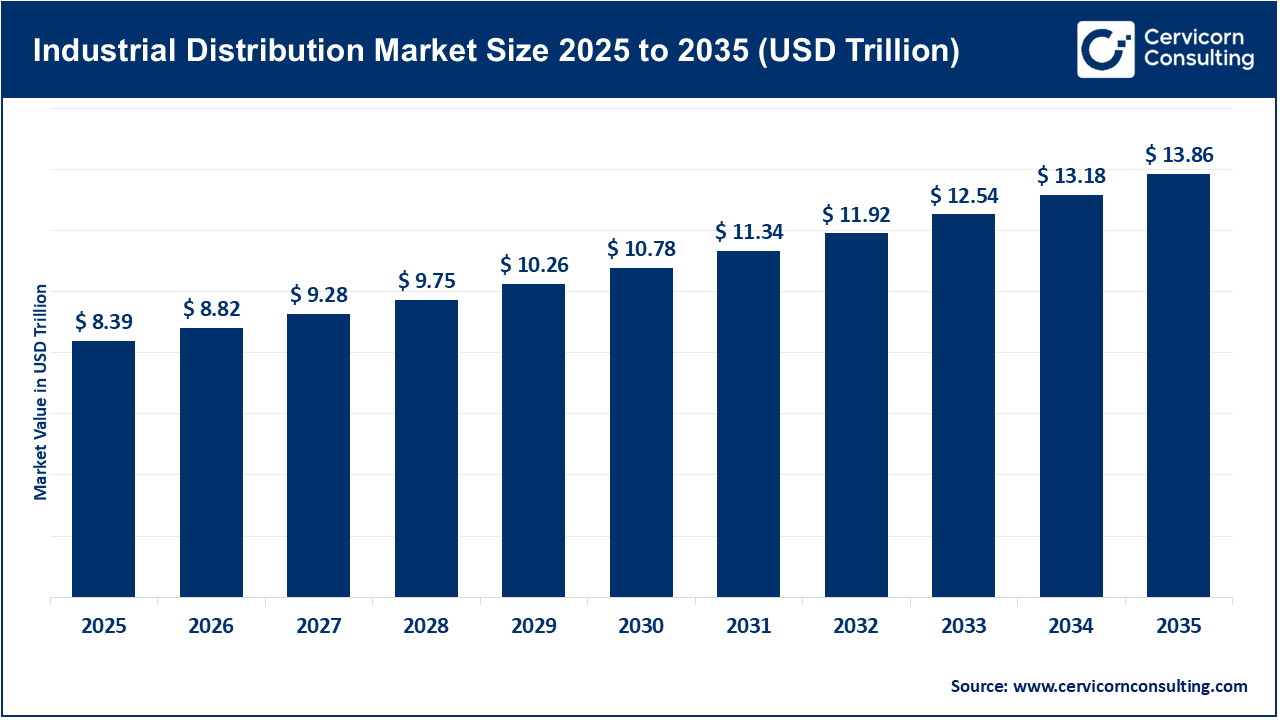

The global industrial distribution market size reached at USD 8.39 trillion in 2025 and is expected to be worth around USD 13.86 trillion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2026 to 2035. The expansion of the industrial distribution market is driven by the continued demand for maintenance, repair, and operations (MRO) throughout the manufacturing, construction, and energy sectors. Maintenance professionals within an organization require distributors to provide them supplies, systems, and equipment to maintain the organization's operations. The movement towards factory automation and modernization and construction of new infrastructure will continue to create stable demand MRO products. Organizations are also focused on building their value chain to minimize downtimes, and requiring distributors that can provide trusted products and services for an organization that operates across industries.

Additionally, online and e-commerce platforms are generating considerable growth opportunities for industrial distribution market. Many distributors are investing in digital platforms to offer customers faster and easier options for selecting and ordering products. This digital transformation improves inventory management and business opportunity, and positively enhances the customer experience. There is also increasing focus on sustainability and using energy efficient equipment, to which the distributor in industrial distribution is responding by expanding their offerings in products. Overall, the key market drivers for the industrial distribution market include industrial growth, technology adoption, and reliable supply and service offerings.

What is Industrial Distribution?

Industrial distribution is the process of supplying products, tools, equipment, and materials from manufacturers to businesses and industries that use these in their everyday business activity. It acts as the intermediary between producers and end users to make sure that they receive the critical products, such as electrical components, safety tools, fasteners, and parts of machinery, whenever they need them. Industrial distributors provide inventory management, technical support, and other value-added functions, such as product modification, logistics, and maintenance. Their primary goal is to help a company run more effectively and efficiently by providing the right product at the right time.

How Industrial IoT and Automation Accelerate Industrial Distribution Growth

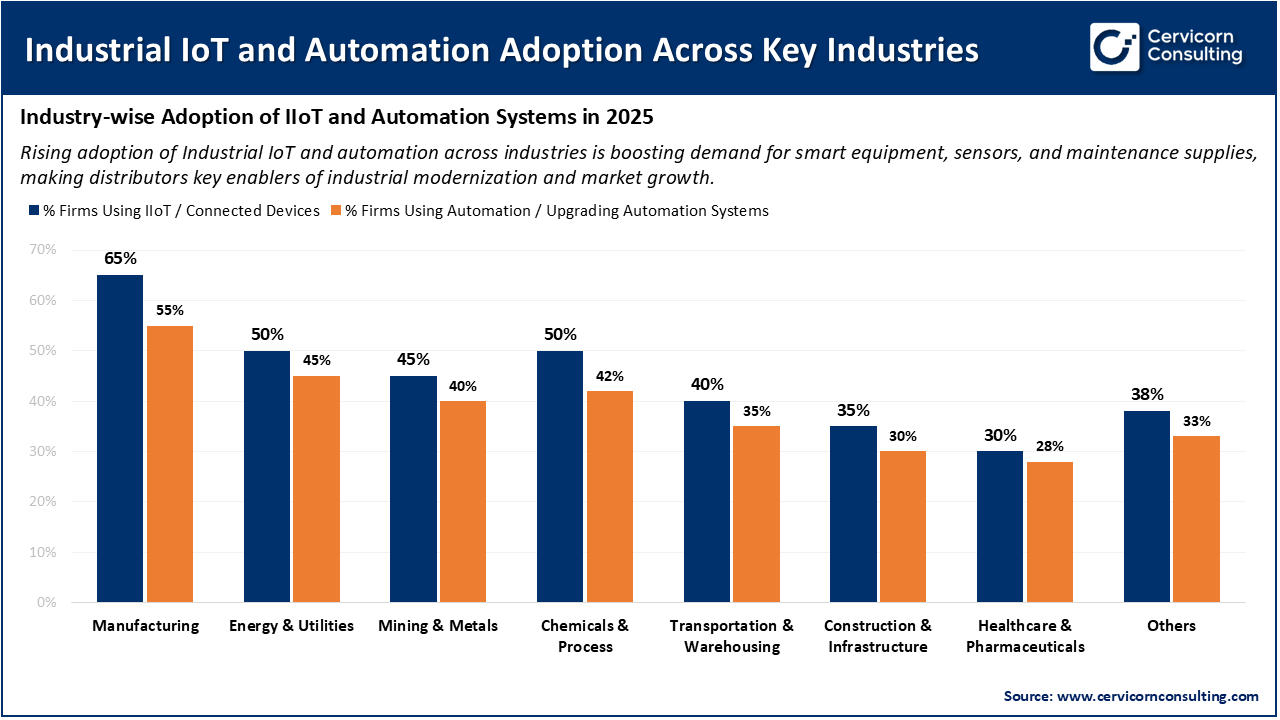

The Industrial IoT (IIoT) and automation are an important contributor in the growth of the industrial distribution market. Smart factories and industrial facilities leverage connected devices and automation to monitor sensors for performance, accurately predict maintenance needs, maintain real-time inventory management, and prioritize shipping. This action creates demand for a variety of sensors and advanced control systems as well as numerous other ancillary industrial products that the distributor can supply. The growing acceptance of automation maximizes efficiency and precision, thereby enabling distributors to minimize errors and speed up overall deliveries during warehouse and logistics operations. Overall, the IIoT and related automation are transforming conventional distribution channels into data-rich, agile sources of information to allow immediate decisions, and therefore stronger relationships with customers.

The accelerated embrace of Industrial IoT (IIoT) and automation in several industries represents a substantial thrust in generating growth in the industrial distribution market. With more industries, specifically manufacturing, energy, and process, starting to use connected devices and automation, the demand for industrial components, sensors, control devices, and maintenance supplies continues to grow. A significant number of manufacturers (65%) and energy companies (50%) are already leveraging IIoT, which has led to distributors receiving more orders for smart equipment and technical support services for their customers. Furthermore, many industries are also realizing efficiency and reduced downtime from automation has led to equipment purchases and the need for maintenance inventory strategies. This increased demand for advanced connected and automated solutions is evolving distributors into valued partners in the modernization of the industrial sector and is driving consistent growth in the industrial distribution market.

1. Rise of E-commerce and Digital Platforms

2. Growth of Infrastructure, Electrification, and Automation End-Markets

3. Mergers and Acquisitions Strengthening Market Position

4. Focus on Supply Chain Resilience and Digital Inventory Management

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 8.82 Billion |

| Expected Market Size in 2035 | USD 13.86 Billion |

| Estimated CAGR 2026 to 2035 | 5.15% |

| Dominant Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product, End-User Industry, Distribution Channel, Region |

| Key Companies | Fastenal Company, Motion Industries Inc., WESCO International Inc., MRC Global Inc., MSC Industrial Direct Co. Inc., W.W. Grainger Inc., Rexel Group, Graybar Electric Co., Airgas Inc., Sonepar USA, Winsupply Inc., Ferguson PLC, HD Supply (HD Inc.), Applied Industrial Technologies Inc., Bisco Industries, Anixter International |

Growing Industrial and Infrastructure Development

Digitalization and E-commerce Expansion

Price Volatility and Supply Chain Disruptions

High Market Competition and Margin Pressure

Adoption of Industrial IoT and Automation

Sustainability and Green Initiatives

Digital Transformation and Workforce Skill Gaps

Global Supply Chain Complexity and Risk Management

The industrial distribution market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia-Pacific industrial distribution market size accounted for USD 2.94 trillion in 2025 and is forecasted to grow around USD 4.86 trillion by 2035. The Asia-Pacific is currently experiencing rapid growth customized by the extensive industrialization process, infrastructure projects, and booming manufacturing in China, India, and Southeast Asia. Different governments are heavily investing in industrial corridors, logistics hubs, and smart city development processes, which generate significant demand for construction materials, electrical equipment, and tools related to industries. The extreme pace of urbanization and foreign direct investments (FDI) is present because many global manufacturers are looking to set up manufacturing bases in these regions, since they are also present in some of their industries, facilitating the utilization of these investments. The region has also noticeably shifted toward digital procurement and online B2B platforms to engage even smaller industrial buyers, improving supply chain transparency and accessibility to all, including smaller manufacturers. Hence, Asia-Pacific is becoming the world's most dynamic region for industrial distribution growth.

Recent Developments:

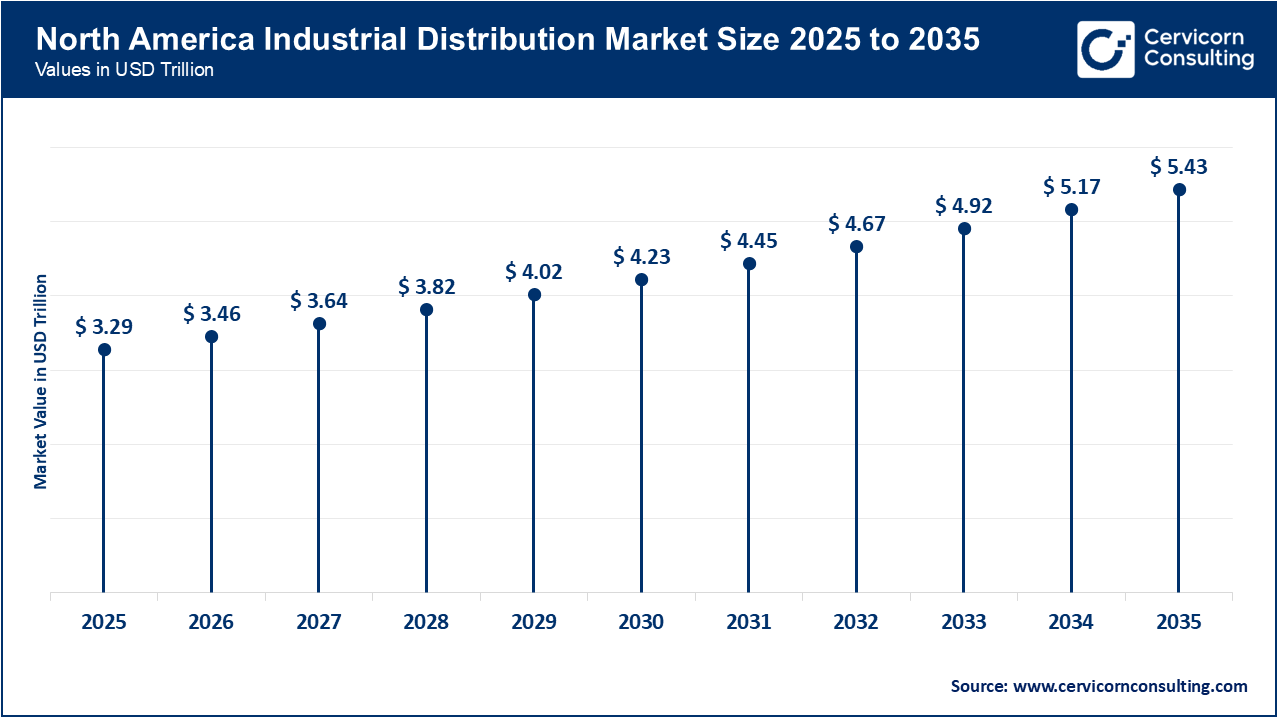

The North America industrial distribution market size reached at USD 3.29 trillion in 2025 and is anticipated to surpass around USD 5.43 trillion by 2035. North America industrial distribution market is fueled by its advanced industrial infrastructures, the transition to a digital economy, and robust manufacturing activity in the United States and Canada. Organizations are capitalizing on data analytics and automation, as well as utilizing IoT-enabled platforms for improved logistics, inventory management, and consumer-oriented services. The region's advanced supply chain networks and a commitment to improved operational efficiency will continue to propel growth. Distributors are also investing in sustainable practices and making headway in an electric vehicle (EV) supply chain, which expands opportunities. Government spending on industrial modernization and infrastructure provides intrigue and solidity to the distribution networks in the region, preserving North America's leadership in digital and efficient industrial distribution.

Recent Developments:

The Europe industrial distribution market size valued at USD 1.75 trillion in 2025 and is projected to hit around USD 2.90 trillion by 2035. The Europe is propelled by an ongoing commitment to Industry 4.0, automation, and sustainability. This commitment is enabling producers in Germany, France and the UK to modernize their production with connected equipment and digital monitoring systems, which is driving strong demand for smart components, MRO tools, and technical support services. The region is tackling energy efficiency and carbon reduction, and the advancement of this focus on green and sustainable products has also enhanced growth opportunities. European distributors are adapting by incorporating digital platforms and predictive inventory to remain competitive in heavily regulated markets.

Recent Developments:

The LAMEA industrial distribution market reached at USD 0.40 trillion in 2025 and is forecasted to reach around USD 0.67 trillion by 2035. The LAMEA is experiencing an accelerated growth trajectory as the countries advance their economies beyond oil and into industrial development and infrastructure building. Countries are allocating large sums of money for both renewable energy and construction and logistics under foreign initiatives called Saudi Vision 2030 and UAE Industrial Strategy 2031, resulting in significantly higher demands for electrical supplies, safety supplies, and industrial tools. In addition, newly built free trade zones and logistics hubs (e.g. Dubai and Saudi Arabia) will further increase efficiency in the distribution systems. Similarly, Africa's mining, utilities and energy sectors continue to generate demands for industrial products and maintenance, repair and operations (MRO) products. Furthermore, the expansion toward industrial self-sufficiency and localization in the region keep on generating new distribution opportunities for distributors.

Recent Developments:

The industrial distribution market is segmented into product, distribution channel, end-user industry, and region.

Electrical supplies represent a significant portion of the industrial distribution market as these products will be used in nearly every industrial end-user market, which includes manufacturing, construction, and utilities. Electrical supplies are essential to the distribution of power in electrical installations, automated systems, and repaired equipment. This segment remains very strong given the dynamic demand for ongoing future electrical wiring, cable, switch, and lighting needs. Additionally, the ongoing market growth in energy-efficient and smart electrical products continues to favor the market share of electrical supplies.

Industrial Distribution Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Electrical Supplies | 28.50% |

| Safety & PPE Supplies | 11.40% |

| HVAC Equipment | 9.20% |

| Fasteners | 7.50% |

| Tools & Instruments | 10.20% |

| Industrial Fluids & Lubricants | 6.70% |

| Power Transmission & Bearings | 5.90% |

| Material Handling & Packaging | 4.70% |

| Others | 15.90% |

Safety and personal protective equipment (PPE) are experiencing the most rapid growth due to increased awareness of safety at work and compliance regulations. Safety and PPE industries will receive more investment directed toward protective equipment (helmets, gloves, goggles, and respiratory equipment) for safety and well-being. Moreover, the COVID-19 pandemic has ushered in the long-term adoption of safety protocols. Consequently, safety and personal protective equipment (PPE) will continue to be an essential part of growth expectations within the industrial distribution market.

The offline distribution channel remains dominant because many industrial clients prefer personal interactions and technical consultations before making large or customized purchases. Local distributors and in-person sales teams provide trusted service, immediate assistance, and after-sales support. This direct connection helps in handling complex industrial needs and builds customer loyalty. Even as digital sales rise, offline distribution continues to hold a strong market presence due to its reliability and relationship-based approach.

Industrial Distribution Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Offline | 72.4% |

| Online | 27.6% |

Online/E-commerce platforms are evolving quickly as industries begin to adopt digital procurement and manage orders online. The convenience of online channels over traditional channels, driver speed of delivery, and tracking products in real time are causes for the shift to online ordering. Automation of inventory management with AI-based product recommendations continues to improve the user experience. Overall, digital transformation is the way distributors lower operating costs while effective accessing a more broad audience, making online e-commerce a legitimate growth source for the industrial distribution market.

Manufacturing has the highest share of the industrial distribution market given the continuous need for a variety of MRO (maintenance, repair and operations) products. Manufacturers depend on distributors to provide the necessary components to ensure production lines operate effectively. The emergence of automated manufacturing and new manufacturing nodes around the world has contributed to the market need for products. Continuous growth in automotive, electronics, and machinery manufacturing continues to keep the manufacturing sector's highest market share.

Industrial Distribution Market Share, By End-Use Industry, 2025 (%)

| End-Use Industry | Revenue Share, 2025 (%) |

| Manufacturing | 36.2% |

| Energy & Utilities | 11.0% |

| Construction & Infrastructure | 19.1% |

| Healthcare & Pharmaceuticals | 5.5% |

| Mining & Metals | 8.7% |

| Transportation & Warehousing | 6.5% |

| Chemicals & Process | 7.6% |

| Others | 5.4% |

The energy and utilities sector is rapidly expanding, driven by increased investment in renewable energy, power generation, and smart grid infrastructure. Ideally, distributors of electrical, safety, and automation products should benefit from the transition to renewable energy. Governments and utilities are now focused mainly on upgrading the old infrastructure, accompanied by the constant need for supplies and components. Across the segment, the traditional energy systems continue the drive to digitize and become more efficient. Not surprisingly, this sector is experiencing steady growth within the industrial distribution market.

By Product

By Distribution Channel

By End-User Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Industrial Distribution

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Distribution Channel Overview

2.2.3 By End-User Industry Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Industrial and Infrastructure Development

4.1.1.2 Digitalization and E-commerce Expansion

4.1.2 Market Restraints

4.1.2.1 Price Volatility and Supply Chain Disruptions

4.1.2.2 High Market Competition and Margin Pressure

4.1.3 Market Challenges

4.1.3.1 Digital Transformation and Workforce Skill Gaps

4.1.3.2 Global Supply Chain Complexity and Risk Management

4.1.4 Market Opportunities

4.1.4.1 Adoption of Industrial IoT and Automation

4.1.4.2 Sustainability and Green Initiatives

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Industrial Distribution Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Industrial Distribution Market, By Product

6.1 Global Industrial Distribution Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Electrical Supplies

6.1.1.2 HVAC Equipment

6.1.1.3 Fasteners

6.1.1.4 Tools and Instruments

6.1.1.5 Industrial Fluids and Lubricants

6.1.1.6 Safety and PPE Supplies

6.1.1.7 Power Transmission and Bearings

6.1.1.8 Material Handling and Packaging

6.1.1.9 Others

Chapter 7. Industrial Distribution Market, By Distribution Channel

7.1 Global Industrial Distribution Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Online

7.1.1.2 Offline

Chapter 8. Industrial Distribution Market, By End-User Industry

8.1 Global Industrial Distribution Market Snapshot, By End-User Industry

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Manufacturing

8.1.1.2 Energy and Utilities

8.1.1.3 Construction and Infrastructure

8.1.1.4 Healthcare and Pharmaceuticals

8.1.1.5 Mining and Metals

8.1.1.6 Transportation and Warehousing

8.1.1.7 Chemicals and Process

8.1.1.8 Others

Chapter 9. Industrial Distribution Market, By Region

9.1 Overview

9.2 Industrial Distribution Market Revenue Share, By Region 2024 (%)

9.3 Global Industrial Distribution Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Industrial Distribution Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Industrial Distribution Market, By Country

9.5.4 UK

9.5.4.1 UK Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Industrial Distribution Market, By Country

9.6.4 China

9.6.4.1 China Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Industrial Distribution Market, By Country

9.7.4 GCC

9.7.4.1 GCC Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Industrial Distribution Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Fastenal Company

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Motion Industries Inc.

11.3 WESCO International Inc.

11.4 MSC Industrial Direct Co. Inc.

11.5 MRC Global Inc.

11.6 Rexel Group

11.7 Graybar Electric Co.

11.8 Airgas Inc.

11.9 Sonepar USA

11.10 Winsupply Inc.

11.11 Ferguson PLC

11.12 HD Supply (HD Inc.)

11.13 Applied Industrial Technologies Inc.

11.14 Bisco Industries

11.15 Anixter International