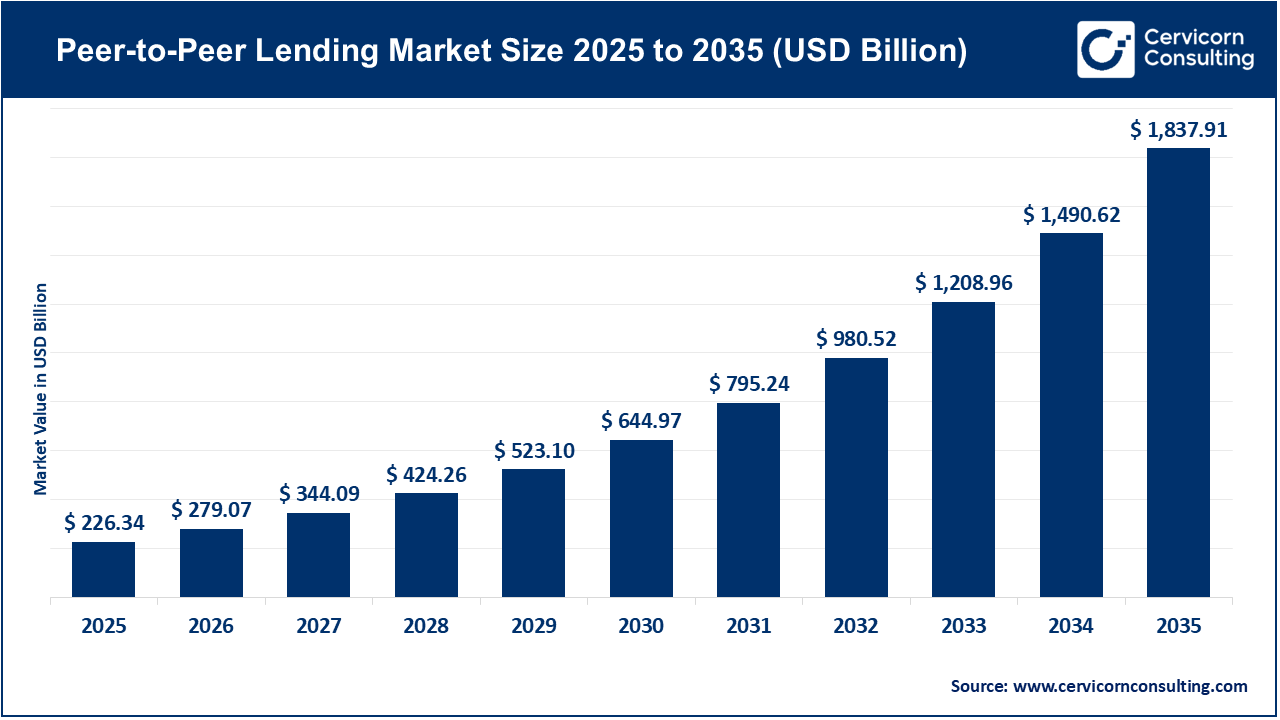

The global peer-to-peer (P2P) lending market size reached at USD 226.34 billion in 2025 and is expected to be worth around USD 1,837.91 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 23.3% over the forecast period 2026 to 2035. The growth of peer-to-peer (P2P) lending market is a result of the increasing demand for convenient and quick credit to borrow. Traditional banks are limited in the extent of accessing credit because they tend to have more lengthy processes and restrictive criteria for borrowers. P2P lending platforms are able to reduce the time and cost involved in borrowing due to their use of digital technology which matches borrowers with lenders. Adoption of lending in the P2P space has been facilitated by the increase in (fintech) financial technologies, digital banking, and mobile applications to perform a simple task on the P2P lending platform.

The growth of P2P lending is also positively influenced by a growing confidence in online financing, as well as technology (the use of data analytics) in assessing credit for loan decisions. Investors are attracted to P2P lending because it can offer higher return and yield compared to traditional. Borrowers will often seek P2P lending as a lower interest option and with flexible terms for the loan. The peer-to-peer lending market is further encouraged by government agency (e.g., state, SEC) regulations and further extension of alternative financing in the market.

What is Peer-to-Peer Lending?

Peer-to-Peer (P2P) lending refers to a category of online lending whereby individuals can obtain funds, or lend funds, directly to individuals, independent of any bank or traditional financial institution. P2P lending occurs through digital platforms that connect borrowers needing funds to lenders/investors who will lend funds and earn interest on those funds. P2P lending relies on technology to assess creditworthiness, facilitate lending and borrowing transactions, and provide transparency throughout the lending process - therefore, without P2P lending, borrowing and lending would be easier, quicker, and more transparency in and in the lending process.

Importance of Peer-to-Peer Lending:

Rising Demand for Alternative Financing Fueling P2P Lending Growth

The increasing demand for rapid and flexible finance is one of the main drivers of the peer-to-peer lending market. The majority of people and small businesses have difficulty obtaining loans from banks due to cumbersome documentation and long approval processes. P2P lending has a competitive advantage, as many online providers facilitate a direct relationship between the borrower and the investor, which minimizes fees and paperwork. This direct model greatly facilitates borrowing and limits the necessity for documentation and two-way fees. As more people seek convenience and affordability in financing, peer-to-peer lending remains a growing, trusted, and efficient alternative to traditional bank lending.

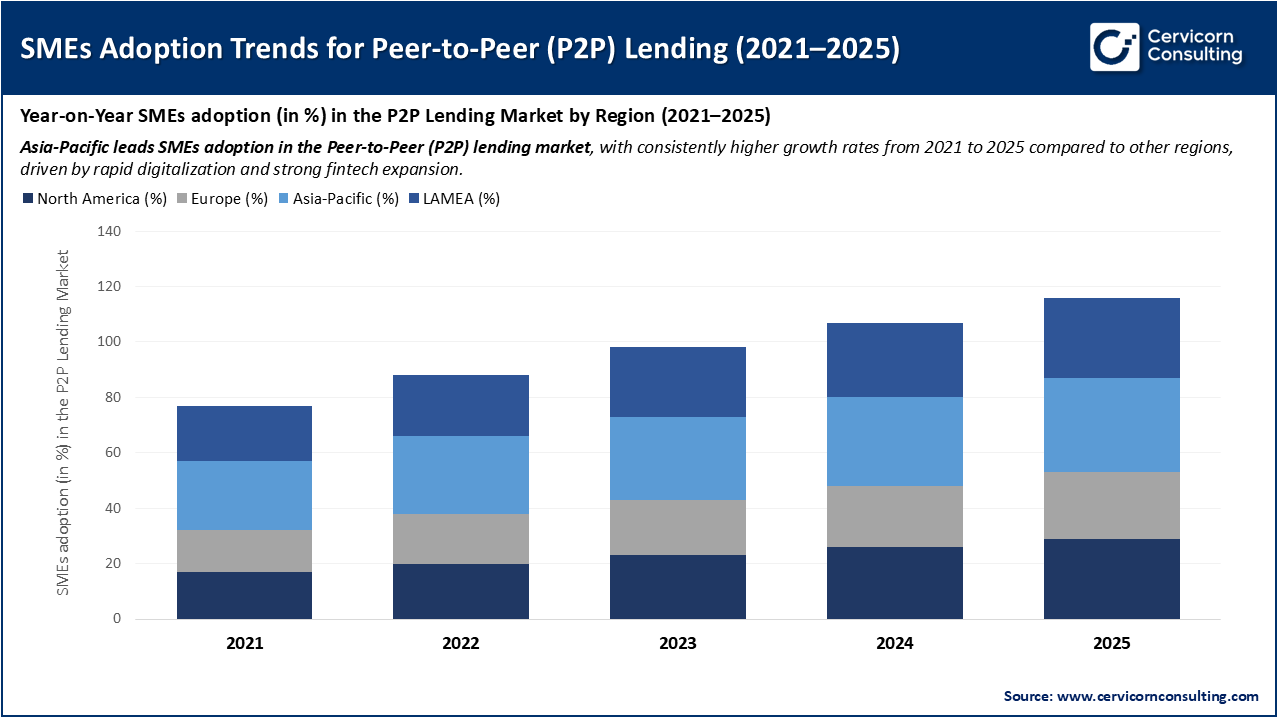

The recent uptick in Small and Medium Enterprise (SME) adoption of peer-to-peer (P2P) lending reflects a healthy movement away from traditional means of financing. Many SMEs have been blocked from obtaining traditional credit from a bank due to limitations, requirements, and length of the approval process. P2P lending can offer a faster approval with less paperwork and flexibility in repayment. All these benefit the market by increasing the flow of credit to small businesses, access to entrepreneurship, and confidence in the digital lending space.

Regulatory Tightening by the Reserve Bank of India (RBI) – 2024

Prosper Marketplace’s USD 500 Million Institutional Investment Deal – 2025

LenDenClub’s Profitability Achievement – FY25

Integration of AI and Advanced Technology in P2P Platforms

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 279.07 Billion |

| Estimated Market Size in 2035 | USD 1,837.91 Billion |

| Projected CAGR 2026 to 2035 | 23.30% |

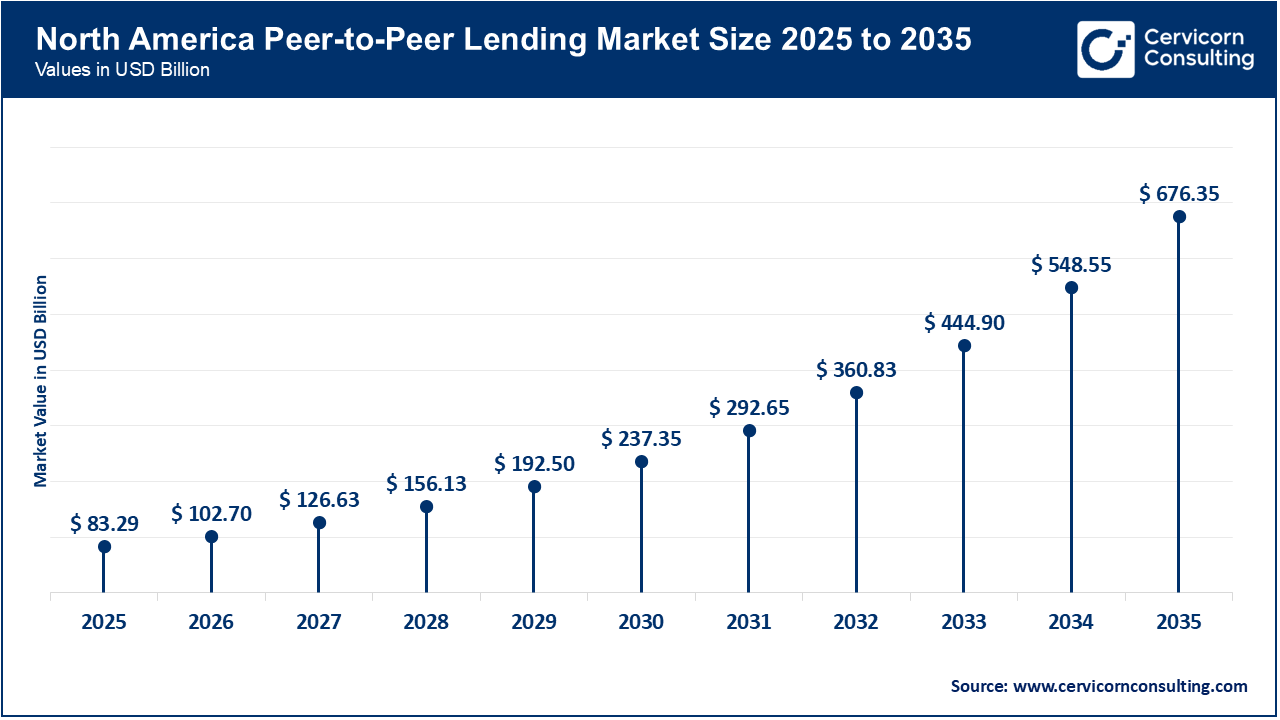

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type of Loan, Funding Method, Business Model, End User, Region |

| Key Companies | Zopa Bank Limited, Avant LLC, Funding Circle, Kabbage Inc., Social Finance Inc., RateSetter, Prosper Funding LLC, Lending Club Corporation, OnDeck, LendingTree LLC |

The P2P Lending market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America peer-to-peer (P2P) lending market size reached at USD 83.29 billion in 2025 and is projected to surpass around USD 676.35 billion by 2035. The North American market is the foremost region, due to a robust fintech environment and high digital adoption rates. There are several larger P2P platforms in the U.S. that deliver successful lending solutions for individuals and small businesses. The shift towards electronic lending and acceptance of online services, the interest from investors to P2P lending, and the absence of regulatory barriers is fuelling market growth. Knowledge of alternative funding sources and substantial internet penetration will also undoubtedly help maintain the region's leadership position.

Recent Developments:

The Asia-Pacific peer-to-peer (P2P) lending market size estimated at USD 57.94 billion in 2025 and is forecasted to surge around USD 470.50 billion by 2035. The Asia-Pacific region constitutes the fastest-growing geographical segment, due to increasing financial inclusion and accelerating digitalization in the region. Countries such as China, India, and Indonesia are experiencing high growth due to the number of internet users increasing along with the need of borrowers seeking easily accessible credit. The sheer number of unbanked individuals in the region, as well as government support for fintech activity and innovation, are potential growth catalysts in the P2P lending market. The increase of smartphone adoption and the growing appeal of mobile-based P2P lending growth is expected to continue to increase.

Recent Developments:

The Europe peer-to-peer (P2P) lending market size valued at USD 63.87 billion in 2025 and is projected to hit around USD 518.29 billion by 2035. The Europe operates with steady growth, and there is a reasonable possibility for further growth due to the evolving government regulation and growing awareness of transparency standards in finance. The European Union is developing a digital finance framework that will further enhance the potential efficiencies of cross-border lending. With the highest levels of confidence by consumers and investors in crowdfunding applications, the U.K. and Germany are at the forefront of P2P and fintech development. The market continues to evolve with a focus on sustainable finance and supporting lending to micro and small-sized enterprises, which suggests continued growth for P2P lending.

Recent Developments:

Peer-to-Peer Lending Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 36.80% |

| Europe | 28.20% |

| Asia-Pacific (APAC) | 25.60% |

| LAMEA | 9.40% |

The LAMEA peer-to-peer (P2P) lending market size accounted for USD 21.28 billion in 2025 and is anticipated to reach around USD 172.76 billion by 2035. The P2P lending landscape within Latin America, the Middle East, and Africa (LAMEA), while emerging, displays considerable promise. Demand for small business and personal loans is increasing as traditional banking systems maintain less accessibility for many borrowers. Brazil, the United Arab Emirates (UAE), and South Africa are experiencing a growth of fintech firms, which benefit from improving internet infrastructure and youthful populations who are accustomed to technology. In addition, the appetite for financial inclusion and digital transformation is anticipated to produce gradual growth in the market across the region.

Recent Developments:

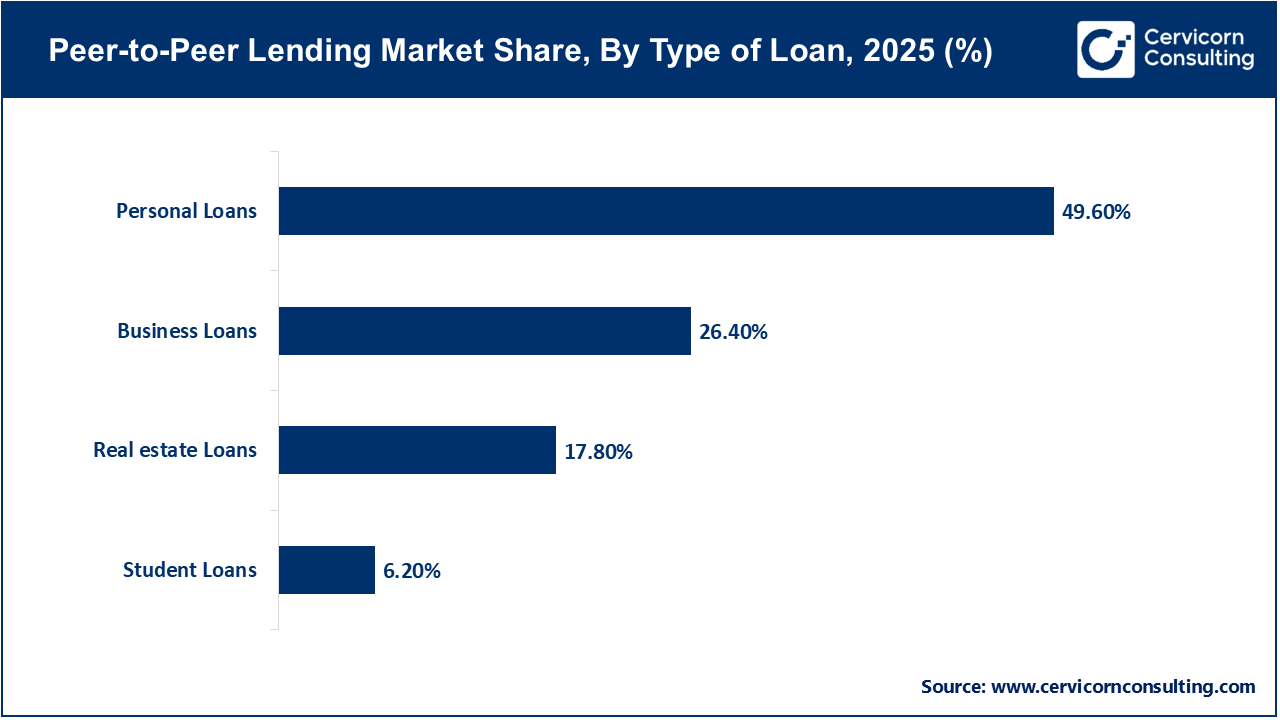

The peer-to-peer lending market is segmented into type of loan, funding method, business model, end user, and region.

Personal loans have the largest market share in the P2P lending sector due to their straightforward processing and repayment terms. Many borrowers use personal loans for several purposes, including debt consolidation, medical expenses, or personal purchases. Personal loans are appealing to consumers because they offer the ease of processing, quick credit decisions, and lower interest rates than banks. This is why personal loans are the most popular loan type for users on P2P platforms.

Business loans have the fastest growing segment in the P2P lending market. Small and medium enterprises (SMEs) are beginning to use P2P lending platforms to borrow quickly without strict collateral requirements. Generally, these loans are used to cover working capital, expand a business or invest in growth. As digital entrepreneurship and traditional bank credit availability grow, this segment of borrowing is also expanding.

Direct lending has a dominating segment in the P2P lending market which allows a borrower and an investor to engage directly via a platform that operates entirely online. Eliminating the mediator not only reduces the total overall costs, but creates transparency in P2P lending. Direct lending provides better control over money for investors which has further solidified its' establishment as the most trusted segment of the P2P lending market.

Peer-to-Peer Lending Market Share, By Funding Method, 2025 (%)

| Funding Method | Revenue Share, 2025 (%) |

| Automated Investing | 44.70% |

| Direct Lending | 55.30% |

Automated investing is the fastest growing segment in the P2P lending market due to its' ease and efficiency as an investor. With regards to automated investing, platforms rely on an algorithm that automatically matches investors with borrowers that meet risk and return requirements. Automated investing has a direct beneficial impact on the investor, saving them time consumed in sorting through manual investing and provided the ability to diversify their investments.

Traditional lending platforms are the preeminent model in P2P lending. Traditional lending platforms facilitate bank-like structured loan processes while still maintaining adequate regulatory compliance. These lenders function as online banks, electronically accommodating cautious investors and serious borrowers. Traditional lending platforms dominate with trust and stability, and risk mitigation.

Peer-to-Peer Lending Market Share, By Business Model, 2025 (%)

| Business Model Segment | Revenue Share, 2025 (%) |

| Traditional Lending | 58.60% |

| Alternate Marketplace Lending | 41.40% |

Alternative marketplace lending is an emerging market segment that is growing extremely fast due to the higher flexibility and innovation rate that is needed in lending business models. These lending platforms typically leverage technology, data analytics, and partnerships to be presented as a "Custom Fit" loan or investment option. The combination of flexibility and ability to address underserved niches in the market have made alternative marketplace lending the fastest growing model in P2P lending.

The personal end-user segment dominates the P2P lending market, as the majority of users use the loan for personal purposes (i.e. education, medical expenses, home improvement, etc.). The appeal of a quick loan application and fast disbursal of funds makes peer-to-peer platforms flexible and enjoyable options for individual borrowing.

Peer-to-Peer Lending Market Share, By End User, 2025 (%)

| End User Segment | Revenue Share, 2025 (%) |

| Business | 30.20% |

| Personal | 69.80% |

The business segment is growing, as more small and medium-sized enterprises (SMEs) are using peer-to-peer platforms to obtain financing. SMEs are at an advantage, as loan approvals and flexibility in repayment are typically resolved much faster than in the traditional banking world. The growth of digital startups and e-commerce will make this segment a major growth engine for the peer-to-peer (P2P) lending market in the future.

Industry Leaders’ Perspectives on the Peer-to-Peer (P2P) Lending Market:

Samir Desai – Co-founder & Former CEO, Funding Circle

Bhavin Patel – Co-Founder & CEO, LenDenClub

By Type of Loan

By Funding Method

By Business Model

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Peer-to-Peer Lending

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type of Loan Overview

2.2.2 By Funding Method Overview

2.2.3 By Business Model Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Digital and Easy Credit Access

4.1.1.2 Technological Advancements in Fintech and AI

4.1.2 Market Restraints

4.1.2.1 High Risk of Default and Fraud

4.1.2.2 Regulatory and Compliance Challenges

4.1.3 Market Challenges

4.1.3.1 Maintaining Trust and Transparency

4.1.3.2 Rising Competition and Market Saturation

4.1.4 Market Opportunities

4.1.4.1 Expanding Access in Emerging Economies

4.1.4.2 Partnerships and Platform Innovation

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Peer-to-Peer Lending Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Peer-to-Peer Lending Market, By Type of Loan

6.1 Global Peer-to-Peer Lending Market Snapshot, By Type of Loan

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Personal Loans

6.1.1.2 Real Estate Loans

6.1.1.3 Business Loans

6.1.1.4 Student Loans

Chapter 7. Peer-to-Peer Lending Market, By Funding Method

7.1 Global Peer-to-Peer Lending Market Snapshot, By Funding Method

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Automated Investing

7.1.1.2 Direct Lending

Chapter 8. Peer-to-Peer Lending Market, By Business Model

8.1 Global Peer-to-Peer Lending Market Snapshot, By Business Model

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Traditional Lending

8.1.1.2 Alternate Marketplace Lending

Chapter 9. Peer-to-Peer Lending Market, By End-User

9.1 Global Peer-to-Peer Lending Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Business

9.1.1.2 Personal

Chapter 10. Peer-to-Peer Lending Market, By Region

10.1 Overview

10.2 Peer-to-Peer Lending Market Revenue Share, By Region 2024 (%)

10.3 Global Peer-to-Peer Lending Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Peer-to-Peer Lending Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Peer-to-Peer Lending Market, By Country

10.5.4 UK

10.5.4.1 UK Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Peer-to-Peer Lending Market, By Country

10.6.4 China

10.6.4.1 China Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Peer-to-Peer Lending Market, By Country

10.7.4 GCC

10.7.4.1 GCC Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Peer-to-Peer Lending Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Zopa Bank Limited

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Avant LLC

12.3 Funding Circle

12.4 Kabbage Inc.

12.5 Social Finance Inc.

12.6 RateSetter

12.7 Prosper Funding LLC

12.8 Lending Club Corporation

12.9 OnDeck

12.10 LendingTree LLC