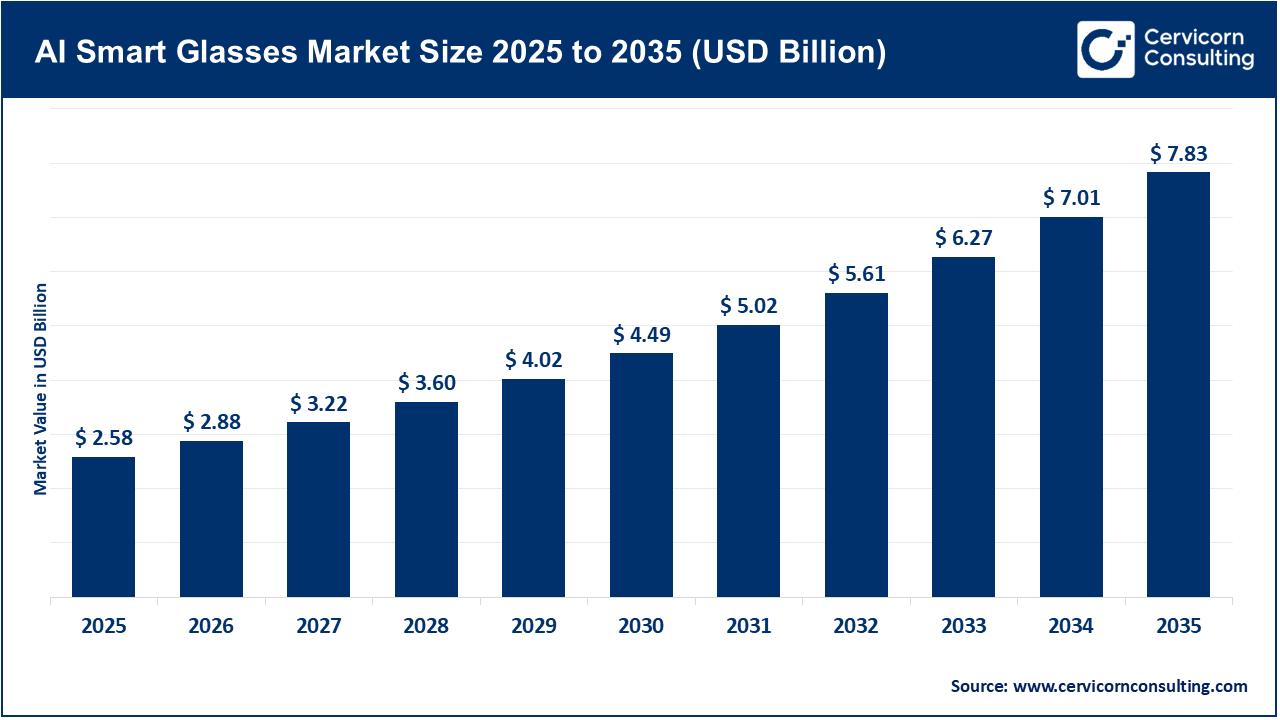

The global AI smart glasses market size was valued at USD 2.58 billion in 2025 and is expected to be worth around USD 7.83 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.74% over the forecast period 2026 to 2035. The AI smart glasses market is gaining rapid growth momentum as both enterprise and consumer use cases expand. For instance, shipments of smart glasses grew by 110% year-over-year in 1H 2025, with the AI-enabled segment by itself accounting for around 78% of the total shipments of smart glasses in that period. One important driver is the enterprise rollout of smart glasses to multiple industries like manufacturing, logistics, field-service and healthcare for hands-free access to needed real-time information, remote assistance and augmented guided experiences.

There are multiple interrelated technological and market-factors driving the growth of the AI smart glasses market. The ability for devices to enable comprehensive AR and also integrate AI mean that more effective real-time translation, visual recognition, gesture control, and cloud/edge compute will be possible. At the same time, the wide adoption of 5G technology and enhanced connectivity mean that the low-latency and high bandwidth, essential for AI workloads on-the-go, can be employed. On the consumer side, greater acceptance of wearable devices, greater interest in immersive experiences (Gaming, Sports, Navigation) and lifestyle tracking is expanding the potential market away from pure industrial applications.

What is AI smart glasses?

Artificial Intelligence Smart Glasses are wearable devices that merge augmented reality (AR) and artificial intelligence (AI) technologies into light-weight eyewear. They use sensors, cameras, displays, microphones, and processors to provide the user with a real-time view with information, translation, navigation, and contextual inferences in their field of vision. Any artificial intelligence-enabled smart glasses have the ability to perceive its environment, recognize objects and people, and provide reasonable feedback or intelligence instantaneously, and in a completely hands-free mode, through either voice activation, gesture or eye motion control.

Applications of AI smart glasses:

How Industry Investments in AR and VR Are Accelerating the Growth of the AI Smart Glasses Market

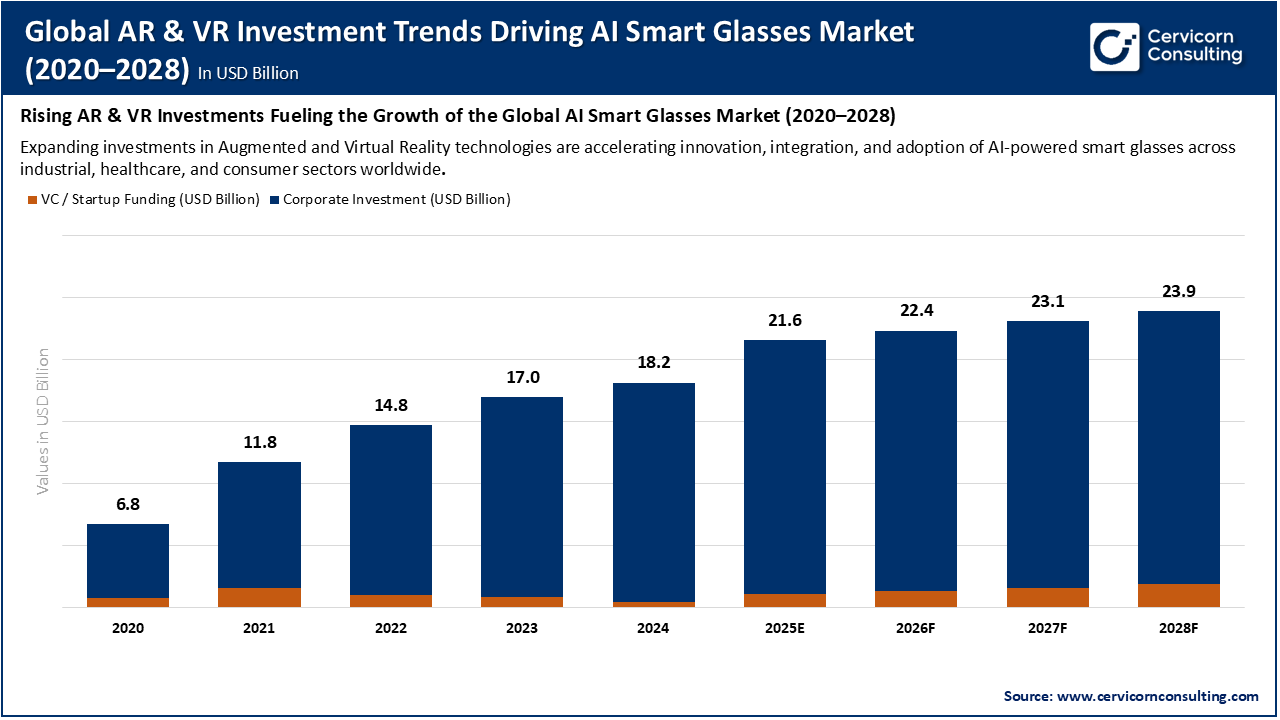

As industries from manufacturing and healthcare to retail and aerospace increase their investments in immersive technologies like Augmented Reality (AR) and Virtual Reality (VR), these AR/VR deployments create a strong ecosystem to the development of AI-enabled smart glasses. In manufacturing, 75% of companies introducing AR/VR technologies at scale are realizing around a 10% improvement in operational efficiency, which increases demand for hardware and software. In healthcare, the value of AR/VR applications in surgery, diagnostics, and training has grown from USD 610 million in 2018 to a projection of USD 4.2 billion by 2026. These investments are enabling sensor-rich, AI-enabled eyewear (smart glasses) to become practical and useful in enterprise and industrial applications, where hands-free data overlays, object recognition, remote expert assistance and alerts based on situation awareness are increasingly being perceived as valuable. As AR/VR platforms become commonplace, smart glasses as a category will gain traction as a natural interface for AI-based visual-computing, thus accelerating a new market for devices that can integrate AI, optics, and connectivity.

The chart depicts AR and VR investment growth from 2020 to 2028, which is fundamentally driving the growth of the AI smart glasses market. As venture capital and corporate investment continues to grow in immersive technologies, it is accelerating innovation and improvements in AI convergence, display technology, and sensor technology that is used in smart glasses. The increased investment supports R&D for lightweight and high-performing devices that enhance user experience, real-time analytics, and industry applications, slowly transforming AI smart glasses from niche-based products to widespread enterprise and consumer products.

Industry Adoption Trends Driving AI Smart Glasses Demand

| Industry Sector | Key AR/VR Adoption Trends | Implications for AI Smart Glasses |

| Manufacturing & Industrial | Common use of AR augmented maintenance, remote support and digital twins | Heightens demand for engagement-free visuals and real-time analytics through smart glasses |

| Healthcare | Increase in AR-enabled products visualization and try-on experience | Drives movement for immersion AI smart glasses for precision visualization and remote collaboration |

| Retail & E-commerce | Increase in AR-enabled products visualization and try-on experience | Encourages usage of AI glasses for product visualization and experiential shopping needs |

| Education & Training | Increased used of VR/AR for immersive learning and upskilling the workforce | Utilizes AI glasses as an interactive, portability training tool |

| Defense & Public Safety | Use of AR for situational awareness and tactical planning | Improves implementation of AI glasses for data overlays and field-based communication |

| Logistics & Field Service | Use of AR to tracking inventory and optimizing routes | Increases implementation of AI glasses for navigation and workflow needs |

Ray-Ban × Meta Launch Bringing AI Glasses to the Mass Market

Rapid Growth in AI-Powered Smart Glasses Shipments

Ecosystem Growth with New Players Including Alibaba and Xiaomi

4. Advances in Display and On-Device AI Integration

Meta’s new smart glasses with AR displays and real-time AI processing power is a notable advancement in this area of capability and user experience. Combining lightweight optics, high-resolution micro-displays, and efficient chip design to perform visual overlays, provide contextual feedback, and improve object recognition without being reliant on unlimited cloud connectivity, these advancements truly change the functionality of smart glasses. Smart glasses are transforming from simple notification devices to fully interactive intelligent companions, which will ultimately serve as a significant growth driver within the larger AI wearables ecosystem.

The AI smart glasses market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

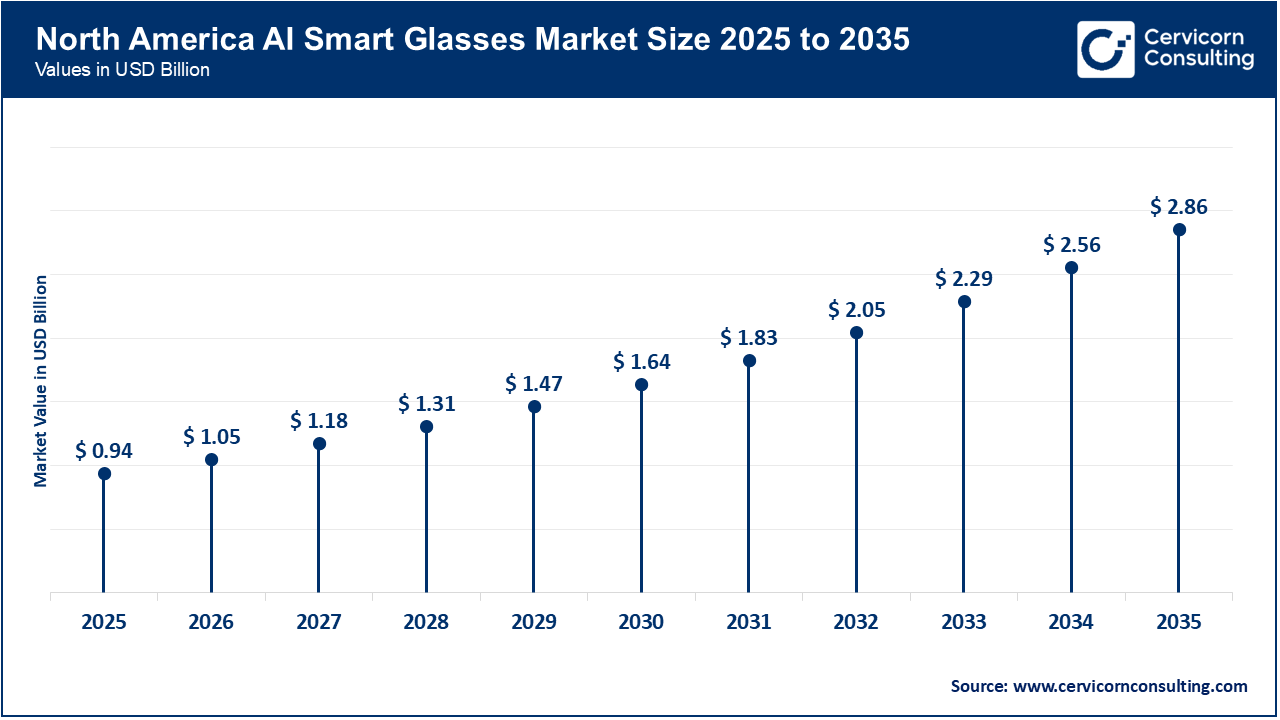

North America is leading the global AI smart glasses market due to its solid advanced technologies foundation, a mature digital infrastructure, and the early adoption of wearable AI across the region. Meanwhile, the U.S. has maintained its largest contribution to the global AI smart glass market thanks to companies like Meta, Microsoft, and Google developing AI-enabled AR glasses for enterprise and consumer use. North America’s market leadership is strengthened by growing adoption in hospitals and healthcare (e.g., remote support, treatment, and training), defense (e.g., situational awareness, augmented training, and embedded operational support), and manufacturing industries (e.g., augmented role simulations, assembly assistance, and quality control). The growing adoption of AI assistants and an increasing number of IoT systems as part of enterprise workflows will drive operational efficiency and move towards a fully digitalized workplace. Industrial smart glass applications are further strengthened by increasing venture capital investment and growing technology firm and industry collaborations across industries in North America as a global innovation hub for AI wearables.

Recent Developments

Asia-Pacific (APAC) AI Smart Glasses Market: Accelerated Growth Driven by Consumer Electronics Innovation and Expanding Industrial Digitization

The Asia-Pacific region has the highest growth of the market driven by rising consumer electronics adoption, fast-tracked industrial digitalization, and government support for AR/VR-based approaches. China, Japan, South Korea, and India benefit from advanced semiconductor production capabilities and investments in AI research and development (R&D), creating innovation hotspots. Increased disposable incomes, a younger tech-sensitive population, and an expanded smartphone ecosystem have led to the growing acceptability of smart wearable devices. China is an emerging production and innovation hub, with local companies like Xiaomi, Rokid, and Alibaba launching AI-enabled smart glasses that combine AR overlays with voice and gesture recognition. Meanwhile, Japan and South Korea are using smart glasses for production efficiency and optimization, healthcare assistance, and education. As companies begin to implement AI vision and AR technology into mainstream consumer devices, APAC is expected to secure the largest volume growth in the segment in the next few years.

Recent Developments

Europe AI Smart Glasses Market: Industry 4.0 Transformation and Regulatory Support Catalyzing Smart Glasses Adoption in Industrial and Consumer Domains

Europe is growing steadily due to the increasing acceptance of Industry 4.0 applications, public sector digitalization programs, and increased usage of wearables in consumer and enterprise applications. The focus on sustainability and efficiency in manufacturing in the region has resulted in greater use of AR-powered remote assistance and predictive maintenance. Major economies such as Germany, the U.K., and France are implementing smart glasses for logistics, automotive assembly lines, and field service. In healthcare, devices are being designed that integrate AI to enhance surgery or training in Northern European countries. In addition, European startups are working with industry leaders to make lightweight, highly efficient smart glasses for use in local markets.

Recent Developments

AI Smart Glasses Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 36.50% |

| Europe | 27.20% |

| Asia-Pacific | 30.30% |

| LAMEA | 6% |

LAMEA AI Smart Glasses Market: Emerging Market Potential Strengthened by Infrastructure Development and Growing Enterprise Applications

The LAMEA region is emerging as a moderately growing opportunity zone for AI smart glasses due to its growing infrastructure, internet penetration, and digital transformation. Greater awareness for technology and education affordability initiatives is driving the uptake. Furthermore, in the Middle East, spending in the UAE and Saudi Arabia on smart city projects and investments to integrate AI wearables within the defense, construction, and industrial training sectors is increasing. The rise of smart glasses in the LAMEA region is primarily supported by government digitalization initiatives and private sector companies pursuing efforts to improve their labor forces' efficiency through wearable technology. With additional pilot projects and partnerships with globally recognized companies, LAMEA will be a key emerging frontier for AI smart glasses within five years.

Recent Developments

Voice Interaction: Drives Market Expansion as Visual Interaction Gains Traction with Advancements in AR and Computer Vision.

Voice interaction segment currently leads the AI smart glasses market with the majority share. This is due to voice interaction being implemented widely amongst both enterprise and consumer use cases. Voice interaction features have advanced in natural language processing (NLP) which assistant tools like Alexa, Meta AI, and Google Assistant use to allow users to accomplishing hands-free tasks such as navigation, messaging, or real-time translation. Voice interaction user interface succeeds in ease-of-use, low learning curve, and minimal visual distraction which makes it optimal for industrial, logistics, and lifestyle users. By 2025, over 60% of AI smart glass products will incorporate voice interaction as the primary user interface and was a significant portion of the mass-market use case.

AI Smart Glasses Market Share, By Type, 2024 (%)

| Type | Revenue Share, 2025 (%) |

| Voice Interaction | 56.20% |

| Visual Interaction | 43.80% |

Visual Interaction

Visual interaction is the fastest growing segment, driven by advances in AR overlays, object recognition, and AI powered computer vision. Visual interaction uses smart glasses to provide wearers with contextual information such as equipment status, navigation directions, and other immersive and intelligent experiences. The inclusion of micro displays, eye tracking, and gesture recognition is broadening jurisdiction use cases in surgery, training, or smart retail. With the advance of AR displays and vision AI technologies and their increased efficiencies and cost effectiveness, the visual interaction will have the highest anticipated growth rate through 2026-2030, taking smart glasses to a fully immersive AI powered intelligent companion from assistants.

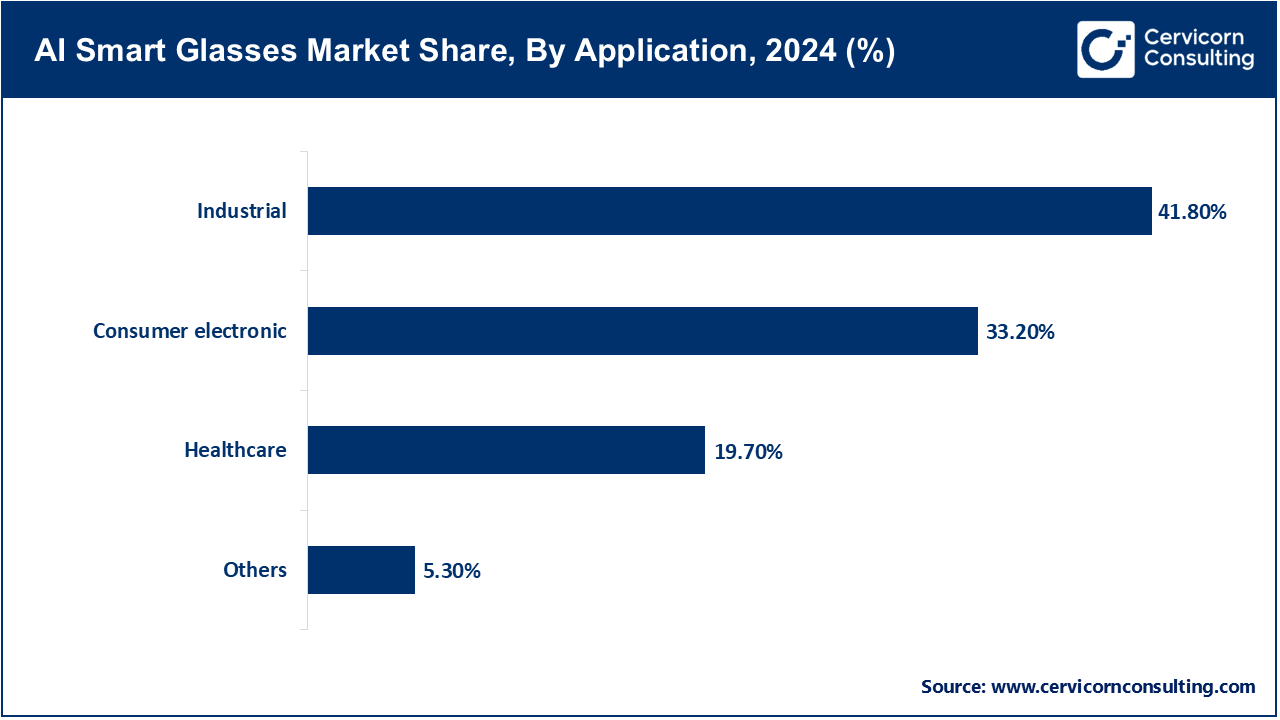

The industrial segment remains the leading application area for AI smart glasses, as organizations continue to fast track adoption in manufacturing, logistics, energy and field service. Organizations have used AI glasses for remote assistance, predictive maintenance, and workflow automation to increase efficiency and safety in these various environments. In fact, the leader of AI smart glasses, the industrial segment, represented over 45% of enterprise deployments of smart glasses in 2025 in industrial environments. Measurable productivity gains and reduced downtime continue to drive organizations in this segment to deploy AI smart glasses. Leading organizations like Siemens, Boeing, and GE also leverage AI smart glasses to see and share real-time data while collaborating, which also adds to the leadership of this segment in terms of market revenue.

The healthcare segment is the one growing fastest due to the increasing use of AI-powered smart glasses in surgical visualization, diagnostic applications, and telemedicine. Surgeons and clinicians can use AR overlays for patient vitals, 3D anatomical visualization, and remote expert collaboration. Hospitals that have implemented mixed-reality solution have seen up to a 30% decrease in procedure time, while increasing the accuracy of surgeries. The focus on telehealth and the digital transformation of healthcare post-COVID continues to be a driver of adoption, and the most dynamic growth driver in the AI smart glasses ecosystem.

Industry Leaders’ Perspectives: Voices Shaping the Future of AI Smart Glasses (2025):

Chris Cox - Chief Product Officer, Meta Platforms

“Smart glasses are the future of computing devices... We talk to them, we will see with them, we will use gestures the same way we interact with each other to interact with our computers.”

Cox believes AI smart glasses will be the next generation personal computing interface, effortlessly blending physical and digital interaction. Meta's partnership with Ray-Ban is an example of this vision in action which focuses on interaction in a natural and multimodal way through voice, vision, and gesture - fused through on-device AI. His comment illustrates a broader strategy from Meta to move away from VR headsets, toward attractive everyday wearable AI companions that integrate generative AI and contextual computing into our lives.

Paul Travers – President & CEO, Vuzix Corporation

“It’s going to be game-changing… Getting that look and feel is key, and smart glasses are going to be part of our everyday lives all over the place.”

Travers places importance on the practical nature of design and ergonomic innovation as hand-in-hand enables of market expansion. Vuzix has been a leader in enterprise-focused AI smart glasses, allowing companies to improve remote collaboration and improve field efficiency. His comments illustrate that widespread adoption depends on not just a product's performance, but the aesthetics, battery life, and comfort barriers the industry is addressing through improvements in microdisplay and optical waveguide.

Market Segmentation

By Type

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of AI Smart Glasses

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Adoption of AR/VR Across Industries

4.1.1.2 Technology Enhancements in On-Device AI and Connectivity

4.1.2 Market Restraints

4.1.2.1 High Expense and Limited Battery Life

4.1.2.2 Privacy and Data Security

4.1.3 Market Challenges

4.1.3.1 User Comfort and Form Factor Limitations

4.1.3.2 Lack of Standardization and Interoperability

4.1.4 Market Opportunities

4.1.4.1 Expansion into Consumer and Lifestyle Segments

4.1.4.2 Integration with IoT and Cloud Ecosystems

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global AI Smart Glasses Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. AI Smart Glasses Market, By Type

6.1 Global AI Smart Glasses Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Voice Interaction

6.1.1.2 Visual Interaction

Chapter 7. AI Smart Glasses Market, By Application

7.1 Global AI Smart Glasses Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Industrial

7.1.1.2 Healthcare

7.1.1.3 Consumer Electronic

7.1.1.4 Others

Chapter 8. AI Smart Glasses Market, By Region

8.1 Overview

8.2 AI Smart Glasses Market Revenue Share, By Region 2024 (%)

8.3 Global AI Smart Glasses Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America AI Smart Glasses Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe AI Smart Glasses Market, By Country

8.5.4 UK

8.5.4.1 UK AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific AI Smart Glasses Market, By Country

8.6.4 China

8.6.4.1 China AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA AI Smart Glasses Market, By Country

8.7.4 GCC

8.7.4.1 GCC AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA AI Smart Glasses Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Meta

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Vuzix

10.3 RealWear

10.4 Xreal

10.5 Lucyd

10.6 Rokid

10.7 Lenovo

10.8 Goertek

10.9 Microsoft

10.10 Epson

10.11 Magic Leap

10.12 OrCam