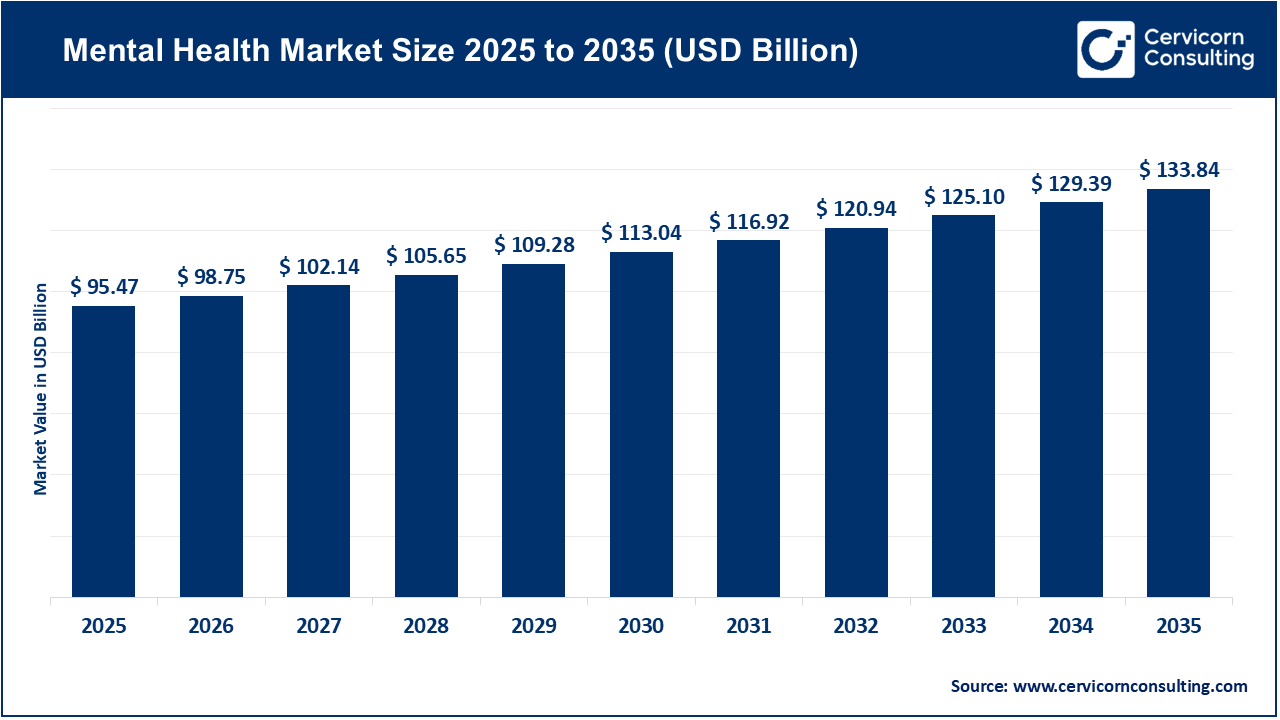

The global mental health market size was accounted for USD 95.47 billion in 2025 and is forecasted to hit around USD 133.84 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 3.4% over the forecast period from 2026 to 2035. The mental health market is being driven primarily by the rising global prevalence of mental disorders, increasing stress levels, and greater awareness of mental well-being. Factors such as urbanization, workplace pressure, social isolation, and lifestyle changes have significantly elevated the incidence of anxiety, depression, and related conditions. At the same time, the reduction of stigma around seeking help supported by public health campaigns, celebrity advocacy, and government initiatives has encouraged more people to access mental health services. Growing recognition of mental health as a key component of overall health has also pushed employers, schools, and governments to expand mental health programs and coverage.

Growth in the market is further accelerated by advancements in digital health technologies, including tele-psychiatry, AI-based mental health apps, and online therapy platforms that improve accessibility and affordability. Increased investment from both private and public sectors, coupled with supportive regulations and insurance reimbursements, is boosting service availability. Aging populations, post-pandemic mental health needs, and expanding corporate wellness programs also contribute to sustained demand. Together, these factors are creating strong momentum for market expansion across healthcare providers, digital platforms, and pharmaceutical companies.

Rising Prevalence of Mental Health Disorders

The global burden of mental health disorders has recently surged to staggering levels: over a billion people worldwide are now living with mental health conditions. This increase is driving a sharp rise in demand for mental health services, especially as more countries expand access to care, integrate mental-health support into emergency responses, and strengthen public awareness programs.

At the same time, technological advances are transforming how mental-health care is delivered. The digital mental-health market including tele-therapy, mobile apps, and digital therapeutics is seeing rapid expansion. As of 2025, its global value is already in the tens of billions of dollars, with forecasts pointing to dramatic growth over the next decade. Innovations such as AI-powered therapy platforms, smartphone-based interventions, and virtual-reality mental-health tools are making mental-health support more accessible, scalable, and affordable especially in regions or populations where traditional in-person care remains limited.

These combined forces rising prevalence of disorders and disruption through digital access are accelerating the growth of the mental health market, shaping both demand and the business models that respond to it.

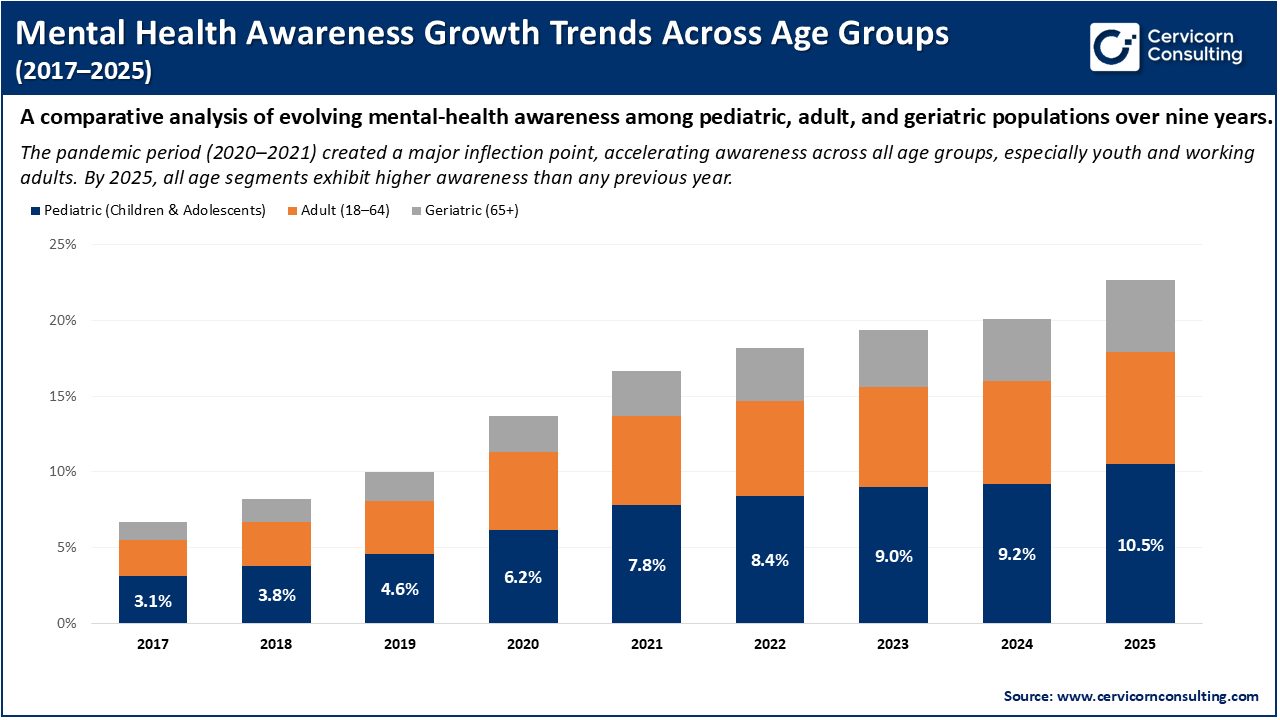

The chart shows a clear and steady rise in mental health awareness across all age groups from 2017 to 2025, with the fastest growth occurring among children and adolescents, followed by consistent increases in adults and slower but stable gains in the geriatric population. This upward trend indicates that more individuals are recognizing symptoms earlier, seeking support, and engaging with mental health services. As awareness climbs, demand for counselling, digital therapeutics, school and workplace wellness programs, and preventive care expands, effectively broadening the consumer base and significantly accelerating overall market growth.

1. Regulatory Approval of Prescription Digital Therapeutics for Mental Health

A major milestone is the regulatory approval of prescription digital-therapeutic apps for treating mental-health disorders, highlighted by the clearance of the first app designed for major depressive disorder. This move officially integrates digital tools into clinical treatment pathways, similar to traditional therapies. With more than 50 digital-therapeutic products currently under regulatory review worldwide, this approval accelerates adoption by motivating clinicians to prescribe them, insurers to consider reimbursement, and healthcare systems to expand digital-first treatment options-ultimately making mental-health support available to millions who struggle with access.

2. Government Initiatives Expanding Mental-Health Infrastructure

Governments globally have intensified mental health commitments, with over 80% of countries now including mental health components in national emergency-response plans and more than 20 nations launching tele-mental-health helplines in the last few years. In India alone, the Tele-MANAS program has set up over 40 regional call centers, handling hundreds of thousands of calls since launch. These efforts expand reach, reduce stigma, and drive the market by increasing service demand, strengthening public-sector partnerships, and encouraging private providers to scale complementary solutions.

3. Rapid Adoption of AI-Driven Mental-Health Technologies

AI-powered mental health tools have surged, with more than 2,000 mental health apps incorporating some form of AI and dozens of platforms piloting AI-assisted triage or therapy features. Some digital platforms report that AI assistants now handle over 60% of initial patient interactions, helping reduce wait times and clinician workload. This milestone drives the market by delivering scalable, 24/7 support, enabling faster assessment, improving personalization, and attracting investment into companies developing next-generation mental-health technologies.

4. Expansion and Partnerships by Leading Mental-Health Providers

Major mental health companies have expanded aggressively through partnerships, with leading platforms securing contracts that collectively cover more than 30,000 employers and organizations worldwide. For example, large digital-therapy providers now offer services to employee populations exceeding 50 million people, while collaboration with schools and universities has added access for over 10 million students. These expansions drive the market by embedding mental health services into workplaces, campuses, and community environments, increasing utilization, and boosting both digital and in-person service demand.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 98.75 Billion |

| Estimated Market Size in 2035 | USD 133.84 Billion |

| Projected CAGR 2026 to 2035 | 3.4% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Disorder, Service Type, Age Group, Region |

| Key Companies | Universal Health Services (UHS), Acadia Healthcare, Centene Corporation, Teladoc Health, CVS Health, Carelon Behavioral Health (Elevance Health), Talkspace Inc., BetterUp Inc., Lyra Health, Spring Health, CloudMD Software & Services Inc. (MindBeacon), Calm.com Inc. |

The mental health market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

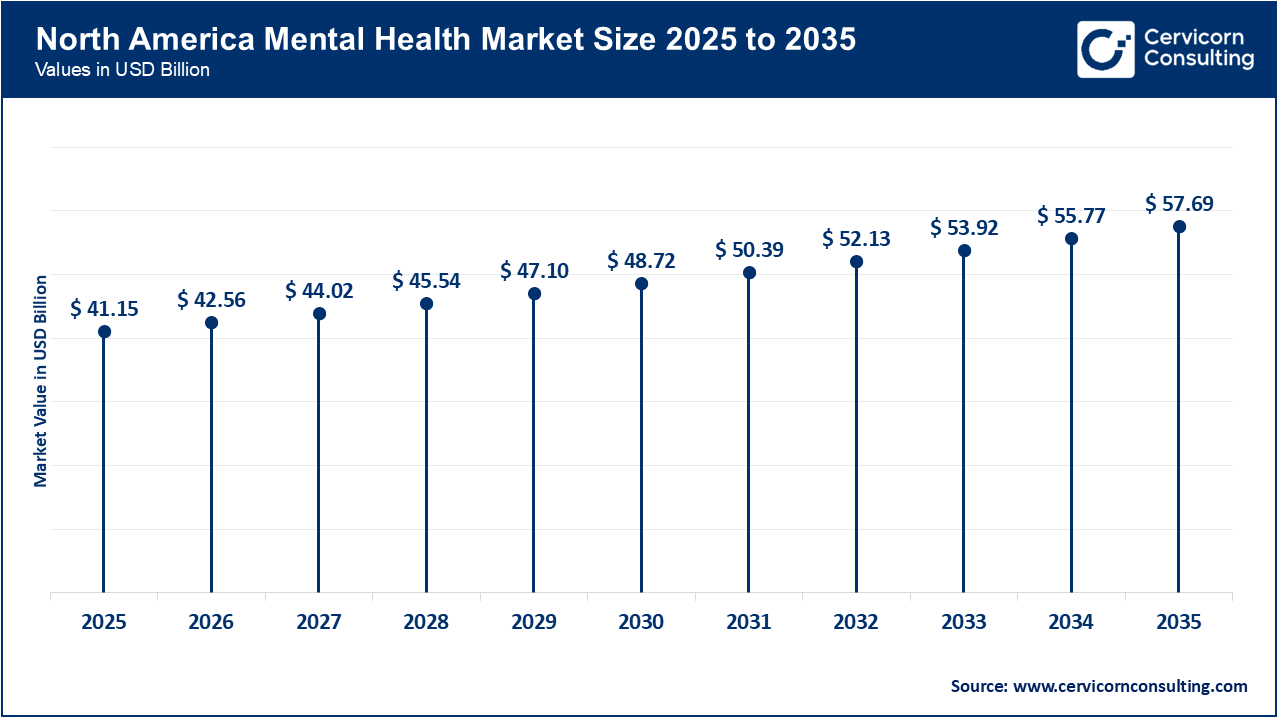

The North America mental health market size was reached at USD 41.15 billion in 2025 and is estimated to grow around USD 57.69 billion by 2035. North America leads the market due to high awareness, strong insurance coverage, and early adoption of digital mental health solutions. The region has a mature healthcare ecosystem, widespread acceptance of therapy, and strong employer-driven mental wellness programs. A major driver is the rapid expansion of tele-mental health services, supported by regulatory flexibility and investment in digital therapeutics. The presence of leading industry players also accelerates innovation and service integration across hospitals, workplaces, and schools.

Recent Developments:

The Asia-Pacific mental health market size was estimated at USD 20.81 billion in 2025 and is projected to surpass around USD 29.18 billion by 2035. Asia-Pacific is the fastest-growing region due to increasing mental health awareness, urbanization pressures, and widespread smartphone adoption enabling digital care solutions. Rising cases of anxiety and depression among youth and working professionals are key demand drivers. Governments across India, China, Japan, and Australia are strengthening national mental health frameworks and scaling tele-mental health programs. The region also sees rapid growth in app-based platforms, making mental health support more accessible in underserved areas.

Recent Developments:

The Europe mental health market size was valued at USD 25.97 billion in 2025 and is expected to hit around USD 36.40 billion by 2035. Europe market benefits from robust government policies, national mental health strategies, and extensive public-health coverage. The region’s driver is strong regulatory support that integrates mental health services into national healthcare systems, improving accessibility. Countries like the UK, Germany, and the Nordics are also expanding digital therapeutics and reimbursement for mental health apps. Growing awareness campaigns and investments in community mental-health centers are further strengthening regional demand.

Recent Developments

Mental Health Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 43.10% |

| Europe | 27.20% |

| Asia-Pacific | 21.80% |

| LAMEA | 7.90% |

The LAMEA mental health market was valued at USD 7.54 billion in 2025 and is anticipated to reach around USD 10.57 billion by 2035. The LAMEA region is experiencing rising demand due to increasing awareness, government-backed mental health reforms, and stronger telehealth infrastructure. The main driver is the push to expand accessible mental health services amid growing cases of stress, trauma, and substance-use disorders. While the region faces workforce shortages, digital platforms and NGO-driven programs are filling gaps in care availability. Investments from both governments and international organizations are helping strengthen regional service capacity.

Recent Developments:

The mental health market is segmented into disorder, service type, age group, and region.

Depression remains the dominating disorder segment because it affects hundreds of millions globally and is one of the most commonly diagnosed mental illnesses across all age groups. Its impact on daily functioning, work productivity, and overall well-being drives a high volume of therapy visits, medication prescriptions, and digital-care utilization. Healthcare systems worldwide prioritize depression screening and treatment, and growing openness to therapy ensures that this segment consistently attracts the largest share of mental health services.

Mental Health Market Share, By Disorder, 2025 (%)

| Disorder | Revenue Share, 2025 (%) |

| Depression | 33% |

| Anxiety | 27% |

| Schizophrenia | 8% |

| Bipolar Disorder | 7% |

| Substance-Use Disorders | 12% |

| Others | 13% |

Anxiety disorders are expanding faster than any other category, fueled by rising work pressure, financial uncertainty, social isolation, and the growing influence of social media on emotional health. Younger populations, especially students and working professionals, are increasingly seeking help for anxiety-related symptoms, boosting both traditional and digital service demand. The segment is also growing rapidly due to the popularity of anxiety-management apps, mindfulness platforms, and early-intervention programs, making it the most dynamic disorder category.

Out-patient counselling dominates the service landscape because it is the most accessible, flexible, and widely adopted form of mental health care. Patients can receive ongoing therapy without hospitalization, making it suitable for mild to moderate conditions and long-term management. Expanded insurance coverage, employee assistance programs, and the normalization of therapy sessions have significantly increased demand. Out-patient centres, private clinics, and hybrid therapy models continue to attract the highest number of users, reinforcing their leading market position.

Mental Health Market Share, By Service Type, 2025 (%)

| Service Type Segment | Revenue Share, 2025 (%) |

| In-patient Treatment | 20% |

| Emergency Mental-Health Services | 8% |

| Out-patient Counselling | 35% |

| Digital Therapeutics & Apps | 12% |

| Virtual & Tele-psychiatry | 18% |

| Others | 7% |

Digital therapeutics and mental-health apps are the fastest-growing segment as consumers increasingly prefer convenient, on-demand, and low-cost support options. These platforms provide evidence-based interventions, AI-assisted guidance, real-time monitoring, and personalized care pathways that appeal especially to young and tech-savvy users. Governments and regulators are also beginning to approve digital therapeutics as legitimate clinical tools, accelerating integration into mainstream healthcare. Their ability to scale rapidly and reach millions makes this segment the most rapidly expanding service type.

Adults remain the dominant age group due to their high exposure to work-related stress, financial pressures, lifestyle challenges, and chronic mental-health conditions. They represent the largest share of patients seeking therapy, medication, corporate wellness programs, and digital mental health solutions. Adults are also more likely to have the financial means or insurance coverage to access regular treatment, solidifying their position as the largest consumer base in the market.

Mental Health Market Share, By Age Group, 2025 (%)

| Age Group Segment | Revenue Share, 2025 (%) |

| Pediatric | 18% |

| Adult | 65% |

| Geriatric | 17% |

Pediatrics is the fastest-growing age segment as mental-health issues among youth have risen sharply due to academic stress, bullying, digital addiction, and social-media influence. Schools and governments are investing heavily in early detection, counselling, and emotional-wellness programs, creating a surge in demand for child-focused mental-health services. Parents are increasingly aware of behavioral and emotional health needs, and new youth-centered digital therapy tools are further accelerating growth in this category.

By Disorder

By Service Type

By Age Group

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Mental Health

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Disorder Overview

2.2.2 By Service Type Overview

2.2.3 By Age Group Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Prevalence of Mental Health Disorders

4.1.1.2 Expansion of Digital and Tele-Mental Health Services

4.1.2 Market Restraints

4.1.2.1 Shortage of Trained Mental Health Professionals

4.1.2.2 Stigma and Low Awareness

4.1.3 Market Challenges

4.1.3.1 Data Privacy and Security Concerns

4.1.3.2 Fragmented Mental Health Infrastructure

4.1.4 Market Opportunities

4.1.4.1 Rising Workplace Mental Health Programs

4.1.4.2 Rising Workplace Mental Health Programs

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Mental Health Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Mental Health Market, By Disorder

6.1 Global Mental Health Market Snapshot, By Disorder

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Depression

6.1.1.2 Anxiety

6.1.1.3 Schizophrenia

6.1.1.4 Bipolar Disorder

6.1.1.5 Substance-Use Disorders

6.1.1.6 Others

Chapter 7. Mental Health Market, By Service Type

7.1 Global Mental Health Market Snapshot, By Service Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 In-patient Treatment

7.1.1.2 Emergency Mental-Health Services

7.1.1.3 Out-patient Counselling

7.1.1.4 Digital Therapeutics & Apps

7.1.1.5 Virtual & Tele-psychiatry

7.1.1.6 Others

Chapter 8. Mental Health Market, By Age Group

8.1 Global Mental Health Market Snapshot, By Age Group

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pediatric

8.1.1.2 Adult

8.1.1.3 Geriatric

Chapter 9. Mental Health Market, By Region

9.1 Overview

9.2 Mental Health Market Revenue Share, By Region 2024 (%)

9.3 Global Mental Health Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Mental Health Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Mental Health Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Mental Health Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Mental Health Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Mental Health Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Mental Health Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Mental Health Market, By Country

9.5.4 UK

9.5.4.1 UK Mental Health Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Mental Health Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Mental Health Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Mental Health Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Mental Health Market, By Country

9.6.4 China

9.6.4.1 China Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Mental Health Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Mental Health Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Mental Health Market, By Country

9.7.4 GCC

9.7.4.1 GCC Mental Health Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Mental Health Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Mental Health Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Mental Health Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Universal Health Services (UHS)

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Acadia Healthcare

11.3 Centene Corporation

11.4 Teladoc Health

11.5 CVS Health

11.6 Carelon Behavioral Health (Elevance Health)

11.7 Talkspace Inc.

11.8 BetterUp Inc.

11.9 Lyra Health

11.10 Spring Health

11.11 CloudMD Software & Services Inc. (MindBeacon)

11.12 Calm.com Inc.