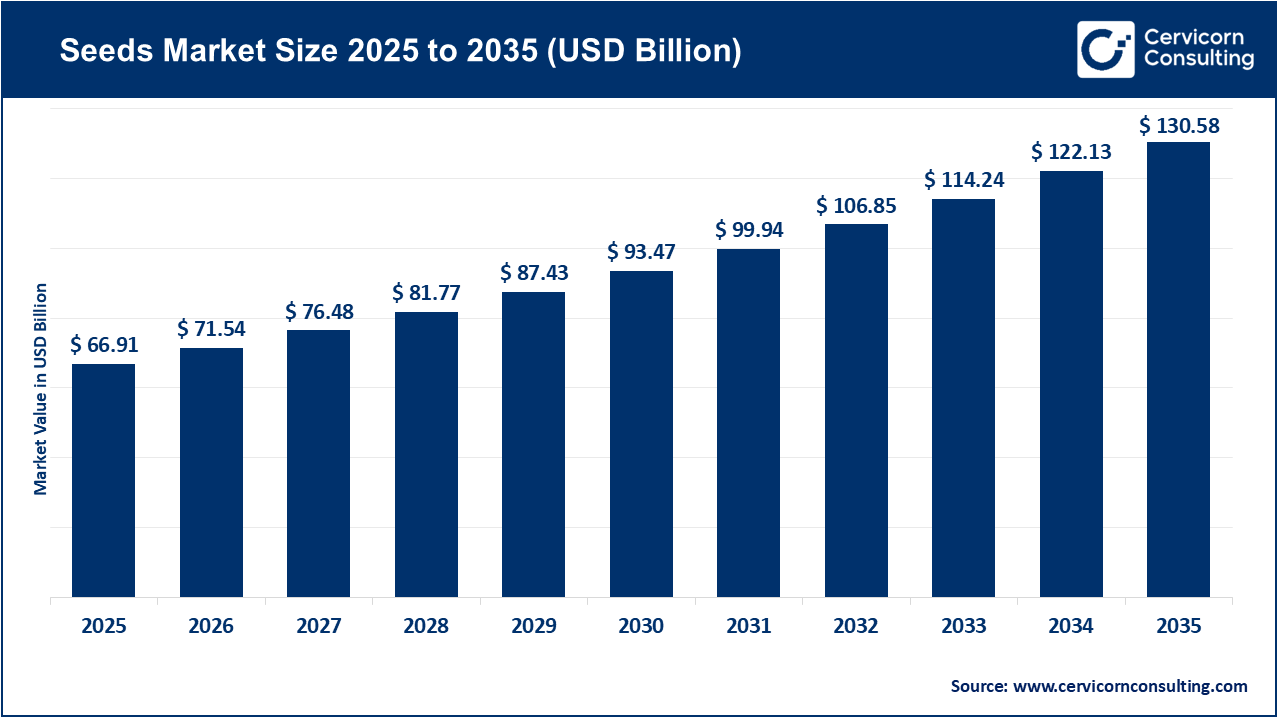

The global seeds market size reached at USD 66.91 billion in 2025 and is expected to be worth around USD 130.58 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.9% over the forecast period 2026 to 2035. The seeds market is expanding due to rising demand for high-quality crops and sustainable farming practices. Crop yields are improving, resulting in a great increase in hybrid and genetically-modified seed usage. The organic food sector growth and changing dietary preferences are helping drive demand for better-quality seeds. Government initiatives that support farmer subsidies (which overlap) and modern agricultural practices are also driving expansion.

The future of the seeds market has some influences including biological and advancements in climate resilience. The generation of drought-tolerant and pest-resistance seed varieties increasingly helps farmers adapt to changing weather and future crop loss reduction. Also, precision agriculture and digital-tool agriculture are improving seed selection and field management. Therefore, innovation and adoption of technology will remain key drivers of the global seeds market growth.

What are seeds?

Seeds are small embryonic structures in plants that become new plants when planted under favorable conditions. They contain the genetic composition of the parent plant. Seeds are essential to agriculture as they determine the quality, yield, and vigor of the plants produced. Moreover, the seeds development and selection are important for food security, biodiversity, and productivity of agriculture throughout the world.

Types of Seeds:

Increasing Development of New Farming Techniques Driving the Seeds Market

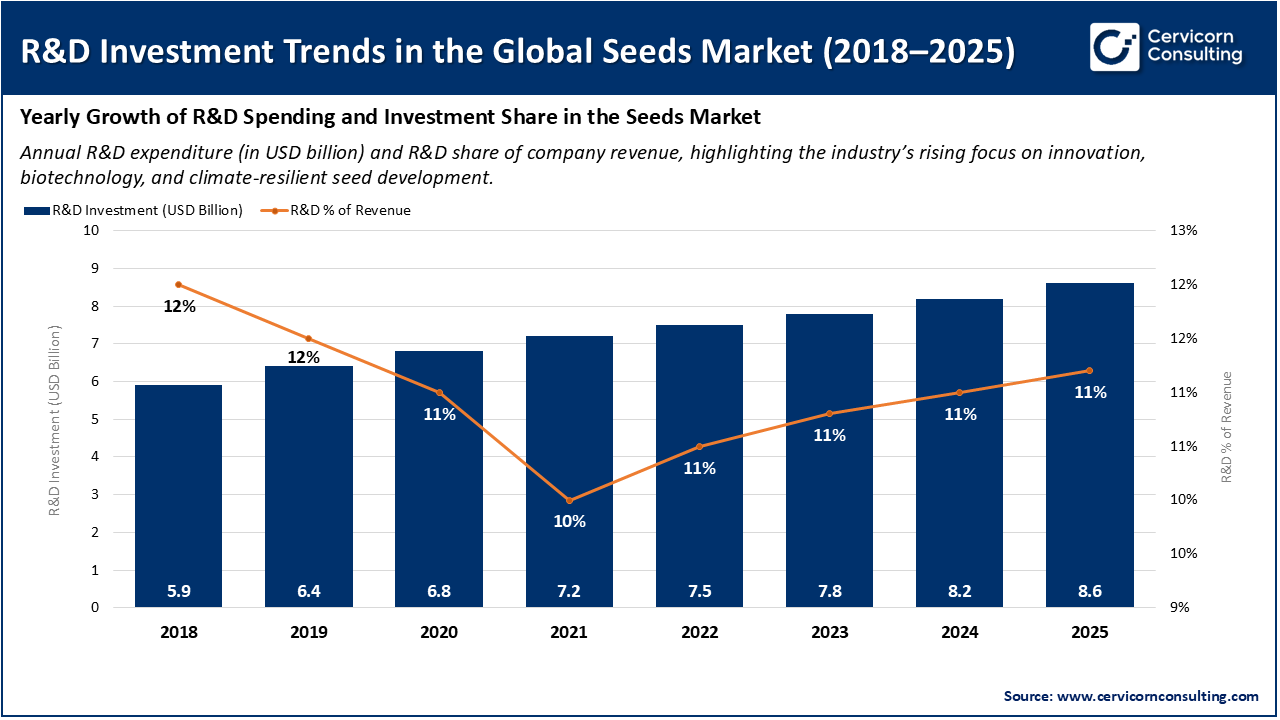

The seeds market is being propelled forward by the development of modern farming techniques and smarter seed-technologies. Research suggests that newer seed varieties are 31% more productive than older seed varieties when matched well with field conditions. As consumers (farmers) adopt data-driven precision agriculture tools like soil sensors, GPS planting, and variable-rate application of seed, they will increasingly be a driving force in the seeds market. And as consumers become familiar with these tools, they too will push seed companies to create seeds that match these technologies. This is an important part of how innovation and demand will drive the seeds market.

At the same time, advances in biotechnology and digital farming are changing how seed is developed, selected, and ultimately used. For example, advanced seed coatings, drought- and pest-resistant features, and seed-breeding with analytics are becoming routine. Lastly, as modern planting hardware (most notably, those that place seed with precision-spacing and depth) matures in the market, there is a growing expectation that seeds will perform uniformly every time in that planting process. All of this creates more access to new premium seed varieties and helps expand the seeds market forward with the evolving base of newer farming techniques.

1. Launch of Light-Activated Seed Trait Technology

2. BASF’s Expansion into Seeds and Asian Markets

3. Rise of Seed Treatment and Advanced Seed Technologies

4. Strengthening of Seed Regulations and Policy Frameworks

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 71.54 Billion |

| Estimated Market Size in 2035 | USD 130.58 Billion |

| Projected CAGR 2026 to 2035 | 6.90% |

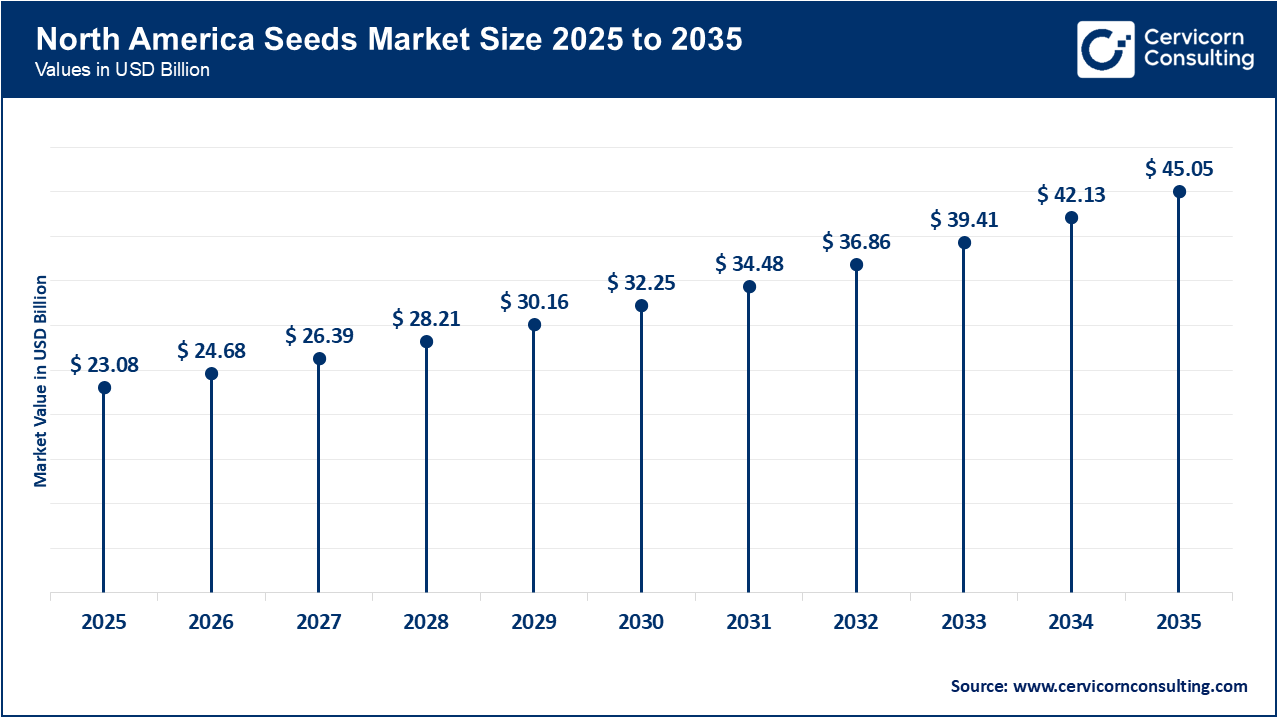

| Top-performing Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Type, Seed Type, Traits, Availability, Seed Treatment, Region |

| Key Companies | Bayer AG, Advanta Seeds, Syngenta Crop Protection AG, BASF SE, KWS SAAT SE & Co. KGaA, FMC Corporation, Corteva, Rallis India Limited, Limagrain, Sakata Seed Corporation, Royal Barenbrug Group, DLF Seeds A/S, TAKII & CO., LTD., Enza Zaden Beheer B.V. |

The seeds market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America seeds market size reached at USD 23.08 billion in 2025 and is projected to reach around USD 45.05 billion by 2035. The North America is propelled by innovation, advanced farming, and strong investment in biotechnology research. A well-established seed industry in the region is supported by multinational corporate leaders, such as Corteva, Bayer and Syngenta. U.S. and Canadian farmers, as early adopters of genetically modified (GM) and hybrid seeds, benefit from the improved yield and improved crop resilience these seeds offer. Precision agriculture tools, such as GPS-based planting, drone monitoring, and seed-treatment technologies, also increase efficiency. The market is diversifying due to increasing consumer demand for organic/non-GMO seeds. Moreover, strong presence of research and development centers, supportive government policy regarding crop biotechnology, and high-investment values regarding crop biotechnology, make North America a prominent place for seed development and sales globally.

Recent Developments:

The Asia-Pacific seeds market size valued at USD 19 billion in 2025 and is forecasted to surpass around USD 37.08 billion by 2035. The Asia-Pacific is one of the most rapidly growing region, due to high demand for food because of a growing population and modernization of agriculture. Countries such as India, China, Japan, and Indonesia continue to pursue hybrid, GM, and bio-fortified seeds to improve food security. The Asia-Pacific region has diverse climatic conditions which makes it conducive for a wide range of crops such as rice, corn, vegetables, and oilseeds, which results in high seed consumption. Furthermore, governments are launching initiatives to promote the use of certified seeds, improve seed quality, and enable local seed production. Ultimately, farmers will increase their seed consumption in response to the rapid take up of advanced smart farming technologies and the expansion of organic agriculture. In addition, national cooperation and seed fairs also have and are helping to promote innovation and awareness amongst farmers.

Recent Developments:

The Europe seeds market size accounted for USD 18.20 billion in 2025 and is predicted to reach around USD 35.52 billion by 2035. The Europe is molded by strict regulations, sustainability aims, and a focus on high-quality seed production. European farmers are adopting certified, traceable, and sustainable seeds to comply with the EU Green Deal. The demand for organic seeds and hybrid seeds is increasing in Europe as the region works to shift towards sustainable agriculture with lower pesticide applications. The European seed sector is also investing in genomic breeding and other modern molecular approaches to develop climate-resilient varieties. Furthermore, consumer demand for healthy and chemical-free produce is pushing seed companies to innovate more rapidly.

Recent Developments

Seeds Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 34.50% |

| Europe | 27.20% |

| Asia-Pacific | 28.40% |

| LAMEA | 9.90% |

The LAMEA seeds market size reached at USD 6.62 billion in 2025 and is anticipated to hit around USD 12.93 billion by 2035. The LAMEA is growing rapidly due to modernization of agriculture, better access to seeds, and greater awareness among farmers. As the leader in Latin America, Brazil and Argentina are continuing to lead in the adoption of hybrids and GM seeds for soy, maize, and cotton. Meanwhile, in the Middle East and Africa, there is an interest in food security and sustainable farming, which translates into demand for drought-tolerant and pest-resistant seeds. The government and NGO efforts to encourage farmers to move away from informal seed exchanges to certified seed systems. While there are challenges to the region, specifically weak infrastructure and regulatory issues, global seed company investment and activity is improving the market ecosystem. The agricultural possibilities of LAMEA are huge, and more investment in research and local production of hybrid seed is expected to make it a dynamic area of growth in the next few years.

Recent Developments:

The seeds market is segmented into type, seed type, traits, and region.

Conventional seeds dominate the market because they are used by farmers in developing and developed countries. They are inexpensive, easy to grow, and appropriate for traditional agricultural practices that most small and medium-sized farmers rely upon. Many small and medium-scale farmers prefer conventional seeds because they are inexpensive and readily available. Government-supported distribution systems and local seed exchange systems also facilitate the ongoing use of conventional seeds, aiding the position of conventional seeds in the global seeds market. Further, conventional seeds retain a reputation for reliably performing and responding to different soil and climatic conditions, making for an easy choice for farmers. The ease of availability for conventional seeds through both formal and informal seed channels also aids the position of conventional seeds in the market.

Seeds Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Genetically Modified Seeds | 48% |

| Conventional Seeds | 52% |

Genetically Modified (GM) seeds are the fastest-growing segment of the overall seeds market; they are becoming more popular to traits such as pest resistance, drought tolerance, and increased productivity. Farmers are using GM seeds to reduce the use of pesticides and improve crop yield. With biotechnological advancements and regulatory approvals, GM seeds are being adopted rapidly across the globe, and especially in the U.S., Brazil, and China. Moreover, the evolution of gene-editing tools (like CRISPR) will accelerate the category of GM seed development with more precision. As the effects of climate become even more pressing, GM seeds will become an even bigger part of the solution for food security globally.

Cereals and grains dominate the seeds market as the world’s major food crops. Wheat, corn, rice, and sorghum are grown worldwide for both human consumption and animal feed. Corn and rice are among the largest cereals in terms of production due to their respective food processing and biofuel demand. Supported by strong government and cooperative industry support, improved hybrid varieties and continual research and development (R&D) are the backbone of the global seeds market. The continued urbanization and the consequent rising population, as well as the rising population demand for staple foods, will continue to drive investments in this segment. Additionally, advanced seed genetic research and hybridization programs will help farmers increase productivity and obtain better disease resistance.

Seeds Market Share, By Seed Type, 2025 (%)

| Seed Type | Revenue Share, 2025 (%) |

| Cereals and Grains | 48.30% |

| Oilseeds | 23.50% |

| Fruits and Vegetables | 20.20% |

| Others | 8.0% |

The fruits and vegetables segment offers the highest growth potential within the seeds market. The rising health consciousness and demand for fresh produce encourage demand for high-quality vegetable and fruit seeds. Short growing cycles and profitability are leading to the popularity of varieties such as tomato, pepper, and lettuce. The shift to organic farming and greenhouse farming is also supporting the rapid growth of the segment. Urban farming and hydroponic systems are opening avenues for demand for fruit and vegetable seeds. There is also an increased demand for fresh produce generating an export market and motivating farmers to purchase high-grade hybrid or disease-free seeds.

Herbicide-tolerant (HT) seeds occupy a significant portion of the seeds market because they enable farmers to manage weeds more effectively and reduce manual labor. HT seeds are well suited for large farms that grow soybeans, corn, and cotton. The ability to tolerate specific herbicides gives farmers more time efficiency, cost savings, and cleaner fields. For these reasons HT seeds are dominant choice for commercial farmers around the world. Farmers are increasingly drawn to HT varieties as the need for effective weed control becomes more necessary. Additionally, the development of new herbicide-resistant traits has only facilitated the growing dominance of HT seeds across agricultural regions globally.

Seeds Market Share, By Traits, 2025 (%)

| Traits | Revenue Share, 2025 (%) |

| Herbicide-Tolerant (HT) | 41% |

| Insecticide-Resistant (IR) | 34% |

| Other Traits | 25% |

Insecticide-resistant (IR) seeds are the fastest growing trait category in the seeds market. They reduce chemical sprays and protect crops from serious insect pests. The adoption of IR seeds is increasing in the areas of pest infestation and when faced with environmental pressure to reduce pesticide use. Advances in biotechnology are providing seed companies the ability to make multi-trait seeds with pest and stress resistance, further adding to market growth. The growth of this segment is also being driven by greater awareness of sustainable agricultural practices.

OECD Seed Schemes Certified Seeds Globally

China’s Biotechnology and Seed Self-Reliance Plan (2024–28)

CGIAR “Seed Equal” Initiative for Climate Resilient Seeds

Global Pledge: International Seed Federation / Seed Sector Declaration

By Type

By Seed Type

By Traits

By Availability

By Seed Treatment

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Seeds

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Seed Type Overview

2.2.3 By Traits Overview

2.2.4 By Availability Overview

2.2.5 By Seed Treatment Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for High-Yield and Quality Crops

4.1.1.2 Technological Advancements in Agriculture

4.1.2 Market Restraints

4.1.2.1 High Cost of Hybrid and GM Seeds

4.1.2.2 Strict Government Regulations and Approval Processes

4.1.3 Market Challenges

4.1.3.1 Climate Change and Environmental Stress

4.1.3.2 Seed Counterfeiting and Quality Issues

4.1.4 Market Opportunities

4.1.4.1 Rising Adoption of Organic and Sustainable Farming

4.1.4.2 Expansion in Emerging Agricultural Economies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Seeds Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Seeds Market, By Type

6.1 Global Seeds Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Genetically Modified Seeds

6.1.1.2 Conventional Seeds

Chapter 7. Seeds Market, By Seed Type

7.1 Global Seeds Market Snapshot, By Seed Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Cereals and Grains

7.1.1.2 Oilseeds

7.1.1.3 Fruits and Vegetables

7.1.1.4 Others

Chapter 8. Seeds Market, By Traits

8.1 Global Seeds Market Snapshot, By Traits

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Herbicide-Tolerant (HT)

8.1.1.2 Insecticide-Resistant (IR)

8.1.1.3 Others

Chapter 9. Seeds Market, By Availability

9.1 Global Seeds Market Snapshot, By Availability

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Commercial Seeds

9.1.1.2 Saved Seeds

Chapter 10. Seeds Market, By Seed Treatment

10.1 Global Seeds Market Snapshot, By Seed Treatment

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Treated

10.1.1.2 Untreated

Chapter 11. Seeds Market, By Region

11.1 Overview

11.2 Seeds Market Revenue Share, By Region 2024 (%)

11.3 Global Seeds Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Seeds Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Seeds Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Seeds Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Seeds Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Seeds Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Seeds Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Seeds Market, By Country

11.5.4 UK

11.5.4.1 UK Seeds Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Seeds Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Seeds Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Seeds Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Seeds Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Seeds Market, By Country

11.6.4 China

11.6.4.1 China Seeds Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Seeds Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Seeds Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Seeds Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Seeds Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Seeds Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Seeds Market, By Country

11.7.4 GCC

11.7.4.1 GCC Seeds Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Seeds Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Seeds Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Seeds Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Bayer AG

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Advanta Seeds

13.3 Syngenta Crop Protection AG

13.4 BASF SE

13.5 KWS SAAT SE & Co. KGaA

13.6 FMC Corporation

13.7 Corteva

13.8 Rallis India Limited

13.9 Limagrain

13.10 Royal Barenbrug Group

13.11 DLF Seeds A/S

13.12 TAKII & CO., LTD.

13.13 Enza Zaden Beheer B.V.