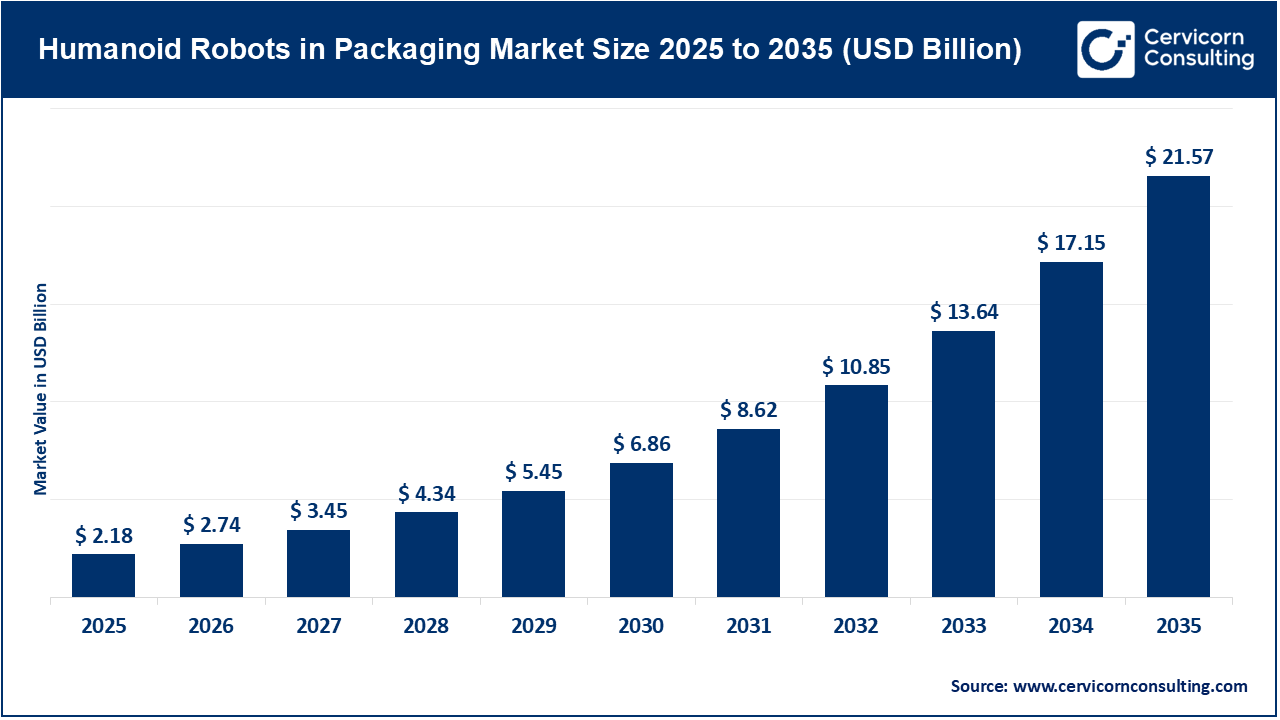

The global humanoid robots in packaging market size was valued at USD 2.18 billion in 2025 and is expected to be worth around USD 21.57 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 25.76% over the forecast period 2026 to 2035. The humanoid robots in packaging market is driven primarily by a considerable demand for automation that can integrate with human-focused work environments. Humanoid robots can operate in spaces designed for people completing a range of packaging tasks (e.g. picking, placing, palletizing, and quality inspection) without major changes to infrastructure. An increasing challenge with labor availability in logistics and packaging facilities, coupled with the desire for higher efficiency and flexibility, has led both manufacturers and packaging companies to consider humanoid systems. Advances in artificial intelligence, computer vision, and dexterous manipulation also give humanoid robots an added capability to complete more complex and sensitive packaging procedures accurately.

Another significant driver is the shift in the packaging industry toward customization, e-commerce fulfillment, and short production runs, all simultaneously, seeking flexible automation solutions. Humanoid robots can adapt to changes in SKUs, product types, and packaging formats; the use of humanoid robots will offer a viable answer for those looking at high-mix, low-volume applications. The emergence of Robots-as-a-Service (RaaS) models is also reducing the barrier for companies to engage in the adoption of humanoid robots as flexibility permits the use of robots without the burden of a heavy capital investment upfront. Furthermore, robotics manufacturers have made significant R&D investments, while partnerships between robotics and packaging automation companies are increasing technology collaboration, advancing usability, and promoting confidence in commercial scale deployment.

What is a Humanoid Robot in Packaging?

A humanoid robot in packaging is a robot having a humanoid shape, most typically possessing arms, torso, and sometimes legs, that would perform packaging tasks generally associated with humans. These robots utilize sophisticated (i.e. machine vision, artificial intelligence (AI), manipulation) for many packaging activities defined by the human-oriented workspace, and therefore reduce the necessity for custom automation setups.

Major Applications in the market

Rising Investments in Robotics Transforming the Packaging Industry

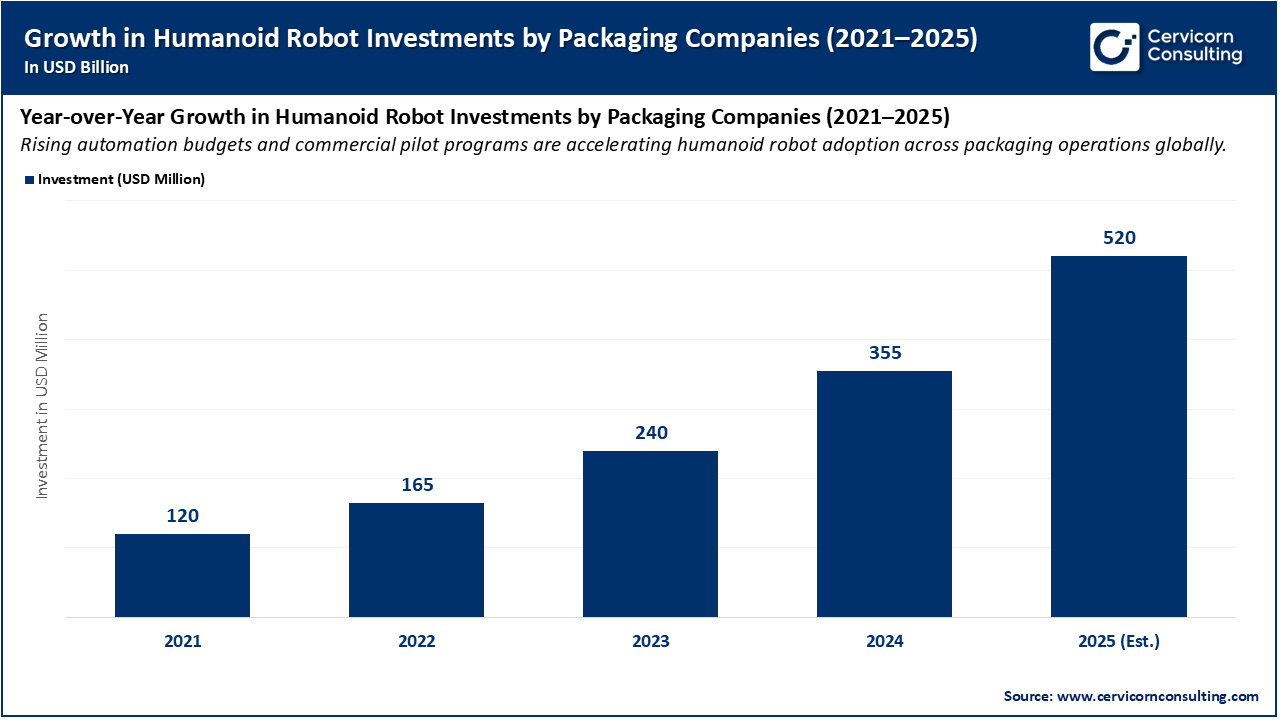

The increased investment in robotics for the packaging industry is changing production efficiency, flexibility, and workforce-related issues in production. Companies are putting more capex towards automatic robots such as humanoid and collaborative robots for productivity elements, such as labor shortages, the ability to allow custom packaging, and the push for continual operations. The investment in automatic machines increases speed and accuracy while enabling packing lines to switch between product type and orders in a very short time frame. As the price of robotics decreases and the functionality of AI-driven automation becomes more intuitive, large manufacturers and smaller packaging companies are expediting the use of robotic systems to remain competitive. At the same time, this effort will enable quality and sustainable production at scale.

The consistent increase in funding depicted in the chart is driving swift innovation and commercialization of humanoid robots in packaging. Funding is anticipated to be nearly four times larger in 2025 relative to 2021. Packaging companies are transitioning from pilot testing and initiating full-scale deployment, increasing automation and labor efficiency, and extending humanoid development throughout logistics and production processes.

Key Investment Areas and Their Impact on the Packaging Robotics Industry

| Investment Focus Area | Impact on Packaging Industry | Trends |

| Automation & Robotics Integration | Streamlines repetitive packaging tasks, improves productivity | Robotic arms, humanoid robots, cobots |

| AI and Vision Systems | Enables precision handling and real-time defect detection | 3D vision, machine learning algorithms |

| Flexible Packaging Solutions | Allows rapid changeovers for different products or SKUs | Modular robotic systems, adaptive grippers |

| Workforce Augmentation | Addresses labor shortages and reduces human fatigue | Collaborative humanoid robots |

| Sustainability & Efficiency | Optimizes material usage and reduces waste | Smart packaging, energy-efficient robotics |

| Robots-as-a-Service (RaaS) | Reduces upfront costs, making automation accessible |

Subscription-based robotic deployment |

Figure AI Showcases Vision-Guided Humanoid Robot for Package Sorting

Figure AI demonstrated its humanoid robot sorting packages using AI and advanced vision systems handling boxes, envelopes, and polybags with human-like agility. Approximately four seconds per package sorting capability exhibited the robot's ability to perform in mixed item and unstructured packaging environments. This accomplishment will take the humanoid robots in packaging market to the next level by proving AI-enhanced humanoids can handle complex and high variance iconic packaging task, and culminating in scalable automation for e-commerce and distribution fulfilment.

Agility Robotics Deploys Digit in Real-World Warehousing and Packaging

Digit, Agility Robotics' humanoid robot, made its commercial debut with GXO Logistics, representing one of the first commercial deployments in warehousing and packaging in practice. Digit performs tote handling, picking, and material movement without a facility redesign, indicating a practical application of a humanoid robot in human-centric environments. Digit's deployment advances market acceptance by demonstrating that humanoid robots can create meaningful efficiency and flexibility in existing packaging infrastructure.

Kepler Robotics Begins Mass Production of Industrial Humanoid Robot K2 “Bumblebee”

Kepler Robotics has commenced mass production of K2, “Bumblebee,” a hybrid humanoid robot designed to carry out many industrial and packaging-technology functions. Transitioning from prototyping to mass quantities significantly lowers cost barriers and greatly increases the ability of global manufacturers to access this technology. This marks a major milestone to the market because it signifies a transition from experimental technology to fully developed, commercially deployable humanoid robots that are mission-ready for packaging and palletizing functionality.

Humanoid Robots Integrated with Enterprise Packaging and Safety Systems

Next-generation humanoid robots, such as Agility's Digit V4, are now combined with certain enterprise packaging systems and safety protocols to enable co-worker collaboration with humans. The systems include configurable connectivity, predictive analytics, safety compliance, and other key capabilities. This important milestone will drive the market providing more trust, interoperability, scalability, and other critical aspects needed for humane robot adoption in packaging environments.

Automation and E-Commerce Growth

The rise in e-commerce is prompting packaging companies to automate quickly. With more SKU variations and a growing desire for faster delivery, humanoid robots are more flexible and faster than traditional systems. Recent reports indicate that global demand for e-commerce packaging is increasing by more than 11% per year and is creating investments into adaptive robotic systems that can accommodate diverse packaging functions.

Labor Shortages and Cost Pressures

Continued labor shortages and increasing operational costs are driving the use of humanoid robots. Many packaging plants are unable to source labor for mundane and monotonous work, and automation becomes a necessity. New data shows in excess of 20 % automation adoption in logistics and packaging since 2022, mainly due to continued staffing issues.

High Initial Investment and ROI Concerns

Although technology has potential, high costs for humanoid robots—hardware, integration, and training—impede use, particularly with small and medium-sized businesses. Many companies hesitate because of uncertainty around short-term ROI, thereby limiting large-scale deployment for packaging.

Technical Integration Challenges

Bringing humanoid robots into current packaging lines is still difficult due to older machines, size variability of products, and lack of digital infrastructure. Without synchronization, the technical mismatch leads to slower initiation and greater customization costs for manufacturers.

Multi-Functional Humanoid Robots

A significant market opportunity exists in developing humanoid robots for the ability to perform a variety of packaging tasks ranging from pick-and-place, to palletizing, to inspection. This broad functional capability can support the replacement of as many as 4-5 fixed automation systems thus benefiting site space, maintenance, cost, and productivity.

Robots-as-a-Service (RaaS) Models

RaaS products are gaining traction as a major pathway to democratizing humanoid robotics in the packaging sector. They allow companies to move from capital expenditures and products to a subscription model for a new robotic technology with little risk, and this is accelerating adoption within mid-sized packaging and logistics organizations worldwide.

Safety and Regulatory Compliance

A considerable challenge is ensuring humans and humanoid robots can work in collaboration in a safe manner. There is wariness in packaging plants due to strict safety standards and certification. There are active pilot programs evaluating migrating to robotic programming that are focused on building sensors, movement control, and emergency protocols so that they meet industrial safety standards.

Handling Diverse Packaging Formats

Packaging lines can include a variety of products: soft bags, boxes, and irregular shapes and humanoid robots struggle to manage those forms of packaging quickly and efficiently. Gripping and vision task are complex with transparent or flexible materials, risky and slow down the wide-scale adoption of full automation.

The humanoid robots in packaging market are segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

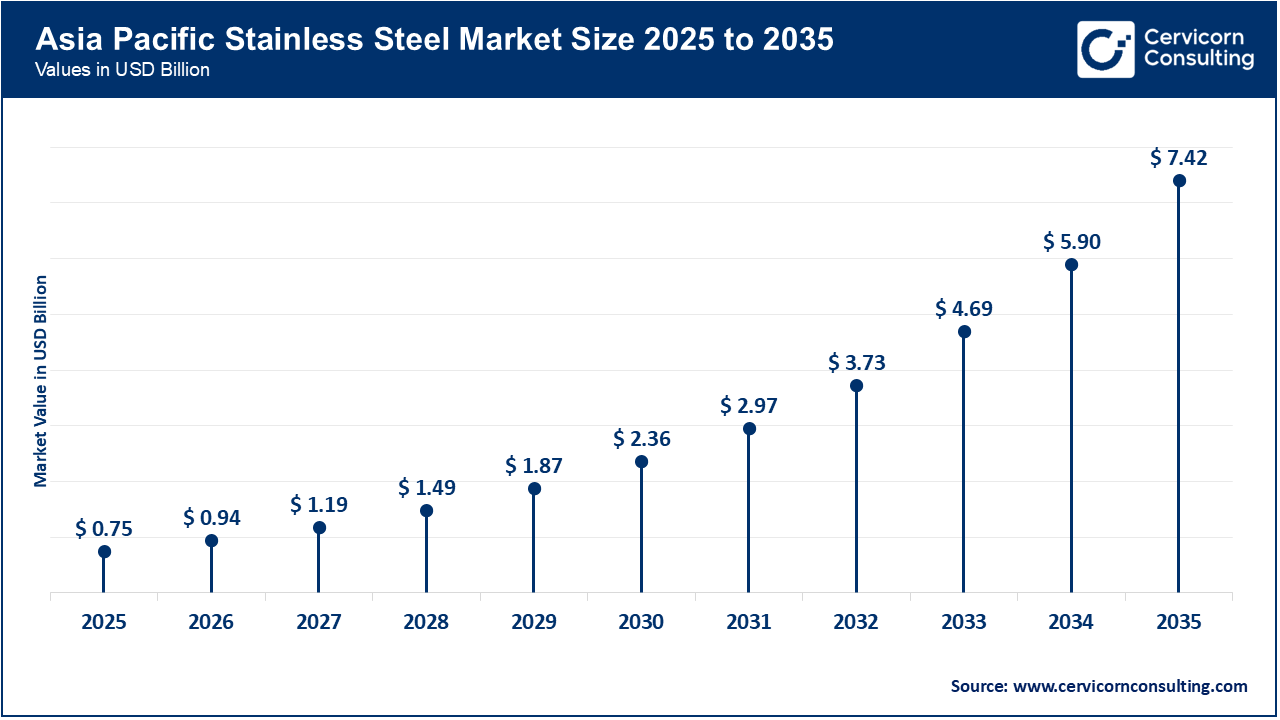

The Asia-Pacific region dominates the market in 2025. Asia-Pacific region is advancing humanoid robotics development through intentional industrial policy, industrial manufacturing supply chains, and private sector investment. Governments and industry associations are providing funding support for AI/robotics research and development, while local companies are quickly iterating hardware and software to build humanoid platforms for packaging and factory work at a lower cost. The combination of government roadmaps, dense electronics supply chains, and existing high-volume manufacturing capabilities in the region means APAC will be the fastest mover toward production readiness and pilot scale-ups.

Recent Developments:

North America is the fastest-growing region. North America is at the forefront of the commercial adoption of robots because Government-backed venture funding, large-scale logistics companies, and the willingness of logistics operators and shippers to experiment with Robots-as-a-Service (RaaS) have moved humanoid robots from product demonstrations to RaaS-Paid pilots and initial production deployments. Startups and integrators in the US have capital markets, relationships and partnerships with large 3PLs and OEMs, and an already large logistics network of fulfillment centers to conduct trials, even without having to redesign the expensive layout of their warehouses. In the end, North America is the proving ground for the enterprise deployments of humanoid robots and the scalable service model.

Recent Developments:

Europe shows substantial growth and technological advancement in the humanoid robots in packaging market. Europe's acceptance is characterized by extensive safety specifications, existing partnerships with packaging-automation integrators, and pilot projects between robotics suppliers and packaging equipment manufacturers. European companies are committed to the certified, safe integration of robotics into food, pharma, and consumer-products production lines subject to regulations; the European segment supports validated humanoid solutions within specifications (e.g., CRAN, ETL) and collaborative partnerships with OEMs versus pushing for deployment. Consequently, Europe is a leading region for certified, lineside humanoid use in regulated sectors.

Recent Developments:

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 34.4% |

| North America | 31.7% |

| Europe | 28.1% |

| LAMEA | 5.8% |

LAMEA is a developing market for humanoid packaging robots. The adoption appears more geographically fragmented into larger ports, logistic hubs, and select groups of industrial players who are testing automation to fill labor gaps and stay competitive. The growth criteria are met through select capital investments, regional activity from integrators, and growing government and multinational interest in modernizing supply chains. However, deployments by scale and quantity do not measure up to scale and number in North America, APAC, and Western Europe.

Recent Developments:

The humanoid robots in packaging market are segmented into application, mobility, level of autonomy, end-user, and region.

Pick & Place & Case Packing (Dominating Segment)

The humanoid robots in packaging market is largely focused on pick-and-place and case-packing applications due to their flexibility with existing automation systems and repetitive high speeds. These applications are designed for lightweight items to be moved or placed accurately into a packing unit. These applications leverage humanoid flexibility to pack lighter items in boxes or bags. For these applications, manufacturers are focusing on using humanoid robots because they are designed with reach, flexibility, human-like handling, along with industrial-grade reliability and allow for easy integration into packaging lines without changing existing designs.

Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2025 (%) |

| Pick & Place & Case Packing | 32% |

| Palletizing & Depalletizing | 15% |

| Sorting & Order Consolidation | 20% |

| Inspection & Quality Control | 8% |

| Lineside Delivery & Fixture Placement | 6% |

| Secondary & Final Packaging | 12% |

| Others | 7% |

Sorting & Order Consolidation (Fastest-growing Segment)

Sorting and order consolidation represent the fastest growing applications driven by the increase in e-commerce and omni-channel distribution. Humanoid robots are being utilized for sortation of parcels that have mixed SKUs as they have various sizes, shapes, and weights. Historically, this was a job that required manual labor. Advances in vision-enabled AI with tactile feedback have now given humanoids the ability to identify, grab, and place each item even in unstructured conditions.

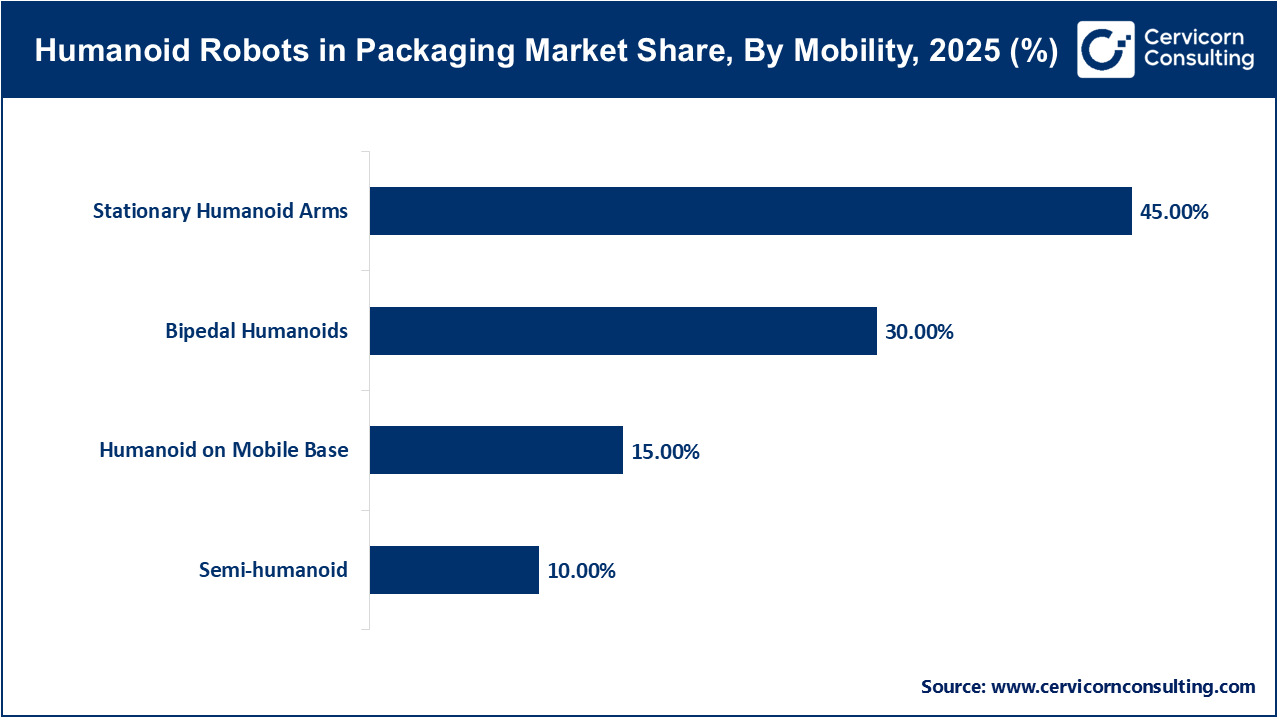

Stationary Humanoid Arms (Dominating Segment)

Due to their inherent stability, accuracy, and lower risk of operations as compared to a fully-mobile humanoid robot, stationary humanoid arms are greatly favored as robotic manipulators. These systems are commonly found in pick-and-place, packaging, and quality inspections tasks or stations, where motion is significantly reduced, but precision is still paramount. Since stationary humanoid arms are also more cost-effective, often easier to program, and don't require conveyor modification, they are the top choice for semi-humanoid automation applications in the packaging sector.

Bipedal Humanoids (Fastest-Growing Segment)

Bipedal humanoids are now the fastest-growing mobility class. Their greatest advantage is that they can function in environments designed for humans, without structural changes. They are also capable of autonomous navigation, package delivery, and pallet loading. Logistics companies are deploying bipedal humanoids to support labor-intensive tasks like tote movement and packaging line replenishment. Bipedal humanoids are filling an important hole in the labor market.

Semi-Autonomous Systems (Dominating Segment)

Semi-autonomous humanoid robots maintain superiority based on their combination of control and flexibility - human operators can still remotely intervene as needed while robots perform everyday packing work independently. This will increase safety, efficiency, and scalability, particularly in packing workflows where humans still must be present for complex decision making.

Market Share, By Level of Autonomy, 2024 (%)

| Level of Autonomy | Revenue Share, 2025 (%) |

| Semi-autonomous | 55% |

| Fully autonomous | 30% |

| Teleoperated | 15% |

Fully Autonomous Systems (Fastest-Growing Segment)

Fully autonomous humanoid robots are emerging with advancements in large AI models, multimodal vision, and reinforcement learning. These systems can make decisions based on context, learn from real-world data, and adapt to new packaging configurations—all without reprogramming the robot. Autonomous humanoids are in many ways considered the future of high-volume, flexible packaging automation.

E-commerce & 3PL Warehousing (Dominating Segment)

E-commerce companies and third-party logistics (3PL) providers spearhead humanoid robot use cases because of the intense pressure for efficiency in order fulfillment and reduced reliance on labor. Humanoid robots are particularly well suited for activities like box picking, labeling, and lineside delivery; once programmed, they can behave continuously and efficiently no matter the number or types of packages being handled. They can be used to fill labor gaps and support facilities's peak seasons.

Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2025 (%) |

| E-commerce / 3PL & Warehousing | 35% |

| Consumer Packaged Goods (FMCG) | 20% |

| Food & Beverage | 15% |

| Pharmaceuticals & Cosmetics | 12% |

| Electronics | 10% |

| Others | 8% |

Pharmaceuticals & Cosmetics (Fastest-Growing Segment)

Humanoid robots are being adopted by the pharmaceutical and cosmetic industries to provide guidance for their precision-driven packaging, inspection, and operations in a sterile area. The vast capability of humanoid robots to manipulate delicate packaging materials, provide transparency, and operate in a non-contaminated manner make them a rapidly growing end-user category of robotic systems. Automation is assisting manufacturers with compliance to strict GMP and FDA standards while maintaining efficiency.

Industry Leaders’ Perspectives

1. Brett Adcock – Founder & CEO, Figure AI

Brett Adcock argues that humanoid robots are at the edge of commercial scalability in logistics and packaging. He shared, “Humanoid robots will be filling labor shortages in warehouses, as well as manufacturing floors. They will handle repetitive and physically taxing work without risk or injury.” Figure’s mission is to build robots that can do flexible packaging and sorting operations powered by AI and learning, and believes humanoids will be a standard part of the workforce in a few years.

2. Damion Shelton – CEO, Agility Robotics

Shelton prioritizes the practical deployment of humanoid robots over prototypes. He said, “Humanoids will need to demonstrate value for a business before they are adopted on a larger scale,” which implies scale in logistics. Shelton’s comment underscores that Agility Robotics’ right now will not focus on their quality as futuristic robots, but on their usefulness. Agility’s “Digit” robot is now commercially deployed - this milestone indicates we have possibly reached the market readiness for humanoids who integrate directly into the processes of packaging and warehousing automation.

Market Segmentation

By Application

By Mobility

By Level of Autonomy

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Humanoid Robots in Packaging

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Mobility Overview

2.2.2 By Level of Autonomy Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Automation and E-Commerce Growth

4.1.1.2 Labor Shortages and Cost Pressures

4.1.2 Market Restraints

4.1.2.1 High Initial Investment and ROI Concerns

4.1.2.2 Technical Integration Challenges

4.1.3 Market Challenges

4.1.3.1 Safety and Regulatory Compliance

4.1.3.2 Handling Diverse Packaging Formats

4.1.4 Market Opportunities

4.1.4.1 Multi-Functional Humanoid Robots

4.1.4.2 Robots-as-a-Service (RaaS) Models

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Humanoid Robots in Packaging Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Humanoid Robots in Packaging Market, By Mobility

6.1 Global Humanoid Robots in Packaging Market Snapshot, By Mobility

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Bipedal Humanoids

6.1.1.2 Stationary Humanoid Arms

6.1.1.3 Humanoid on Mobile Base

6.1.1.4 Semi-humanoid

Chapter 7. Humanoid Robots in Packaging Market, By Level of Autonomy

7.1 Global Humanoid Robots in Packaging Market Snapshot, By Level of Autonomy

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Teleoperated

7.1.1.2 Semi-autonomous

7.1.1.3 Fully autonomous

Chapter 8. Humanoid Robots in Packaging Market, By Application

8.1 Global Humanoid Robots in Packaging Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pick & Place & Case Packing

8.1.1.2 Palletizing & Depalletizing

8.1.1.3 Sorting & Order Consolidation

8.1.1.4 Inspection & Quality Control

8.1.1.5 Lineside Delivery & Fixture Placement

8.1.1.6 Secondary Packaging & Final Packaging

8.1.1.7 Others

Chapter 9. Humanoid Robots in Packaging Market, By End-User

9.1 Global Humanoid Robots in Packaging Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 E-commerce

9.1.1.2 Food & Beverage

9.1.1.3 Pharmaceuticals & Cosmetics

9.1.1.4 Consumer Packaged Goods (FMCG)

9.1.1.5 Electronics

9.1.1.6 Others

Chapter 10. Humanoid Robots in Packaging Market, By Region

10.1 Overview

10.2 Humanoid Robots in Packaging Market Revenue Share, By Region 2024 (%)

10.3 Global Humanoid Robots in Packaging Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Humanoid Robots in Packaging Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Humanoid Robots in Packaging Market, By Country

10.5.4 UK

10.5.4.1 UK Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Humanoid Robots in Packaging Market, By Country

10.6.4 China

10.6.4.1 China Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Humanoid Robots in Packaging Market, By Country

10.7.4 GCC

10.7.4.1 GCC Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Humanoid Robots in Packaging Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Agility Robotics

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Apptronik

12.3 Figure AI

12.4 Halodi Robotics

12.5 Leju (Shenzhen) Robotics

12.6 Schubert Group

12.7 Paxiom

12.8 Harpak-Ulma

12.9 Svaya Robotics

12.10 Robotous Co., Ltd.