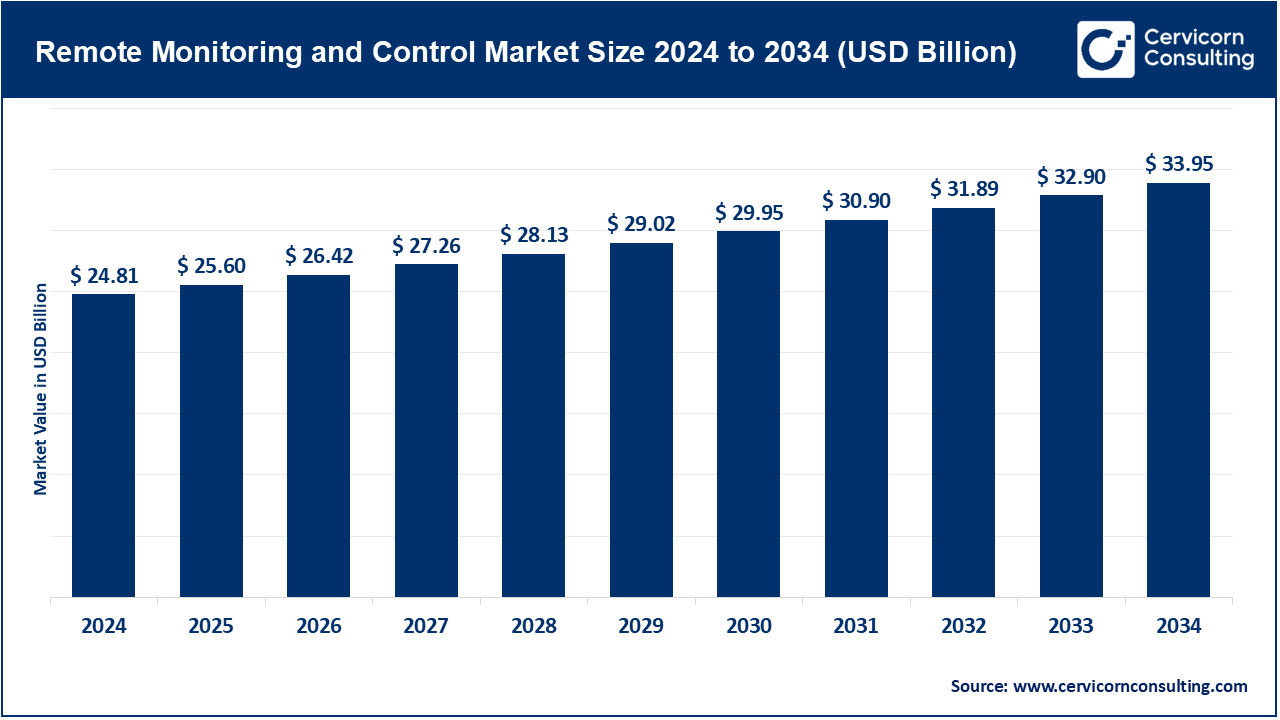

The global remote monitoring and control market size was valued at USD 24.81 billion in 2024 and is anticipated to reach around USD 33.95 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.8% over the forecast period 2025 to 2034. The remote monitoring and control market is expanding quickly due to the requirement for precise and scalable monitoring in healthcare and other industries. Monitoring chronic diseases, managing industrial operations, and scheduling predictive maintenance in real time require the balance of precision, speed, and accessibility. To remedy this, manufacturers are adopting eco-friendly innovations such as user-friendly, energy-efficient sensors, automated systems, and IoT integrated technologies guaranteeing user satisfaction and environmental safety.

The ongoing digitalization of ecosystems is transforming remote monitoring and control into interconnected, intelligent solutions, offering cloud-based analytics, real-time reporting, and AI predictive insights. With the advent of telemedicine and smart factories and IoT-enabled infrastructure, systems are becoming increasingly intelligent, scalable, and interactive, improving operational efficiency and outcomes. Technological innovations are set to advance fortitude and sustainability, and transform data-driven decision-making for global industries as competition increases.

Report Scope

| Area of Focus | Detail |

| Market Size in 2025 | USD 25.60 Billion |

| Estimated Market Size in 2034 | USD 33.95 Billion |

| Projected CAGR 2025 to 2034 | 5.80% |

| Dominant Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Component, Application, Communication Technology, Deployment Mode, Industry End Use, Region |

| Key Companies | ABB Ltd., Advantech Co., Ltd., AVEVA Group plc, Cisco Systems, Inc., Emerson Electric Co., Endress+Hauser Group, General Electric Company (GE Digital), Hitachi, Ltd., Honeywell International Inc., Iconics, Inc., L&T Technology Services, Mitsubishi Electric Corporation, Omron Corporation |

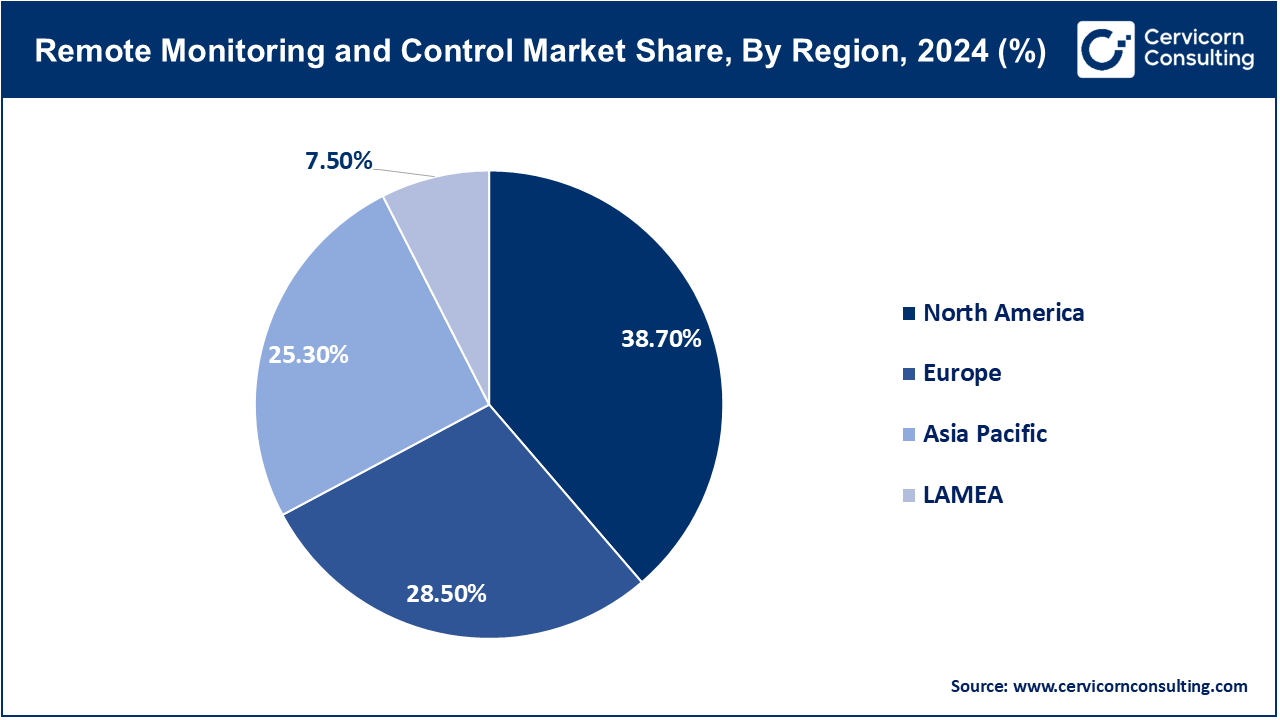

The remote monitoring and control market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

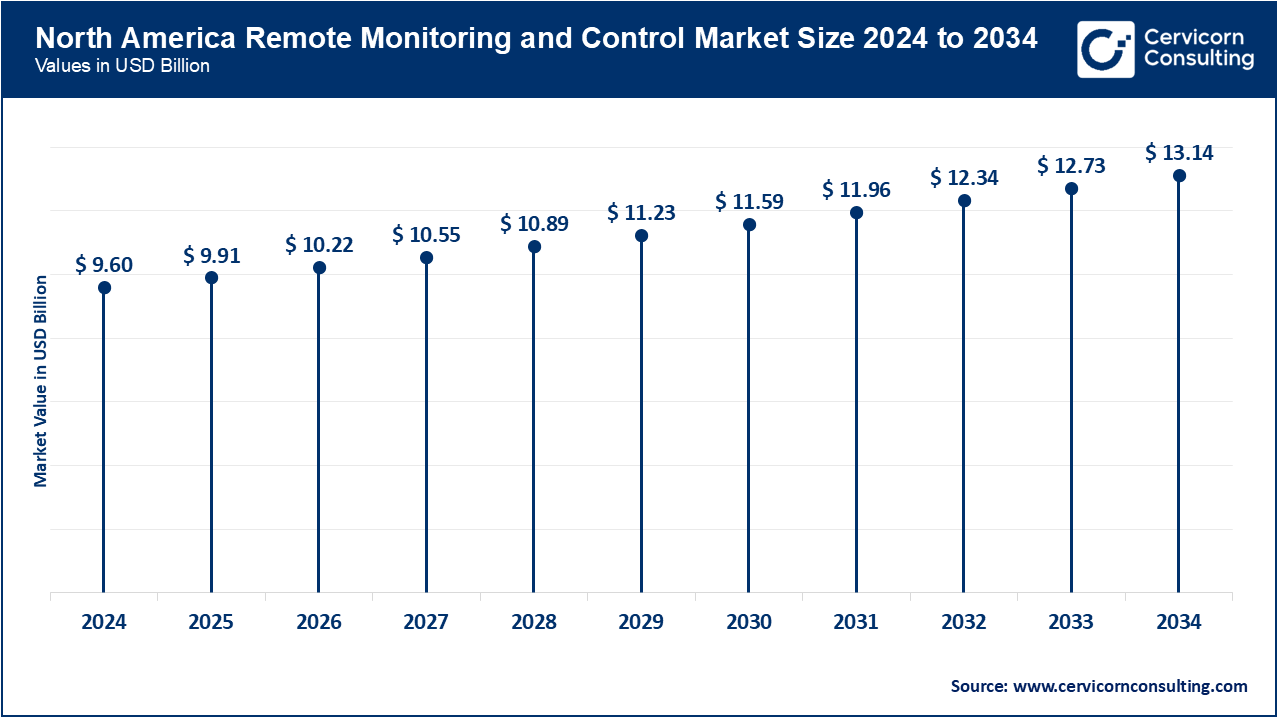

North America is the market leader because it has developed industrial and health care infrastructure, high level expenditure on R&D as well as rigorous regulations. The use of AI-enabled and cloud-integrated predictive maintenance and patient care monitoring solutions is fast becoming widespread in hospitals, utilities, and industrial plants. The Cleveland Clinic installed next-generation CLIA-based analyzers in its labs in August 2025 enhancing throughput and diagnostic capacity. The adoption is further facilitated by high government investments in healthcare digitization and personalized medicine. The efficiency, safety, and technological innovation that the region aims to achieve solidify its hegemony in the global market.

Europe focuses on the elements of standardization, compliance and sustainability, which in turn makes it one of the primary markets of RMC technologies. The industries are focusing on systems that are energy efficient and environment friendly and the hospitals are using AI improved and chemiluminescence based monitoring to achieve the accuracy of diagnostics. Siemens Healthineers presented its remote monitoring solutions with a hybrid cloud-based strategy at the Medica 2025 in May 2025 and demonstrated secure and scalable implementations at hospitals. Industrial automation and smart infrastructure are also in the spotlight of the region and incorporate predictive analytics and monitoring through IoT. A combination of strict regulations, sustainability plans, and modern health systems in Europe contributes to the universal adoption.

Asia-Pacific is witnessing a rapid growth in market as a result of urbanization, industrial development and more investments in healthcare. Its adoption is good in manufacturing, agriculture, and cost-effective and portable solutions are very valued in hospitals and clinics at the tier II-IV. In July 2025, QuidelOrtho introduced the region with rapid immunoassay kits, which provided the possibility to diagnose respiratory infection rapidly when there is an outbreak of a seasonal infection. China, India and Japan governments are also advancing smart infrastructure and telehealths which further fuel demand. The trend of digitization, scalability and localized solutions is driving positive market growth in the region.

LAMEA is a growing market due to pilot projects, updating medical infrastructures and increased awareness of diagnostic solutions. The adoption is still behind when compared to North America and Europe but growing faster with more investment in monitoring hospitals, utilities, and industries. South African scientists confirmed immunoassay kits of healthcare programs on HIV and hepatitis testing in June 2025, demonstrating the attempts to increase the scope of diagnostics. The industrial automation projects and smart infrastructure initiatives support the demand of LAMEA with a significant potential not being exploited.

Hardware: The hardware segment has captured highest revenue share in the market. Within the scope of RMC systems, Hardware is the backbone and can be construed as sensors, controllers, data acquisition systems, gateways, and edge devices. These devices fetch data from industrial tools, healthcare devices, agricultural sensors, and even infrastructure systems facilitating Monitoring, Automated Decision Making, and Automated Monitoring and Fault Detection Systems in real time. These innovations center on longevity, energy efficiency, ease of use, small modular systems, and inter-device connectivity. For instance, Schneider Electric in May 2025, launched the next-generation industrial sensors equipped with edge computing, enabling rapid detection and on-site processing of anomalies and thus, low latency and predictive maintenance for critical rear-guard functions.

Software: Actionable insights, predictive analytics and, decision-support systems derived from the raw sensor data are the main constructs of the software platforms. These solutions utilize AI, Cloud Computing, IoT, real-time dashboards, Anomaly detection, and ERP systems. For instance, Siemens in June 2025, released an AI industrial monitoring software suite that automated the detection of anomalies, scheduled production in an optimized manner, and subsequently, provided predictive maintenance alerts, thus, demonstrating that software, as much as hardware, drives the operational efficiency.

Services: They are provided as an extension to the hardware and software which include installation, configuration, training, maintenance, and remote assistance. Managed services assist with system operational uptime, compliance, and operational workflow optimization. In July 2025, Honeywell offered global service modules for their industrial monitoring platforms which provided maintenance preemptive to system diagnosing, and constant system optimization to reduce unplanned system downtimes and enhance the equipment lifecycle.

Industrial Automation: Within industry remote monitoring streamlines operational efficiency by relaying real-time statistics about machines and processes. Predictive analytics identifies faults early in the operation sequence, thereby minimizing downtime and enhancing safety in the workplace. These systems are more frequently incorporated for production and maintenance schedule optimizations. ABB, for instance, in June 2025, introduced a smart factory predictive analytics platform which monitors numerous machines at the same time. These types of systems assist factories in minimizing unscheduled interruptions while maximizing factory output.

Utilities: Remote monitoring within the Utilities Industry serve as a mechanism for uninterrupted operation of power grids, water networks, and energy distribution systems. Sensors connected to IoT assist in monitoring and identifying blockages, energy wastages, and unwarranted conditions in real-time. The addition of AI and cloud schedules also aids in predictive maintenance and load prediction. The smart grids in operation are integrating these systems to boost reliability and cut down on expenses. The expanding reliance also corresponds to a need for improved sustainable energy management and service provision.

Oil & Gas Sector: Enhanced operational efficiency and safety are achieved through the use of remote monitoring on pipelines, refineries, and offshore platforms. Ongoing monitoring of apparatus and early detection of leaks save costly equipment downtime and avert possible environmental disasters. In July 2025, Schlumberger introduced a solution of remote monitoring of oilfields that combines LPWAN and satellite communication, minimizing the need for manual oilfield inspections. The industry is steadily adopting predictive maintenance and real-time data analysis. Meeting safety and compliance standards is increasingly becoming the norm, owing to remote monitoring.

Smart Infrastructure: In smart infrastructure, remote monitoring checks the energy use of buildings and cities, controls security and lighting systems, and tracks the environmental parameters of urban spaces. Automated urban infrastructure systems driven by data analytics reduce energy consumption and enhance sustainability. There is a growing reliance on IoT devices and cloud analytics which operate data smart cities and buildings for efficiency maximization. Smart urban systems improve safety, traffic, and resource management. The adoption of such systems by developers and governmental institutions aims at building resilient, automated urban ecosystems.

Healthcare: The healthcare segment has generated highest revenue share in the market. With remote monitoring, patients can be observed and managed more closely while at home and throughout the home. It also enables clinicians to track a patient’s vitals and respond to any changes, increasing a patient’s prognosis. In August 2025, Philips Healthcare deployed remote monitoring for patients suffering from heart failure, allowing patients to electronically transmit real-time vitals and receive remote supervision from clinicians. Integrated telemedicine enhances patient access, reduces the frequency of in-office visits, and addresses patient needs on a more personalized and pro-active level. This also shifts the burdens from healthcare facilities.

Agriculture: In remote sensing and monitoring, and in agriculture telemetry remote monitoring provides real time and measurable data on soil moisture levels, crop growth, and livestock well-being for precision resource farming. This data enhances the prediction of pests and manages yields more effectively. In 2025, John Deer incorporated IoT devices for soil monitoring and analytics to enhance the productivity of the crops, which then minimizes the expenditure of fertilizers and water with the rising efficiencies. These devices are crucial for the security of farming and food with sustenance progressive practices.

Transportation & Logistics: Within the area of telemetry and remote management of equipment and vehicles, the focus is the real-time vehicles location monitoring, the condition of the loads, the current monitoring of the maintenance, and also the prognostics. Predictive and maintenance driven optimization reduces: travel routes and time, fuel consumption, and scheduled delivery windows. In August 2025, Honeywell launched a connected logistics monitoring system enabling live cargo tracking and predictive route optimization. Operational costs are cut through improved route planning, enhanced fuel inventory management, and greater delivery. Enhanced compliance to safety regulations and improved system monitoring leads to greater customer satisfaction across the entire supply chain.

Wired: The wired segment held maximum revenue share in the market. Technologies allow for low latency, industrial strength, and secure data transmission for a wide variety of applications in energy and utilities. Wired communication systems allows for seamless integration for high bandwidth and automation along with analytic platforms in a factory, power plant, and setups for critical missions. Although there may be wireless communication, it does not provide the quality of a wired connection.

Wireless: Remote tracking systems can make use of 3G/4G/LTE bandwidth with cellular systems, as they provide limitless coverage and download speeds. These technologies compliment the use of in-cloud analytic systems as they provide data timely and globally. Space monitoring, environmental studies, and offshore rigs can be integrated with low power technologies giving customizable real-time data. These systems, along with portable electronics, have a tendency to be applied in the healthcare sector.

Satellite: Satellite communication systems have the ability to offer global coverage for shifting remote monitoring systems, as well as for the mining industry and maritime operations in off-grid areas. These satellites can help monitor rigs, offshore pipelines, and environmental conditions with real-time data without the use of land resources. New technologies can assist in budgeting low satellite costs as well.

LPWAN (LoRa, NB-IoT): LPWAN technologies such as LoRa and NB-IoT enable low-power and long-range communication with various applications in smart cities, agriculture, and environmental sensing and monitoring. The devices can operate for months without changing batteries. These networks also provide low-touch maintenance which makes it suitable for large-scale deployments. LPWAN provides affordable and easily scalable IoT solutions for distributed use cases. LPWAN use cases are proliferating in urban monitoring and precision agriculture projects.

Zigbee/Bluetooth: The short-range technologies, Zigbee and Bluetooth, are applied in smart homes, wearables, and localized industrial monitoring environments. They offer shifting connected device networks low-power consumption and dependable connectivity. These networks facilitate the real-time data transfer between distributed sensors and central control systems. Zigbee and Bluetooth are critical in integration systems for automatic control, smart healthcare devices, and environmental monitoring and sensing systems. They are used in conjunction with other wireless and LPWAN networks.

On-Premises Subscription Model: The on-premises segment accounted for a highest revenue share in the market. For enhanced security and local control, enterprises can deploy monitoring and control systems on their own infrastructure, which is termed as on-premises systems. It is preferred in data sensitive industries like industrial, healthcare, or even defense. On-premises systems fulfills the requisite compliance in regulatory standards. Provides continuous and reliable uptime even without the internet. This is ideal for organization whose primary focus is on data privacy and control, irrespective of the cloud infrastructure.

Off-Premises Subscription Model: Reduced infrastructure investments, remote access, greater customization, ease integrations, and scalability offered by cloud-deployed systems, makes it the preferred choice. This model is more common in Industrial Automation, Utilities, and Healthcare systems. Off-prem provided monitoring systems real time dashboards, predictive as well as proactive maintenance, and multi-site control and coordination. Off-prem systems are easier to update and faster to implement as compared to on-prem.

Mixed Subscription Model: The best of both worlds: on-prem security and cloud scalability. This model also supports economical and flexible monitoring. Domains like Healthcare, Energy, and Industrials are the most common. Flexible and hybrid security and scalability solutions are in greater demand. Critical data can remain local while the analytics and integration benefit from cloud resources. The adoption is also growing in the healthcare, energy, and industrial sectors.

Manufacturing: In the manufacturing sector, remote monitoring manages the performance of machinery, evaluates the environment, and supervises production lines simultaneously. It minimizes operational downtimes and encourages predictive maintenance. Workflow and resource use optimization is achieved through AI-driven analytics. Compliance with safety and quality regulations is guaranteed with real-time monitoring. These systems are increasingly deployed by manufacturing firms to cut costs and increase efficiency.

Energy & Utilities: Monitoring solutions improve operations in power plants, renewable energy plants, and even in the water treatment sector. These systems foster predictive maintenance, fault detection, and operational efficiency inline with mandated regulations. Remote monitoring enhances the efficiency of utilities by reducing operational risks. AI and IoT further improve resource use and grid control.

Oil & Gas: In the oil and gas sector, remote monitoring improves safety and operational efficiency during exploration, drilling, and pipeline management. It cuts the chances of environmental and operational downtimes, as well as equipment failure through predictive maintenance and real-time alerts. These systems take care of regulatory standards while protecting the workforce. Remote and offshore oilfield operations greatly depend on this technology.

Healthcare: With regard to healthcare, With remote patient monitoring, chronic disease management, ICU devices, and other sophisticated technology solutions, patient outcomes and early intervention improve and hospitalizations are reduced, while continuous patient management is provided. The use of telemedicine and cloud technology further improves access and efficiency. Most hospitals use such systems to remotely monitor vitals and manage patients at risk of decompensating. These technologies are essential to achieving tailored, personalized, accessible and continuum of care patient healthcare.

Agriculture: On agriculture, wireless sensor networks and remote monitoring technologies monitor soil and weather conditions, and manage crop growth and livestock location and health. Data-driven practices improve productivity per unit of water and fertilizer and improve overall yield and resource efficiency. Such systems enable precision farming and sustainable agriculture practices. With Internet of Things (IoT) technology and Artificial Intelligence (AI) integrated, predictive systems can monitor and predict pest and other ecosystem disturbances. Such technologies enable farmers to increase productivity and resource use efficiency.

Transportation: With regard to transport, Fleet management and cargo monitoring, together with predictive maintenance, improve overall effectiveness transport. Operational costs and route optimization ease with real-time data. Remote monitoring systems assist to improve vehicle overall compliance, safety, and fuel efficiency. Such systems are used by logistic companies to improve their reliability in delivery. Supply chains benefit with reduced downtime and improved use of data driven decisions to increase overall efficiency in the system.

Water & Wastewater: Real-time monitoring works on plants, distribution systems, and environmental regulatory compliance. This helps with the early identification of leaks, malfunctions and deviations in quality. Improved operational efficiency and lowered costs through predictive systems maintenance. This system ensures the safe delivery of water and the environmentally responsible processing of wastewater. AI integration provides proactive decision support and resource optimization.

Mining: Improved equipment condition monitoring systems, MSHA compliance, and worker protection in mining operations. Accidents and operational downtime are avoided. Real-time data assists with resource allocation and predictive maintenance. Remote monitoring in mining improves productivity and decreases environmental footprint. This is critical for remote and largescale mining operations.

Aerospace & Defense: Remote monitoring in aerospace and defense tracks military assets, aircraft systems, and drones. This increases mission readiness, predictive maintenance, and operational safety, while real-time data assists with critical decision making to mitigate the risk of equipment failures. Defense organizations heavily rely on remote monitoring systems to conduct safe and efficient operations. Aerospace firms utilize monitoring systems to enhance flight safety along with the performance of on-board systems.

Others: Other uses are smart buildings, retailing, research laboratories, and experimental Internet of Things projects. An operational free and smart system improves efficiency, sustainability, and decision quality. It is progressively being employed for commercial and experimental use cases. IoT facilitated monitoring systems improve energy, security and resource management. Adoption is increasing in the technology of the future.

Market Segmentation

By Component

By Application

By Communication Technology

By Deployment Mode

By Industry End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Remote Monitoring and Control

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Communication Technology Overview

2.2.3 By Deployment Mode Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Operational Complexity

4.1.1.2 Point-of-Care and Remote Applications

4.1.2 Market Restraints

4.1.2.1 Excessive Expense of Innovation

4.1.3 Market Challenges

4.1.3.1 Infrastructure and Accessibility Gaps

4.1.4 Market Opportunities

4.1.4.1 Telemedicine and Smart Home Integration

4.1.4.2 Technological Innovations

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Remote Monitoring and Control Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Remote Monitoring and Control Market, By Component

6.1 Global Remote Monitoring and Control Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7. Remote Monitoring and Control Market, By Communication Technology

7.1 Global Remote Monitoring and Control Market Snapshot, By Communication Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Wired

7.1.1.2 Wireless

7.1.1.3 Satellite

7.1.1.4 LPWAN (LoRa, NB-IoT)

7.1.1.5 Zigbee/Bluetooth

Chapter 8. Remote Monitoring and Control Market, By Deployment Mode

8.1 Global Remote Monitoring and Control Market Snapshot, By Deployment Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 On-Premises

8.1.1.2 Cloud-Based

8.1.1.3 Hybrid

Chapter 9. Remote Monitoring and Control Market, By Application

9.1 Global Remote Monitoring and Control Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Industrial Automation

9.1.1.2 Utilities

9.1.1.3 Oil & Gas

9.1.1.4 Smart Infrastructure

9.1.1.5 Healthcare

9.1.1.6 Agriculture

9.1.1.7 Transportation & Logistics

Chapter 10. Remote Monitoring and Control Market, By End-User

10.1 Global Remote Monitoring and Control Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Manufacturing

10.1.1.2 Energy & Utilities

10.1.1.3 Oil & Gas

10.1.1.4 Healthcare

10.1.1.5 Agriculture

10.1.1.6 Transportation

10.1.1.7 Water & Wastewater

10.1.1.8 Mining

10.1.1.9 Aerospace & Defense

10.1.1.10 Others

Chapter 11. Remote Monitoring and Control Market, By Region

11.1 Overview

11.2 Remote Monitoring and Control Market Revenue Share, By Region 2024 (%)

11.3 Global Remote Monitoring and Control Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Remote Monitoring and Control Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Remote Monitoring and Control Market, By Country

11.5.4 UK

11.5.4.1 UK Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Remote Monitoring and Control Market, By Country

11.6.4 China

11.6.4.1 China Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Remote Monitoring and Control Market, By Country

11.7.4 GCC

11.7.4.1 GCC Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Remote Monitoring and Control Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 ABB Ltd.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Advantech Co., Ltd.

13.3 AVEVA Group plc

13.4 Cisco Systems, Inc.

13.5 Emerson Electric Co.

13.6 Endress+Hauser Group

13.7 General Electric Company (GE Digital)

13.8 Hitachi, Ltd.

13.9 Honeywell International Inc.

13.10 Iconics, Inc.

13.11 L&T Technology Services

13.12 Mitsubishi Electric Corporation

13.13 Omron Corporation