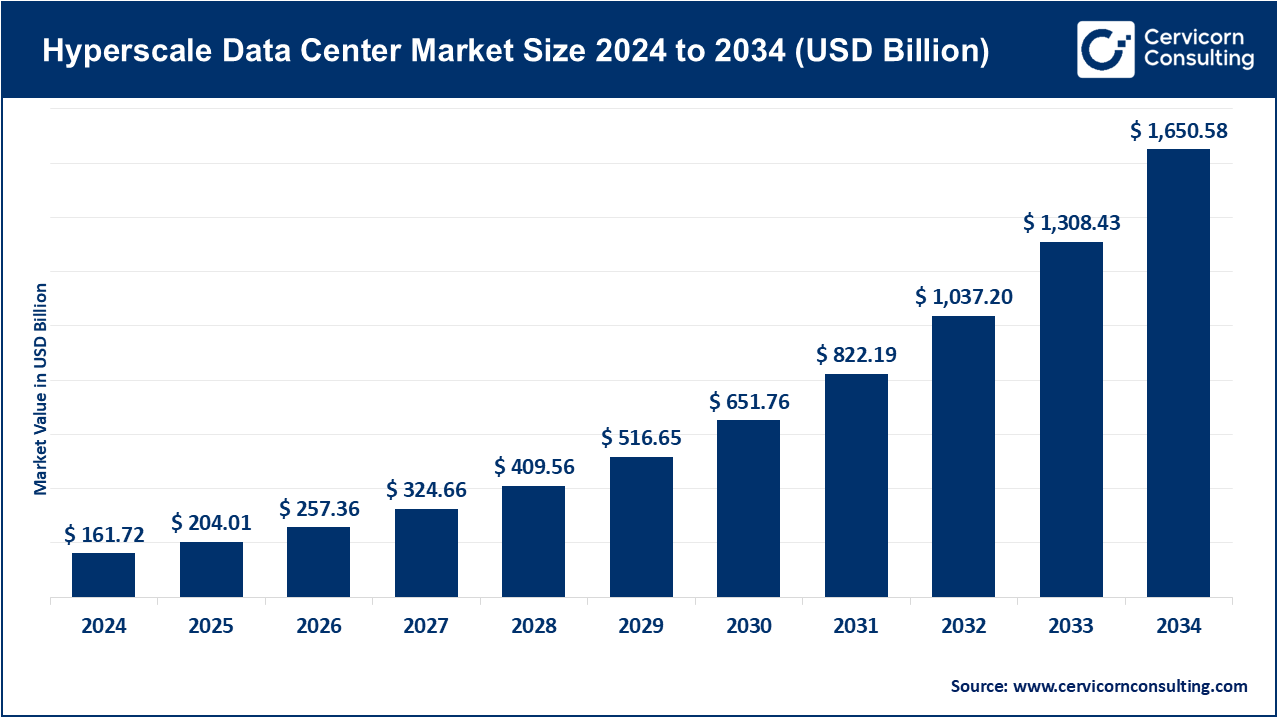

The global hyperscale data center market size was estimated at USD 161.72 billion in 2024 and is expected to surpass around USD 1,650.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 26.15% over the forecast period from 2025 to 2034. The hyperscale data center market is undergoing a swift international growth because of escalating demand of cloud computing, big data, and digital services in the industries. The necessity to have high-performance infrastructures that have minimum energy consumption and carbon emissions is causing growth. Increasingly advanced technologies are being used to optimize cooling, power usage, and predictive maintenance with the use of advanced technologies like AI-assisted management, automation, and digital twins. The uptake of energy-efficient hyperscale facilities are also being spurred by government efforts in encouraging the use of renewable energy in operations and having sustainable operations.

Contemporary hyperscale data centers are also growing smarter and connected and are incorporating IoT-based monitoring systems that allow real-time tracking, predictive analytics, and resource optimization. Hybrid solutions which involve the integration of more sophisticated data center designs and renewable energy sources and smart energy management have the effect of lowering the operational costs, constrain the impact on the environment as well as promote sustainable growth. Therefore, the next-generation data center taking the form of hyperscale is becoming energy-saving, environmentally friendly, and efficient to meet the ever-increasing requirements of the digital economy.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 204.01 Billion |

| Estimated Market Size in 2034 | USD 1,650.58 Billion |

| Projected CAGR 2025 to 2034 | 26.15% |

| Dominant Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Component, Electrical Infrastructure, Power Capacity, Enterprise Size, End Use, Region |

| Key Companies | Amazon Web Services (AWS), Microsoft Corporation, Google LLC, Meta Platforms, Inc., Apple Inc., IBM Corporation, Oracle Corporation, Alibaba Cloud, Tencent Holdings Ltd, Huawei Technologies Co., Ltd., Equinix, Inc., Digital Realty Trust, Inc., NTT Communications Corporation, Hewlett Packard Enterprise (HPE), Cisco Systems, Inc. |

The hyperscale data center market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

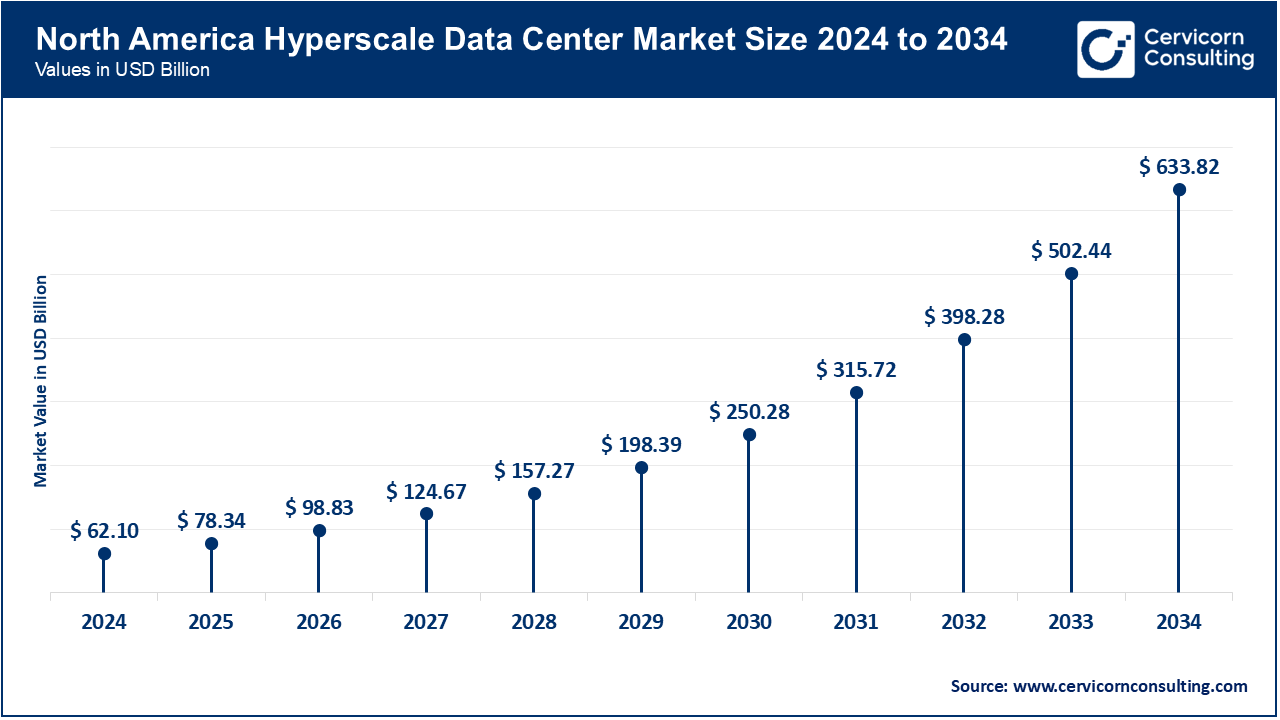

North America leads in the market all over the world because of its robust digital foundation, high-level industrial base, and proactive use of cloud and AI technologies. The United States and Canada are the leaders in the spread of hyperscale facilities in the industrial, commercial, and enterprise sectors. The combination of AI, IoT surveillance, and digital twins technologies can be used to facilitate predictive maintenance, energy savings, and carbon emission reduction. The government policies to encourage the use of renewable energy and the low-carbon requirements further enhance the growth of the market. There are strategic alliances between hyperscale operators, utilities, and technology companies that are driving innovation and creation of hybrid and energy efficient data centres.

The Europe is growing at a high rate because of the high sustainability requirements and regulatory frameworks that encourage energy saving and carbon emission cuts. Germany, the U.K, France and the Netherlands among others are key contributors to growth. Europe focuses on integrating renewable energy, being hydrogen-ready, and optimizing workflow with AI. Cooperation between research organizations, construction companies, and technology suppliers has resulted in more intelligent infrastructure and predictive maintenance. The region remains a reference point of sustainable and technologically advanced hyperscale facilities, which meets the EU climate and digital transition objectives.

The Asia-Pacific is the fastest-growing market due to the high growth of industrialization and urbanization, as well as digital ecosystems. China, India, Japan, and South Korea are the most popular markets, with their focus on the high-scale adoption of the cloud and renewable-powered facilities. The smart city plan, as well as the digital infrastructure programs of India, and the emphasis of energy efficiency and modularity of the systems of Japan, is creating a robust momentum in the region. The emerging centers include Southeast Asian nations like Vietnam, Indonesia and Thailand, which are affordable in terms of labour, government policies and renewable energy investments. The region will also be at the forefront in the world to equip energy efficient and low carbon hyperscale infrastructure.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.40% |

| Europe | 25.70% |

| Asia-Pacific | 28.50% |

| LAMEA | 7.40% |

The propelling factor of the LAMEA region is the increase in adopting infrastructure, industrial, and urban modernization. Brazil, Mexico and Chile are leading markets in Latin America, which are concerned with scalable and cost-efficient operations. Being the first to invest in renewable-powered and hydrogen-ready, as well as smart modular data centers, the Middle East is led by the UAE and Saudi Arabia. Localised industrial and digital infrastructure projects are slowly being embraced by African countries, such as South Africa and Kenya. International partnerships and modernization are facilitating expansion despite regulatory and infrastructure hassles. LAMEA demonstrates a great potential of using sustainable and intelligent infrastructure in a hyperscale.

IT Infrastructure: The IT Infrastructure component consists of the data center's servers, storage, and networks. With the implementation of AI, automation, and the IoT technologies, systems predictive analytics, real-time tracking, and resource management. With these technologies the systems scalability improves, downtimes lessen, and processes become more efficient. Substantial investments are due to the fast adoption of cloud services and the digital transformation of businesses.

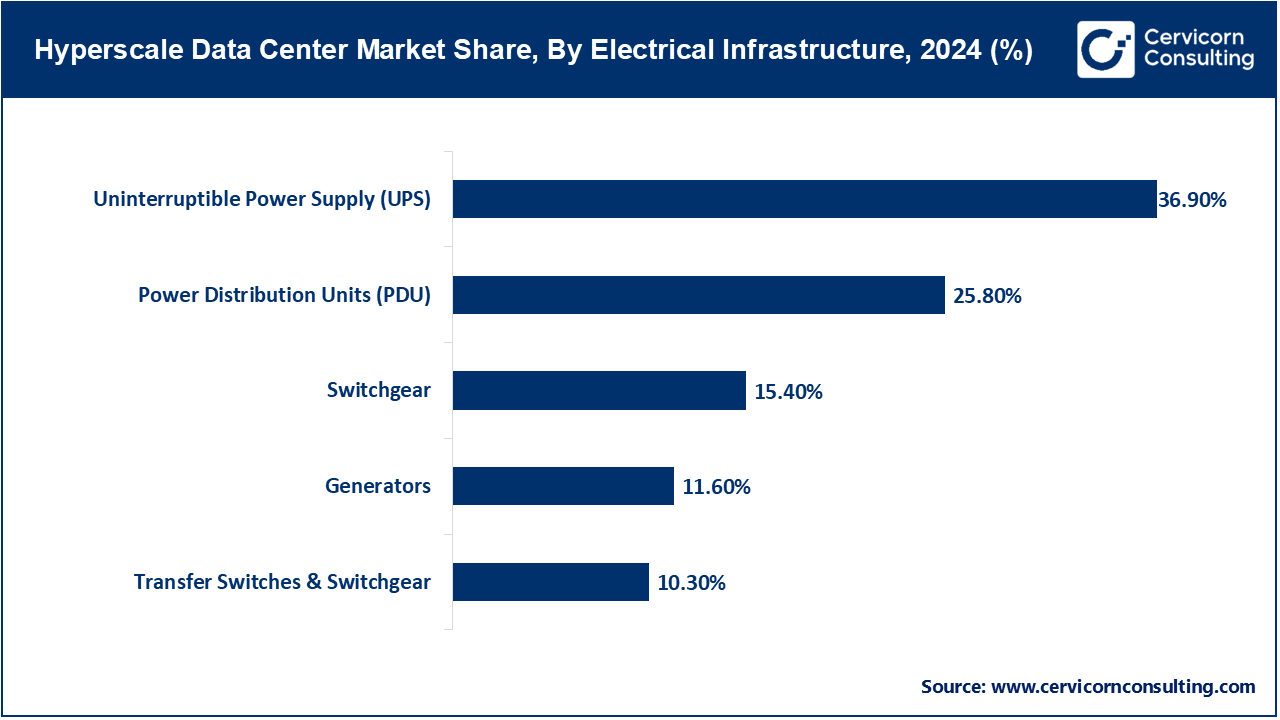

Electrical Infrastructure: This division protects all the systems from failures and provides uninterrupted power supply to all the components of the data center. AI-powered smart grids, the use of renewed systems, and energy management processes reduce power consumption and carbon footprints. All UPS, PDUs, and Generators incorporate predictive maintenance and are energy-efficient. Advanced data center systems are eco-friendly, which is a response to the rise of energy costs and mandated sustainability.

Mechanical Infrastructure: The systems for cooling, racks, and managing air for each component of each system are all vital to the mechanical infrastructure. For more thermal efficiency and lower energy costs, more innovations like liquid cooling and AI-controlled airflow systems are used. Predictive maintenance is possible due to real-time tracking of IoT environmental sensors. Modular systems are designed to scale faster and are more compatible with renewable energy sources, which is a positive change.

General Construction: General construction focuses on the physical design and structural development of hyperscale data centers. Incorporating digital twins, smart materials, and layout sustainability provides precision and operational efficiency. Modular construction techniques shorten timelines while still allowing large-scale expansions. Designing energy-optimized buildings with integrated renewables will quickly become the standard as the world moves to carbon-neutral buildings.

Server: Servers power AI, cloud computing, and the IoT applications running on hyperscale data centers. Rapid data processing and analytics are supported by advanced GPU-based and high-density server systems. Automation and digital twins integration provide predictive maintenance and load optimization. Modular server architectures combined with energy-efficient processors improve computational performance while driving down operational costs.

Market Share, By IT Infrastructure, 2024 (%)

| IT Infrastructure | Revenue Share, 2024 (%) |

| Server | 44.80% |

| Storage | 35.70% |

| Network | 19.50% |

Storage: Storage infrastructure processes and stores massive amounts of data generated by cloud platforms, enterprises, and connected devices. AI-powered analytics and data-tiering techniques enhance storage speed and utilization. The use of hybrid systems containing solid-state drives (SSD) boosts data reliability and access times. With big data and IoT applications on the rise, the development of efficient and scalable storage systems remains a high priority.

Networking: Credit goes to advanced network technology for providing low latency and unhindered connectivity in hyperscale environments. The use of AI-enabled traffic management and SDN provides dynamic bandwidth management and fault-avoidance. IoT-based flow monitoring and situational IoT analytics provide operational resilience and resilience. As cloud services gain traction, intelligent network infrastructure will become indispensable for scalable, sustainable cloud services hoping to achieve high uptime.

Uninterruptible Power Supply (UPS): Modern systems mitigate the effects of power cuts and fluctuations by diverting redundant power to critical systems. Most systems in the market now feature advanced AI systems integrated for constant uptime powered predictive fault flow systems. The integration of advanced systems with renewable and battery powered assistive systems further enhance the systems energy posture. Their energy posture and reliability in meeting operational hyperscale operational demands globally further UP systems advanced the decarbonization operational resilience of the energy infrastructure in data centers.

Power Distribution Units (PDU): PDUs have the primary task of efficient energy distribution to server racks for uninterrupted operational flow. PDUs now have quasi control through IoT systems for real time energy use monitoring and high accuracy predictive fault flow systems. This provides for improved operational resource allocation for energy use, operational cost, and sustainability compliance. The advanced systems with automation and situational awareness are PDUs now capable of responding to automation and compliance globally.

Generators: Generators guarantee that operations can continue during power outages or grid failures. The latest generators have advanced fuel efficiency along with low emissions. The integration of hybrid solar and battery systems adds to their sustainability. Continuous operational predictive analytics maintenance furthers reliability.

Switchgear: In hyperscale facilities, Switchgear systems have the responsibility of controlling and protecting all the electrical circuits. The most recent digital switchgear combines AI and IOT for remote access and monitoring of fault activities. These units are designed to improve safety and energy control and control systems responsiveness to power disturbance issues. The demand for these units is increasing.

Transfer Switches & Switchgear: Primarily they provide seamless switching to backup power. When used with digital switchgear, these units can provide energy control. AI with predictive maintenance facilitates fault monitoring and control. Such systems are crucial for hyperscale environments to maintain operational agility.

Market Segmentation

By Component

By IT Infrastructure

By Electrical Infrastructure

By Power Capacity

By Enterprise Size

By End Use

By Region