Video Streaming Market Size and Growth 2026 To 2035

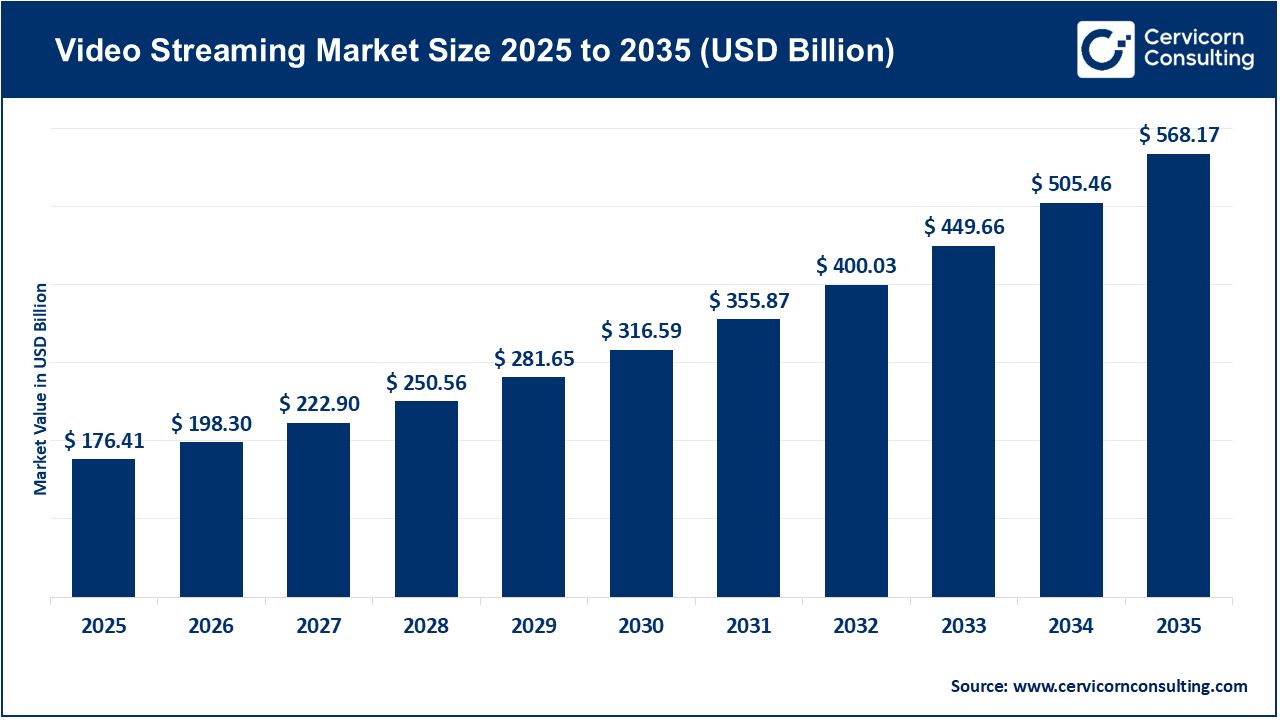

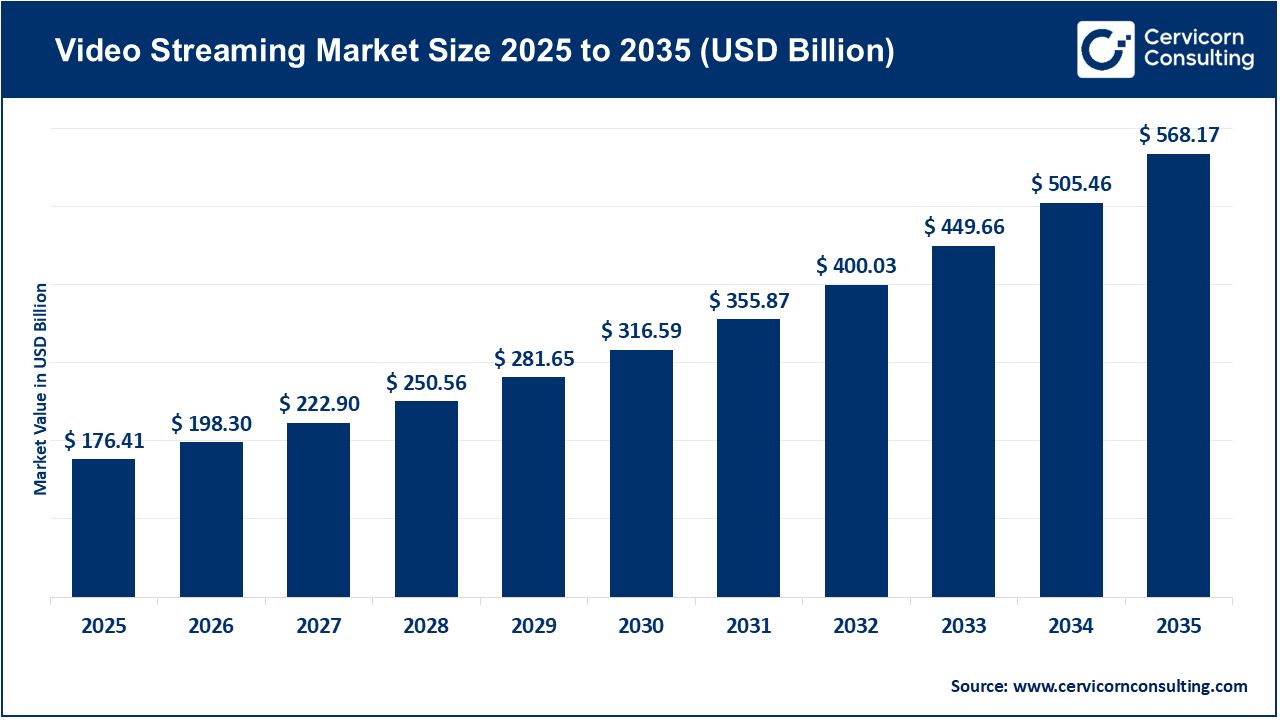

The global video streaming market size reached at USD 176.41 billion in 2025 and is expected to be worth around USD 568.17 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 12.41% over the forecast period 2026 to 2035. The video streaming market is experiencing growth due to a combination of high-speed internet availability and the availability of smartphones, smart TVs, and other connected devices. The popularity of online video consumption is increasing with each new generation catering to the trend of removing the television as their preferred content medium. Video is more easily consumed with on-demand content, live-streaming, and user-generated video. The growth of cloud technology and content delivery networks (CDNs) have also improved the loading times for most consumers and have switched many to online mediums entirely.

Another potential driver of the video streaming market is a demand for personalized and original content. Many streaming platforms use artificial intelligence and analytics to create individual viewing experiences while building viewer engagement and viewing time. With advertising shifts toward digital devices, and the shift to a subscription-based society, the video streaming market has room to grow as video consumption increases. As consumer technology improves, video quality, and innovative watching formats improve to viewing experiences across multiple verticals, including but not limited to entertainment, education, sports and corporate video.

Report Highlights

- By Region, North America leads the market with 32.1% share, followed by Europe at 28.9%, Asia-Pacific at 27.3%, and LAMEA at 11.7%.

- By component, solution dominates with 72% share, while services account for 28% of the market.

- By Streaming Type, non-Linear Video Streaming leads with 63%, supported by high demand for on-demand content, while Live/Linear Streaming holds 37%.

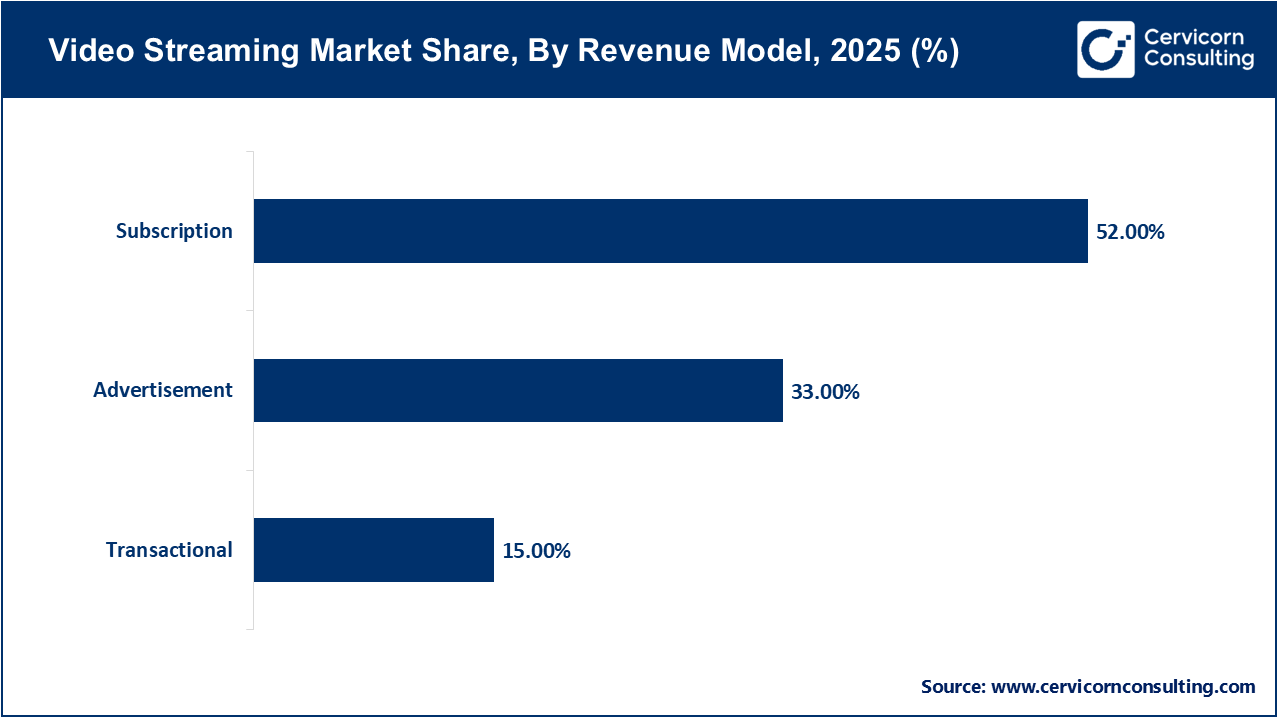

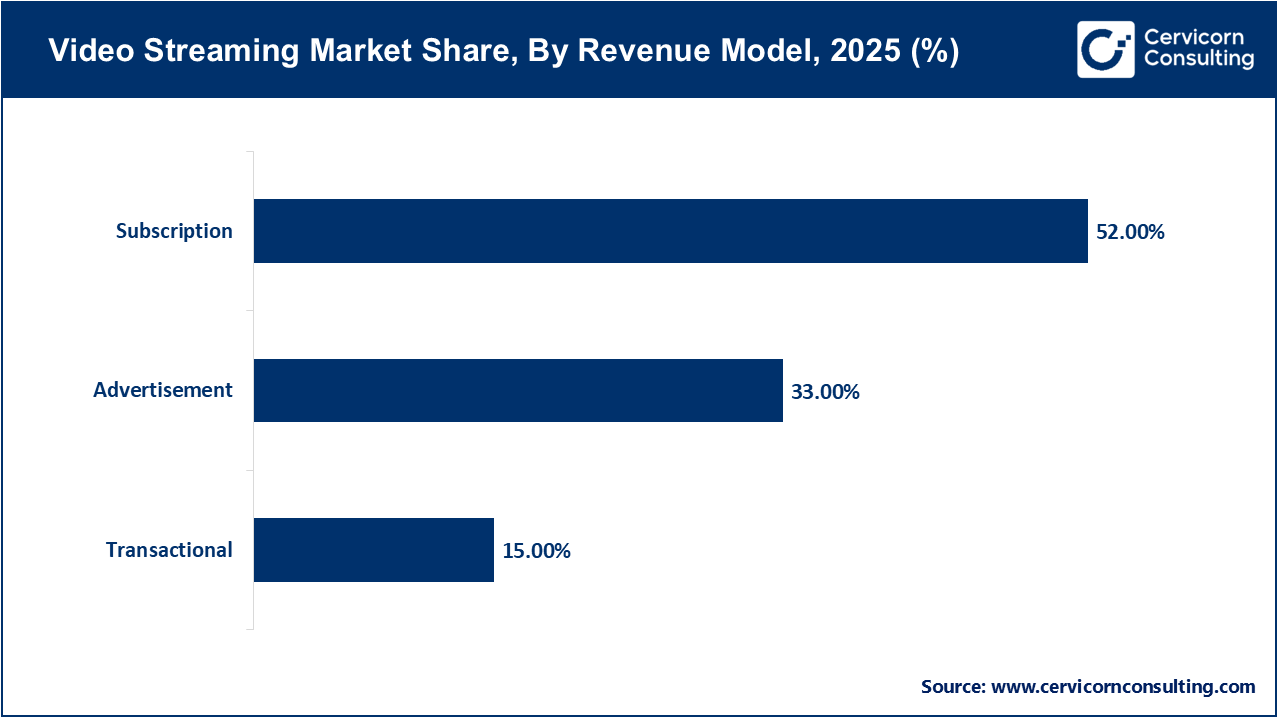

- By Revenue Model, the subscription model holds the highest share at 52%, followed by Advertisement at 33%, and Transactional at 15%.

- By End User, the personal segment accounts for 78%, driven by smartphone usage and home entertainment adoption, while the commercial segment holds 22%.

- By Platform, Smartphones & Tablets segment has captured revenue share of 42% in 2025.

- By Deployment, cloud segment has generated maximum revenue share of 78% in 2025.

What is Video Streaming?

Video streaming is watching videos via the internet in real time rather than downloading them onto your device first. Users can access movies, TV episodes, music videos, or live broadcasts at any time on their smartphone, computer, or smart TV device. The video data is broken into smaller parts on a server and is played continually as parts of it are received. This provides instant access to content for people whenever they have internet.

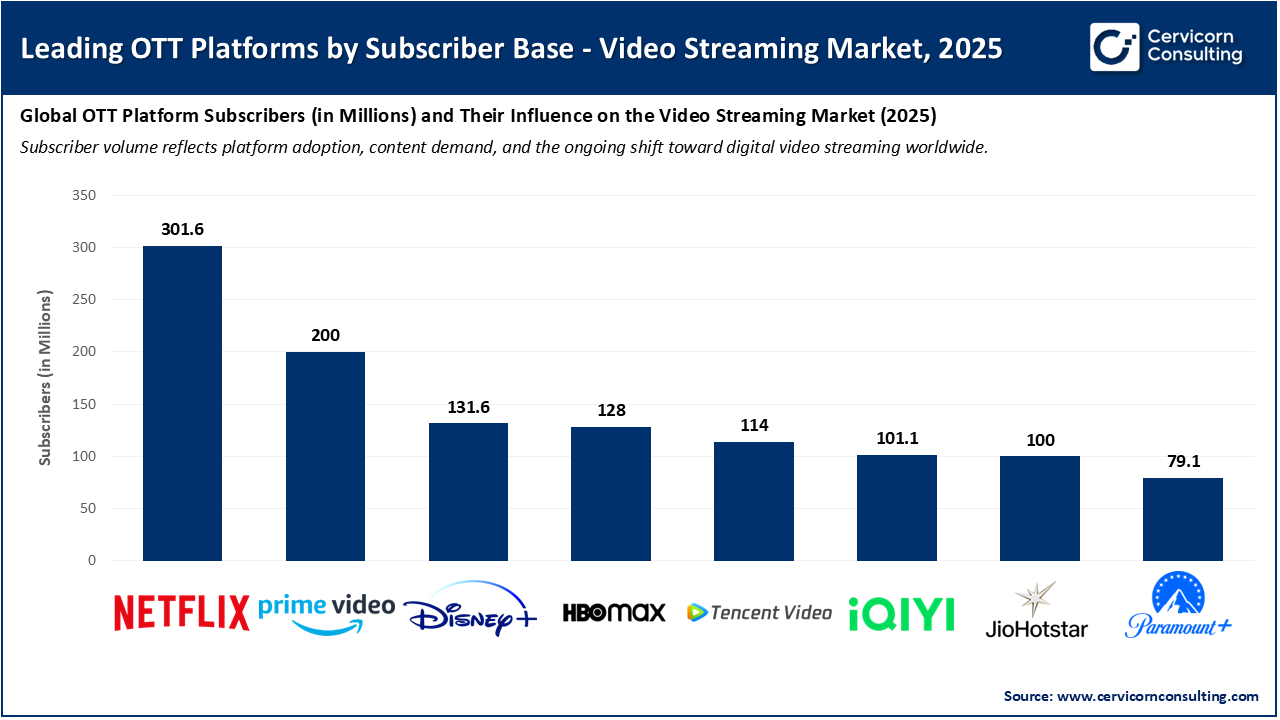

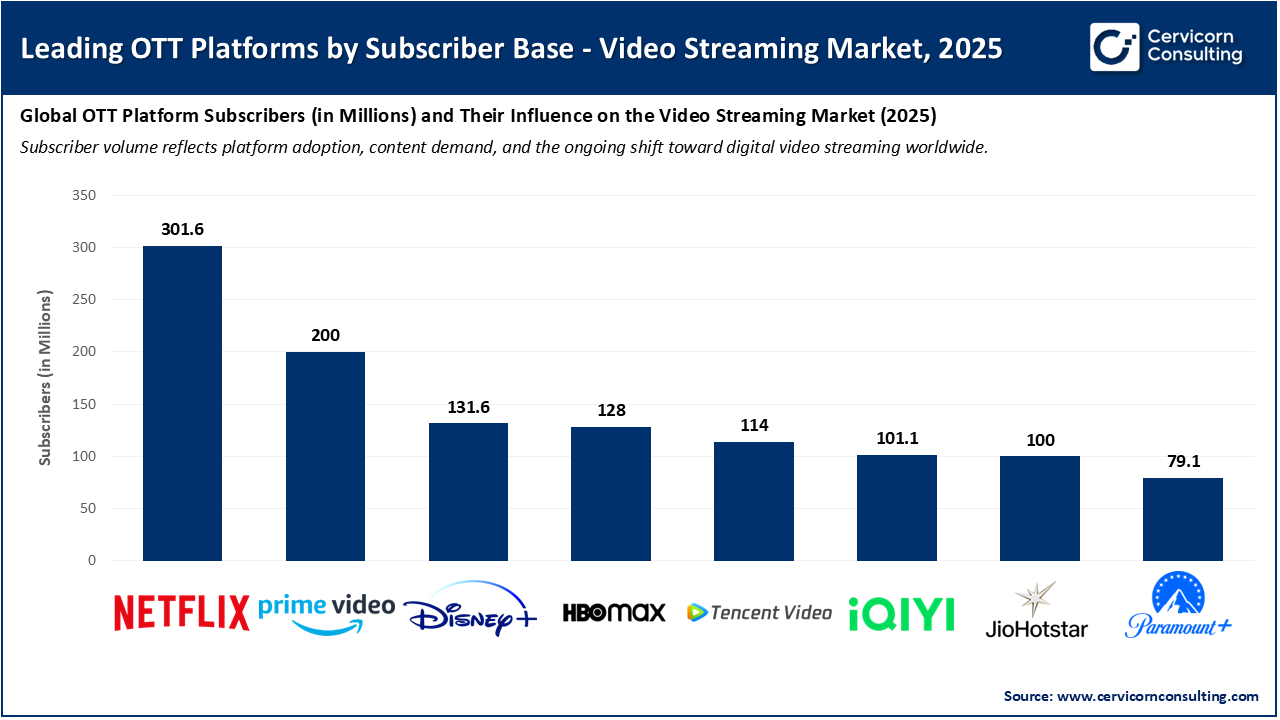

Impact of Growing Adoption of OTT Platforms on the Video Streaming Market

A major reason for the growth of the global video streaming industry is the increasing use of Over-the-Top (OTT) services. Consumers can access content almost instantly through OTT services (for example, Netflix, Amazon Prime Video, and Disney+) without subscribing to traditional cable television or satellite service. Consumers can watch shows and movies, on demand, for a subscription fee at price points that are suitable for audiences of all ages. This phenomenon has enhanced the pace of adoption for OTT services. Generally, producers of OTT shows generate original content or content that can be packaged and scaled to fit the audience/target market which can create some degree of loyalty among the viewing audience. More significantly, with greater levels of internet penetration and more smart devices on the market, consumers feel even more comfortable viewing content on an OTT service using their smart devices or platforms. As OTT services become increasingly accepted, there will be continued growth in digital entertainment which will enhance the overall growth of the video streaming industry.

Market Trends

1. Streaming Surpasses Traditional Broadcast and Cable

- In 2025, streaming services took the lead over traditional broadcasting and cable TV in total viewing for the first time. This was a watershed moment for the video streaming industry. This research suggests that audiences have a preference for non-linear, flexible content on demand as opposed to linear video content. As viewers continue to abandon cable television, the advertising revenue distribution is increasing, and subscriptions on a streaming service are growing faster than traditional media. This change incentives content companies to invest in innovative technology, unique content acquisition, and the international expansion of on-demand streaming services, making this the new form of consumption.

2. Growth of Live Sports and Event Streaming

- Live sports and events streaming have developed into a major growth engine for the video streaming industry. As rights/IP of sports and events have been shifted to streaming platforms by major Leagues and Broadcasters, fans are streaming live matches, concerts, and events, sometimes in real time, with interactive (chat/voice) features or using multiple camera angles. This generates new audiences and creates higher engagement levels in the fan, combined with significant advertising and sponsorship value. Incorporating live events into streaming services builds user loyalty and captures demographics that relied on traditional television, and helps accelerate industry growth.

3. Rise of Free Ad-Supported Streaming (FAST) Models

- Free Ad-Supported Streaming TV (FAST) platforms are transforming the video streaming market. They are offering free, high premium content to users, supported by advertising and compared to paid subscriptions. As many consumers search for "buys" alternatives to paid subscriptions, FAST channels appeal more to advertisers telling them they have opportunities to reach broad, digital-sized audiences. This type of advertising-based model allows a platform to expand its reach, expand user growth, and unlikes subscription fees. FAST growth therefore expands the total addressable market for content and makes streaming easier, less expensive and more accessible to users around the world.

4. Advancements in Streaming Technology and Infrastructure

- Broadband speed, 5G, and video compression improvements augment the quality and accessibility of streaming on devices. These improvements continue to allow the streaming video market to offer less buffering and interaction, with a rise in resolution and low latency for live and interactive output. An advanced and improved infrastructure allows for the streaming of content in emerging and developing markets that previously had limited bandwidth and connectivity. Overall, technology improvements and growth are improving experiences in the video streaming market, while supporting large-scale events and expanding globally while maintaining an improved video experience.

Report Scope

| Area of Focus |

Details |

| Market Size in 2026 |

USD 198.30 Billion |

| Expected Market Size in 2035 |

USD 568.17 Billion |

| Projected CAGR 2026 to 2035 |

12.41% |

| Dominant Region |

North America |

| Fastest Growing Segment |

Asia-Pacific |

| Key Segment |

Component, Streaming Type, Revenue Model, Platform, Deployment, End User, Region |

| Key Companies |

Amazon.com, Inc., Google LLC (Alphabet Inc.), WarnerMedia Direct, LLC, Apple Inc., Akamai Technologies, Comcast Corporation, Brightcove Inc., Kaltura, Wowza Media Systems LLC, Netflix Inc., Hulu LLC (The Walt Disney Company), International Business Machines Corporation, Image Future Investment (HK) Limited |

Market Dynamics

Market Drivers

- Rising Internet Penetration and Smart Device Adoption: The increasing dissemination of high-speed Internet and the growing ownership of smartphones, tablets, and smart TVs, and is a primary force behind the video streaming market. Enhanced capacity and speed allows users to stream videos without interruptions in HD or 4K, while smart devices make it convenient to consume and watch wherever they want. This drove a significant transition from the traditional world of broadcast to the digital streaming world, reaching both urban and rural customer bases.

- Growing Demand for On-Demand and Personalized Content: Viewers increasingly prefer to watch shows and movies on their own terms, which has led to the increasing popularity of on-demand platforms. The video streaming market is able to tap into personalization technologies that recommend content based on user behavior solely designed to keep audiences watching longer and ultimately stays subscribed. Stay tuned because the market will increase in subscription retention, foster continuous growth for streaming platforms, and build customer loyalty in a competitive environment.

Market Restraints

- High Content Licensing and Production Costs: One of the most significant restraints in the video streaming market is the price to acquire, produce, and license high-quality content. The competition among platforms for exclusive shows and movies drives the prices up and cuts into profitability for newer or smaller players. Even when players invest heavily to acquire or create original content, it can jeopardize long term growth without sizable cash infusion.

- Data Privacy and Copyright Issues: Concerns about protecting the privacy of user data and copyright issues are other restraints for the video streaming market. Pirates, users sharing illegal content, and being re-published without the proper royalties and copyright ownership continue to be issues. Employee time to address data privacy issues and to ensure compliance to new rules and regulations created by a government entity also rises. All of these problems raise operational costs and although they are not impeding immediately market entry, they create uncertainty with the platforms plans for global expansion.

Market Opportunities

- Expansion in Emerging Markets: Emerging markets with high internet penetration, such as India, Brazil, and parts of Africa, have massive growth opportunities in the video streaming business. The availability of mobile and broadband services, means that more users have access to cost-effective streaming content. Substantial opportunities exist for platforms to gain subscribers and/or advertisers through local content, language and pricing options.

- Integration of Advanced Technologies (AI, AR, and VR): The video streaming market has interesting opportunities with the introduction of new technologies that include artificial intelligence (AI), augmented reality (AR), and virtual reality (VR). Platforms can use AI to innovate content recommendation, optimization of streaming, and user experience, while AR and VR can provide a more differentiated experience. Companies can leverage all these technologies to draw in tech-savvy audiences, develop entirely new content formats, and drive other revenue streams within the streaming sector.

Market Challenges

- Intense Competition and Market Saturation: The video streaming industry is highly competitive among global and regional competitors (e.g., Netflix, Disney+ and Amazon Prime). This means there are many providers, all having literally similar content and hence it is difficult to attract and retain customers. The level of market saturation results in price wars, subscription fatigue and higher costs of doing business that affect profitability.

- Network and Bandwidth Limitations in Some Regions: While the video streaming market economy is characterized by global growth, network infrastructure in certain areas continues to be challenging for video streaming. For example, in regions with slow-speed internet or inconsistent connections, users are challenged by buffering and product quality which affect their experience. This creates a barrier to adoption and access in some spaces, especially for developing or rural areas where this type of infrastructure is still relatively new.

Regional Analysis

The video streaming market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

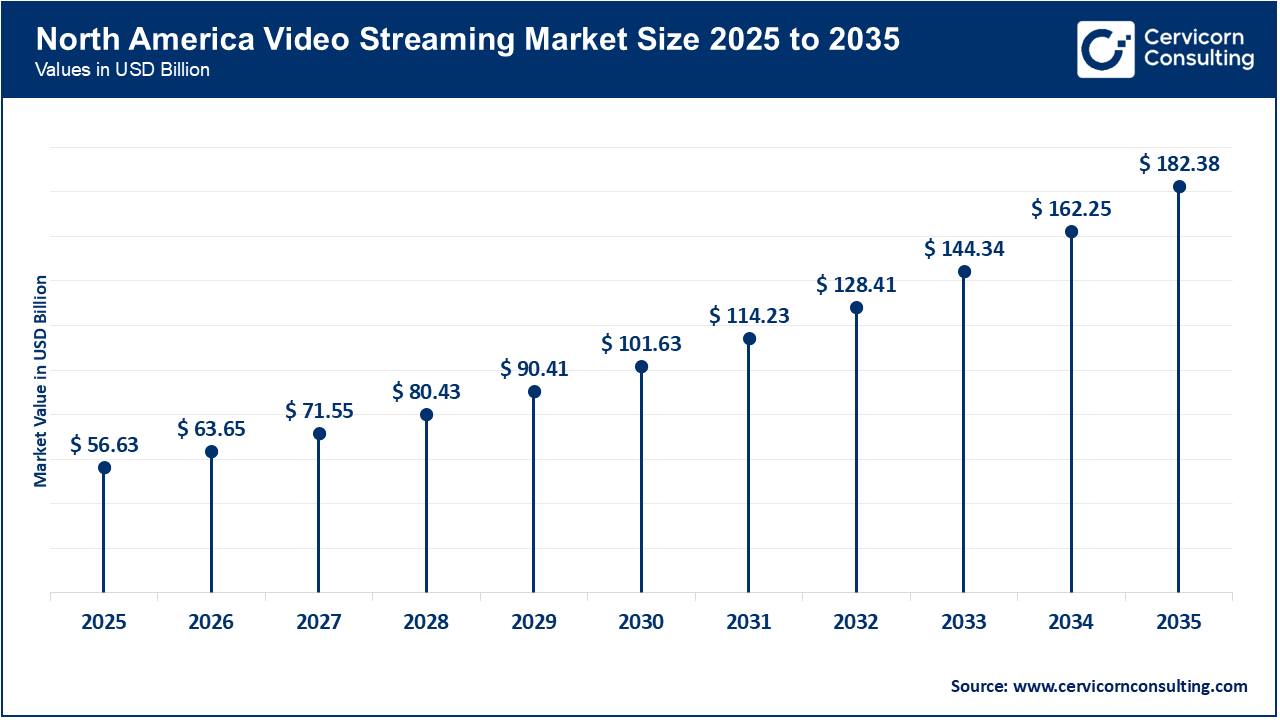

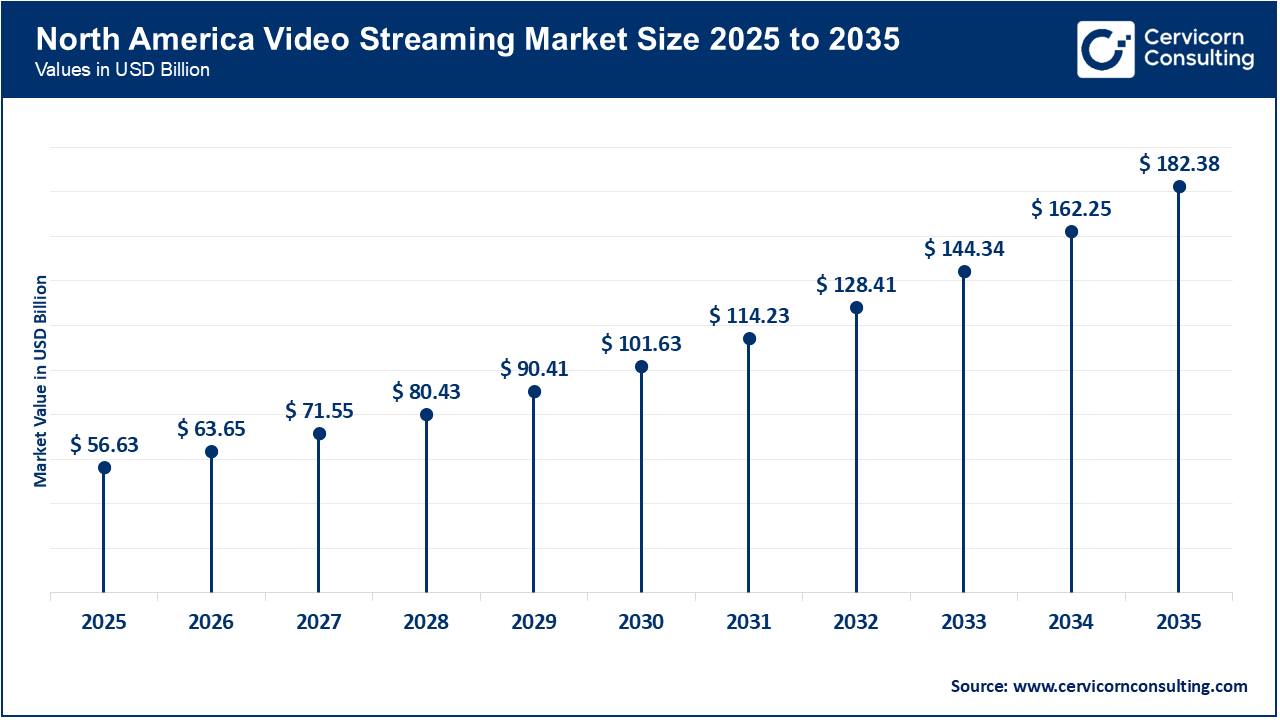

North America Video Streaming Market: Driven by Technological Advancements and High Content Demand

The North America video streaming market size reached at USD 56.63 billion in 2025 and is forecasted to reach around USD 182.38 billion by 2035. North America dominates the market due to strong internet infrastructure, high adoption of smart devices, and large companies such as Netflix, Amazon Prime Video, and Disney+. Consumers in North America, specifically in the U.S. or Canada, prefer on-demand, high-quality content, which provides robust subscription and ad-based revenues. The focus on original production and on-going innovation in the streaming technology also continue to support the expansion of the North American video streaming market.

Recent Developments:

- Netflix and Amazon introduced the integration of an ad-supported subscription plan.

- Disney+ and Hulu announced the integration of streaming services to one product experience

- The advancement of 5G technology supported the greater development of ultra-HD and mobile streaming adoption.

Asia-Pacific Video Streaming Market: Driven by Internet Penetration and Local Content Expansion

The Asia-Pacific video streaming market size accounted for USD 48.16 billion in 2025 and is predicted to hit around USD 155.11 billion by 2035. The Asia-Pacific is the largest growth market, buoyed by greater smartphone penetration, low-cost internet access, and increased demand for content in local languages. Key markets include India, China, Japan, and South Korea. In most cases, the advent of low-cost subscriptions and free ad-supported video streaming services has broadened the audience for streaming content. Local OTT platforms such as Hotstar, iQIYI, and Viu are now becoming strong rivals to global players.

Recent Developments:

- Disney+ Hotstar and JioCinema signed exclusive streaming deals for sports in India.

- Tencent Video and iQIYI expanded original content production in China.

- Governments in Southeast Asia promoted local media development and advanced OTT projects.

Europe Video Streaming Market: Driven by Regulatory Support and Diverse Content Consumption

The Europe video streaming market size estimated at USD 50.98 billion in 2025 and is projected to surpass around USD 164.20 billion by 2035. The Europe is expanding steadily with the benefit of a strong regulatory framework on data protection, along with content originating from numerous local and international sources. The UK, Germany, and France are leading in subscription-based video-on-demand (SVOD) uptake across Europe. European tastes favour content in regional languages, and local broadcasters are launching streaming platforms that compete with global players.

Recent Developments

- BBC and ITV expand their BritBox operations into new European territories.

- Netflix has increased its investment in European origination.

- The EU is promoting regulations for all streaming platforms to include a quota of 30% local content.

- Sky and Apple TV+ have jointly launched promotional offerings in a number of markets.

Video Streaming Market Share, By Region, 2025 (%)

| Region |

Revenue Share, 2025 (%) |

| North America |

32.10% |

| Europe |

28.90% |

| Asia-Pacific |

27.30% |

| LAMEA |

11.70% |

LAMEA Video Streaming Market: Driven by Connectivity Growth and Affordable Services

The LAMEA video streaming market size valued at USD 20.64 billion in 2025 and is anticipated to reach around USD 66.48 billion by 2035. The LAMEA is growing quickly with improved internet access and less expensive mobile data. Latin America - especially Brazil and Mexico - shows a strong adoption rate due to localized and less expensive content. The Middle East and Africa is also experiencing growth due to more smartphones, and telecom companies partnering with streaming companies to provide access. Consumers are increasingly preferring for mobile-first streaming and consumables in the language of the region.

Recent Developments:

- Netflix and Amazon Prime video created new originals for the region in the language of the region.

- StarzPlay and Shahid enhanced their Arabic language library.

Segmental Analysis

The video streaming market is segmented into component, streaming type, revenue model, end user, and region.

Component Analysis

OTT platforms continue to lead and accelerate the market as more consumer preferences for content delivery shift from linear programming to on-demand and online content. OTT platforms such as Netflix, Amazon Prime Video, and Disney+ have established robust ecosystems with a mix of global and regional content that ensure their success. The compelling portion of the OTT segment includes cost, convenience, flexibility, and a different value proposition compared to traditional Pay TV that has drawn consumers to OTT services and spurred growth, particularly since COVID-19.

Video Streaming Market Share, By Component, 2025 (%)

| Component |

Revenue Share, 2025 (%) |

| Solution |

72% |

| Services |

28% |

The services segment, especially managed and support services, is the fastest growing component. The growth of this segment is driven by the increasing demand for technical maintenance, content delivery optimization, and customer support. Managed services are relied upon as streaming platforms continue to scale globally (e.g content management to product management, cloud management, monitoring networks and data analytics). Smaller streaming platforms are sourcing managed service solutions to improve their customer experience.

Streaming Type Analysis

Non-linear video streaming provides the freedom to watch shows and movies whenever the viewer wants, making it popular in the video streaming market. Shows with binge-watching appeal and personalized content recommendations are fully taking advantage of this. Non-linear video streaming, which allows users to pause, replay, and skip, is now a worldwide preference amongst viewers.

Video Streaming Market Share, By Streaming Type, 2025 (%)

| Streaming Type |

Revenue Share, 2025 (%) |

| Non-Linear Video Streaming |

63% |

| Live/Linear Video Streaming |

37% |

Live video streaming is the fastest-growing segment due to increasing popularity of sports, gaming, concerts, or virtual events streamed online. Platforms such as YouTube Live, Twitch, and sport streaming services have successfully gained large audiences looking for live experiences. These platforms also drive participation in synergy with live chat and social media integration.

Revenue Model Analysis

The subscription revenue model has dominated the market, simply because viewers want predictable pricing, unlimited access, and large content libraries. Most large streaming platforms adopted subscription models to position themselves to build loyal subscribers, which in turn help create a predictable revenue stream. Subscription models offer several options of service at a low monthly or yearly fee and a variety of ad-free options. The majority of premium streaming platforms offer a subscription revenue model as their standard.

The advertisement-based revenue model has become the fastest growing segment by quickly meeting consumer demand for free or low-cost content. The growth of free advertising-supported streaming television (FAST) services, such as Pluto TV, Tubi, and Roku Channel, demonstrate that consumers are willing to watch advertisement service for free entertainment. Additionally, advertisers will be drawn to a service with the goal of targeting an audience digitally and measurably for substantial market growth.

End User Analysis

The personal user segment is the largest segment in the market, as the majority of viewers stream content alone or individually based on individual choices through smartphones, laptops and smart TVs. The personal user segment uses personalized recommendations, accessible mobile devices and convenience, which allows an individual to stream the most content. The increasing number of individual subscriptions and mobile users adds to the dominance of this segment.

Video Streaming Market Share, By End User, 2025 (%)

| End User |

Revenue Share, 2025 (%) |

| Personal |

78% |

| Commercial |

22% |

The commercial segment is the fastest-growing, which is driven by the implementation of streaming solutions within the enterprise, education and media sector. Businesses are using streaming for virtual meetings, webinars, online training and marketing and education sectors are using streaming for e-learning. Corporate communication tools and hybrid work environments are dramatically increasing the growth rate of commercial users.

Video Streaming Market Top Companies

Major Industry Investments in the Video Streaming Market:

Baidu acquisition of JOYY’s live-streaming business (YY Live) for USD 2.1 billion

- This acquisition emphasized Baidu's substantial push into the digital-video and live-streaming market in China, and the deal provided Baidu with a strong position in real-time and interactive content to diversify its business beyond search engines and cloud services. This is an important acquisition, since it supports the continued growth of the video streaming market, reinforces the value of live-streaming platforms, encourages further consolidation, and sends a signal that the largest tech players (like Baidu) are willing to invest in dominating the growing streaming-audience growth business.

DAZN / Public Investment Fund (Saudi Arabia) USD 1 billion investment

- The Saudi Public Investment Fund investment into DAZN, a global sports-streaming service, is indicative of how strategic sports rights and worldwide distribution are being viewed as assets in the video streaming market. DAZN will be able to attract high engagement as it grows its live-sports content and expands into new markets with this capital. This is relevant to the streaming strategies of large partners, which will, in accordance with DAZN, allow the streaming market to evolve from on-demand video to premium live content and new revenue models and strategies, to grow revenue.

Warner Bros. Discovery (WBD) stake investment in OSN Streaming Ltd. (USD 57 million for 30 % in the Middle East/ North Africa)

- WBD's minority investment into OSN Streaming reinforces the growing importance of regional streaming platforms and regional content partnerships in the video streaming market. WBD is partnering with a major MENA (Middle East & North Africa) regional player, which gives it access to a fast-growing streaming audience in territories beyond traditional western markets. This type of investment is helping develop the streaming market by enabling global streaming platforms to localize content, reach new audiences and territories, and scale streaming infrastructure, which are all factors contributing to the next phase of growth in the market.

Market Segmentation

By Component

- Solution

- Services

- Consulting

- Managed Services

- Training and Support

By Streaming Type

- Live/Linear Video Streaming

- Non-Linear Video Streaming

By Revenue Model

- Subscription

- Advertisement

- Transactional

By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

By Deployment

By End User

By Region

- North America

- APAC

- Europe

- LAMEA

TOC not available, you can contact to us for TOC.

...