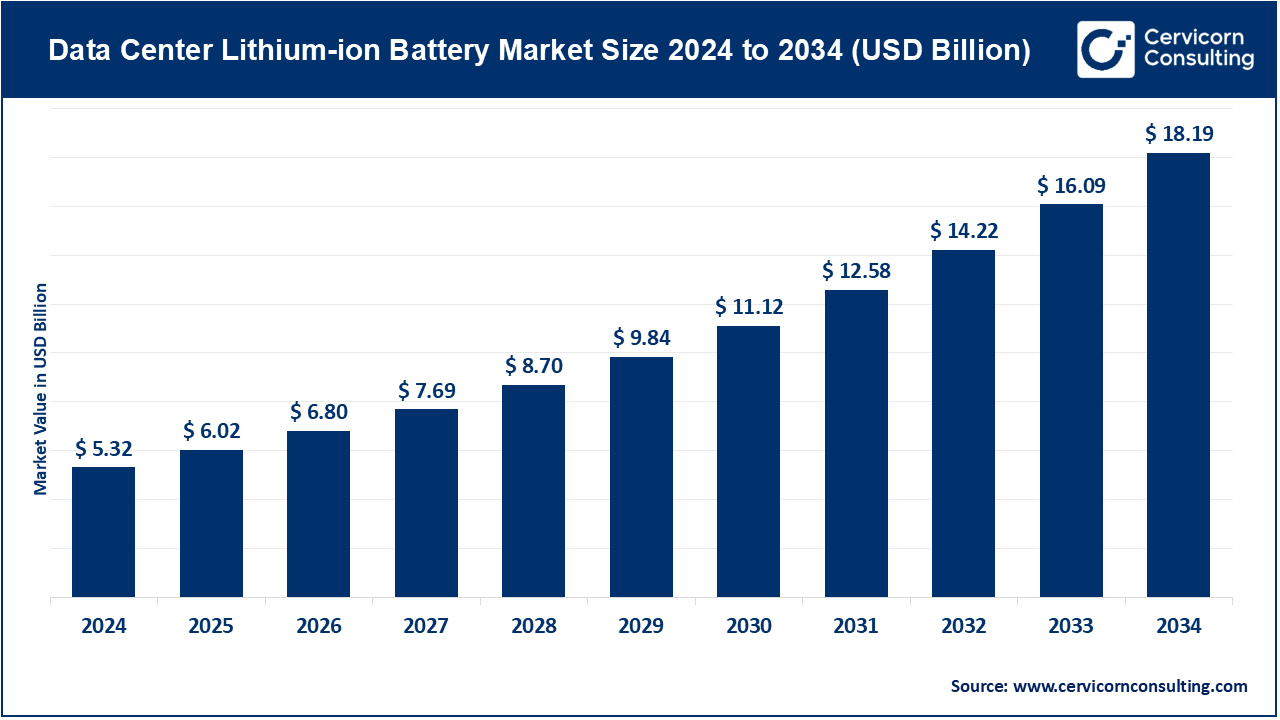

The global data center lithium-ion battery market size was valued at USD 5.32 billion in 2024 and is expected to be worth around USD 18.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.8% during the forecast period 2025 to 2034. The lithium-ion battery market is fast growing in data centers with organizations increasingly adopting high-performance, reliable energy storage solutions to enable a continuous operation in the organization. Batteries are required in data centers that can supply rapid backup power, high efficiency, and reliability of the systems especially against the increasing tendencies of digitalization and cloud computing. Conventional power backup systems have a weak lifecycle, slow reaction, and high maintenance cost, but the lithium-ion batteries have quick reaction, longer lifecycle and high-power density.

Increasingly energy-efficient requirements, sustainability, and the worldwide drive to green technologies are making lithium-ion batteries the battery of choice in the contemporary data centers. In addition to a fundamental backup capability, these batteries are currently being combined with smart energy management, predictive maintenance and AI-controlled monitoring to maximize performance, lower operational expenses, and increase resilience. With the adoption of newer technologies and the increase in capacities in data centers to cater to the demands of Industry 4.0, lithium-ion batteries are increasingly becoming a catalyst to efficiency, reliability, and sustainability to enable digital operations to be pursued without interruption in an increasingly competitive global marketplace.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 6.02 Billion |

| Expected Market Size in 2025 | USD 18.19 Billion |

| Projected CAGR 2025 to 2034 | 13.80% |

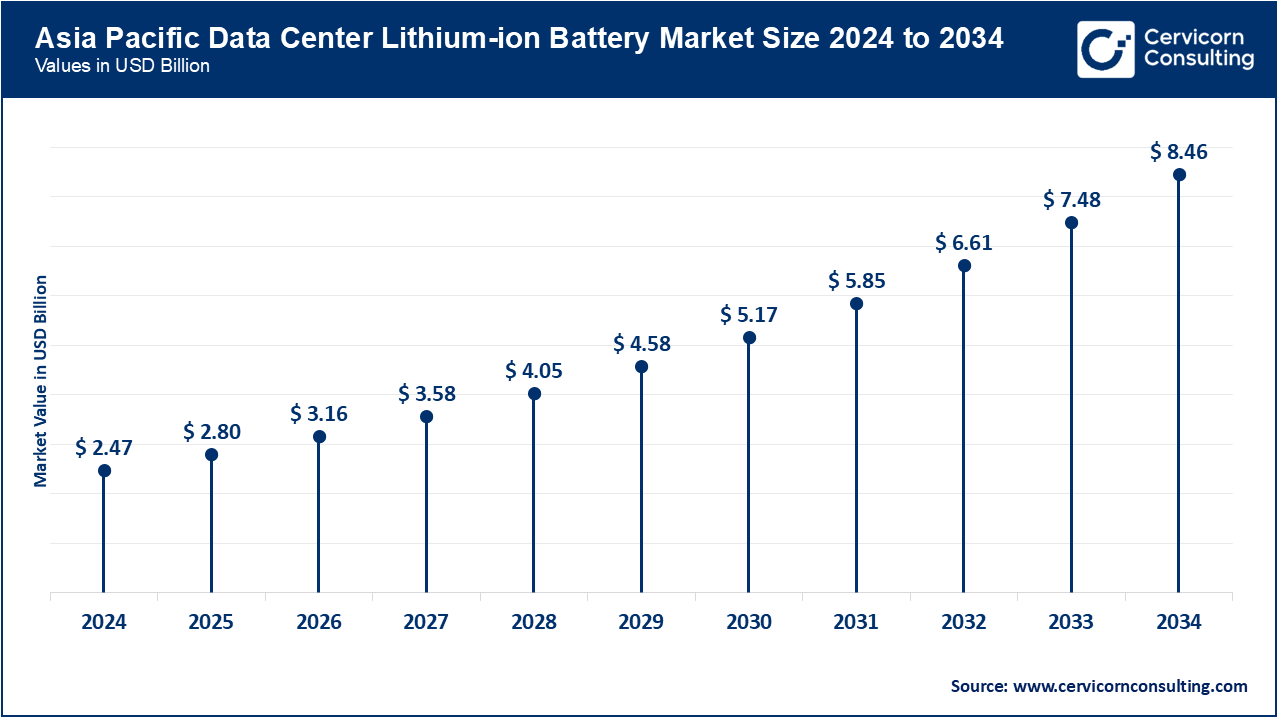

| Prime Region | Asia-Pacific |

| Key Segments | Battery Chemistry, Data Center Type, Component, Application, By End User, Region |

| Key Companies | Vertiv Group Corp., Eaton Corporation, Schneider Electric SE, Legrand SA, Delta Electronics Inc., Huawei Technologies Co., Ltd., Samsung SDI Co., Ltd., LG Energy Solution, Contemporary Amperex Technology Co. Ltd. (CATL), BYD Company Limited, Toshiba Corporation, Tesla, Inc., Panasonic Holdings Corporation |

The cata center lithium-ion battery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The Asia-Pacific data center lithium-ion battery market size was estimated at USD 2.47 billion in 2024 and is expected to surpass around USD 8.46 billion by 2034.

The Asia-Pacific region is witnessing unprecedented growth in the deployment of lithium-ion batteries and data centers. While China remains the leading center for advanced manufacturing, India is expanding its manufacturing base in order to meet its self-sufficiency goals. With the commissioning of lithium-ion battery facilities in June 2025, India is aiming to support the region's cloud and hyper-scale data centers, serving the region's energy storage needs. This enhances the region's position in the global framework.

Alongside current digital infrastructures, North America stands out in terms of data center within the adoption of lithium-ion batteries aimed at achieving sustainability objectives. The adoption of lithium-ion batteries in lieu of lead-acid batteries in UPS systems is aiding in the performance of AI workloads, cloud services, and hyperscale data centers. In August 2025, Redwood Materials, in attempting to convert and second life of batteries for EVs, initiated Redwood Energy and installed 12 MW, 63 MWh systems in Crusoe's GPU driven data center. This stood to be the largest second life battery installation globally, which strengthened the scalable and sustainable energy solutions of Redwood Materials.

Europe, in comparison to North America, has placed more emphasis on and integrated energy data center systems centered on the efficiency of the energy used and the adoption of renewable sources within data centers. The development of policies that center on environmental sustainability and the energy data center of Germany, along with the Netherlands, has resulted in the policy being termed the Bosch Center for Artificial Intelligence. By the year 2025, Germany was noted to successfully deploy lithium-ion systems across multiple data centers which further improved the sustainable targets in heightened demanded data services and cloud computing.

The LAMEA region is still in the process of the deployment of data center batteries, focusing on collaborations and pilot projects. Brazil is integrating energy storage systems to enhance its energy reliability, and alongside South Africa and the UAE, is deploying systems for renewable energy and regulatory compliance. The launch of pilot projects for energy storage systems in data centers in July 2025 points towards the region's increasing collaboration with global technology providers, despite the region's sluggish growth.

Lithium Iron Phosphate (LFP): The batteries of LFP possess remarkable thermal stability and safety and have long lifecycles, making LFP batteries perfect candidates for large and hyperscale data centers with a focus on low-maintenance, reliable, and convenient energy storage. They also minimize thermal runaway, thus reducing the operational risks of high-density servers. The growing trend of favoring LFP batteries over traditional lead-acid solutions became evident when, in March 2025, Eaton Incorporated LFP batteries into next-generation UPS systems for hyperscale data Centers. There was improved lifecycle management, charge/discharge efficiency, and decreased risk of thermal hazards, which also correspond to the data centers’ tendency to favor LFP batteries for enhanced safety and longevity.

Lithium Nickel Manganese Cobalt Oxide (NMC): Ultra hyperscale and colocation facilities increasingly deploy NMC batteries, which have high energy density, to data centers with heavy energy demands. In April 2025, Vertiv launched NMC UPS systems with AI-driven energy management systems. The high energy density of NMC batteries is suitable for applications with limited volume. These systems enable operators to improve operational continuity and reduce electricity expenditures by optimizing load leveling and peak shaving.

Data Center Lithium-ion Battery Market Share, By Battery Chemistry, 2024 (%)

| Battery Chemistry | Revenue Share, 2024 (%) |

| Lithium Iron Phosphate (LFP) | 41.20% |

| Lithium Nickel Manganese Cobalt Oxide (NMC) | 28.40% |

| Lithium Cobalt Oxide (LCO) | 10.30% |

| Lithium Titanate (LTO) | 12.50% |

| Others (NCA) | 7.60% |

Lithium Titanate (LTO): Ultra rapid charging, long cycle lifetime, great performance at low temperature, these features makes these batteries suited for edge and micro data centers which need instant response and reliability. In feb 2025, Delta Electronics showcased edge batteries LTO based battery racks designed for edge facilities in Asia. These systems cater to the growing demands of edge computing and IOT driven infrastructure by supplying power instantaneously during peak loads and outages.

Lithium Cobalt Oxide (LCO): These batteries are used in older and smaller systems within the data center because of their high energy density and low lifespan. In january 2025, Samsung SDI released LCO’s with new thermal tech aimed at mid sore data centers that need dense, compact energy. The LCO is widely used and the technology is well known, therefore, facilities that are switching from the lead acid systems their UNS systems will find it useful.

Others (e.g. NCA): For hyper-scale data centers that focus on maximum energy density and efficiency, newer chemistries like NCA (Nickel Cobalt Aluminum) are being developed. In May 2025, LG Energy Solution showcased NCA modules for AI driven predictive maintenance load management and integration with renewable energy. This shows a high demand for smart, high capacity batteries in modern data centers.

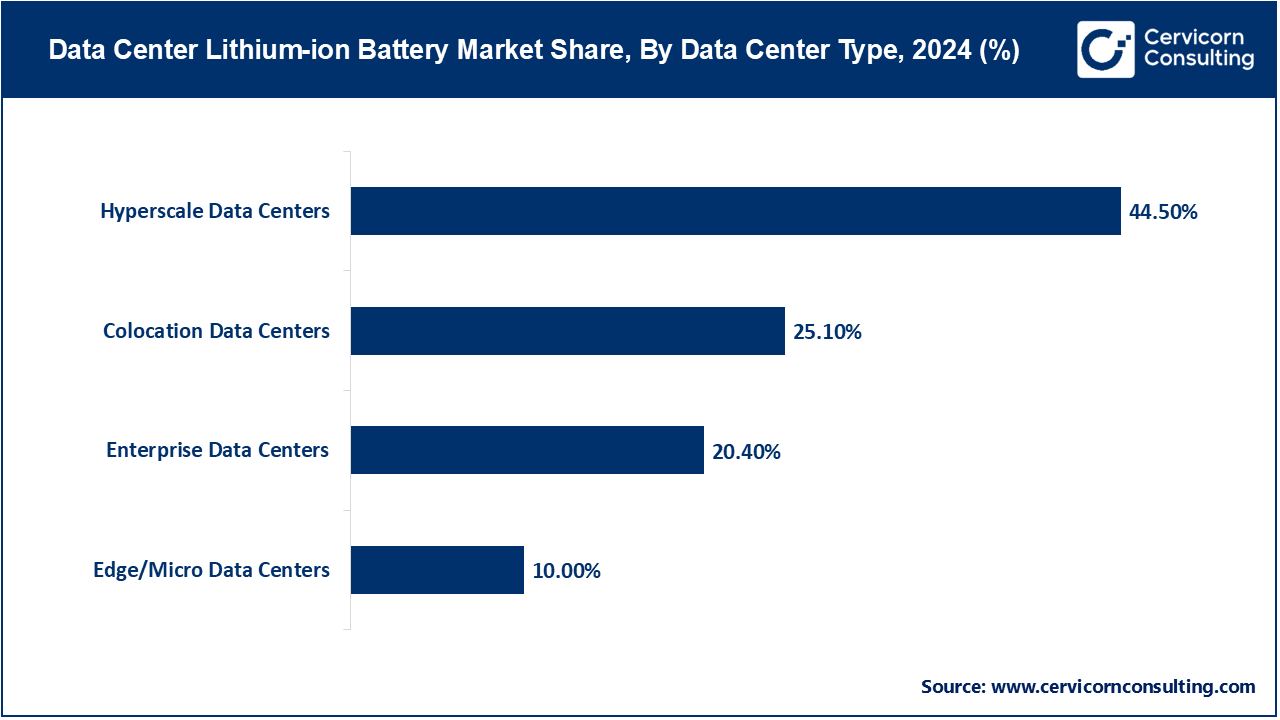

Hyperscale Data Centers: These cross-regional facilities needing massive electricliity supplies for AI workload computing see Huawei configure AI-equipped SmartLi UPS system buffers with hyperbatters and predictive capacity energy moinitoring modules, improving effectiveness and resilience towards energy fluctuation shocks at midguard. Battery buffers achieve 24-7 uptime with no disruption to MIT service workloads.

Colocation Data Centers: These mlt-tenants energy segmented facilities see Schneider Electric launch EcoStruxure Liuith-ion systems designed for colocation operators. These systems provide remote charge control, and power Optimization to help operators and empower autonomy while minimizing the rising power usage level at different charge units.

Enterprise Data Centers: These Corporate IT, and private center facilities see CATL launch modular lithium-ion packs for mid ctor configurations. These lithium modules support increased charge usage, and monitored charge systems, ultra charge modules provide a stable answer for the rising data workloads.

Edge/Micro Data Centers: For computing and IoT, edge and micro data centers need compact and high-performance batteries that can fast charge and discharge. Delta Electronics, in June 2025, showcased LTO battery systems for telecom and edge computing, stressing rapid deployment, low maintenance, and functionality in remote and scattered operational areas.

Uninterruptible Power Supply (UPS): Lithium-ion batteries have increased in usage because they are more energy efficient and require less maintenance compared to lead-acid systems. While lead-acid systems still are more reliable than Lithium-ion batteries, the predictive maintenance on batteries systems by Eaton in March 2025 allows data centers to address maintenance issues before downtimes occur. This allows the batteries to be in seamless systems which uninterruptedly operate during critical downtimes. This ensures the operational continuity of the systems for the very critical IT structures.

Energy Storage Systems (ESS): In Jan 2025, the new North American units of Vertiv are capable of using lithium-ion batteries for load optimization and peak shaving. They are proactive not just on cost energy issues, but also supportive to sustainability. This is because of the systems analytics and smart response of the AI which align and allocate core systems, on which demand is predicted, especially during peak times, and integrate the energies of renewables.

Data Center Lithium-ion Battery Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Uninterruptible Power Supply (UPS) | 42.80% |

| Energy Storage Systems (ESS) | 30.40% |

| Load Management / Peak Shaving | 16.60% |

| Others | 10.20% |

Load Management / Peak Shaving: Beating energy hungry demands during peak times is done through AI real-time load optimization. Peak operational cost and load endpoints are reached through the use of predictors towards load algorithms performed by LG energy which also use operable NCA batteries within computed algorithms during peak periods of energy usage. This also occurs in the hyperscope areas which have more severe energy demands.

Others: Hyper battery systems also integrate support for remote facilities through grids for uninterrupted operational energy systems, and for quicker response times, enhanced operational systems. In June 2025, operational and enhancement pillars through smart systems for the edges are achieved by mid-tier Huawei units for operational resilient systems on dispersed micros.

Battery racks/Modules: Modular design allows easy scaling, maintenance, and redundancy. Samsung SDI, in February 2025, launched LCO battery racks for enterprise facilities which greatly improves operational energy reliability and allows seamless expansion.

BMS: Advanced BMS utilizes AI analytics to monitor battery health, predict failures, optimize charging cycles, and extend overall lifecycle. Schneider Electric, in March 2025, equipped its BMS for colocation centers with real-time energy analytics which allows proactive maintenance through automated alert systems.

Inverters/Converters: The rate of energy loss during conversion is dependent on the efficiency of the inverters. In April 2025, Eaton's newly launched inverters with LFP modules, marked a step towards improvement of power conversion efficiency in hyperscale data centers, and stable power delivery.

Data Center Lithium-ion Battery Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Battery Racks/Modules | 39.50% |

| Battery Management Systems (BMS) | 25.30% |

| Inverters/Converters | 15.20% |

| Monitoring & Cooling Systems | 12% |

| Others | 8% |

Monitoring & Cooling systems: Continuous monitoring and management of the system, helps prevent overheating and performance degradation. In May 2025, Delta Electronics, with the aid of AI, released LTO battery racks for edge data centers that helps with real-time monitoring and predictive changes in thermal adjustments.

Others: In June 2025, LG Energy Solution deployed NCA modules with embedded thermal and safety sensors which enables predictive intervention and automated fault mitigation. Fire suppression, sensors, and safety monitoring systems are becoming standard in Li-Ion battery systems.

Market Segmentation

By Battery Chemistry

By Data Center Type

By Component

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Data Center Lithium-ion Battery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Chemistry Overview

2.2.2 By Data Center Type Overview

2.2.3 By Component Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Scalability and Performance

4.1.1.2 Green Energy Transition

4.1.2 Market Restraints

4.1.2.1 Large Start-Up Cost

4.1.2.2 Thermal Management Concerns

4.1.3 Market Challenges

4.1.3.1 Scaling in Legacy Facilities

4.1.3.2 End-of-life lithium-ion batteries

4.1.4 Market Opportunities

4.1.4.1 Hyperscale Expansion

4.1.4.2 Integration with Renewable Microgrids

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Data Center Lithium-ion Battery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Data Center Lithium-ion Battery Market, By Battery Chemistry

6.1 Global Data Center Lithium-ion Battery Market Snapshot, By Battery Chemistry

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lithium Iron Phosphate (LFP)

6.1.1.2 Lithium Nickel Manganese Cobalt Oxide (NMC)

6.1.1.3 Lithium Cobalt Oxide (LCO)

6.1.1.4 Lithium Titanate (LTO)

6.1.1.5 Others (NCA)

Chapter 7. Data Center Lithium-ion Battery Market, By Data Center Type

7.1 Global Data Center Lithium-ion Battery Market Snapshot, By Data Center Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hyperscale Data Centers

7.1.1.2 Enterprise Data Centers

7.1.1.3 Colocation Data Centers

7.1.1.4 Edge/Micro Data Centers

Chapter 8. Data Center Lithium-ion Battery Market, By Component

8.1 Global Data Center Lithium-ion Battery Market Snapshot, By Component

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Battery Racks/Modules

8.1.1.2 Battery Management Systems (BMS)

8.1.1.3 Inverters/Converters

8.1.1.4 Monitoring & Cooling Systems

8.1.1.5 Others

Chapter 9. Data Center Lithium-ion Battery Market, By Application

9.1 Global Data Center Lithium-ion Battery Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Uninterruptible Power Supply (UPS)

9.1.1.2 Energy Storage Systems (ESS)

9.1.1.3 Load Management / Peak Shaving

9.1.1.4 Others

Chapter 10. Data Center Lithium-ion Battery Market, By End-User

10.1 Global Data Center Lithium-ion Battery Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Cloud Service Providers

10.1.1.2 Telecom Operators

10.1.1.3 BFSI

10.1.1.4 Government & Defense

10.1.1.5 Healthcare

10.1.1.6 IT & Tech Enterprises

10.1.1.7 Others (Education, Retail, Media)

Chapter 11. Data Center Lithium-ion Battery Market, By Region

11.1 Overview

11.2 Data Center Lithium-ion Battery Market Revenue Share, By Region 2024 (%)

11.3 Global Data Center Lithium-ion Battery Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Data Center Lithium-ion Battery Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Data Center Lithium-ion Battery Market, By Country

11.5.4 UK

11.5.4.1 UK Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Data Center Lithium-ion Battery Market, By Country

11.6.4 China

11.6.4.1 China Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Data Center Lithium-ion Battery Market, By Country

11.7.4 GCC

11.7.4.1 GCC Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Data Center Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Vertiv Group Corp.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Eaton Corporation

13.3 Schneider Electric SE

13.4 Legrand SA

13.5 Delta Electronics Inc.

13.6 Huawei Technologies Co., Ltd.

13.7 Samsung SDI Co., Ltd.

13.8 LG Energy Solution

13.9 Contemporary Amperex Technology Co. Ltd. (CATL)

13.10 BYD Company Limited

13.11 Toshiba Corporation

13.12 Tesla, Inc.

13.13 Panasonic Holdings Corporation