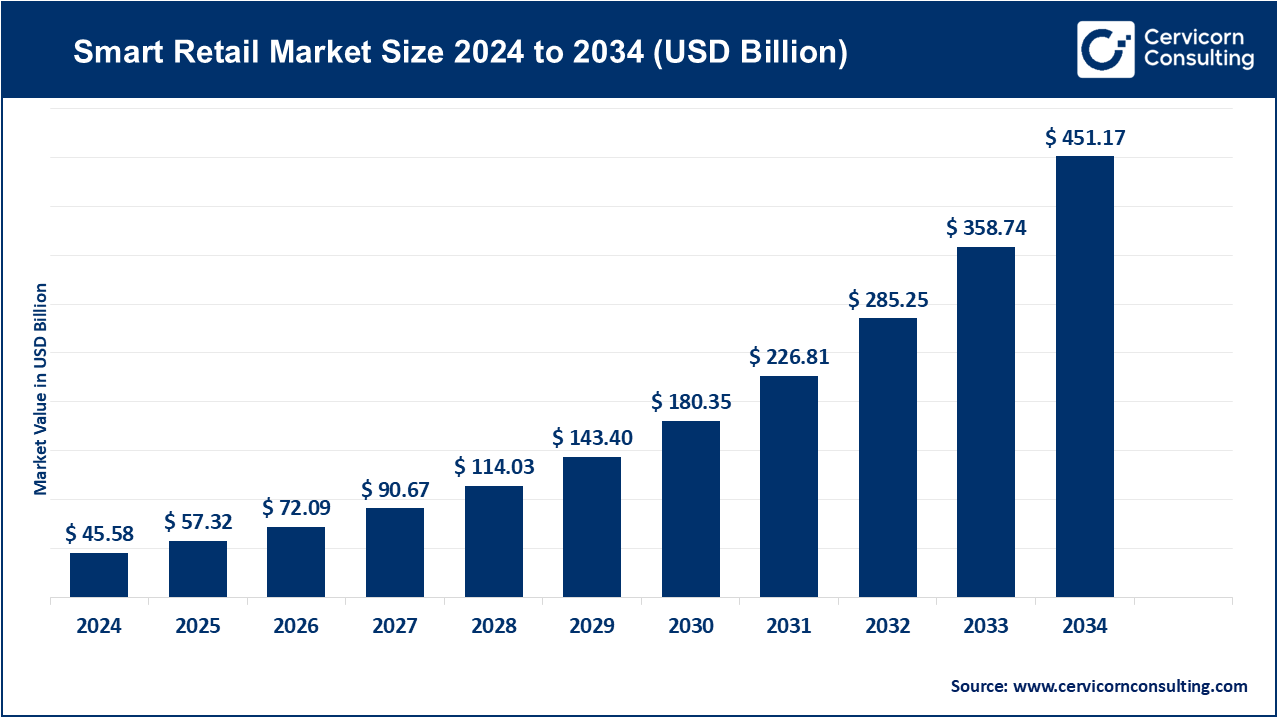

The global smart retail market size was accounted for USD 45.58 billion in 2024 and is anticipated to hit around USD 451.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 30.4% over the forecast period from 2025 to 2034. The smart retail market is driven by rising consumer behavior of wanting to shop in an easy and personalized experience as well as the rising use of digital technology in retail outlets. Intelligent retail solutions help to increase operational efficiency, decrease human mistakes, and boost customer satisfaction through real-time inventory management, automated checkout, and offering personalized recommendations. The combination of technologies like IoT, AI, RFID, and data analytics has seen smart retail systems become more resilient and effective, leading to their increased use in supermarkets, convenience stores, and specialty retail stores.

Additionally, the market advantages innovations in mobile payment system, self-checkout kiosk, and smart shelf as they facilitate faster and more convenient shopping experience. The trend toward omnichannel retailing and the increased interest in customer engagement helps to embrace these solutions. More retailers are now using AI-based analytics and predictive algorithms to optimize stock, personalise offers, and generally improve customer experience. These technological innovations, coupled with growth in investments in retail digitization and working towards making shopping more convenient, should propel the smart retail market in the coming few years.

The smart retail market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

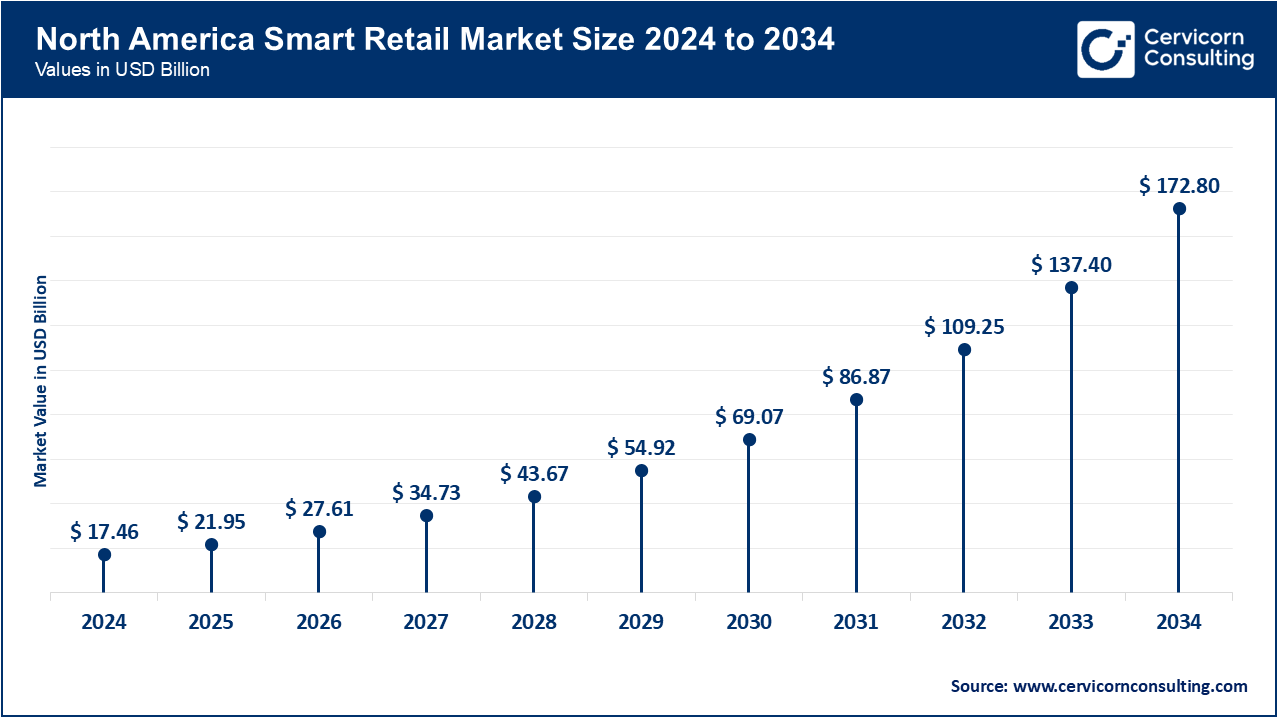

Due to its exceptional retail infrastructure, quick adoption of mobile and digital technologies by consumers, and increasing demand for individualized retail experiences, North America possesses the largest market in the world. The United States and Canadian stores adopting infusing AI, Smart Retail, mobile, AR, VR technologies to enhance consumer engagement, sales conversion, and streamline operational processes will flourish by 2025. The establishment of ecommerce and omnichannel retail, the comprehensive omnichannel retail strategies, the legal frameworks and smart technology investments are the pillars of the regional market.

The second largest share of the market is in Europe, and is based on The Europe’s high retail standards in place. By the April 2025 timeframe forecast, retailers in Germany, France and The UK will deploy AI-integrated autonomous oversight, digital interactive resource sign, and smart pay tech to unlock the automated individualized shopping experiences and streamline efficient stock oversight and resource balance. The compliance to The EU market’s regulations on the developments of digital transparent interface and the sustainable green tech principles for integration in smart retail systems are the key pillars for the development of the Europe market innovation.

The Asia-Pacific is witnessing strong growth over the forecast period. This is due to the increasing integration of digital technologies, the growth of disposable incomes, urbanization, and the expansion of new retail formats. By June 2025, retailers in Japan, India, China, and South Korea started offering advanced customer service technologies and operational efficiency boosters, such as mobile payments, AR and VR-embedded shopping, and IoT-connected inventory management. The partnerships of regional players with Western tech companies and the pro-digital retailing government policies are rapid transforming the region's smart retail practices.

Smart Retail Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.30% |

| Europe | 27.10% |

| Asia-Pacific | 30.50% |

| LAMEA | 4.10% |

LAMAE is still an emerging region. Retailing digital technologies and smart retail technologies are still in the infancy of growth, for which the region of LAMAE (World Bank, 2023) is in the world. Smart retail systems that are mobile-integrated and AI-enabled started to be used in the region as early as 2025. This is for the personalization of product offering, optimized operational efficiency, and enhanced payment convenience. With the increased consumer awareness of interactive, digital-embedded retailing and focused government digital infrastructure policies, LAMAE is projected to experience gradual market growth for the smart retail technologies through 2026 and further.

Digital Signage Solutions: Interactive kiosks, digital displays, and video walls are all incorporating new technologies and being employed for in-store promotions, wayfinding, and live updates on products. Retailers in North America and Europe have incorporated AI-Integrated Cloud Analytics Digital Signage as of March 2025. These systems enabled stores to personalize promotions in accordance with consumer behavior and determine interest to make adjustments in real time. It also lessened the manual effort of updating changing promotional content while finishing work in the shopper's experience.

Smart Labels: With real-time pricing control, product authentication, inventory control, and RFID tags, electronic shelf labels (ESLs) perform all of these functions. ESL technology was embraced within the supermarkets and electronics retailers in Europe and the Asia-Pacific region by April 2025. Retailers benefited from automated price adjustments and minimized human-error in price adjustments, allowing customers to access detailed product info and tailored offers through mobile apps. Retailers also experienced less out-of-stock situations due to automated inventory alerts.

Smart Retail Market Share, By System, 2024 (%)

| System | Revenue Share, 2024 (%) |

| Digital Signage Solutions | 38.10% |

| Smart Labels | 21.70% |

| Smart Payment Systems | 17.30% |

| Intelligent Vending Machines | 13.10% |

| AR/VR Solutions | 9.80% |

Smart Payment Systems: Mobile payment options, POS systems, and contactless transactions plays a big role in facilitating customer convenience and operational efficiency. AI-powered POS systems, capable of analyzing purchase lanes and predicting demand, integrated loyalty programs, and offered advanced and secure transactions, had been adopted in retailers across the U.S., Japan, and Western Europe by May 2025. These systems significantly reduced customer queue wait time and enhanced transaction efficiency.

Intelligent Vending Machines: Real time inventory tracking, personalized recommendations, and cashless transaction capabilities of IoT enabled vending machines is a recent trend in airports, offices, and hospitals. Vending machines across North America and Europe implemented AI driven recommendation systems and allowed app based payment systems by June 2025, transforming customer interaction and vending machine sales through predictive analytics based on prior purchasing behaviors.

AR/VR Solutions: Augmented and virtual reality tools in different industries provide customers advanced capabilities to visualize, simulate and interact with different items. By July 2025, enhanced customer experience through reduced returns and increased purchase confidence had been recorded as a result of the implementation of AR/VR tools for virtual try-ons and interactive product demos in fashion and electronics retail stores in Europe and the U.S.

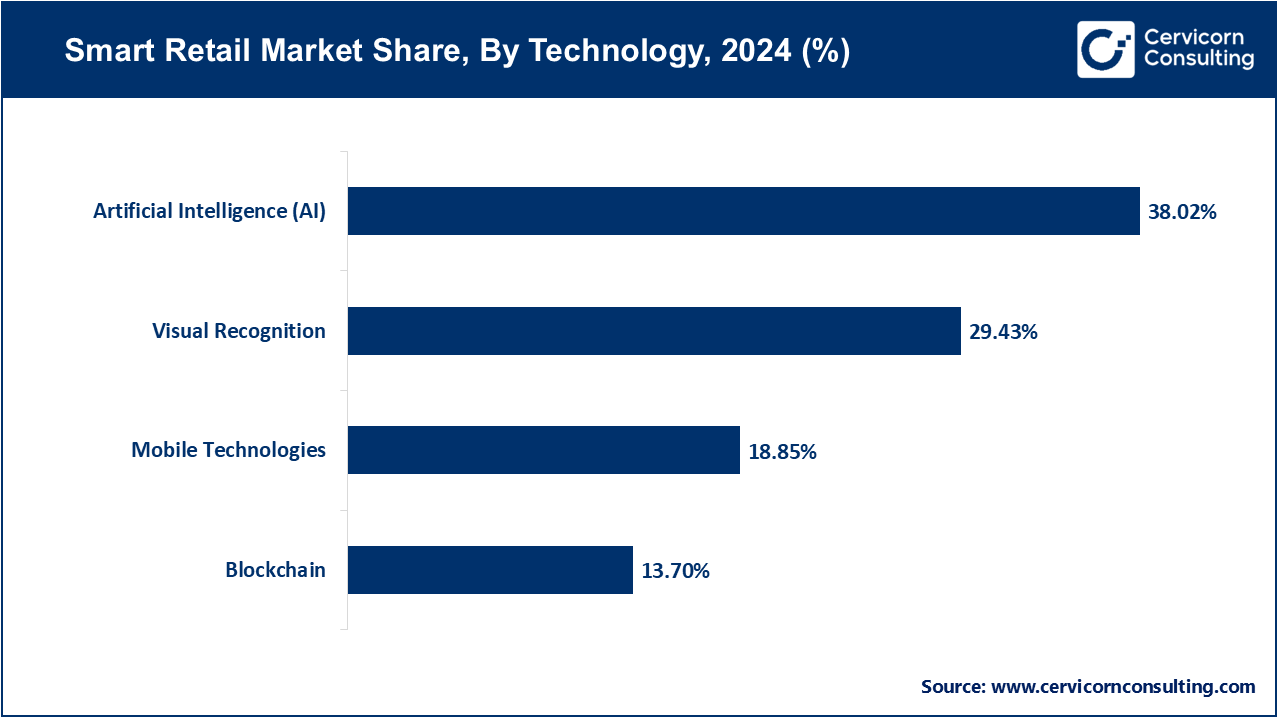

Visual Recognition: Personalized promotions, shopper tracking, security monitoring, and AI-powered customer traffic analysis advanced individualized marketing techniques to transform shopper experience. Retailers in Europe began implementing AI-powered customer traffic monitoring to optimize product placement and carpet-bomb shopper personalized marketing messages in real time in April 2025.

Blockchain: Retailers in the Asia-Pacific and Europe regions piloted blockchain-enabled transparency in supply chains, tracking product origins, and counterfeiting mitigation in luxury goods and electronics by May 2025. This improvement strengthened trust in the branded and premium products offered to the consumers in the region, thus encouraging repeat purchases.

Artificial Intelligence (AI): Retail chains in the U.S. and Europe widely adopted AI to automate real-time analysis of shopper behavior, in-store promotions, trends, and predictive ordering, thus aligning and updating inventory on hand to unprecedented levels of accuracy by June 2025.

Mobile Technologies: Mobile technologies such as apps, digital wallets, mobile point-of-sale (POS) systems, and seamless checkout systems enhances customer engagement, loyalty program integration, and offered frictionless checkout experiences. Retailers in North America and the Asia-Pacific region helped adopted mobile payments to exceed 45%, improving customer convenience and reducing queueing time, thus improving sales and overall customer experience.

Foot-Traffic Monitoring: Customer movement and store engagement are tracked by IoT sensors, heat mapping, and video analytics. By March 2025, European retailers primarily utilized store layout optimization, congestion management, and high demand area identification for product placement and promotion to add value to their traffic monitoring systems.

Inventory Management: Automated stock tracking, real time alerts, and predictive replenishment are designed to eliminate waste and minimize out-of-stock scenarios. North American supermarkets increased AI driven inventory management in their supply chains responsiveness and loss cutting margins within their systems waste by April 2025.

Loyalty & Payment Management: Customer retention, customer satisfaction and marketing personalization increased with the integration of loyalty programs with POS systems. By May 2025, retailers from the U.S. and Europe implemented cloud based loyalty programs intertwined with payment systems to provide customers with digital rewards, personalized coupons and frictionless checkout.

Smart Retail Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Foot-Traffic Monitoring | 22.10% |

| Inventory Management | 37.50% |

| Loyalty & Payment Management | 19.70% |

| Predictive Equipment Maintenance | 13.30% |

| Brand Protection | 7.40% |

Predictive Equipment Maintenance: Hardware performance is assessed by IoT devices which lowers downtime. By June 2025, Predictive maintenance for self check out kiosks, vending machines and digital signage in European and Asian retail was the new standard to provide uninterrupted service and limit system down time.

Brand Protection: Protecting value and ensuring quality through counterfeit detection, product authentication, and blockchain tracking. Smart labeling and innovative blockchain solutions to guarantee authenticity and fraud protection were standard for the North American and European luxury and electronics retailers by July 2025.

Hardware: Smart shelves, self-checkout kiosks, RFID readers, and digital signage devices. These all are essential pieces of equipment in retail. Leading retailers in Europe and North America increased operational efficiencies and lowered error rates in stores while improving customer engagements after installing these solutions. Improvements in customer engagements were realized before the end of March 2025.

Software: Retail management, customer relationship management (CRM) systems, and artificial intelligence (AI) analytical applications software are designed to optimize the functions, operations, and workflows of organizations, and gain insight about customers. Fully integrated cloud-based software systems with mobile applications for real-time sales, inventory, and customer behavior tracking were available by April 2025.

Analytics Platforms: Retailers of North America and Europe linked with analytics platforms to gain insight about customer behavior, inventory, and sales under the cloud environment. This increased adoption by 30% by May 2025 and enabled the deployment of personalized marketing and analytics-driven decision-making.

Robotics and Automation: Self-checkout kiosks and digital signage devices. These all are essential pieces of equipment in retail. Leading retailers in Europe and North America increased operational efficiencies and lowered error rates in stores while improving customer engagements after installing these solutions. Improvements in customer engagements were realized before the end of March 2025.

Market Segmentation

By Solution

By System

By Technology

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Smart Retail

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Solution Overview

2.2.2 By System Overview

2.2.3 By Application Overview

2.2.4 By Technology Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Consumer Interest in Experiences

4.1.1.2 AI and Automation Technology

4.1.2 Market Restraints

4.1.2.1 High Implementation Costs

4.1.2.2 Privacy and Security Issues

4.1.3 Market Challenges

4.1.3.1 Rapid Technological Advancements

4.1.3.2 Supply Chain Disruptions

4.1.4 Market Opportunities

4.1.4.1 Breakneck Technology Change

4.1.4.2 Supply Chain Disruptions

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Smart Retail Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Smart Retail Market, By Technology

6.1 Global Smart Retail Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Visual Recognition

6.1.1.2 Blockchain

6.1.1.3 Artificial Intelligence (AI)

6.1.1.4 Mobile Technologies

Chapter 7. Smart Retail Market, By Solution

7.1 Global Smart Retail Market Snapshot, By Solution

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hardware

7.1.1.2 Software

7.1.1.3 Analytics Platforms

7.1.1.4 Robotics & Automation

Chapter 8. Smart Retail Market, By Application

8.1 Global Smart Retail Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Foot-Traffic Monitoring

8.1.1.2 Inventory Management

8.1.1.3 Loyalty & Payment Management

8.1.1.4 Predictive Equipment Maintenance

8.1.1.5 Brand Protection

Chapter 9. Smart Retail Market, By System

9.1 Global Smart Retail Market Snapshot, By System

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Digital Signage Solutions

9.1.1.2 Smart Labels

9.1.1.3 Smart Payment Systems

9.1.1.4 Intelligent Vending Machines

9.1.1.5 AR/VR Solutions

Chapter 10. Smart Retail Market, By Region

10.1 Overview

10.2 Smart Retail Market Revenue Share, By Region 2024 (%)

10.3 Global Smart Retail Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Smart Retail Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Smart Retail Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Smart Retail Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Smart Retail Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Smart Retail Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Smart Retail Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Smart Retail Market, By Country

10.5.4 UK

10.5.4.1 UK Smart Retail Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Smart Retail Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Smart Retail Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Smart Retail Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Smart Retail Market, By Country

10.6.4 China

10.6.4.1 China Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Smart Retail Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Smart Retail Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Smart Retail Market, By Country

10.7.4 GCC

10.7.4.1 GCC Smart Retail Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Smart Retail Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Smart Retail Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Smart Retail Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amazon

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Walmart

12.3 Alibaba

12.4 Caper AI (Instacart)

12.5 NVIDIA

12.6 Cisco Systems

12.7 Huawei Technologies

12.8 IBM

12.9 Intel Corporation

12.10 Honeywell International

12.11 Microsoft

12.12 PAX Global Technology

12.13 Verifone Systems

12.14 NCR Corporation