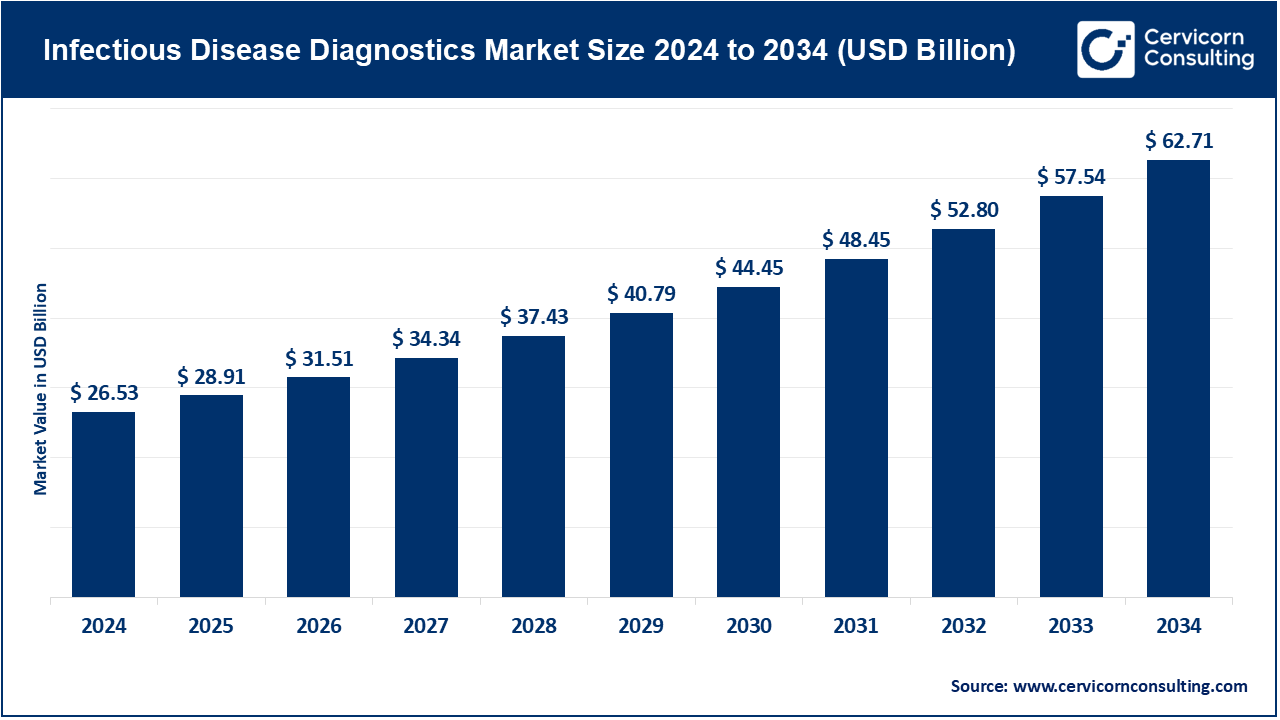

The global infectious disease diagnostics market size was estimated at USD 26.53 billion in 2024 and is expected to be worth around USD 62.71 billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.98% over the forecast period from 2025 to 2034. In hospitals, diagnostic centers, and homecare settings, the need for quick and efficient evaluation of infections and the control of infections enhances the need for effective and timely diagnostics for infectious diseases. The growing awareness of hospital-acquired infections, coupled with the increasing incidence of chronic and infectious diseases, facilitates the use of single use sterile diagnostic instruments that aid in the prevention cross contamination and cross infection. The rise of homecare services and the use disposable gloves, masks, syringes, and point of care diagnostic kits, motivates the use of diagnostic instruments. The need for sustainable and eco-friendly diagnostic depends on the use of disposable instruments for diagnostic procedures or infection control and care.

The shifting of technological strategies is fostering the changed paradigm of the different markets. The use of AI, automation, and IoT in manufacturing processes has positively impacted the quality of products, efficiency, safety of the patients, and operations within a healthcare facility. The lack of responsibility, authoritarian laws regarding markets with increased investment in the healthcare sector is positively impacting markets on the rise. The pivot of the healthcare industry to more decentralized and value directed systems, the demands will only grow in the coming years regarding the affordability and the integration of new technology to diagnostics.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 28.91 Billion |

| Estimated Market Size in 2034 | USD 62.71 Billion |

| Projected CAGR 2025 to 2034 | 8.98% |

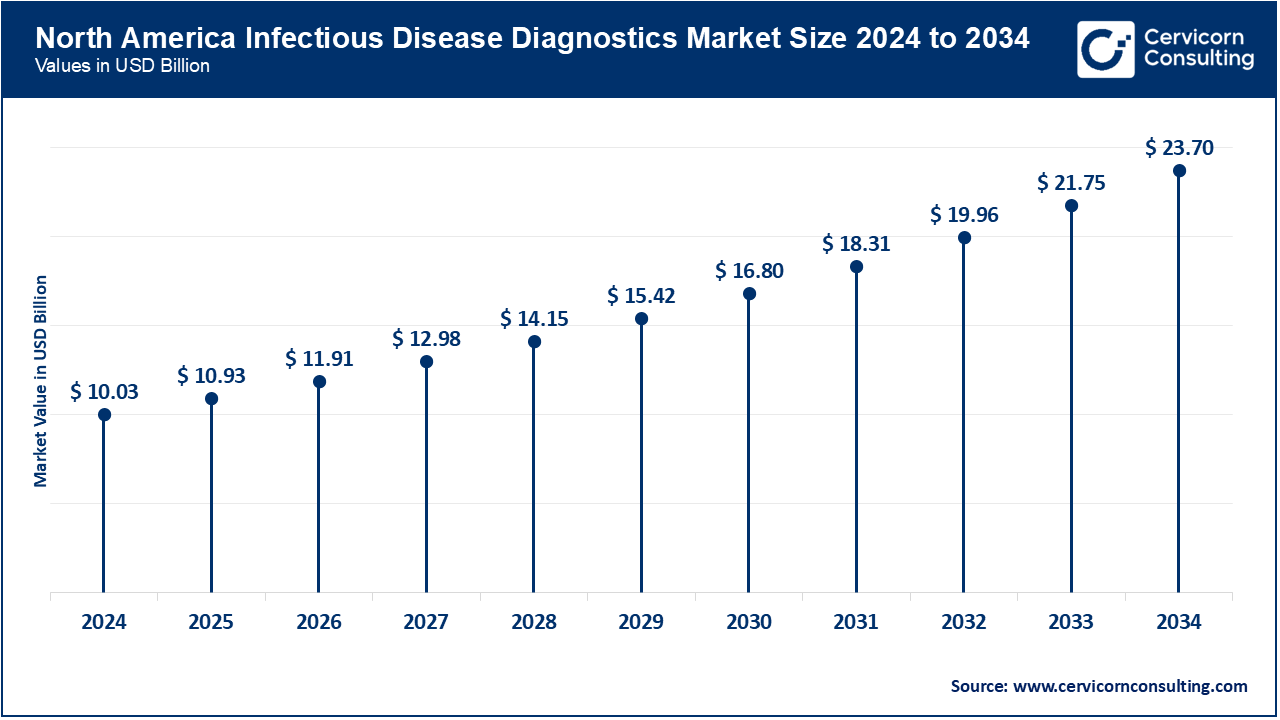

| Dominant Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Product Type, End User, Technology, Material Type, Region |

| Key Companies | 3M, Becton Dickinson (BD), Medline Industries, Smith & Nephe, Thermo Fisher Scientific, Qiagen, Paul Hartmann AG, Nipro Corporation, Terumo Corporation |

The infectious disease diagnostics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Heres an in-depth look at each region.

The North America takes the greatest portion because of the well-developed healthcare system and the high priority on infection prevention. More than 70% of U.S. hospitals and ambulatory surgical centers (ASCs) had confirmed by March 2025 an expansion of their usage of environmentally friendly single-use items (gloves, gowns, and syringes, among others). In February 2025, the use of disposable products was further encouraged through the CDC Infection Control Funding Program that was launched in hospitals and outpatient facilities. Leaders in the market such as 3M, Becton Dickinson (BD) and Cardinal Health were producing recyclable and biodegradable disposables to achieve internal sustainability goals. Demand has been also triggered by the expansion of outpatient and home care medical services. The focus of the region on healthcare innovation and the fast adoption of the latest technologies makes North America the leader in the adoption of products and industry.

Europe is the second largest market that is backed by stringent hygiene laws and sustainability programs. In April 2025, nonwoven disposables such as Germany, France, and the U.K., had shifted to biodegradable items in healthcare facilities in accordance with Green Healthcare Directive of the EU. The higher expenditures during March 2025 on the waste management and infection prevention in hospitals only further enhanced the use of single-use diagnostics. The companies like Paul Hartmann AG, Mollnlyke Health Care and Smith and Nephew have intensified their relationships with the national health care systems in order to have reliable delivery of sterile products. Economic growth is facilitated by the interest of the European Commission in the processes of the circular economy and the environmentally more efficient production, and the stability in the market growth is ensured by the regulatory power of the region and its interest to ensuring healthcare eco-friendliness.

The Asia-Pacific is experiencing high growth rate because of government incentives, the increasing healthcare infrastructure and the increased awareness of infection control by the people. By May 2025, 40 percent of the world will require disposable masks and gloves, and this compartment was comprised of India, China, and Japan. On June 2025, China and South Korea had public-private partnerships to enhance domestic manufacturing of infection prevention products and home health. Increasing hygienic awareness and increasing prevalence of chronic diseases in other countries such as Thailand and Vietnam also helped the demand. Existing companies such as Nipro, Medline, and Terumo developed regional manufacturing to build the supply chain in both the local and international market. The momentum of market leadership of the region is still supported by modernization of healthcare systems and well-developed production base.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 37.80% |

| Europe | 27.70% |

| Asia-Pacific | 25.40% |

| LAMEA | 9.10% |

The LAMEA region is growing well because of the maturing hospital infrastructure and rising investments in the area related to the population health. Other nations including Brazil, UAE, South Africa started using sterile disposable kits in surgical and diagnostic use by April 2025. The aim to decrease the level of import reliance promoted the domestic production and sterilization. In May 2025, the Saudi Health Initiative helped in the automation of preventing infection and waste management in healthcare facilities. With increasing hygienic awareness, chronic disease treatment is becoming more important, and healthcare changes are taking place, LAMEA will be among the areas of growth in infectious disease diagnostics after 2026.

Wound Management Products: These are bandages, gauzes, and dressings needed for surgical aftercare and managing chronic wounds. By April 2025, hospitals and clinics in North America and Europe were increasing their orders for advanced wound dressings with antimicrobial properties, aimed at preventing infections and aiding in quicker recovery. Smith & Nephew and 3M launched hydrocolloid and foam dressings to elevate patient comfort and minimize the frequency of dressing changes.

Drug Delivery Disposables: Syringes, IV sets, and catheters are integral to the precise delivery of medications and fluids. By February 2025, healthcare professionals in the U.S. and India noted the greater use of prefilled syringes and safety IV catheters to cut down the risk of contamination and needle-stick injuries. In May 2025, Becton Dickinson (BD) launched disposable, eco-friendly catheters, encouraging hospitals to adopt greener practices.

Market Share, By Product Type, 2024 (%)

| Product Type | Revenue Share, 2024 (%) |

| Disposable Gloves | 36.50% |

| Masks & Respirators | 14.60% |

| Syringes & Needles | 10.80% |

| Gowns & Drapes | 8.20% |

| Point-of-Care Diagnostic Kits | 19.70% |

| Catheters | 6.40% |

| Wound Dressings | 3.80% |

Diagnostic & Laboratory Disposables: For molecular testing, diagnostic specimen containers, collection kits, and pipette tips are necessary. In June 2025, diagnostic centers in Europe and the Asia-Pacific region experienced high demand for rapid test cartridges and disposable pipette filters to facilitate testing for infectious diseases. Thermo Fisher Scientific and Qiagen expanded their range of disposable kits to boost automation efficiency in labs.

Dialysis and Infusion Disposables: Used in renal and critical care, this includes dialysis filters, tubing sets, and infusion bags. In March 2025, Fresenius Medical Care announced next generation single-use dialyzers that enhanced filtration and lowered the infection risks. With rising chronic kidney disease in Southeast Asia and Latin America, regional implementation of these products occurred.

Incontinence and Sterilization Products: In aged care, the infection control effectiveness of disposable adult diapers, underpads, and sterilization wraps cannot be overstated. Demand for eco-friendly hygiene products, especially framed within the Kyoto Protocol, has particularly increased in Japan and Europe. By May 2025, this has prompted Kimberly-Clarks focus on developing more biodegradable solutions aimed at comfort, hygiene, and ecological sensitivity.

Plastic Resins: Polypropylene, polyethylene, and PVC are rapidly employable disposable medical items and these are the three most used resins in the disposable medical items as they are durable, resistant to chemicals and are cost-effective. By January 2025, most recyclables and medical disposable resins are used as disposable medical items and initiatives in recyclable disposable medical items. Bio-based polypropylene is used in Europe Plants and these reduce environmental impact. Becton Dickinson and 3M are the most use disposable resins in syringes, catheters, and diagnostic consumables.

Nonwoven Materials: Infection control and barrier protection is provided by masks, gowns, drapes and operating room covers. These are Nonwoven fabrics. These Masks are made of high filtration non woven materials which was adapted in North America and Asia Pacifc regions by March 2025. DuPont and Ahlstrom-Munksjo were the companies which made innovative non woven surgical barrier in composites.

Paper & Paperboard: Paper materials are used for packaging, sterilization wraps and for enclosed test kits. In April 2025, Germany and South Korea were the eco friendly manufacturers which expanded biodegradable medical packaged to minimize waste. For hospital eco sustainability to minimize waste, sterilize and protect diagnostic consumables packaged in approved waste was the trend.

Glass and rubber materials: Glass and rubber materials used for syringes, vials, and for the rubber part of the stopper systems are due to their thermal resistance as well as chemical stability. They are also compatible with vaccines and drugs that are injectable. These materials were in high demand all over the world as the increased use of advanced prefilled syringes and diagnostic kits were adopted in hospitals and laboratories. These suppliers place an emphasis on the quality of these materials being safe and efficacious. This demand started in May of 2025 and was fueled during the vaccine and therapeutic procedures.

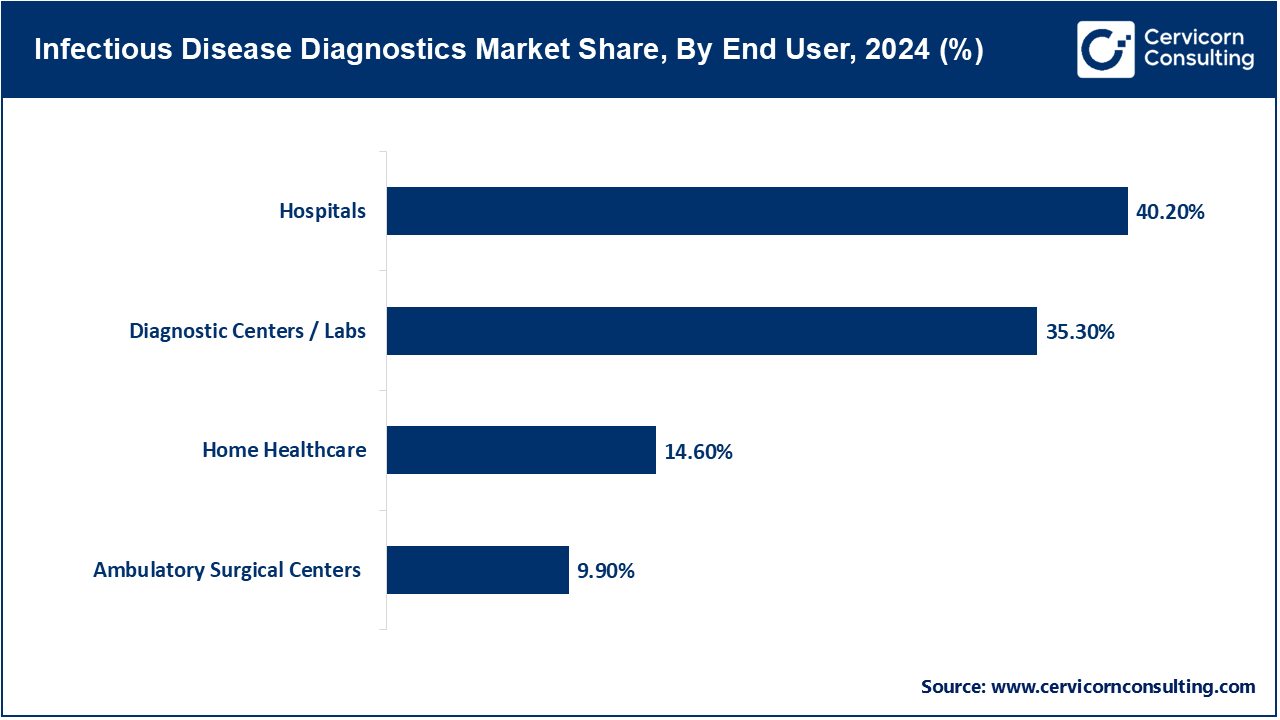

Hospitals and Clinics: Hospitals have been major consumers of diagnostic consumables specially designed for the protection of healthcare workers and patients from infections. By June 2025, large chains of hospitals in U.S. and Europe, purchased in large quantities, single-use surgical kits, disposable catheters and PPE. This reduced cross-contamination and improved hospital operational efficiency. Hospital automation diagnostic kits are also commercially available to help hospitals cope with high patient volumes and rapidly available results.

Home Healthcare: The demand for home healthcare products continues to grow due to the increasing aged population and chronic diseases. By April 2025, Medline and Cardinal Health, homecare kits (&IV lines, wound care consumables and diagnostic test kits) became available. These kits enabled patient monitoring of diabetes and chronic infections at home, decreasing the need for hospital visits, confirming support of Ñentralized healthcare.

Ambulatory Surgical Centers (ASCs): ASCs are readily utilizing, single-use instruments, sterile drapes and gowns for minor surgical surgeries. By May 2025, the ASCs in the U.S. and Japan adopted disposable-laparoscopic instruments and disposable-surgical kits. This strategy was aimed at cost reduction of sterilization, operational efficiency and hygiene. This practice encourages quick surgical procedure turnarounds and reduces risk of infection.

Diagnostic Centers & Laboratories: For high-volume testing, including molecular and rapid diagnostic tests, diagnostic labs use disposable sample tubes, test kits, and pipette tips. By July 2025, AI-integrated disposable kits were adopted by laboratories in North America and Europe, enhancing accuracy, automating workflows, reducing contamination, and minimizing the need for manual lab work. To meet the growing need for testing for infectious diseases, Thermo Fisher Scientific and Qiagen have broadened their product offerings.

Managing Cardiovascular Conditions: ECG electrodes, disposable catheters, and pressure monitoring kits are essential components in cardiovascular care. Advanced single-use hemodynamic monitoring systems that assess the hemodynamic parameters improve real-time monitoring of the cardiac systems and are integrated within North American hospitals cardiovascular care infrastructure focusing on patient safety and efficiency within the procedural frameworks.

Managing Diabetes and Chronic Diseases: Hybrid reusable and disposable systems for in-home monitoring for integrated care of diabetes using continuous glucose monitoring systems, insulin delivery systems, and lancets are integral. Healthcare systems for the Asia-Pacific are expanding diabetic care systems under the hybrid reusable and disposable models focusing on improved disease management and lower reliance on the hospital in the continuum of care by April 2025.

Controlling Infectious Diseases: PPE, masks, gloves, and test kits are integral components in the continuum of infection control. The rise in monitoring for influenza and COVID-19 in Europe increased demand for high-barrier disposable protective equipment by May 2025. Advanced cross infection control measures including the use of disposable sampling systems, rapid diagnostics and integrated protective equipment were introduced in hospitals and clinics for high risk areas.

Surgical and Postoperative Care: Pre-packed single-use surgical kits, disposable scalpels and wound dressings are crucial in maintaining sterile procedures and infection control. By June 2025, the use of disposable antimicrobial wound care products became integrated systems for enhancing post-operative recovery along with disposable kits within Latin American and Indian hospitals.

Market Segmentation

By Product Type

By Material Type

By Technology

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Infectious Disease Diagnostics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Material Type Overview

2.2.3 By Technology Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Health Initiatives and Safety Standards

4.1.1.2 Hospitalization and Surgical Volume Increases

4.1.2 Market Restraints

4.1.2.1 Environmental Issues and Waste Disposal

4.1.2.2 High Production and Procurement Costs

4.1.3 Market Challenges

4.1.3.1 Supply Chain Vulnerabilities

4.1.3.2 Regulatory Compliance and Standardization

4.1.4 Market Opportunities

4.1.4.1 Eco-Friendly and Intelligent Disposable Products

4.1.4.2 Home Care Healthcare

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Infectious Disease Diagnostics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Infectious Disease Diagnostics Market, By Technology

6.1 Global Infectious Disease Diagnostics Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 RFID-Enabled / Smart Devices

6.1.1.2 IoT-Connected Devices

6.1.1.3 Automated / AI-Integrated Diagnostics

Chapter 7. Infectious Disease Diagnostics Market, By Product Type

7.1 Global Infectious Disease Diagnostics Market Snapshot, By Product Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Disposable Gloves

7.1.1.2 Masks & Respirators

7.1.1.3 Syringes & Needles

7.1.1.4 Gowns & Drapes

7.1.1.5 Point-of-Care Diagnostic Kits

7.1.1.6 Catheters

7.1.1.7 Wound Dressings

Chapter 8. Infectious Disease Diagnostics Market, By Material Type

8.1 Global Infectious Disease Diagnostics Market Snapshot, By Material Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Plastic-Based Disposables

8.1.1.2 Biodegradable / Eco-Friendly Materials

8.1.1.3 Intelligent / Smart Materials

Chapter 9. Infectious Disease Diagnostics Market, By End-User

9.1 Global Infectious Disease Diagnostics Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Hospitals and Clinics

9.1.1.2 Diagnostic Centers/Labs

9.1.1.3 Home Healthcare

9.1.1.4 Ambulatory Surgical Centers

Chapter 10. Infectious Disease Diagnostics Market, By Region

10.1 Overview

10.2 Infectious Disease Diagnostics Market Revenue Share, By Region 2024 (%)

10.3 Global Infectious Disease Diagnostics Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Infectious Disease Diagnostics Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Infectious Disease Diagnostics Market, By Country

10.5.4 UK

10.5.4.1 UK Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Infectious Disease Diagnostics Market, By Country

10.6.4 China

10.6.4.1 China Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Infectious Disease Diagnostics Market, By Country

10.7.4 GCC

10.7.4.1 GCC Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Infectious Disease Diagnostics Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 3M

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Becton Dickinson

12.3 Medline Industries

12.4 Smith & Nephe

12.5 Thermo Fisher Scientific

12.6 Qiagen

12.7 Paul Hartmann AG

12.8 Mölnlycke Health Care

12.9 Nipro Corporation

12.10 Terumo Corporation