Electronics Co., Ltd., Oneplus, Panasonic Corporation, Koninklijke Philips N.V., LG Corporation, Lenovo Inc., Hitachi Ltd., Hewlett-Packard Company, Sennheiser Electronics, AB Electrolux, Google Inc., Robert Bosch GmbH, Microsoft Corporation |

The consumer electronics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America consumer electronics market size was valued at USD 237.08 billion in 2025 and is forecasted to hit around USD 397.19 billion by 2035. North America leads the market due to strong demand for premium devices, rapid adoption of emerging technologies, and high consumer spending power. The region benefits from early integration of AI, IoT, smart home solutions, and next-generation wireless connectivity. Strong retail infrastructure, established brands, and high digital literacy further support product upgrades and category expansion. With a tech-savvy population and wide penetration of smart home devices, North America remains one of the most innovation-driven consumer electronics landscapes.

Recent Developments:

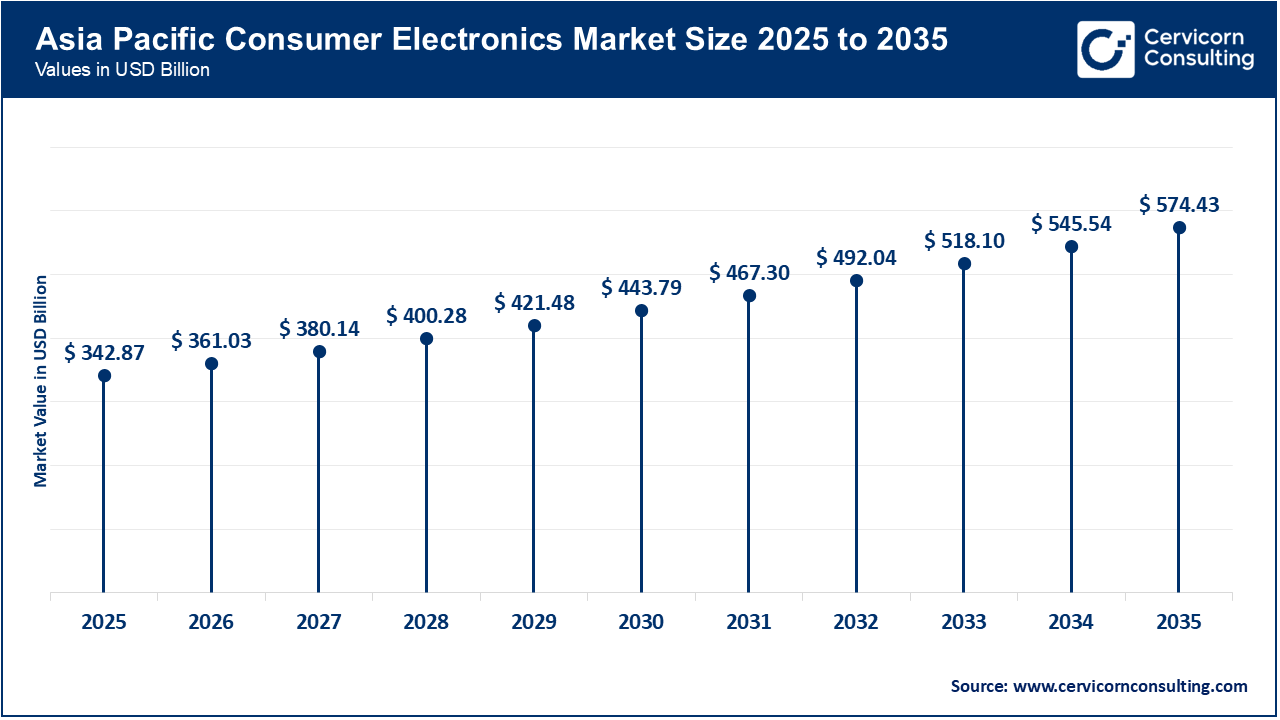

The Asia-Pacific consumer electronics market size was accounted for USD 342.87 billion in 2025 and is poised to reach around USD 574.43 billion by 2035. Asia-Pacific is the fastest-growing region due to its massive manufacturing base, expanding middle-class population, and rapid digitalization. Countries like China, India, South Korea, and Japan dominate electronics production and innovation, enabling cost-efficient devices for global and local markets. Smartphone penetration, online retail expansion, and growing adoption of wearables and smart appliances contribute significantly to market growth. With strong government support for semiconductor development and digital infrastructure, Asia-Pacific continues to shape global electronics trends.

Recent Developments:

The Europe consumer electronics market size reached at USD 225.75 billion in 2025 and is projected to hit around USD 378.21 billion by 2035. The Europe market is heavily influenced by strong environmental regulations and rising consumer interest in sustainable, energy-efficient devices. The region prioritizes low-power appliances, recyclable materials, and eco-friendly product designs. Consumers are also shifting toward smart home products that help reduce energy usage and improve efficiency. Combined with widespread digital transformation, developed infrastructure, and strict quality standards, Europe fosters steady demand for both premium and environmentally responsible electronics.

Recent Developments:

Consumer Electronics Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 36.30% |

| North America | 25.10% |

| Europe | 23.90% |

| LAMEA | 14.70% |

The LAMEA consumer electronics market was valued at USD 138.85 billion in 2025 and is anticipated to reach around USD 232.62 billion by 2035. The LAMEA region is experiencing steady growth driven by rising internet penetration, urbanization, and expanding access to affordable smartphones and appliances. As digital infrastructure strengthens, consumers increasingly adopt online services, streaming platforms, and connected devices. Growing e-commerce ecosystems in Latin America and major smart city projects in the Middle East further stimulate demand for advanced electronics. Although income levels vary widely, improved financing options and expanding retail networks continue to support the market’s upward trajectory.

Recent Developments:

The consumer electronics market is segmented into product type, distribution channel, end-user, and region.

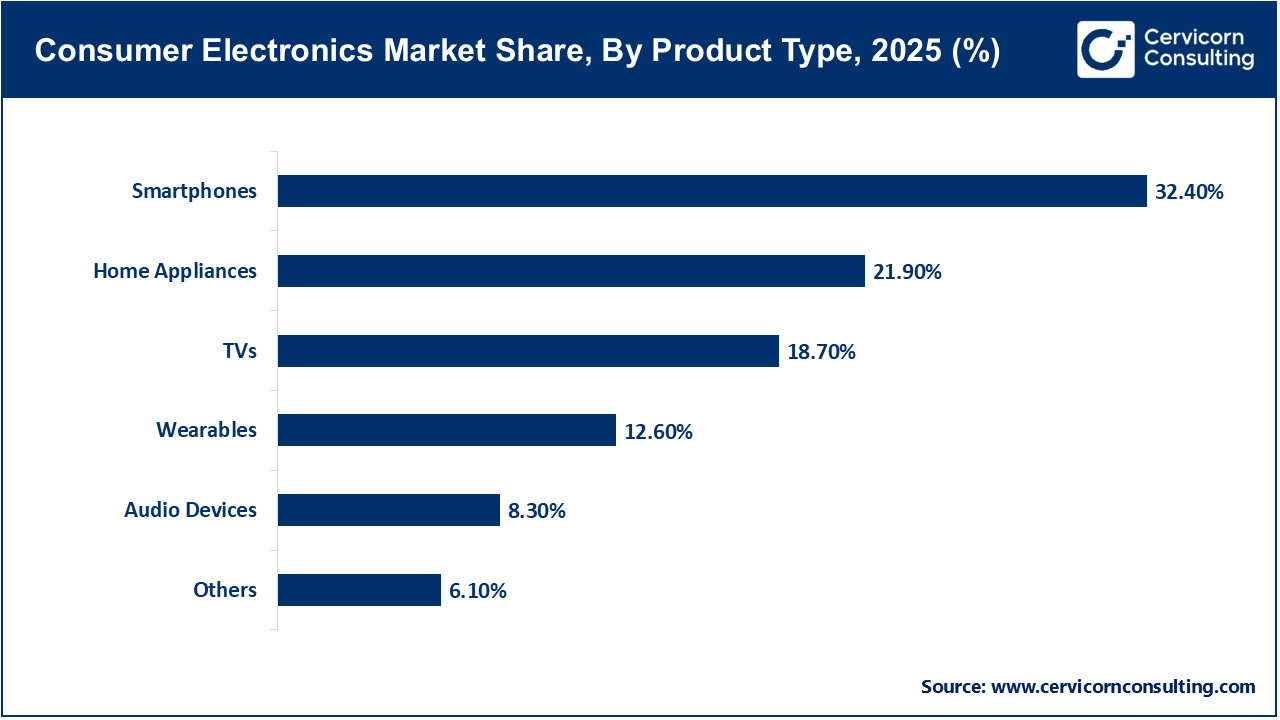

Smartphones dominate the consumer electronics market because they are essential daily-use devices with the highest global penetration. Continuous upgrades in camera quality, battery performance, processors, and AI features make smartphones the central hub for communication, entertainment, payments, and productivity. Their frequent replacement cycle compared to other electronics also drives strong annual sales. Brands like Apple, Samsung, and Xiaomi fuel this dominance through regular flagship launches, attracting both premium and budget consumers across all regions.

Wearables are the fastest-growing product segment due to rising demand for fitness tracking, health monitoring, and seamless connectivity with smartphones. Smartwatches, smart bands, and advanced health wearables are gaining rapid adoption as consumers prioritize wellness and real-time health data. New features such as ECG monitoring, sleep analysis, and AI-driven insights further boost interest. The segment also benefits from strong integration with mobile ecosystems and increasing popularity among younger, tech-savvy consumers.

Offline stores dominate the consumer electronics market because many consumers still prefer to physically inspect high-value electronics before purchasing. Retail outlets, brand showrooms, and large electronics chains provide hands-on product trials, personalized support, and instant purchase satisfaction. Offline channels also build consumer trust through demonstrations, warranty clarity, and on-the-spot assistance. This traditional retail presence remains strong, especially in developing regions where online adoption is still growing.

Consumer Electronics Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel Segment | Revenue Share, 2025 (%) |

| Offline | 62.80% |

| Online | 37.20% |

Online channels are the fastest-growing segment as e-commerce platforms offer discounts, easy price comparison, wider product choices, and fast delivery. The convenience of home shopping, combined with flexible payment methods like BNPL and EMIs, encourages more consumers to buy electronics online. Digital-first launches, flash sales, and exclusive online models further accelerate growth. As internet access and mobile shopping increase worldwide, online distribution continues to expand rapidly across all product categories.

The household segment leads the consumer electronics market because most electronics, including smartphones, TVs, wearables, and home appliances, are primarily purchased for personal or family use. Growing smart home adoption, rising income levels, and the need for connected lifestyle products drive high demand. Households consistently upgrade appliances, entertainment systems, and personal gadgets, contributing to recurring market revenue. This segment remains dominant due to its large consumer base and broad application across daily life.

Consumer Electronics Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| Commercial | 28.50% |

| Household | 71.50% |

The commercial segment is the fastest-growing end-user category as businesses increasingly adopt electronics for productivity, security, communication, and customer engagement. Offices, retail stores, hospitals, and hospitality sectors are investing in displays, audio systems, smart appliances, and connected devices to enhance operations. The rise of hybrid work models is also boosting demand for laptops, monitors, conferencing devices, and enterprise-grade wearables. As more industries digitize their workflows, commercial electronics consumption continues to accelerate.

Recent Developments by Major Companies

Apple

Samsung

Sony

Market Segmentation

By Product Type

By Distribution Channel

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Consumer Electronics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Distribution Channel Overview

2.2.3 By End-User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Adoption of Smart and Connected Devices

4.1.1.2 Growth of Flexible Payment Options, Including BNPL

4.1.2 Market Restraints

4.1.2.1 Volatility in Semiconductor Supply Chains

4.1.2.2 Rising Inflation and Declining Consumer Spending Power

4.1.3 Market Challenges

4.1.3.1 Fast Technology Obsolescence and High Replacement Pressure

4.1.3.2 Increasing Cybersecurity and Data Privacy Risks

4.1.4 Market Opportunities

4.1.4.1 Expansion of AI-Enabled Consumer Devices

4.1.4.2 Rapid Growth in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Consumer Electronics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Consumer Electronics Market, By Product Type

6.1 Global Consumer Electronics Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Smartphones

6.1.1.2 TVs

6.1.1.3 Wearables

6.1.1.4 Home Appliances

6.1.1.5 Audio Devices

6.1.1.6 Others

Chapter 7. Consumer Electronics Market, By Distribution Channel

7.1 Global Consumer Electronics Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Offline

7.1.1.2 Online

Chapter 8. Consumer Electronics Market, By End-User

8.1 Global Consumer Electronics Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Commercial

8.1.1.2 Household

Chapter 9. Consumer Electronics Market, By Region

9.1 Overview

9.2 Consumer Electronics Market Revenue Share, By Region 2024 (%)

9.3 Global Consumer Electronics Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Consumer Electronics Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Consumer Electronics Market, By Country

9.5.4 UK

9.5.4.1 UK Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Consumer Electronics Market, By Country

9.6.4 China

9.6.4.1 China Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Consumer Electronics Market, By Country

9.7.4 GCC

9.7.4.1 GCC Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Consumer Electronics Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Sony Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Samsung Electronics Co., Ltd.

11.3 Oneplus

11.4 Panasonic Corporation

11.5 Koninklijke Philips N.V.

11.6 LG Corporation

11.7 Lenovo Inc.

11.8 Hitachi Ltd.

11.9 Hewlett-Packard Company

11.10 Sennheiser Electronics

11.11 AB Electrolux

11.12 Google Inc.

11.13 Robert Bosch GmbH

11.14 Microsoft Corporation