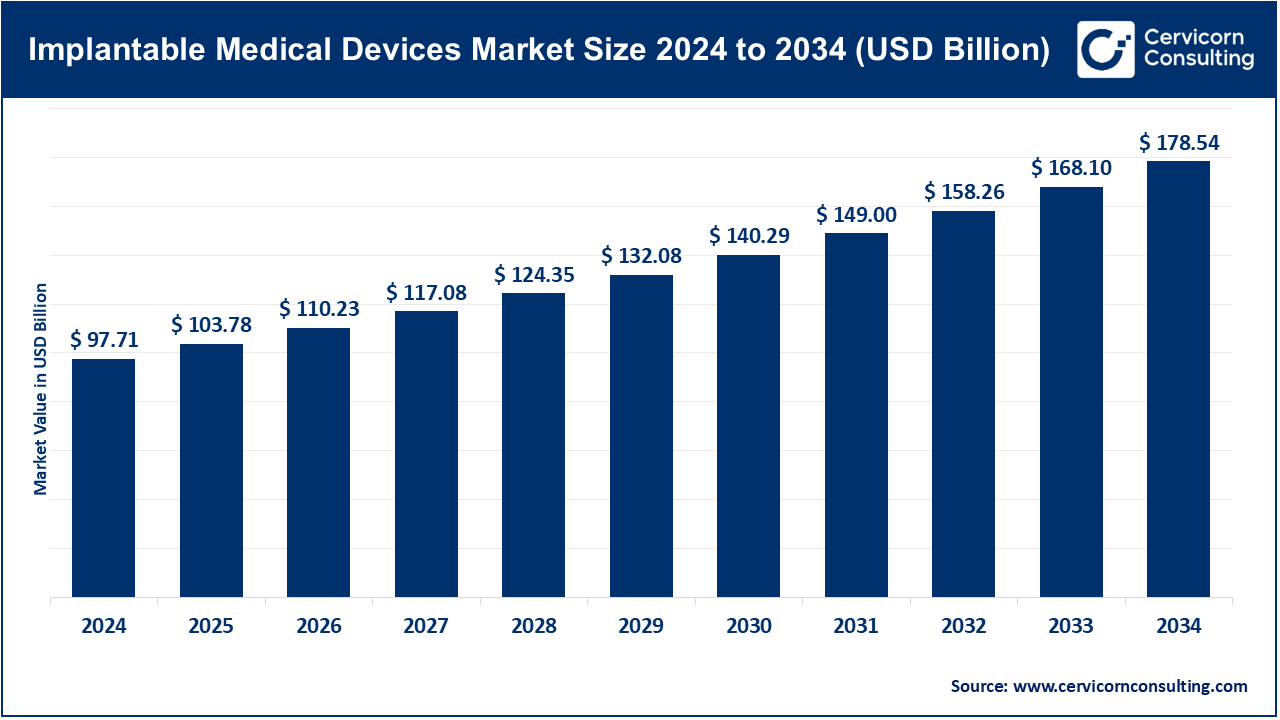

The global implantable medical devices market size was valued at USD 97.71 billion in 2024 and is forecasted to surpass around USD 178.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.21% over the forecast period from 2025 to 2034. The aging global population as well as the growing burden of cardiovascular, orthopedic, and neurological disorders increases the need for implantable medical devices. The adoption of implantable medical devices is due to their capacity to restore functionality, enhance quality of life, and minimize hospitalization expenditure. The use of minimally invasive methods and the development and use of biocompatible and bioresorbable implants increases the effectiveness and safety and prolong the use of implantable medical devices, fueling their adoption.

Moreover, smart implantable devices with built-in biosensors are changing the way patient treatment is administered and managed, allowing real-time monitoring, remote diagnosis, and personalized adjustment of treatment. This flexibility reaches well beyond the hospital to outpatient and home care. This increases patient accessibility and decreases the cost of care. Implantable medical devices are positioned to be the key drivers of next-generation healthcare. They enhance efficiency and patient outcome by facilitating the transition to more personalized and cost-effective care.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 103.78 Billion |

| Estimated Market Size in 2034 | USD 178.54 Billion |

| Projected CAGR 2025 to 2034 | 6.21% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Biomaterial, End-Use, Region |

| Key Companies | Abbott Laboratories, Alcon, Cochlear Limited, Fresenius Medical Care, GE Healthcare, Globus Medical, Integra LifeSciences, Johnson & Johnson, Medtronic, NuSil Technology, LLC, Royal Philips, Siemens Healthineers, Silq Technologies Corporation, Stryker Corporation |

The implantable medical devices market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

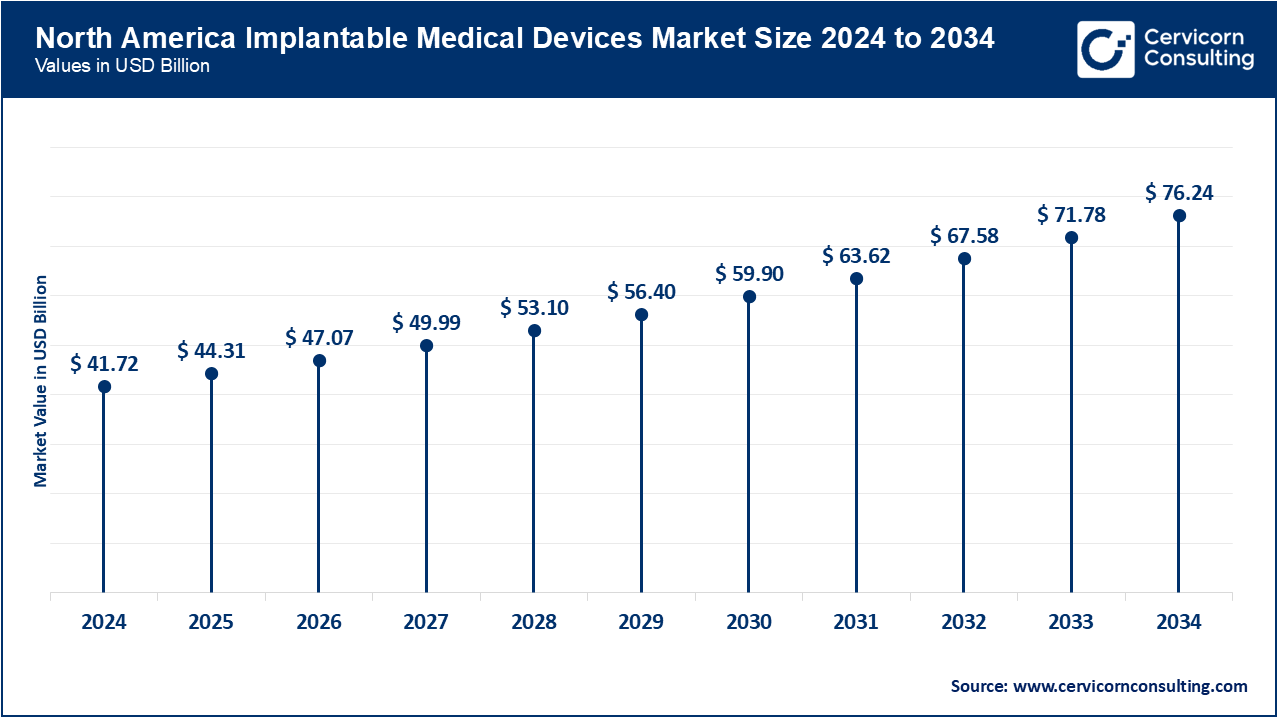

North America has been leading the market due to the good healthcare system, high rate of chronic illnesses, and high rate of adoption of new technologies. There was the next round of Abbott leadless pacemaker, which was approved by the U.S. FDA in April 2025, allowing the provision of safer and less invasive cardiac services. Moreover, AI-based platforms are being incorporated in hospitals and clinics throughout the U.S and Canada to track the performance of implants, minimize complications and minimize hospital readmissions. All these, coupled with good reimbursement models, have still rendered North America the most profitable.

The market development in Europe relies on strict regulatory measures, the integration of technology, and the increase of the demand towards the use of minimal implants. June 2025 in Germany and France, orthopedics surgery assisted by robotics showed an increase in surgeries which enhanced precision in surgery and recovery period. The U.K., Italy and the Netherlands are steadily embracing bioresorbability stents and dental implants composed of ceramic and zirconia in order to achieve the aspirations of patient safety and sustainability. The concentration on regulatory compliance and novel material in Europe makes it one of the forefronts in developing safe and effective implantable solutions.

Asia-pacific is also the fastest-growing region because of the rapidly aging population, the growing access to healthcare and the governmental backing. In July 2025, Japan, South Korea, and India also implemented nationwide programs to provide increased access to affordable cardiac and orthopedic implantation, especially in elderly populations. In the meantime, China is investing in smart implants that have AI-based monitoring capabilities and local production to come less reliant on imports. The high demand of affordability coupled with the innovative state of the art is also driving APAC as the spearhead of market growth.

Implantable Medical Devices Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 42.70% |

| Europe | 26.10% |

| Asia-Pacific | 22.40% |

| LAMEA | 8.80% |

LAMEA is a slowly developing region when it comes to the use of implantable medical devices, with most growth being in urban centers and privately-owned healthcare centers. In August 2025, Brazil introduced a government-funded initiative to subsidize orthopaedic implants to low-income earners making them highly accessible. Saudi Arabia and the UAE in the Middle East are also investing in sophisticated cardiac and neurology implant centers to stay up to date with the increasing demand. Some African countries like South Africa are even testing out the mobile health units and tele-implant follow up system so as to enhance access in the rural areas. Although adoption is still in its infancy, there is specific government investment that is establishing the groundwork to long-term expansion.

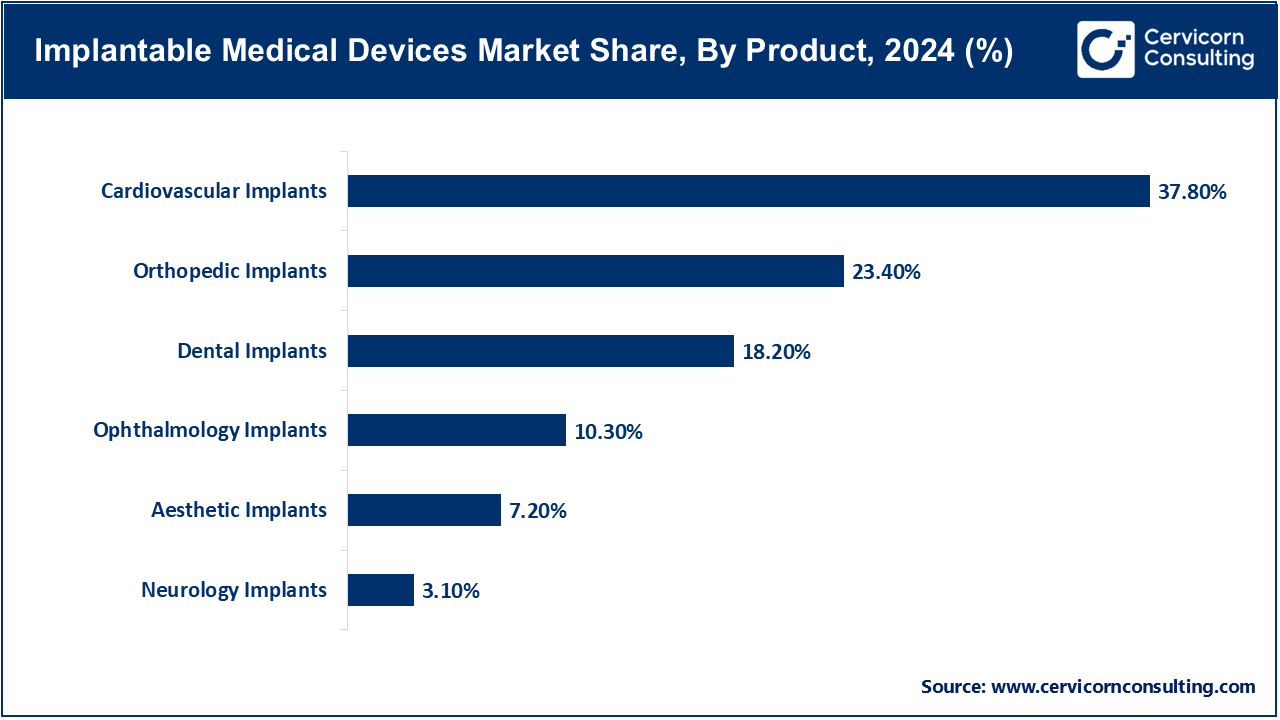

Cardiovascular Implants: Cardiovascular implants (stents, pacemakers, heart valves and implantable defibrillators) are the biggest product because of the prevalence of cardiovascular diseases around the globe. The devices play a critical role in improving survival, and the management of cardiac functions, as well as avoiding complications. Edwards Lifesciences purchased implantable hemodynamic monitoring devices to add to its portfolio with the acquisition of Vectorious Medical Technologies in September 2025 to the tune of almost half a billion dollars. This is an indication of a trend in the industry to develop smarter, data-driven cardiovascular implants which can constantly assess the health of the heart and enhance patient outcomes in the long-term.

Dental Implants: Dental implants are also gaining popularity with patients seeking long lasting and cosmetic tooth replacement. The increasing number of senior citizens and the rise in oral healthcare awareness is driving the extensive growth in this segment. In June 2025, Straumann Group introduced a new titanium-zirconium alloy line of implants in Europe, which aimed to make the implants stronger and improve the strength of the bone in the patient with a poor bone quality. This was a development that highlights the increased need to have superior biomaterials that would shorten the healing process and also raise the success rate of dental restoration.

Orthopedic Implants: Orthopedic implants such as hip, knee and spinal implants play a critical role in the management of arthritis, injury as well as degenerative bone conditions. This segment is also growing with an ageing population and as more people replace their joints. The Stryker robotic-assisted hip implant system was launched in the U.S. in August 2025 and is aimed at enhancing precision in surgery and reducing recovery time of a patient. This demonstrates that orthopedic care is being redefined, complications are being minimized and surgeries are becoming less invasive through robotics integration.

Ophthalmology Implants: Ophthalmology Implants, including intraocular Lenses and glaucoma implants, deal with vision correction and treatment of eye diseases. As the number of cataract cases and age-related visual impairment cases increases, there is an international demand. In May, 2025, Alcon released its new intraocular lens, which has enhanced vision and less dependency on glasses after cataract surgery. This showcases the way ophthalmic implants are being modified to suit medical and lifestyle requirements, to increase their usage both in developed and emerging markets.

Aesthetic Implants: Aesthetic implants are implants applied in cosmetic and reconstructive surgery, such as breast and facial implants. The driving forces of demand are the increasing disposable income, social influence and medical tourism. Mentor (a Johnson and Johnson company) was able to obtain FDA approval of its next-generation breast implants in July 2025, which have new features of stronger durability and safety. This is a regulatory milestone that will lead to an increase in consumer confidence in aesthetic implants and raise the bar in terms of safety and innovation in this market.

Neurology Implants: Neurology implants, such as deep brain stimulators and brain-computer interface (BCI) devices, are evolving with increasing rapidity as neurological disorders and need of new therapeutic approaches are increasing. In May 2025, Paradromics the first human trial of the Connexus brain implant, that interprets neural signals into text and speech to provide communication to patients with communication impairments, was started. This is a major breakthrough in neurotechnology that opens the potential of the use of AI-enabled implants in restoration of critical functions and quality of life.

Metallic: Titanium and cobalt-chromium are the two main materials of the implantable devices because they are strong, durable and biocompatible. Zimmer Biomet has planned to add a 3D-printed titanium spinal implant to its titanium-based implant line in July 2025, which offers better fit and faster bone integration. This innovation demonstrates the transformation of more sophisticated production, which has enabled metallic implants to become more precise and less costly in recovery.

Natural: Natural biomaterials such as collagen, grafts and bone substitutes are increasingly being used in tissue regeneration and bio-integration. In 2025 Geistlich Pharma launched a new generation of the collagen matrix in dental implants in Europe, with the aim of achieving faster healing of the soft tissues. This invention highlights the ultimate significance of natural biomaterials in regenerative medicine and this renders using implants to be safer and more effective.

Implantable Medical Devices Market Share, By Biomaterial, 2024 (%)

| Biomaterial | Revenue Share, 2024 (%) |

| Metallic | 45.60% |

| Natural | 11.80% |

| Ceramic | 19.20% |

| Polymers | 23.40% |

Ceramic: Ceramic implants are acclaimed by their high biocompatibility, wear resistance and naturalistic look, particularly in dentistry and orthopedics. In August 2025, Nobel Biocare added to its ceramic implant line-up, offering a metal-free solution to patients sensitive to metal. This is indicative of the growing need of the use of hypoallergenic and sustainable materials in implantable devices.

Polymers: Polymers are flexible with the capability of delivery of drugs as well as are versatile and may be used as coatings and implant body. In September 2025 Medtronic released a polymer-coated stent, which was also drug-eluting, targeting to reduce the rates of restenosis in cardiovascular patients. This is the emphasis on how polymer innovations are improving the results of treatments and minimizing the long term complications.

Hospitals: Hospitals are the end-use segment because they have the infrastructure, qualified human resources and can do the complex implant surgeries. In the month of April, 2025, hospitals in the U.S. reported an increase in the number of cardiovascular implant surgeries, which are now being facilitated by the adoption of AI-enabled monitoring systems during the surgery. This offers a reflection of the fact that hospitals are becoming more integrated in the implementation of surgical expertise alongside digital tools so as to enhance the outcome of a surgery post-surgery.

Outpatient Facilities: Outpatient centers are increasingly involved in implantable surgery and this is due to the development of minimally invasive procedures. The facilities provide patients with quick recovery and low costs than hospitals do. In June 2025, Japanese outpatient clinics started using the new system of dental implantation that allows placing an implant in a day. This trend suggests the increasing decentralization of the process of implants, becoming available to the patients.

Implantable Medical Devices Market Share, By End-Use, 2024 (%)

| End-Use | Revenue Share, 2024 (%) |

| Hospitals | 55.40% |

| Outpatient Facilities | 27.10% |

| Specialty Clinics & Centers | 17.50% |

Specialty Clinics and Centers: Specialty clinics like orthopedics, neurology, and dental centers are playing a central part in the adoption of the implants. Such centers offer specialized skills and sometimes act as pilot projects to new technology. In July 2025, the connections European neurology centers started trials of the Connexus brain implant and noted the importance of the facilities in the development of the next generation of neurological care.

Market Segmentation

By Product

By Biomaterial

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Implantable Medical Devices

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Biomaterial Overview

2.2.3 By End-User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Personalized Medicine Demand

4.1.1.2 Cost-Effectiveness and Efficiency

4.1.2 Market Restraints

4.1.2.1 Regulatory Problems

4.1.2.2 Expensive Development Costs

4.1.3 Market Challenges

4.1.3.1 Regulatory Complexity

4.1.3.2 Costs are created by the high Development and Production Costs

4.1.4 Market Opportunities

4.1.4.1 Individual and Personalized therapies

4.1.4.2 Next-Generation Surveillance Solutions

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Implantable Medical Devices Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Implantable Medical Devices Market, By Product

6.1 Global Implantable Medical Devices Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Cardiovascular Implants

6.1.1.2 Dental Implants

6.1.1.3 Orthopedic Implants

6.1.1.4 Ophthalmology Implants

6.1.1.5 Aesthetic Implants

6.1.1.6 Neurology Implants

Chapter 7. Implantable Medical Devices Market, By Biomaterial

7.1 Global Implantable Medical Devices Market Snapshot, By Biomaterial

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Metallic

7.1.1.2 Natural

7.1.1.3 Ceramic

7.1.1.4 Polymers

Chapter 8. Implantable Medical Devices Market, By End-User

8.1 Global Implantable Medical Devices Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospitals

8.1.1.2 Outpatient Facilities

8.1.1.3 Specialty Clinics & Centers

Chapter 9. Implantable Medical Devices Market, By Region

9.1 Overview

9.2 Implantable Medical Devices Market Revenue Share, By Region 2024 (%)

9.3 Global Implantable Medical Devices Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Implantable Medical Devices Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Implantable Medical Devices Market, By Country

9.5.4 UK

9.5.4.1 UK Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Implantable Medical Devices Market, By Country

9.6.4 China

9.6.4.1 China Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Implantable Medical Devices Market, By Country

9.7.4 GCC

9.7.4.1 GCC Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Implantable Medical Devices Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Abbott Laboratories

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Alcon

11.3 Cochlear Limited

11.4 Fresenius Medical Care

11.5 GE Healthcare

11.6 Globus Medical

11.7 Integra LifeSciences

11.8 Johnson & Johnson

11.9 Medtronic

11.10 NuSil Technology, LLC

11.11 Royal Philips

11.12 Siemens Healthineers

11.13 Silq Technologies Corporation

11.14 Stryker Corporation