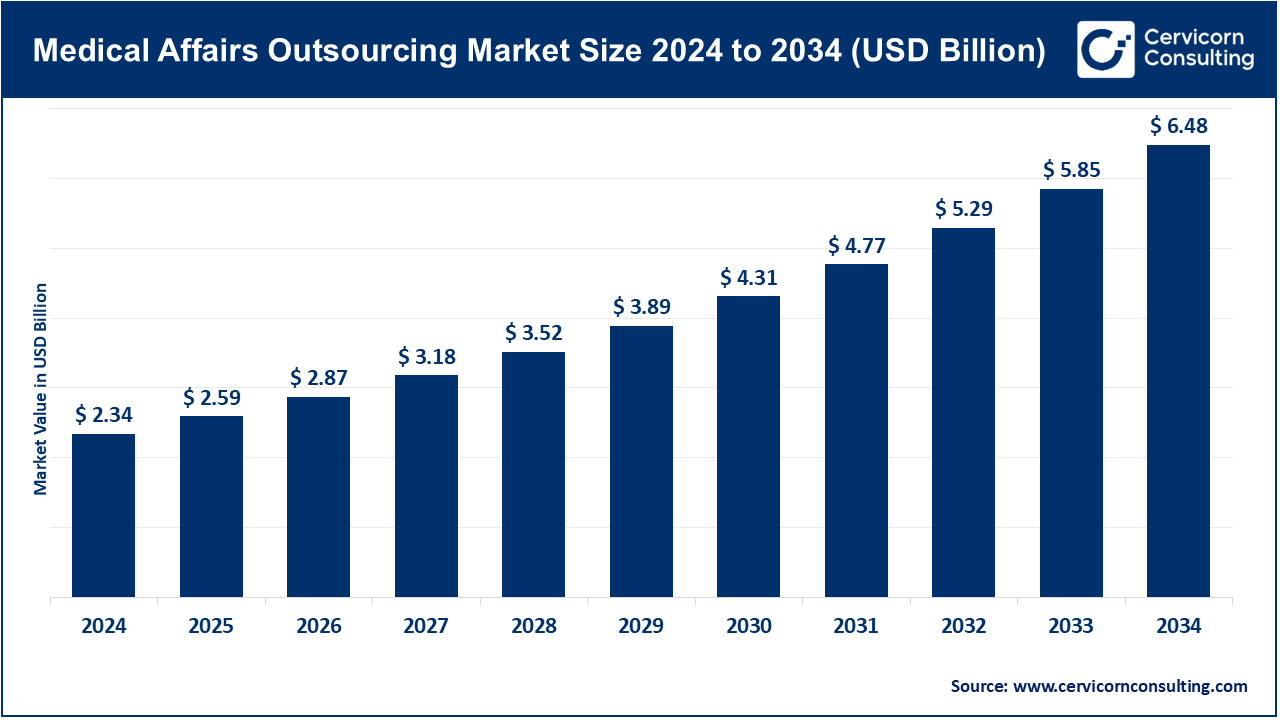

The global medical affairs outsourcing market size was valued at USD 2.34 billion in 2024 and is forecasted to surpass around USD 6.48 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.72% over the forecast period from 2025 to 2034. The increasing demand of specialized expertise, regulatory support and strategic medical communication in hospitals, in pharmaceutical companies, and in clinical research organisation is leading to the growth of medical affairs outsourcing. Firms are increasingly turning to the services of outsourcing to handle evidence creation, real-world data analysis, and medical education, and to guarantee sufficient and prompt availability of scientific knowledge. The increased complexity of therapeutic domains, combined with the emergence of personalized medicine and the development of sophisticated biologics, is also driving organizations to use outsourced solutions that improve operational efficiency and quality.

Such technological innovations like artificial intelligence-based analytics, automation, and the use of digital platforms have a positive influence on decision-making, compliance with regulations, and overall efficiency of operations in the field of medical affairs. Combined with the rise in the recent R&D spending, the trend toward decentralized and patient-centered care models, and the necessity of cost-saving strategies, they are leading to a high growth rate in the market. The interest in medical affairs outsourcing will only increase in the future as pharmaceutical and biotech companies keep focusing on innovation, compliance, and strategic alliances.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.59 Billion |

| Estimated Market Size in 2034 | USD 6.48 Billion |

| Projected CAGR 2025 to 2034 | 10.72% |

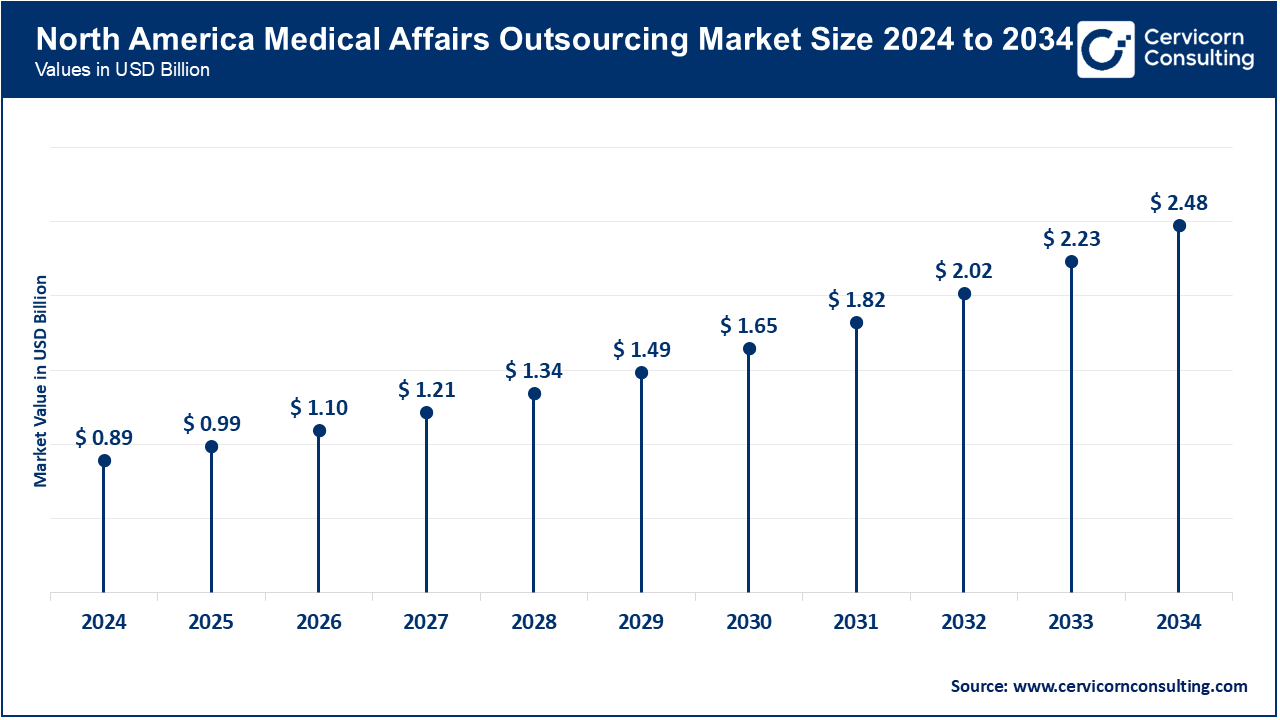

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Service Type, Therapeutic Area, End User, Region |

| Key Companies | Parexel, ICON plc, Syneos Health, Covance (Labcorp Drug Development), Medpace, IQVIA, PAREXEL International, PharmaLex, Accenture Life Sciences, KCR |

The medical affairs outsourcing market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is a leader in market because of the sophisticated drug and healthcare infrastructure, robust regulatory frameworks, and high investments in R&D. By March 2025, more than 65% of U.S. hospitals and pharmaceutical firms will have expanded collaborations with outsourcing partners that provide clinical trial support, regulatory compliance, and medical communications. Outsourced services encouraged the FDA Real-World Evidence Program for rapid data evaluation and evidence generation. Market leaders, including Parexel, Syneos Health, and ICON, have incorporated AI-powered tools in medical information systems and pharmacovigilance. Innovation and the region focus on digital technologies improves the efficiency and quality of medical affairs. Increasing homecare frameworks and decentralized healthcare models increase the need for outsourced solutions.

In Europe, growth has consistently placed. Strain on regional regulatory bodies and the European Medicines Agency’s guidance on use external expertise has spawned innovation within the market. Improved collaborations with Parexel, ICON and Covance and National Healthcare services has bolstered reliability in the market. European governmental bodies and National healthcare services prioritize sustainable practices within medical affairs to reinforce market growth. Outsourcing services relieve the burden of launching healthcare products regionally while maintaining compliance with healthcare regulations. Takeda’s decision to consolidate its European medical affairs activities has been viewed as a positive step toward EU integration.

In the Asia-Pacific region, outsourcing growth has been the most exponential in the world. The Philippines, Vietnam, and Thailand’s demand for western therapeutics has modernized and expanded exportable healthcare systems. Thailand and Indonesia’s regulatory framework and systems have expanded alongside demand for therapeutic exports. Japan, India, and China’s investment in outsourced medical communications, as well as real-world and post-market evidence, has been key in supporting expansion of exportable healthcare. Public-private partnerships in China and South Korea have increased local contracting expertise, using contract outsourced services. This has generated demand and more supply for outsourcing services. The region is becoming more patient-centered in its healthcare provisions and is decentralizing its system, reinforcing growth of market and demand for outsourcing services.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.20% |

| Europe | 20.50% |

| Asia-Pacific | 31.40% |

| LAMEA | 9.90% |

The improving healthcare systems, growing investments in the pharmaceutical sector, and advances in clinical research being carried out in LAMEA are cause for the region's growth. While Brazil, South Africa, and the UAE were outsourcing medical affairs regulatory support, clinical trial management, and pharmacovigilance services in the 1st quarter of 2025, domestic partnerships were developed to limit foreign dependency for expertise. This, in turn, improved the provision of services within the region. The integration of the outsourced healthcare provider teams in the Saudi Health Initiative on 2025, May improved the regulatory compliance and patient safety measures put in place. The growing understanding of evidence-based approaches to managing chronic illnesses increased the demand.

Medical Information Services: These services are services that deliver precise, timely, and evidence-based medical information to patients and health care practitioners. As of June 2025, the pharmaceutical firms in North America and Europe have stepped up their involvement with the outsourced medical information teams to address the inquiries, adverse event reporting, and scientific communications. Such companies as Parexel and Syneos Health added to their services the artificial intelligence-based medical query management services, which improved the response time and guaranteed compliance with regulation.

Medical Communications: It involves development of scientific material, publications and education to healthcare providers. In May 2025, biopharmaceutical companies in both U.S and Japan adopted outsourced medical communications to create disease awareness campaign and clinical study summaries. Medpace and ICON introduced combined digital content delivery and medical education webinar platforms, which boosted reach into the market and standardized communication across geographical areas

Support Regulatory and Compliance: Outsourced services are of assistance to companies to navigate hard to understand world regulations, submissions, and compliance requirements. In March 2025, the pharmaceutical groups in Europe and Asia-Pacific engaged CROs to approve new therapeutics across multiple accelerated regulatory approvals, especially in oncology and rare diseases. The strategic partnerships also made automated document management and submission tracking tool to be developed to improve the efficiency and time-to-market.

Clinical Trial Support: These services consist of clinical protocol development, site management and monitoring. As of April 2025, in North America and Latin America, multinational trials of biologics and gene therapies were more and more supported by outsourcing partners. Syneos Health and ICON went a step further to have AI-assisted risk-based monitoring tools to enhance quality data and efficiency of trials.

Pharmacovigilance and Safety Services: International teams are in charge of adverse event reporting, risk assessment and safety surveillance. In Europe and the U.S., by May 2025, firms will use external providers to engage in real-time drug safety monitoring of post-market products and especially in the case of high-risk therapies. Parexel and Covance have implemented AI-based signal detection systems to improve the quality and expediency of safety reports.

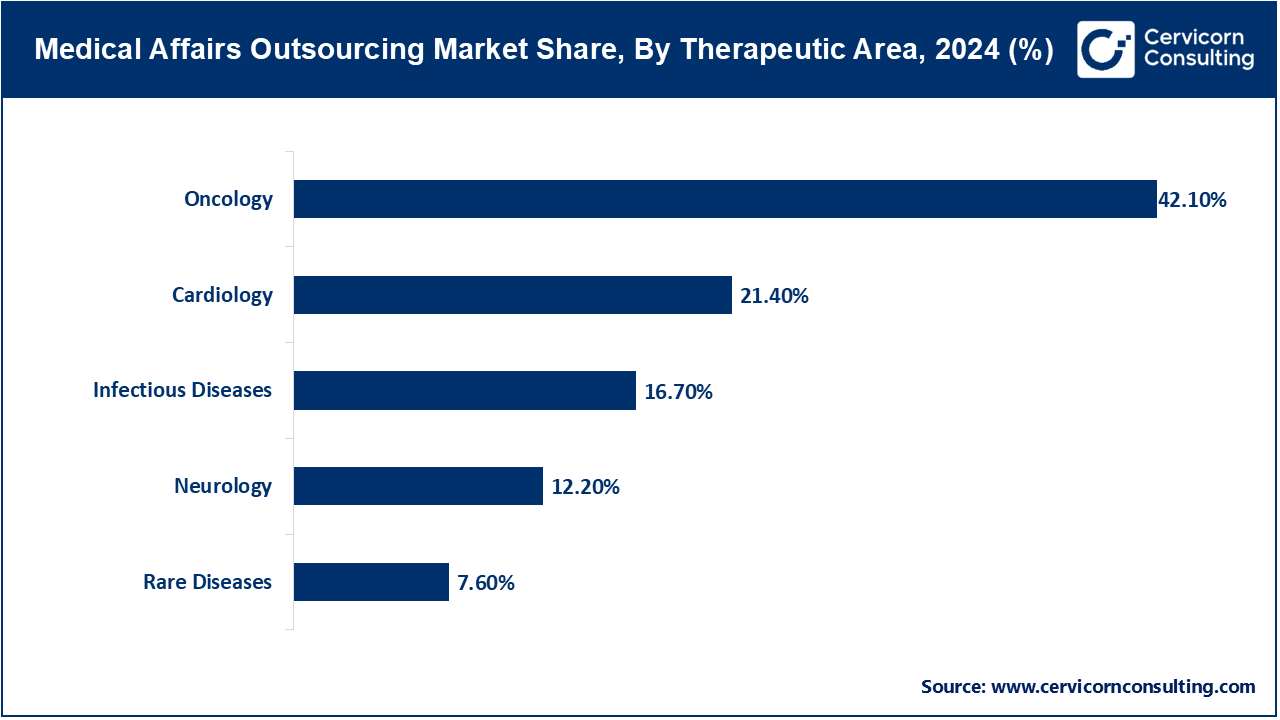

Oncology: Outsourced services assist with management of clinical trials, generation of evidence and medical communications in cancer treatments. By June 2025, North American and European companies relied on outsourcing to make clinical data reporting and regulatory submissions on immunotherapies and targeted therapies faster.

Cardiology: Medical affairs outsourcing involves patient education, data reporting and clinical studies management in cardiovascular drugs and devices. As of April 2025, companies in Asia-Pacific embraced outsourced cardiac trial monitoring and remote data management systems to enhance patient recruitment and compliance.

Neurology: Outsourced neurology support involves the oversight of clinical trials, medical writing and post-market surveillance of therapies used to treat the neurological disorders. By May 2025, the biotech firms in Europe and North America took advantage of the outsourced staff to handle large-scale multiple sclerosis and parkinson disease research effectively.

Infectious Diseases: Services involve evidence preparation and regulatory filings and medical communications of vaccines and anti-infective drugs. In March 2025, the COVID-19 and influenza-related clinical trials in the U.S and Latin America were supported by the outsourcing partners that incorporated AI tools to provide quick data analysis and reporting.

Rare Diseases: Specialized outsourcing provides management of small number of patients, regulations, and international networks of clinical trials. By June 2025, firms in North America and Europe will collaborate with CROs to speed up orphan drug studies and simplify the sharing of medical information.

Pharmaceutical Companies: These companies outsource their medical affairs functions for operational efficiency and regulatory compliance, and for evidence generation. In North America and Europe, larger pharma companies began their partnerships with ICON and Parexel for medical communications, pharmacovigilance, and clinical trial support in May 2025.

Biotech Companies: For niche therapeutic areas, particularly in gene therapies and biologics, biotech companies depend on outsourced expertise. In June 2025, U.S. and European biotech companies started using medical affairs outsourcing for the management of complex, regulatory-driven, closed-loop clinical studies.

Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Pharmaceutical Companies | 39.60% |

| Biotech Companies | 27.20% |

| Contract Research Organizations (CROs) | 21.80% |

| Hospitals & Healthcare Providers | 11.40% |

Contract Research Organizations (CROs): Across medical writing, trial management, and safety reporting, CROs distribute specialized support to pharma and biotech companies. By April 2025, ICON, Covance and Syneos Health enhanced their outsourcing options by integrated, AI-driven technology for real-time monitoring of clinical trials and automated safety signal detection.

Hospitals & Healthcare Providers: For clinical research, continuing medical education, and post-market studies, hospitals outsource medical affairs support. In May 2025, U.S. and Japan hospitals coordinated with external medical affairs teams for operational streamlining of clinical trial management, regulatory reporting, and instructional program development for staff training.

Market Segmentation

By Service Type

By Therapeutic Area

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Medical Affairs Outsourcing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Type Overview

2.2.2 By Therapeutic Area Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing R&D Investments and Complicated Therapeutics

4.1.1.2 Decentralized and Patient-Centric Healthcare

4.1.2 Market Restraints

4.1.2.1 Prohibitive Outsourcing Services

4.1.2.2 Regulatory Complexity

4.1.3 Market Challenges

4.1.3.1 Combination with In-House Teams

4.1.3.2 Data Security and Confidentiality

4.1.4 Market Opportunities

4.1.4.1 Developed Technology and Analytics Integration

4.1.4.2 Growth in the Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Medical Affairs Outsourcing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Medical Affairs Outsourcing Market, By Service Type

6.1 Global Medical Affairs Outsourcing Market Snapshot, By Service Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Medical Information Services

6.1.1.2 Medical Communications

6.1.1.3 Regulatory & Compliance Support

6.1.1.4 Clinical Trial Support

6.1.1.5 Pharmacovigilance & Safety Services

Chapter 7. Medical Affairs Outsourcing Market, By Therapeutic Area

7.1 Global Medical Affairs Outsourcing Market Snapshot, By Therapeutic Area

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Oncology

7.1.1.2 Cardiology

7.1.1.3 Neurology

7.1.1.4 Infectious Diseases

7.1.1.5 Rare Diseases

Chapter 8. Medical Affairs Outsourcing Market, By End-User

8.1 Global Medical Affairs Outsourcing Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical Companies

8.1.1.2 Biotech Companies

8.1.1.3 Contract Research Organizations (CROs)

8.1.1.4 Hospitals & Healthcare Providers

Chapter 9. Medical Affairs Outsourcing Market, By Region

9.1 Overview

9.2 Medical Affairs Outsourcing Market Revenue Share, By Region 2024 (%)

9.3 Global Medical Affairs Outsourcing Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Medical Affairs Outsourcing Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Medical Affairs Outsourcing Market, By Country

9.5.4 UK

9.5.4.1 UK Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Medical Affairs Outsourcing Market, By Country

9.6.4 China

9.6.4.1 China Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Medical Affairs Outsourcing Market, By Country

9.7.4 GCC

9.7.4.1 GCC Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Medical Affairs Outsourcing Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Parexel

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 ICON plc

11.3 Syneos Health

11.4 Covance (Labcorp Drug Development)

11.5 Medpace

11.6 IQVIA

11.7 PAREXEL International

11.8 PharmaLex

11.9 Accenture Life Sciences

11.10 KCR