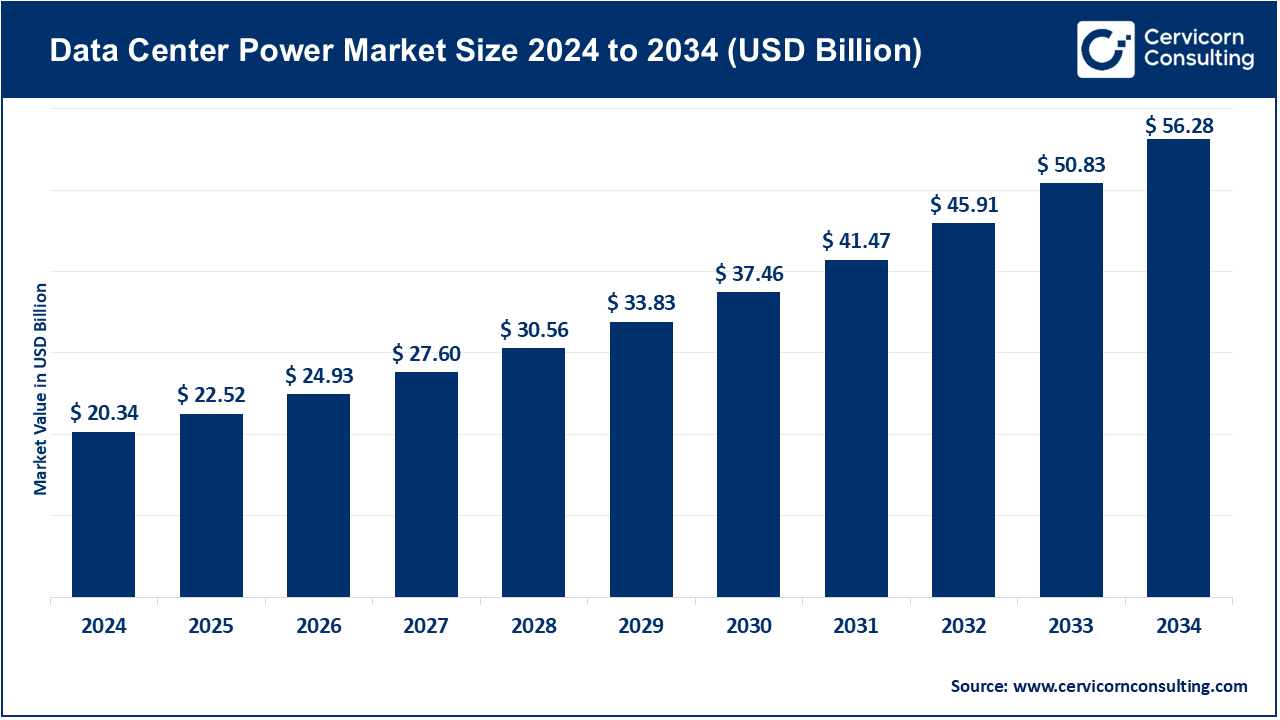

The global data center power market size was estimated at USD 20.34 billion in 2024 and is expected to be worth around USD 56.28 billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.71% over the forecast period from 2025 to 2034. The data center power market is experiencing high growth and businesses are investing in sophisticated power solutions to maintain power continuity in the business, efficient power utilization, and minimizing carbon footprint. The increasing demands of cloud computing, AI, IoT infrastructure demand the provision of sustainable scalable and reliable energy systems. Recent data centers are incorporating renewable energy sources, energy efficient UPS system and highly intelligent energy management platforms to consume minimum energy and reduce operation costs.

Data center power is the technology and systems that is used to supply, store and operate all electric power to data centers to maintain constant power supply, energy load balancing, integration of renewable resources, and backup power when off-the-grid power is lost. Incremental leaps in battery technologies, including high-capacity lithium-ion, solid-state storage, and software-enabled energy management, are rendering these solutions less costly, more robust. The factors boosting adoption include government incentives, more stringent environmental controls, and the ESG, because these factors allow operators to decarbonize, centralize, and have circular energy systems suited to sustainability and efficiency targets.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 22.52 Billion |

| Estimated Market Size in 2034 | USD 56.28 Billion |

| Registered CAGR 2025 to 2034 | 10.71% |

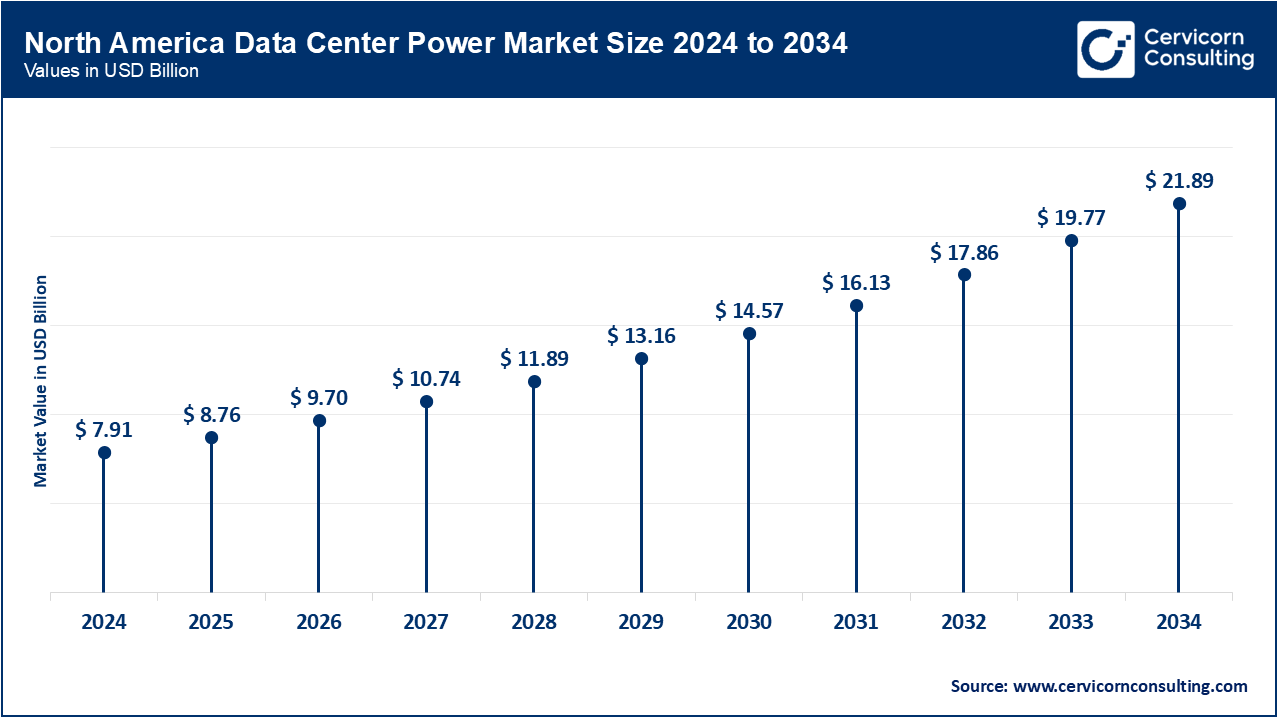

| Leading Region | North America |

| Rapid Growth Region | Asia-Pacific |

| Key Segments | Component, Solutions, Services, End-use, Region |

| Key Companies | ABB, Black Box, CyrusOne, Eaton, Equinix Inc., GDS Holdings, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand, N1 Critical Technologies, NTT Global Data Centers, Raman Power Technologies, Rittal GmbH & Co. KG, Schneider Electric, Vertiv Group Corp. |

The North America is boosted by the presence of favorable policies, corporate environment, social and governance requirements, and clean power investments. In July of 2025 the U.S. DOE invested 0.1 billion on upgrading UPS, PDU, and modular power systems in hyperscale data centers. The states of California and New York will spearhead the use of energy-efficient power solutions by offering incentives. The growth of cloud operations, artificial intelligence and 5G installations are increasing the need to have dependable infrastructures that can scale. Tech companies and utility agencies are working collectively in modernizing grids and energy distribution.

Strict climate policies, renewable energy targets, and energy efficiency incentives help Europe to achieve market growth. In May 2025, the EU Commission advocated the use of modular and renewable-integrated power in commercial data centers. The use of PDU and UPS is being proposed in Germany, the U.K. and the Netherlands to take up green field and retro-fit projects. Increasing costs of electricity and decarbonization objectives are influence operators to seek energy-efficient systems. Smart monitoring and integration technologies are moving forward due to collaborative programs.

Data Center Power Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.90% |

| Europe | 29.10% |

| Asia-Pacific | 26.70% |

| LAMEA | 5.30% |

Asia-Pacific is growing in government programs, adoption of cloud, and smart energy data center management. In May 2025, only in Japan, UPSs and PDUs were subsidized in order to improve efficiency and grid stability. An increase in production and an endorsement of smart power solutions can be identified in China, South Korea, and Australia. Adoption is facilitated by frequent power cuts and increased demand of electricity. The area is becoming a ground of sustainable and resilient data center power systems.

Renewable energy integration, energy access, and the introduction of modern infrastructure are the drivers that promote the growth of LAMEA in the marketplace. UPS and PDU systems were installed at hyperscale data centers in Brazil in April 2025. Solar powered off-grid solutions in the Middle East counties are combining with such systems in Africa. The initiatives create resilience, minimize the emissions, and promote energy independence. Adoption is increasing through the investments of both the government and the individuals in projects in ITs, telecom and marketing.

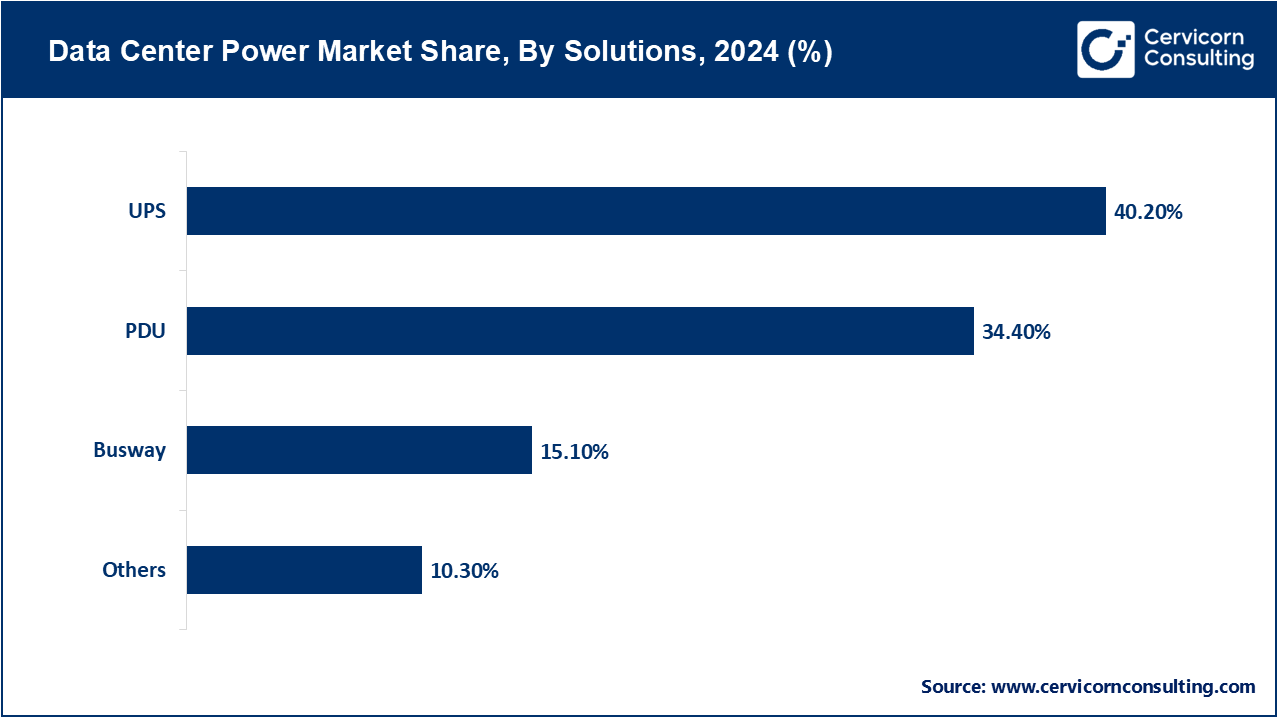

Solutions: Proposed solutions in the data center power market encompass equipment used to control, distribute, and backup power and it includes hardware to maintain consistent operations. They are needed to promote reliability, efficiency, and scalability in contemporary data centers. UPS systems took up 36.5% of the U.S. market share in June 2025, thus their significance. In early 2025, PDUs were increasingly adopted in areas where they are used to manage the load efficiently. In March 2025 busway systems were installed in modular formations. In May 2025, modular and renewable-integrated power became available, sustainable and scalable infrastructure.

Data Center Power Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Solutions | 27.50% |

| Services | 72.50% |

Services: Services involve design, consulting, mix, installation and maintenance of information center power structure to ensure its optimal functionalities. Their use makes the operation less prone to downtimes, more energy-efficient, and increases equipment life. In July 2025, one of the largest consulting firms introduced energy optimization services in data centers. Hyperscale deployments of UPS were done in the month of August 2025 and there was 24/7 support and preventive maintenance programs initiated in June 2025. In April 2025 training was carried out to put operational staff through system upkeep. In May 2025, energy audits and advisory services were launched to increase performance and reliability.

PDU (Power Distribution Unit): PDUs divide the power received in the main power source to the servers and other devices so as to deliver power safely and efficiently. They play an important role in load management and modular data center designs. PDUs became common to work in U.S. hyperscale data centres in the efficient distribution in June 2025. In April 2025, high density upgrades were done to busway-compatible PDUs in the European facilities. In May 2025, the Modular PDUs were tested to increase scalability. Globally practices were applied with remote monitoring PDUs in July 2025. This demonstrates a trend towards smarter and smarter, more agile power management.

UPS (Uninterruptible Power Supply): The UPS segment has registered highest revenue share in the market. UPS systems use backup power whenever there is loss of power or in fluctuations of power to avoid data loss and downtime. They are critical to the mission operations. In June 2025 the UPS systems had a U.S. market share of 36.5%. In August of 2025, modular UPS systems were installed in a hyperscale cloud provider. More energy efficient models of lithium-ion UPS were launched in May 2025. Remote monitoring of UPS was adopted by Asian data centers in March 2025.

Busway: Busway is an encapsulated, modular power conductor which transmits power through racks and floors. They take less time to install and have the maximum use of space. Early 2025 saw U.S. data centers rolling up the use of busways in modular installation. European plants were able to update busways in April 2025, conducting high density deployments. In March 2025, prefabricated busway segments were fitted in Asian data centres. New renewable-compatible busways came to be in June 2025. They are well suited to data centers with scalable, energy efficiency.

Others: This would entail modular power, renewable-integrated solutions that would complement PDU, UPS, and busways. These are essential when it comes to green and flexible data centers. To increase scalability, modular and renewable-integrated systems would be implemented in U.S. facilities in May 2025. Power solutions that made use of energy storage were implemented in April 2025. In March 2025, pilot programs were being done in Europe to test the integration of smart energy.

Design & Consulting: Design and consulting services can make sure power infrastructure is efficient, scalable and reliable. They save on operations costs and other energy wastes. One of the leading consultancies in July 2025 opened services on energy efficient data centers. In May 2025, renewable integration advice was given. The June of 2025 saw the introduction of new software in capacity planning. In April 2025, modular deployments feasibility studies were conducted. In March 2025, specialist audits increased the stability of the system.

Integration & Deployment: Integration and deployment focuses on installing and commissioning of power systems as a way of guaranteeing smooth operations. They make the design plans reality by creating operational infrastructure. The UPS deployment (hyperscale data center) was performed large scale in August 2025. Integration of Modular PDUs took place in June 2025. High-density layout should be commissioned in April 2025 with busway systems. Renewable-integrated systems came in place in May 2025. Lithium-ion-based UPSs were implemented along with the integration support in July 2025.

Support & Maintenance: The support and maintenance segment has dominated the market. Support and maintenance service solutions observes and services power systems avoiding the costs of downtime, as well as lengthening the service life cycle of the equipment. They provide quality operations on 24-hour basis. In June 2025, data center power systems had started a 24/7 support service. Schedules of preventive maintenance were installed in May 2025. PDUs and UPS systems began to be remotely monitored in July 2025. To fix this problem, emergency repair teams were deployed in April 2025. Maintenance staff training was done in March 2025.

IT & Telecommunications: The IT & telecommunications segment has dominated the market. The networks that have data centers that drive cloud services and 5G networks need a stable and scalable source of electricity. They play a vital role in continuity of the network. In March 2025, one of the telecom giants migrated data center power systems to 5G. In April 2025, European cloud centers were increased in capacity. In May 2025, edge data centers implemented the modular UPS system. In June 2025, the Asian hubs started to use PDUs that could be monitored remotely. In July 2025, energy-efficient solutions became available.

Energy: Energy sector data centres are used in grid management and integration of renewables where they need utmost reliability. One of the firms that have invested in renewable-powered data centers was in February 2025. UPS systems configured to connect to the smart grid have gotten deployed in March 2025. In April 2025, busway upgrades were realised. In May 2025, modular PDU was put in use. Connection to solar installations was done in June 2025.

Healthcare: Patient data in hospitals and clinics are kept in health care data centres, and requires continuous power to ensure safety and compliance. In January 2025, one of the hospital networks enhanced UPS and PDU systems. March in 2025, the remote monitoring systems were introduced. Redundant power configurations came into existence in April 2025. May 2025 is when Busway installations maximized space. The emergencies maintenance procedures are adopted in June 2025.

Retail: Data centers support e-commerce and point-of-sale (POS) units in the retail world and demand reliable electricity that can scale. A retail chain was powered up its data centers to meet the peak season demand in December 2024. In January 2025, the UPS systems were improved. In February 2025 the installation of PDUs occurred. In March 2025 busway solutions enhanced flexibility. Integration of renewable energy was done in April 2025.

Other sectors: Other industries also comprise of government, finance, and education data centers, which require safe and stable power. A state organization has updated its power systems in November 2024. UPS and PDUs were upgraded on January 2025 by banks. Modular busways came into use in February 2025 in educational centers. In March 2025 renewable-powered solutions were tested. Remote monitoring services have been introduced in April 2025.

Market Segmentation

By Component

By Solutions

By Services

By End-use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Data Center Power

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Solutions Overview

2.2.3 By Services Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 AI and Cloud Computing Demand Boom

4.1.1.2 Renewable Integration Incentives by Government

4.1.2 Market Restraints

4.1.2.1 Soaring Energy Expenses Attributed to AI Activities

4.1.2.2 Lack of Power Availability in Core Markets

4.1.3 Market Challenges

4.1.3.1 Infrastructure Stress Resulting from Development Acceleration

4.1.3.2 Ensuring Grid Reliability While Incorporating Renewables

4.1.4 Market Opportunities

4.1.4.1 Development of Advanced Energy Storage Solutions

4.1.4.2 Investment in Grid Modernization and Flexibility

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Data Center Power Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Data Center Power Market, By Component

6.1 Global Data Center Power Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Solutions

6.1.1.2 Services

Chapter 7. Data Center Power Market, By Solutions

7.1 Global Data Center Power Market Snapshot, By Solutions

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 PDU

7.1.1.2 UPS

7.1.1.3 Busway

7.1.1.4 Others

Chapter 8. Data Center Power Market, By Services

8.1 Global Data Center Power Market Snapshot, By Services

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Design & Consulting

8.1.1.2 Integration & Deployment

8.1.1.3 Support & Maintenance

Chapter 9. Data Center Power Market, By End-User

9.1 Global Data Center Power Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 IT & Telecommunications

9.1.1.2 BFSI

9.1.1.3 Energy

9.1.1.4 Government

9.1.1.5 Healthcare

9.1.1.6 Retail

9.1.1.7 Others

Chapter 10. Data Center Power Market, By Region

10.1 Overview

10.2 Data Center Power Market Revenue Share, By Region 2024 (%)

10.3 Global Data Center Power Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Data Center Power Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Data Center Power Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Data Center Power Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Data Center Power Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Data Center Power Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Data Center Power Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Data Center Power Market, By Country

10.5.4 UK

10.5.4.1 UK Data Center Power Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Data Center Power Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Data Center Power Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Data Center Power Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Data Center Power Market, By Country

10.6.4 China

10.6.4.1 China Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Data Center Power Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Data Center Power Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Data Center Power Market, By Country

10.7.4 GCC

10.7.4.1 GCC Data Center Power Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Data Center Power Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Data Center Power Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Data Center Power Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 ABB

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Black Box

12.3 Schneider Electric

12.4 CyrusOne

12.5 Eaton

12.6 Equinix Inc.

12.7 GDS Holdings

12.8 Generac Power Systems, Inc.

12.9 General Electric Company

12.10 Huawei Technologies Co., Ltd.

12.11 Legrand

12.12 N1 Critical Technologies

12.13 NTT Global Data Centers

12.14 Raman Power Technologies

12.15 Rittal GmbH & Co. KG

12.16 Vertiv Group Corp